- After a short-term rise during the pandemic, the average size of single-family homes in the US is declining again.

- Source.

Macroeconomics

Snippets on the big picture.

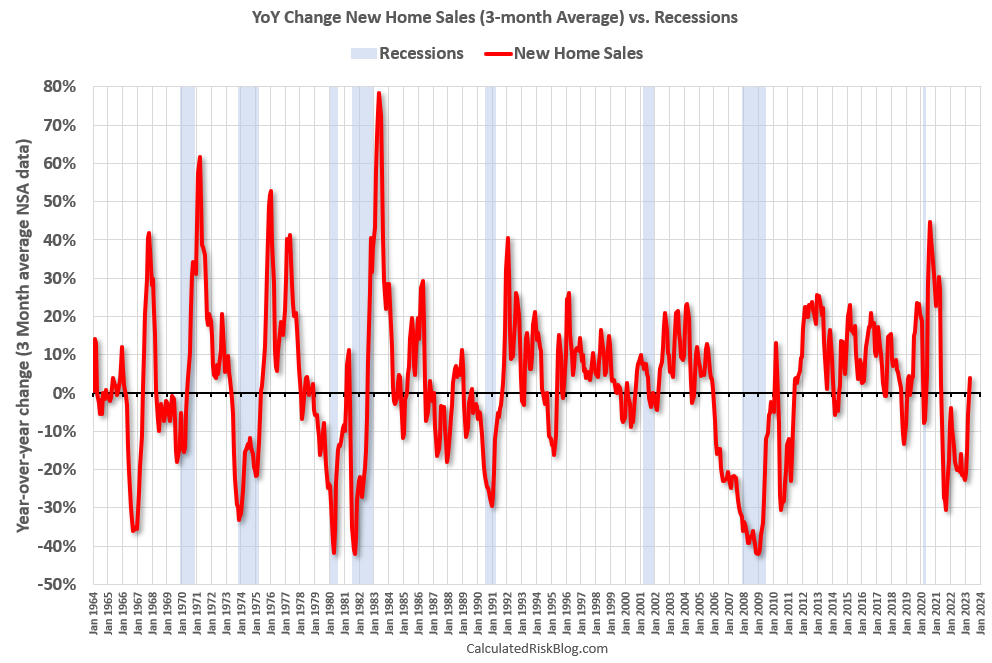

New Home Sales and Recessions

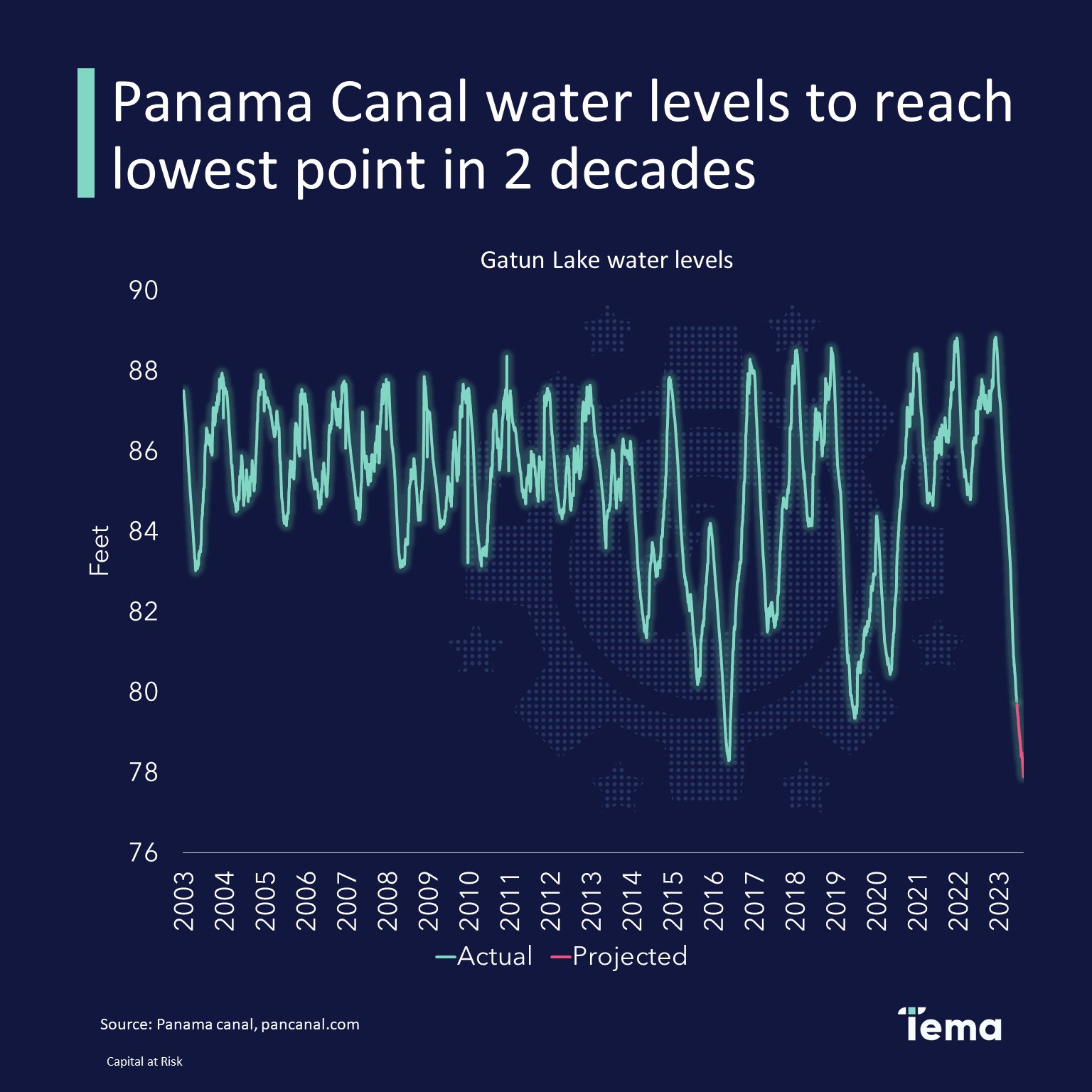

Panama Canal

- Unprecedented drought in the Panama Canal is forcing some ships to offload 40% of their cargo.

- It takes 200m liters of water per ship, that is pumped from Gatun lake.

- Last year we had drought issues in the Rhine.

- The coming El Niño weather pattern could lead to more issues for global transport supply chains.

