Skip to content

The US financial sector return on equity (ROE) has almost closed its relative gap to the market. Despite this the relative price to book ratio is still below pre-covid levels. h/t MRB Partners .

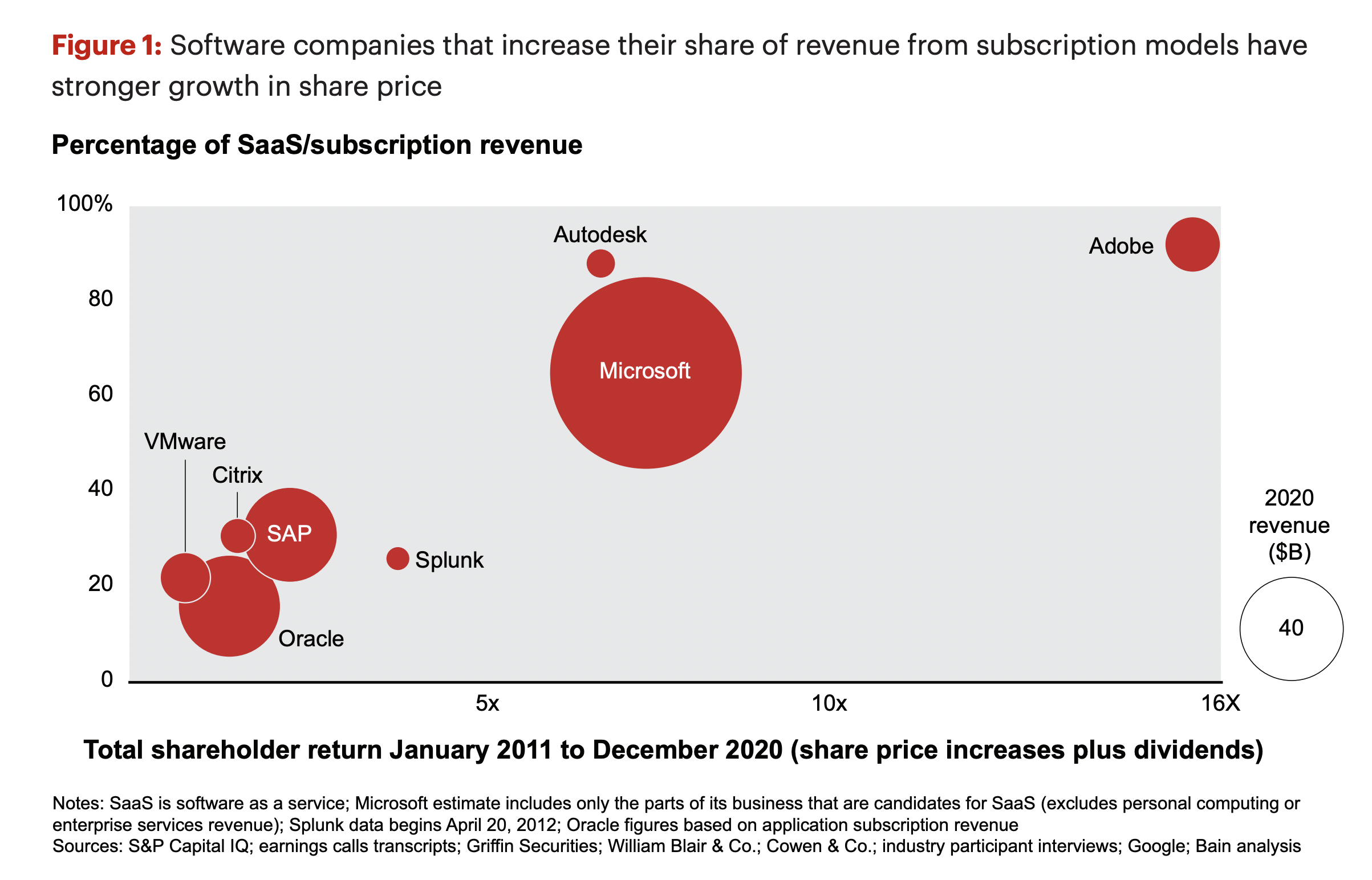

Mature software companies that move to more subscription based business, tend to have strong share price returns. Source .

A useful tool when researching a company. Head to google and type this “[COMPANY NAME] filetype:pdf site:.gov”. Finds any mentions of the company on government websites. Especially good for internal emails. h/t Hidden Monopolies .

