- UK’s fiscal situation isn’t looking good.

Macroeconomics

Snippets on the big picture.

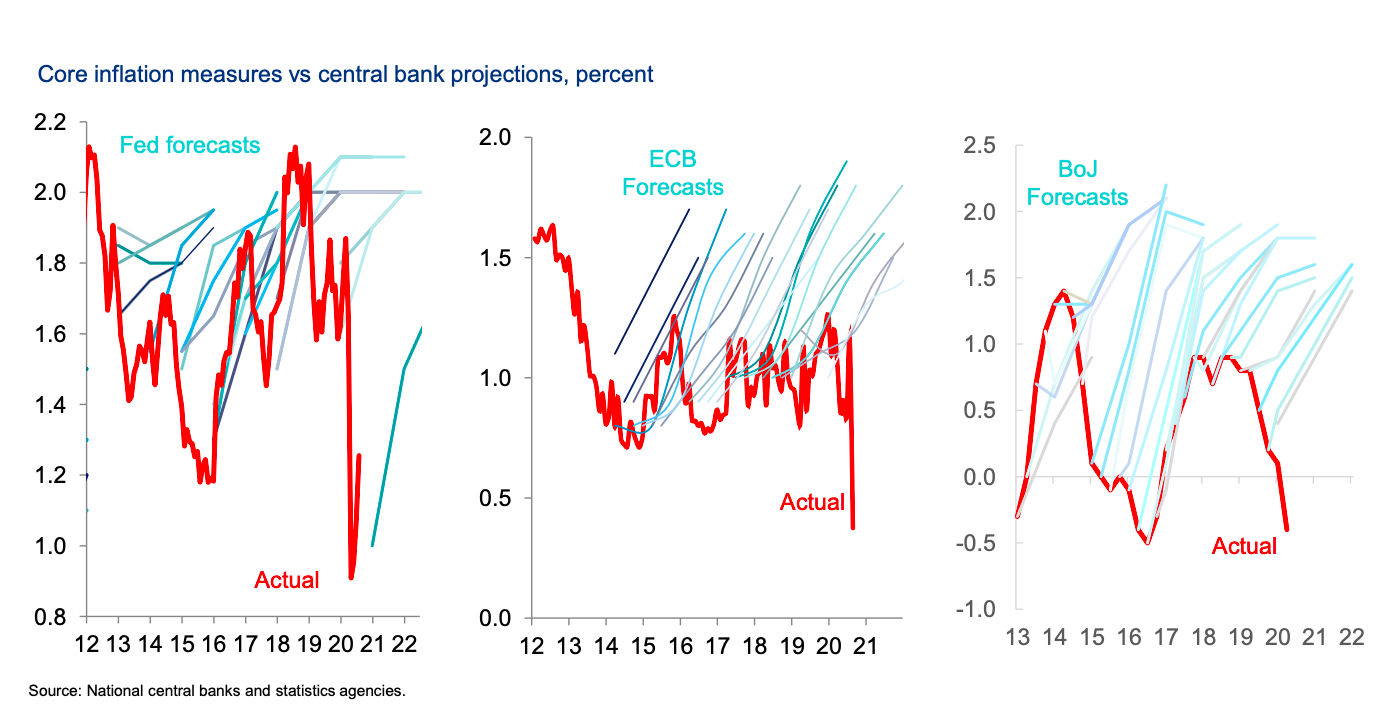

Forecasting Inflation is Hard

- Central banks rarely get it right.

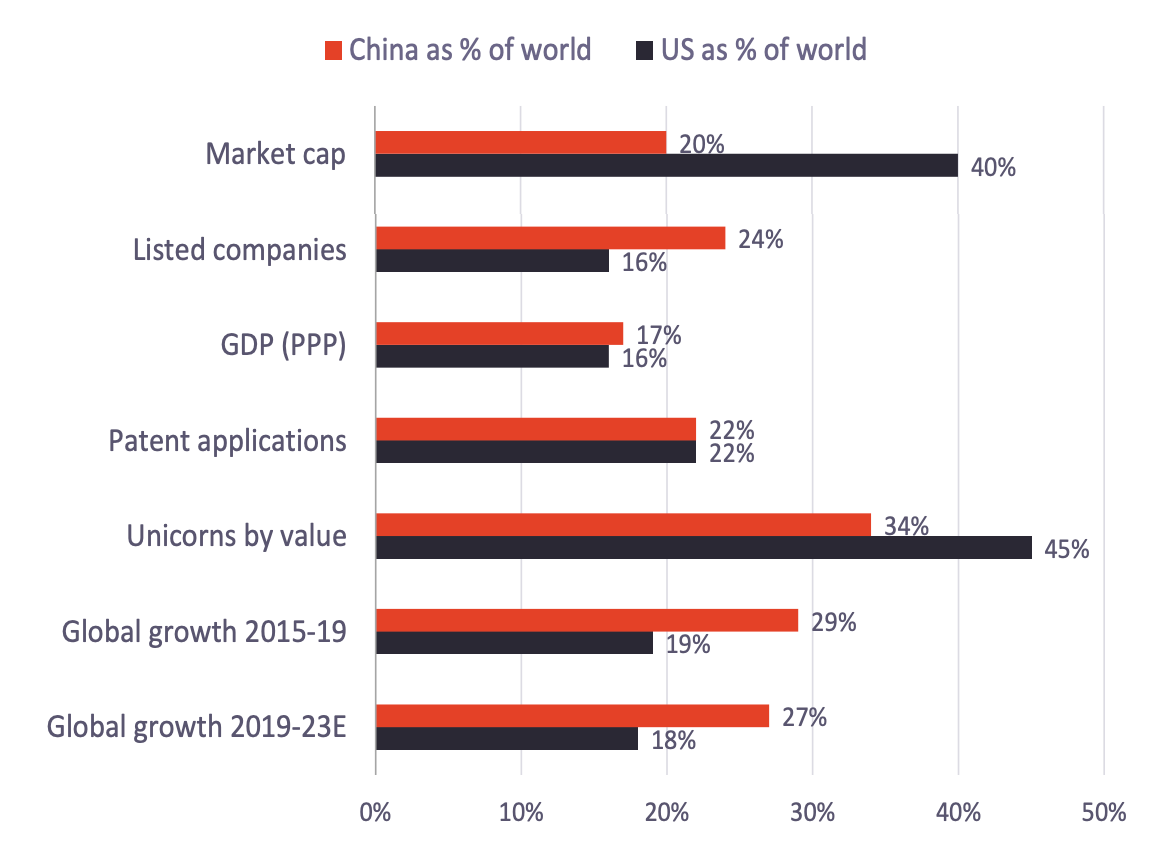

China

- In stark contrast to this chart China’s weight in the MSCI All Country World Index is just 5%.

