- Speech at the Grant’s IR Observer conference (3rd October) from the CIO of Double Line and bond guru is absolutely worth a listen.

- Some interesting points, like that it is the de-inversion of the yield curve is what matters for a recession call and inversion is just an early sign.

Macroeconomics

Snippets on the big picture.

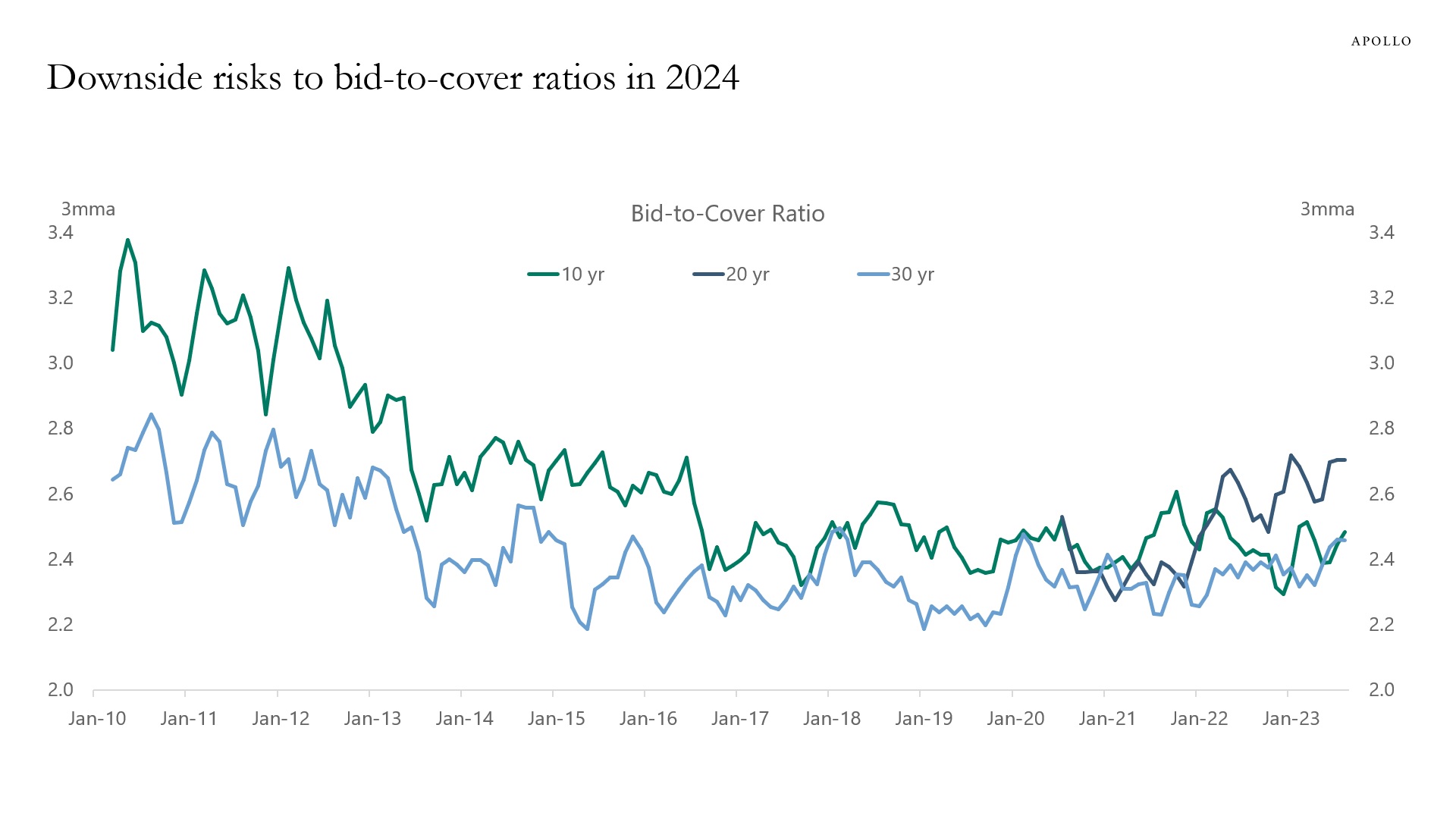

Treasuries Bid-to-Cover

- A key measure to watch in these dislocated treasury markets is the bid-to-cover ratio in treasury auctions.

- Lots of competing forces including – quantitative tightening (shrinking Fed balance sheet), and higher issuance.

- Source: Apollo.

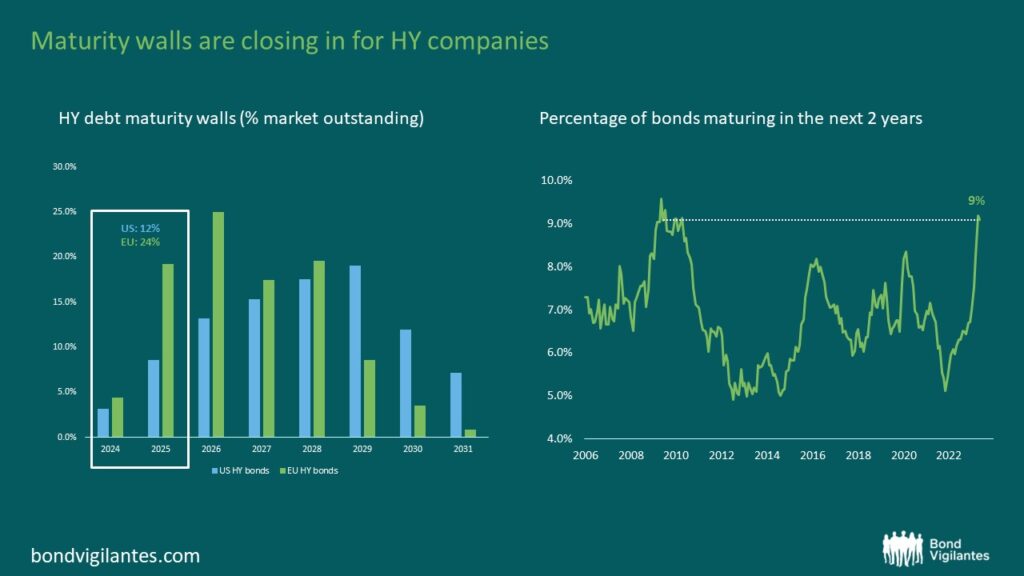

HY Maturity Wall

- “The chart below shows the substantial amount of debt to roll over in the next 2 years with $127bn, or circa 12% of the market’s outstanding debt, being due for US HY companies. In Europe, maturity walls are even steeper, with €97bn of debt (23% of the index) maturing in 2024/2025. Add in 2026 maturities, and the refinancing wall shoots up to just to under 50% of the market. Historically speaking, this is likely to become the largest refinancing effort for HY issuers since the GFC (2008), and while some companies have already begun doing their homework, we expect it to become a key theme in 2024, particularly if base rates and borrowing costs remain elevated.”

