- The European Central Bank (ECB) owns a large share of government bonds across Europe.

Macroeconomics

Snippets on the big picture.

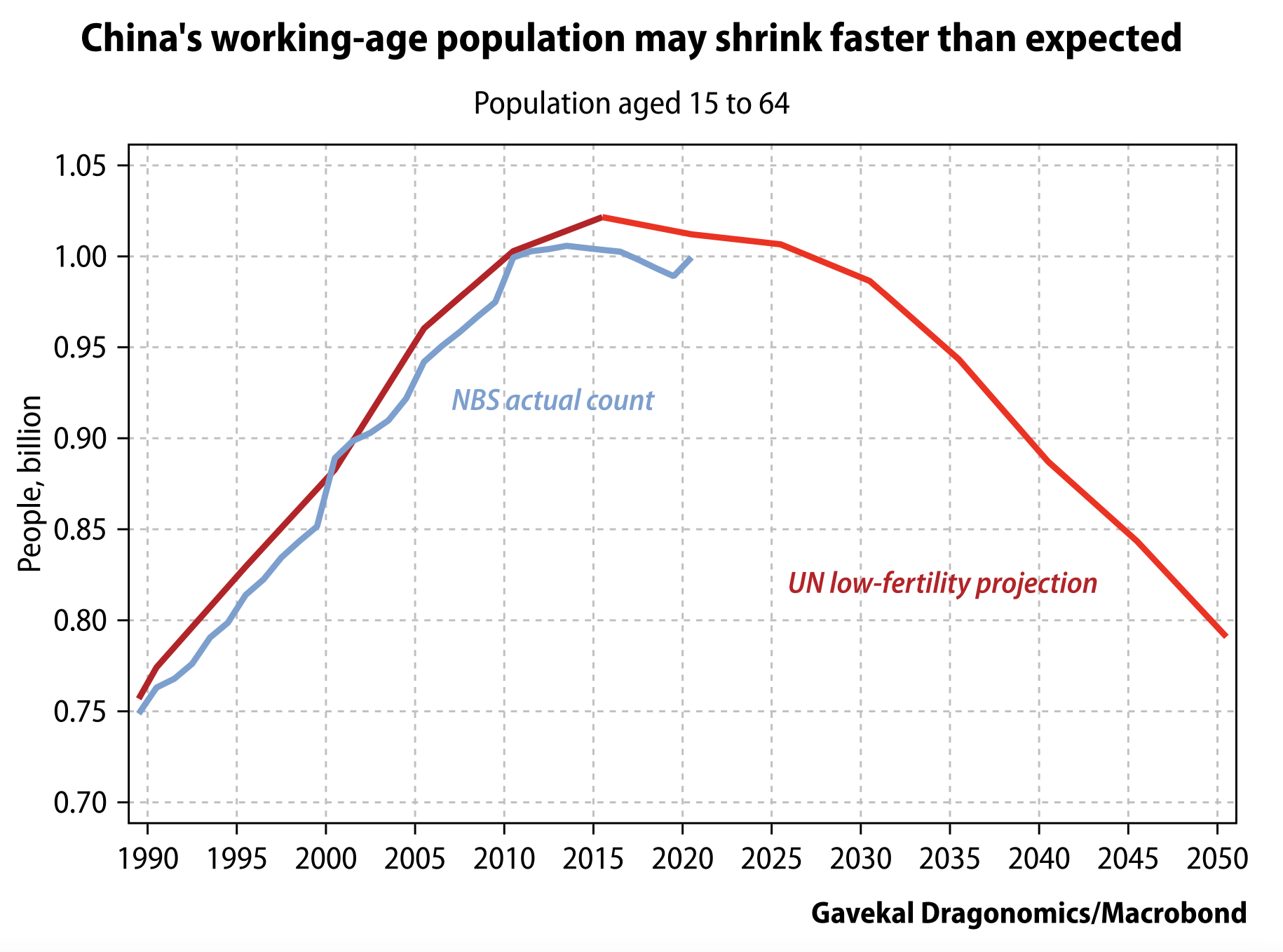

Chinese Working Age Population

- Latest 2020 census in China has painted a worrying picture.

- The working age population is declining faster than expected by models.

- Source: Gavekal.

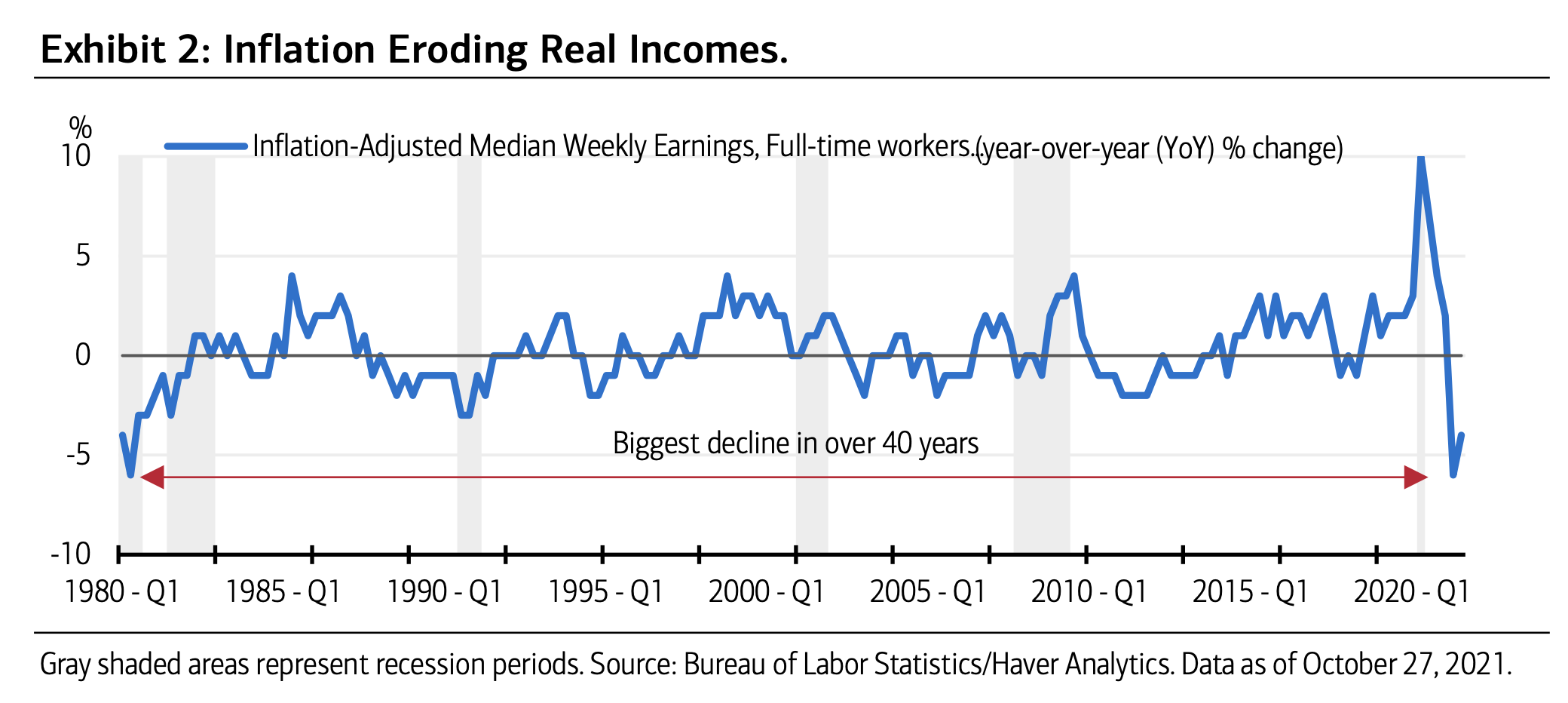

Real Incomes

- Inflation is eroding real incomes, at almost the same rate it did in the 1970s.