- Chart source: Tema ETFs.

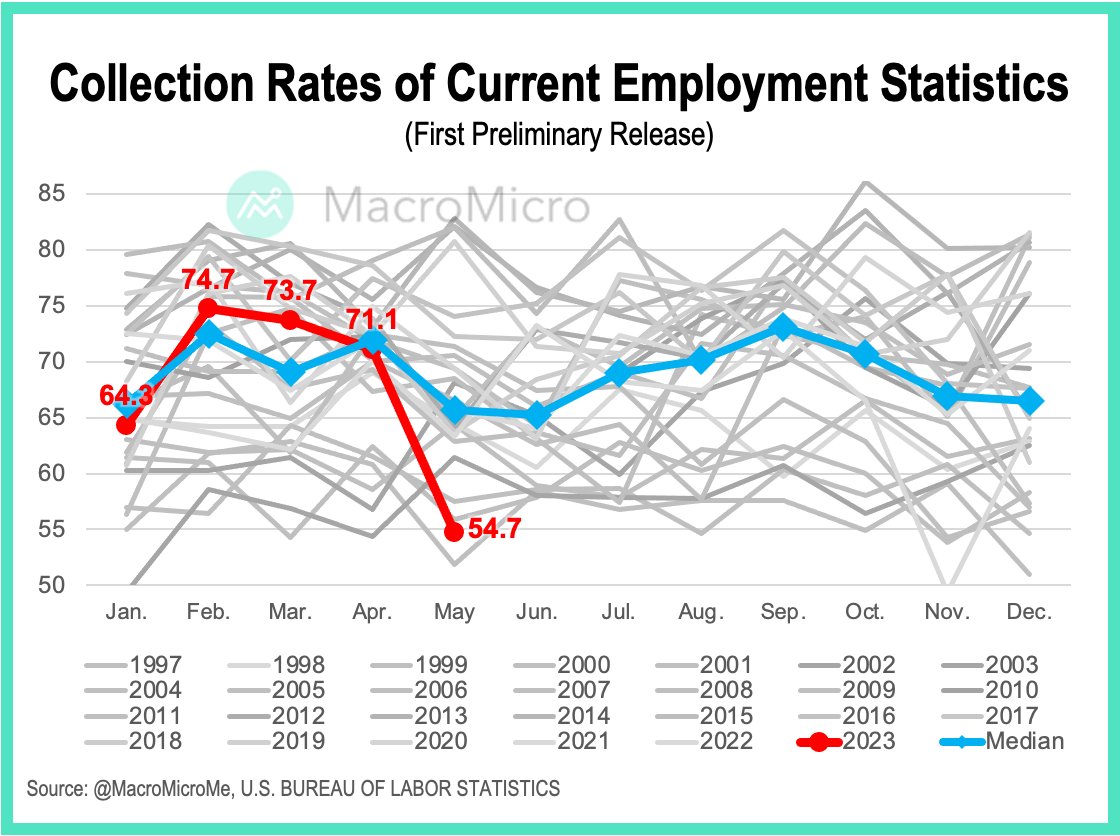

Collection Rate of Employment Stats

- Response rates to the important payroll survey are well below the historic median.

- This usually leads to revisions.

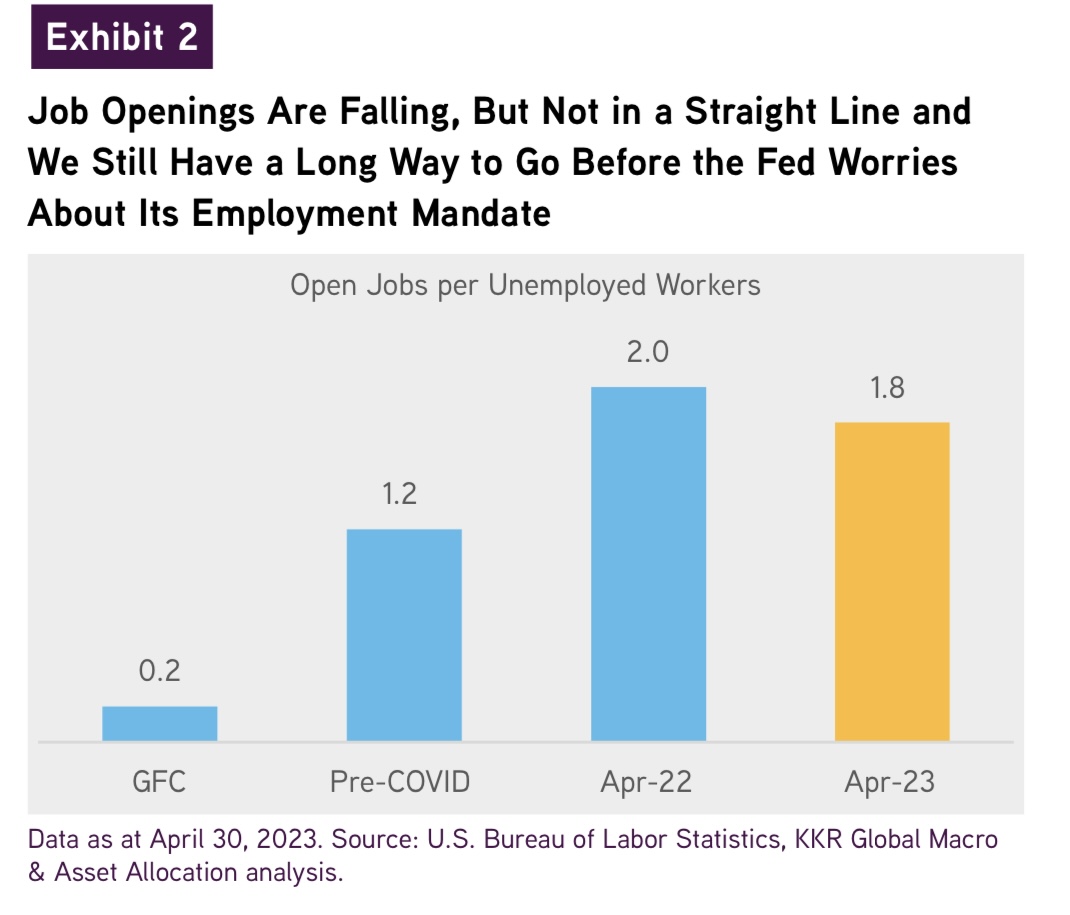

Job Openings to Unemployed Workers

- Far from concerning levels.