- Unlike GFC, as M&G points out, the situation is better – (1) new issuance is open (2) rates are lower despite the spike (3) quality is better.

- Source: M&G.

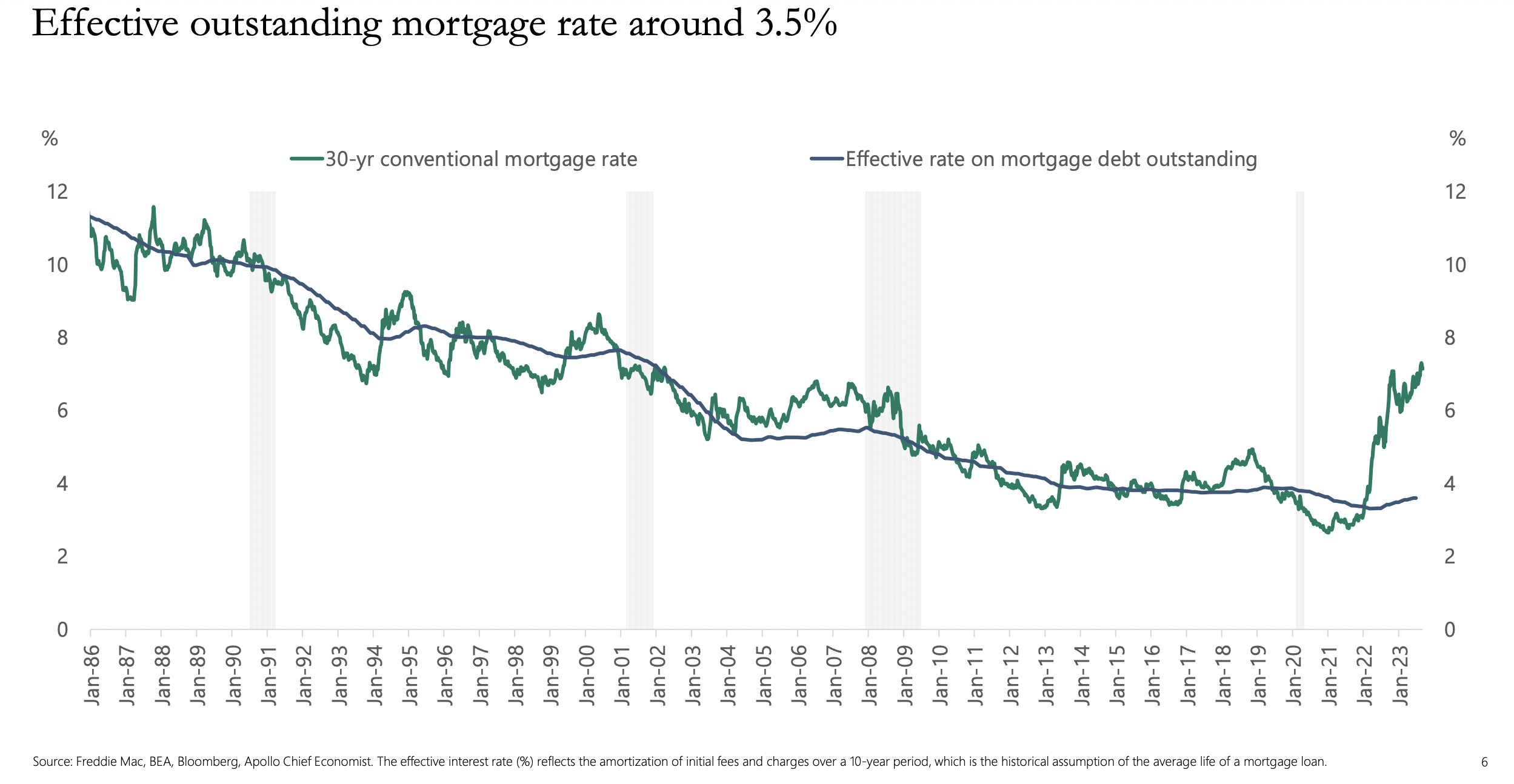

US Mortgage Picture

- Striking visualisation of the extremely rapid rise in new mortgage rates, with the stock sitting at more than half the prevailing rate.

- It is no wonder existing home sales have collapsed and with it mortgage refinancing/origination.

- Source: Apollo deck on US housing.