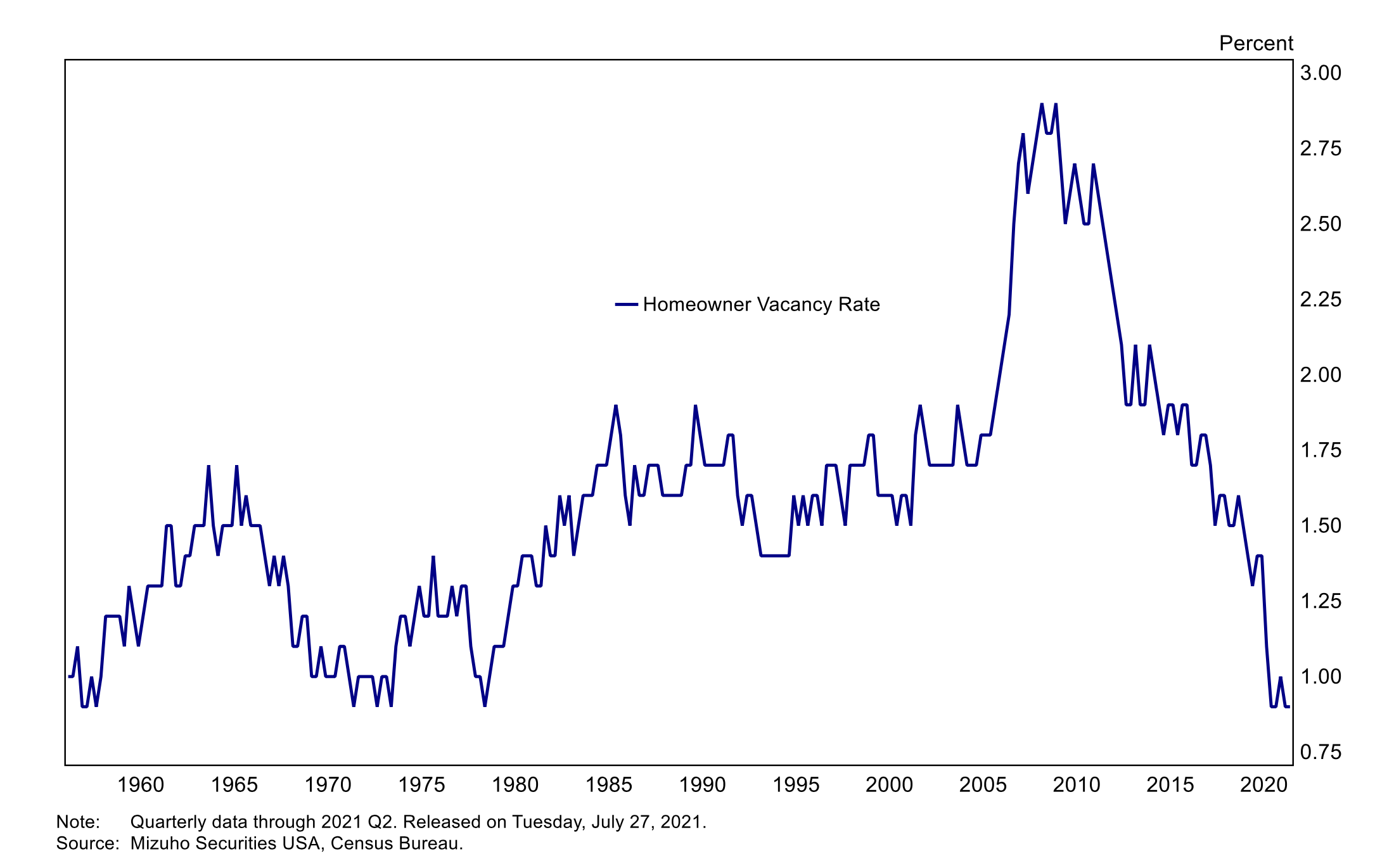

US Homeowner Vacancy Rate

- This rate has fallen to historic lows – a supportive and key variable for housing construction.

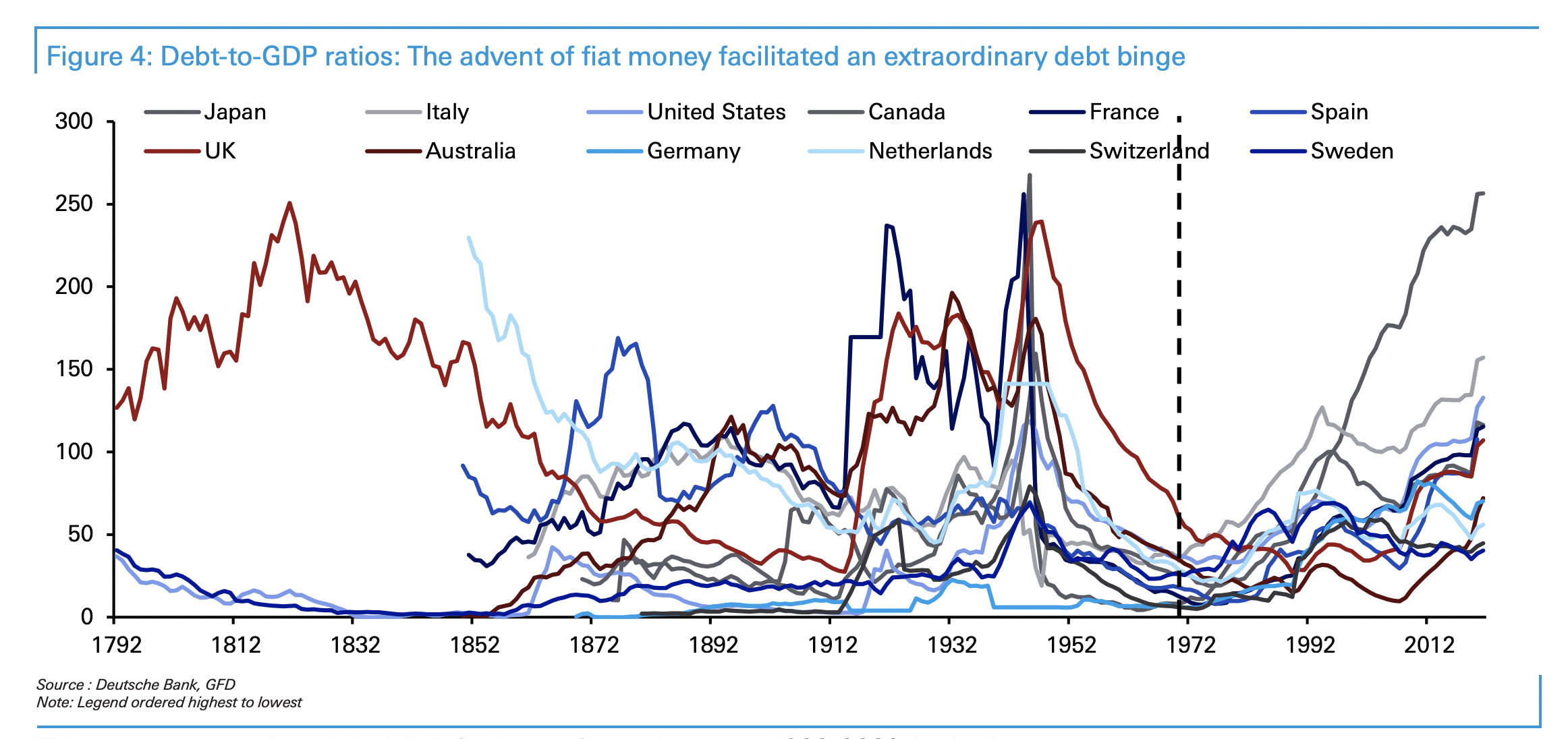

Debt Binge

- Fiat money era has led to a spectacular debt binge.