- Source.

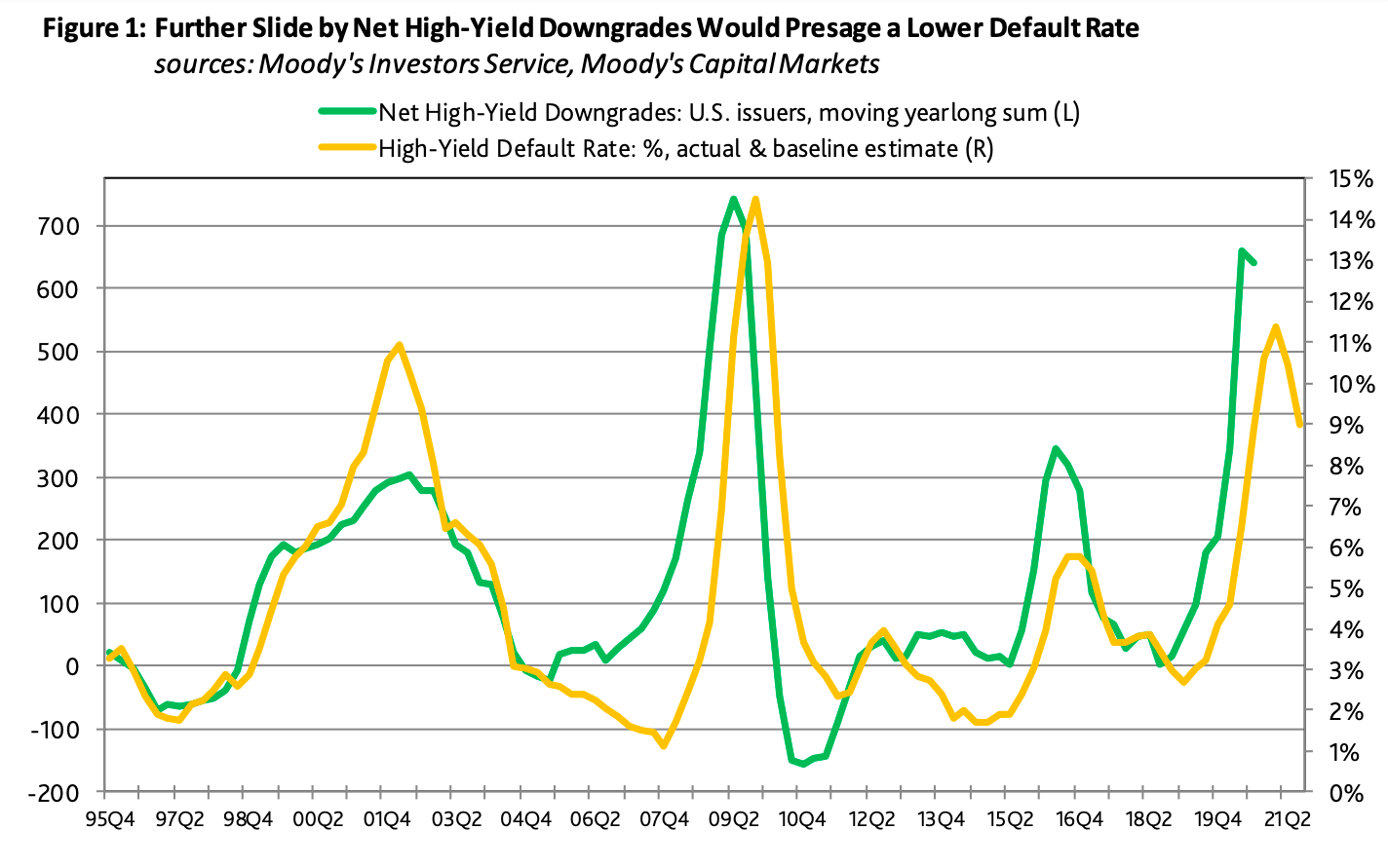

Downgrades and Defaults

- Nice chart from Moody’s Analytics.

- It shows net downgrades (downgrades minus upgrades) of US high yield issuers (green line) against default rate (yellow line).

- It appears the bond downgrade cycle has peaked and is heading down, and this leads default rates.