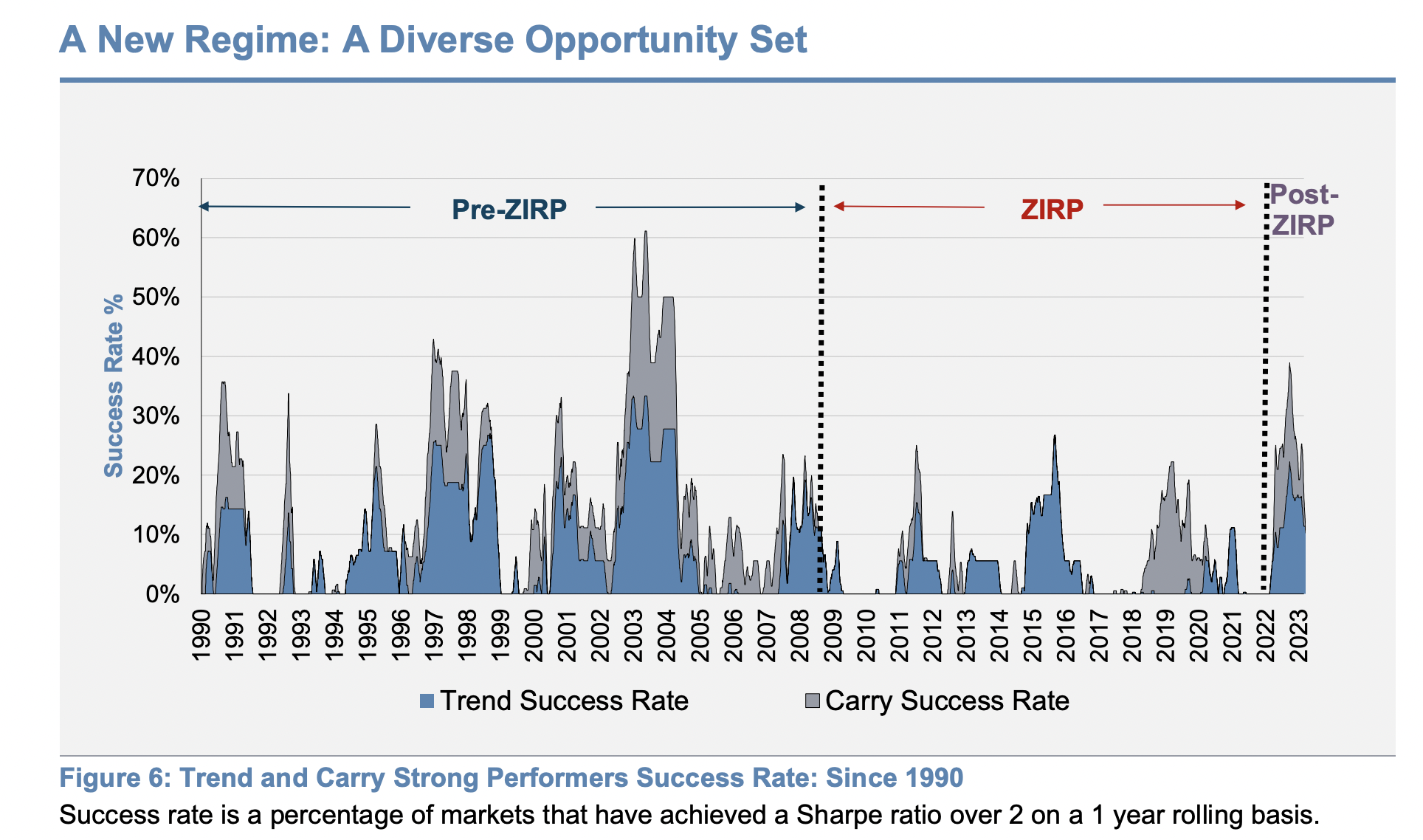

Regime Change FX Edition

- The post-ZIRP (zero interest rate policy) world is re-awakening some old regimes.

- One area is FX markets (the largest in the world) where certain strategies are working again.

- Source: Aspect Capital (h/t bps and pieces)

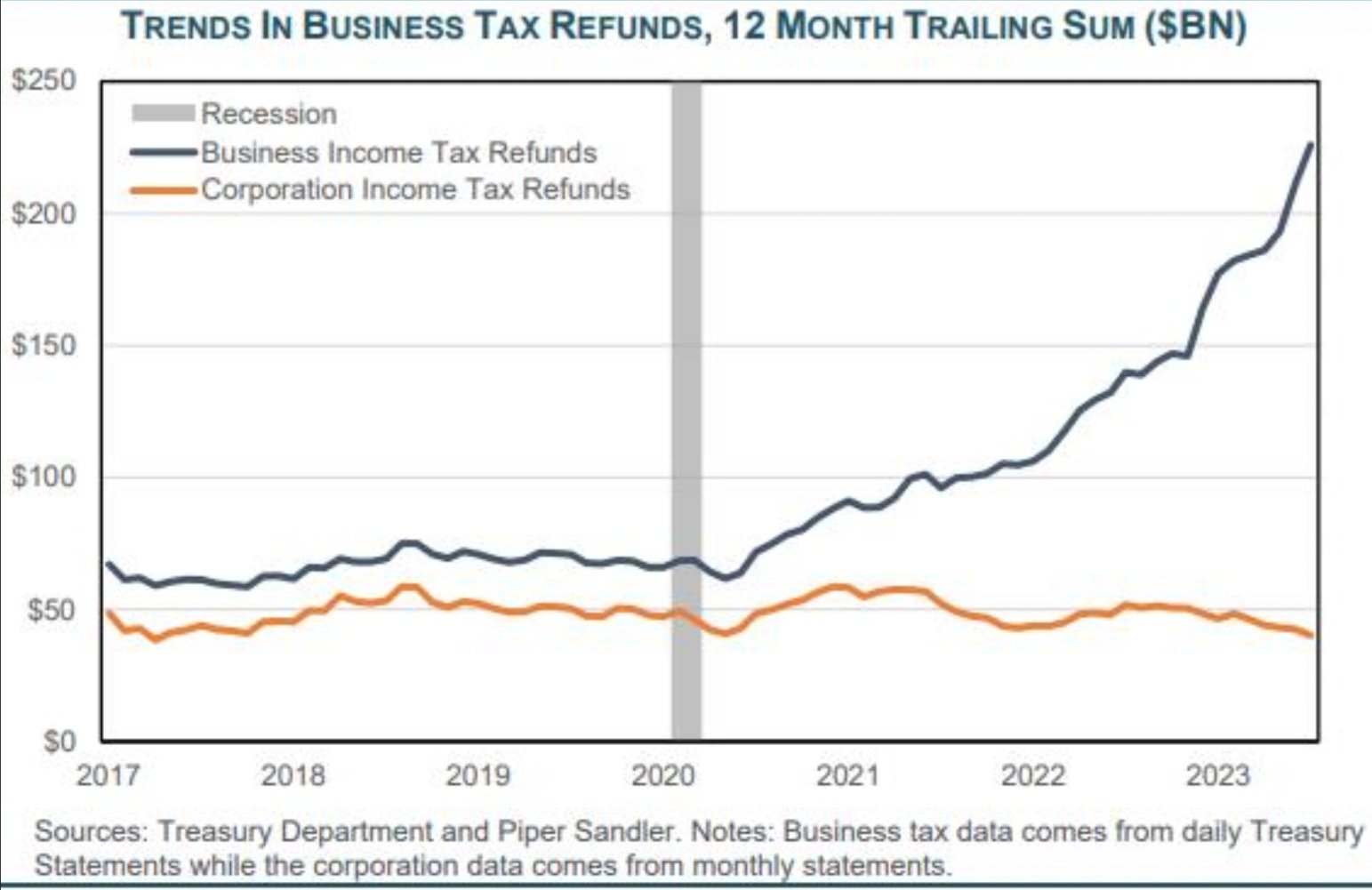

Small Business Tax Refund Boost

- “Recently, the IRS has accelerated payouts from a pandemic-era tax benefit known as the Employee Retention Credit (ERC). We estimate over $220 billion has been disbursed so far ($130 billion this fiscal year) and data on outstanding claims suggests there’s at least another $120 billion yet to be distributed. The use (and in some cases abuse) of this benefit should provide a meaningful tailwind for small business balance sheets and consumption through the end of the year and into 2024.“

