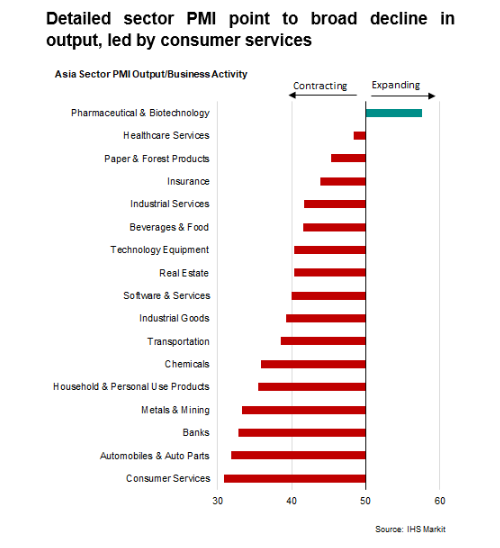

- Interesting landscape of sector PMIs in Europe – March compared to Feb.

- Even pharmaceuticals and biotech are not immune.

- Source: IHS Markit.

Macroeconomics

Snippets on the big picture.

US Economic Activity

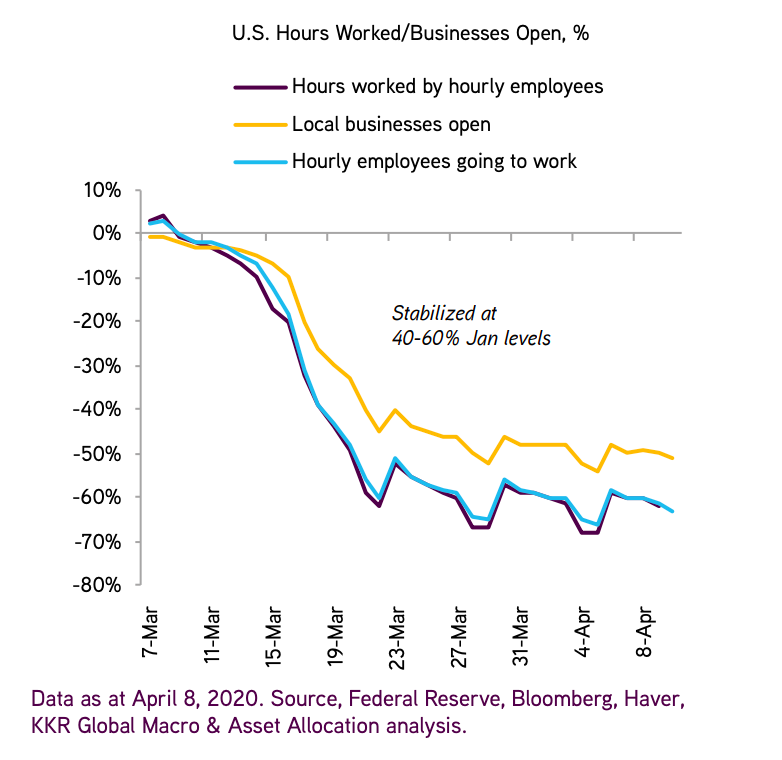

- Interesting economic series from KKR.

- Shows activity across business openings and employees.

- Activity is -40-60% from January levels.

Global Consumer Pulse

- Nice table from McKinsey on the global consumer.

- It shows net intent to purchase a particular category by country.

- Net intent = % who said they would increase purchases in the next two weeks compared to usual minus % who said they wouldn’t.

- Interesting to see China/Korea recovering somewhat but not in all areas.

