Author: Snippet.Finance

Newsletters

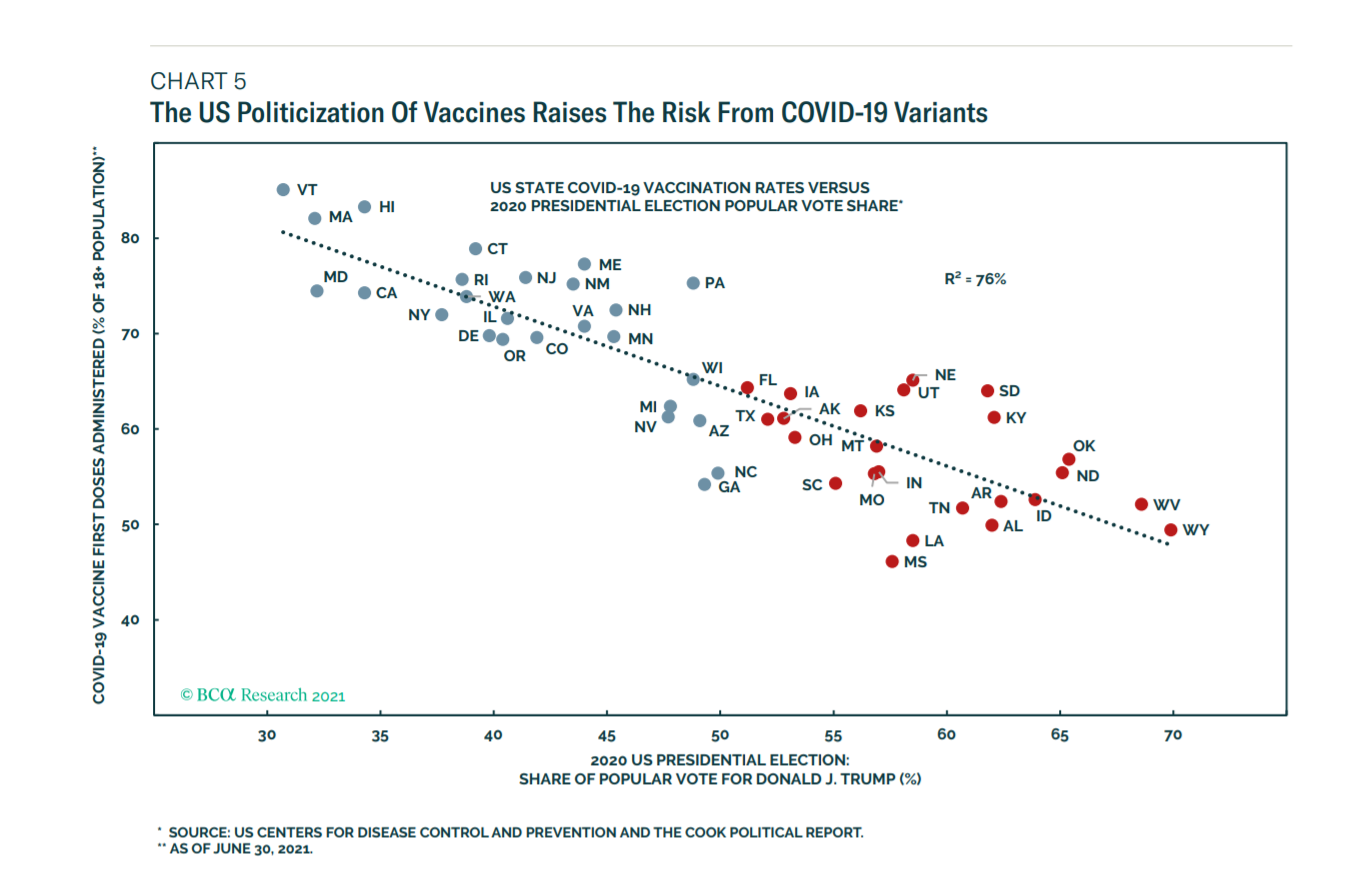

Vaccination and Politics

- US Vaccination rates by state follow the political divide.

- Many Republican-leaning states have more than half of the population still unvaccinated.

- Source: BCA Research.

GSK

- GlaxoSmithKline has been the subject of an activist attack by Elliott, who built up a significant stake in the company in April.

- GSK then hosted their long awaited investor day in June – laying out a plan for a future after spinning off their consumer health division.

- Elliott then released a letter which was quickly rebutted by the board of GSK who called for the usual “stability”.

- This was a good write up of the whole interaction.

- One interesting element that has not entered the discussion is the balance sheet.

- NewGSK will have 2x ND/EBITDA, even after gearing up consumer health to 4x and paying a dividend back. It also has a pension (£2bn deficit) and minority payments to ViiV partner Shionogi. All of this constrains the firm.

