- Equities struggle generally when yields are rising AND forward earnings per share (EPS) expectations are falling.

- Source: Oxford Economics.

Macroeconomics

Snippets on the big picture.

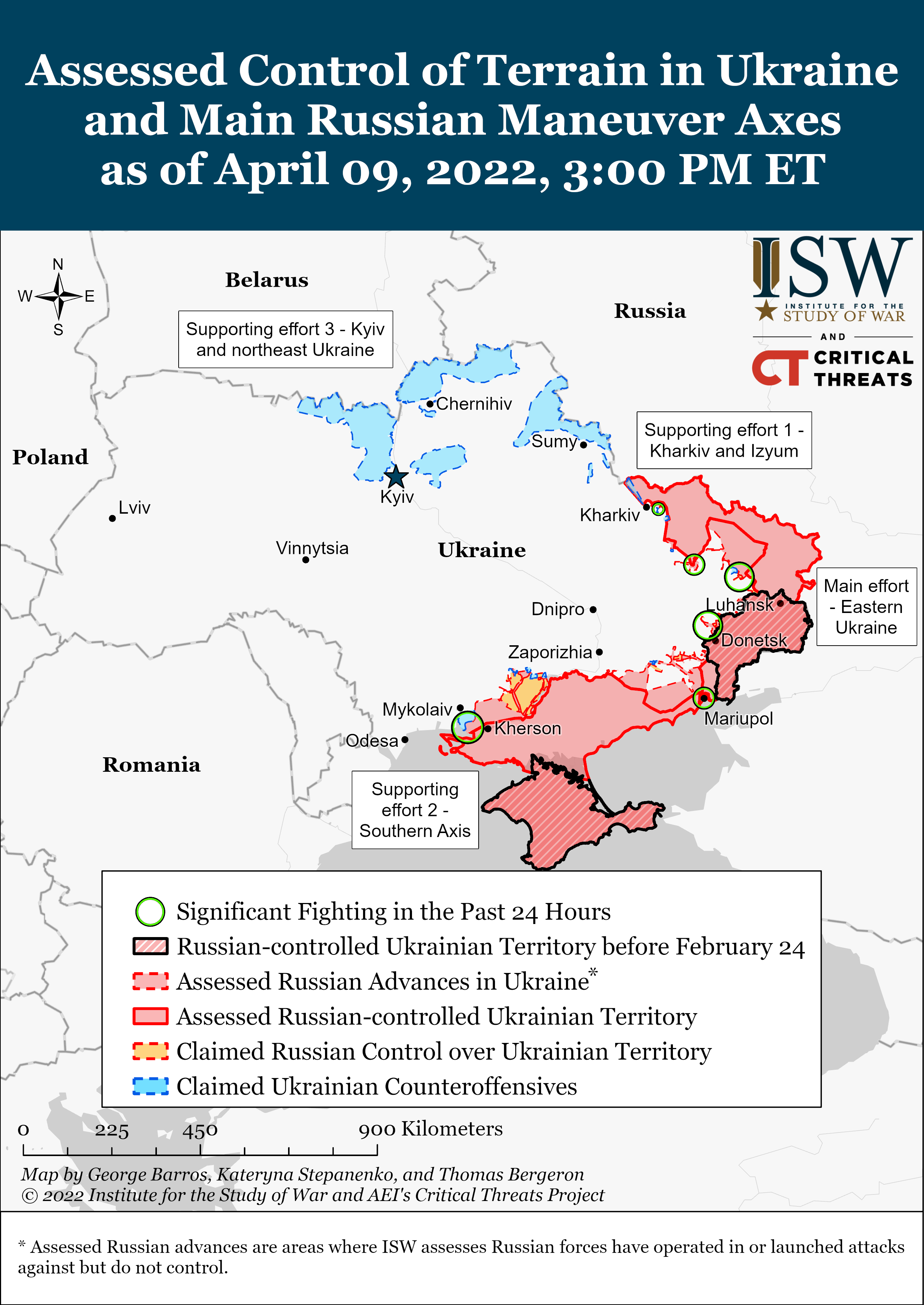

Ukraine

- This is a very useful resource for tracking what is going on in the Ukraine war.

- Produced by The Institute for Study of War (ISW) it is a daily assessment (see under “Latest”, example here) of the situation on the ground along with a useful map (pictured).

- Here is a video that time lapses all the maps since the invasion began.

- This Substack (written by Lawrence Freedman, Emeritus Professor of War Studies at King’s College) provides some very good analysis of the meta situation.

- One angle that is key to watch for second order thinking is China. This was a really great piece to understand the China angle as was this (arguing that perhaps this crisis could push China back to collective leadership).

- (h/t The Browser).

