- Nice table showing all the US stock bear markets since 1929.

- 11 without economic recessions and 17, more severe bear markets, with recessions.

Macroeconomics

Snippets on the big picture.

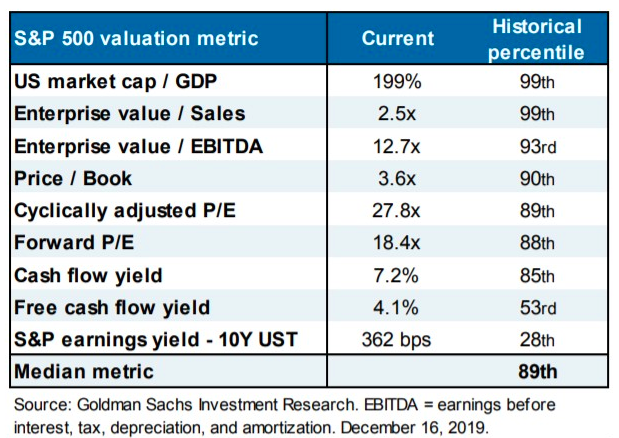

Valuation

- On every measure valuation in the US Stock market is towards to top of historic ranges.

- The stand out is Free Cash Flow yield.

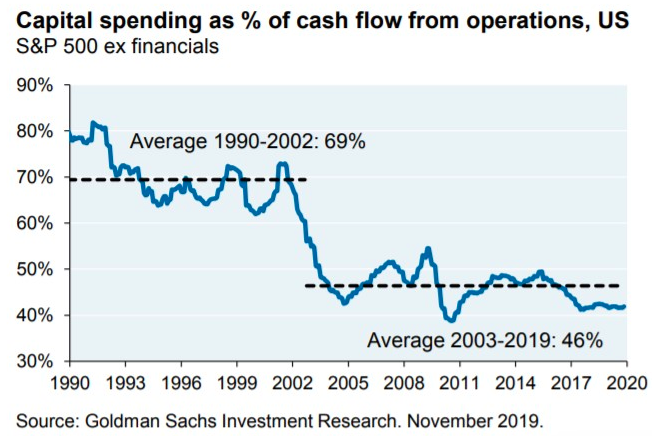

- However, as we saw here, capital spending has reset structurally lower which explains this discrepancy.

Capital Spending

- Capital expenditure in the US looks to have moved structurally lower (as a % of cash flow) in the early 2000s and remains so to this day.

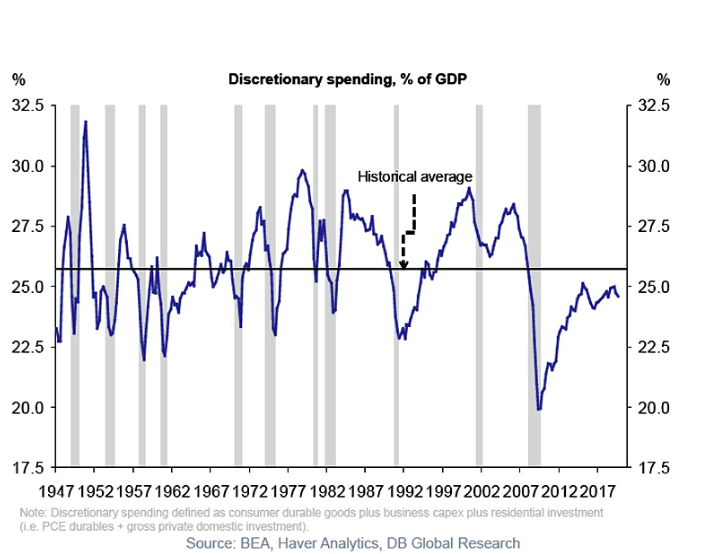

US Imbalances pt 2.

- Discretionary Spending as % of GDP for this expansion is still below historic average.

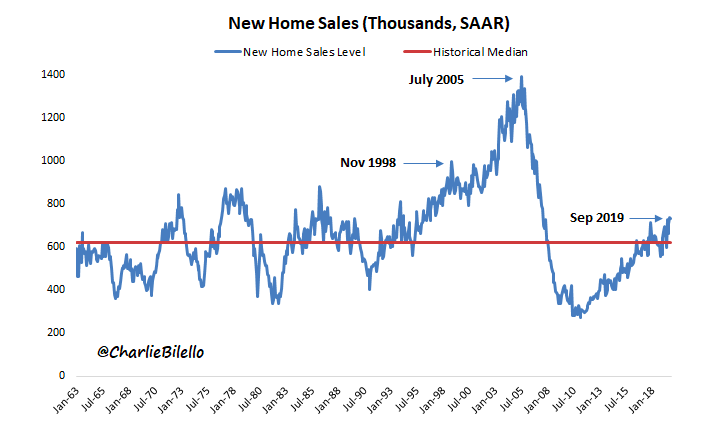

US Imbalances pt 1

- New home sales data shows little exuberance.