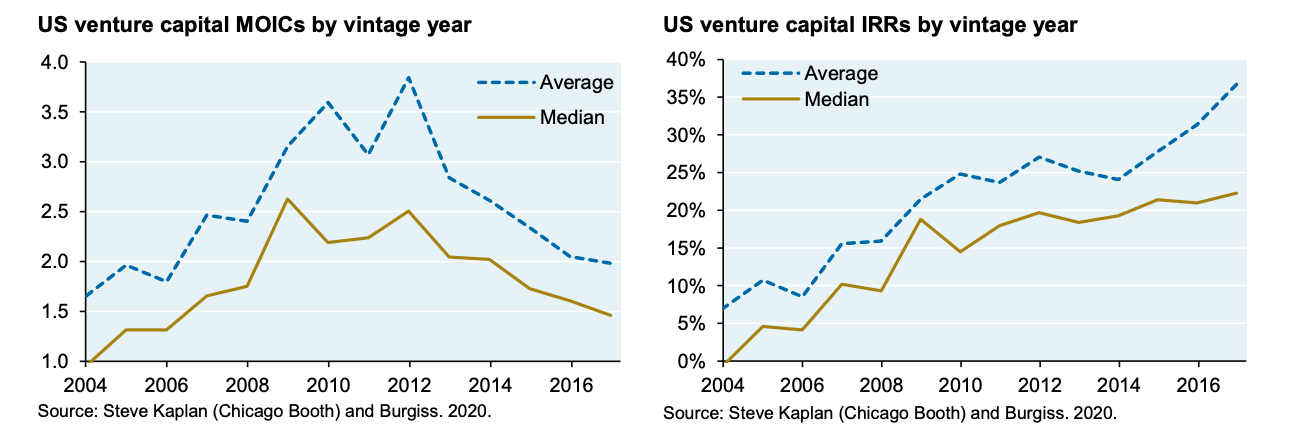

US Venture Returns

- VC managers have seen falling MOIC (multiple of invested capital) returns while IRRs, just like those in private equity buyout, have been rising.

- This can be explained by use of subscription lines and faster distributions.

- Notice the difference between median and average – VC tends to have some very high return/size funds.

- Source.

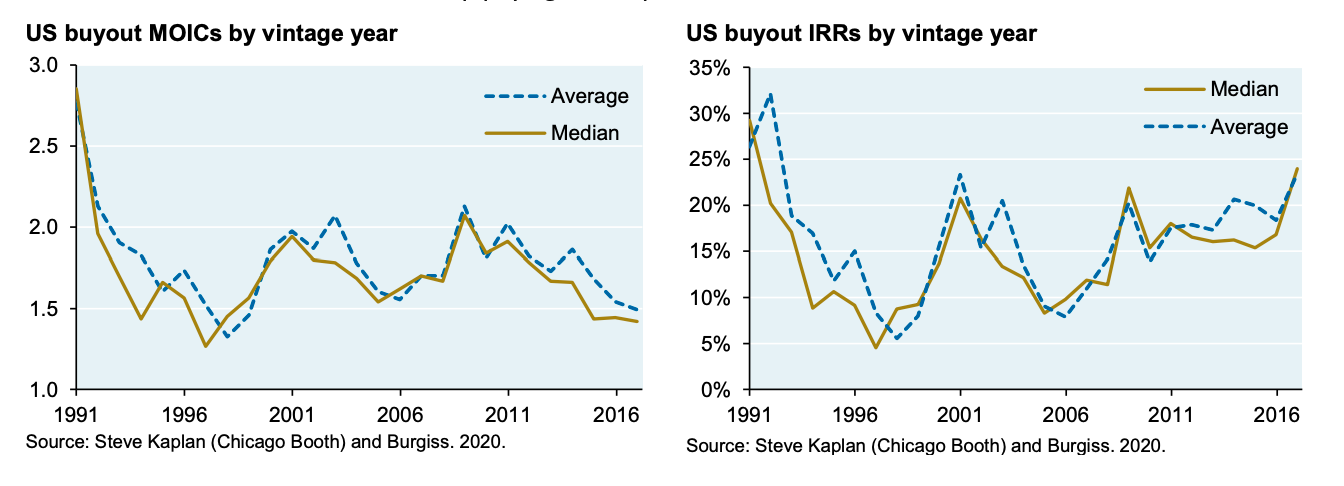

US Buyout Returns

- Private Equity buyout returns measured by multiples on invested capital (MOIC) – a simple cash-in vs. cash-out metric, have been falling since 2009.

- Interestingly internal rate of return (IRR), a time-weighted measure of return, has been rising.

- The reason is the increased use of subscription lines – managers financing investment with bank loans delaying capital calls to LPs until later.

- Mercer data suggests their use has grown 6x since 2010.

- Note also average and median returns don’t differ much.

- The note compares returns to public markets showing 1-5% pa excess returns, which have also fallen.

- Source.

