- “We believe even modest amounts of leverage is risky…

…but large concentrated bets like being 100% in equities are just peachy keen“ - Among the list of beliefs that the investment community holds simultaneously that are at odds.

Behavioural

Idea generation

- “The common trait of people who supposedly have vision is that they spend a lot of time reading and gathering information, and then they synthesize it until they come up with an idea.” — Fred Smith, Overnight Success: Federal Express and Frederick Smith, Its Renegade Creator

Attractiveness and Fund Manager Performance

- “In this paper, we study the relationship between stock fund managers’ facial attractiveness and fund outcomes. Utilizing the state-of-art deep learning technique to quantify facial attractiveness, we find that funds with facial unattractive managers outperform funds with attractive managers by over 2% per annum. We next show that good-looking managers attract significant higher fund flow especially if the funds are available on Fintech platforms where their photos are accessible to investors. Good-looking managers also have greater chance of promotion and tend to move to small firms. The potential explanations for their underperformance include inadequate ability, insufficient effort, overconfidence and inefficient site visits.”

The Laws of Trading

- “A book about trading isn’t ever actually about trading. It is either:

- “A former trader sharing stories from their glory days, e.g. Liar’s Poker, the exposé that morphed into a how-to guide, or“

- “Tales of Icarus flying too close to the sun, where readers revel in schadenfreude, e.g., When Genius Failed.“

- So starts this engaging review of “The Laws of Trading” – a different take on the endeavour with broader lessons for decision-making in other domains.

- The book’s author, Lebron, trained and worked as an engineer before switching to a career as a researcher and quant trader at Jane Street.