- h/t Redubrn,

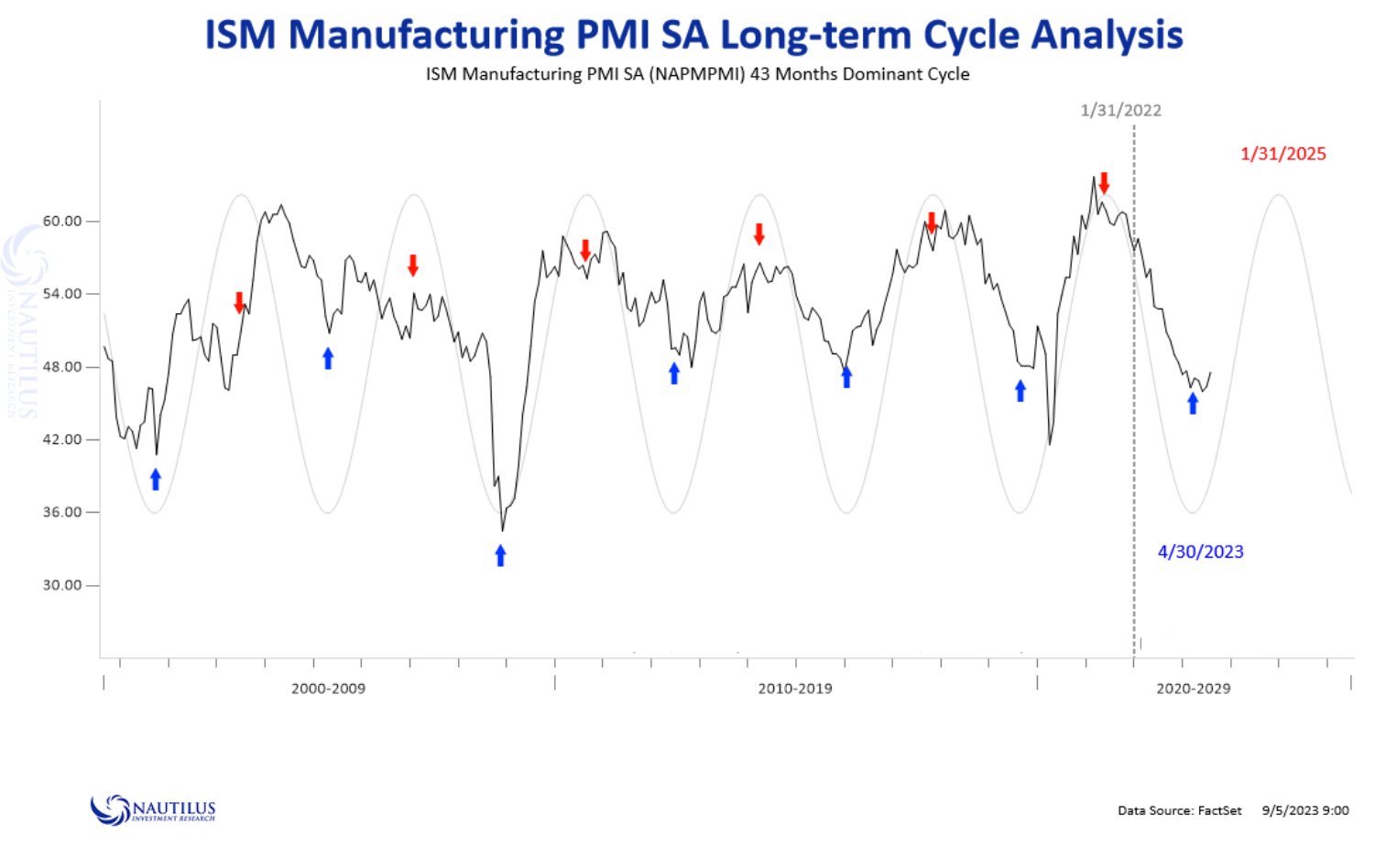

ISM Cycles

- Interesting chart showing that ISM moves in 43 month cycles.

- We are close to a bottom.

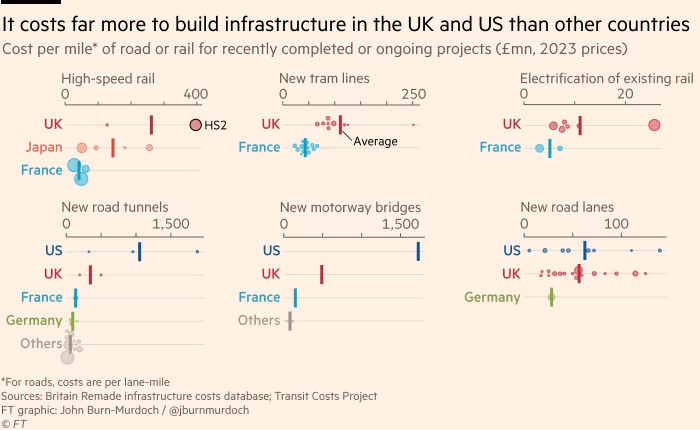

UK and US Infrastructure Costs Stand Out

- State capacity could be to blame.

- Source: FT.