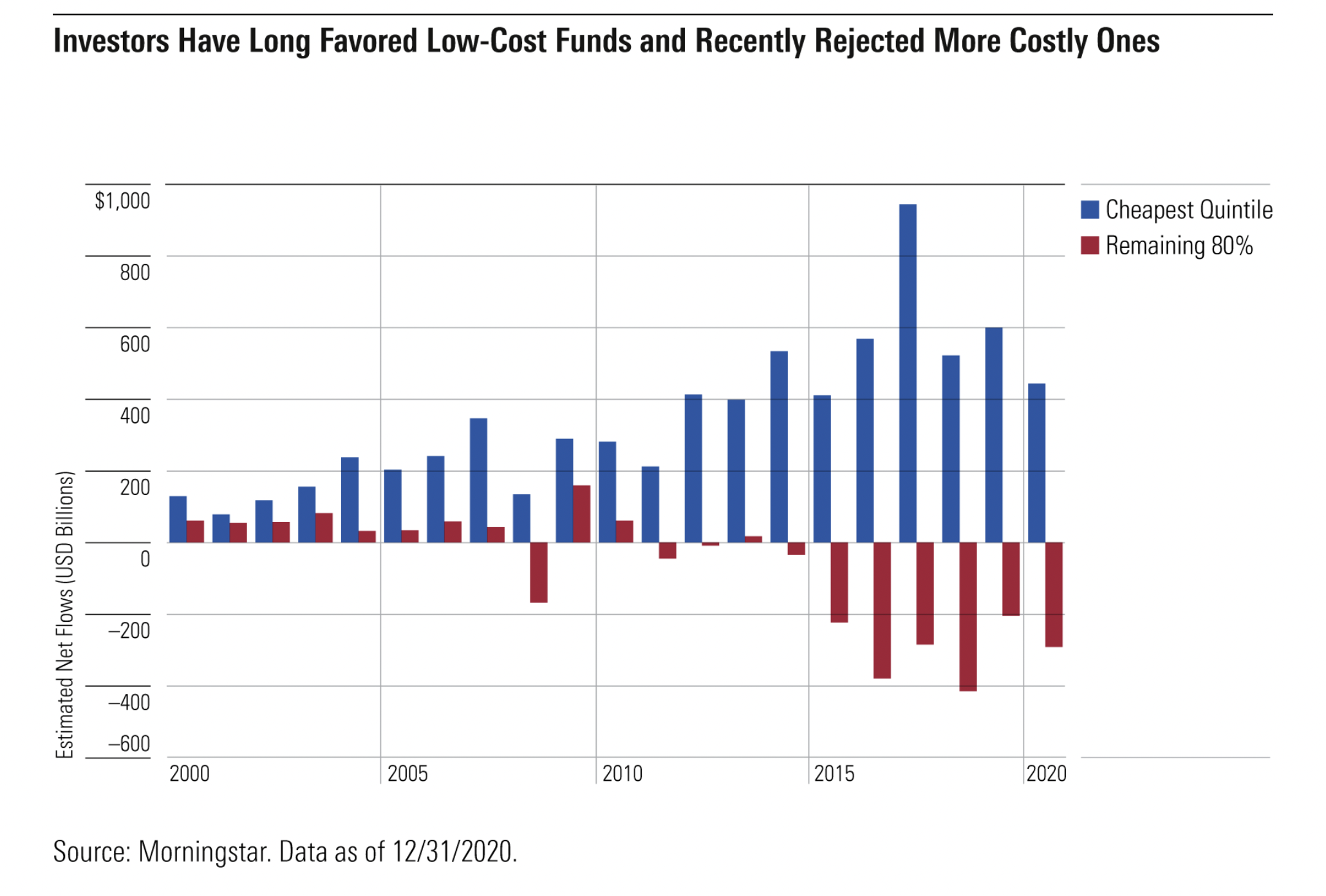

Flows into funds with low fees have always been positive. Interestingly, only the recent period has seen strong outflows from the most expensive funds. Source .

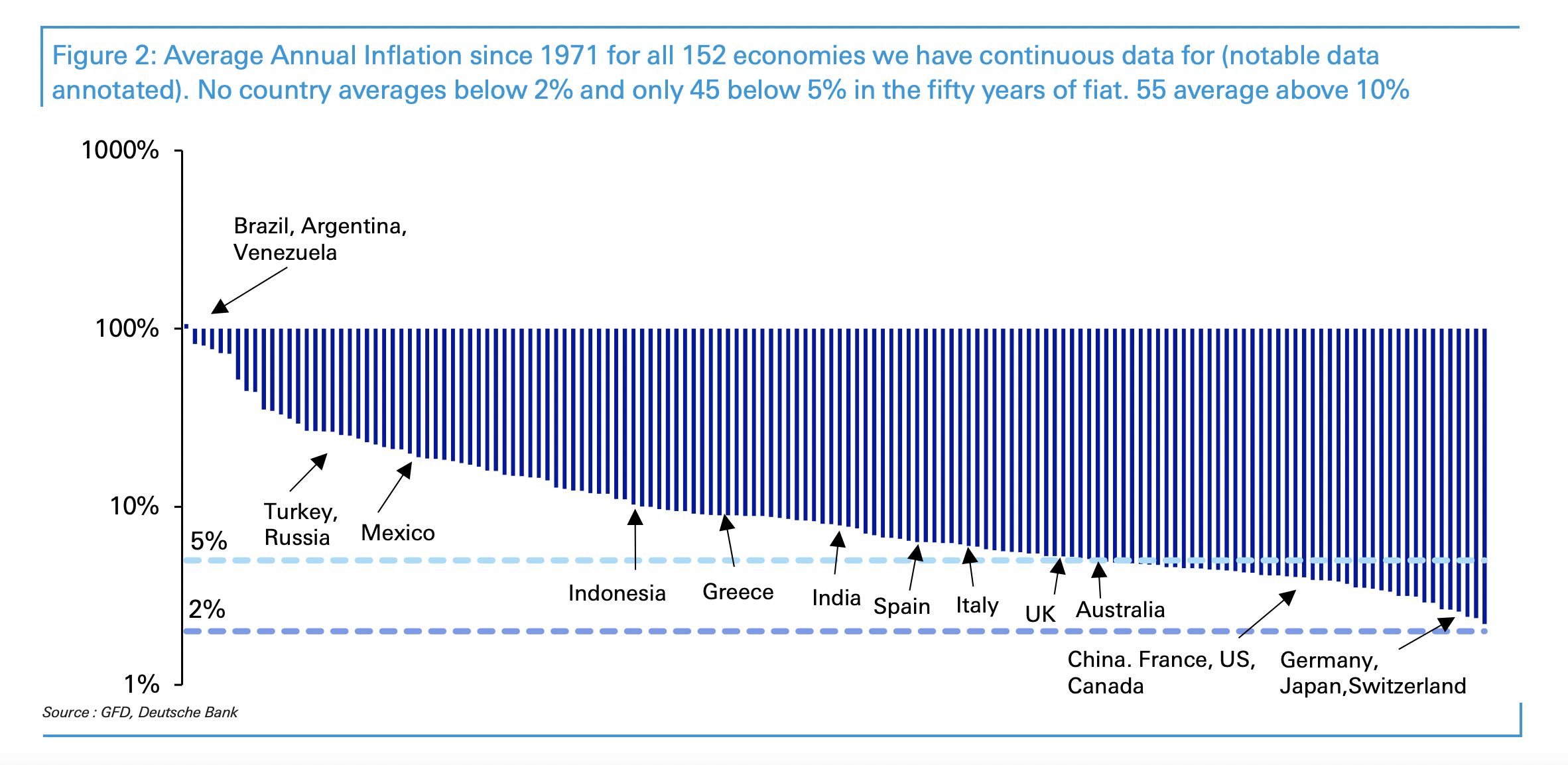

Great chart showing average inflation since 1971 for 152 economies. There is no country that averaged below 2% in the period, and only 45 averaged below 5%.