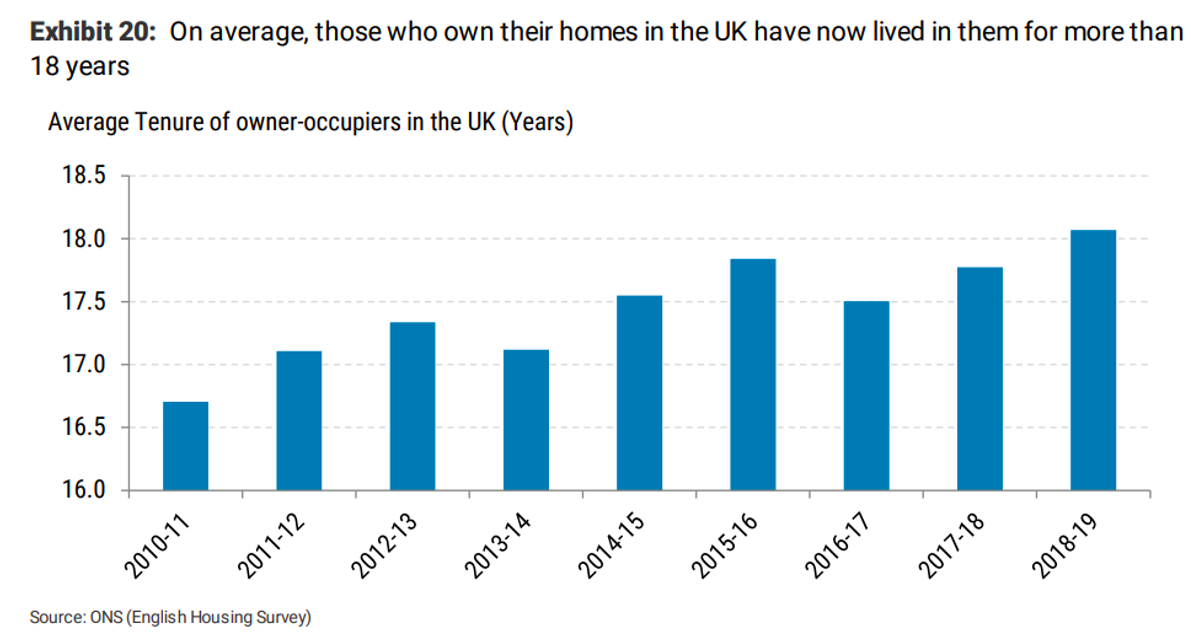

Tenure of Home Owners

- On average, UK home owners are staying living in their homes longer and longer – currently more than 18 years.

Tax cuts and US vs. EU

- Tax cuts instituted by Trump boosted US EPS vs. EU EPS.

- This partly helped the outperformance of US stocks (along with EU stocks higher exposure to exports and EUR strength in that period).

- As themarketear points out, worth remembering should Biden win and the tax cuts are reversed.

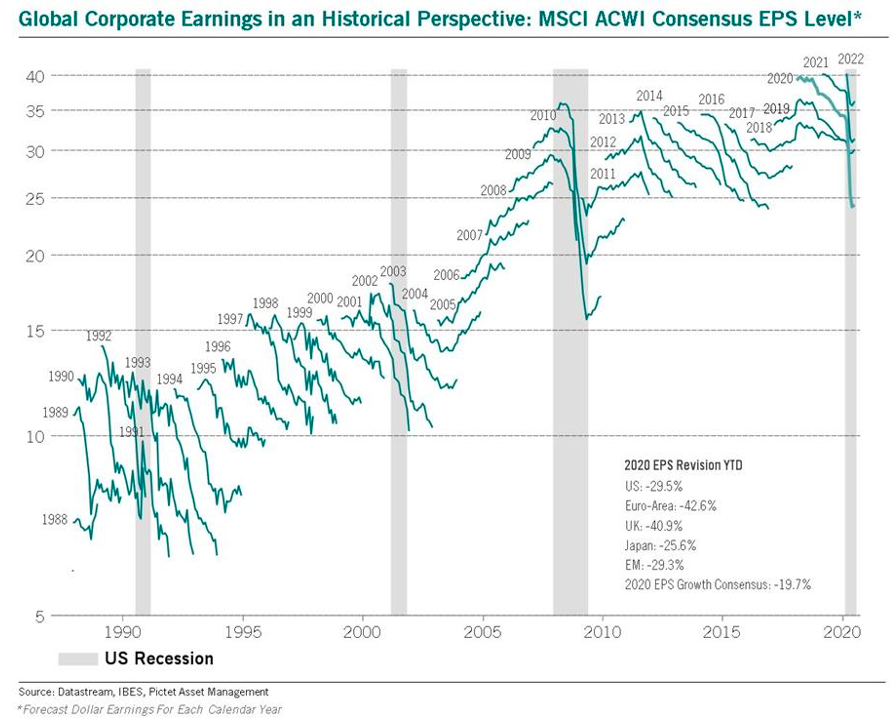

EPS Revisions

- Classic chart showing what happens to EPS forecasts during each year.

- They start optimistic and almost always get revised down.

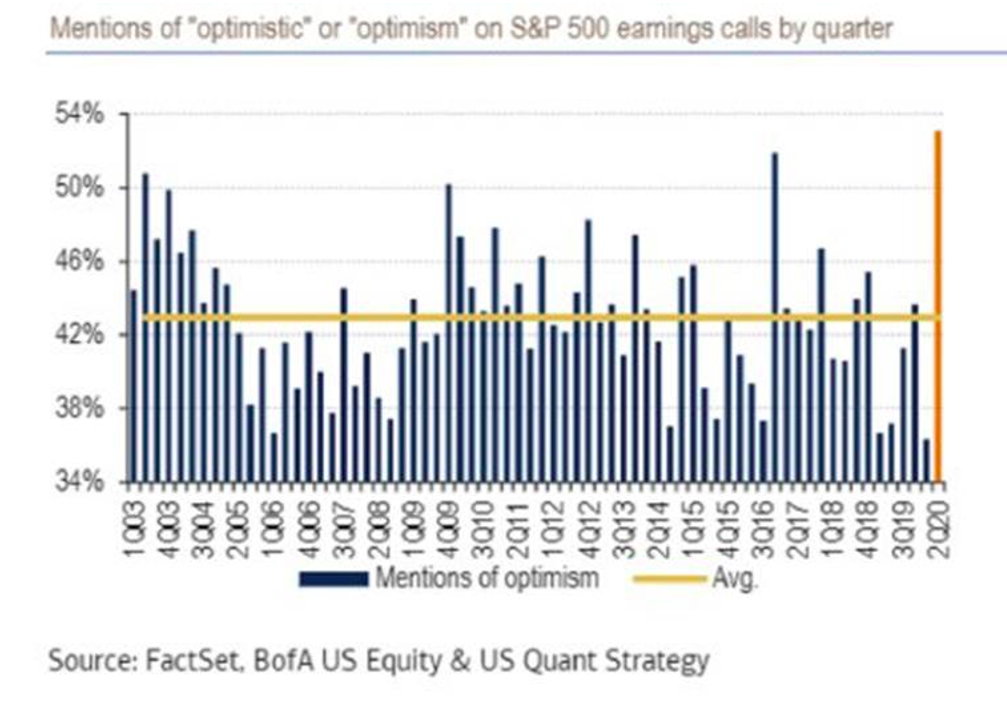

Optimism

- Mentions of optimism on S&P earnings calls hit a record.