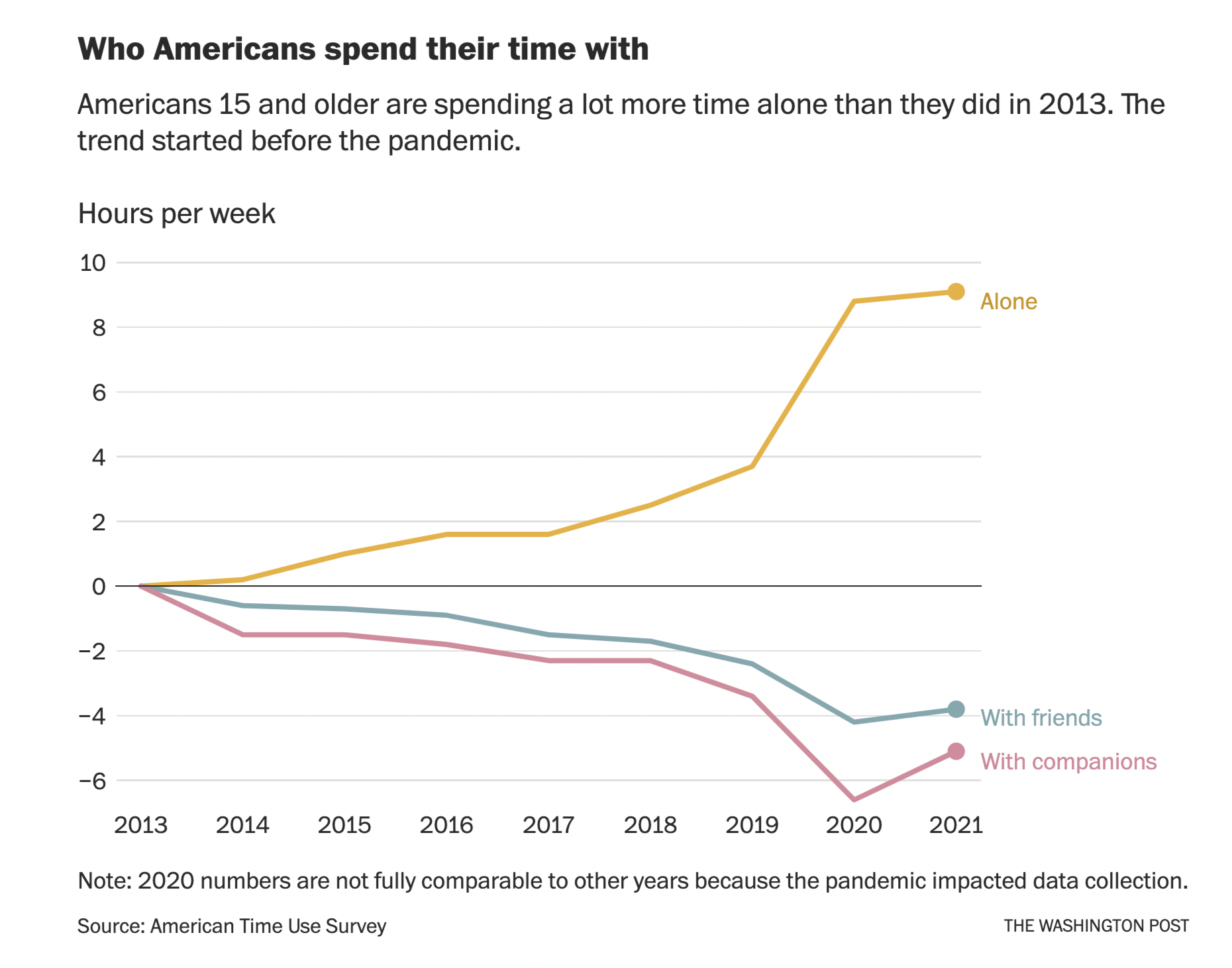

Being Alone

How to Negotiate

- Fascinating article based on a Wharton professor’s guide to negotiating for reasonable people.

- Some of the key points:

- Leverage – “In general, the person who feels better about “no deal” has the most leverage, and the person that’s less okay with “no deal” has the least leverage.“

- Have specific justifiable goals – preparation is key here.

- Establish and maintain trust – “If it’s not there, trust is the single biggest obstacle to a good deal.”

- Get information – “More listening = more leverage.”

- Concessions – “Link them with “if…then.” Make sure they recognize you’re giving up something of value so they feel the need to reciprocate.“

Expert Interview Advice

- How to interview and ask good questions is a key skill in the investor toolkit.

- This ebook guide on how to conduct an expert interview by Stream is well worth a skim (you can grab a 14-week free trial to Stream and read all of their 20,000+ expert interviews on companies).

- This is also a nice complementary FS piece on how to generally ask better questions.

Bewilderment

- They say in investing it is all about having strong opinions weakly held.

- Another way to say this is – bewilderment to combat excessive certainty, inflexibility, over confidence.

- “You no longer need to exhaust yourself pretending to understand what you don’t or making pronouncements about questions that are above your pay grade. You can trade false simplicity for complicated truth. And the resulting worldview is more useful and more beautiful because it genuinely reflects reality. That’s why a synonym for bewilderment is wonder, which, at least for me, is not terrifying but exhilarating.”

The Awkward Silence

- A useful tool for any investor interviewing management.

- “I learned this one from the psychoanalysts. Nobody likes an awkward silence. If a patient tells you something, and you are awkwardly silent, then the patient will rush to fill the awkward silence with whatever they can think of, which will probably be whatever they were holding back the first time they started talking. You won’t believe how well this one works until you try it. Just stay silent long enough, and the other person will tell you everything. It’s better than waterboarding.“

- Source.

Some Things to do

- A delightful list “of things you’re allowed to do that you thought you couldn’t, or didn’t even know you could.“

- Especially like the idea of hiring a researcher or expert consultant – and how to go about doing that.

- Really has something for everyone.

What if reading is bad?

- You are reading text right now. It engulfs our lives.

- “Between 1900 and 1990, the amount of time the average American spent reading and writing remained broadly consistent: somewhere between one and two hours a day.”