EM vs. DM PMIs diverging

- “It is not just Asia which is seeing renewed weakness of manufacturing performance, however, with output in Russia coming close to stagnation again in June as rising virus numbers disrupted the economy, and a further steep fall in output was recorded in Mexico.

- As a result, while developed world production continued to grow at a rate close to decade-highs in June, emerging market output growth came close to stalling, its lowest since June 2020.“

- Source.

Geography and History – the US

- This is a brilliant article on how geography influences history.

- The United States stands out has having some of the best luck when it comes to advantageous geographic features.

- “First, the US is fortunate to have mountains and oceans everywhere for defence.”

- Second it has this – “The US’ Mississippi basin:

- Has mountain ranges on both sides, which concentrate water inwards.

- Has over one million square miles (2.5M km) of extremely well-irrigated land – the world’s largest contiguous piece of farmland.

- Is nearly flat, which is also great for agriculture, but also for building anything for cheap, really.“

- Third it has “more internal navigable waterways than the rest of the world combined!“, which adds a huge cost advantage.

- More interesting analysis in the article including applying these ideas to the rest of the world.

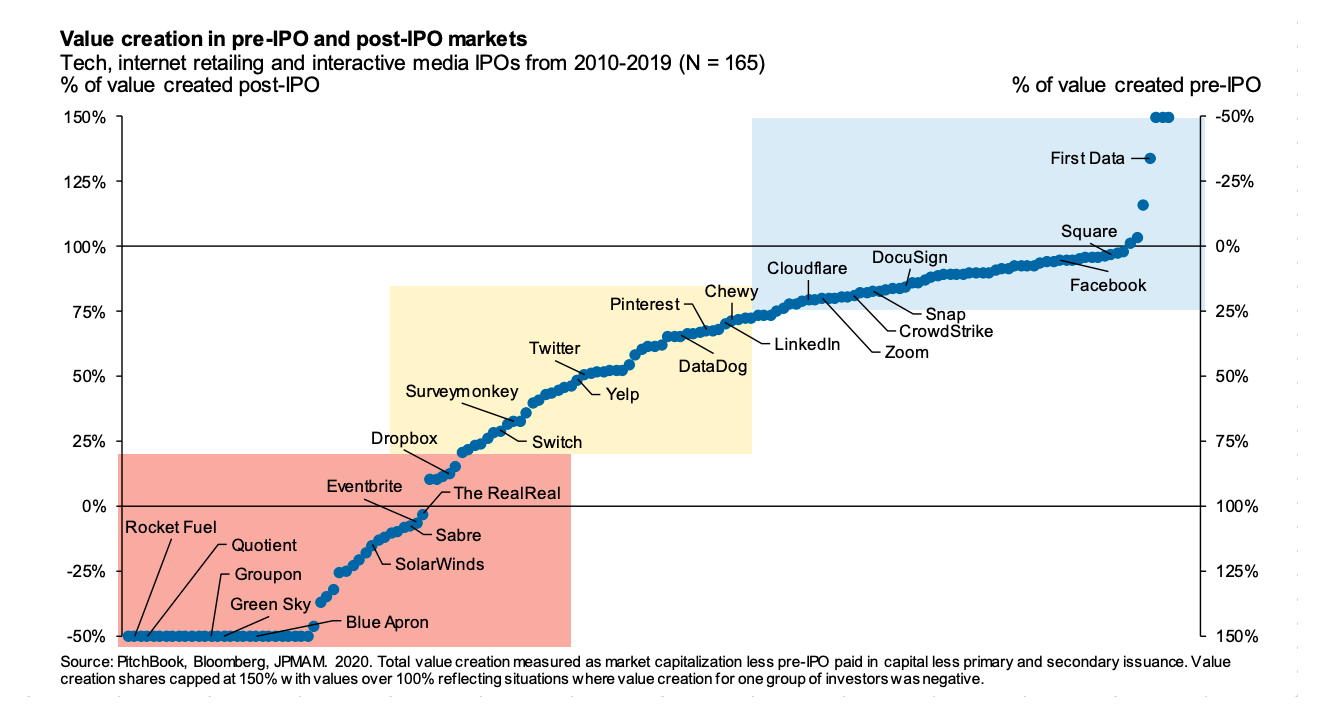

Post and Pre IPO Value Creation

- Who reaps the majority of the rewards from venture backed companies – VC or public markets?

- “Over the last decade when measured in terms of total dollars of value creation accruing to pre- and post-IPO investors: post-IPO investor gains have often been substantial.“

- Of the 165 IPOs analysed – the vast majority had a large share of value accrue to public markets (blue region).

- There are some exceptions (red region), and some shared (yellow region).

- Source.

Stripe

- A lot has been written about this remarkable company and its even more remarkable founders.

- This was a really great, long piece covering everything from history to strategy.