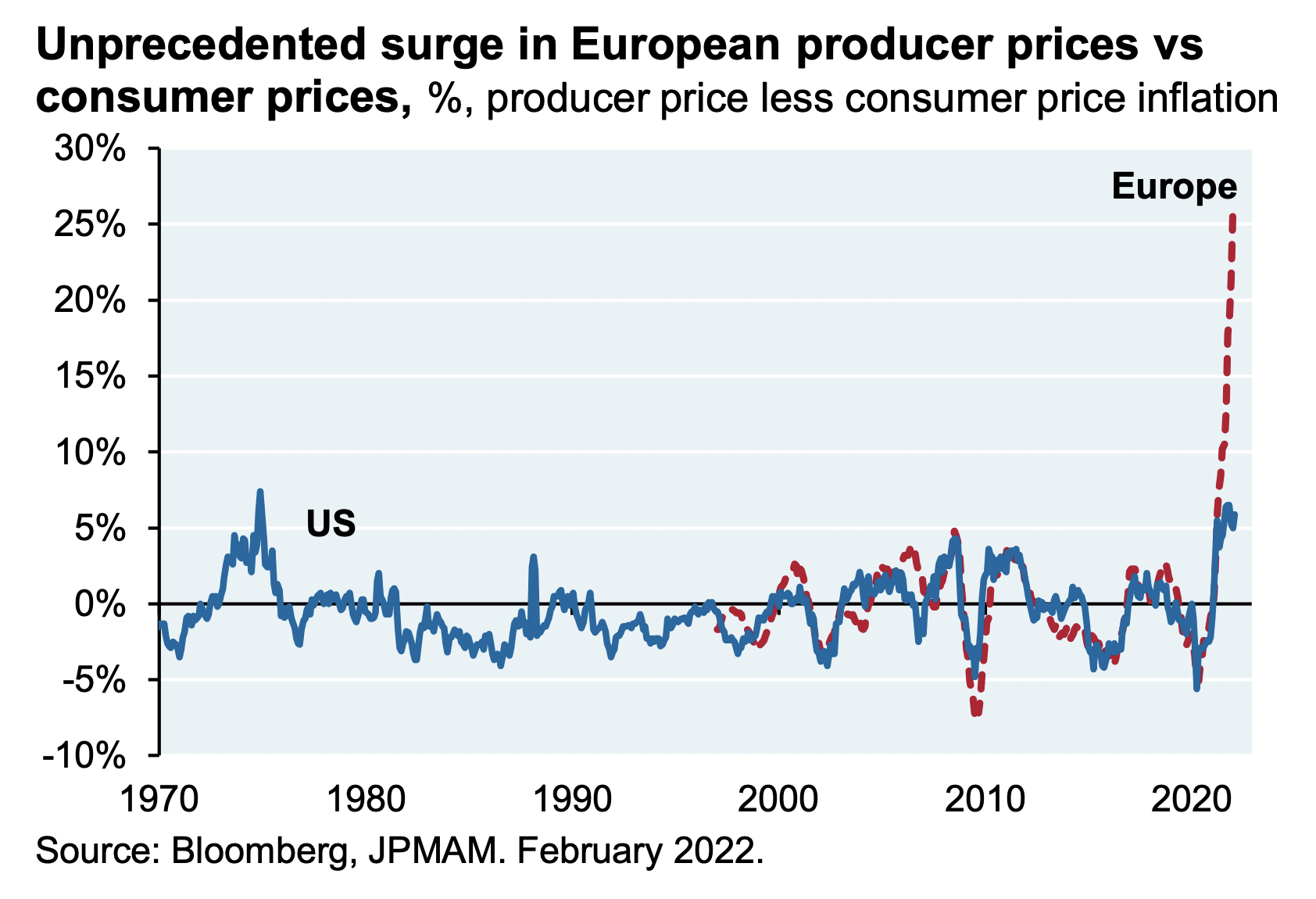

European inflation

- Europe is experiencing an unprecedented surge in producer prices relative to consumer prices.

- This surge is either going to hit margins and profits, or will need to be passed through to consumer prices.

- Source: JPM.

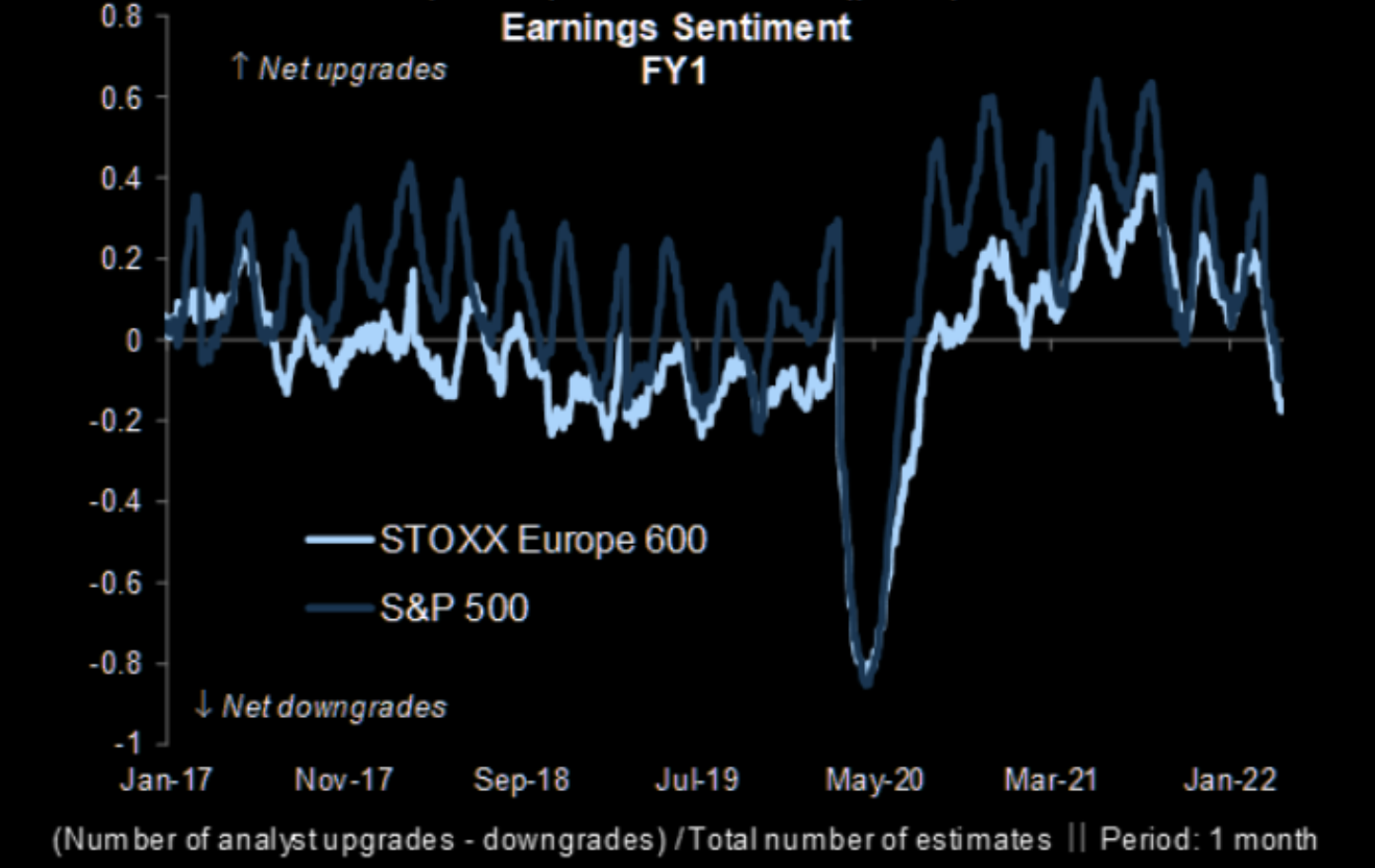

Earnings Sentiment

- Earnings sentiment has taken a big knock in the last two months.

- Source: themarketear.com.

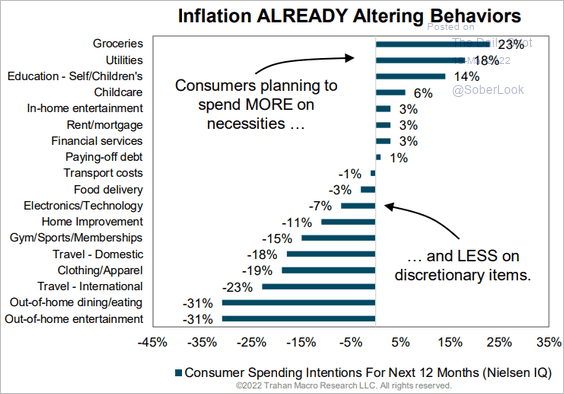

Inflation Impact

- The price shock is already starting to lead to changing consumption patterns.

- h/t Daily Shot.

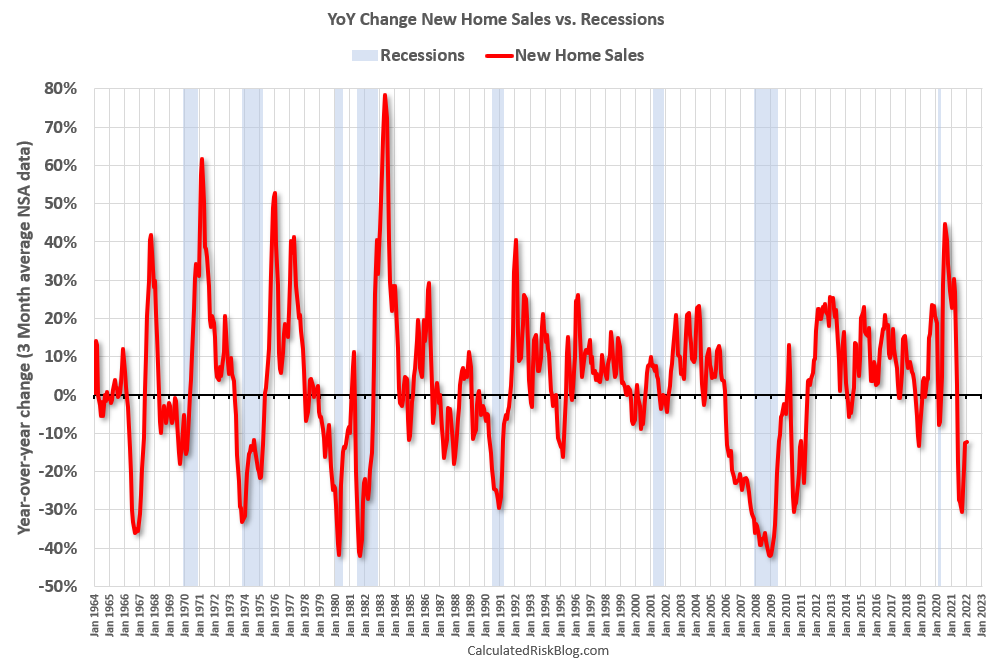

Recession Watching

- New home sales is a great variable to watch for recessions.

