Skip to content

Single stock price to earnings ratio (PE) distribution. Right now there is a record proportion of stocks with P/Es between 25 to 40x. And a record low proportion of stocks less than 15x. Source: Longview Economics .

Another useful tool for researching companies – a podcast search engine. Just put in company name or the name of any of the key management. Source: Adam Keesling (a few more interesting research tools here).

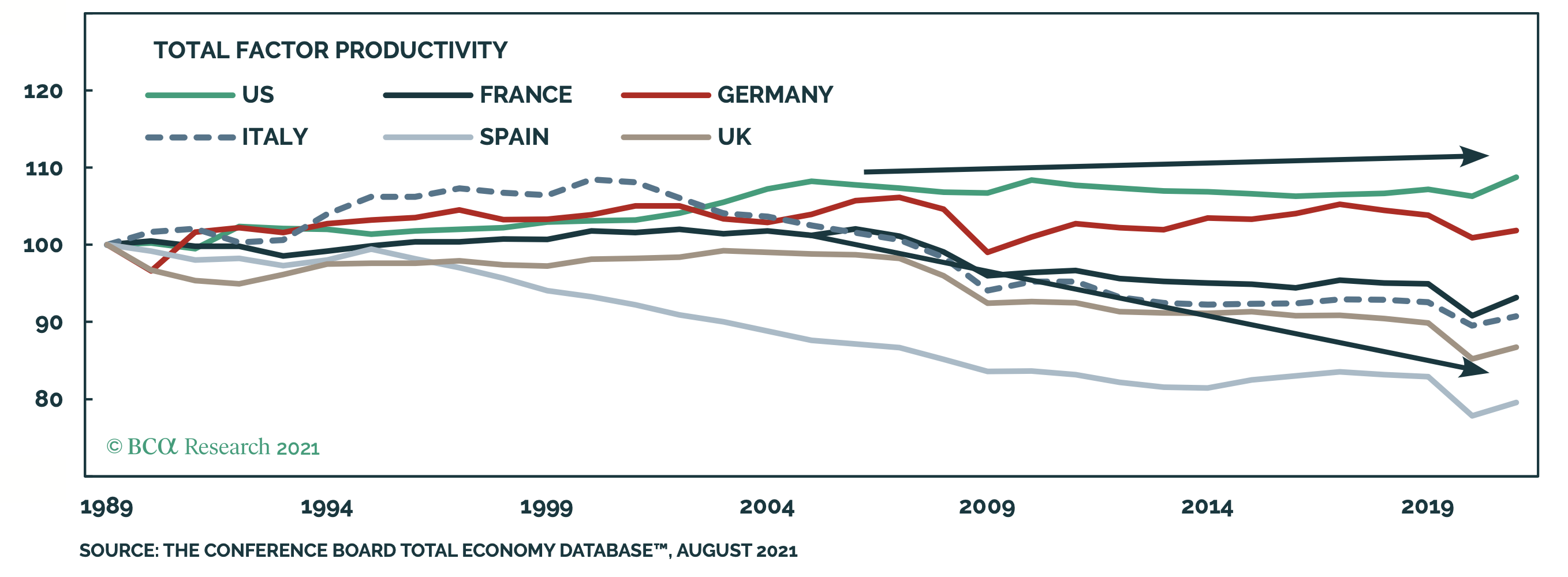

Europe’s Total Factor Productivity (TFP), a key determinant of long term growth, has substantially lagged the US.