- “In 2006, using an SAT score from a test he’d taken at the age of 13 (an infuriating anecdote), Patrick matriculated to Lisp’s birthplace: the Massachusetts Institute of Technology. He’d sped through the final two years of his high school curriculum in just twenty days.”

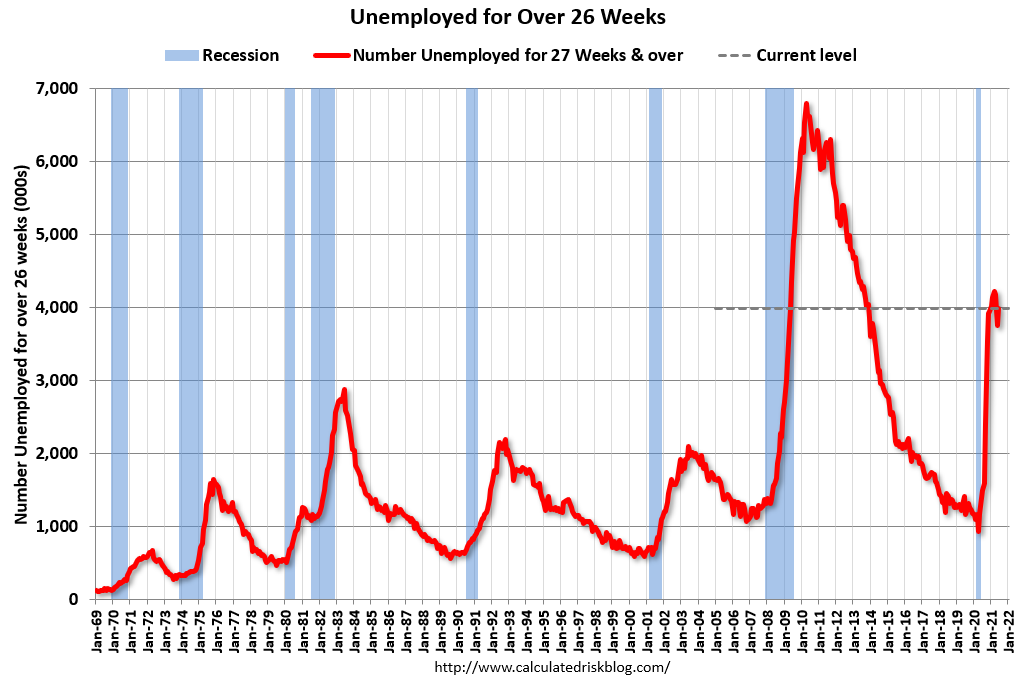

Long Term Unemployed

- The number of long-term (26 weeks or more) unemployed in the US hasn’t budged this recovery.

- There are still nearly 4m people in this category.

- Source.

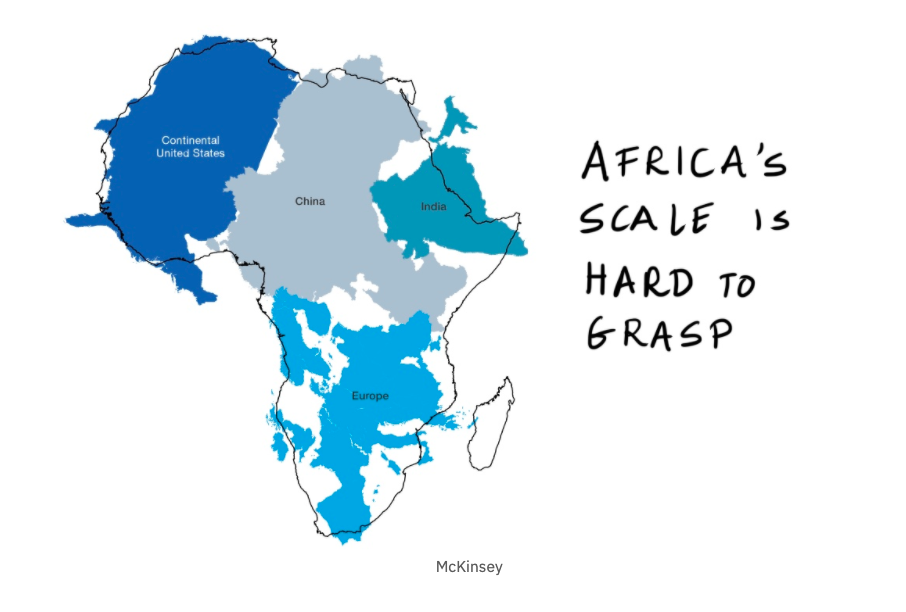

Africa

- Starting with cliches is a good way to start this fantastic piece on Africa.

- It covers everything from demographics to key venture players to opportunities.

- Well worth a read for those interested in this continent.

- Let this map just sink in.

- There are 1.2bn people in Africa, a number that will double in 30 years to 2.4bn.

- Roughly 50% will be under 25 years old. The staggering stats go on.