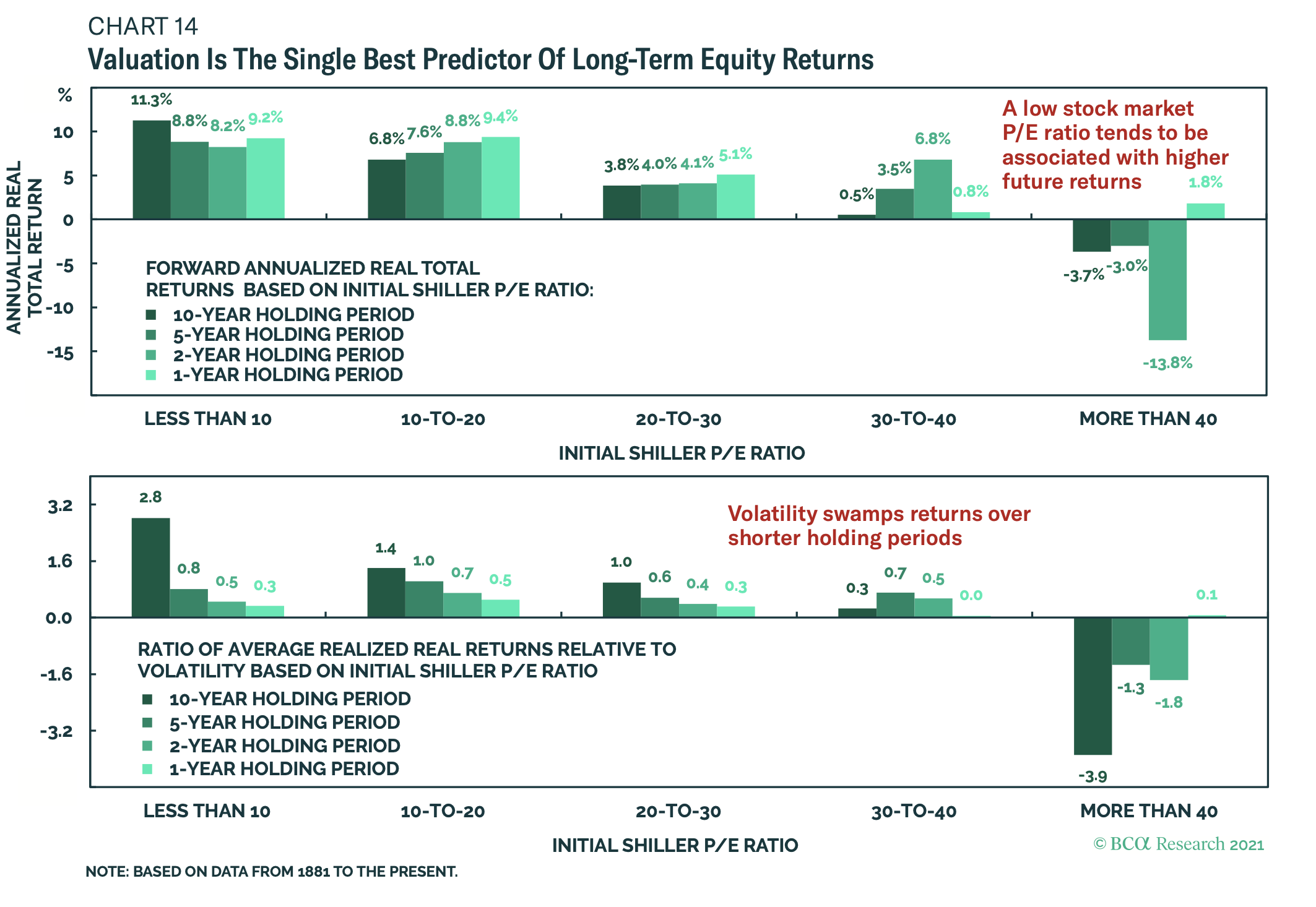

Over the long-term valuation is the best predictor of stock returns. However, volatility dominates over shorter holding periods. h/t BCA Research .

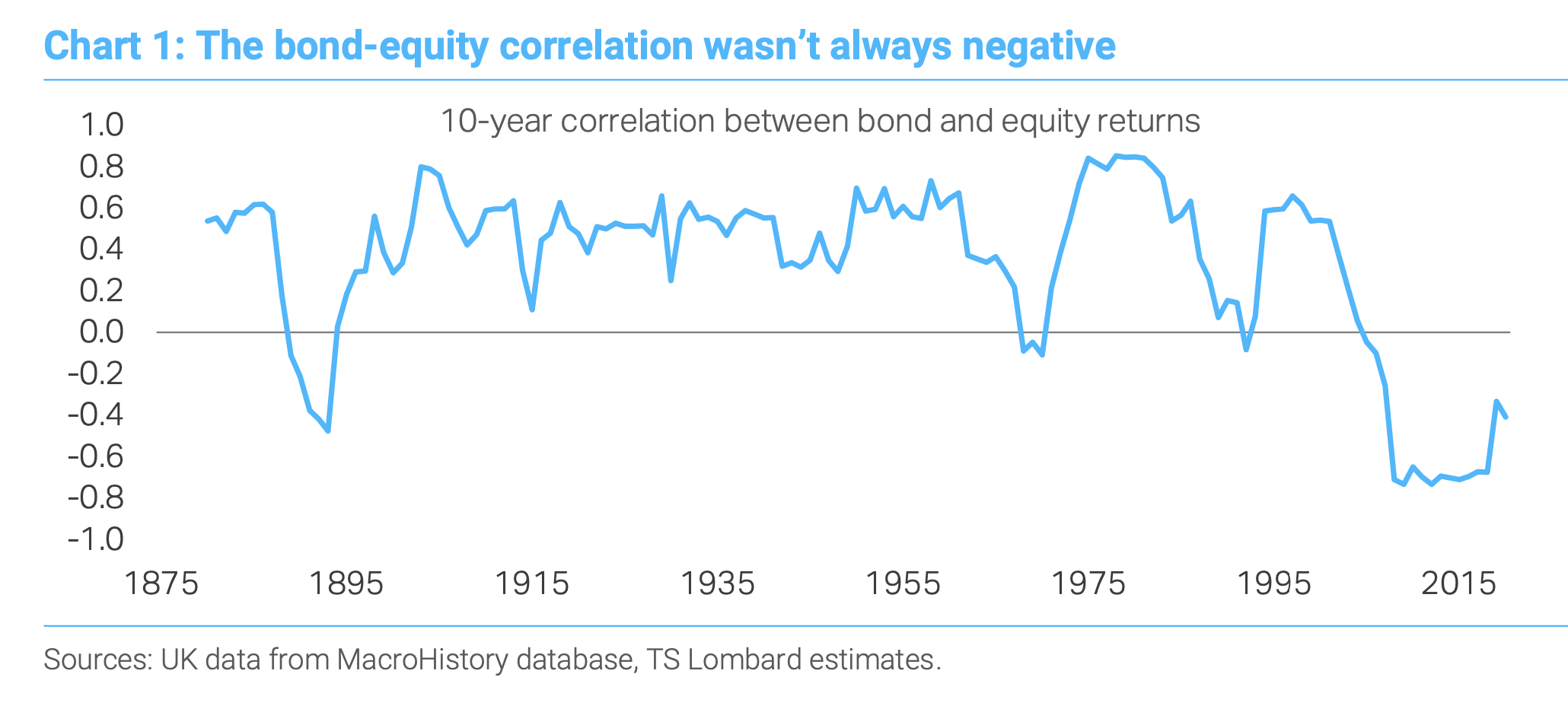

The negative correlation between bonds and equities, as demonstrated by UK data, is actually a feature of the last two decades. Historically bonds and stocks moved together more often than they didn’t.

Useful resource for capital market history enthusiast out there. A large library of manuscripts on investing and securities going back more than 300 years.