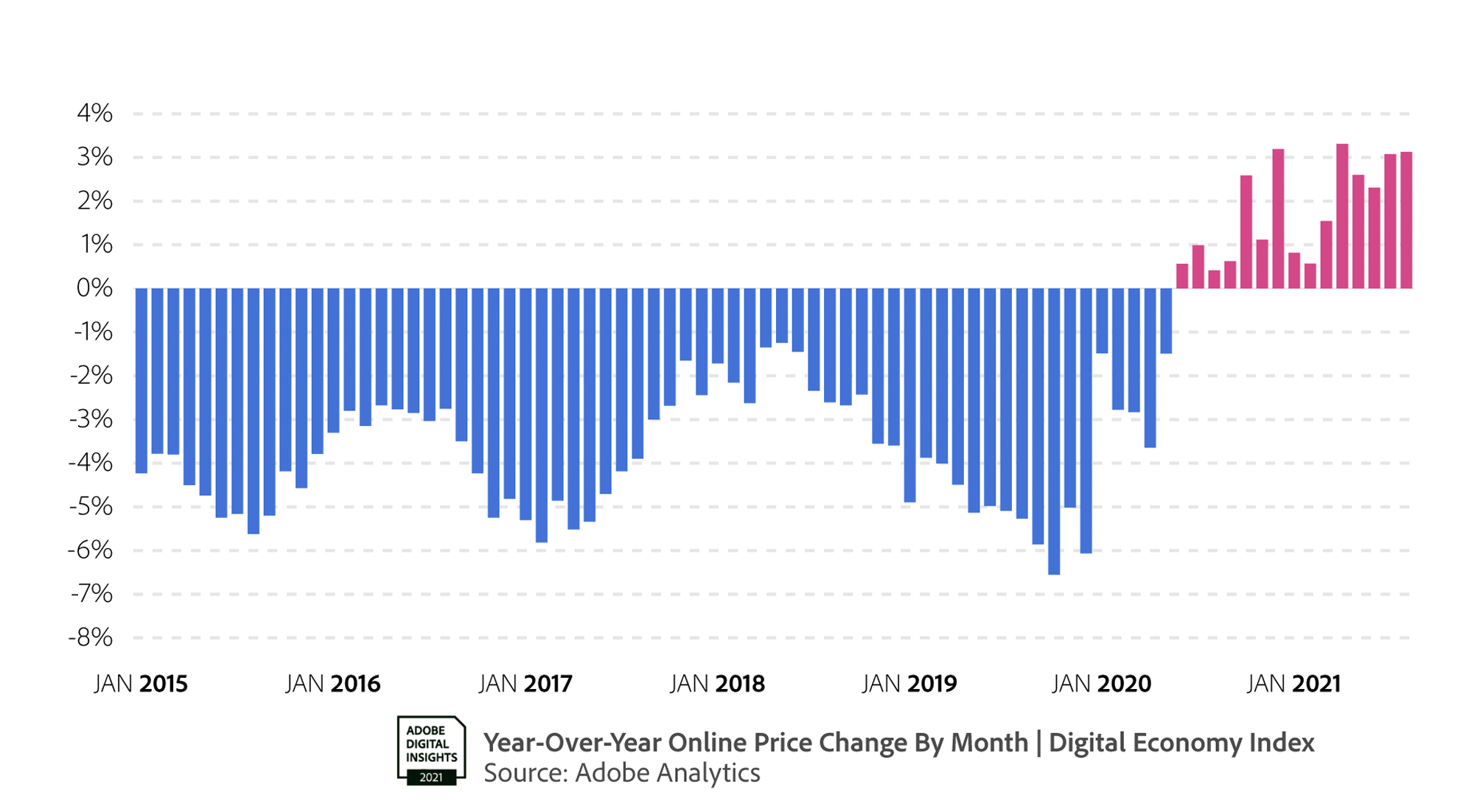

US online holiday pricing is experiencing inflation for the first time ever. “Instead of overall online prices being 5% lower YoY, before seasonal discounts hit, they are up 3.3% YoY “. Source: Adobe Holiday Shopping Forecast 2021 .

What accounts for the difference between “cognitive stamina and observed levels of energy between individuals “? This article is a really interesting start on understanding these so-called “energetic aliens ” – people who can work hard, consistently and obsessively. Examples include George Church who “after finishing his undergrad in 2 years, worked 100 hour weeks in the lab during grad school, famously getting kicked out due to not attending classes because he was just so absorbed in his research. “ As well as – Napoleon, Robert Moses, Alexander Grothendieck, Paul Erdos, Isaac Asimov, Honore de Balzac, Danielle Steel and more. Absolutely worth a read.

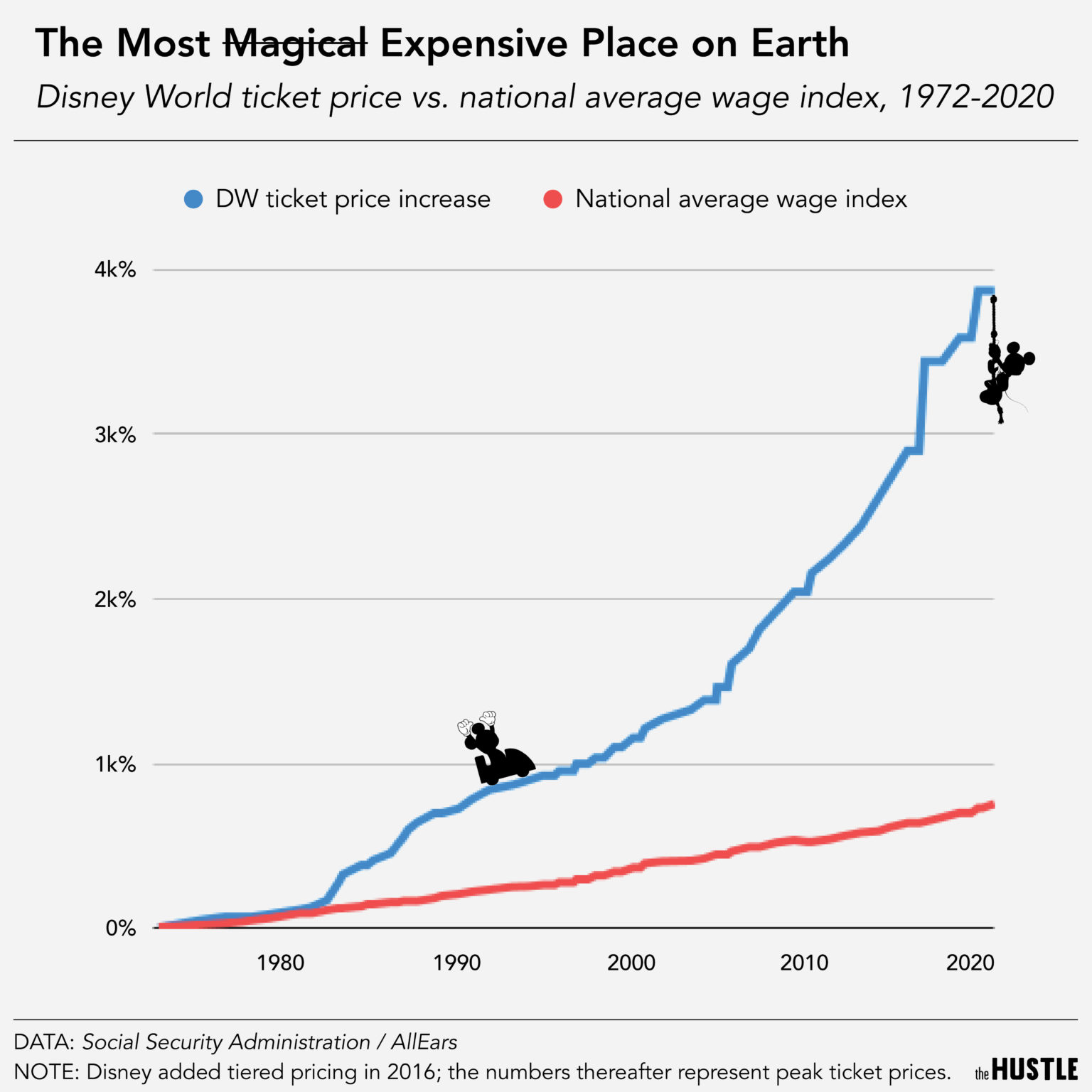

Wonderful article about how reservations are taking over our lives. “The end result of this movement is that our access to real world experiences is experiencing a kind of digital enclosure. “ The master of this new world are Disney Theme parks, which the author covers in all their planning glory. The latest pinnacle here is the Disney Genie app – though consumers aren’t fans (the launch video has 13k dislikes vs. less than a 1,000 likes). The big issue is likely the attached chart – Disney ticket prices have outpaced wage growth for years (Source ).