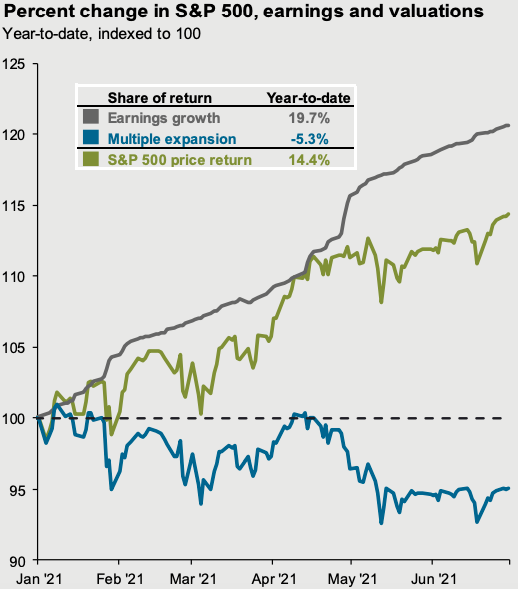

S&P H1 Return Decomposition

- Interesting to see that more than 100% of the 14% H1 2021 return of the S&P 500 index is earnings growth.

- Source.

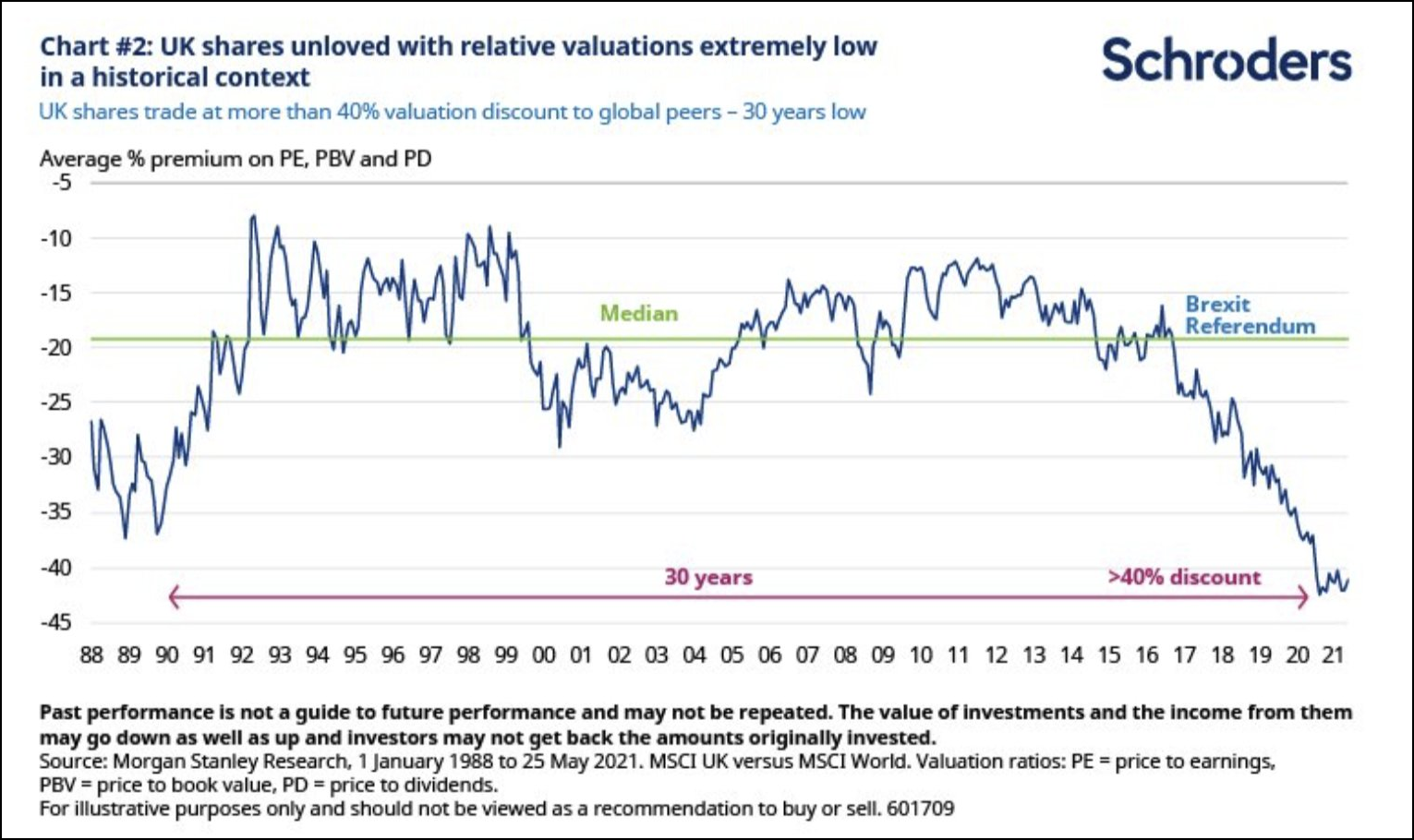

UK Valuation

- UK stocks are very cheap relative to the world (Source).