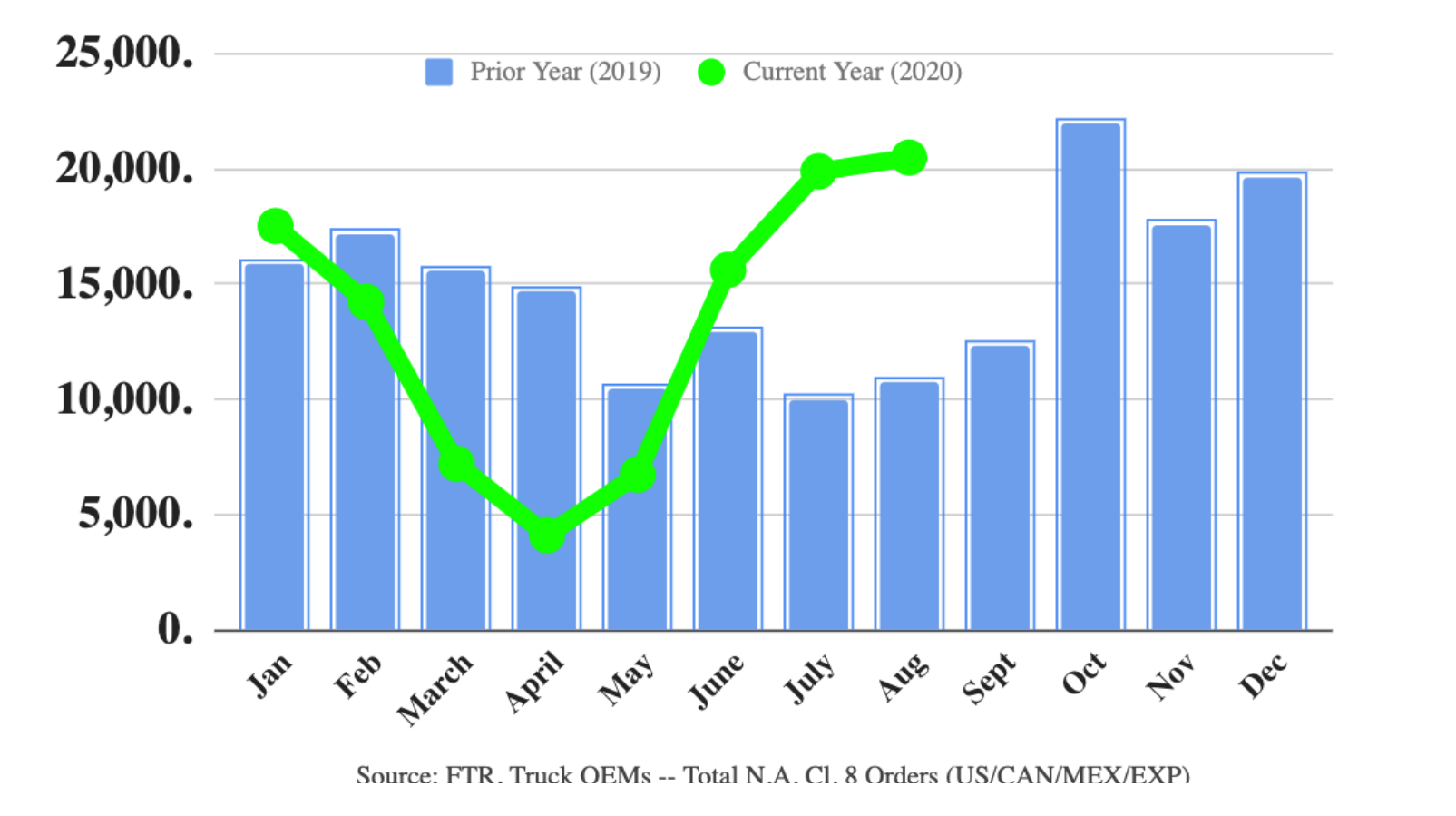

Truck Orders

- The very economically sensitive orders of heavy (Class 8) trucks in the US continue to be robust.

- “This is an odd situation. We are in a highly uncertain, yet very stable, environment. You have a pandemic, a presidential campaign, and social unrest all occurring at the same time. However, the economy is briskly recovering and generating ample freight. Fleets are ordering only what they need, and thus, orders are aligning very closely to production rates.“