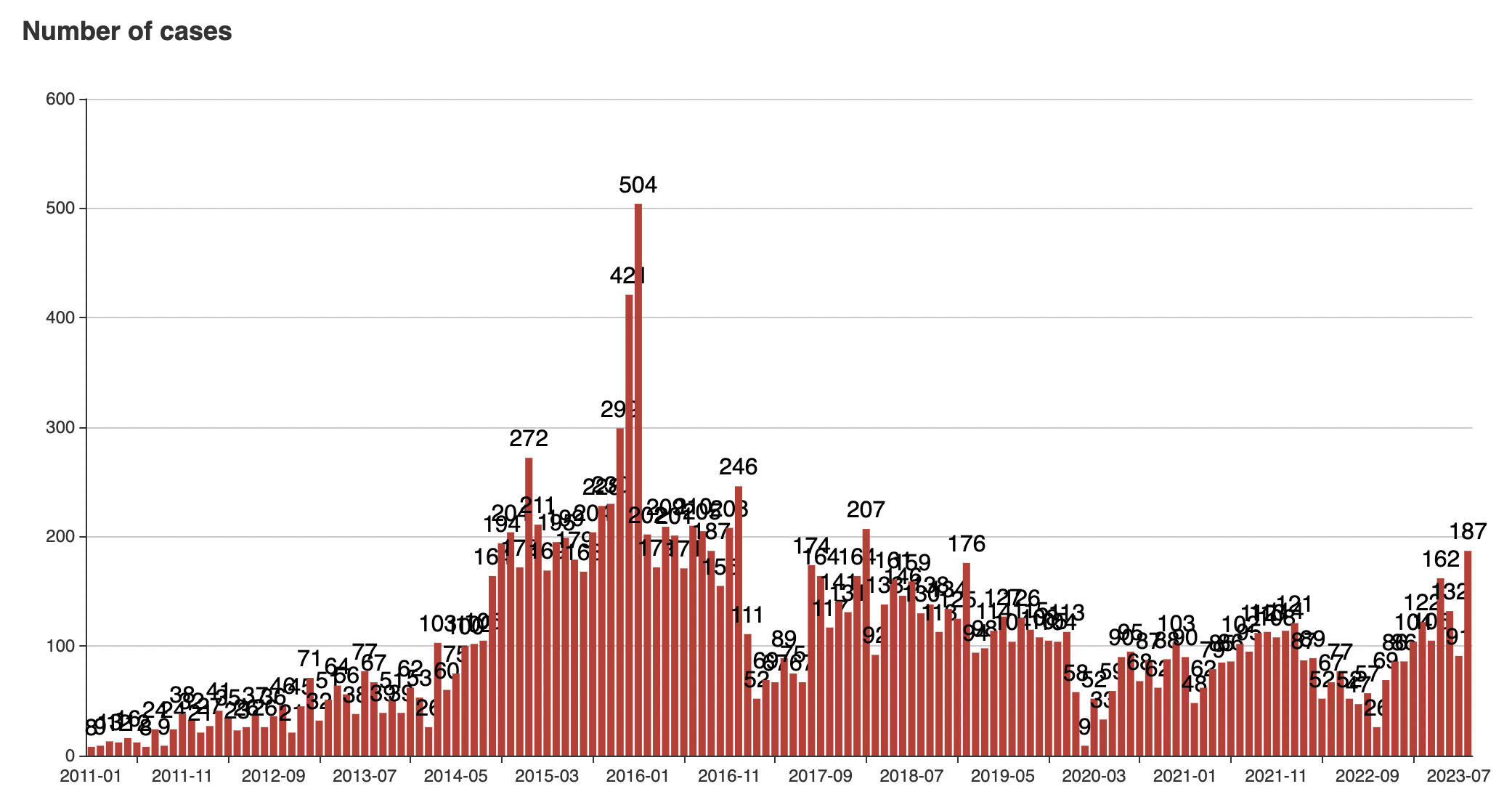

China Strike Tracker

- A very handy tool that tracks strikes in China – both statistics and as a map.

- Latest monthly numbers have seen a spike.

- “Worker strikes have reached a new height after the pandemic,” Aidan Chau, a researcher at CLB, told Nikkei Asia. “Many protests are related to slowing demand in international trade.” (Nikkei Asia).

German Political Risk

- The rise of the AfD (the right-wing populist party) in German polls has been remarkable.

- With elections looming in October 2025, this political risk will soon be on investor’s horizons.

- In this context, this interview with Wolfgang Munchau, former co-editor of FT Deutschland, is a must-read to understand the woes of Europe’s largest economy and how these reflect in politics.

- Interestingly he highlights another possible surprise on the left political spectrum – “there may soon be a party on the Left led by Sahra Wagenknecht, a very sort of maverick politician, who has left or who is on the verge of leaving the Left Party, who may be forming a new party of the Left. And that party was also on opinion polls at potentially 20% of the electorate.”

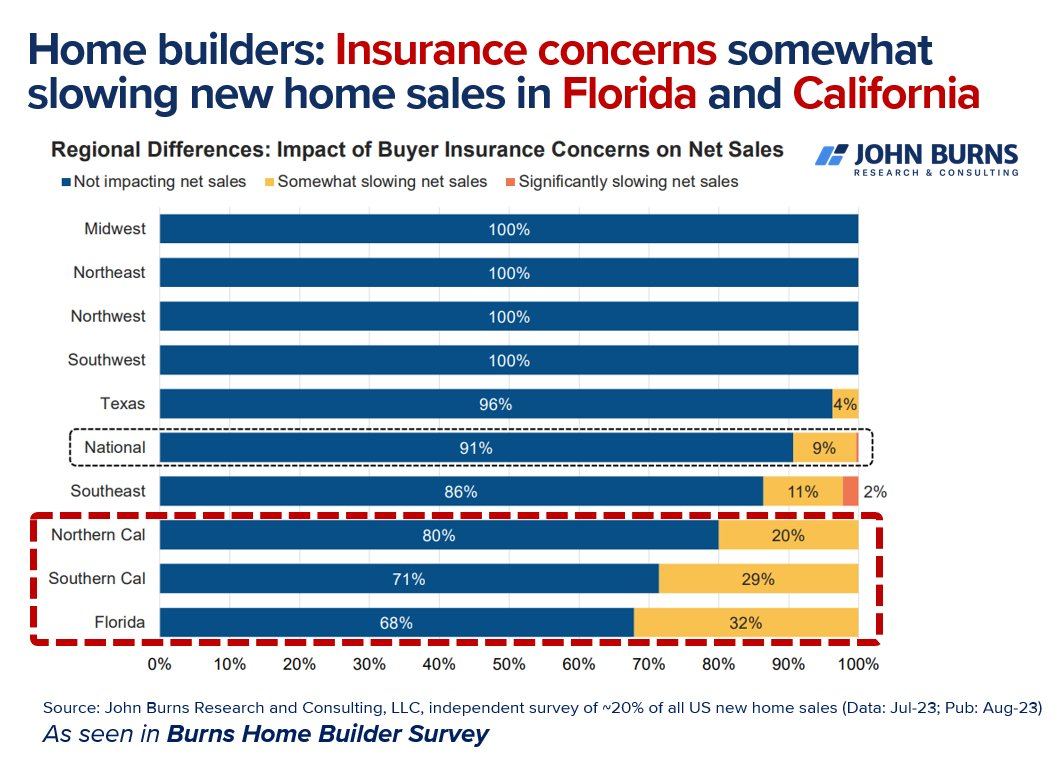

Insurance Hurting New Home Sales

- Rising cost and reduced availability of property insurance are starting to impact new home sales (according to survey of homebuilders) – especially in CA and FL.

- Source.