- “When the YoY change in New Home Sales falls about 20%, usually a recession will follow.”

- Any Fed tightening cycles that cause recessions show up here first.

- There are exceptions to this rule – usually due to strong spending on defence or non-residential investment holding the economy up. The pandemic also distorted the series.

- Currently this indicator isn’t flashing red.

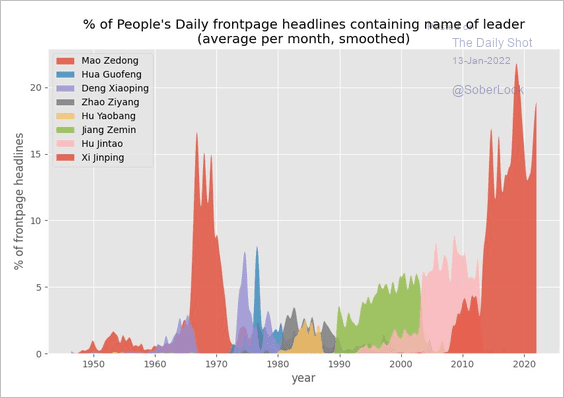

China People’s Daily

- Chart showing the percentage of front page headlines of the People’s Daily in China containing the name of the leader.

- No comment needed.

- Source: DailyShot.

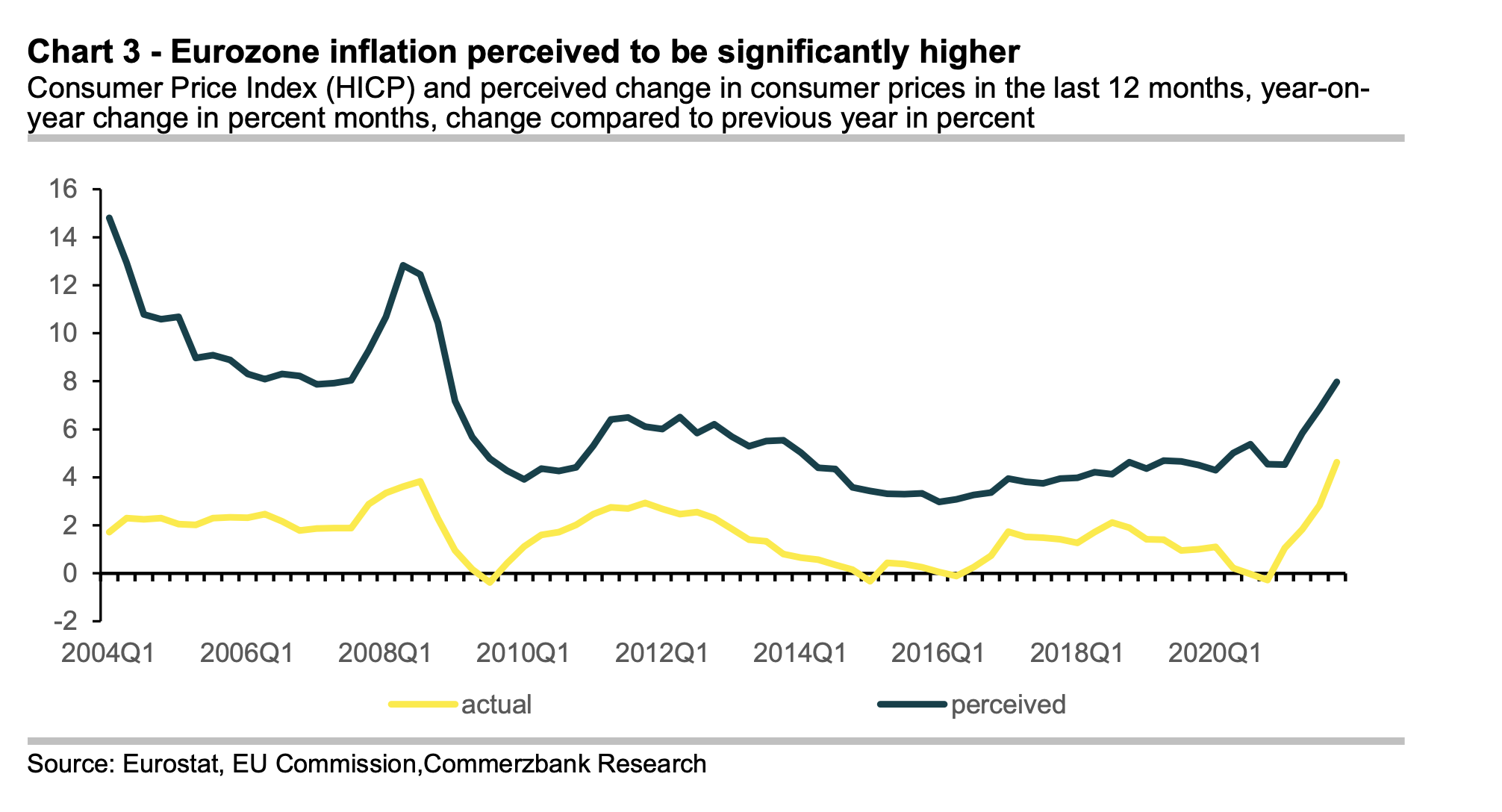

Inflation Perception

- Data from ECB showing that people perceive inflation to be a lot worse than the officially measured values.

- Interesting to see how this difference moves over time and behaves in spikes.