- This compares valuation at index level and hence index sector composition has a big impact.

PMI Heat Map (June 2021)

- Quarterly composite (service and manufacturing) PMIs from around the world – as good as it gets?

- Sourced from the always excellent JPM Guide to Markets (Q2 2021).

Wall Street Reading List

- Comprehensive list of finance and business books.

- “This is a project a few ex-bankers put together to share our favourite business books. Currently 135 books have made the list, 26 are ranked Tier 1, 26 are ranked Tier 2, and 45 are ranked Tier 3.“

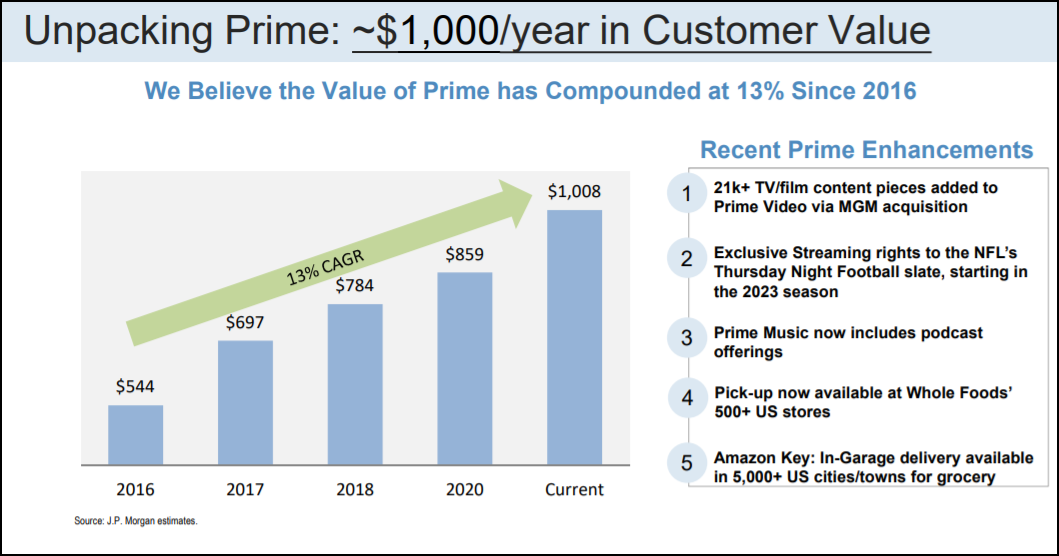

Amazon Prime

- JPM think Amazon Prime, which costs $119 per year, offers over $1,000 of customer value.