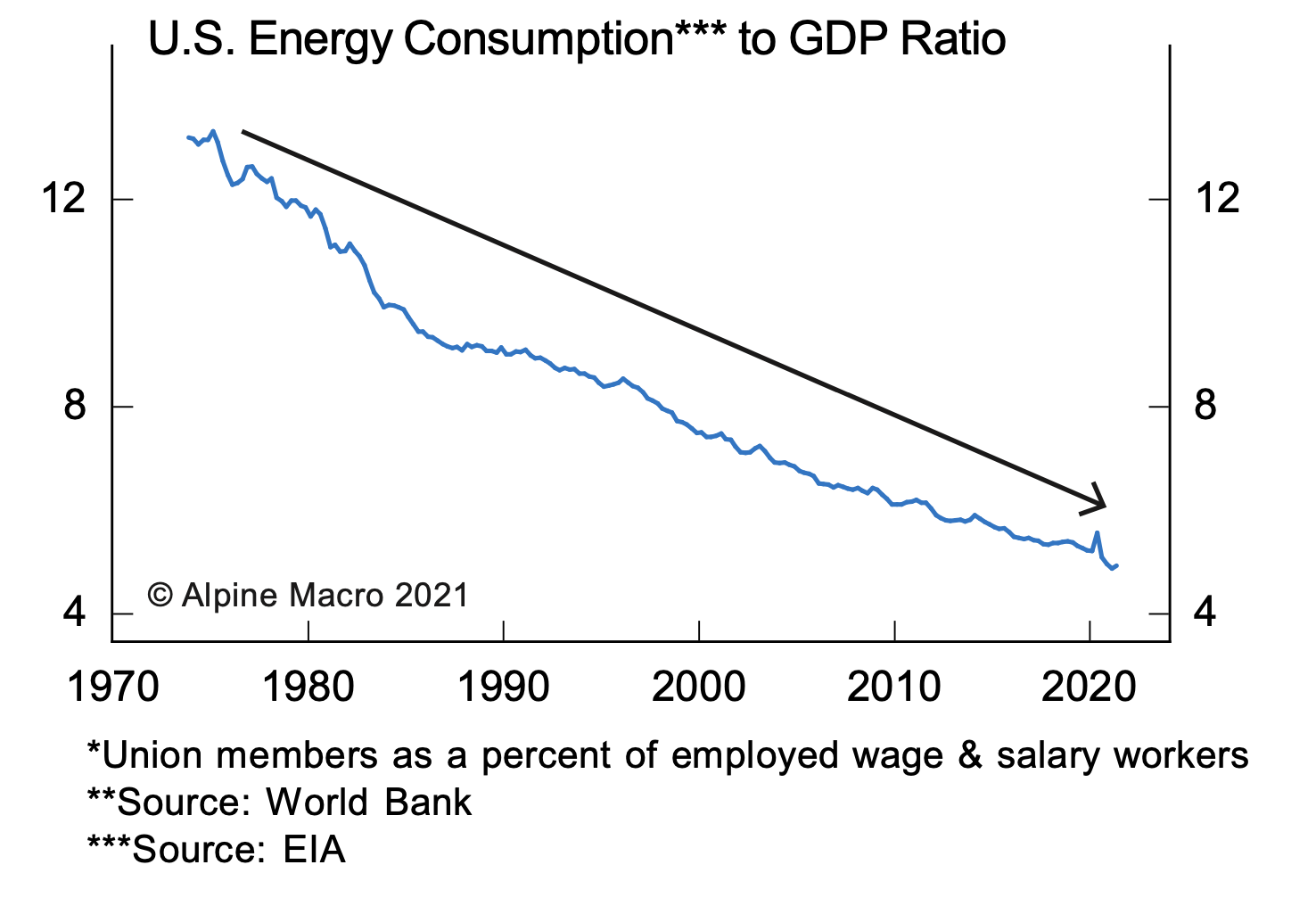

The US is a far less energy intensive economy than it used to be in the 1970s.

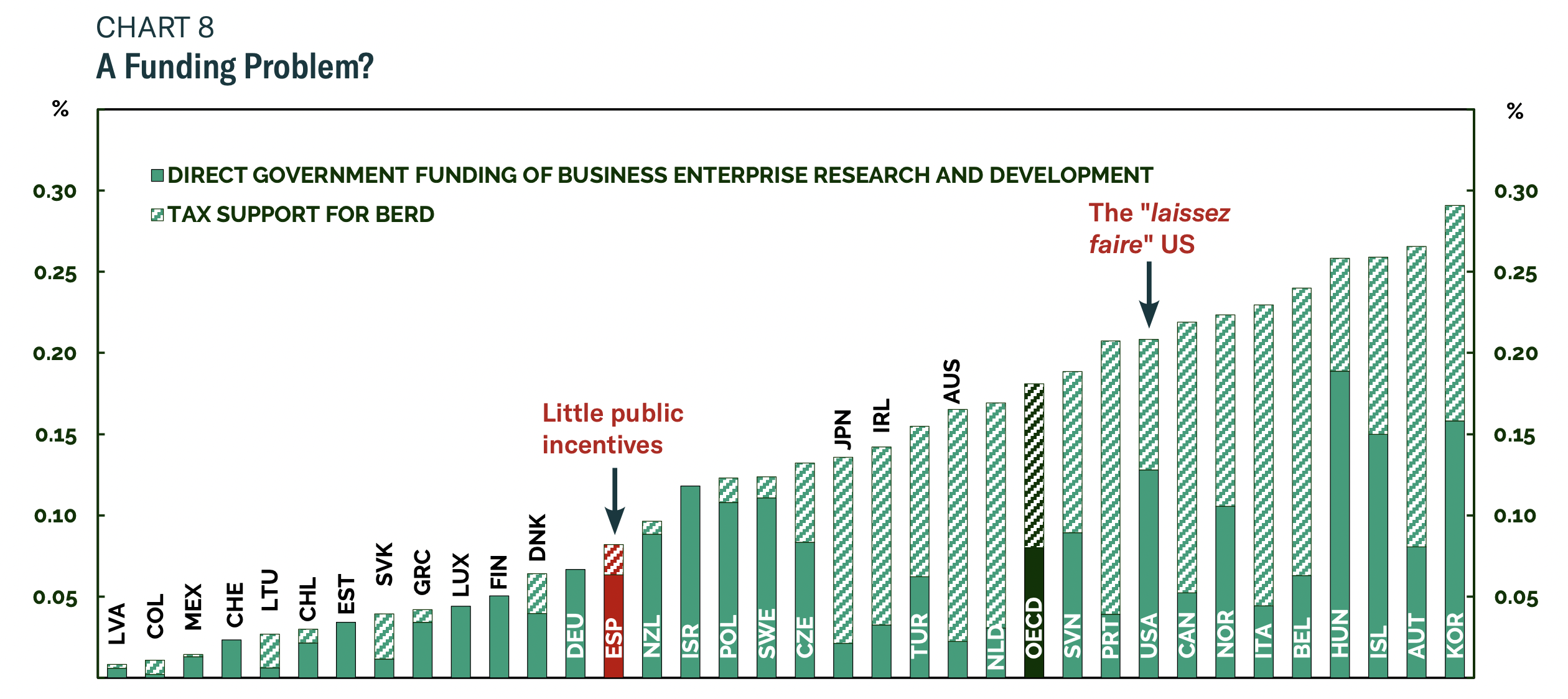

Perhaps paradoxically, the US stands out as having a relatively high level of government funding for corporate R&D. Spain on the other hand is one of the worst in Europe. h/t BCA Research .