- Also, see Exhibit 3 in the Source for a pent-up source of labour demand.

- Source.

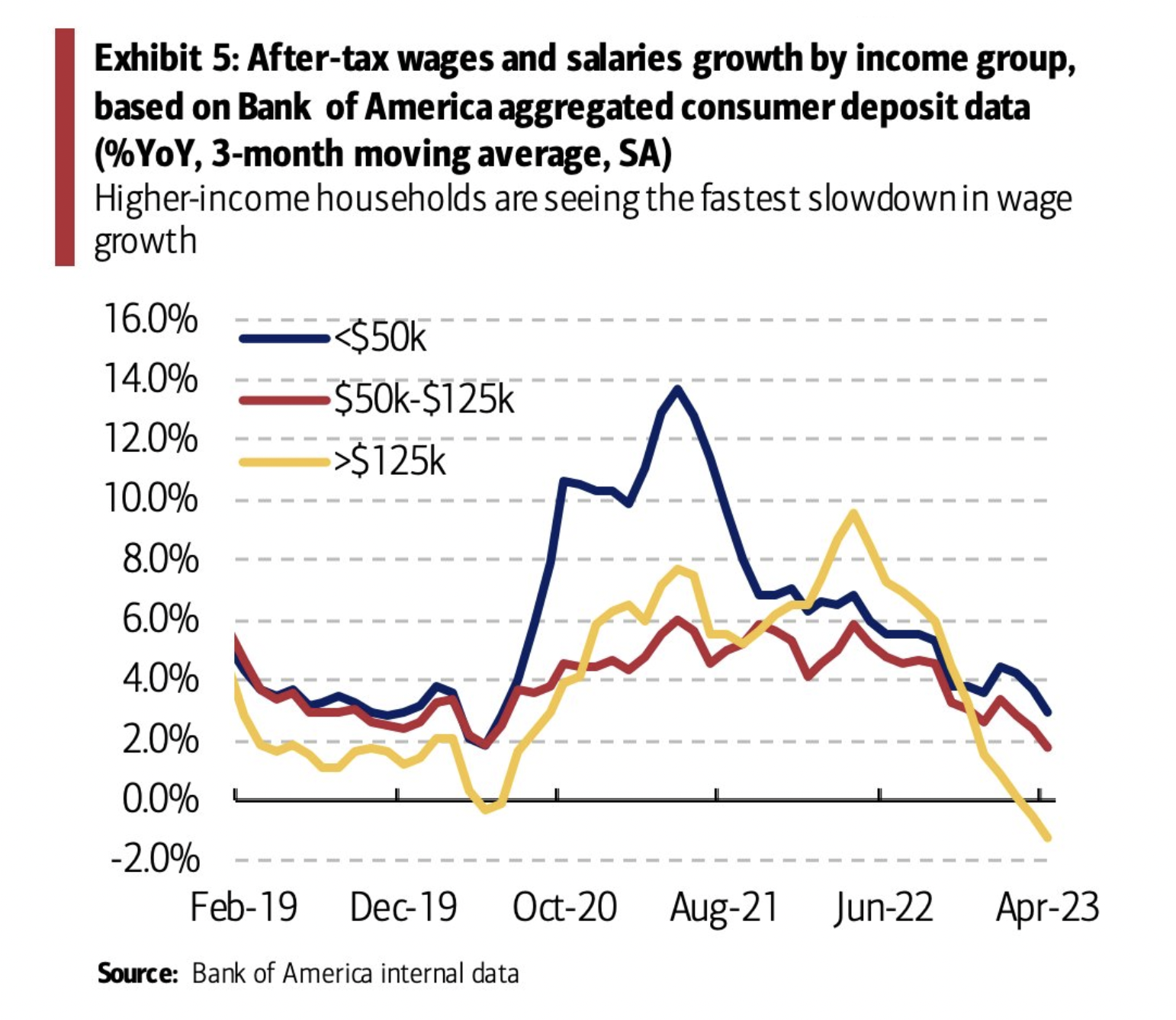

Wage Growth by Income

- Wage growth is decelerating in the US, especially so for those in the highest income bracket.