- A great long-term chart from Deutsche.

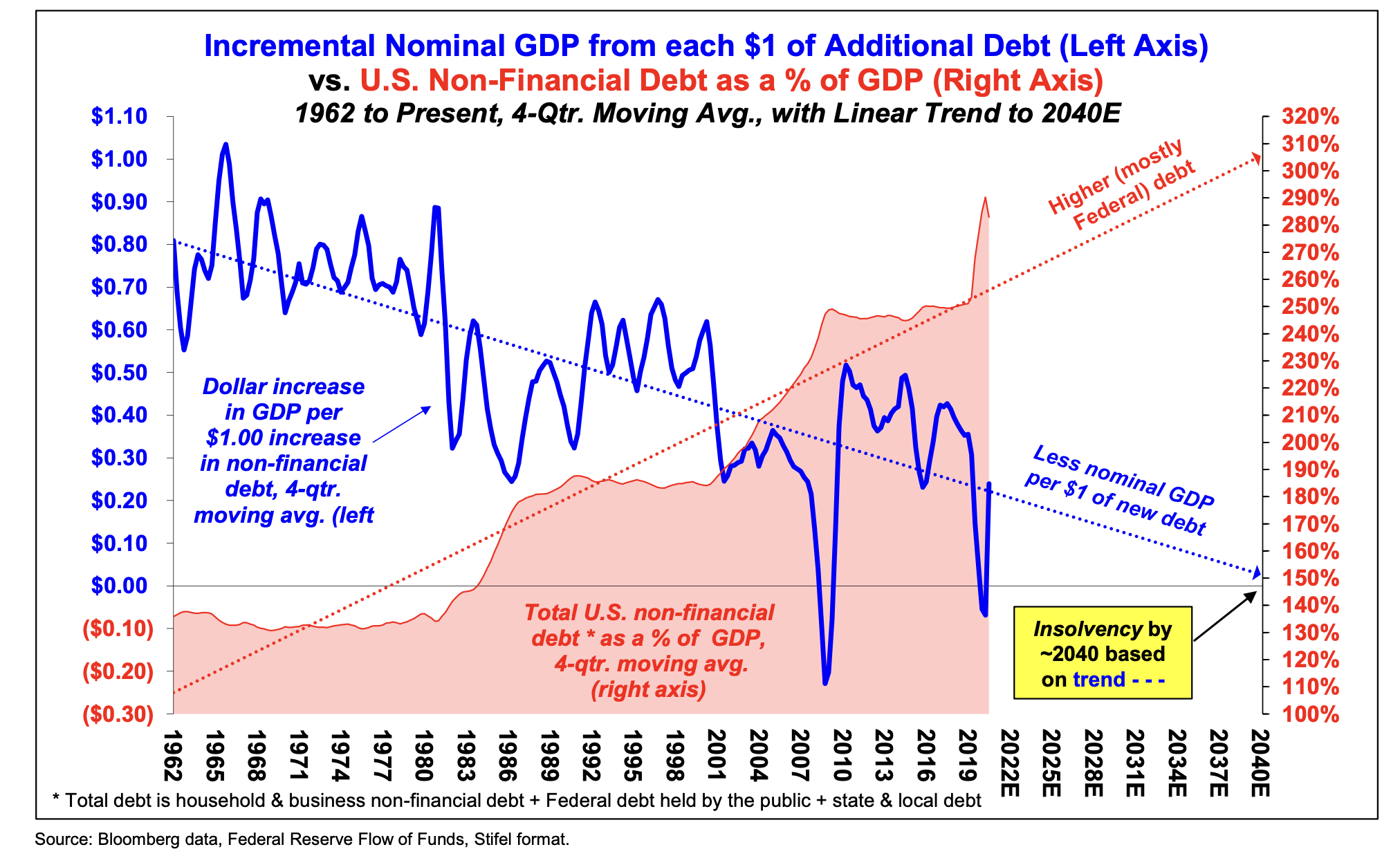

Debt Productivity

- Debt is becoming less and less productive, in terms of units of GDP added.

- Great analysis from Hoisington on the topic.

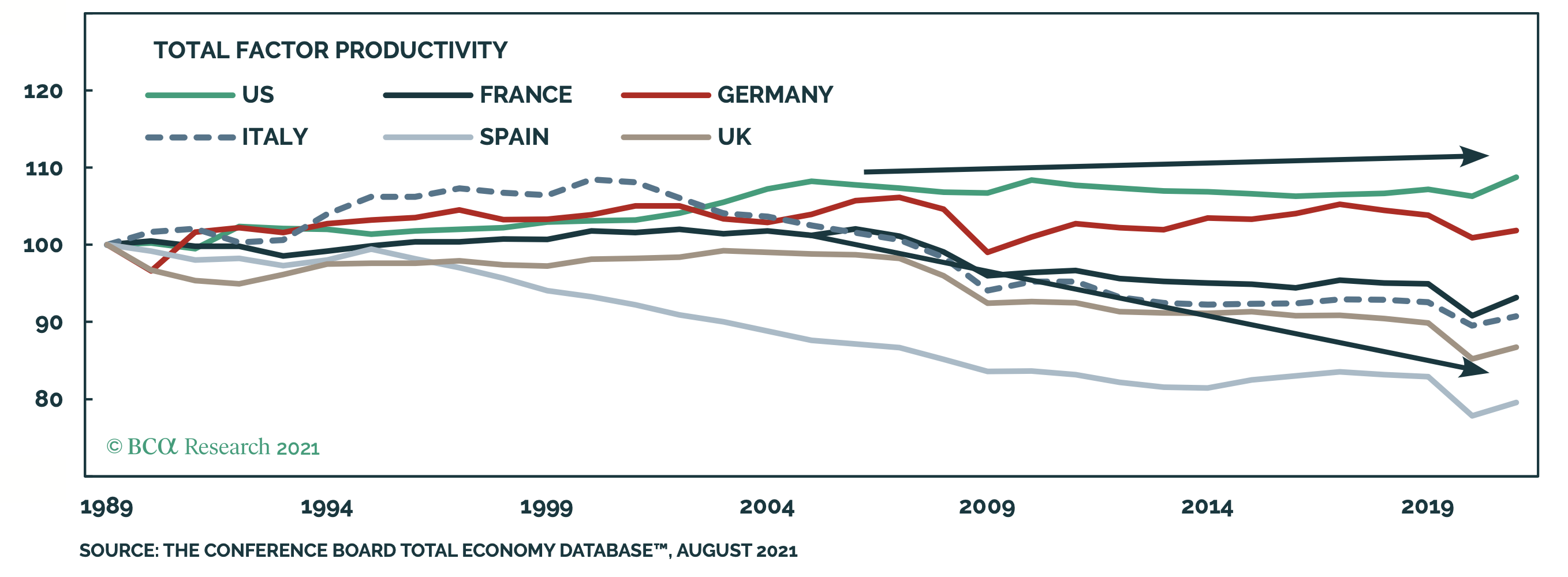

Total Factor Productivity

- Europe’s Total Factor Productivity (TFP), a key determinant of long term growth, has substantially lagged the US.