- With the advent of the internet and text messaging – this more than doubled to four to five hours.

- It is estimated the average internet user sees 490,000 words per day (more than War and Peace!).

- As this wonderful contrarian article argues – this might not, as many argue, be all good.

- “Every time we read, we inevitably conceptualize the world, in perhaps an ever-increasingly abstract way. And it’s conceivable that we may reach a point where those abstracting effects go too far.“

- Article sourced from The Browser – a brilliant resource.

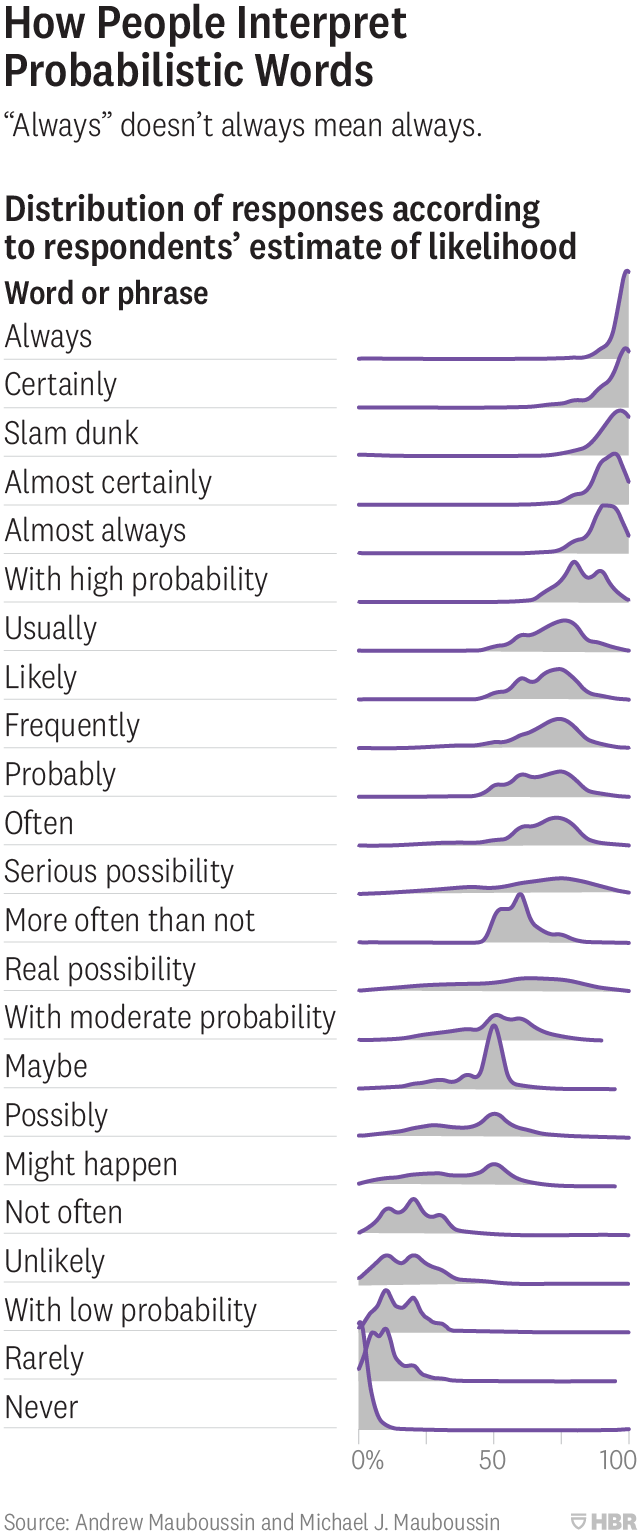

Probabilistic Words

- People use words to describe probabilities all the time.

- Yet this leads to a huge amount of confusion, especially in financial press.

- In this great article, Mauboussin (two of them) lay out learnings from a survey they did on this topic.

