- Sabres are once again rattling in the Middle East.

- We are reminded of an excellent piece comparing the current situation to that of the 30 years war in Europe.

- Historical analogies have limitations but can be useful.

- After all, “History doesn’t repeat but it often rhymes” Mark Twain.

Macroeconomics

Snippets on the big picture.

Boris

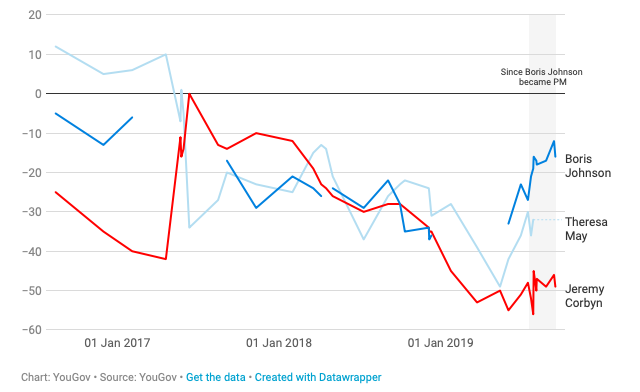

- YouGov latest paradoxically finds that despite the difficulties faced by the prime minister since taking office his popularity has grown.

Oil

- A long but fascinating read about the interplay of technology and oil.

- Exemplified by the Kern River oil field story – how technology renders even the best estimates wildly wrong.

- “From the beginning, it was evident that the Kern River field was rich with oil, millions upon millions of barrels. Wildcatters poured into the area, throwing up derricks, boring wells, and pulling out what they could. In 1949, after 50 years of drilling, analysts estimated that just 47 million barrels remained in reserves—a rounding error in the oil business. Kern River, it seemed, was nearly played out. Instead, oil companies removed 945 million barrels in the next 40 years. In 1989, analysts again estimated Kern reserves: 697 million barrels. By 2009, Kern had produced more than 1.3 billion additional barrels, and reserves were estimated to be almost 600 million barrels.“

Yield Curve Predictive Power

- With yield curves falling to new cycle lows earlier in the summer it is interesting to think about their predictive power.

- This piece from the Bank of England blog is worth reading.

- As the chart below shows – the predictive power of yields has indeed fallen over time but interestingly has started to increase recently.

- There is more in the article for those interested, explaining why this might have happened.

US Consumer

- Bank of America Merrill Lynch uses their credit/debit card data to check the pulse of the US consumer. Their latest report had this to say:

- “The consumer is beginning to worry. Since our last update in mid-August, the BofAML US consumer confidence indicator (USCCI) decline by 3.8 points to 50.1 based on data through September 9. It briefly dipped below the 50 breakeven level during the survey period indcating that the consumer is growing increasingly pessimistic“

- h/t Calculated Risk

Ruffer

- Another fund manager worth following is Ruffer.

- They take a very long term capital preservation approach to investing their client’s wealth.

- They also tend to take contrarian positions.

- The investment reviews published monthly can be found here.

Productivity

- How far productivity has come in 10 years 2020 US Census edition …

- “We were able to verify 65% of addresses using satellite imagery — a massive accomplishment for us,” said Census Bureau Geography Division Chief Deirdre Bishop during the briefing. “In 2010 we had to hire 150,000 people to verify 100% of the addresses in the field, this decade we will only have to hire about 40,000 employees around the nation to verify the remaining 35% of addresses.”

- h/t Calculated Risk

Hoisington

- Another great newsletter to check out is from bond house Hoisington.

- They take a very long term approach to investing and highlight issues that might be outside the horizon of most investors.

- The analysis also tends to be more economically rigorous.

- The latest newsletter is here.

Oaktree Memos

- Reading what other respected fund managers do is very important.

- Howard Marks has made a name for himself as a distressed debt investor and founder of alternative asset house Oaktree.

- His memos found here are always worth reading for their commentary on market cycles and economics.

- Most importantly they are a great source of common sense in financial markets.

- The latest memo (from July) is a perfect example of this – how to understand the Fed’s actions in the current environment.

China

- Some of the most insightful writing on China is done by Michael Pettis (@michaelxpettis)

- The financial press often gets key economic concepts, like imbalances, wrong (for example the idea that every deficit has to have a surplus).

- Pettis writing illuminates these topics which are vital to understand the Chinese economy and what is going on in the world.

- For example the latest piece on US-China Trade war is a must read.

US Manufacturing ISM

- US Institute of Supply Management (ISM) dips below 50.

- First time since 2016.

- It suggests a manufacturing contraction. Not to be confused with a full recession (see 2016 dip).

- New Export Orders, not surprisingly, was the biggest loser among the sub-indices.

- Always interesting to give the full report a glance.

UK Election Opinion Polls

UK PMI

- The UK is looking very weak on the eve of Brexit, inventory re-stocking boost has run out

- IHS Markit/CIPS UK Manufacturing PMI Release hit 47.4 in August – the lowest level since 2012 (https://tinyurl.com/y5qrhe75)

- “The high levels of economic and political uncertainty pervasive across domestic and global markets continued to weigh heavily on the performance of UK manufacturing during August. Output volumes fell as intakes of new work contracted at the fastest pace for over seven years, while business optimism dropped to a series-record low.“