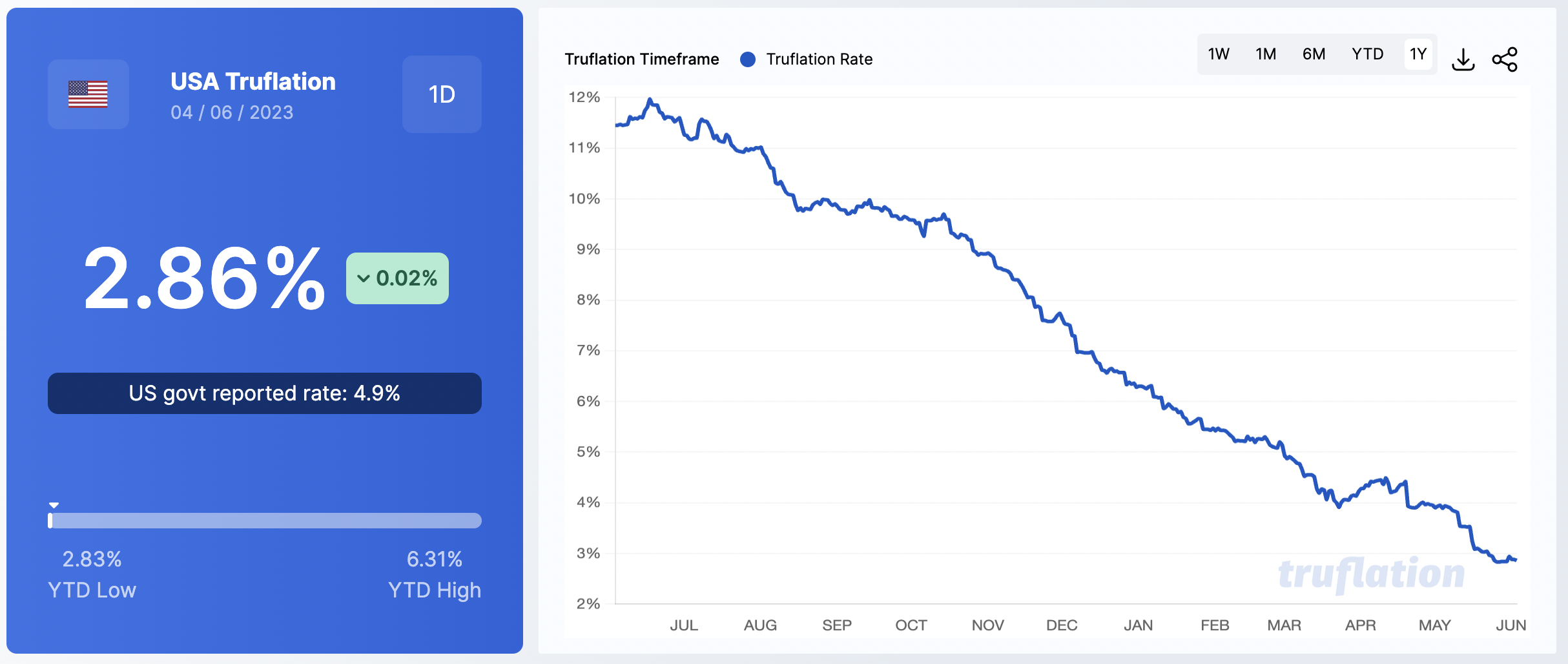

Truflation

- This alternative measure of inflation has been falling for months – and currently sits at 2.86%, well below official measures.

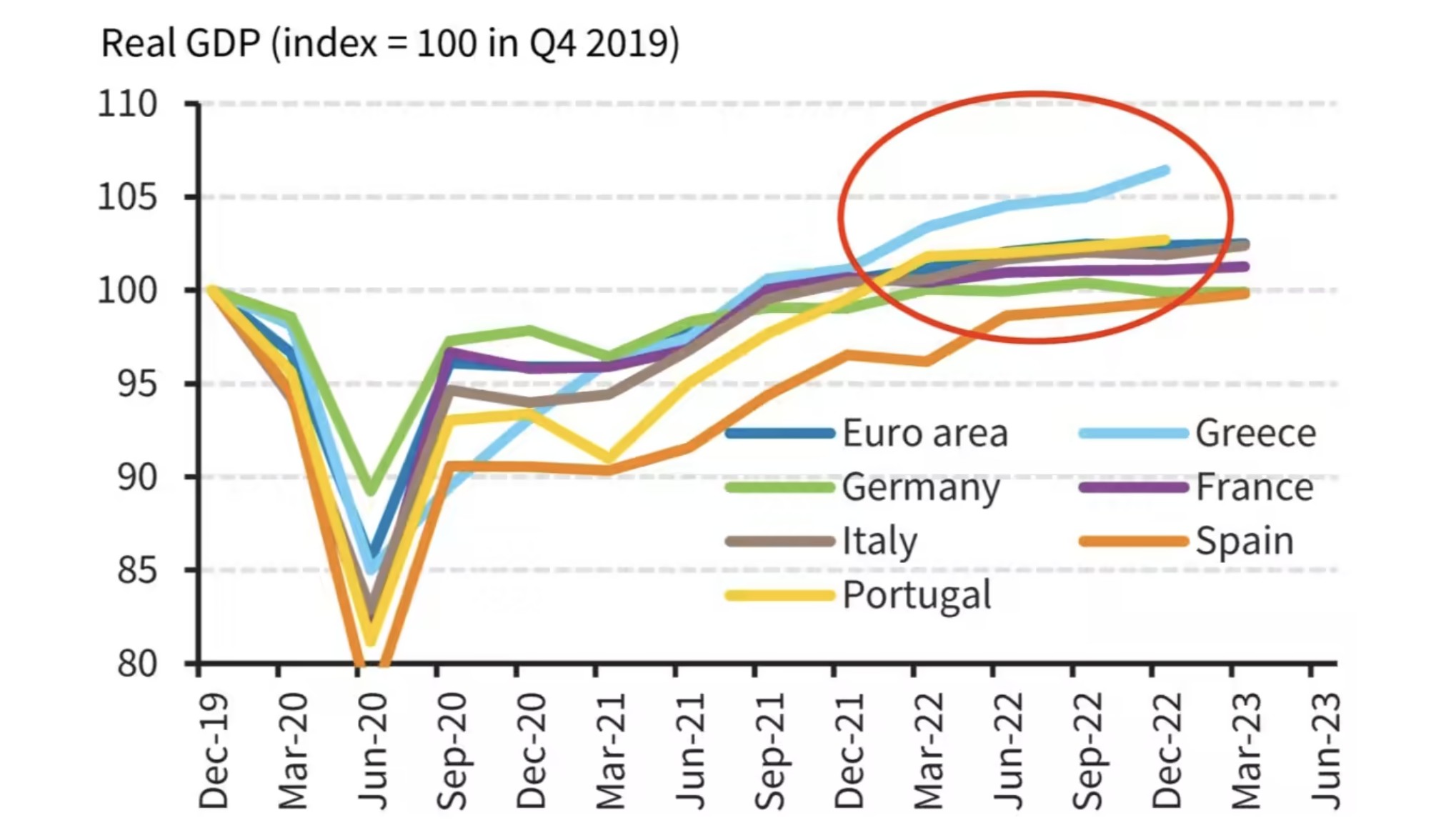

Greece

- The Greek economy is doing rather well, and starting to peel away in terms of growth.

- Barclays, via FT Alphaville, argue it might be entering a third positive “megacycle”.

- This analysis agrees – “Greece is growing, investment is booming, employment prospects are improving, the number of businesses is moving up, salaries are increasing, and the country is becoming less poor, not more“.