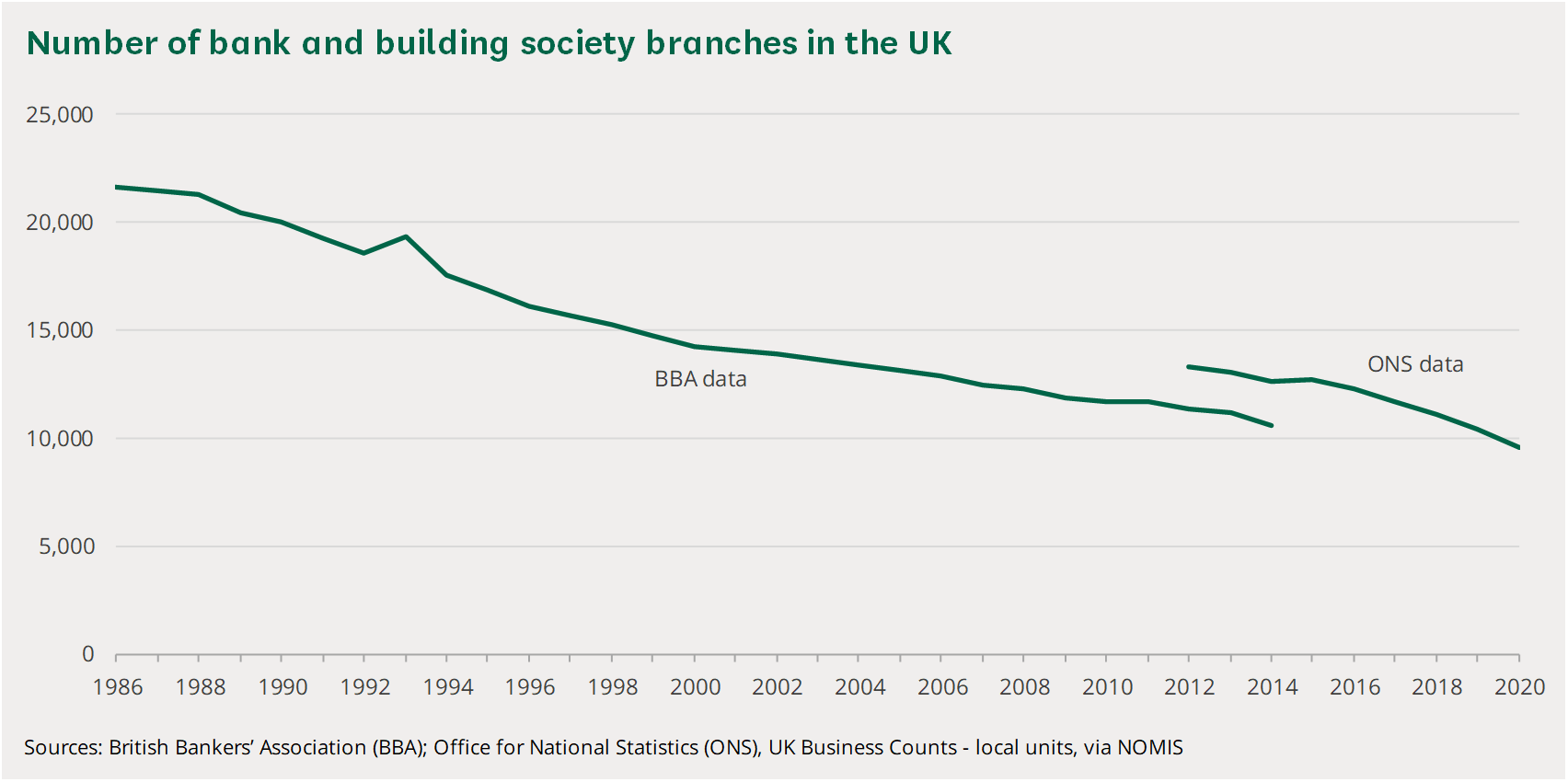

Banks – a Contrast

- These are two very contrasting views on the future of banking.

- The first is a very neat newsletter from Hosking Partners that presents banking in as simple light as possible.

- Banks are trusted to hold deposits, to transform their maturity and take diversified credit risk. As a result they have high earning power. The latter is tough to beat and large banks will beat challengers on customer facing technology reaping the cost savings.

- Contrasting this are two pieces from Net Interest, chronicling his journey through the evolving world of decentralised finance (DeFi – for those interested this is a good background on the topic).

- First he tries to start his own decentralised bank and then writes about Maker DAO, an existing one.

UK Bank Branches

The Hedgehog and The Fox, revisited

- Many readers will have heard of the famous distinction from the celebrated essay by Isiah Berlin.

- But few have read past the first chapter. Much of the brilliant writing has been overlooked.

- The latest Snippet Blog article is a correction of that omission.

- In Berlin’s words are ideas that give the analogy a much deeper meaning and in the process help guide investors.

The Hedgehog and The Fox, revisited.

“There is a line among the fragments of the Greek poet Archilochus which says ‘The fox knows many things, but the hedgehog knows one big thing’“.

Thus starts one of the most celebrate essays of Isiah Berlin, first given as a lecture at Oxford, then written down and buried in an obscure journal before being resurrected, extended and published. It was an instant hit and to this day is Berlin’s most popular work.

The popularity of the work stems almost entirely from the distinction captured in that first line that “marks one of the deepest differences which divides writers and thinkers, and, it may be, human beings in general“. From its first appearance in 1953, this distinction captured the imagination of the Western world, largely because of its simple and powerful intuition. Everywhere commentators were separating people into hedgehogs, who “relate everything to a single central vision, one system … a single, universal, organising principle“, and foxes, who “pursue many ends, often unrelated and even contradictory, connected, if at all, only in some de facto way … related to no moral or aesthetic principle.”

This categorisation, between monists and pluralists, reached the shores of the investing world at the turn of this century (from what I can tell). It was given a big push by the popularity in those circles of the 2005 book Superforecasting by political scientist Philip E. Tetlock. Tetlock borrowed the analogy heavily as a way to support the key finding of the Good Judgement Project – that foxes (generalists, realists) were better forecasters than hedgehogs (experts, specialists). Forecasting, after all, is crucial for investing. Today a Google Search of “investing hedgehog fox” yields 945,000 results – blog posts, articles and even a book – and none of the results involve erinaceous or vulpine ETFs.

I recently re-read the original essay. It is a master class in writing. Sentences span whole paragraphs and yet have the clarity of an alpine lake. Arguments are beaten home to the drum of nuanced repetition. What is astounding though is that Berlin only dwells on the famous analogy for a mere three pages. The thrust of the essay is dedicated to understanding Count Lev Nikolaevich Tolstoy, who, Berlin hypotheses, was “by nature a fox, but believed in being a hedgehog“. This conflict is dissected on the plate of Tolstoy’s view of history, itself dismissed by critics and ignored by readers.