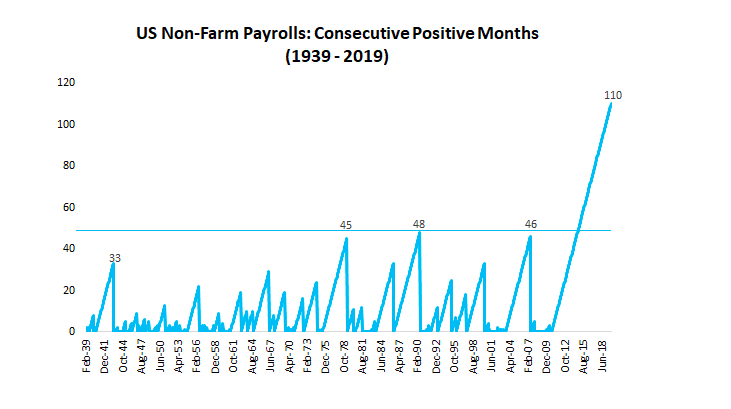

US Payrolls

- Another way to visualise the length of the recent expansion – number of months of consecutive positive payrolls.

Iran

- We have written before about Iran here.

- This is a really interesting article on Operation Ajax.

- It involves the 1953 overthrow of a democratically elected prime minister in Iran by the US and UK.

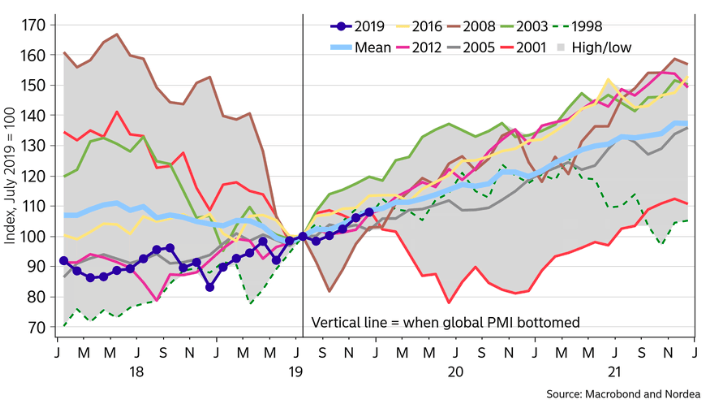

Equities and PMI

- Equities often continue to rise after a major bottom in global PMIs.

Magnus on China

- George Magnus long article on China in 2020 and beyond.

- “China is certain to experience slower economic growth in the years ahead, but the bigger surprise may be that, in US dollar terms, this narrative could be a factoid because of a fault-line that leads to a precipitous fall in the Yuan.“