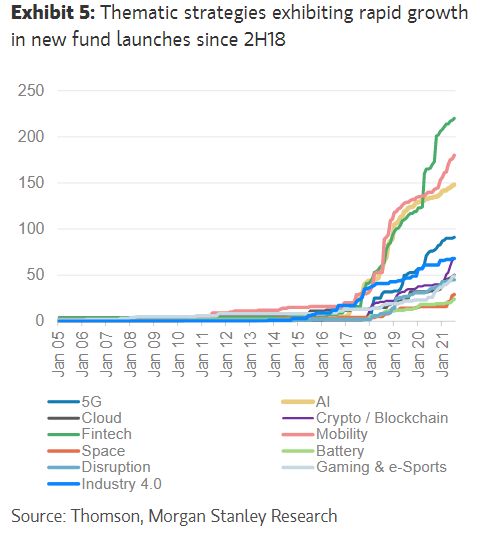

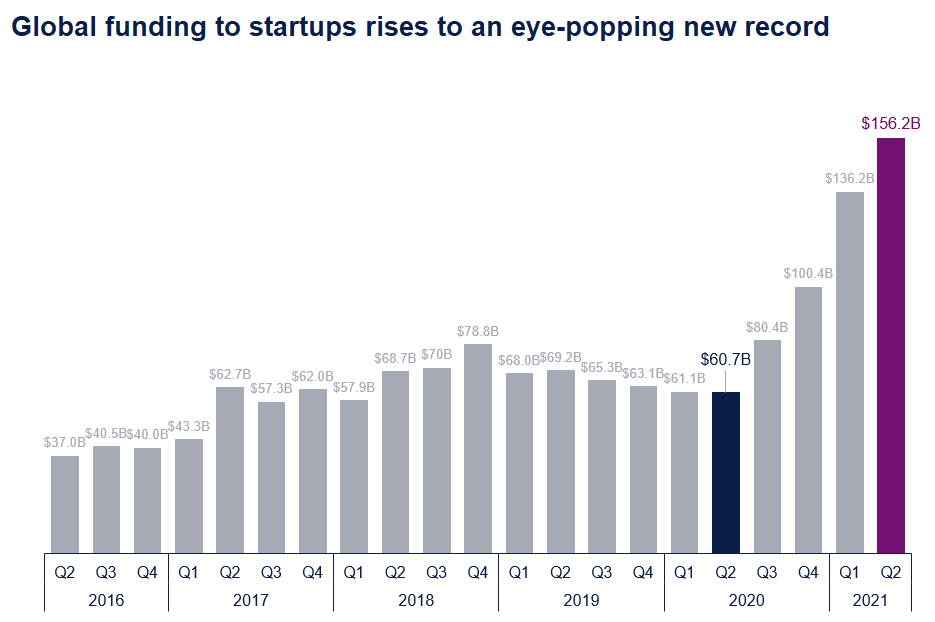

Funding to start-ups has exploded. Is this worrying or just the beginning ? Source .

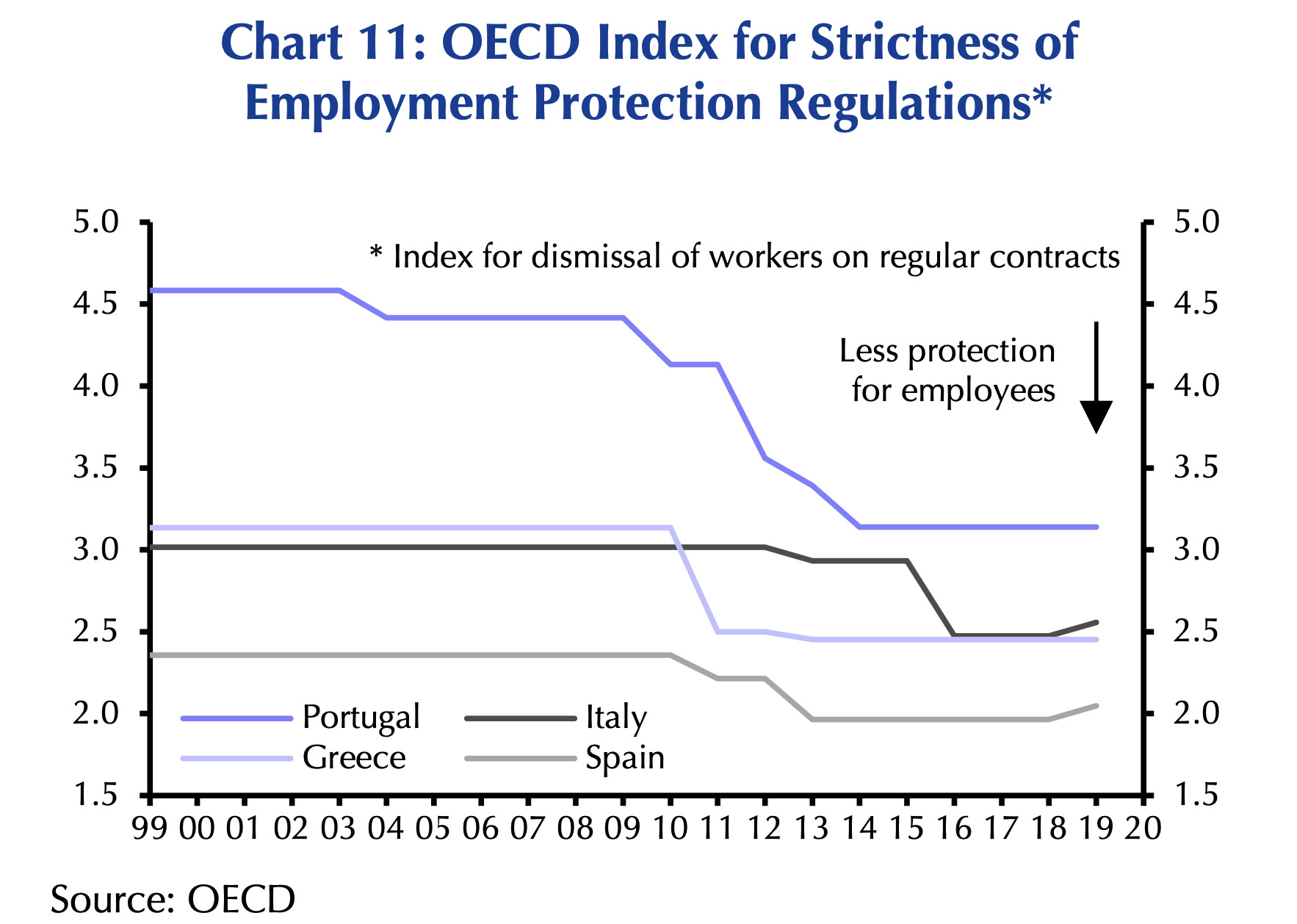

Southern Europe has been on a mission to loosen employment protection since the European crisis. h/t Capital Economics .