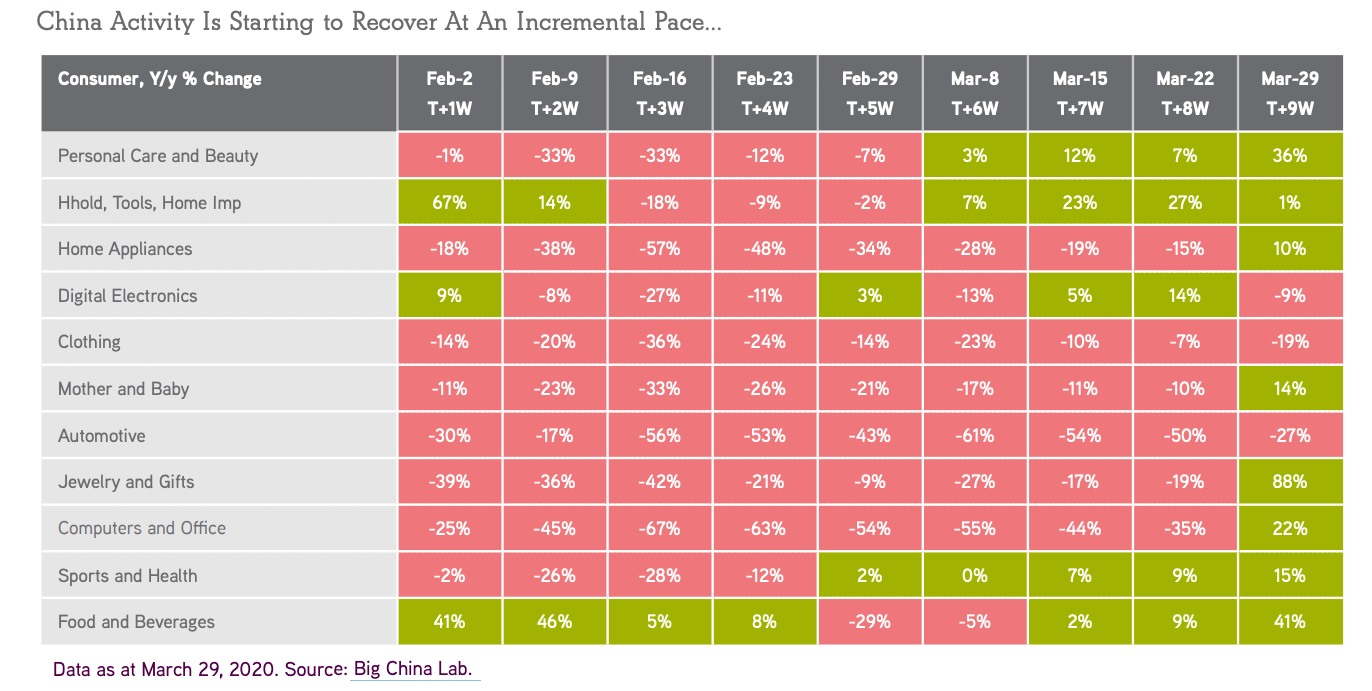

China Economic Activity 2

- Good chart from KKR’s Global Macro Insight.

- Shows activity in China across various consumption categories.

- It is starting to recover at an incremental pace.

- A previous snippet pointed to a shallow recovery in China and has negative read across to other countries.

Chinese Economic Activity

- Interestingly surveys suggest Chinese consumers are cautious despite lifting of the lockdown.

- “A Morgan Stanley online survey of 2019 consumers in 19 provinces last week found that while most respondents—86%—were leaving the house for work, most were still reluctant to go out to shop, eat or socialize. And 69% said they would go out for essentials only, down from 75% in early March—still extremely high.” (Source: WSJ).

- The chart below is also interesting showing how activity across a set of indicators has fared so far in China post the lunar new year as the country opens up.

- In short – activity will take some time to recover.

- Could the same be the case in other countries?