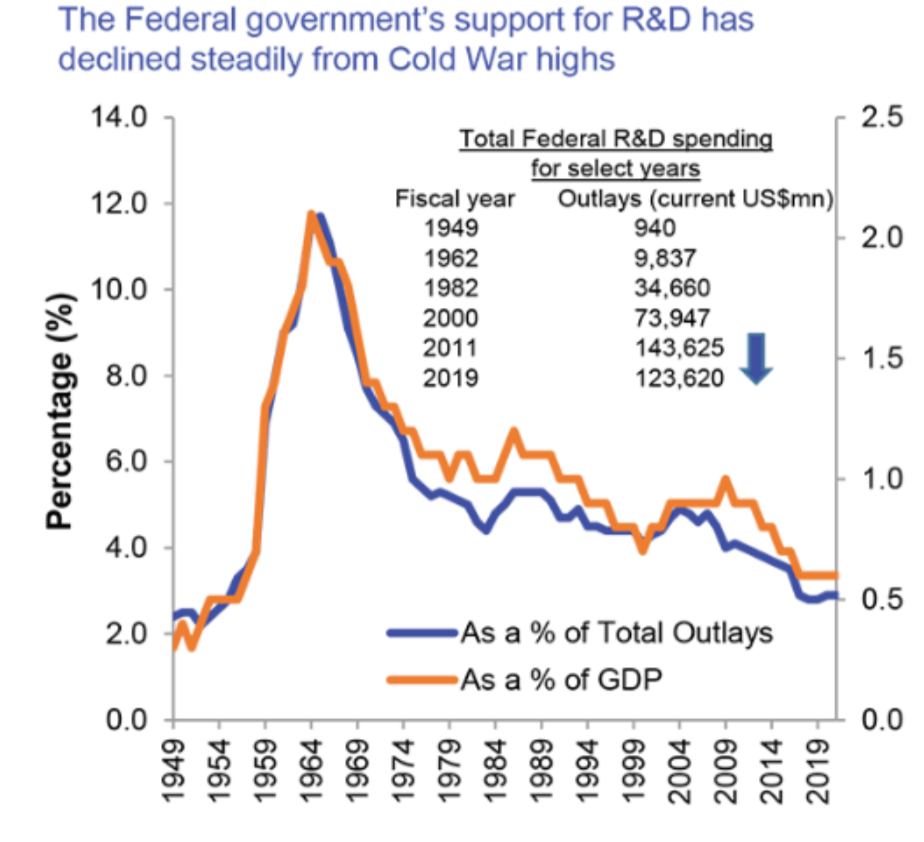

US Government R&D spending

- Over the past six decades, US government spending on R&D has steadily declined as a percentage of total federal spending (outlays) and GDP.

- This has occurred while other countries sped ahead.

- Because of this the government’s role has diminished – from funding 66.8% of all R&D spending in 1964 to just 21.9% in 2018.

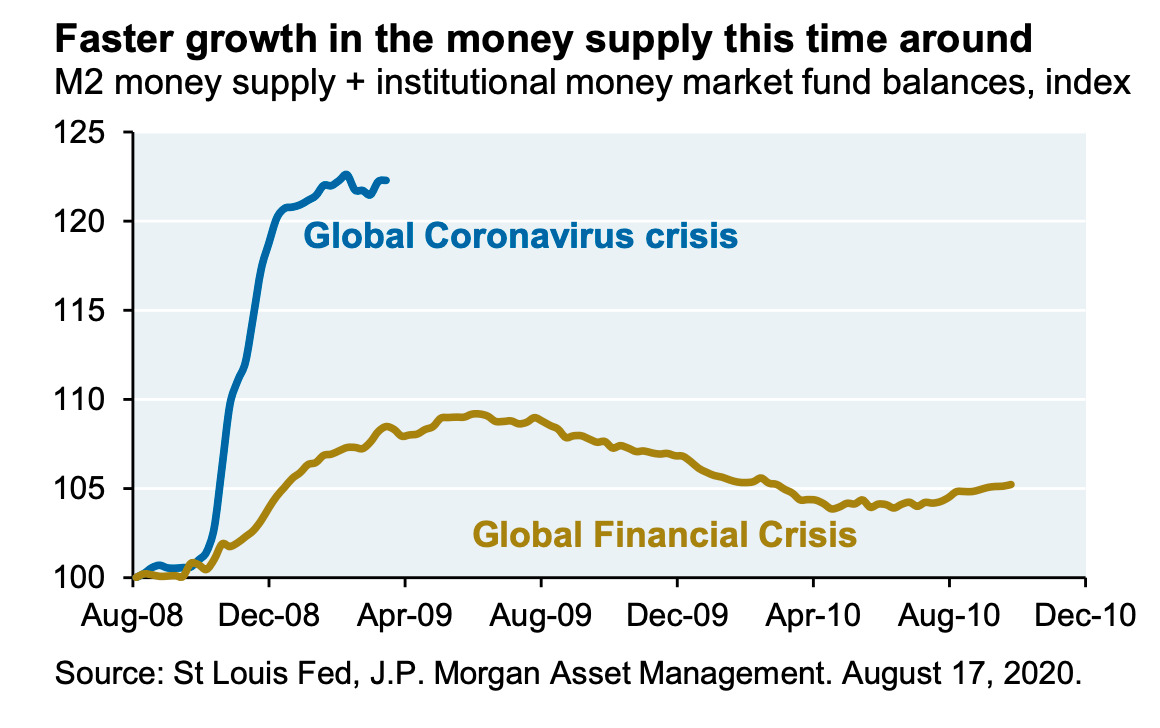

Fed Liquidity

- Money supply growth, driven by the explosion of Fed liquidity, has been considerably stronger than during the last crisis.

- Source.

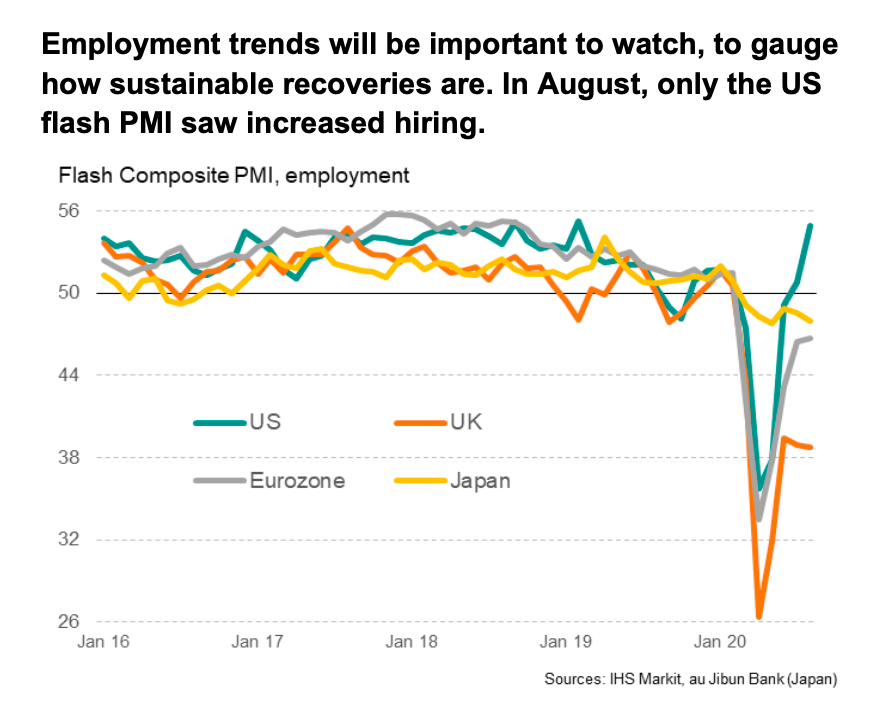

Employment

- Employment PMIs are important to watch for economic follow through.