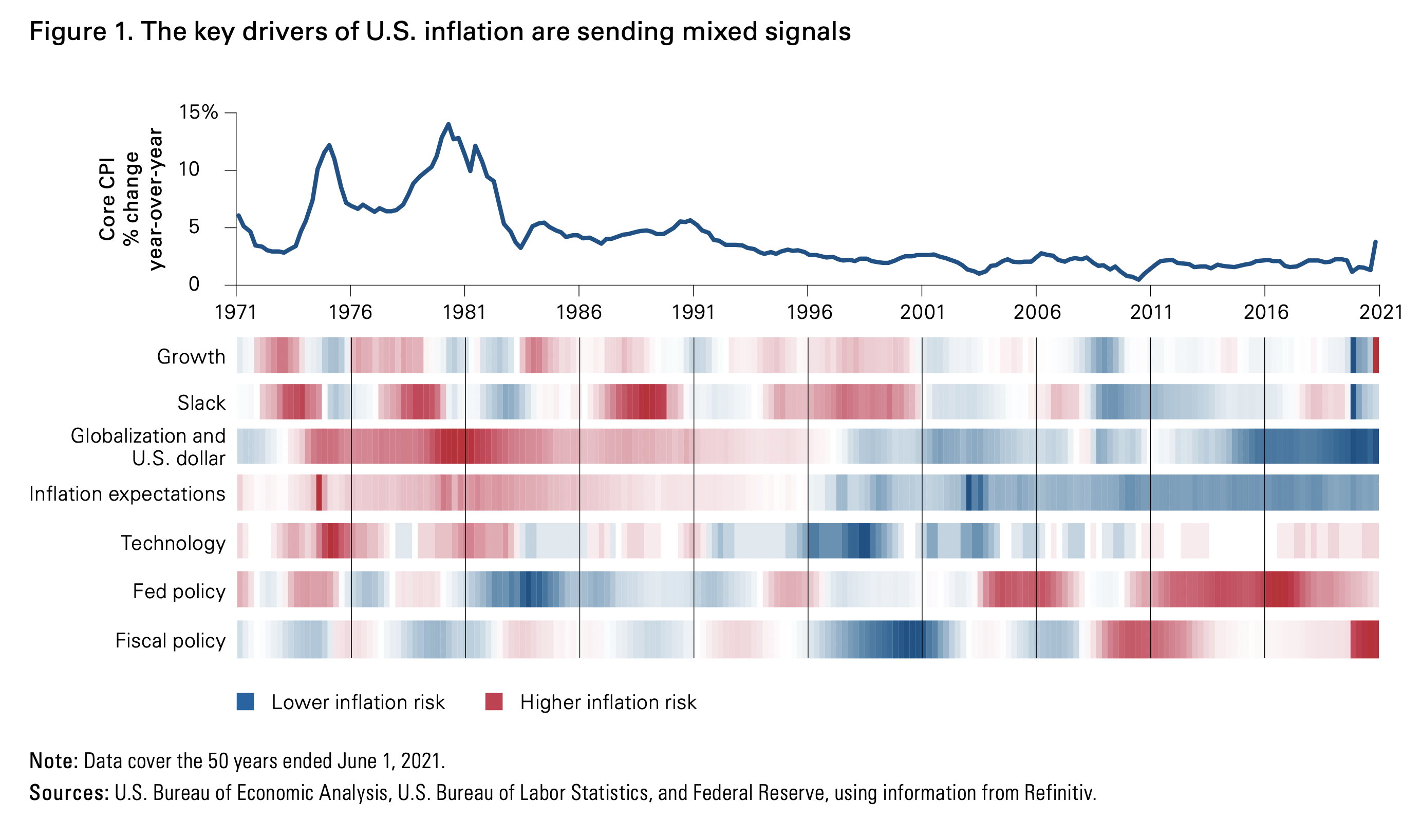

Vanguard produces a useful inflation tracker – highlighting key drivers. It is currently flashing mixed – growth and stimulative policy are pulling against deflationary technology and high unemployment. Interestingly, fiscal policy could continue to run strong driving 2022 inflation above 3%, an outcome not currently predicted by markets.

Interesting article about a company you probably haven’t heard of, but one that owns far more onshore oil and gas wells than Exxon. The strategy is one of buying old “dying” wells to squeeze more life out of them. The company isn’t short on controversy – the environmental cost of such wells is high (they leak gas) and once done they need to be plugged, which the company seems to do at a fraction of the cost of others. Interesting contrast in a world of rising energy costs.

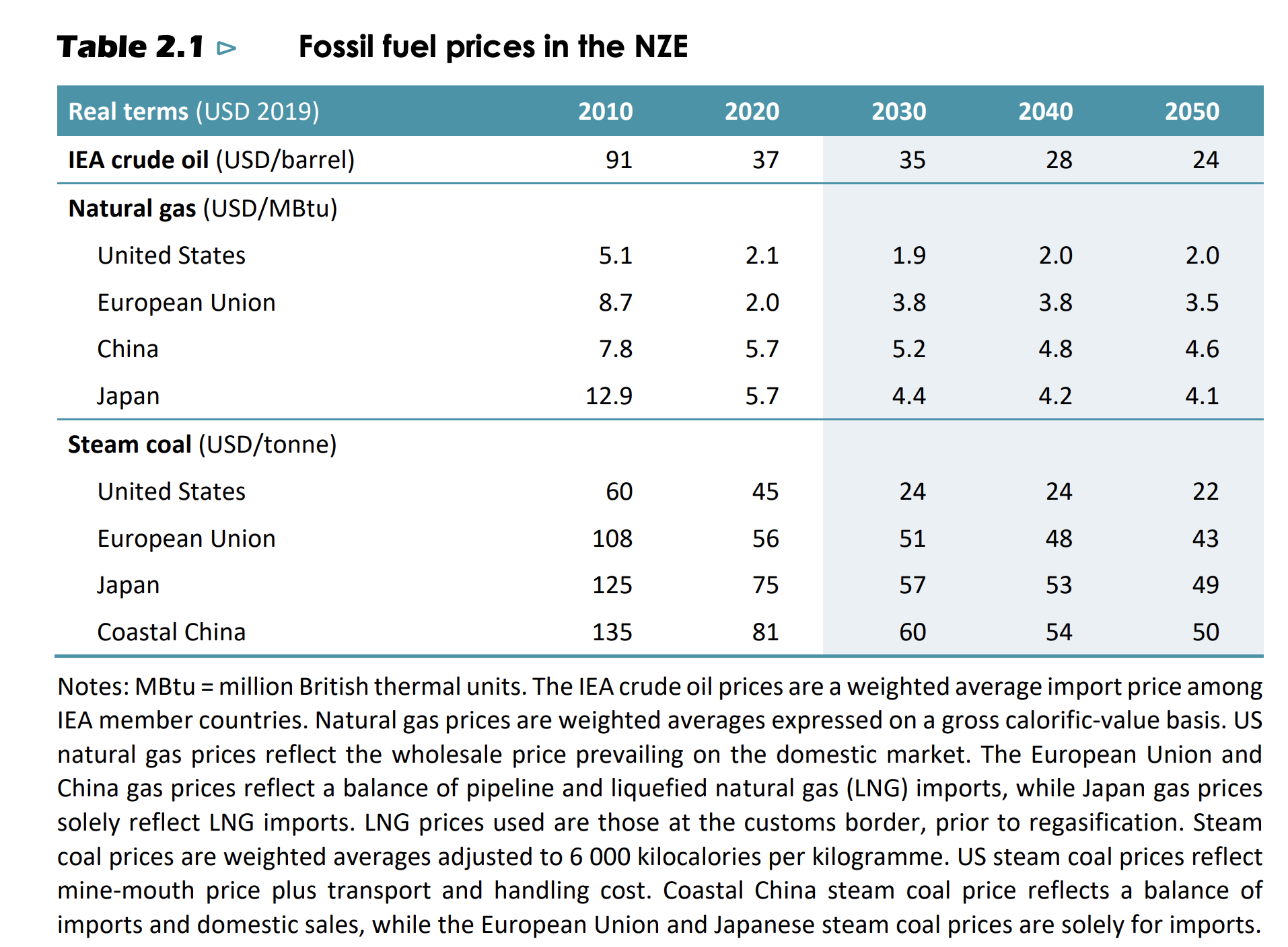

IEA forecasts of various fossil fuel prices in a net zero carbon emissions scenario.