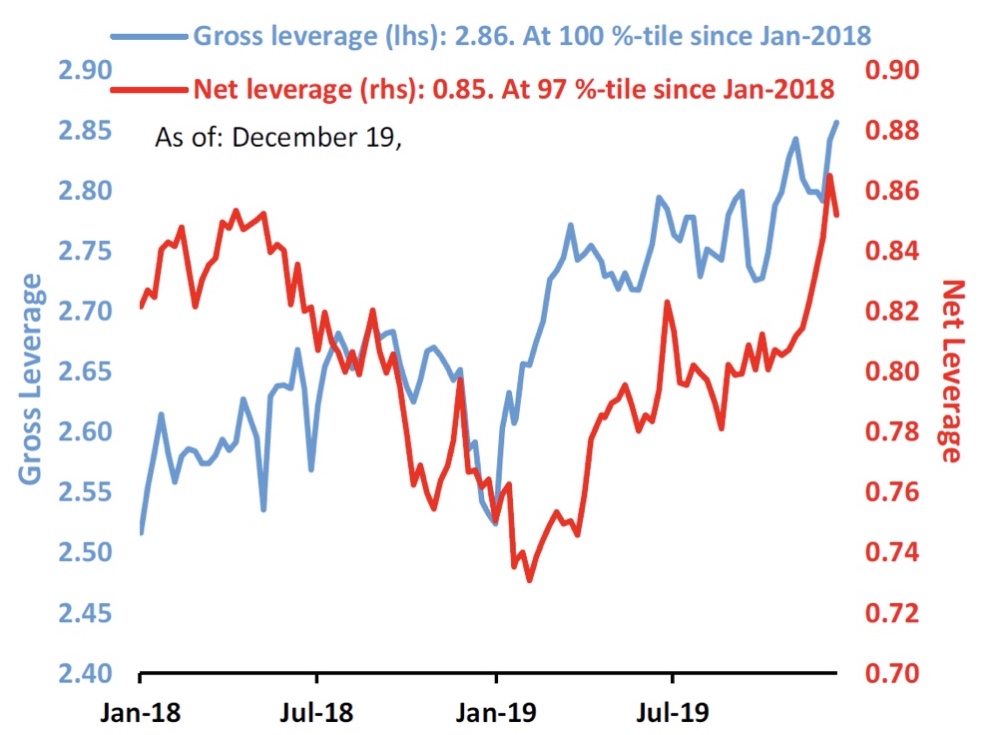

Hedge Fund Gross

- Hedge fund gross exposure is at 2 year highs.

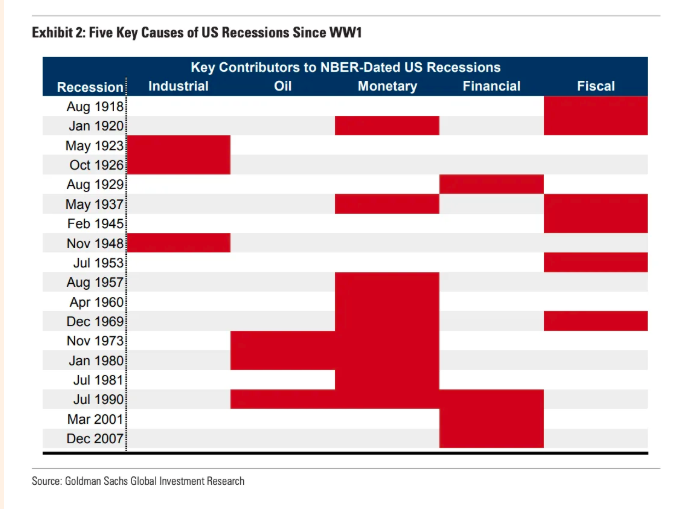

Causes of US Recessions

- Great table from GS Research showing the main causes of US Recessions since World War I.

- “A review of the last century of US recessions highlights five major causes: industrial shocks and inventory imbalances; oil shocks; inflationary overheating that leads to aggressive rate hikes; financial imbalances and asset price crashes; and fiscal tightening.”

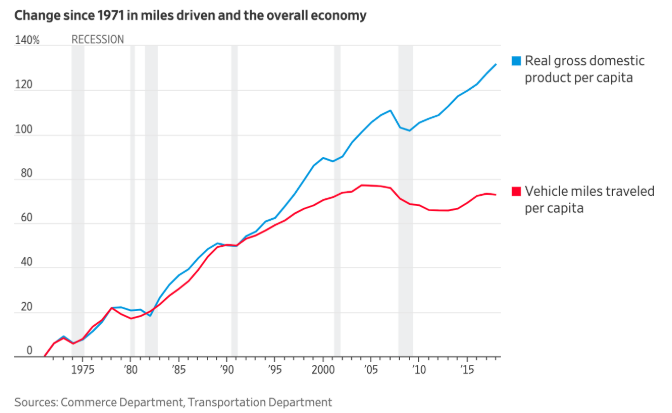

Driving Less

- Miles driven used to match economic growth but this started to diverge since the 1990s in the US.

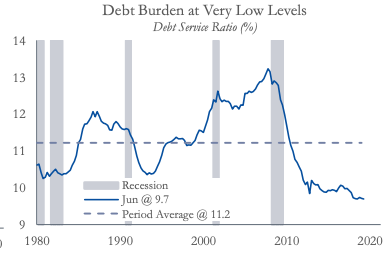

Household Debt

- US household debt burden is at very low levels.