- It appears only the US is seeing a rebound in hiring according to flash PMIs for August.

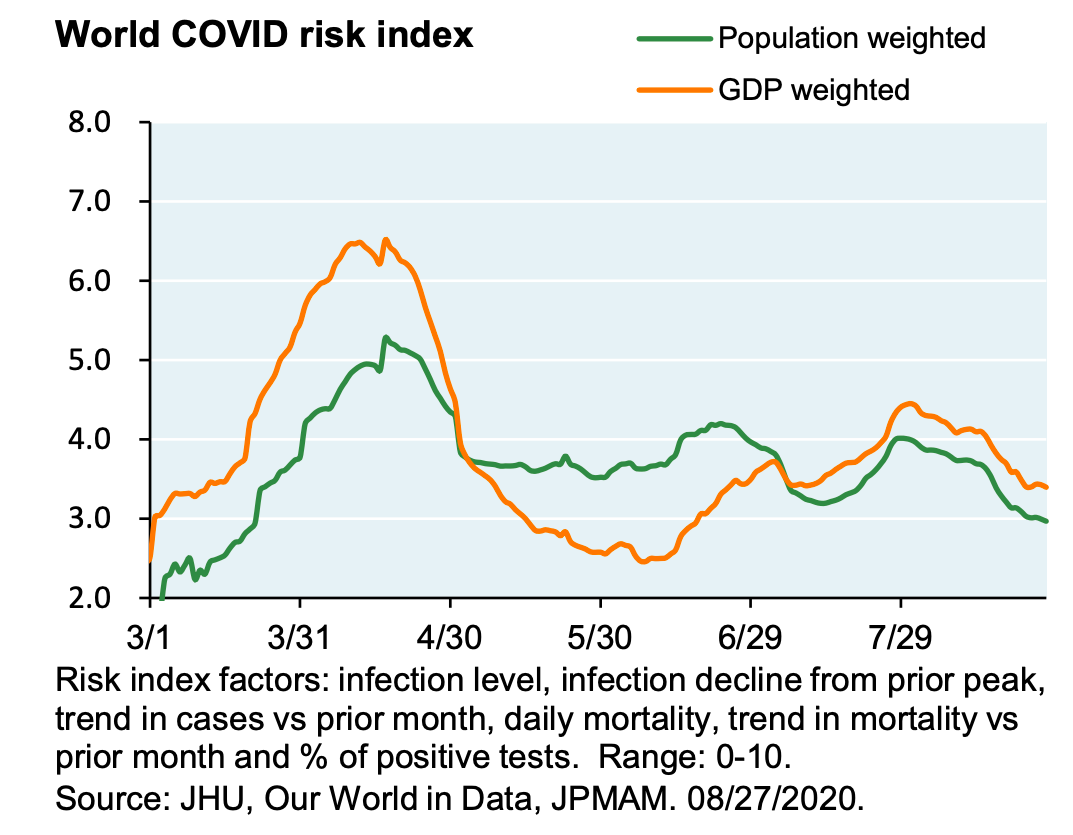

Covid Risk Index

- JPM compiled global Covid risk index (weighted by population (green) and by GDP (orange)), continues to decline.

- Source: JPM Covid Research Compliation.