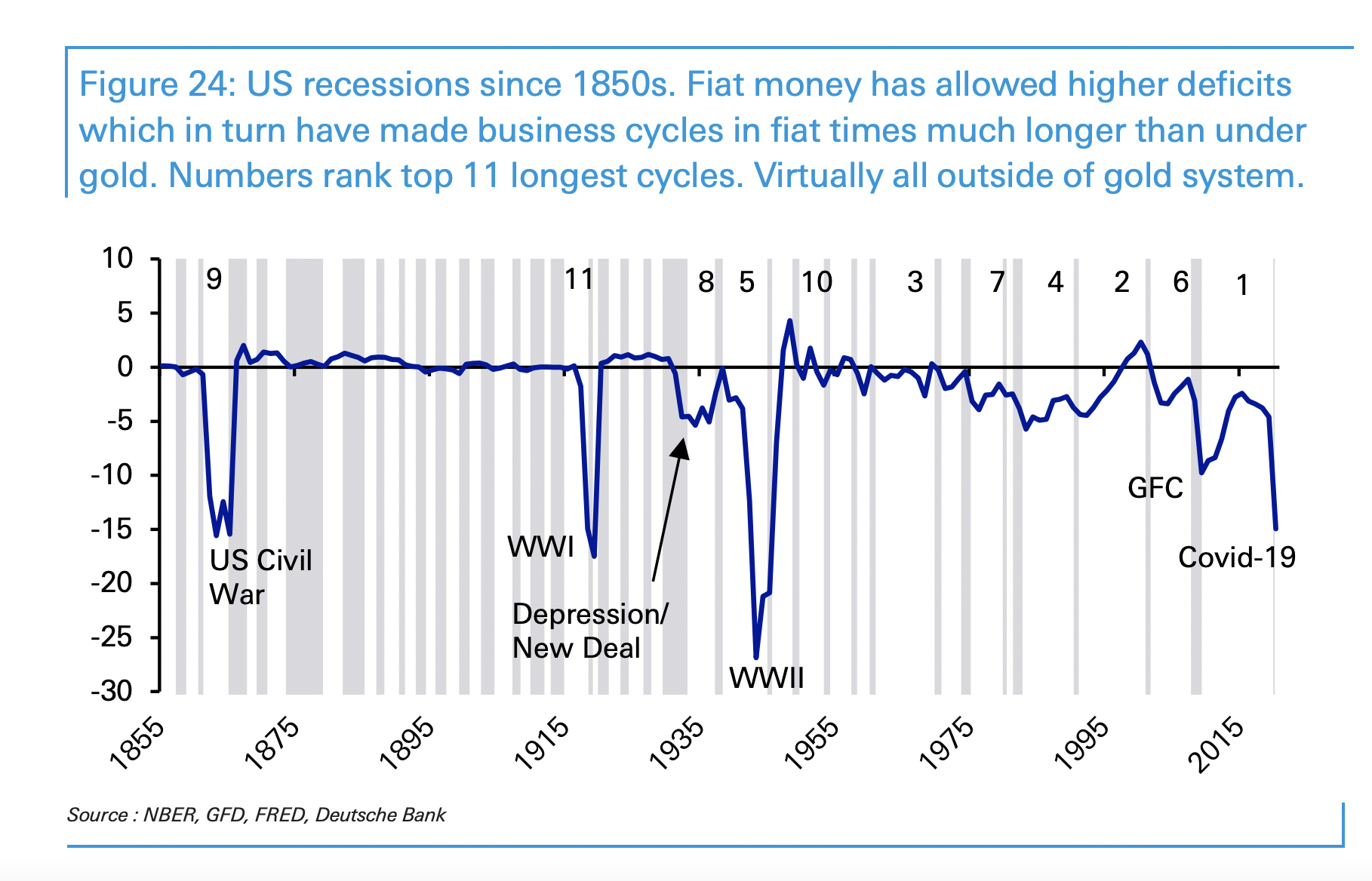

Long-term chart from Deutsche Bank’s Annual Asset Return Study . It suggests that since the introduction of fiat money, cycles have become a lot longer. Of the top 11 longest cycles since 1850, all but two are post the abandonment of gold standards.