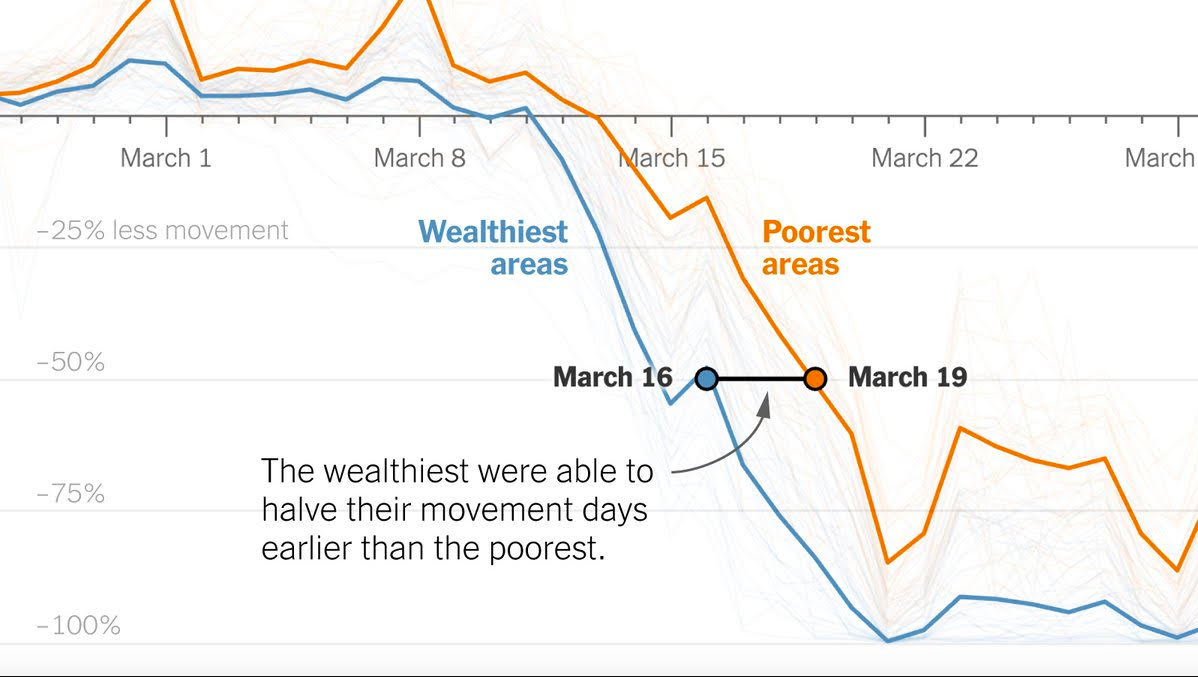

Income inequality and Covid

- Mobility data has allowed New York Times to do some analysis.

- They have found that wealthier areas saw movement halve earlier than poorer areas.

- Covid is likely to expose further inequalities.

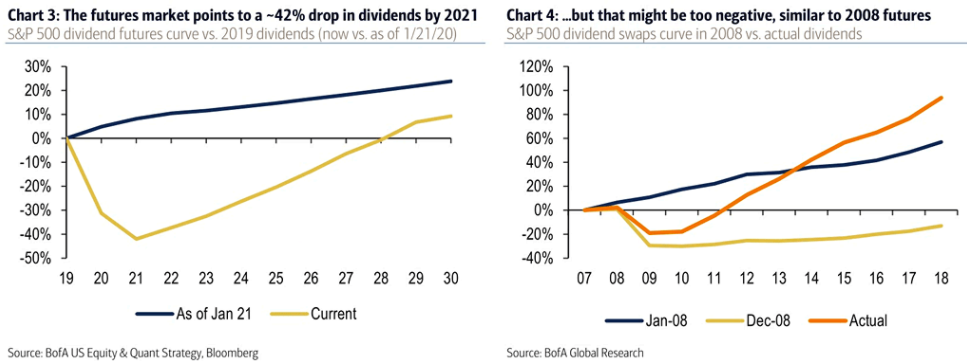

Dividend Futures

- The dividend futures market has been crushed.

- This chart (from ML) on the left shows the futures curve for S&P 500 dividends compared to 2019.

- The blue line is how the market looked at the top (21st Jan 2020) and the orange how it looks today.

- The market is pricing in -42% in dividends by 2021.

- The right hand side shows the situation in 2008 – the actual reality (dark orange line) was far better.

Average daily cause of death in US

- Stark visualisation showing how the daily cause of death in USA has changed from the start of the year.

- Covid has risen to the top.

- Source: Flourish h/t The Big Picture.