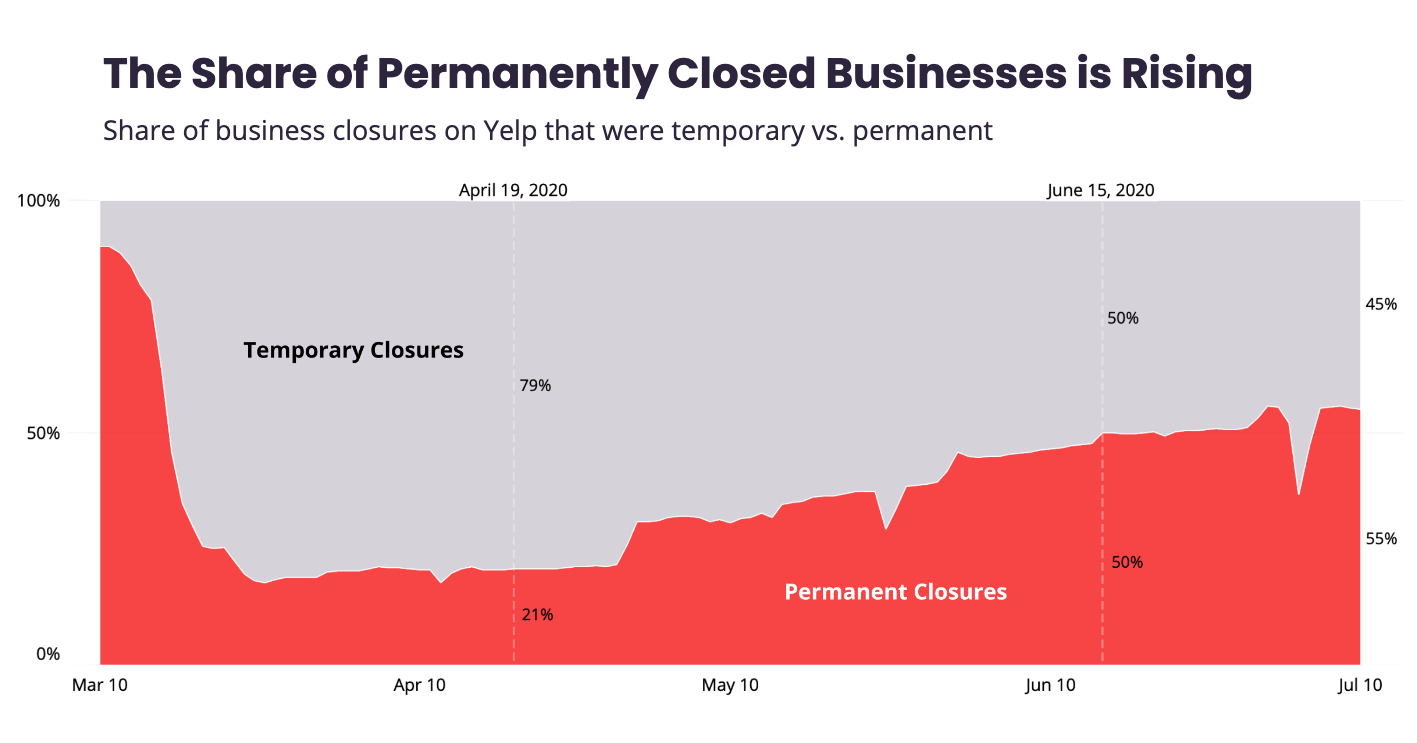

Permanent Business Closures

- Yelp data suggests that, despite total business closures falling, the percentage that are permanent has risen from 41% in June to 55% now.

- Source: Yelp Economic Average Report – which contains lots of interesting data.

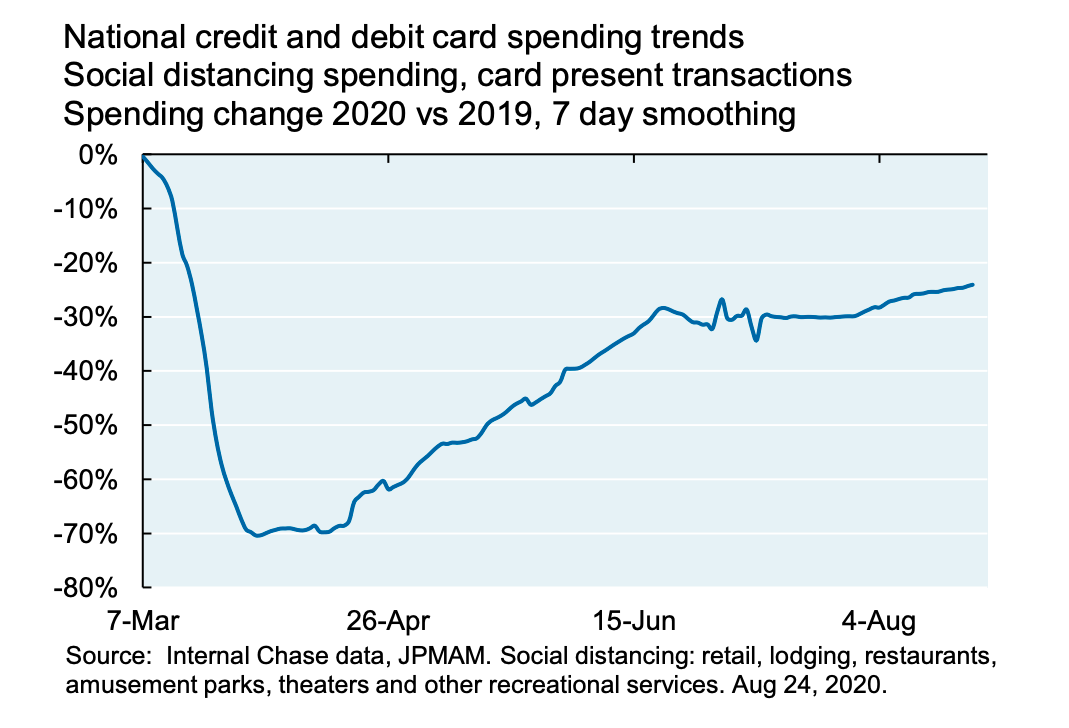

Spending Recovery

- Latest internal JPM Chase data suggests gradual recovery in socially distanced discretionary spending is back after a pause.

- This is defined as “card present” transactions that require people to go someplace and not buy from home (e.g. lodging, rental cars etc).

- Taken from the latest and always excellent JPM Covid Research Compilation.

Biggest Countries in the World in 2100

- Surprising list of the top 10 countries by population in 2100 compared to the past.

- Could you have guessed?

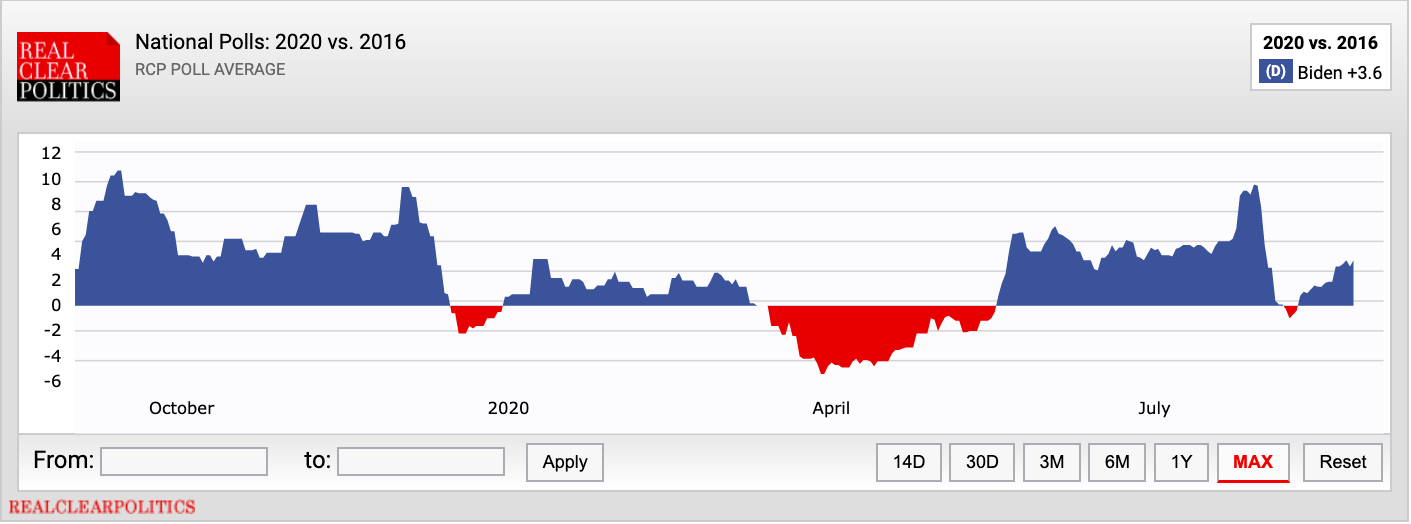

Trump vs. Biden

- A good tool that shows how Trump is tracking vs. Biden when compared to the same time in the 2016 election against Clinton.