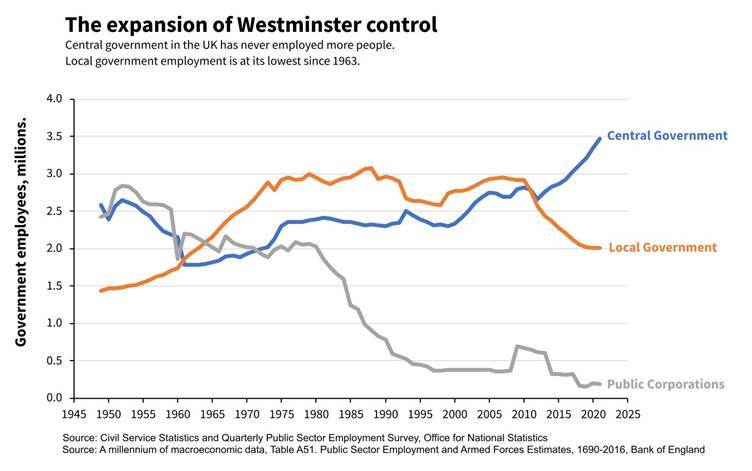

Since the financial crisis the number of people employed in local government in the UK has been declining and currently stands at the lowest level since 1963. In contrast, central government employment is at a record high.

The “Mona Lisa of sports cards” is the Honus Wagner T206. Honus Wagner, though he was a star during his time, was a shrewd operator who restricted images of himself. These cards are so rare – a few dozen are known to exist – that one recently sold for $6.6 million at auction. Great read .