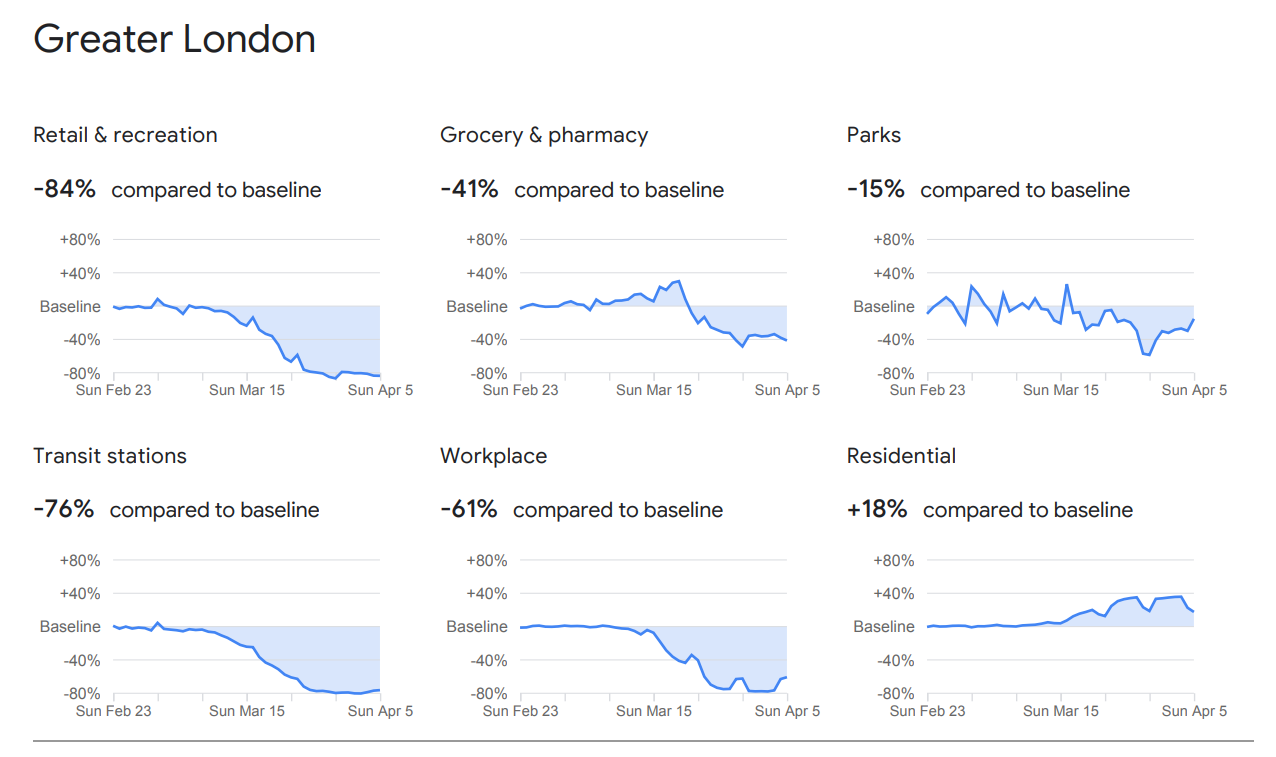

Covid Impact 7 – Mobility

- A cool dataset from Google on community mobility due to COVID-19.

- Just type in your country.

- Similar to Foursquare data.

- The one for UK is interesting. Figure shows Greater London.

- Probably the starting point for this.

- In the end Covid could prove to be a huge boon for analysis. The level of data generated is unprecedented.

- It is also arguably the closest we have come to macro-level natural experiment – an economists dream.

Covid Impact 5 – Citizens Advice

- This website tracks traffic to Citizens Advice in the US.

- Shows traffic in the past 24 hours incl the peak and current traffic.

- It also shows the trending searches (on site and google) as well as content.

Covid Impact 3 – Internet Traffic

- Another great set of data on traffic to specific websites.

- Interesting to see peaking in covid website traffic (e.g. WHO.int and worldometers.info) while travel website traffic declines have bottomed.

Covid Forecasts

- Interesting survey of infectious disease experts and their views on various outcomes of the Covid crisis.

- This chart taken from last week’s survey asks when the peak in hospitalisations will be in the US – most think May.

Covid Impacts

- Interesting data from Foursquare regarding foot traffic (up to 27th March) in the US.

- As expected Airports -66%, Hotels -61%, Bars -60%, Gyms -64%, Malls -61%, Clothing Stores -72%, Movie Theatres -75%, Restaurants -73%.

- There are some interesting observations though.

- Despite restaurant traffic being down 73%, fast food is only -17% – likely due to take away.

- Interestingly after the initial stocking spike traffic to supply stores, grocery stores (pictured) and liquor stores is now well down from the peak (but still up overall).

- Drug stores on the other hand are seeing a +28% and hardware stores continue to see strong traffic (+27%).

- Gas station traffic initially ticked up but are now seeing -7-8% decline.

- Outdoors is booming with visits to trails +34% and parks +10%.