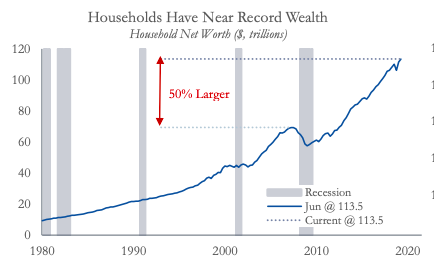

Household Wealth

- US household wealth is at record levels up 50% since the last peak.

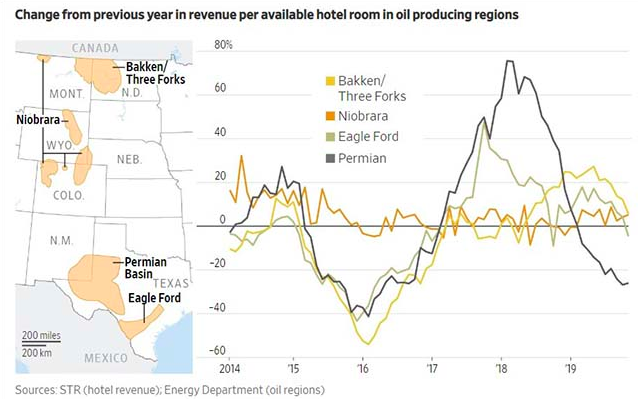

US Oil Patch Struggling

- Interesting chart showing hotel room rates year on year in oil producing regions of the US.

- Shows clearly how investment is coming out of those markets as drillers focus on cash flows.

- This hurts periphery services likes hotels.

- h/t 361 Capital

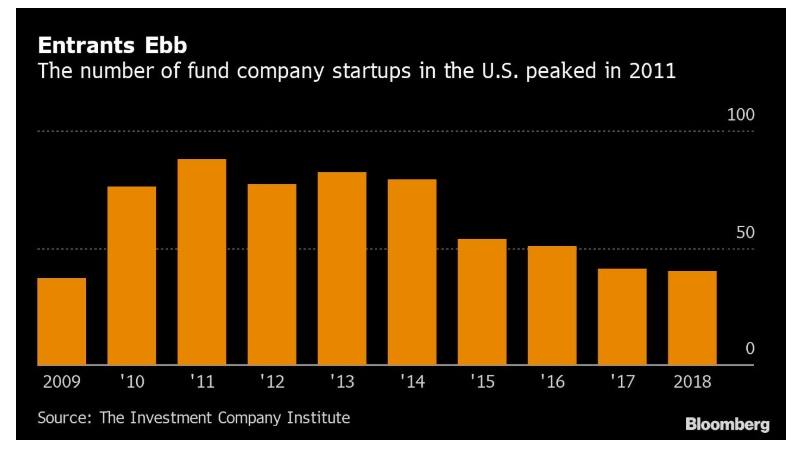

Fund Launches

- The number of new US investment fund launches peaked in 2011.

- Suggests an industry under significant pressure.

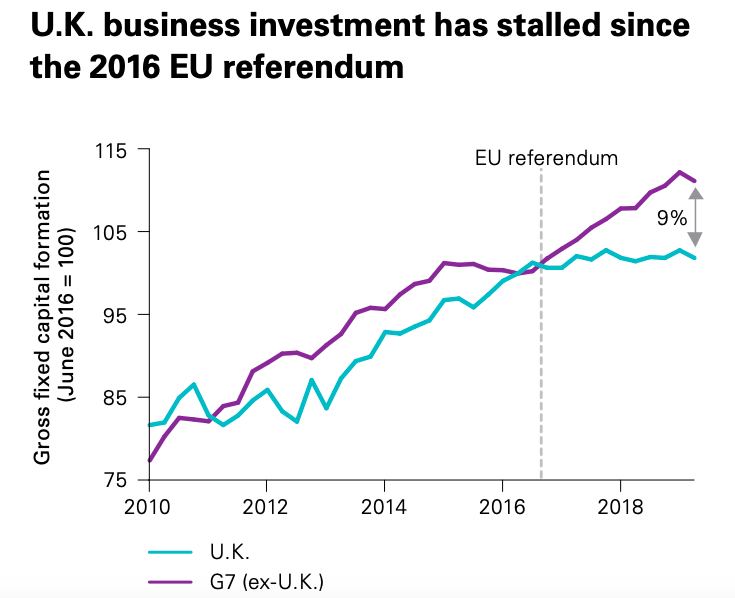

Brexit and the UK

- Interesting chart showing how investment has stalled in the UK after the 2016 vote for Brexit.

- Now that we have a clear political majority and mandate could investment start to return?