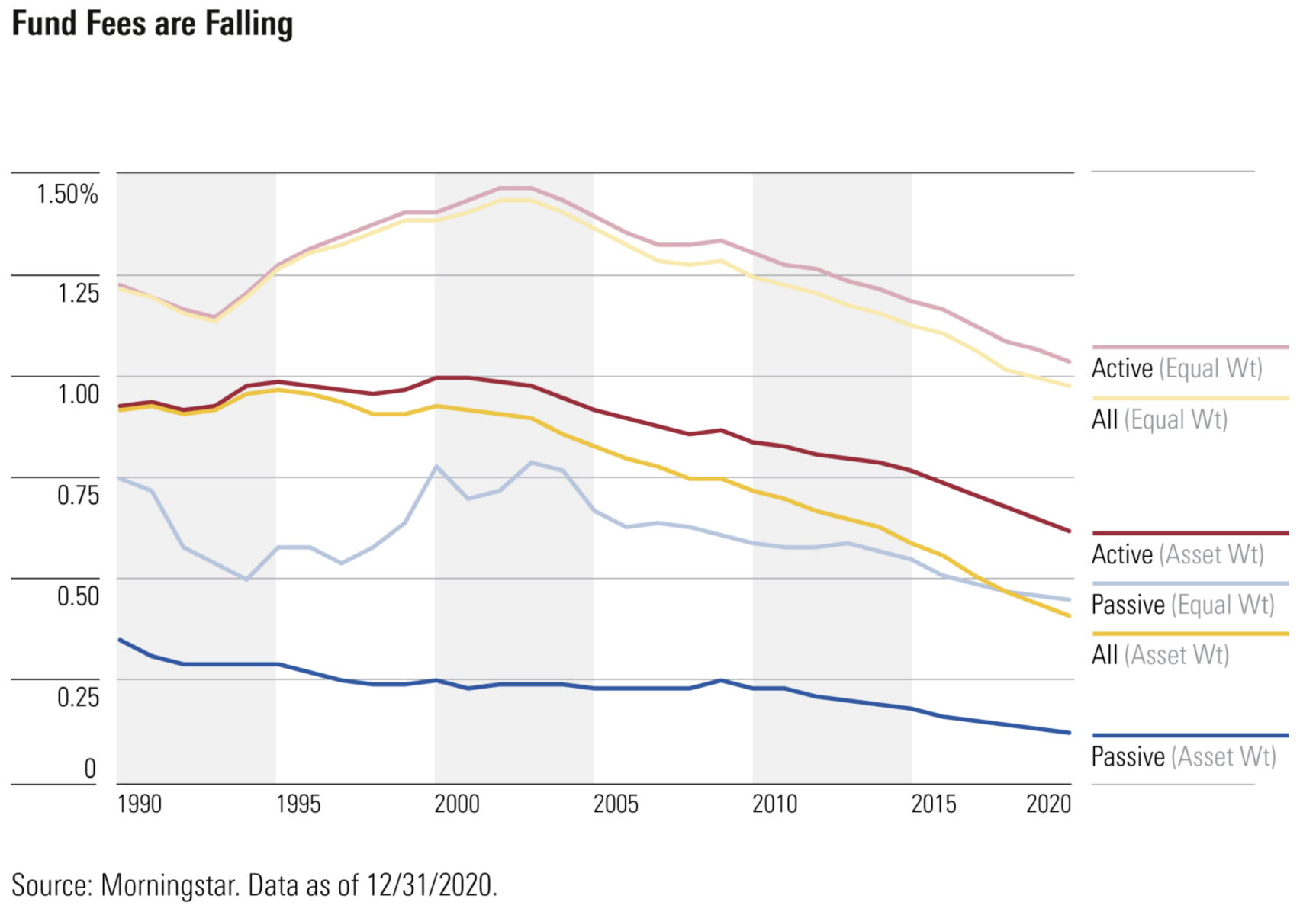

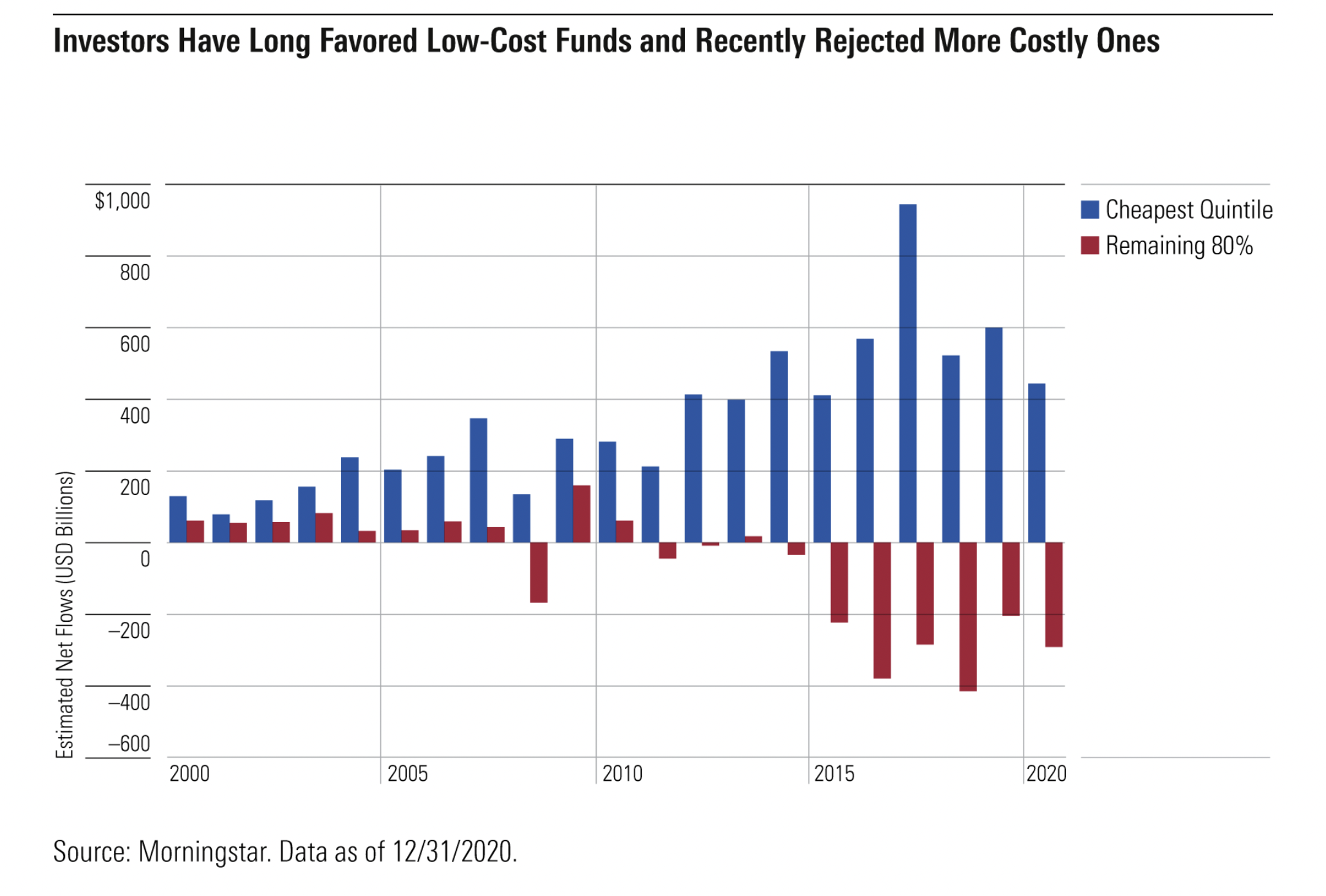

Fees continue to be under pressure across active and passive funds. The associated article from Morningstar makes for interesting reading.