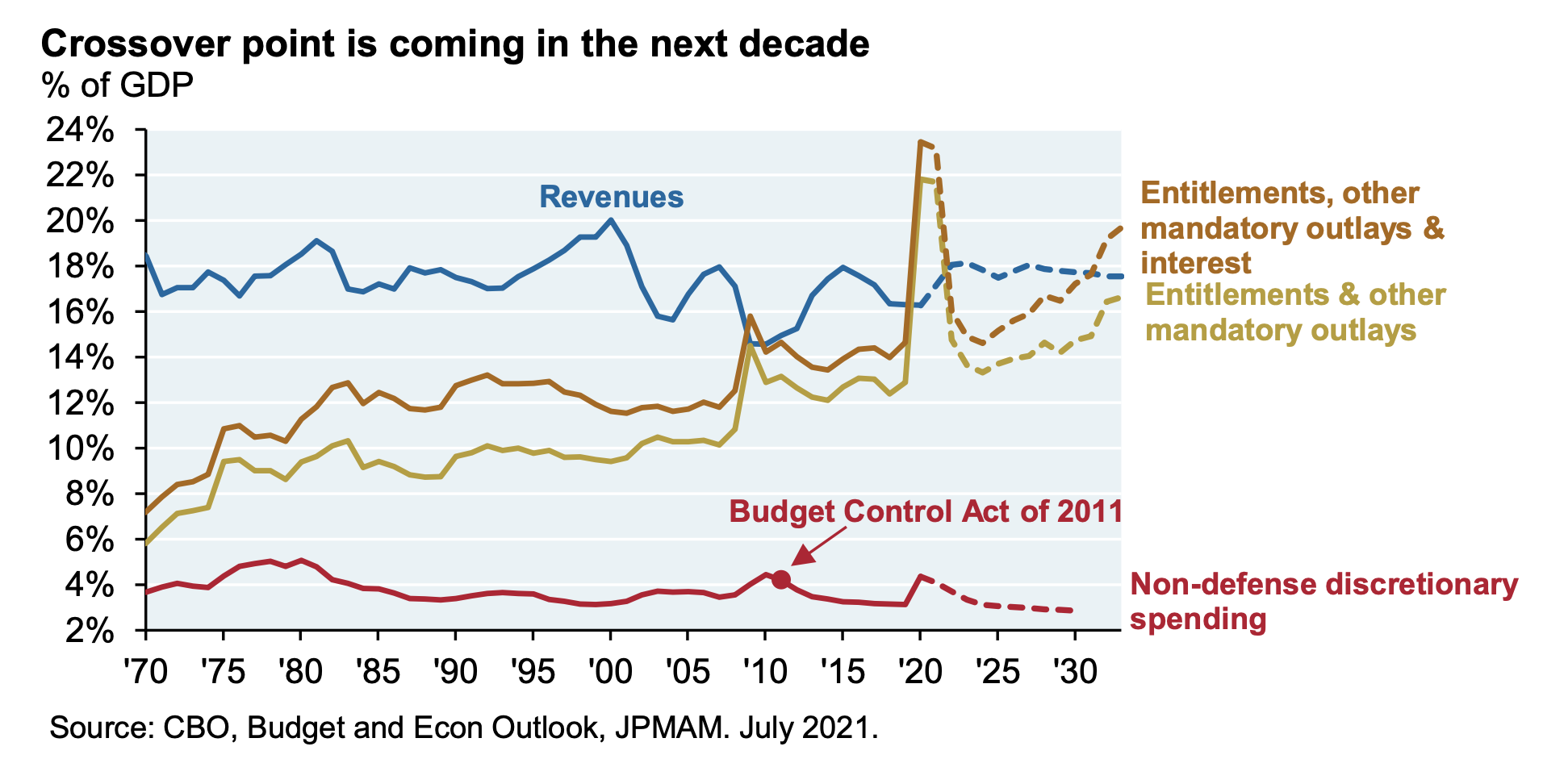

Crossover Point

- In 2030 the US budget will reach a crossover point where entitlements and mandatory outlays will outstrip revenues.

- This means there will be no room for non-defence discretionary spending.

- Source: JPM.

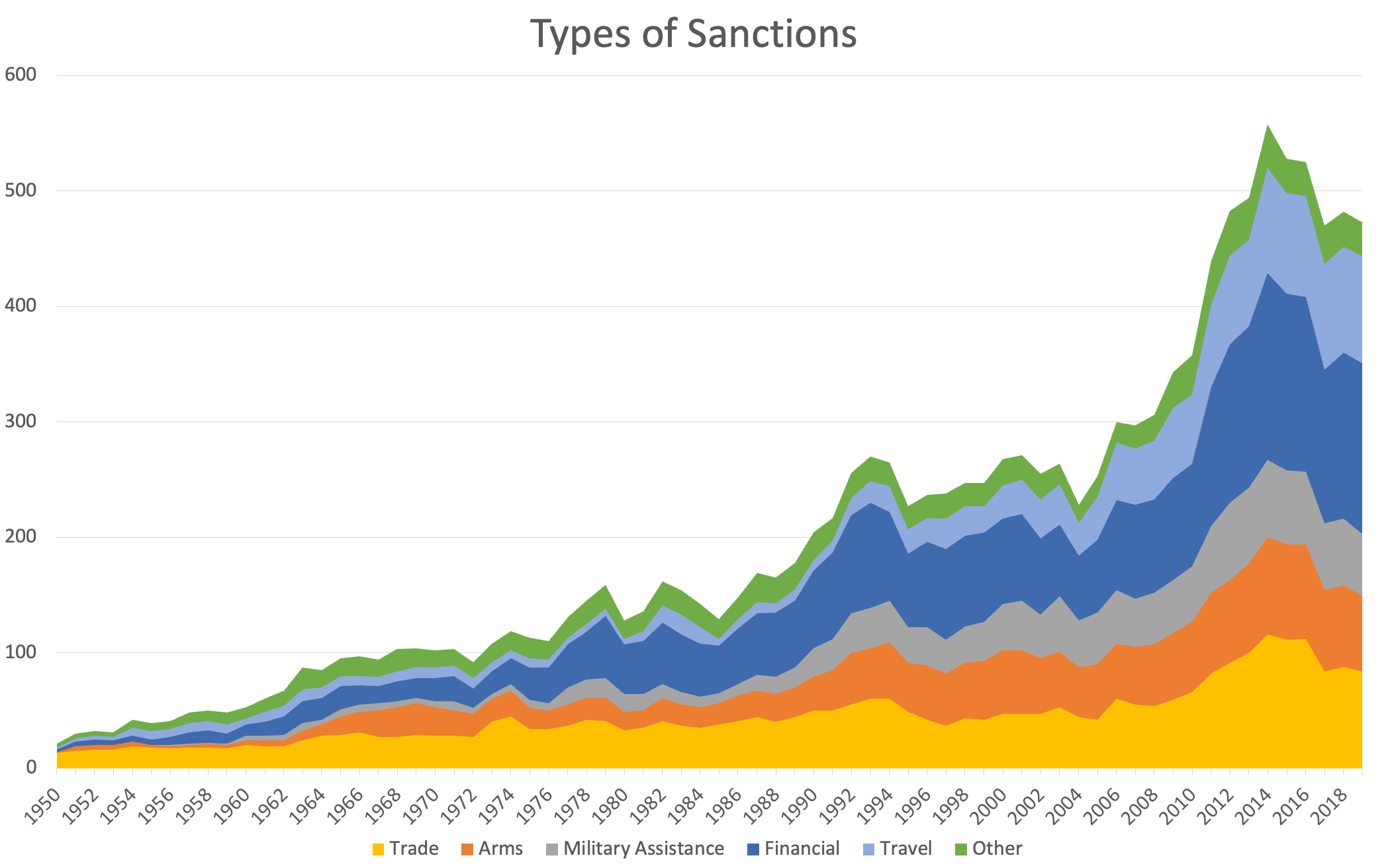

Sanctions

- Nice chart from Net Interest showing global sanctions by type.

- Interesting to see the rise of financial sanctions vs. other sanctions.

- The original source has all the data.