- Take this chart – the term “real possibility” was taken to mean anything from 20%-80% by 1,700 people surveyed – a huge range.

- Lots of interesting ideas inside on how to “combat” this bias.

CEOs Appearing on Podcasts

- A new paper examines the question of why CEO’s allocate precious time to appearing on podcasts.

- Between 2016 – 2020 over a quarter of all S&P 1500 CEOs appeared on at least one podcast.

- This has grown from 6% in 2016 to 22% in 2020.

- They find it tends to be CEO’s of firms more focussed on consumers and ESG.

- It also tends to be CEOs who have strong reputation incentives (looking for a new job, have own twitter account, founders).

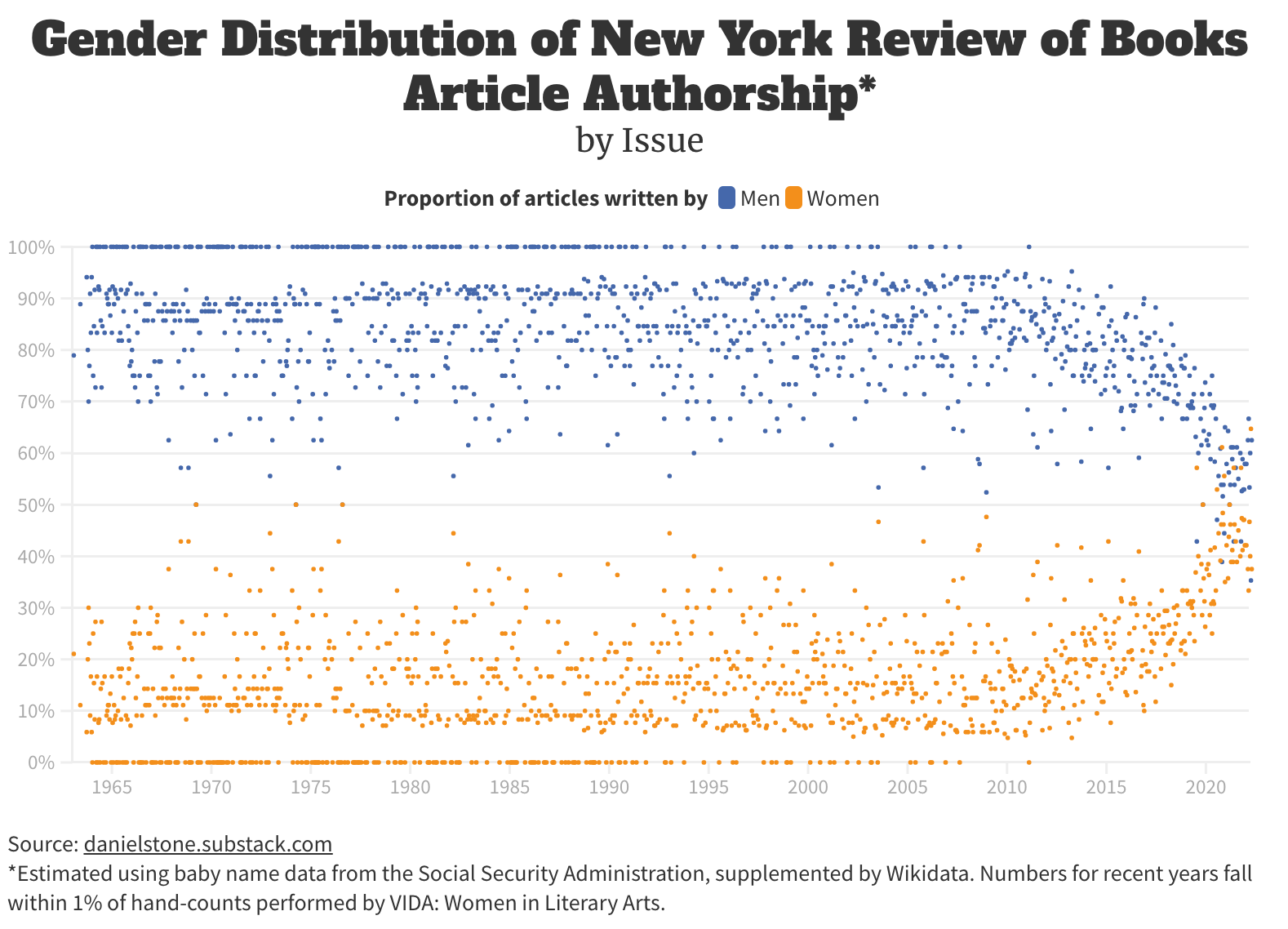

Gender and NYRB

- Interesting chart via The Browser (a must subscribe) plotting each issue of the New York Review of Books (NYRB) by the gender mix of authors.

- “What you are seeing is that there are only twelve issues out of 1228 (1%) to which women have contributed half or more of the articles. Nine of them have appeared within the past three years. Meanwhile there are about 196 issues (16%) to which not a single woman contributed an article.”

- Source (more stats inside).

Thinking Tools

- This is a useful collection of thinking tools and models – presented in a well designed way.

- Several of these are useful to investors – for example the second order thinking advocated by Howard Marks.

Soros and Reflexivity

- Many have heard of George Soros’ idea of reflexivity.

- This idea is important especially as we look at the current market situation.

- To understand it more deeply it is worth reading Soros’ own writing on the subject – especially this piece from the Journal of Economic Methodology (2014).

- Here Soros lays out his full framework which is actually based on two propositions – reflexivity but also human fallibility – together the siamese twins that form “the human uncertainty principle”.

- “My conceptual framework deserves attention not because it constitutes a new discovery, but because something as commonsensical as reflexivity has been so studiously ignored by economists.”

Ten Commandments by Bertrand Russell

1. Do not feel absolutely certain of anything.

2. Do not think it worthwhile to proceed by concealing evidence, for the evidence is sure to come to light.

