- As interest rates have risen, money markets have started to charge fees that they have been waiving for a long time.

- Source: WSJ.

Misc

Miscellaneous is often where the gems are.

Calm Credit Markets

- One of the clear harbingers of the sharp rally last week was not just very negative sentiment, or the CPI print itself, it was the overly calm VIX index.

- The VIX spent most of October falling, despite the bearish drum beat.

- This is also the case in credit land – where things are “surprisingly chilled“.

- “Here’s the US junk bond CDS credit spread index, which remains well below its 2008, 2011 and 2020 peaks, and the shape of the CDS curve, which tends to invert [Pictured] as markets freak out about a rash of near-term defaults.“

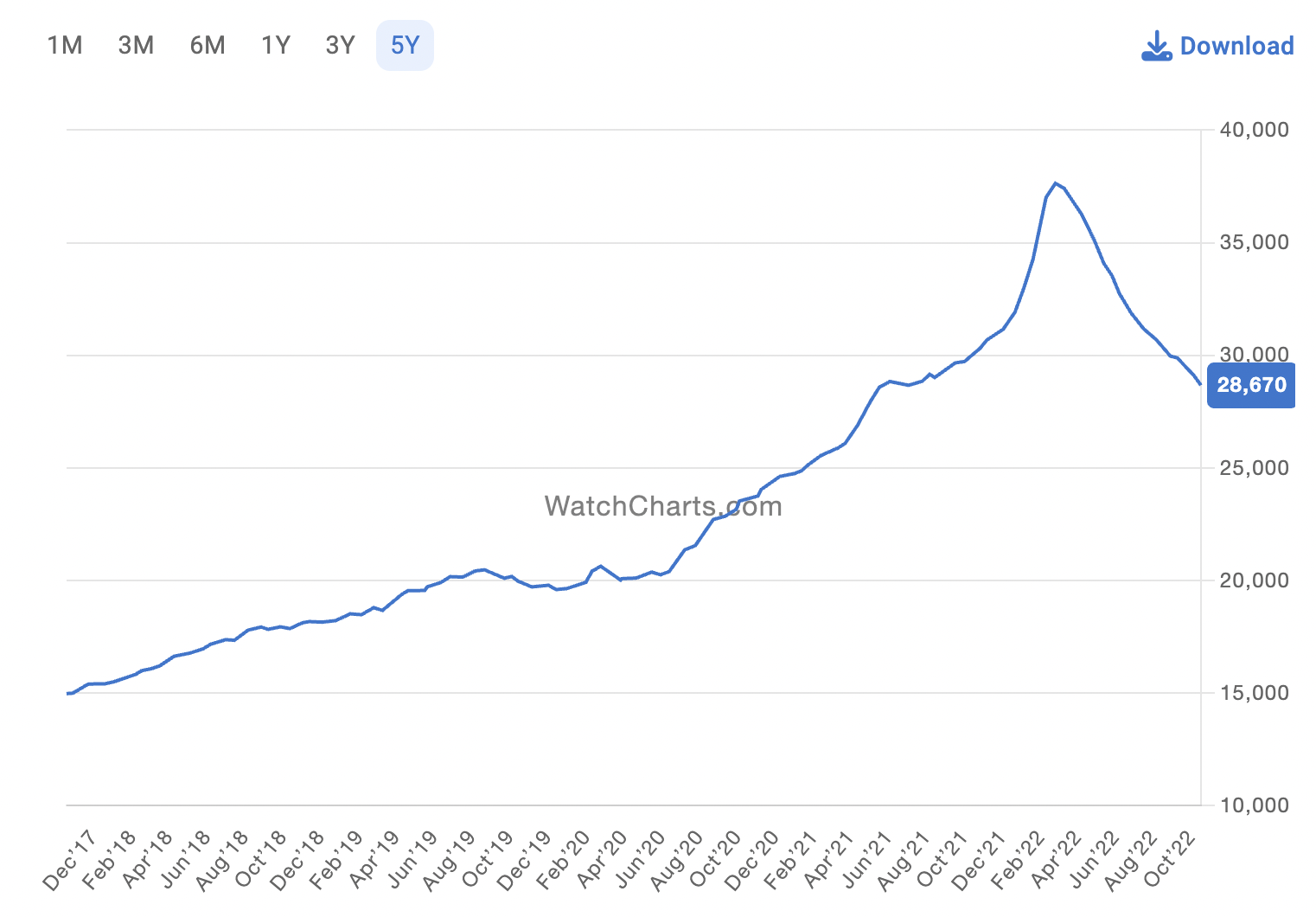

Rolex Index

- Prices of second hand Rolex watches continue to roll over.

- This index comprises the top 30 Rolex models by sales.

Nuclear War

- One of the best forecasting teams in the world puts at 16% [the chance] that Russia uses any type of nuclear weapon in Ukraine in the next year.

- Metaculus market puts this prediction at 4%.

- For those interested in prediction markets – this is a great search engine for probabilities.

Paying for Outcomes

- Sometimes ideas come in seconds and the job is done.

- Yet, those paying for these ideas always equate time spent to value. They want to pay for process.

- “How can it be that you talk to someone and it’s done in a second? But it IS done in a second — it’s done in a second and 34 years. It’s done in a second and every experience, and every movie, and everything in my life that’s in my head.“

- Taken from FS this quote is from Paula Scher who conceived the Citi logo in seconds.

- There is a great story in the link as well along the same lines.

- Professional investing can actually sometimes feel the same way. Especially if you believe in Blink.