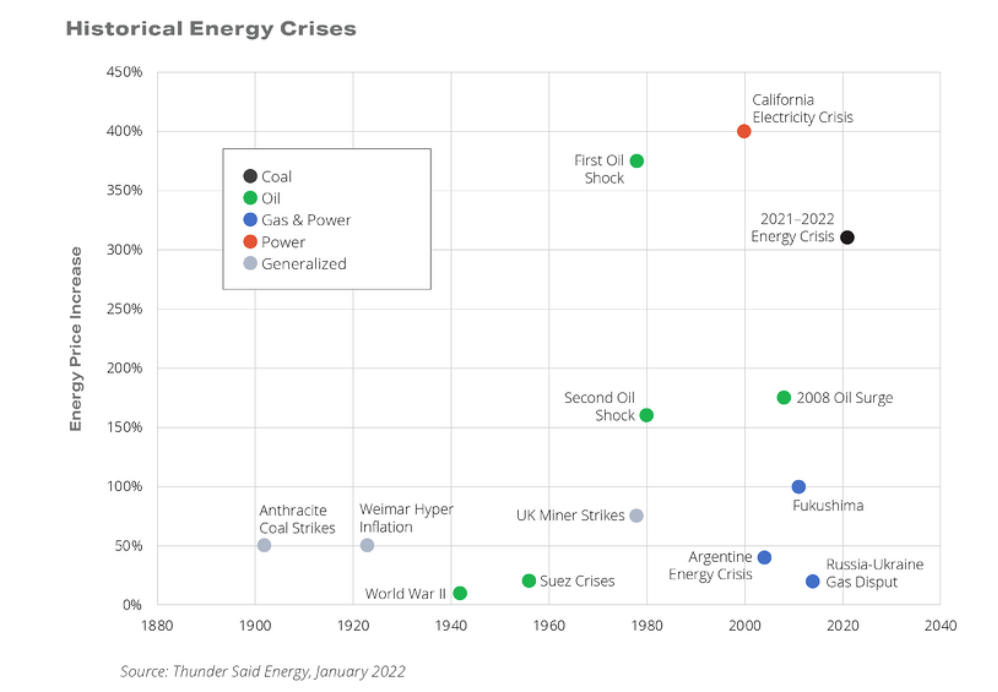

Historical Energy Crises

- A basket of energy commodities – seaborne thermal coal, global gas, European electricity and US gasoline – has risen by a weighted average of 4x since 2018-20 levels.

- This ranks as one of the top three worst price rises in history.

- Source.

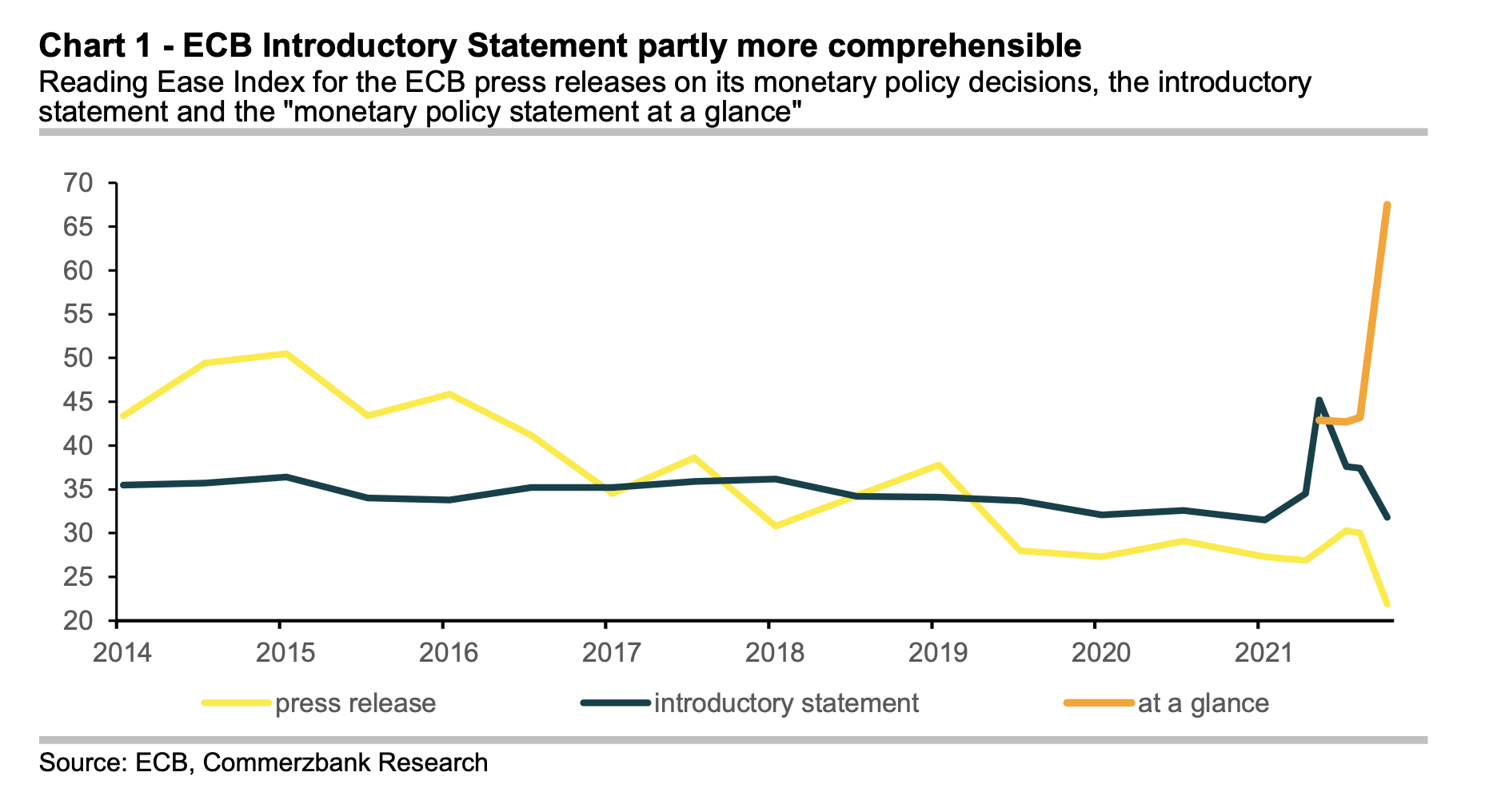

ECB Communications

- The ECB, by introducing a new publication – “monetary policy at a glance“, is trying to address the declining and very poor readability of its existing press releases.

- The decline in readability, measured by the Reading Ease Index (REI), is largely down to the introduction of more complex monetary tools (e.g. TLTRO).