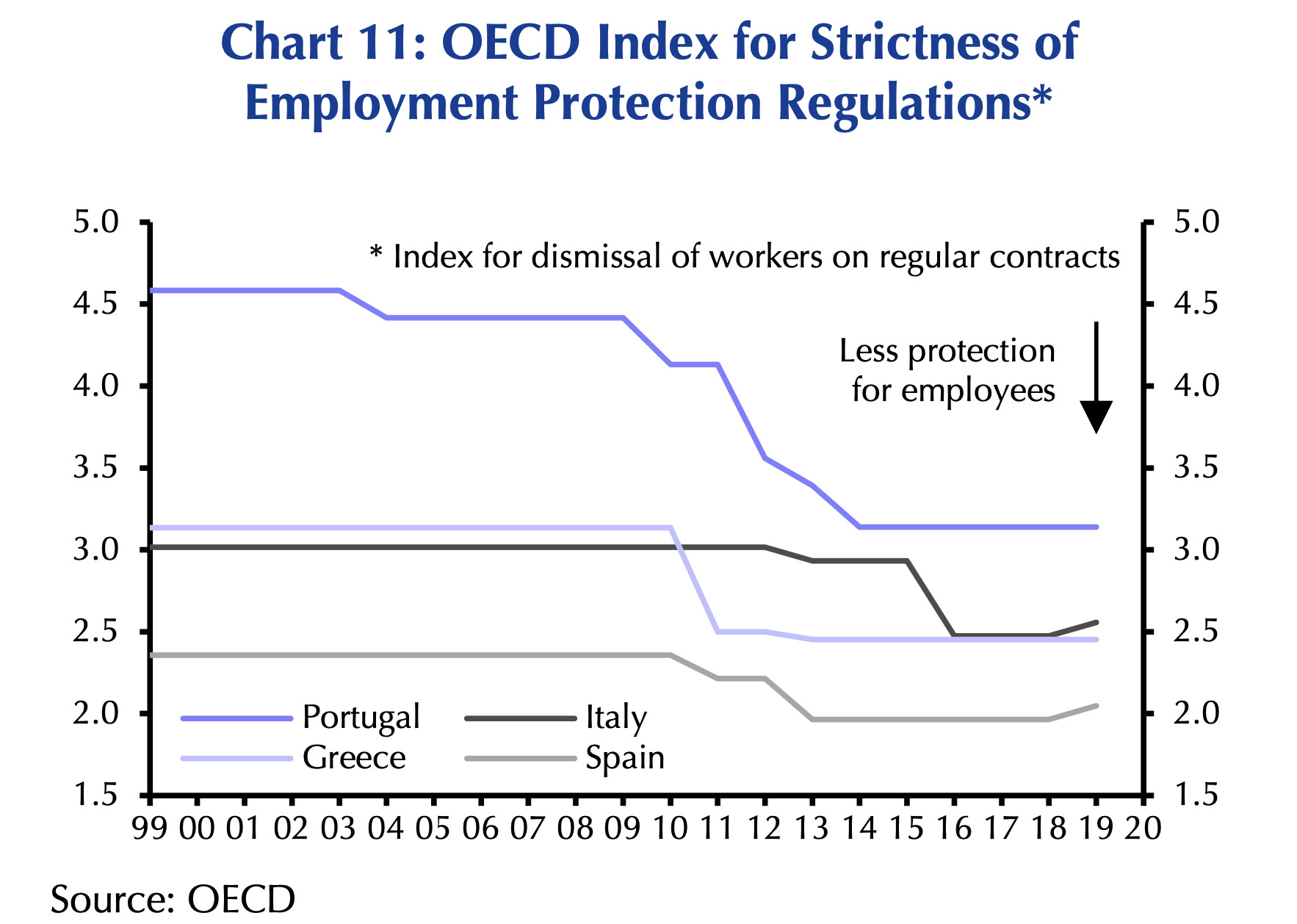

Southern Europe

- Southern Europe has been on a mission to loosen employment protection since the European crisis.

- h/t Capital Economics.

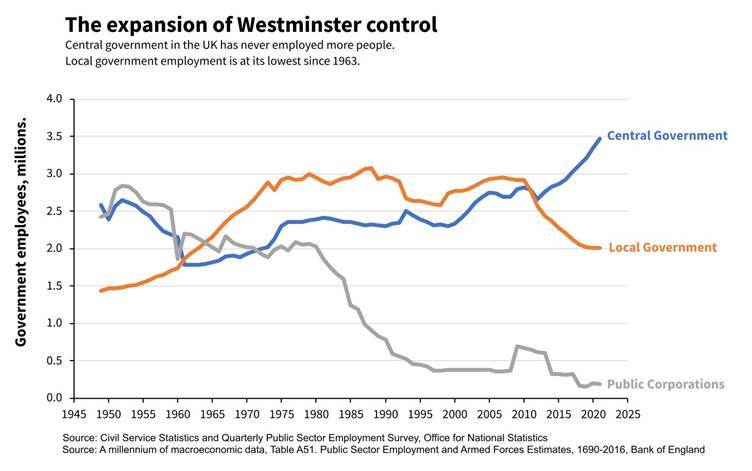

Central Government takes over

- Since the financial crisis the number of people employed in local government in the UK has been declining and currently stands at the lowest level since 1963.

- In contrast, central government employment is at a record high.