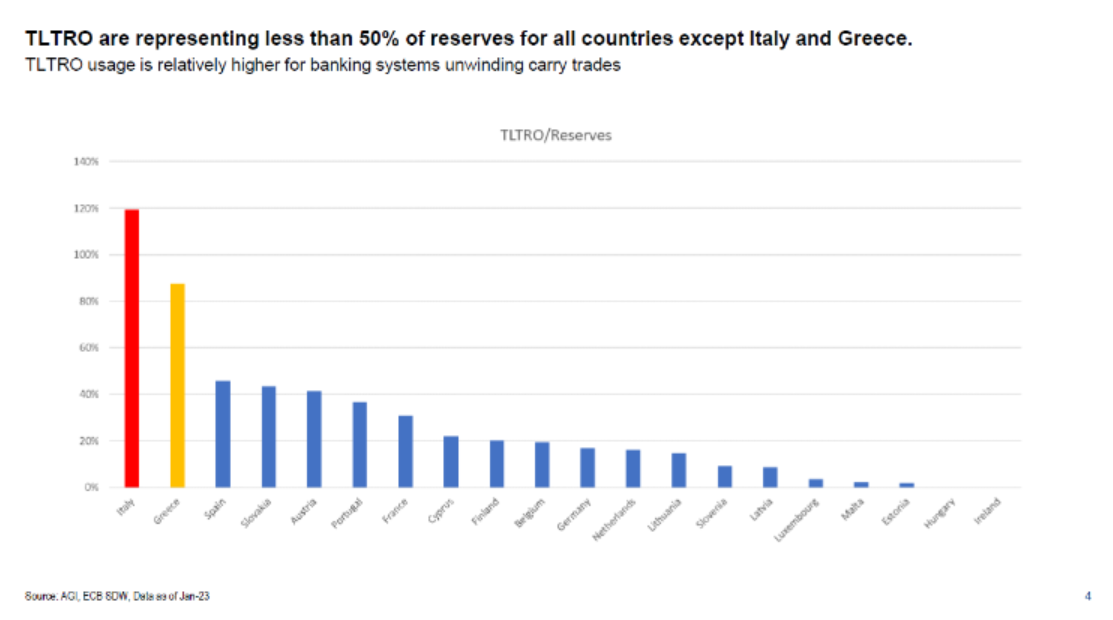

TLTRO

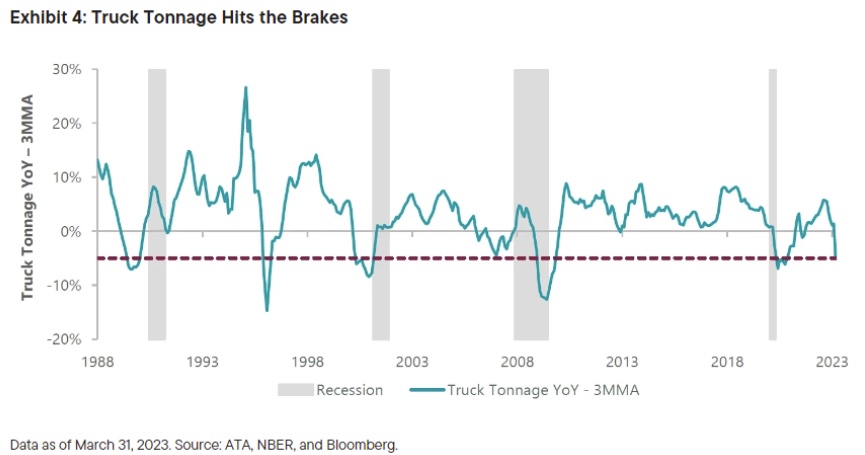

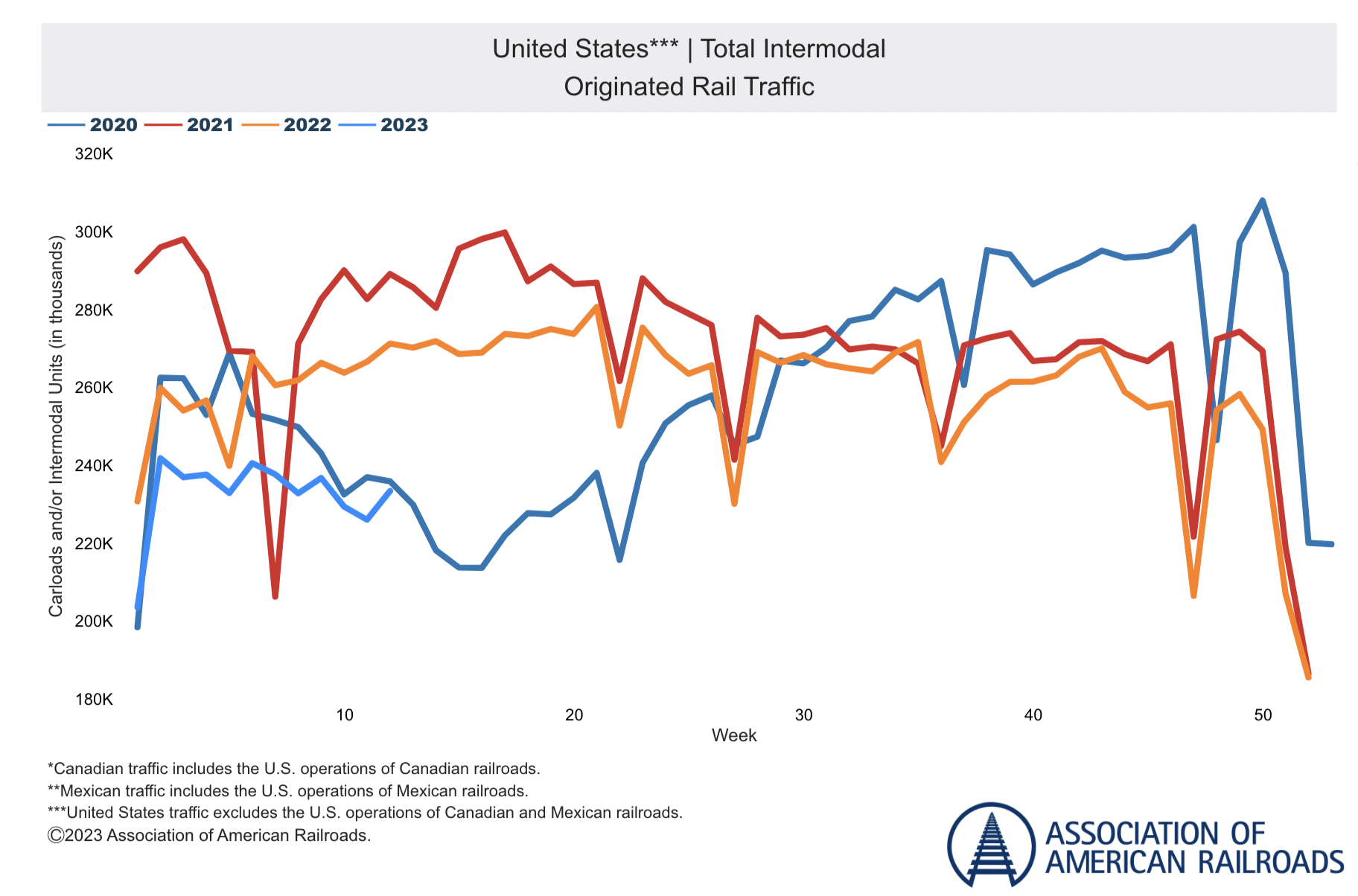

Truck Tonnage

- “The American Trucking Association’s Truck Tonnage Index saw one of its worst monthly declines on record in April going back to the early 1970s”.