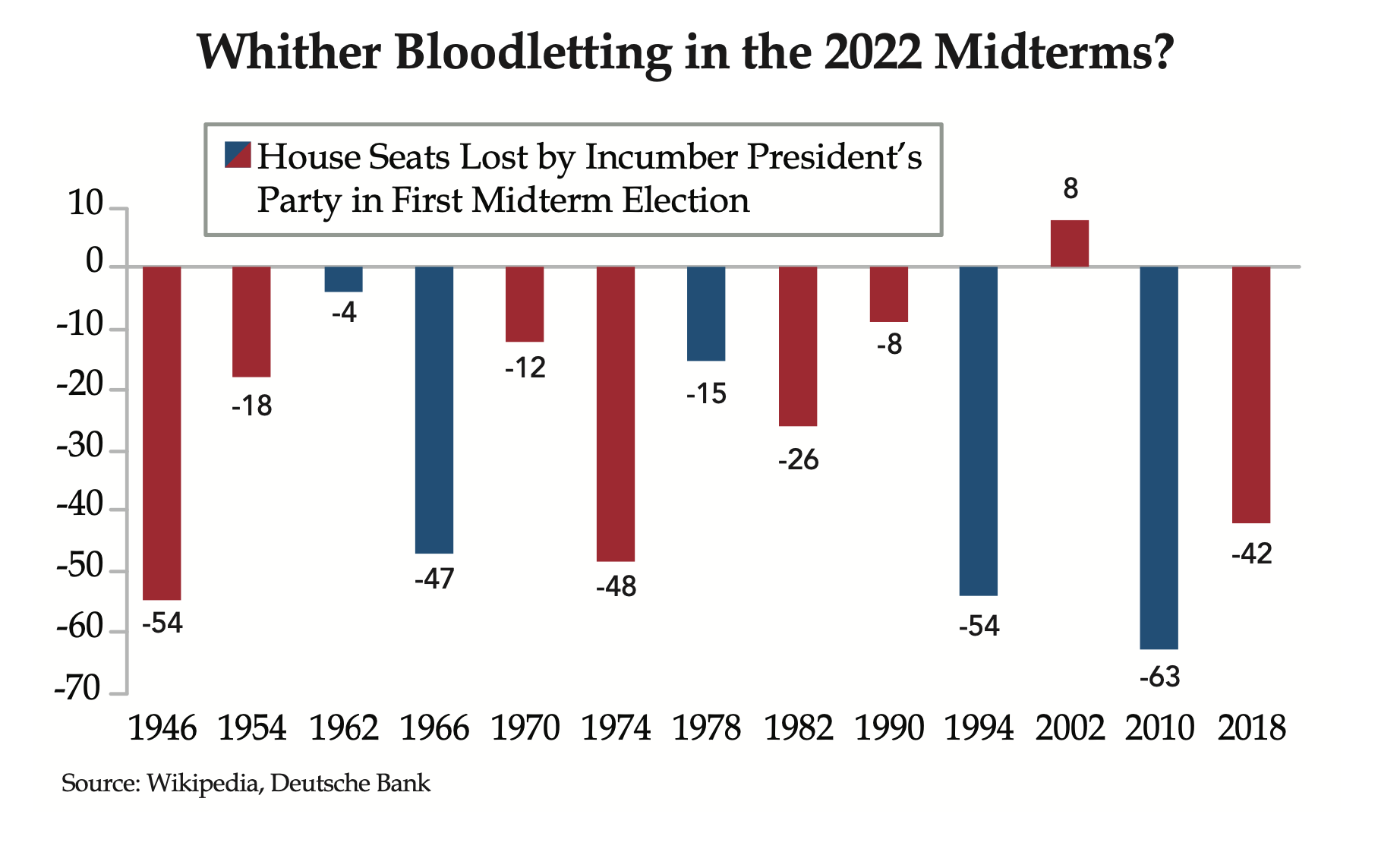

Mid-Term Elections 2022

- Incumbent President’s party typically loses seats in mid-term elections.

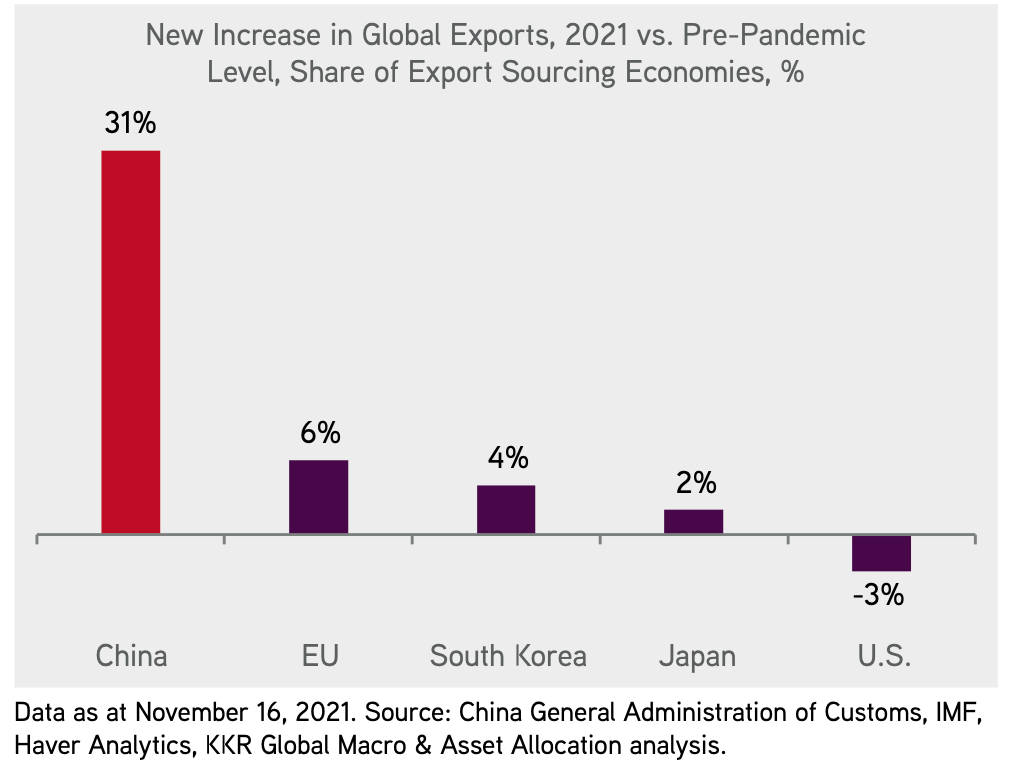

Export Share

- China has taken full advantage of the pandemic, gaining the most share of export growth.

Net Income by Sector

- Nice chart from GS showing contribution of total S&P 500 net income by sector.

- Interesting to see Financials pretty much hold up over a long period of time, with a blip for the financial crisis.

- Tech has been steadily increasing and Energy declining.

Dynamism

- Despite the prevailing narrative, dynamisms in the US has been consistently falling since the last 1970s.