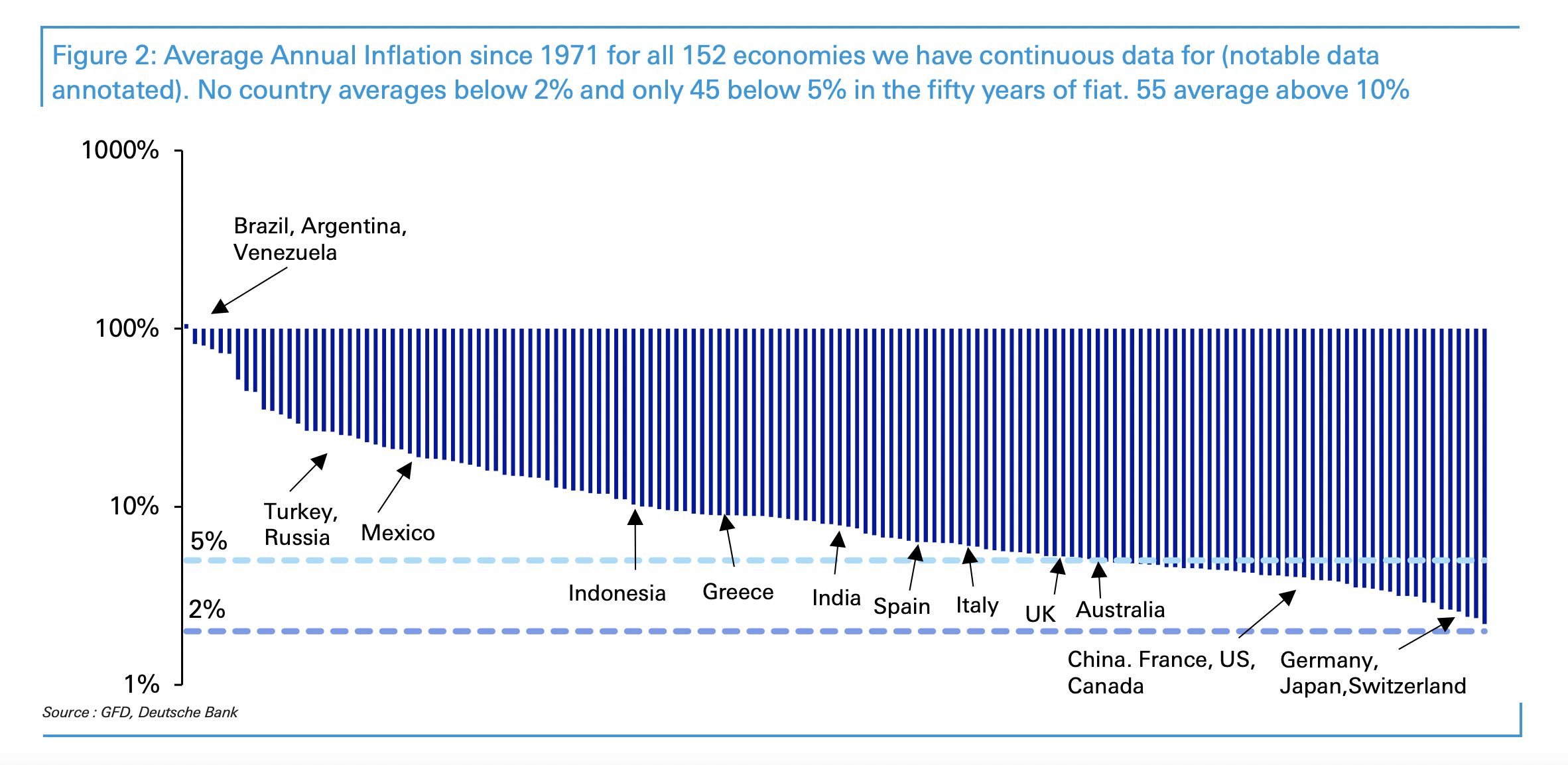

Average Long-Term Inflation

- Great chart showing average inflation since 1971 for 152 economies.

- There is no country that averaged below 2% in the period, and only 45 averaged below 5%.

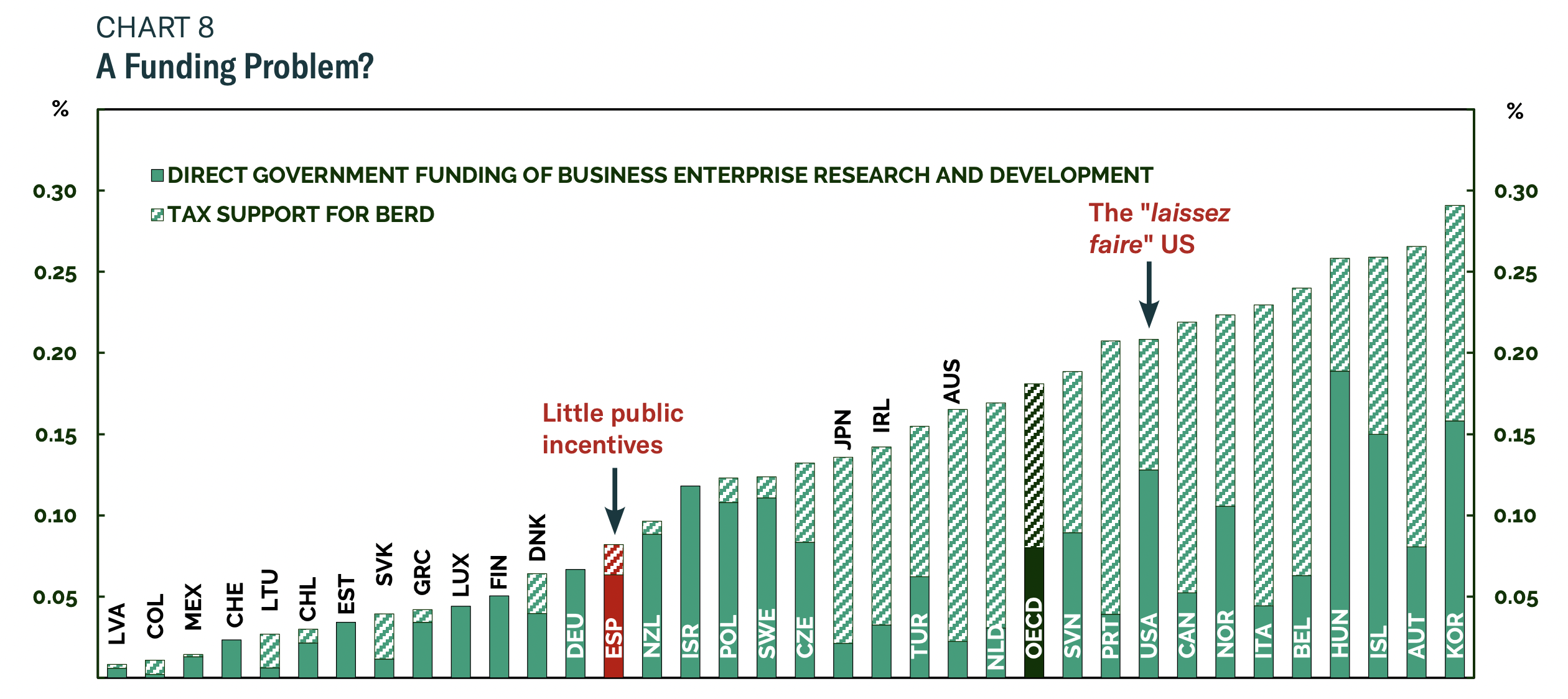

Government Funding

- Perhaps paradoxically, the US stands out as having a relatively high level of government funding for corporate R&D.

- Spain on the other hand is one of the worst in Europe.

- h/t BCA Research.