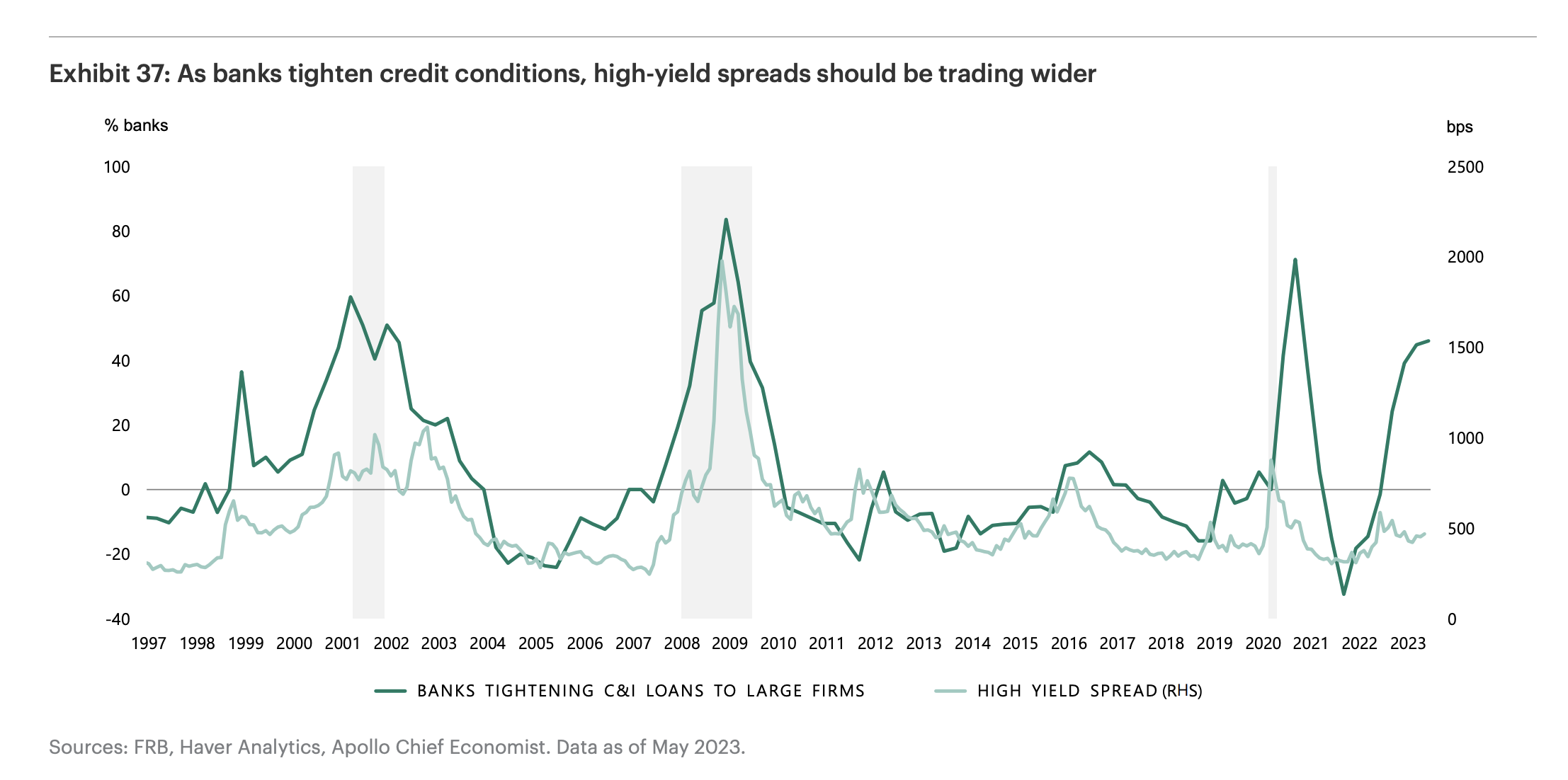

Bank Credit Conditions and HY Spreads

- Have, unusually, diverged – suggesting the latter should start to widen.

- Source.

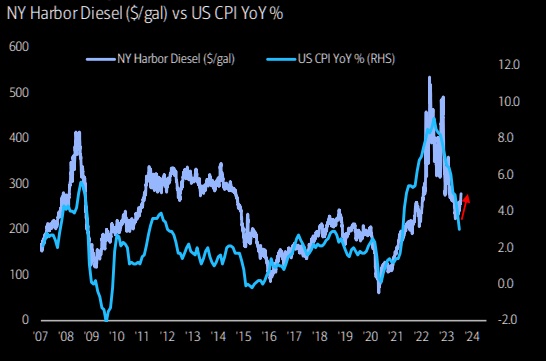

Diesel Prices and CPI

- The great inflation period of the 1970s actually involved two major peaks as inflation rates were extremely variable.

- Could the same happen this time?

- Source: themarketear.

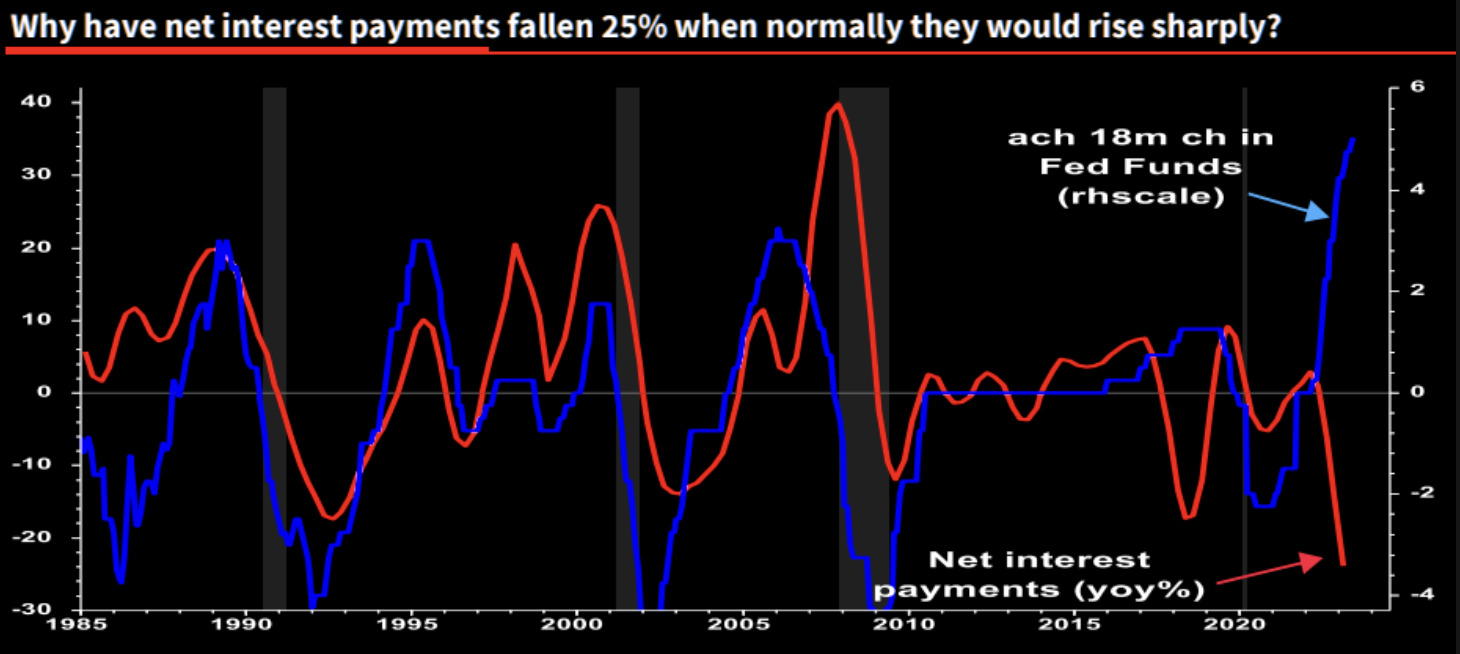

Unusual Decline in Net Interest Payments

- Despite the sharp rise in Fed Funds rate, company net interest payments have actually fallen.

- “We have concluded that a sizeable proportion of huge, fixed-rate borrowings during 2020/21 still survives on company balance sheets in variable rate deposits. Companies have effectively played the yield curve in reverse and become net beneficiaries of higher rates, adding 5% to profits over the last year instead of deducting 10%+ from profits as usual.”