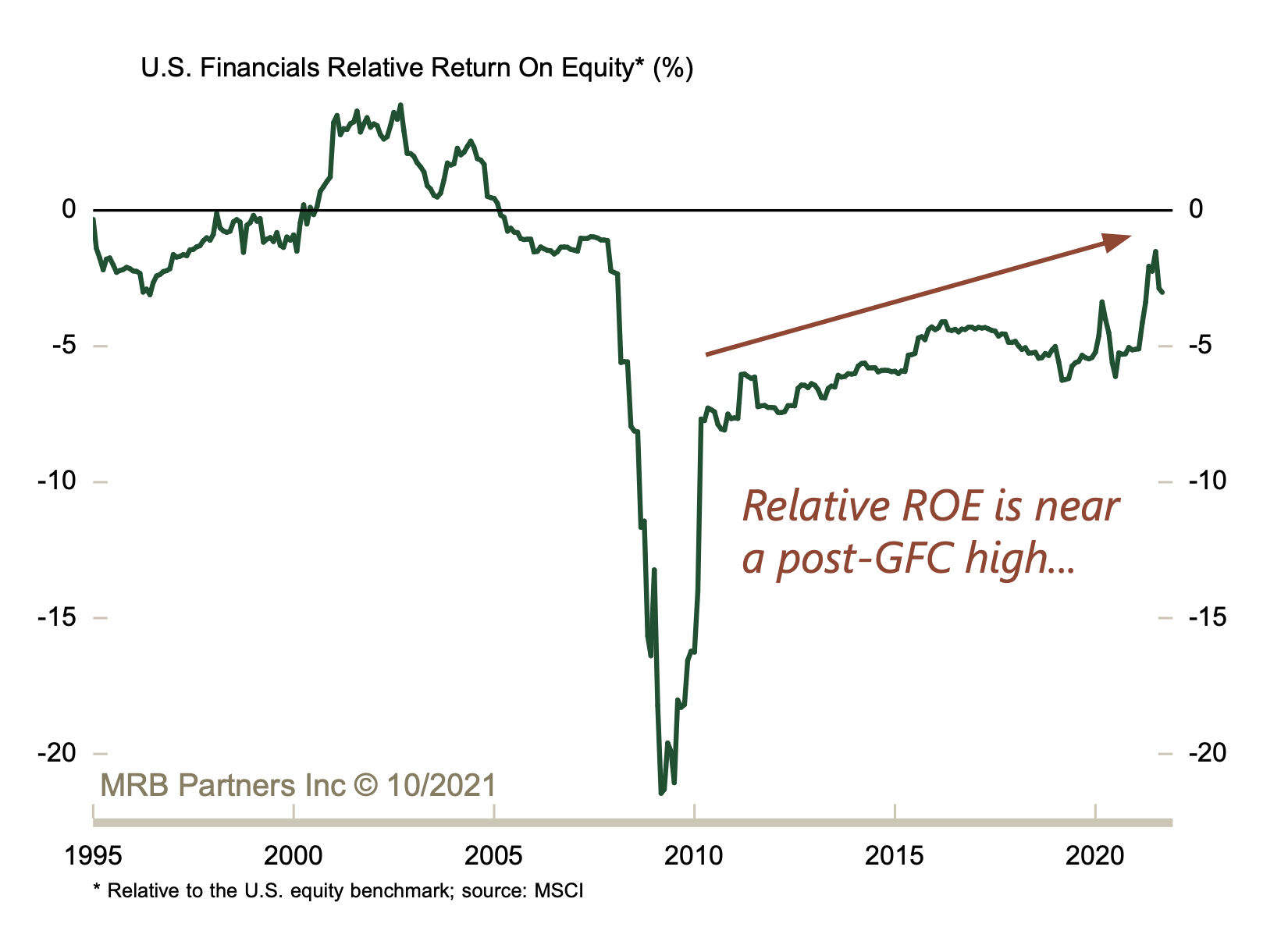

The US financial sector return on equity (ROE) has almost closed its relative gap to the market. Despite this the relative price to book ratio is still below pre-covid levels. h/t MRB Partners .

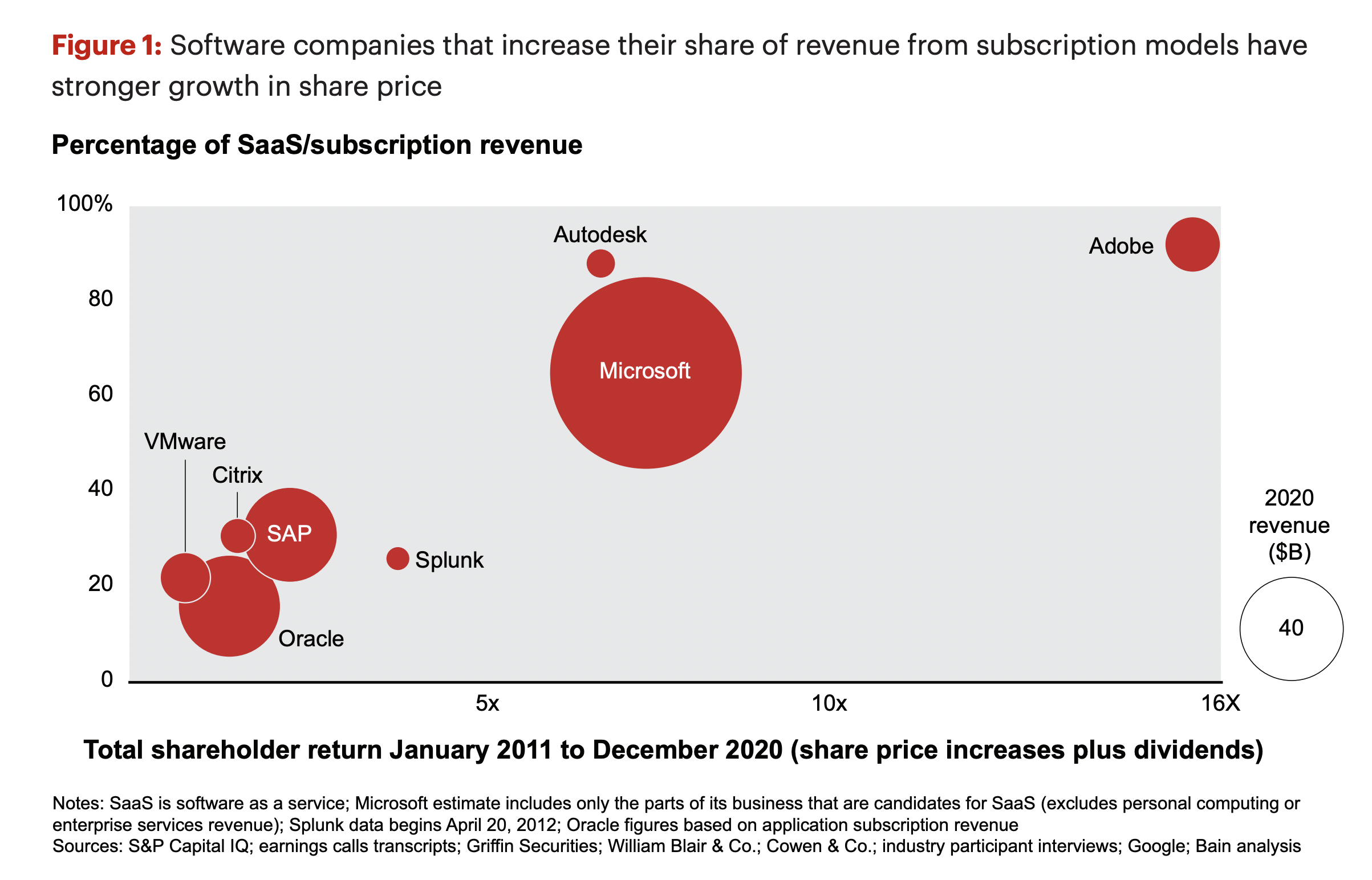

Mature software companies that move to more subscription based business, tend to have strong share price returns. Source .