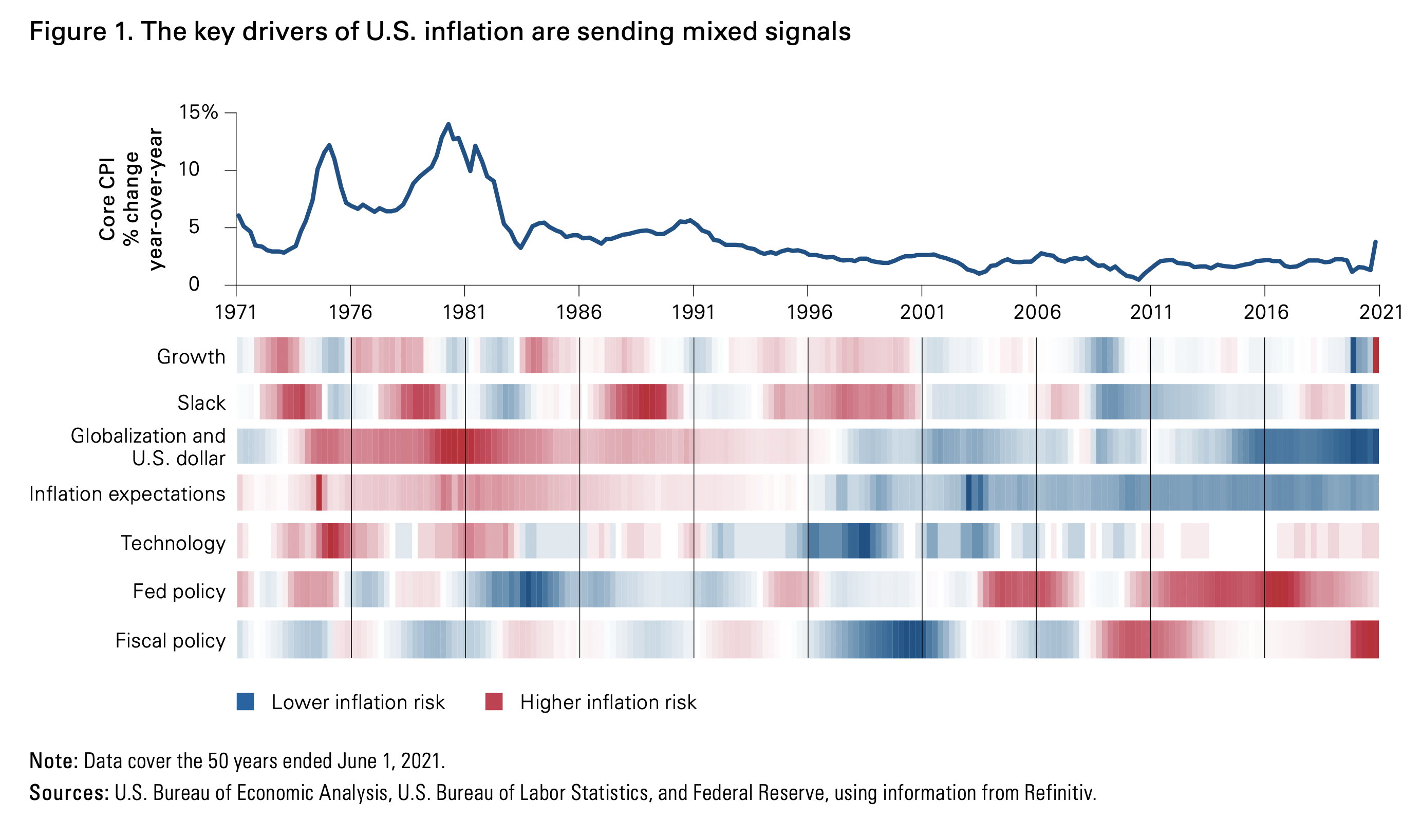

Inflation Tracker

- Vanguard produces a useful inflation tracker – highlighting key drivers.

- It is currently flashing mixed – growth and stimulative policy are pulling against deflationary technology and high unemployment.

- Interestingly, fiscal policy could continue to run strong driving 2022 inflation above 3%, an outcome not currently predicted by markets.

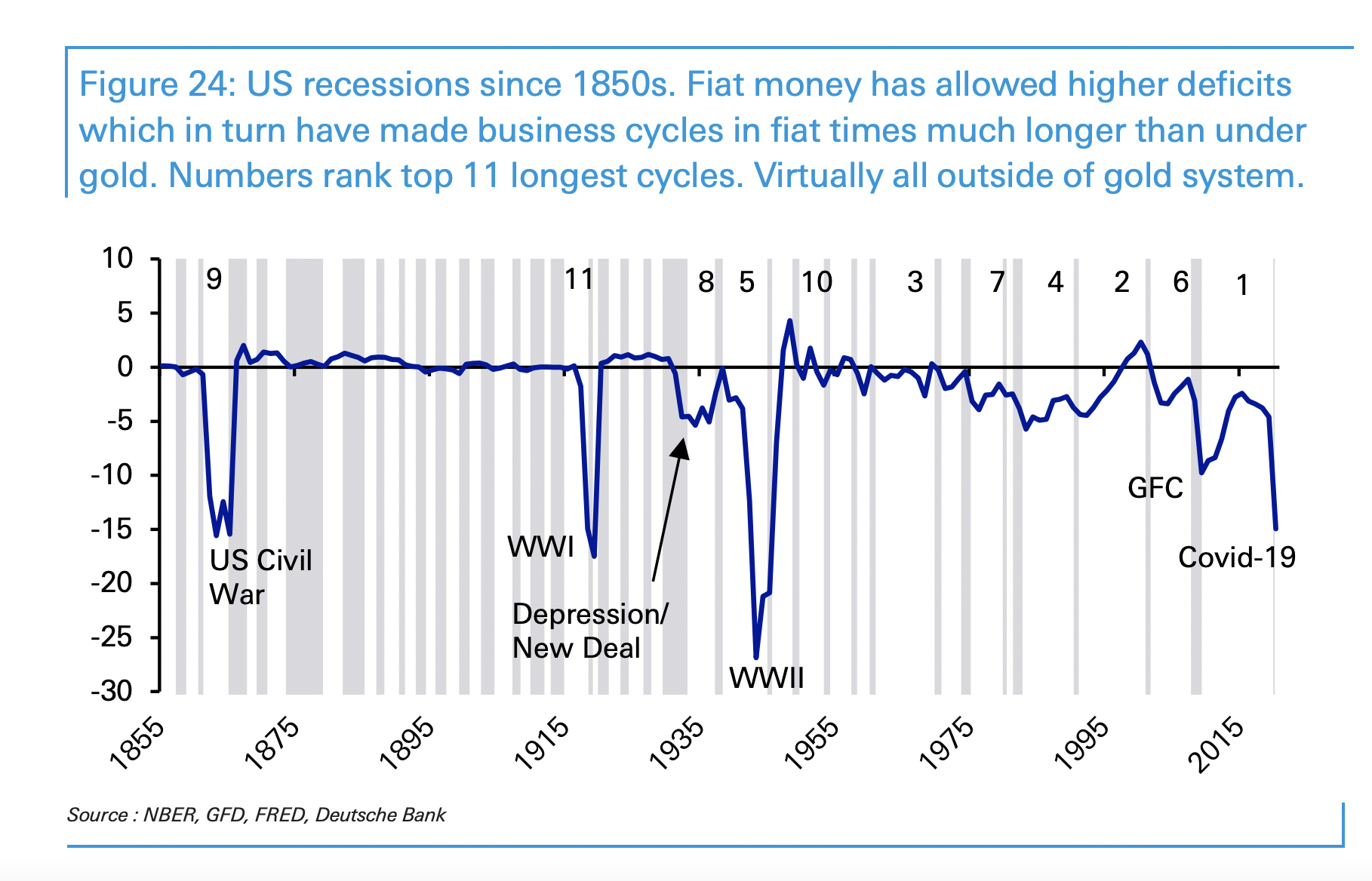

Fiat Money and Recessions

- Long-term chart from Deutsche Bank’s Annual Asset Return Study.

- It suggests that since the introduction of fiat money, cycles have become a lot longer.

- Of the top 11 longest cycles since 1850, all but two are post the abandonment of gold standards.