- There is a 9% gap to make up which is very substantial.

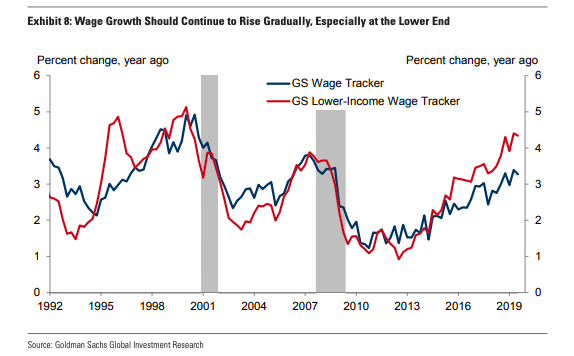

Wage Growth Continues

- Wage growth in the US continues apace – a solid late cycle sign.

- It is also seen in the low income portion of the wage curve.

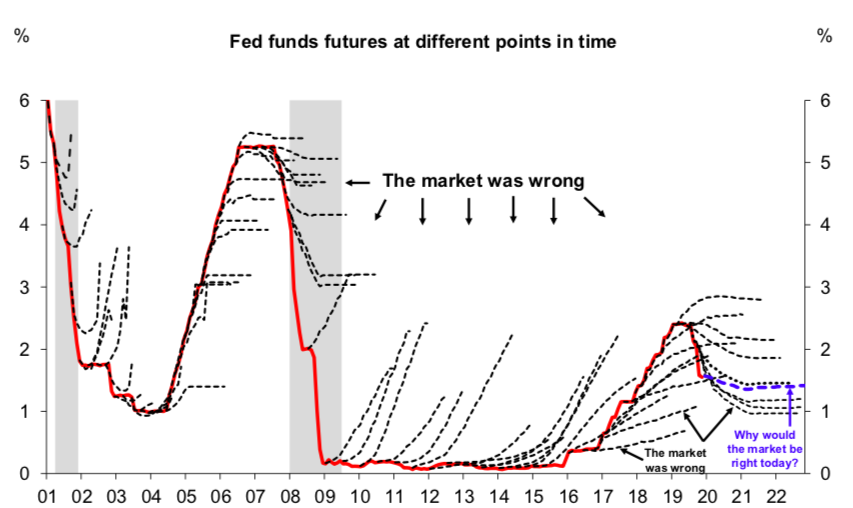

Markets Get the Fed Wrong

- The market almost always gets the Fed wrong.

- Dotted lines are predictions in a given year of the Federal Funds rate and the red line is the actual outcome.

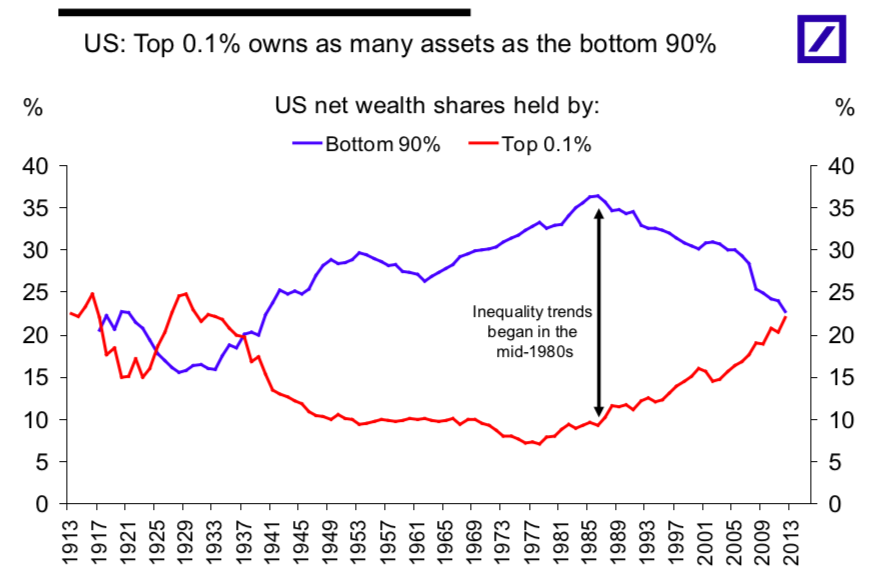

Wealth Distribution

- Amazing chart showing how in the US the top 0.1% of the net wealth distribution own as much as the bottom 90%.

- This trend in income inequality started in 1980s and is likely to have ramifications across society.