As I made my way through this essay it dawned on me that many of the commentators in the investment world (and more widely) had very likely never read past the first chapter. Much like Tolstoy’s philosophy of history, the bulk of The Hedgehog and the Fox, has “not obtained the attention it deserves“. This post is a correction of this omission. Like the fox, I don’t seek to construct a unified theory, but rather pull-out interesting observations, as they relate to investing. Ideas that Berlin clearly intended to help us move beyond the surface level of the analogy, thereby deepening its meaning and usefulness.

Investors are actually foxes that want to be hedgehogs

The premise of Berlin’s essay is that Tolstoy was a fox but wanted to be a hedgehog. It strikes me that investors, the good ones at least, are all in fact exactly like this.

Foxes are good at pointing out flaws in other’s theories (especially those of hedgehogs). Tolstoy was in this respect perhaps the fox. At his hand “pretenders are exposed and struck down one by one” with an intellectual force never seen before (or since). A good investor must posses this quintessential fox’s quality, the ability to take down other’s ideas.

In Tolstoy’s ideas on history we can see this process at work. He strongly rejected the scientific approach to history. There are no dependable laws to be discovered, no underlying causes and hence predictions are impossible. Historians who attempt this, commit “a gross error” by setting emphasis in a world where determinants are vast and varied and, consequently, no one individual, no matter how powerful, can guide destinies.

Yet all this intellectual chipping isn’t destruction – it has a purpose. Tolstoy believed stronger than anyone else that a core exists, the answer is out there. He wanted to be a hedgehog. Yet, this can only be achieved if one walked the path of the fox. Precisely in taking down his opponents the answer might eventually reveal itself. “He continued to kill his rival’s rickety constructions with cold contempt, as being unworthy of intelligent men, always hoping that the desperately-sought-for ‘real’ unity would presently emerge from the destruction of the shams and frauds“. A good investor embodies this – they are compelled by a sense that the truth is out there, although they can’t grasp it. The path to that truth is argument. Like a sculptor who starts with a sheer slab of stone, every chip brings one closer to the truth.

Does the essay give any clue what the truth might be?

History, in Tolstoy’s eyes, is only a blank succession of unexplained events, an “inexorable process”, “a thick, opaque, inextricably complex web of events, objects, characteristics, connected and divided by literally innumerable unidentifiable links – and gaps and sudden discontinuities too, visible and invisible“. One could just as easily use this description for the march of financial markets.

Tolstoy believed those who fail to face the “inexorable historical determinism” miss the most important thing – the “inner events“, “the most real, the most immediate experience of human beings“. In elevating history to political and public events, individuals are blurred. There is stark contrast between “real life – the actual, everyday, ‘live’ experience of individuals with the panoramic view conjured up by historians“. This is ironic because “no one in the actual heat of the battle can begin to tell what is going on” – something Tolstoy makes clear time and time again in his great historic novel War and Peace.

So to understand what is going on around us we must look to the indivisible units – human beings. This is something all great investors know – that companies and markets consists of people. In order to piece together history, and the markets, these units must be integrated. How? “This is the integrating of infinitesimals, not, of course, by scientific but by ‘artisitic-psychological means‘”. In other words, some of the answer lies in understanding human psychology. It is not that we must wholly reject scientific approaches but that we must give the ‘inner’ world equal prominence as the ‘outer’. Tolstoy’s preferred tool here was the novel, and it does beg the question why more novels exploring the inner lives of ordinary workers, market participants or consumers aren’t written.

What makes this integration so difficult is that we simultaneously live inside it. The very tools we use to understand the world, are what we are trying to understand. “Our thoughts, the terms in which they occur, the symbols themselves, are what they are, are themselves determined by the actual structure of our worlds”. Investors live inside the market they are trying to conquer.

Berlin offers some advice here – “for we ourselves live in this whole and by it and are wise only in the measure to which we make our peace with it“. In short, investors must come to terms with their own psychology. This reminds me of another beautiful quote by Huxley “We cannot reason ourselves out of our basic irrationality. All we can do is to learn the art of being irrational in a reasonable way.“

By reading past the title and the first few pages, readers are rewarded with a much deeper understanding that can be carried over to other domains. A fox who wants to be a hedgehog is a more appropriate characterisation of a good investor than the oft drawn distinction between the two animals. It is better to argue one’s way to the truth, than to try to construct it. In the same way, even Tolstoy’s own theory of history holds lessons for investors – to look past the panoramic view and focus instead on the indivisible units – human beings. It is in understanding human psychology, including one’s own, that some of the mysteries of markets can be unlocked.

All is not rosy though. A fox that dreams of being a hedgehog, is a tormented existence. The stronger the instinct of the fox, the stronger the desire to be a hedgehog. Berlin captures this right at the end where he describes the great thinker, and one can’t help but feel the great investor as well, as:

“at once, … omniscient and doubting everything, cold and violently passionate, contemptuous and self-abasing, tormented and detached”.