- NB Covid whipsaw likely distorted many of these supply chain based macro indicators.

- Interestingly new truck sales are hitting record highs.

- Source.

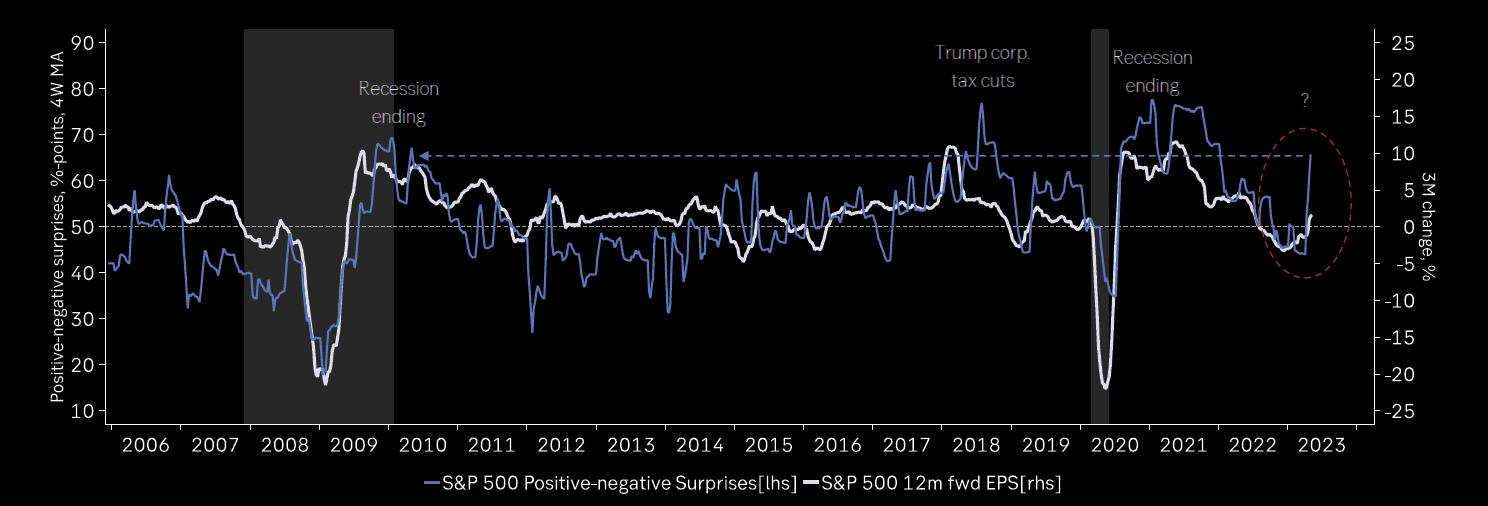

Earnings Surprises

- Rare to see this level of positive surprises when a recession is expected.

- Source: themarketear.com.

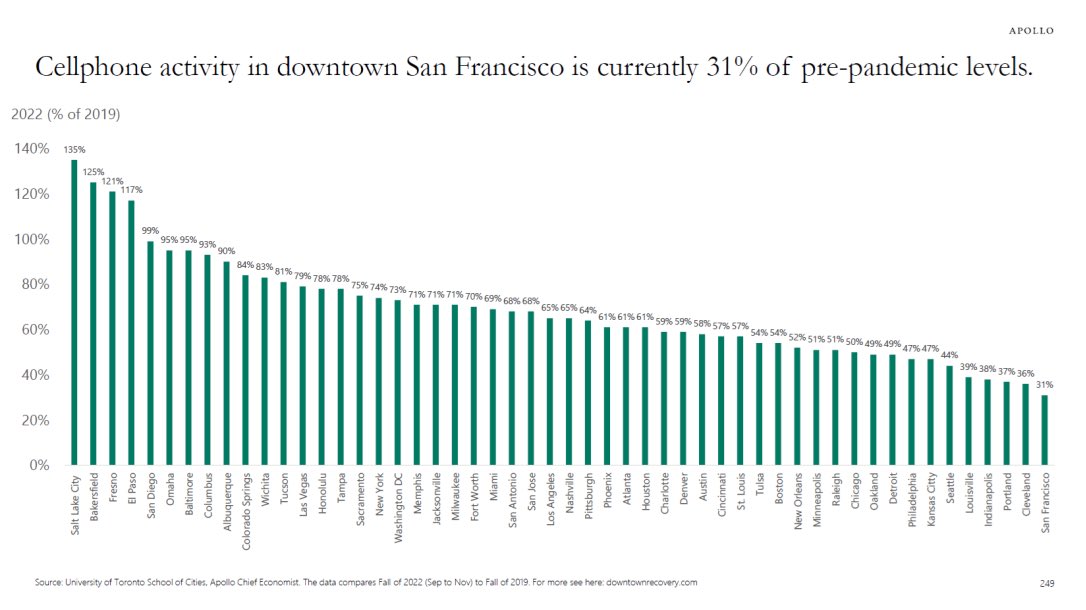

Downtown Cellphone Activity

- Activity in San Francisco is 31% of pre-pandemic levels, New York 74%, Chicago 50%, and Boston 54%.

- Though interesting that Miami (seen as a big pandemic winner) is also 69%.

- Source.

Kotkin on China and Communism

- Kotkin is a scholar of Russia and the Soviet Union. Most famous for his three-part (only two are published so far) biography of Stalin.

- In this interview, he turns his attention to China.

- There are a lot of interesting points made here.

- “There are two subjects at Party School that are absolutely dominant in the Chinese case. One is the supposed decline of the United States … But the other big subject — in fact, it’s an even bigger subject for them — is not having a Soviet collapse in China“

- Interesting to read this together with Dalio’s latest on the US v. China.