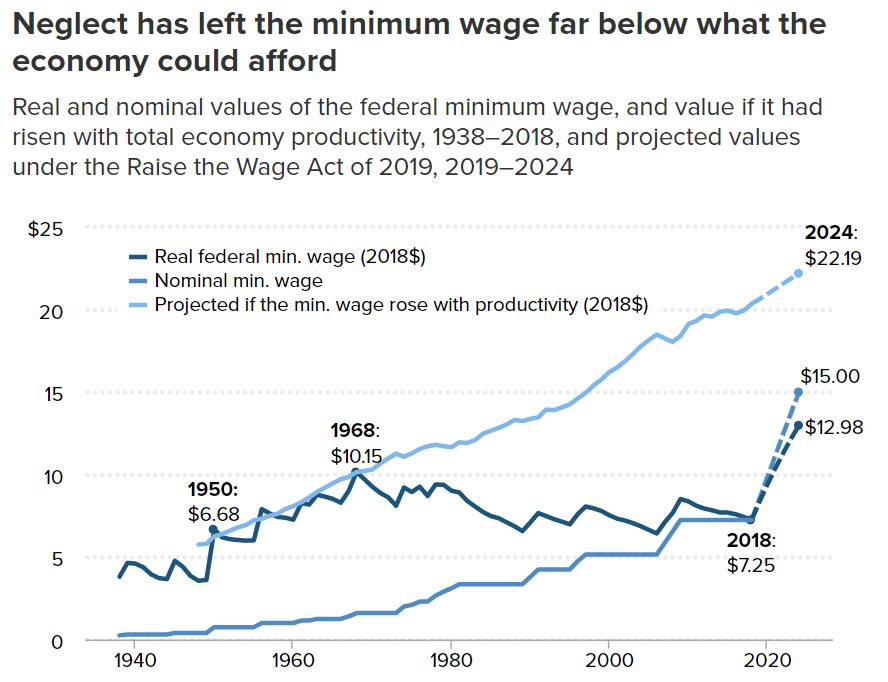

Minimum Wage

- Minimum wages in the US would be a lot higher had they followed productivity (light blue line).

- Instead they have stayed suppressed with some rise expected under new legislation.

- Source.

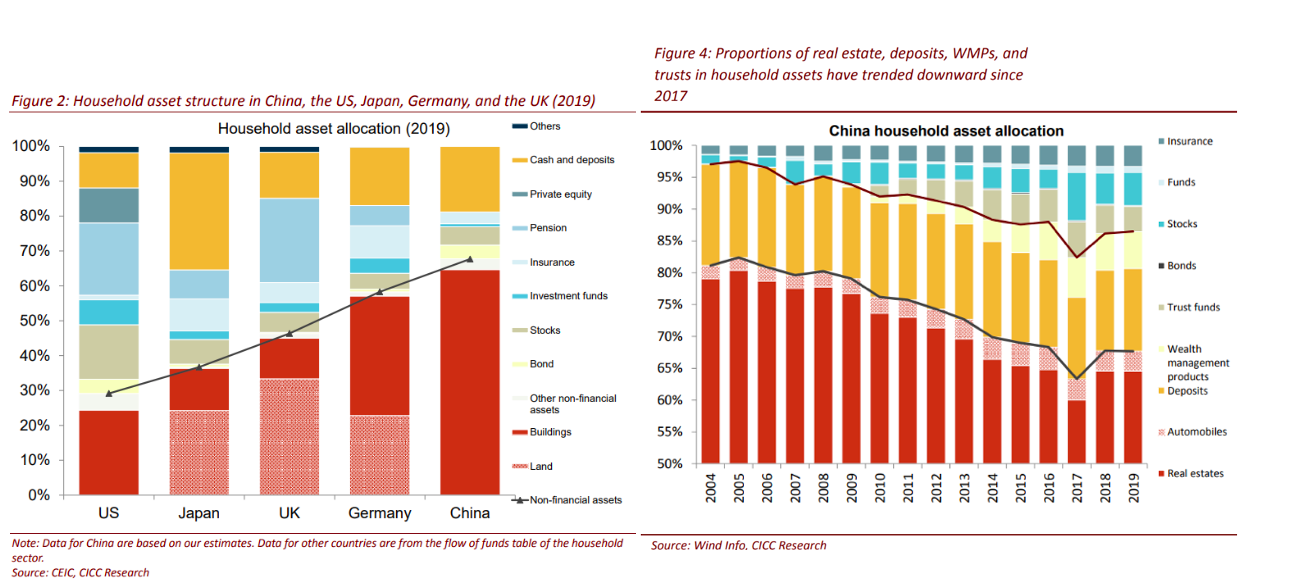

Asset Allocation by Households

- A useful chart showing on the left hand side asset allocation by households of various countries.

- China clearly stands out.

- Right hand side shows that China’s asset allocation has actually been changing over time – with an increase in funds/stocks/insurance.

Liquidity

- As machines takeover liquidity provision isn’t guaranteed

- “With fewer opportunities to profit from connecting buyers and sellers, and a much greater risk of losing money in the meantime, HFT-style market makers pulled back abruptly and in some cases likely shut down entirely. Thus the liquidity they provided dropped to a tiny fraction of its previous peak over the first couple weeks of March“