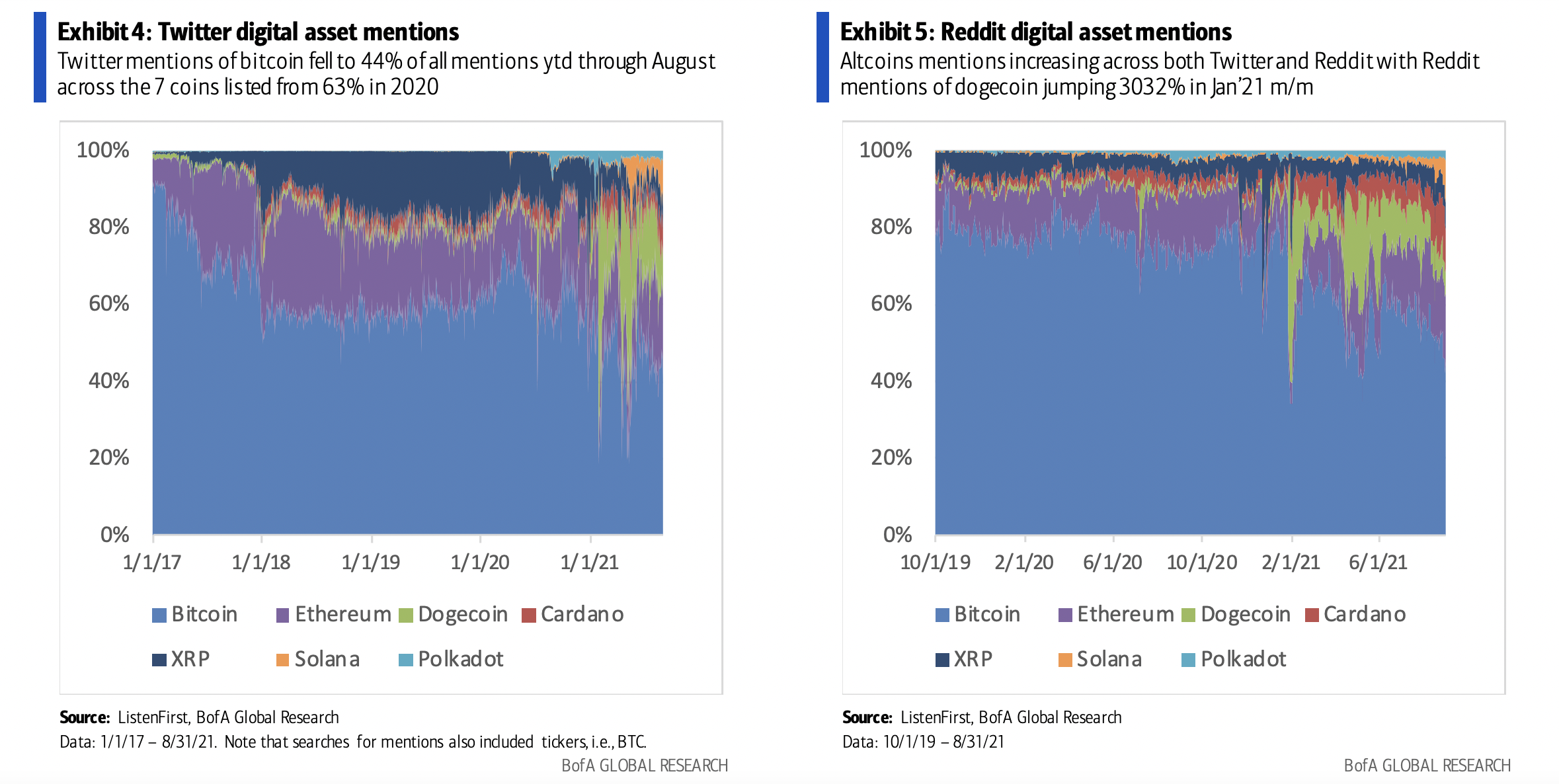

Social media conversations around digital assets are diversifying away from bitcoin.

Must read profile of Wang Huning. “A member of the CCP’s seven-man Politburo Standing Committee, he is China’s top ideological theorist, quietly credited as being the “ideas man” behind each of Xi’s signature political concepts , including the “China Dream,” the anti-corruption campaign, the Belt and Road Initiative, a more assertive foreign policy, and even “Xi Jinping Thought.” “ “Wang Huning is arguably the single most influential “public intellectual” alive today. “

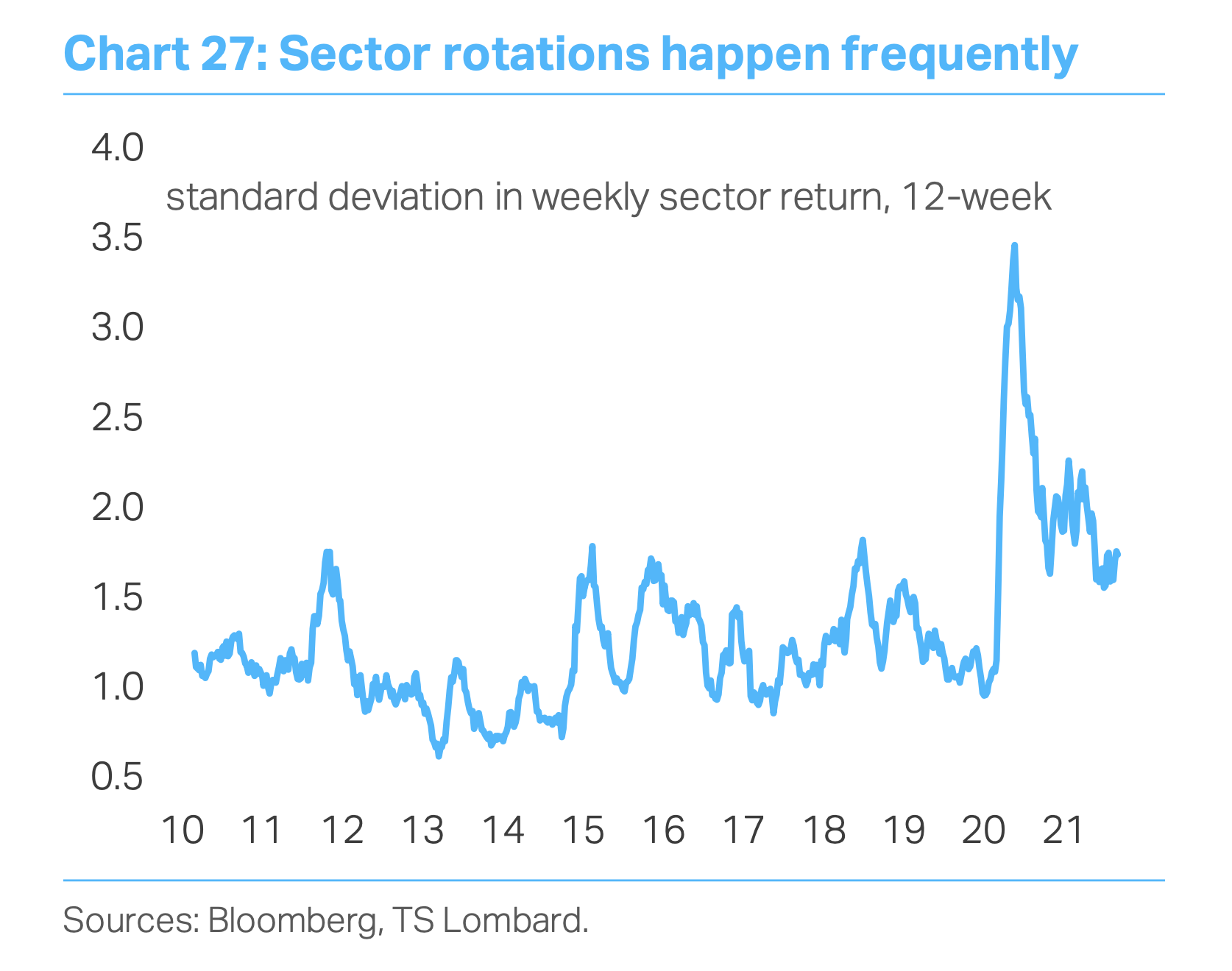

2020-2021 have seen an unprecedented level of sector rotation under the surface. h/t Daily Shot .