A useful tool when researching a company. Head to google and type this “[COMPANY NAME] filetype:pdf site:.gov”. Finds any mentions of the company on government websites. Especially good for internal emails. h/t Hidden Monopolies .

Flows into funds with low fees have always been positive. Interestingly, only the recent period has seen strong outflows from the most expensive funds. Source .

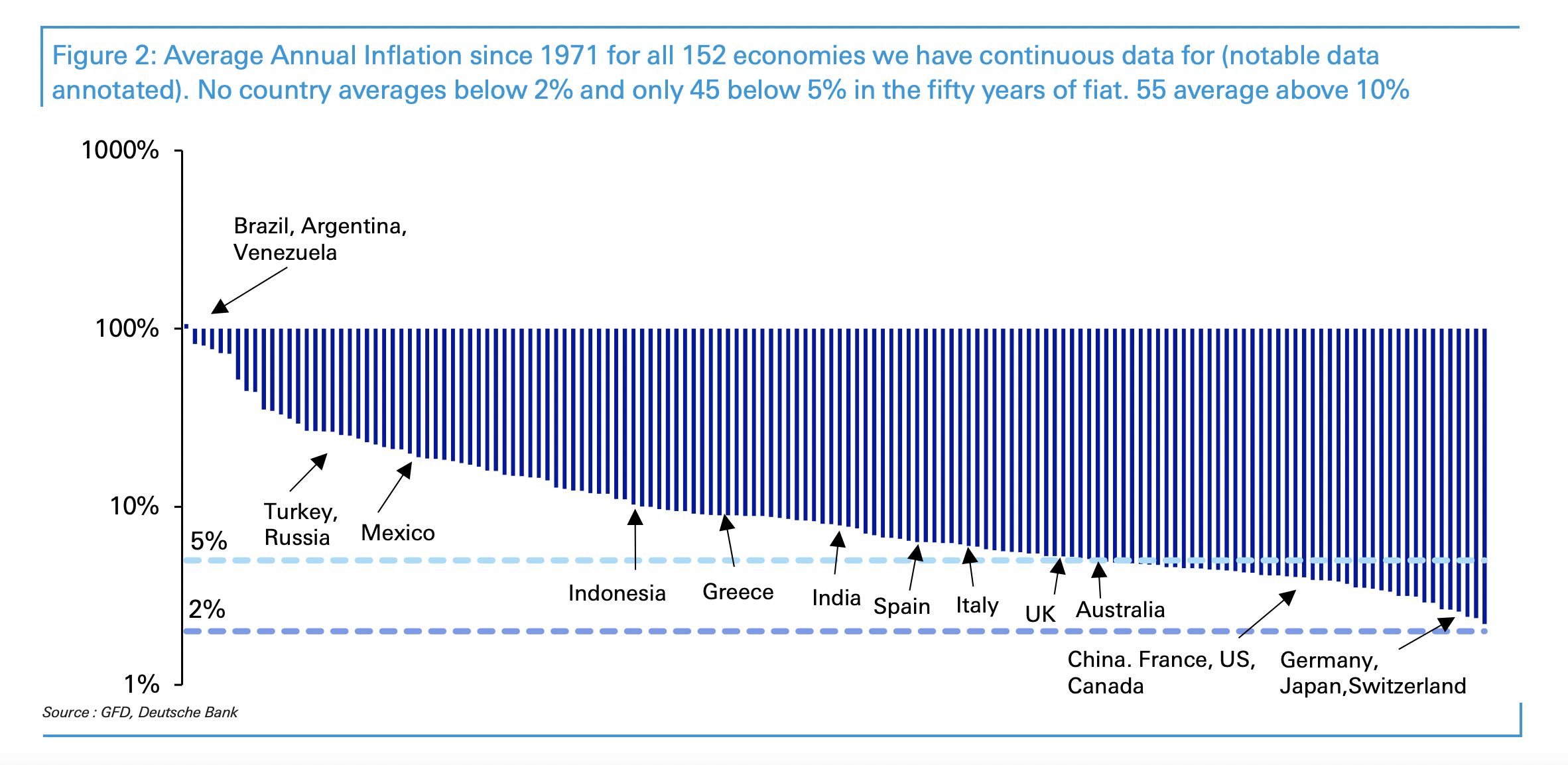

Great chart showing average inflation since 1971 for 152 economies. There is no country that averaged below 2% in the period, and only 45 averaged below 5%.