- Source: Soc Gen (via themarketear).

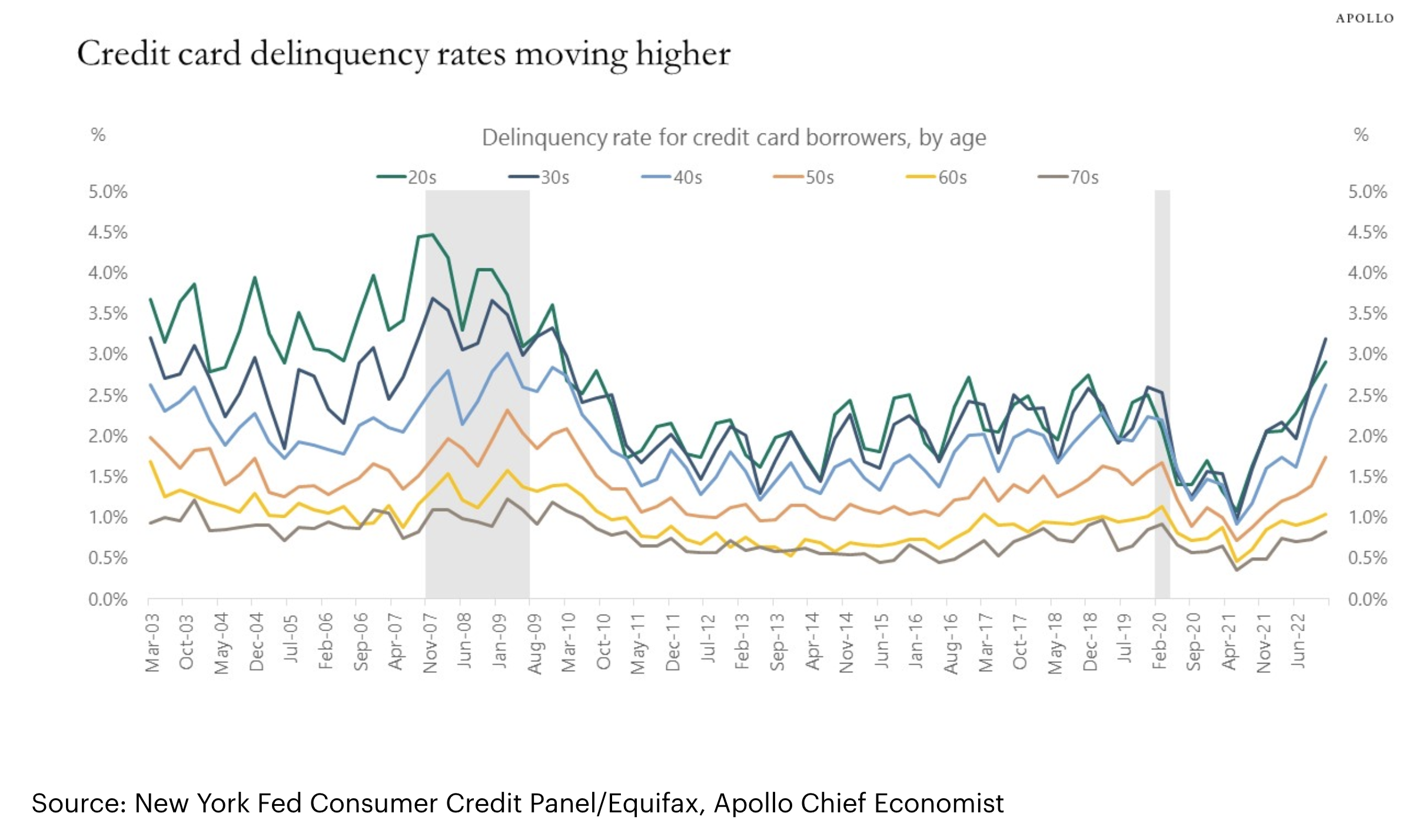

Credit Card Delinquency Rates

- “Delinquency rates for credit card borrowers are approaching 2008 levels across all age categories.“

- Source.

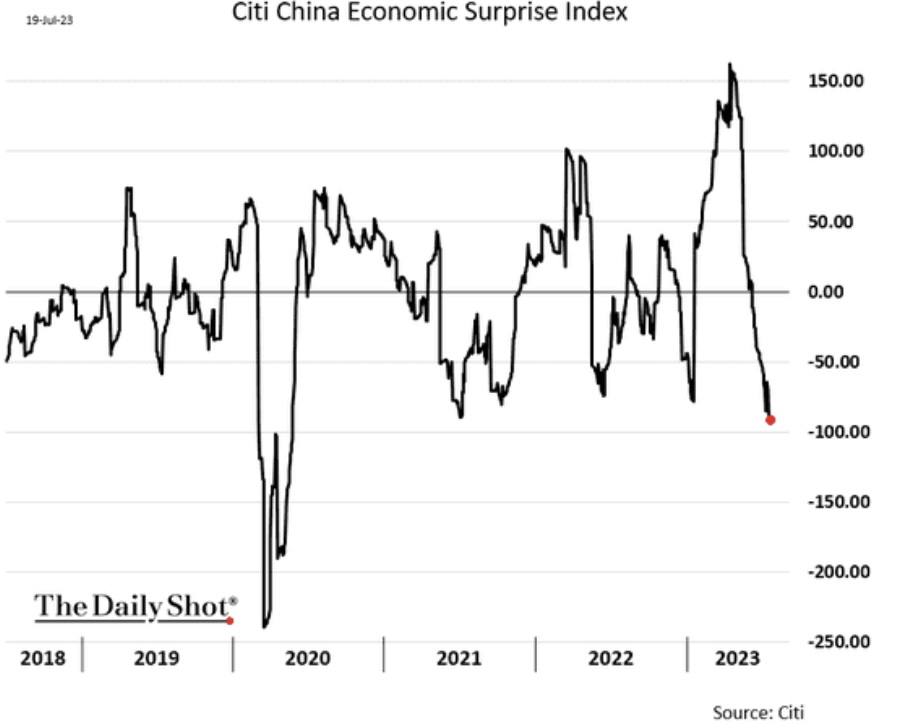

Chinese Economic Surprise

- Time for a rebound?

- Source: Dailyshot.

Productivity

- Always surprising how, despite the venture-backed tech boom, productivity hasn’t increased.

- It will be interesting to see if AI starts to push this up.

- Source: Daily Shot.