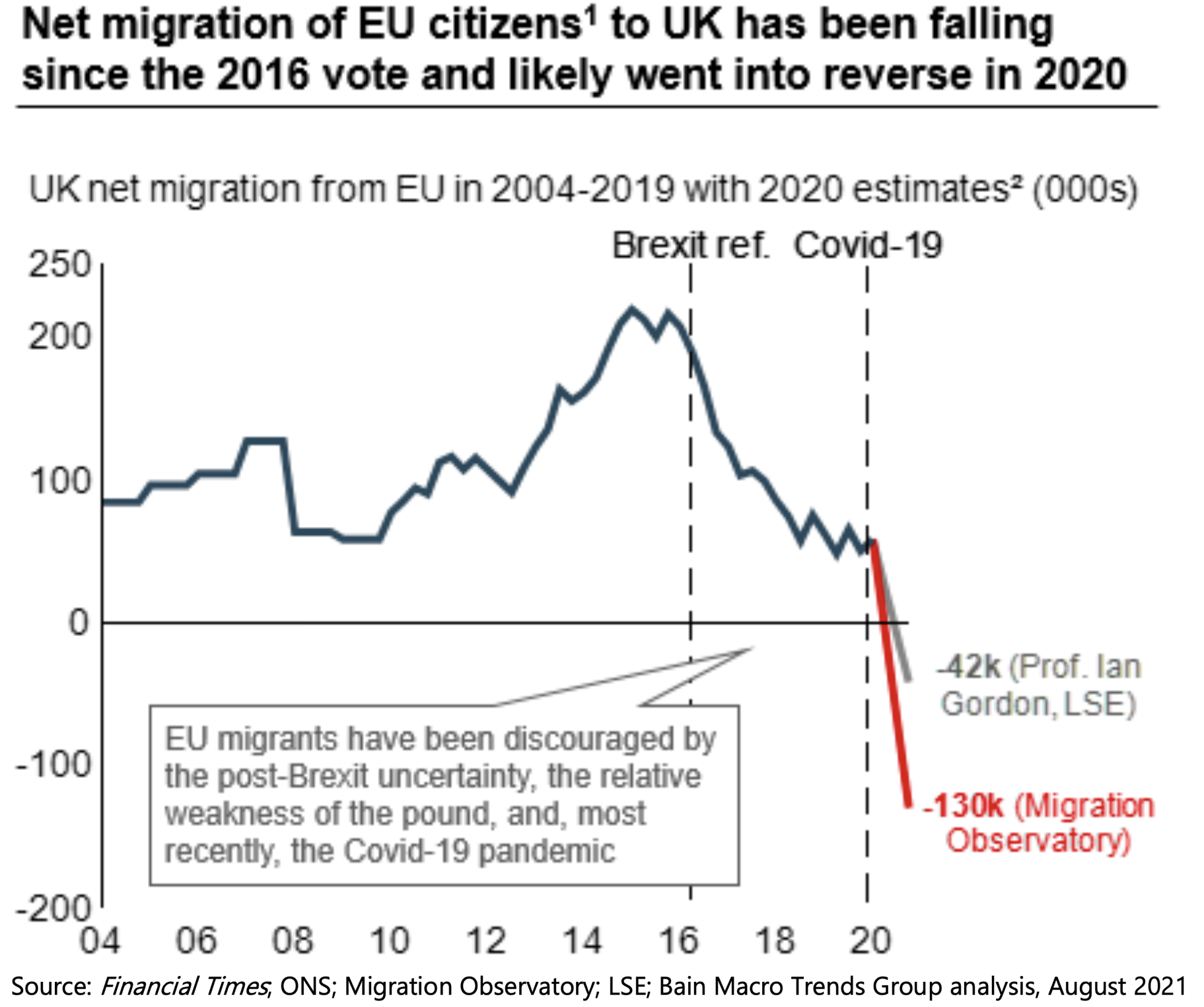

Net Migration EU to UK

- Since 2016 net migration from the EU to the UK has fallen.

- The pandemic has likely pushed it into negative territory.

- Certain sectors – like hospitality, transport, manufacturing, administration and construction – will be hit the hardest as they rely on EU labour for 10-15% of their work force.

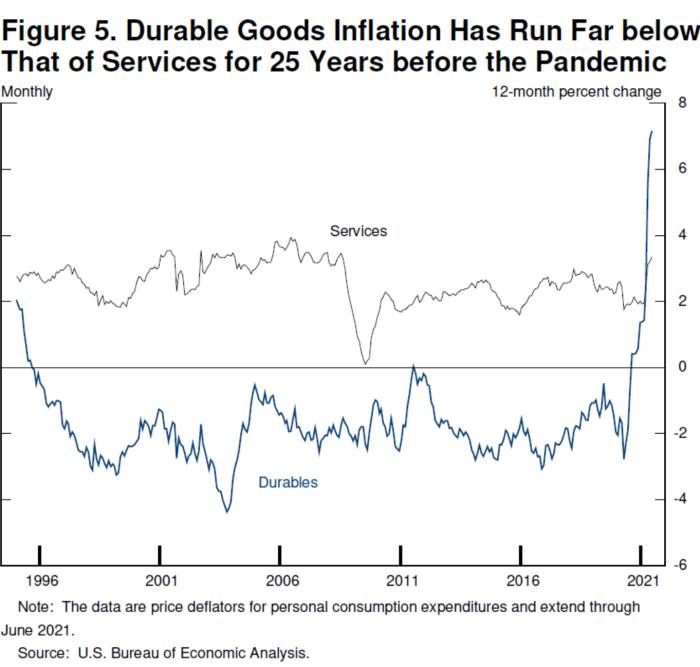

Inflation Goods and Services

- Nice way of showing how service inflation has outpaced goods inflation for largely all of the last 25 years.

Current Situation

- Great chart showing how extreme the current situation is.

- Global survey data points to a record gap between order backlogs and inventory levels.

- h/t Daily Shot.

European Capital Stock

- Europe has too much capital stock when compared to other regions.

- This bodes poorly for future bank lending growth.

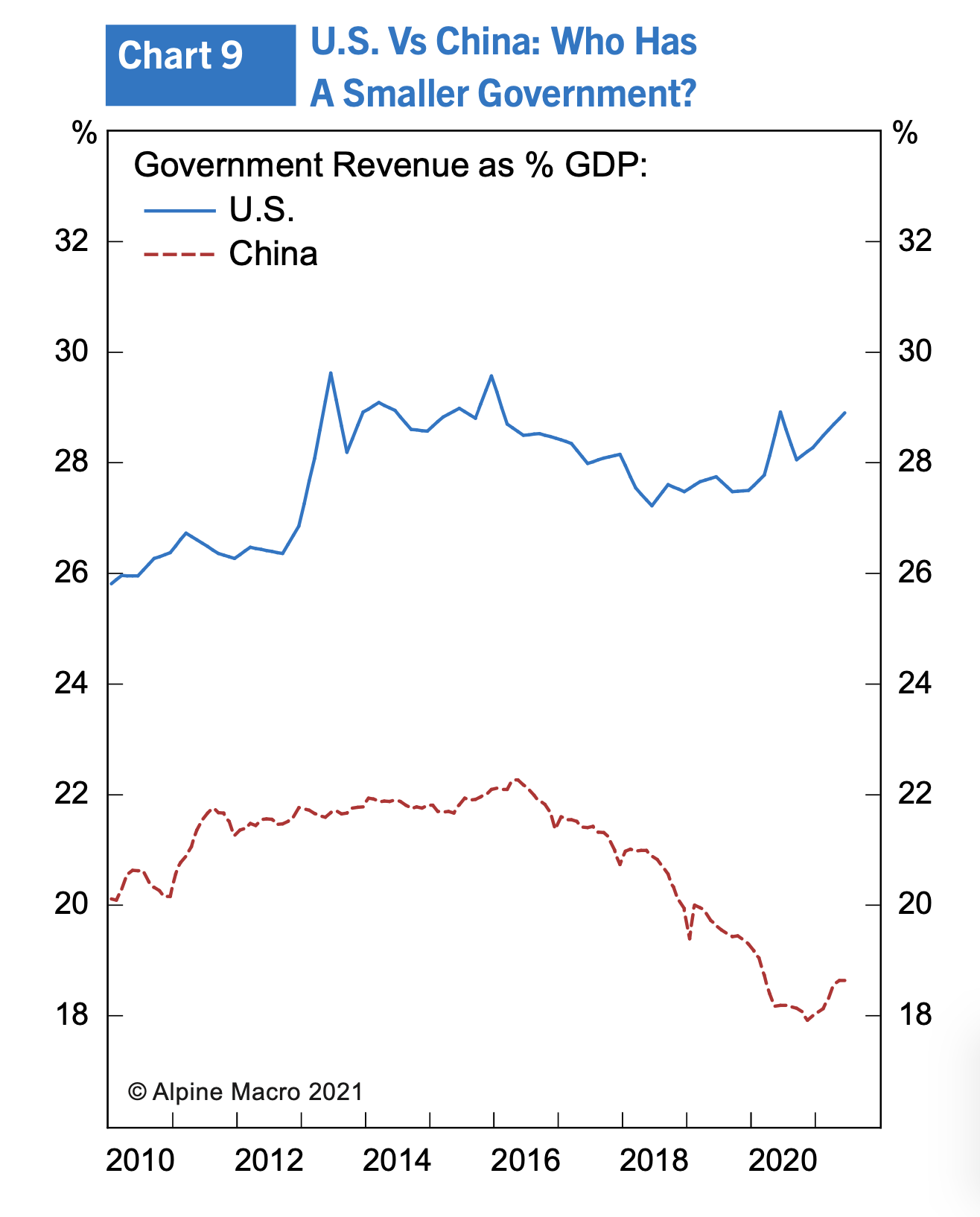

Chinese Government

- Interestingly the government sector in China is actually smaller than in the US.