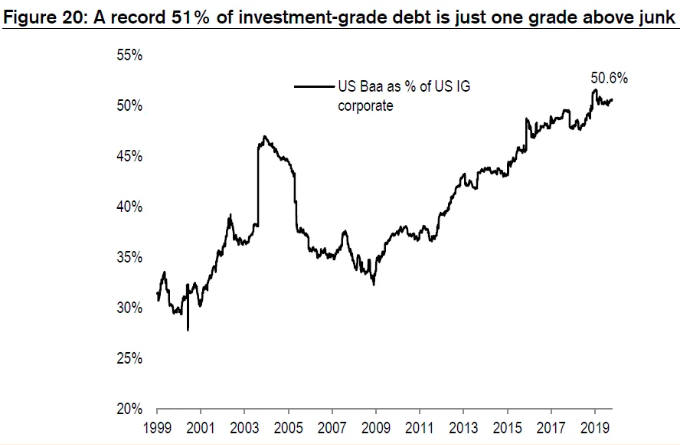

Bond Downgrades Coming

- Chart showing that a record 51% of US Investment Grade debt is rated Baa i.e. one notch above junk.

- Source: Credit Suisse.

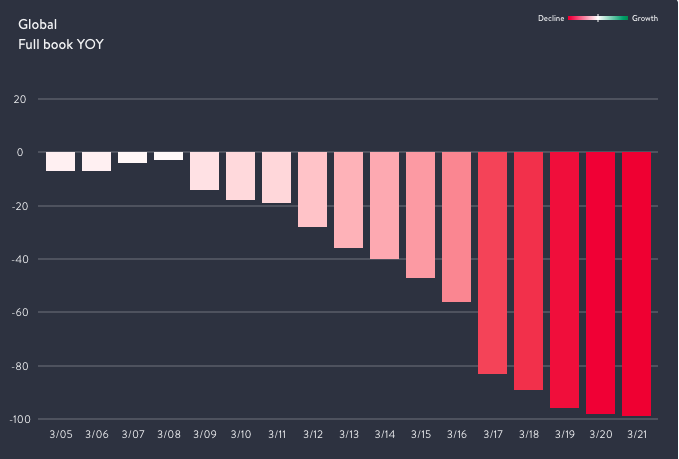

Open Table Traffic

- Open Table has 60,000 restaurants as customers.

- Bookings globally are -99% as of 21st of March.

Sector PMIs

- Interesting chart of sector PMI in Asia.

- Output fell in all but one sector – Biotech.

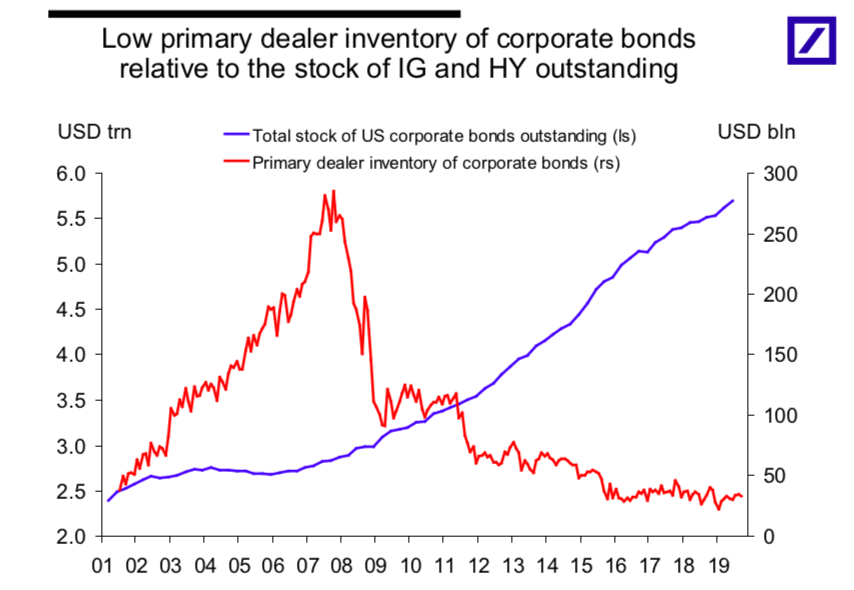

Dealer Inventory (repost)

- US Bonds outstanding continues to grow.

- However, inventory of bonds at primary dealers has stayed low since the financial crisis.

- This doesn’t however capture turnover of inventory – which has risen.

- Overall this still creates a very risky situation in terms of liquidity.

- Especially problematic now that Bond ETFs have hit $1 trillion.