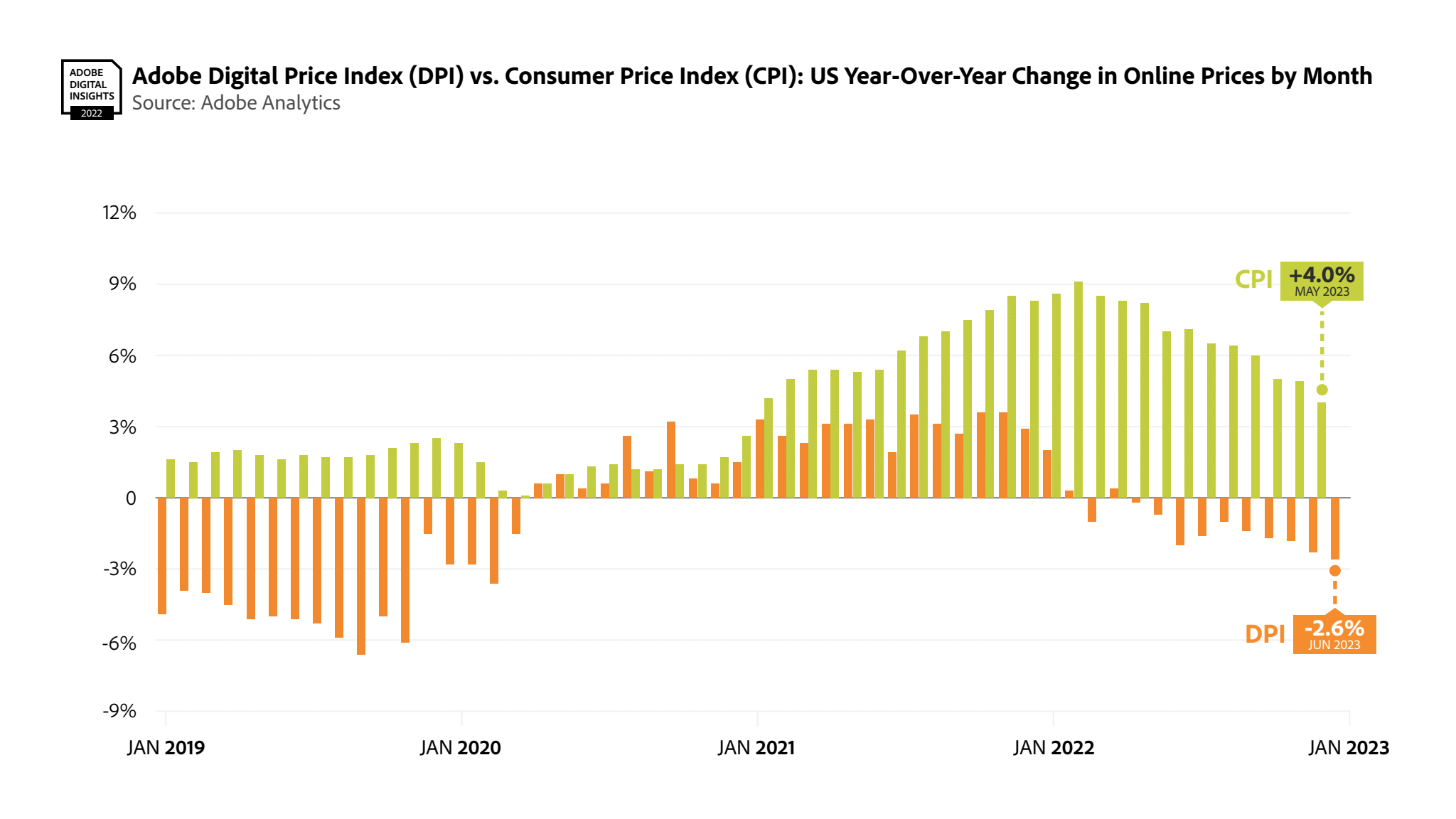

Digital Prices are Falling

- “Online prices in June 2023 fell 2.6% year-over-year (YoY), the most significant decrease since May 2020“

- 11 out of 18 categories were down.

- The sharpest falls are seen in electronics, computers, and appliances.

- Source.

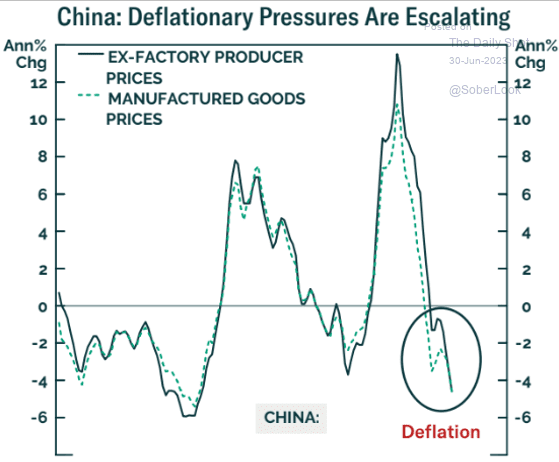

Chinese Deflation

- Could China be about to export deflation around the World?

- Source: DailyShot

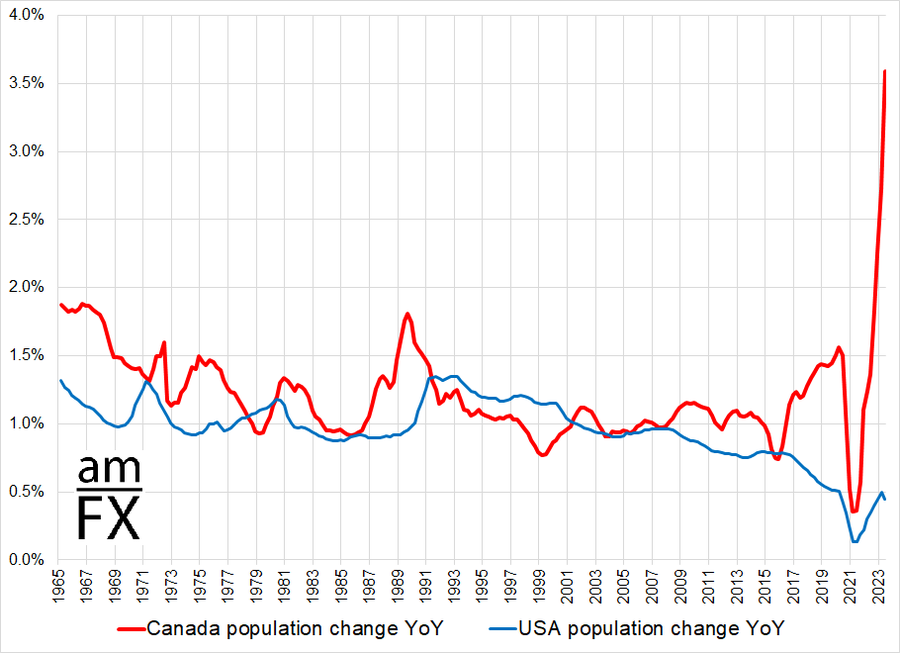

Canadian Population Boom

- This really is an outstanding chart and has huge ramifications for the economy.

- Most of this is down to immigration.

- Source.