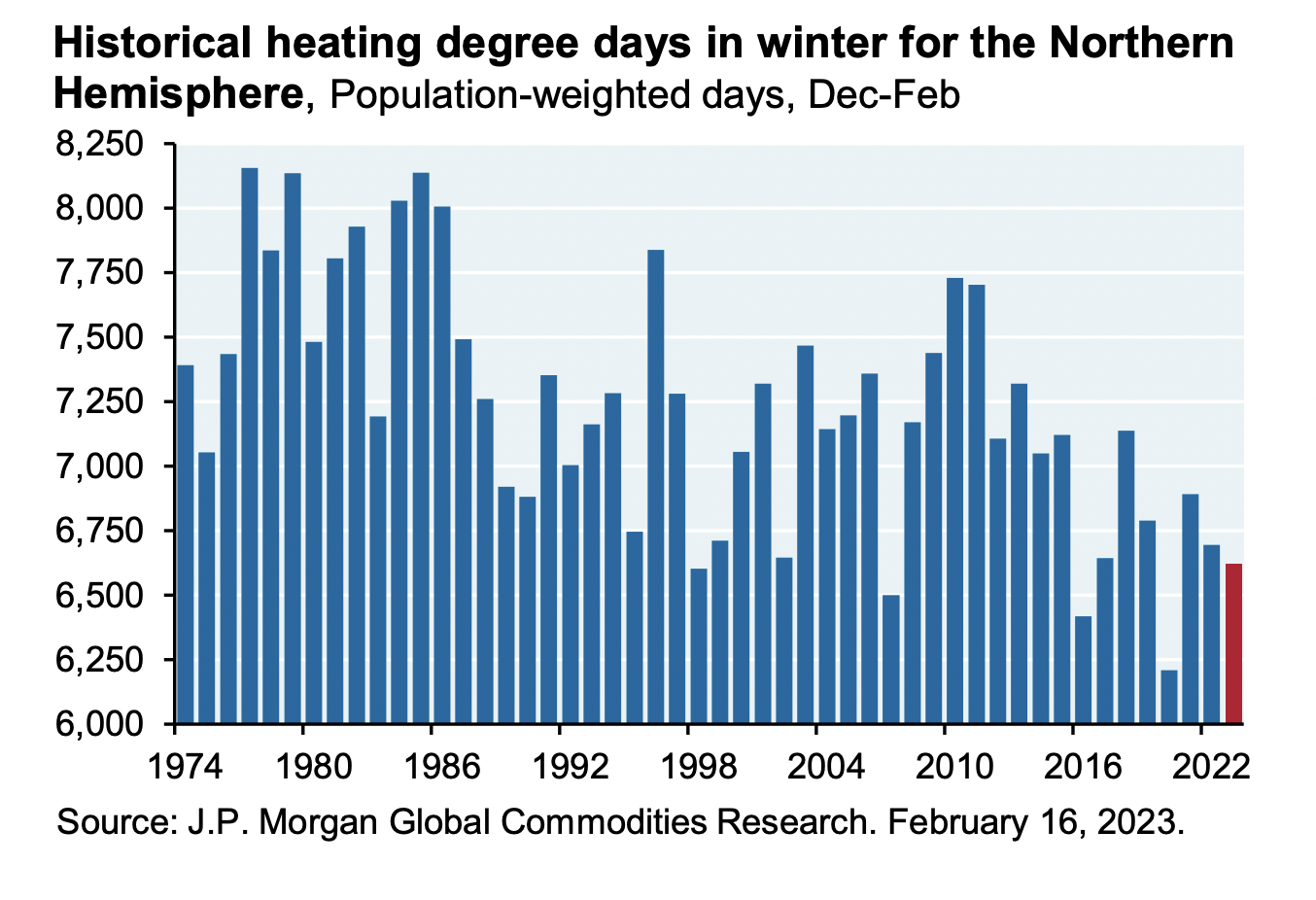

Weather

- Don’t forget we just had one of the warmest winters in the Northern Hemisphere in the past 50 years.

- Source.

America’s Protectionist Turn is at least 15 years Old

- It didn’t start with the Inflation Reduction Act or Trump.

- It started as early as 2008, and took the form, as this article identifies, of four key forces.

- Things in global trade wars move slowly.

- “If this analysis is correct, it should be clear that the American protectionist turn has been taken for a long time and will last long, as one doesn’t see the main forces that provoked it changing direction, starting with the desire to push China back.“

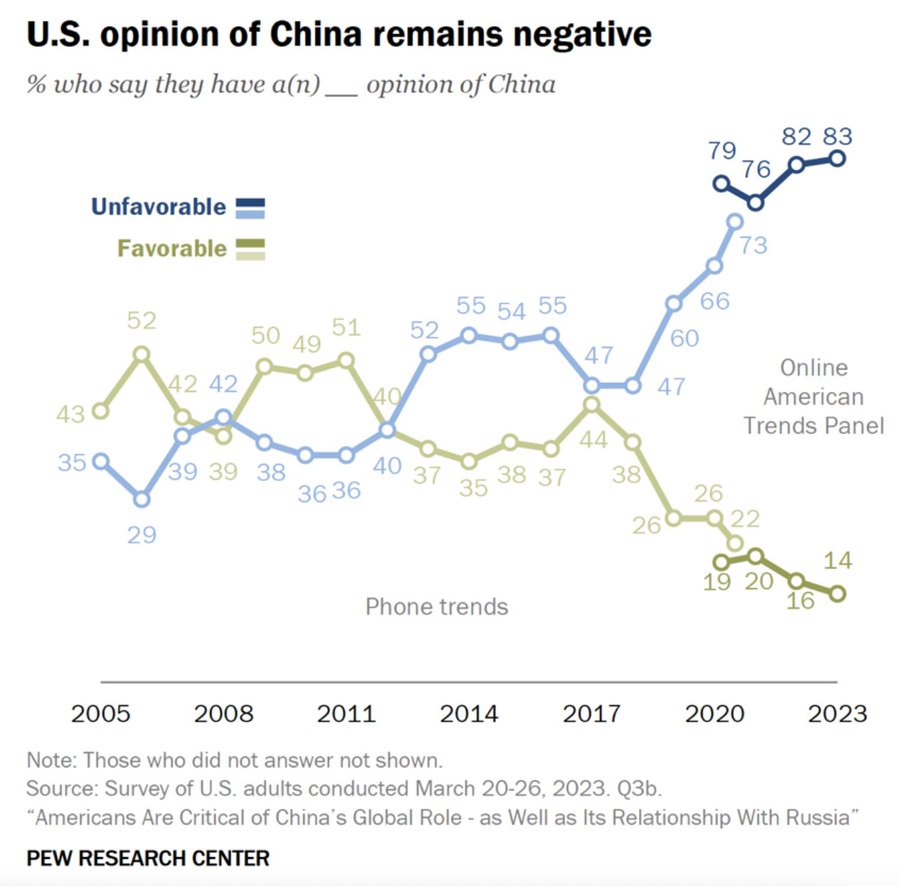

US Opinion of China

- 83% of US adults surveyed had an unfavourable opinion of China.