3. Never try to discourage thinking for you are sure to succeed.

4. When you meet with opposition, even if it should be from your husband or your children, endeavor to overcome it by argument and not by authority, for a victory dependent upon authority is unreal and illusory.

5. Have no respect for the authority of others, for there are always contrary authorities to be found.

6. Do not use power to suppress opinions you think pernicious, for if you do the opinions will suppress you.

7. Do not fear to be eccentric in opinion, for every opinion now accepted was once eccentric.

8. Find more pleasure in intelligent dissent than in passive agreement, for, if you value intelligence as you should, the former implies a deeper agreement than the latter.

9. Be scrupulously truthful, even if the truth is inconvenient, for it is more inconvenient when you try to conceal it.

10. Do not feel envious of the happiness of those who live in a fool’s paradise, for only a fool will think that it is happiness.

Alpha = Pick the Right Stocks

- According to new data analysis – the alpha generated by professional fund managers comes from one major source = research process.

- Inalytics studied 752 portfolios, with at least three year performance data.

- The average alpha was 308bps.

- Stock research added on average 319bps while position sizing led to average alpha loss of 11bps.

- Only 46% of participants delivered any positive alpha from sizing.

- “Stock picking is the primary area in which managers demonstrate skill”

- Source.

Interview Questions

- Google has hard ones.

- But what about the really good ones?

- Reid Hoffman used to ask – “What do you plan to do after you leave Linkedin” – brilliant as it acknowledges that people don’t stay in jobs forever and communicates a support for their vision of the future.

- This one from Marginal Revolution is also great – “What are the open tabs in your browser right now?”

Far from Nick Train

- Brilliant podcast interview with the Nick Train of Lindsell Train.

- Nick has an unique grasp of history when it comes to companies, with a horizon that feels 15-20 years longer than others.

- His recommendation to a younger self, right at the end of the podcast, was also excellent.