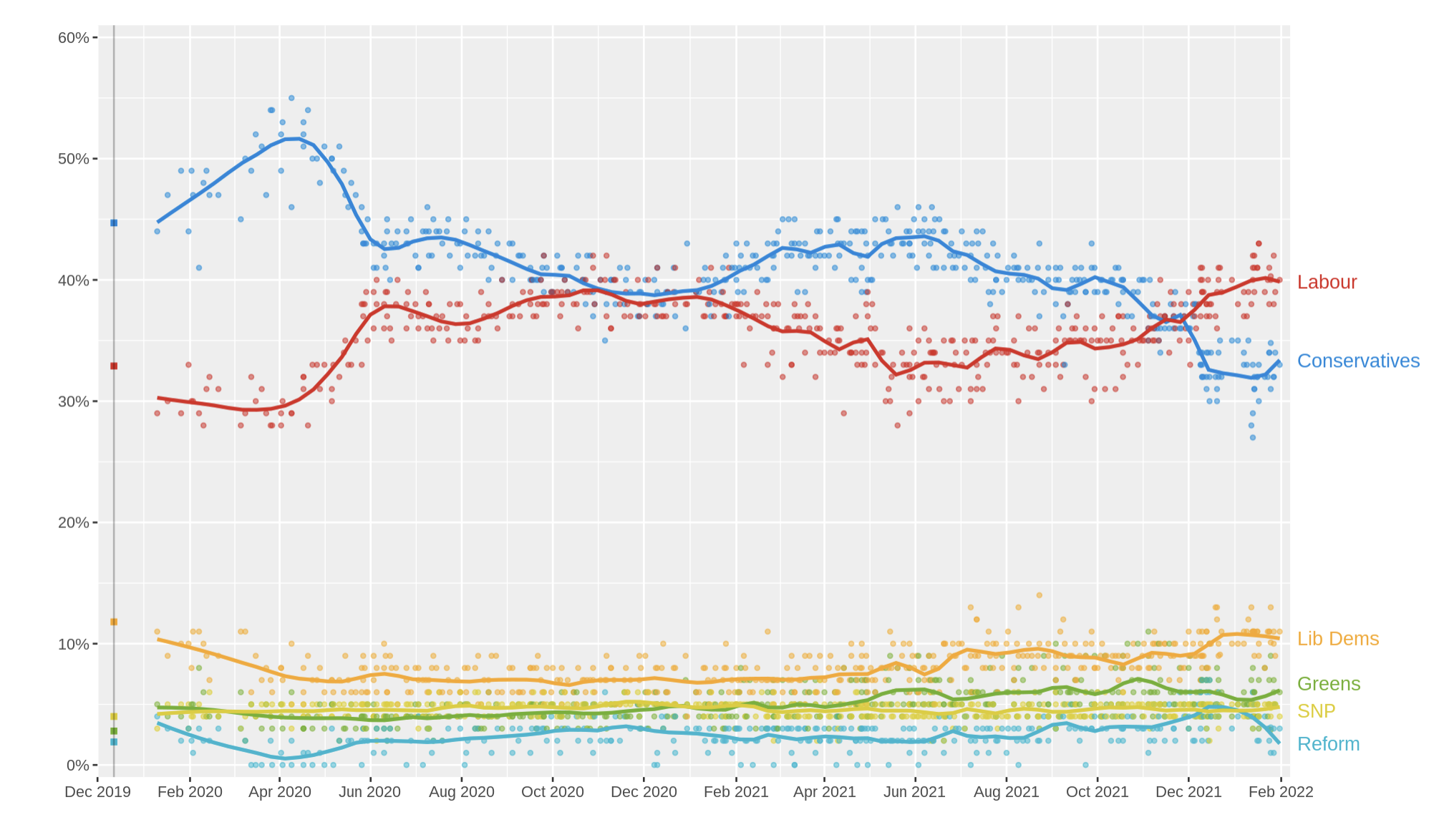

UK’s Labour Takes the Lead

- Latest opinion polls show Labour taking the lead.

- Source: Wikipedia poll tracker.

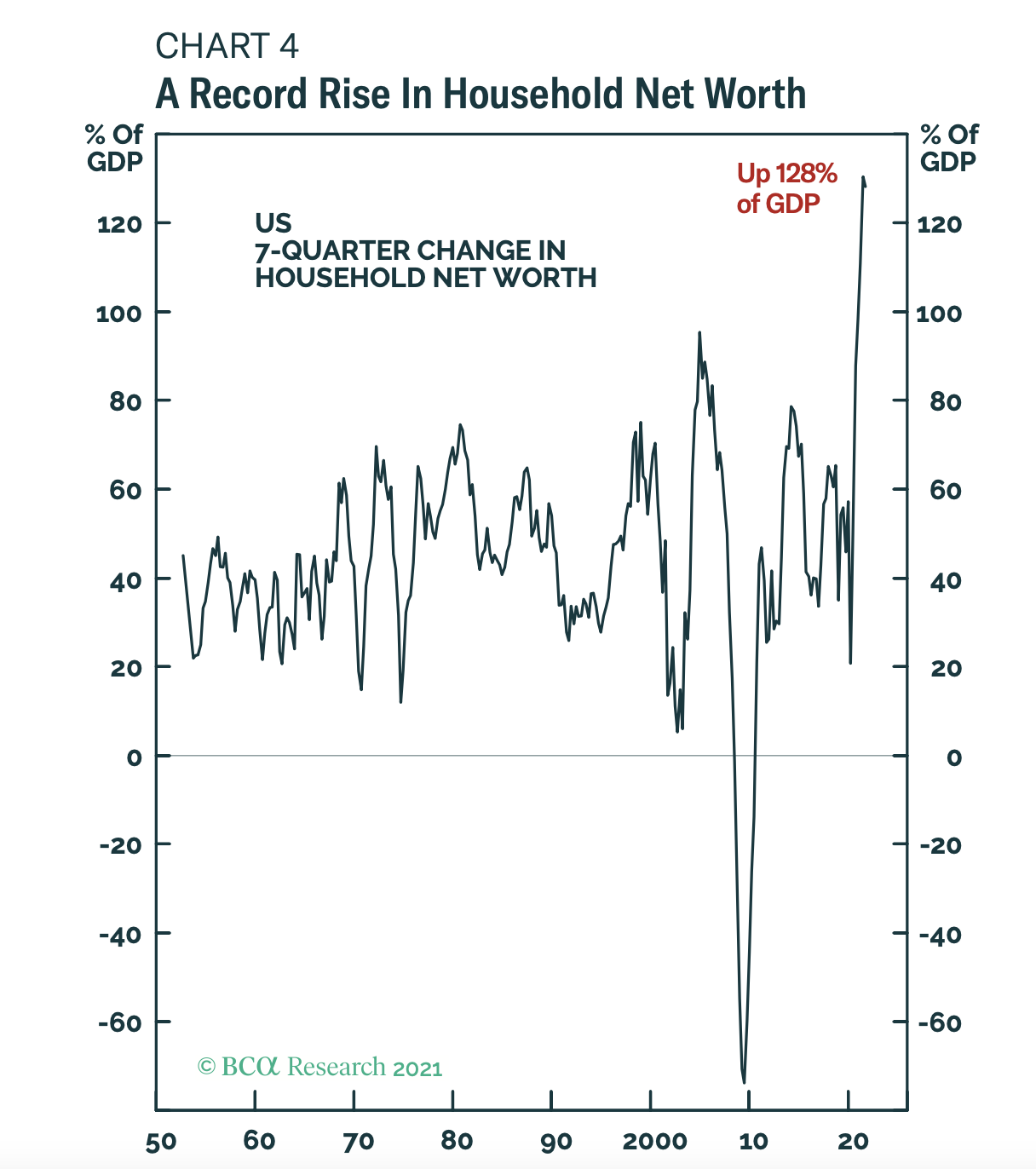

Household Net Worth

- US Household Net Worth is up a staggering 128% of GDP.

- The wealth effect alone can, using historic models, add a few points to GDP growth.

- Source: BCA Research.