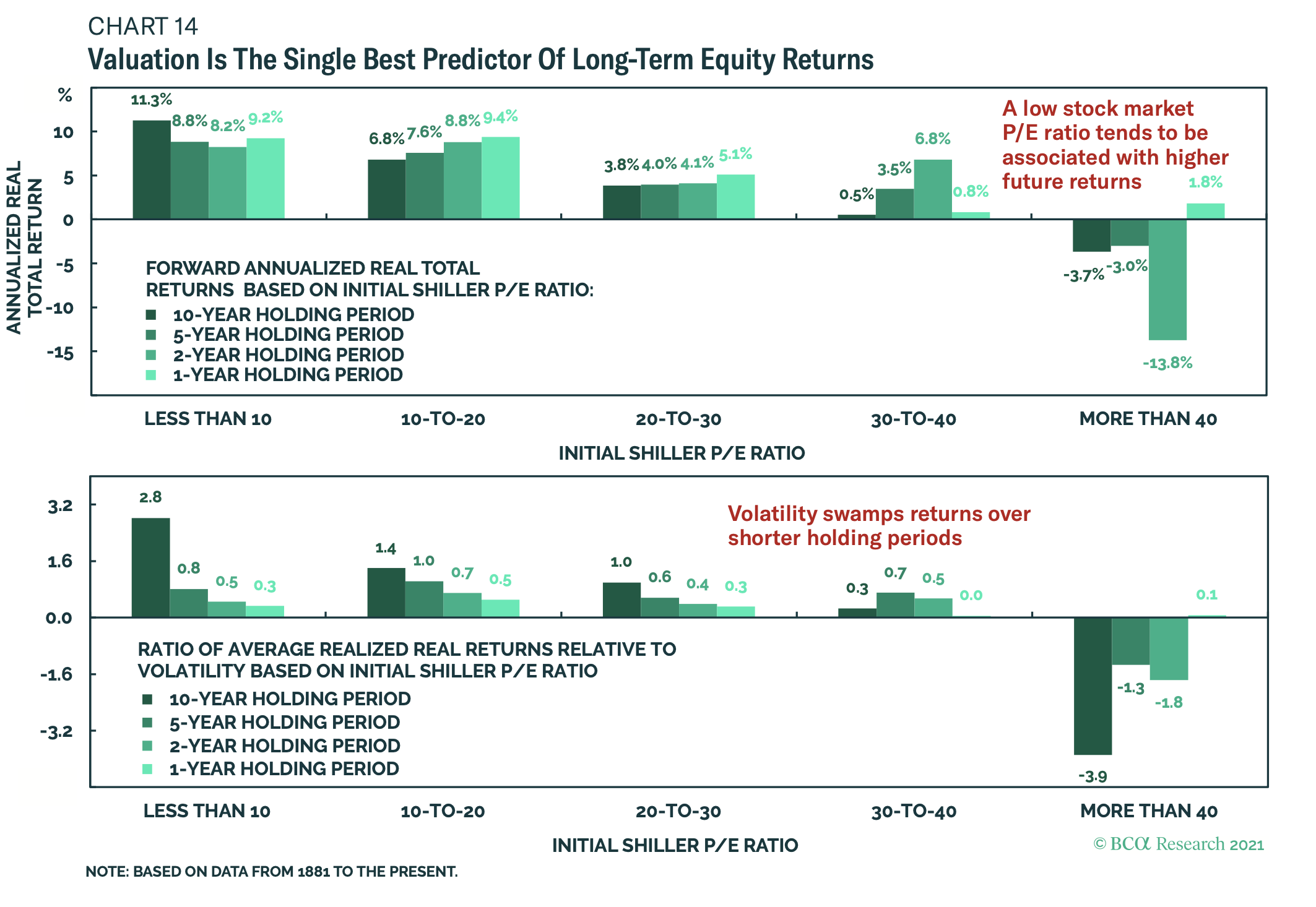

Over the long-term valuation is the best predictor of stock returns. However, volatility dominates over shorter holding periods. h/t BCA Research .

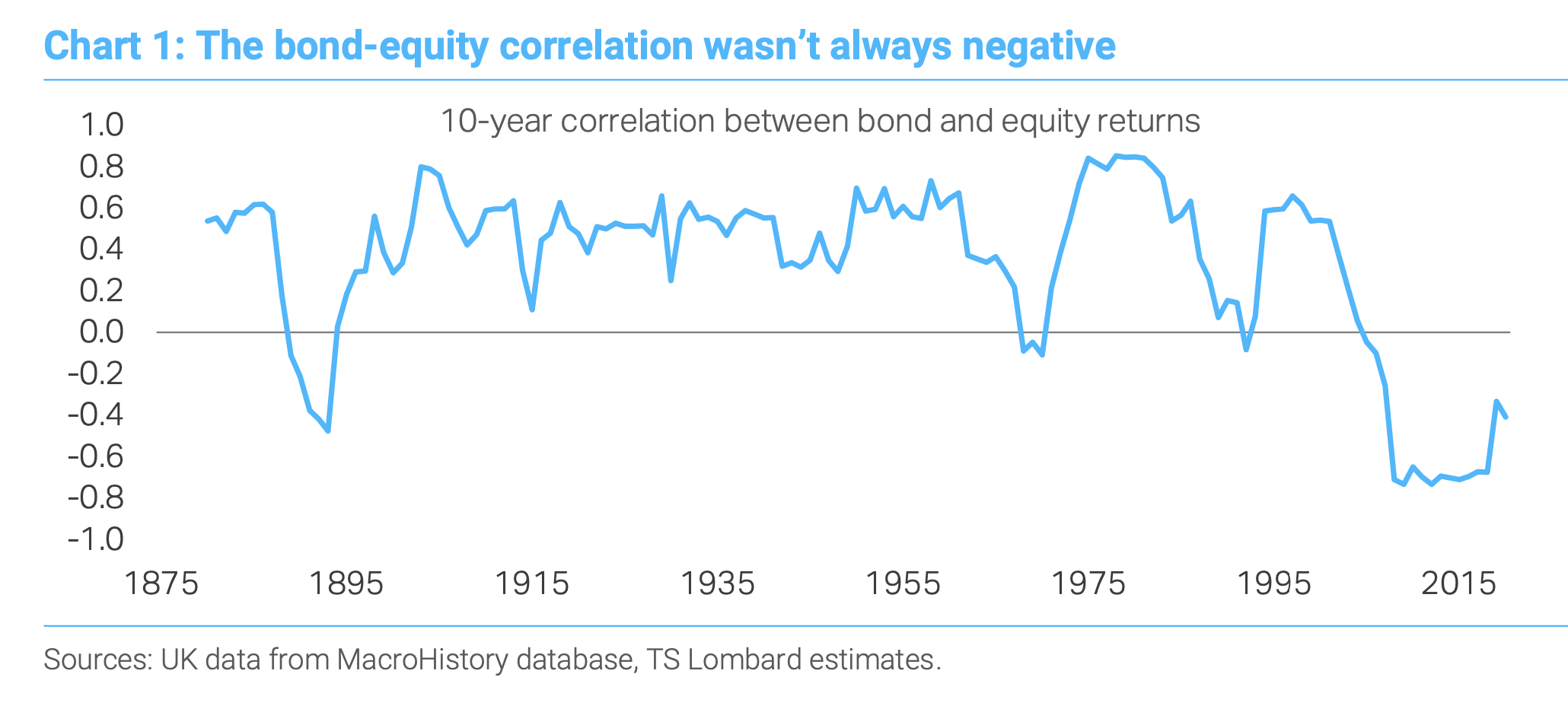

The negative correlation between bonds and equities, as demonstrated by UK data, is actually a feature of the last two decades. Historically bonds and stocks moved together more often than they didn’t.

Useful resource for capital market history enthusiast out there. A large library of manuscripts on investing and securities going back more than 300 years.

WordPress Cookie Notice by Real Cookie Banner