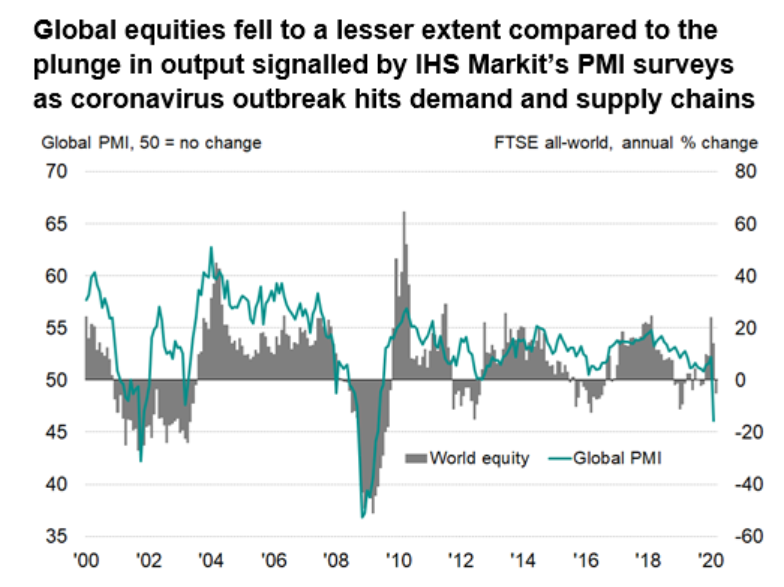

PMI and Equities

- Nice chart from IHS Markit showing PMIs against equities YoY change.

- Suggests equities not yet reflecting weak PMIs.

- World Index P/E is about 15x and earnings still need to come down.

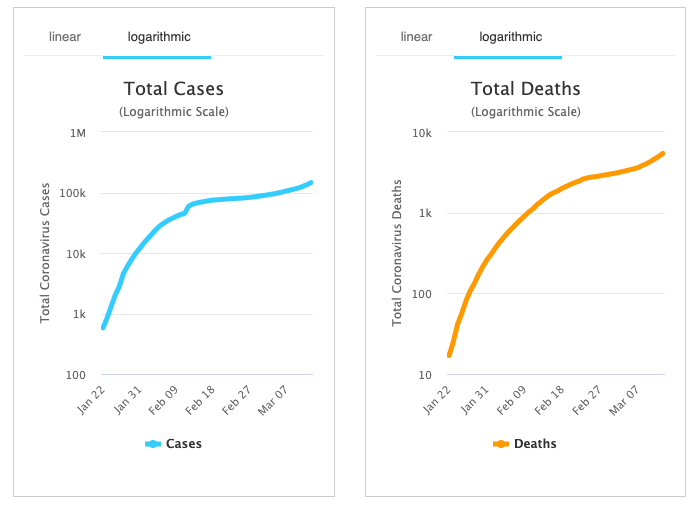

Covid

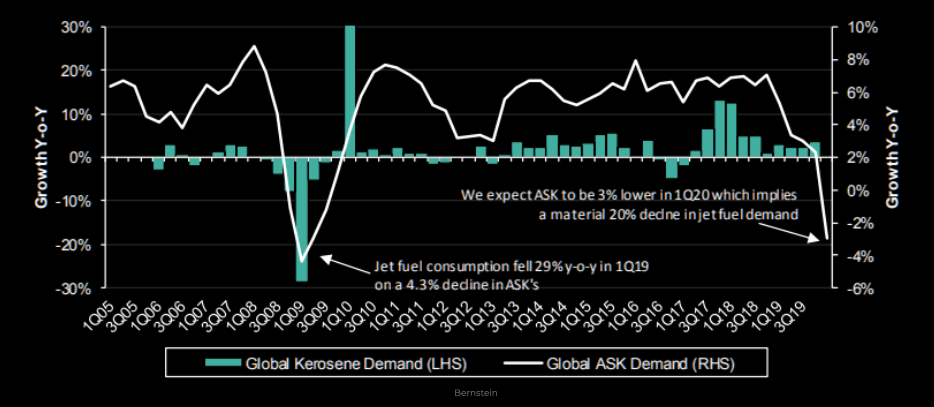

Oil Demand

- Q1 2020 decline in air travel demand is similar to Q1 2009.

- Kerosene demand is going to suffer strongly.