- The perception has deteriorated significantly in the past 5 years.

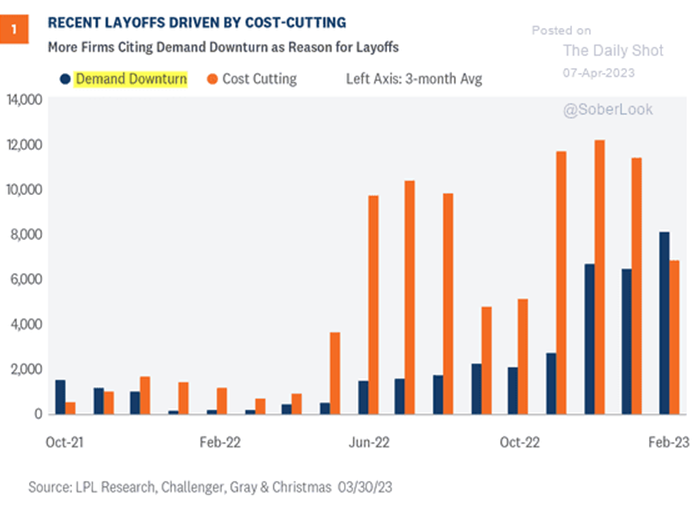

Reason for Layoffs

- “Demand downturn” overtook “cost cutting” as a key reason for layoffs.

- h/t DailyShot.

Setting Global Balance Scene

- For every deficit there is a surplus.

- Studying these global balances helps understand and predict where the stresses of financial systems build.

- To this end, Brad’s re-opening post from November 2022 is a foundational read.

- The short summary – deficits are back to pre-GFC highs, have concentrated in autocratic regime countries but with none of the historic reserve growth.

- Prescient conclusion – “By implication, private financial intermediaries somewhere around the world will need to absorb Treasury bonds. Just as financial intermediaries globally had to absorb U.S. “subprime” (household) risk prior to the global crisis, now they have to absorb U.S. interest rate risk.”

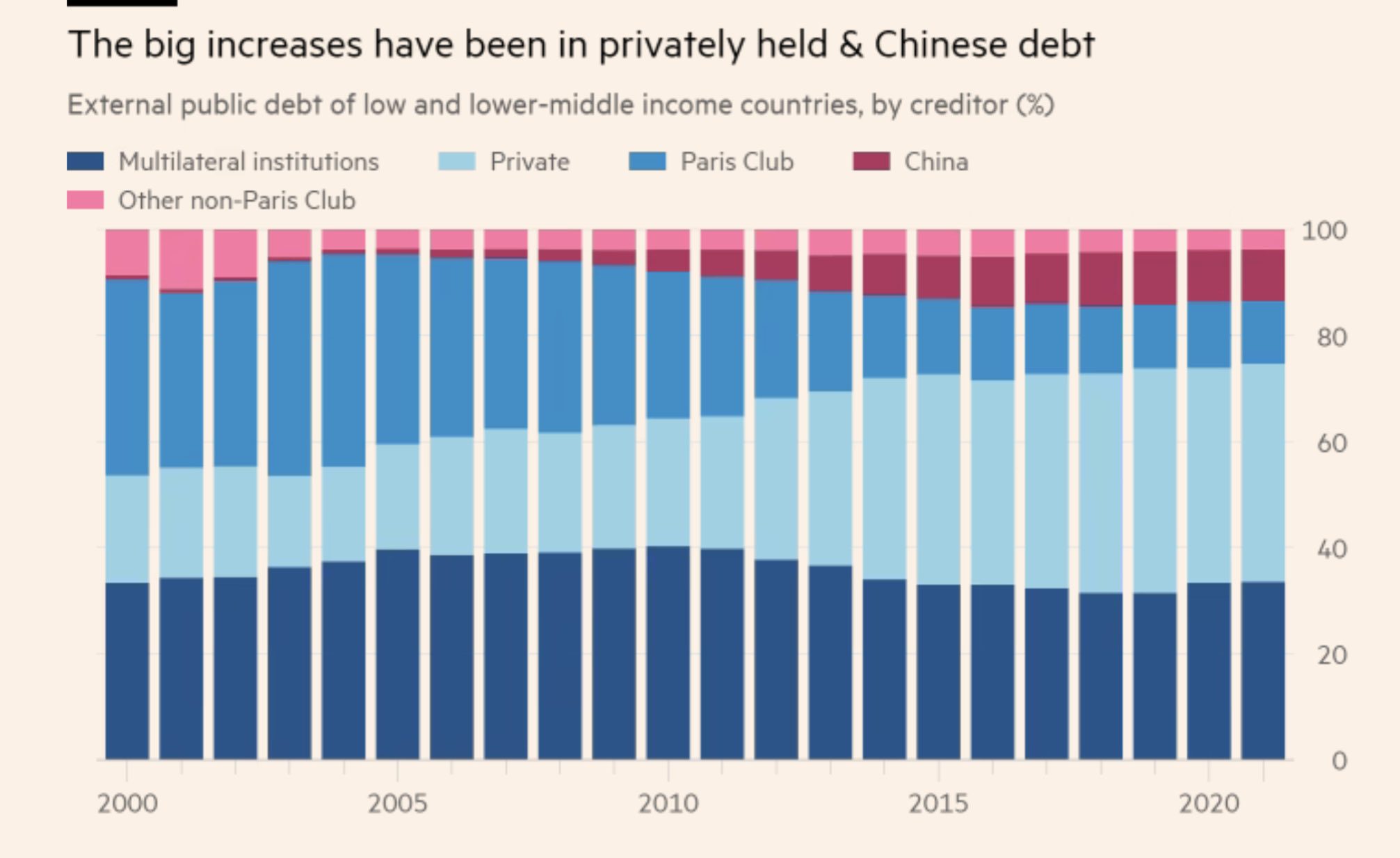

Composition of EM Debt

- “Just between 2000 and 2021, the share of public and publicly guaranteed external debt of low and lower-middle income countries (other than that held by IFIs) owed to bondholders jumped from 10 to 50 percent, while the share owed to China rose from 1 to 15 percent. Meanwhile, the share held by the 22 predominantly Western members of the Paris Club of official lenders fell from 55 to 18 per cent. Thus, co-ordinating creditors in a comprehensive debt restructuring operation has become far harder, because of their greater number and their diversity.“

- Source.