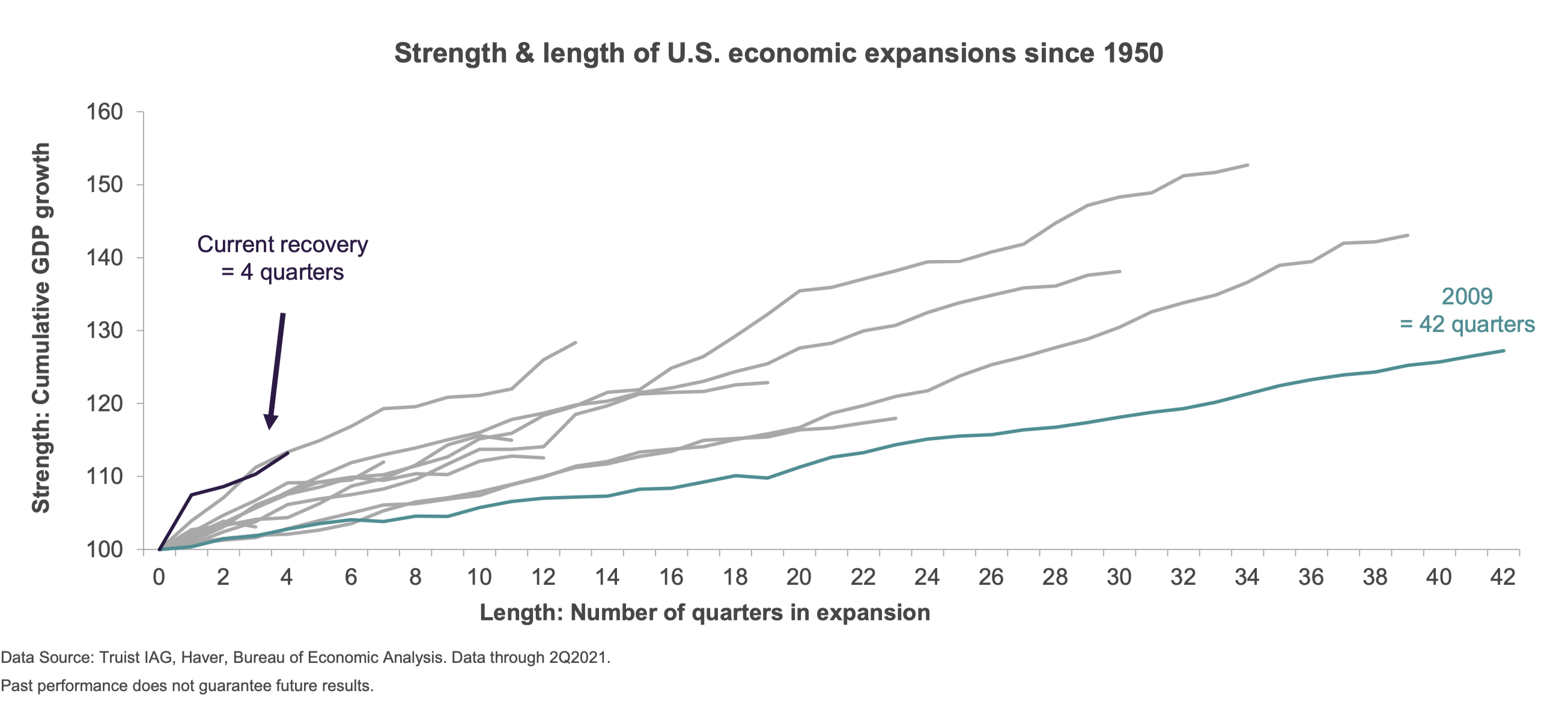

Recovery Timlines

- If history is any guide recoveries tend to last a lot longer than the current four quarters.

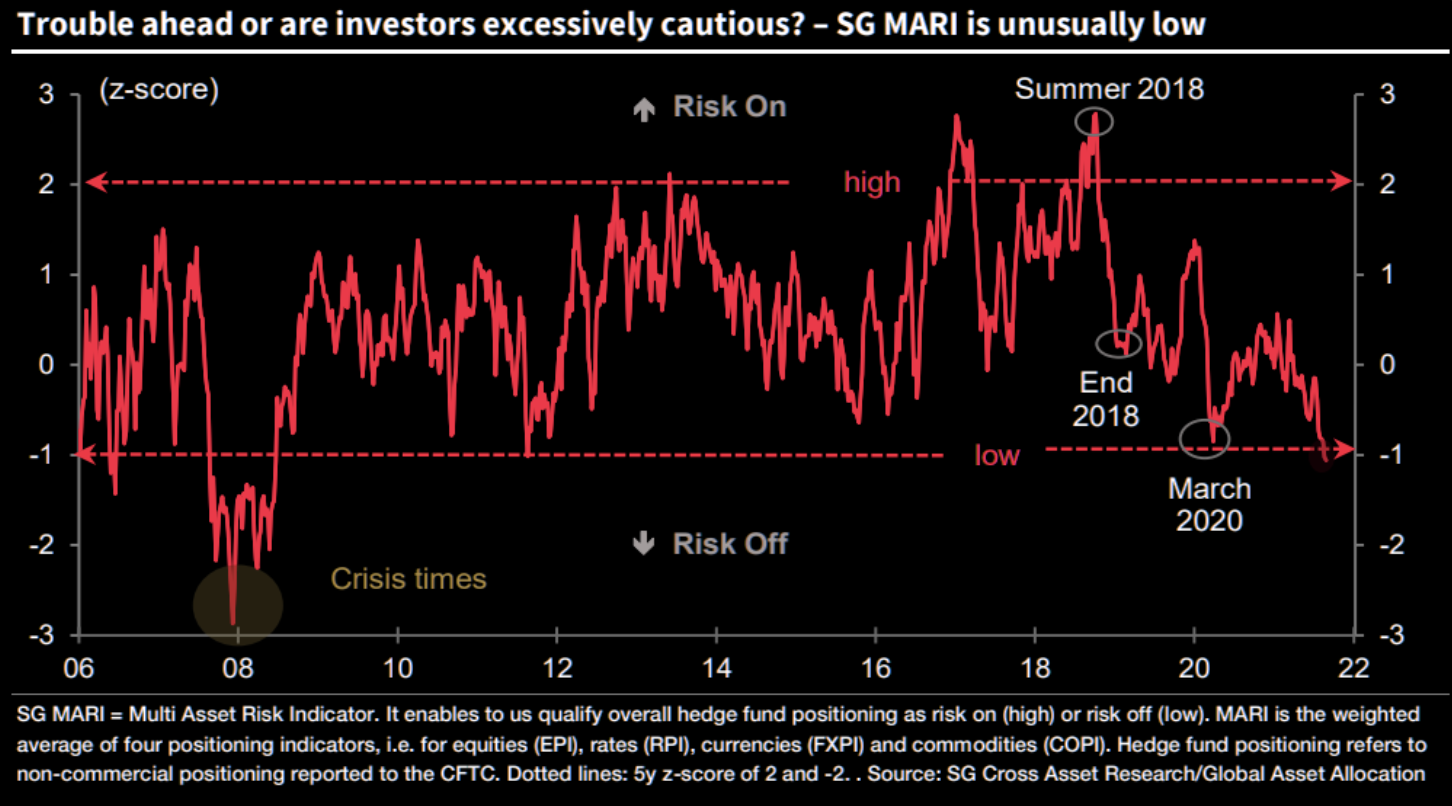

Sentiment

- Despite equities at all time highs Societe Generale’s multi-asset risk indicator is flashing risk-off like it did in March 2020.

- h/t The Market Ear.