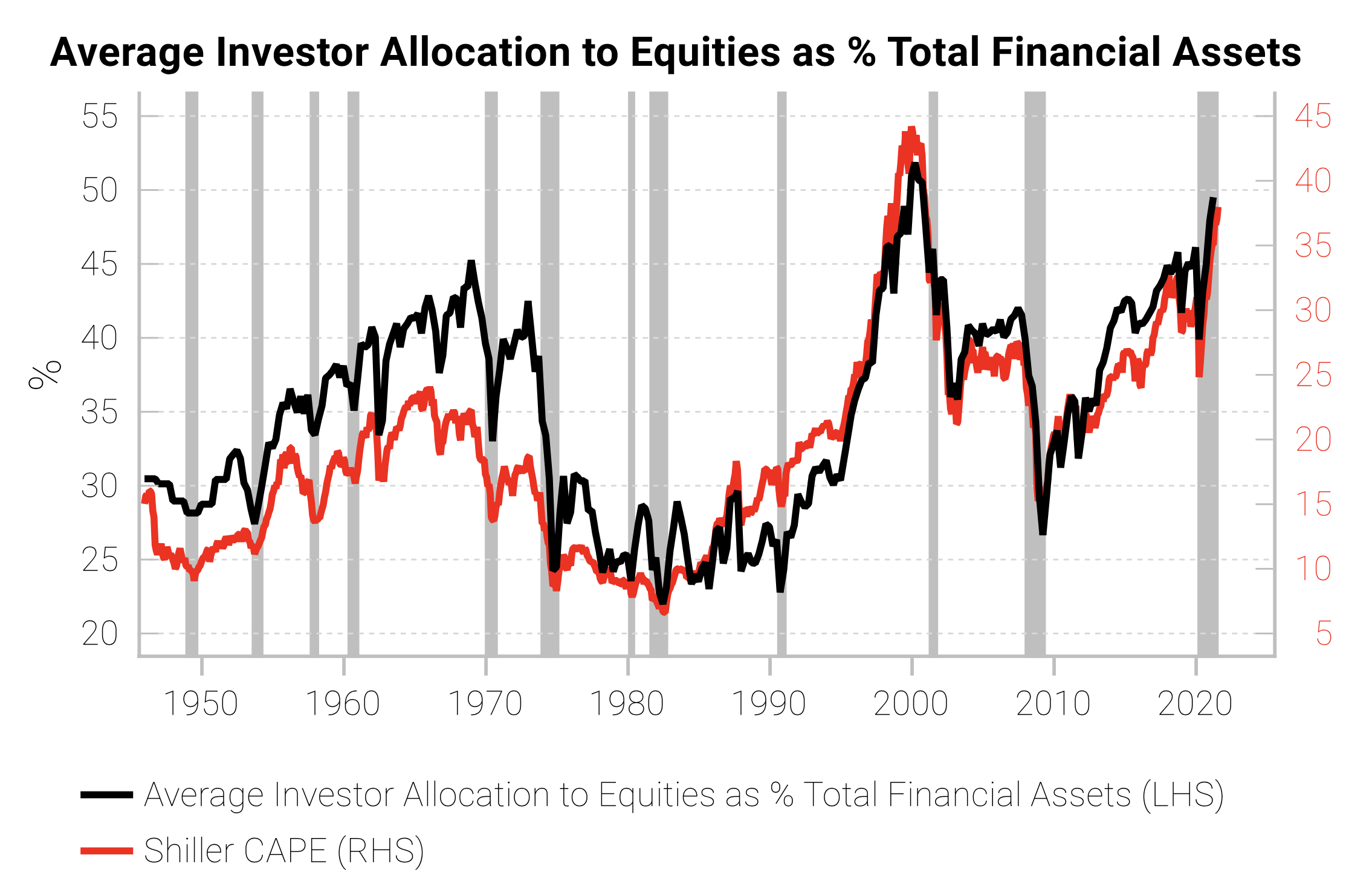

Allocation to equities since the 1950s by the average investor has moved in tandem with the cyclically adjusted P/E ratio (CAPE). Both measures are near records set during the dotcom boom. Food for thought. h/t Variant Perception via Daily Shot .

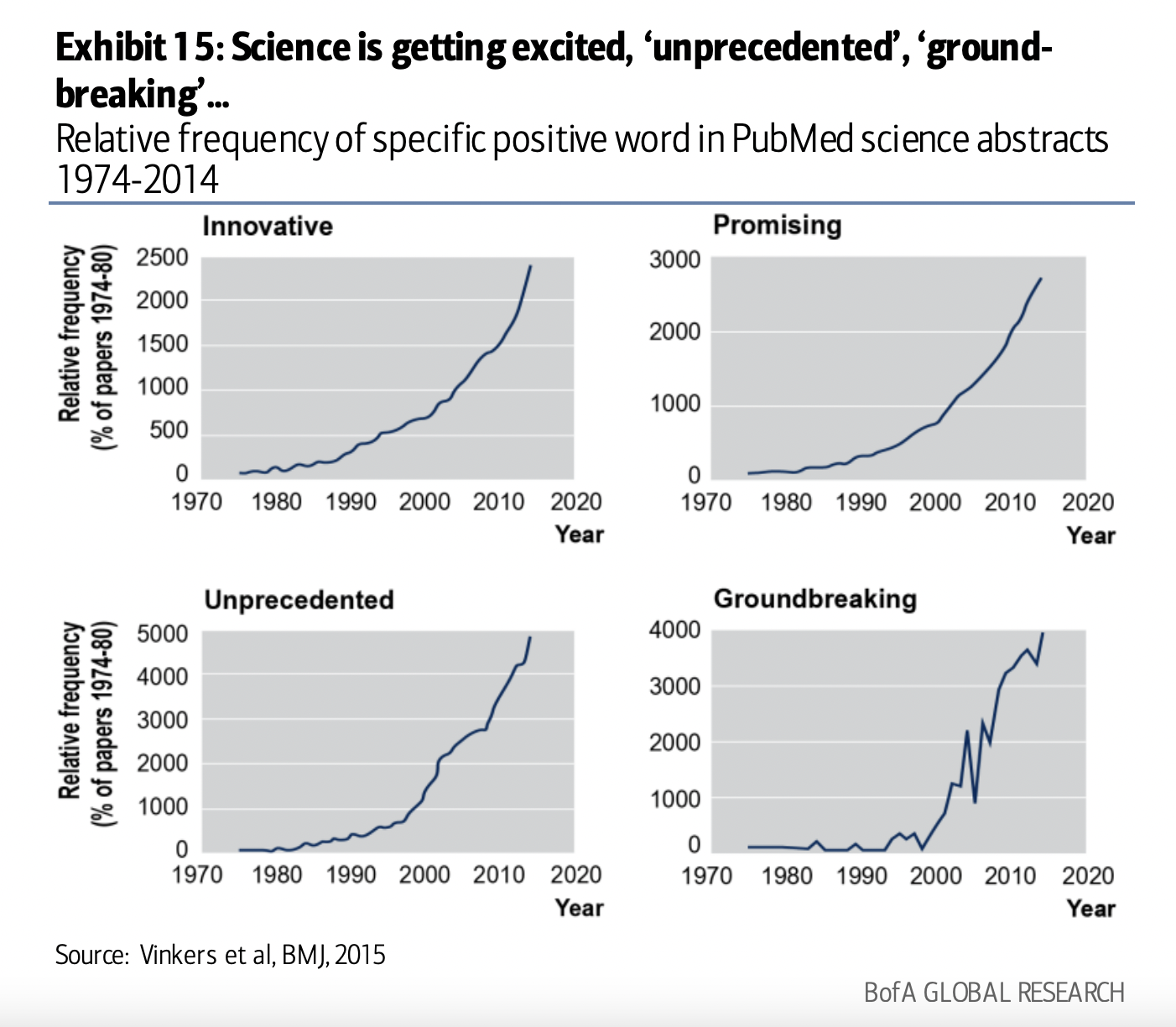

“Innovative”, “promising”, “unprecedented” and “groundbreaking”.

2020 was the 8th year where industrial property (which includes warehouses) was the top performing real estate sector. Longest run by any property sector in the last 30 years.

WordPress Cookie Notice by Real Cookie Banner