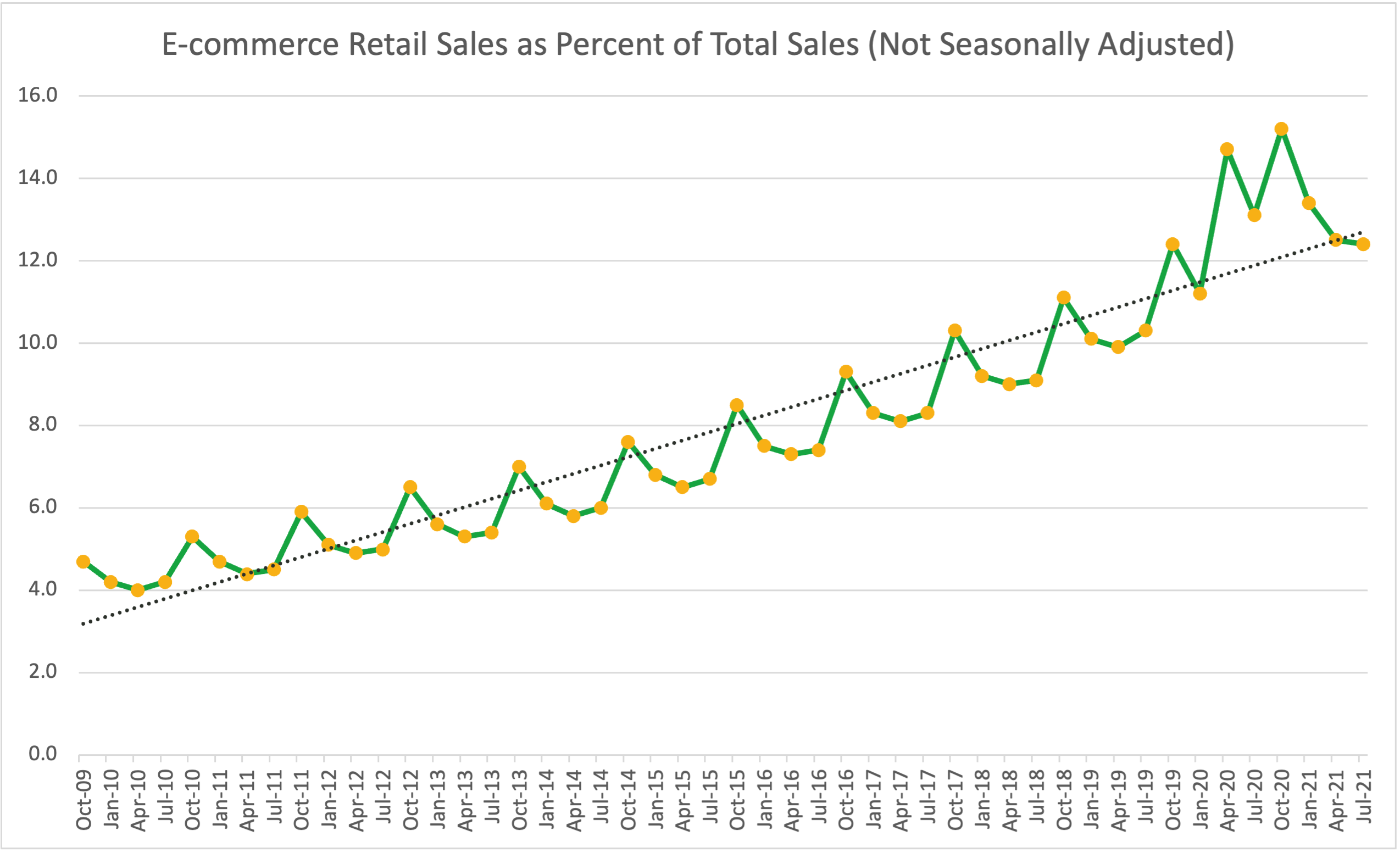

E-Commerce Sales Share

- Counter to the prevailing narrative – e-commerce hasn’t seen a step change and is almost exactly where a 10-year trend line would have predict it would be as a share of total retail in the US.

- The reason for this is that total retail sales has grown strongly (+13% vs. normally being +2-3%). In absolute terms, shoppers spent $204bn on e-commerce in Q3 2021 but the pre-pandemic trend would have predicted $183bn.

- h/t NZS Capital and Marketplace Pulse.

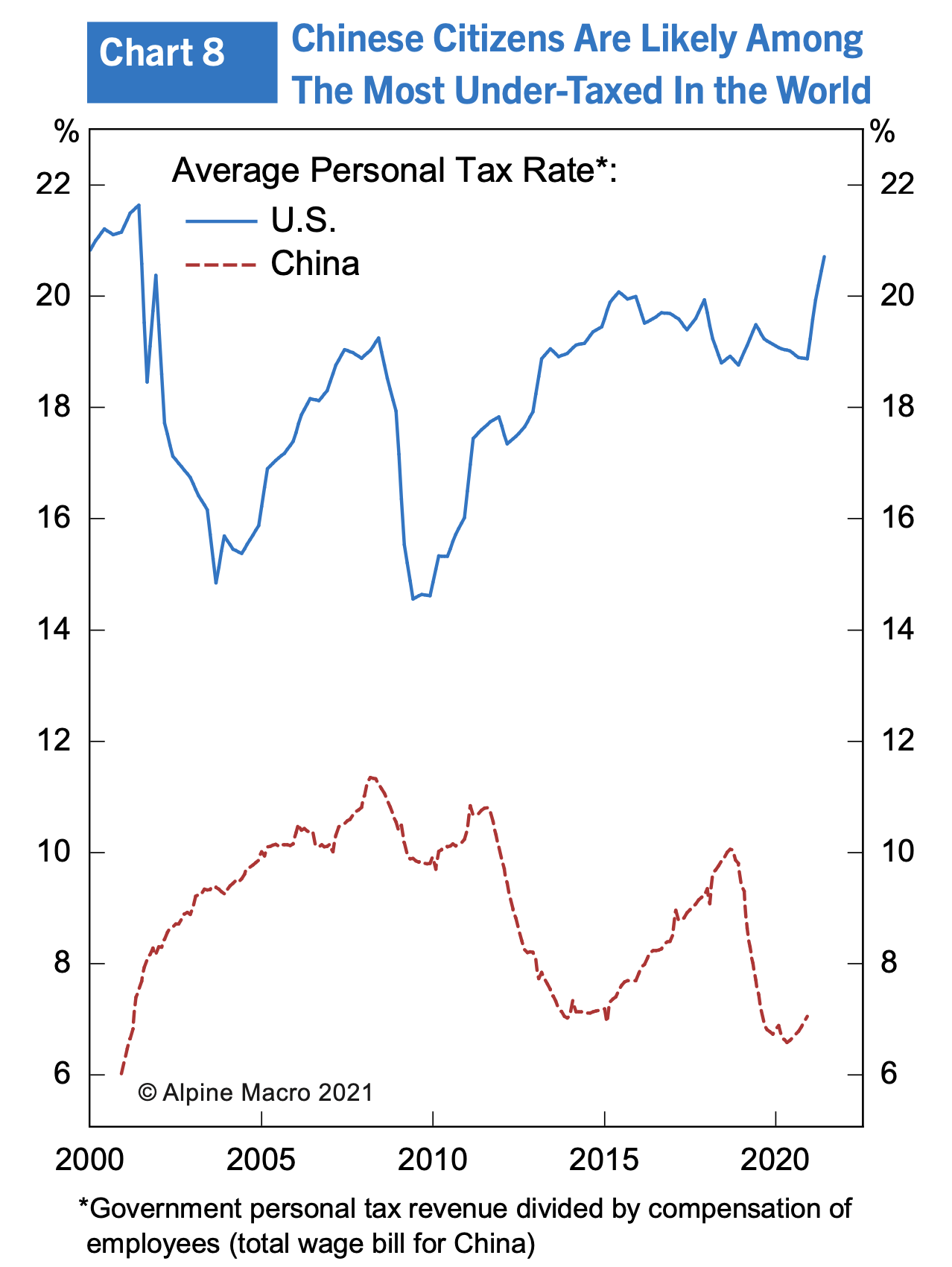

Chinese Tax Rate

- China has a very low personal tax rate.