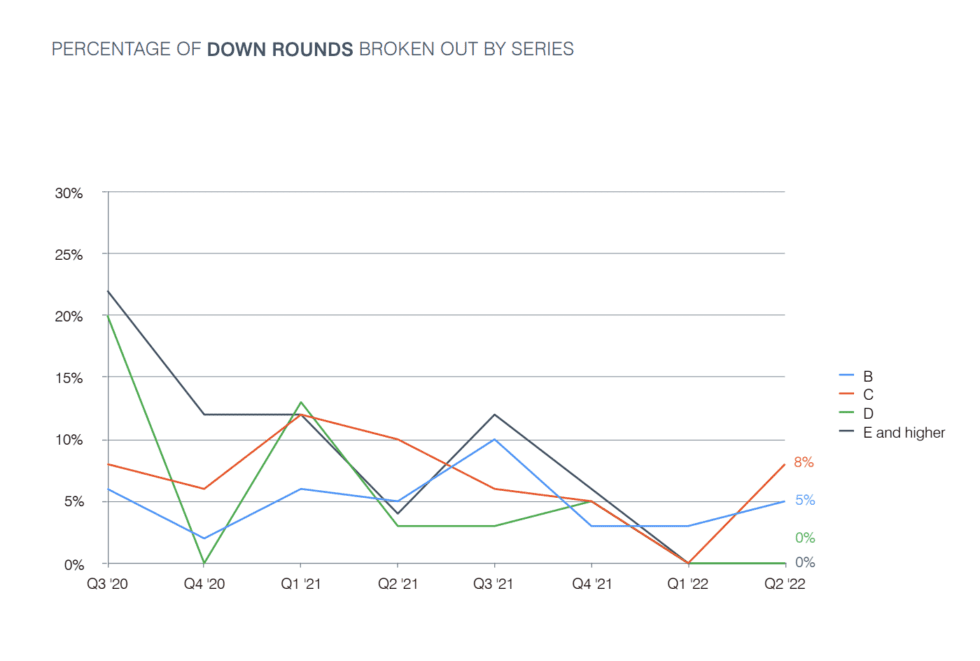

Venture Down Rounds

- Lots of interesting VC data based on actual closed deals from Silicon Valley law firm Fenwick.

- One of them, pictured, is the percentage of down rounds which have gone up but not much yet.

- Although up rounds might be in name only.

- Here is a summary of the most interesting data points.

- In a few words, things are worse than 2021 but not by that much, things are still way up from a few years ago.

Jones Act

- The Jones Act Is a piece of legislation, that mandates that maritime commerce in the US must be conducted with American-built and staffed ships.

- The Act, which finds its origins in the 1920s, causes all kinds of problems – for one such ships are almost 3x more expensive to operate.

- The impact can be felt, as this article explains, in the cost of petrol.

- Fascinating how high prices bring out all sort of aspects of systems.

Effective Altruism

- If you haven’t come across it before, effective altruism is an interesting movement that coined the term “longtermism”.

- It says of the human race – “We’ve been around for approximately 300,000 years. There are now about 8 billion of us, roughly 15 percent of all humans who have ever lived.“

- “You may think that’s a lot, but it’s just peanuts to the future. If we survive for another million years—the longevity of a typical mammalian species—at even a tenth of our current population, there will be 8 trillion more of us. We’ll be outnumbered by future people on the scale of a thousand to one.“

- One of the movements champions – William MacAskill – has recently written a book that has received much attention (to be expected for such a well funded movement).

- “What We Owe The Future” is worth knowing about – and this is a very good review of it.

Bewilderment

- They say in investing it is all about having strong opinions weakly held.

- Another way to say this is – bewilderment to combat excessive certainty, inflexibility, over confidence.

- “You no longer need to exhaust yourself pretending to understand what you don’t or making pronouncements about questions that are above your pay grade. You can trade false simplicity for complicated truth. And the resulting worldview is more useful and more beautiful because it genuinely reflects reality. That’s why a synonym for bewilderment is wonder, which, at least for me, is not terrifying but exhilarating.”

Fire Departments

- In the US in 2021 the NY Fire Department attended 10,639 incidents that were deemed “structural fires” out of a total of 1,213,715 incidents.

- The vast majority of the rest are actually medical incidents.

- Fires are just must less common (more alarms, less smoking, better safety).

- Fire departments in the US perform the role of ambulances – in 1980 they attended 5 million medical calls but in 2020 this was 24 million (Covid notwithstanding, a huge rise).

- Contrarian article arguing why fire departments have perhaps put themselves out of business.

Fusion Power

- Fusion power holds great promise but has never really materialised.

- Why? To find out read this excellent review of the book The Future of Fusion Energy, an introduction to fusion.

- One answer is funding – “The reason we don’t have fusion already is because we, as a civilization, never decided that it was a priority. Fusion funding is literally peanuts: In 2016, the US spent twice as much on peanut subsidies as on fusion research.“

Vitalik Buterin Interview

- Interesting and wide ranging interview with the creator of Etherum.

- “Vitalik Buterin is one of the most well-known and best-loved figures in the crypto/blockchain world — well-known because Ethereum, the blockchain platform he co-created (with Gavin Wood) has become the platform for the entire web3 world, and best-loved because he’s very clearly just a smart, friendly guy who just wants to build cool stuff and not rip anybody off.“

The Awkward Silence

- A useful tool for any investor interviewing management.

- “I learned this one from the psychoanalysts. Nobody likes an awkward silence. If a patient tells you something, and you are awkwardly silent, then the patient will rush to fill the awkward silence with whatever they can think of, which will probably be whatever they were holding back the first time they started talking. You won’t believe how well this one works until you try it. Just stay silent long enough, and the other person will tell you everything. It’s better than waterboarding.“

- Source.

Funding Science

- Did you know that one team of funders supported all but one of the 18 scientists who received the Nobel Prize in genetic molecular biology research, funding this revolution.

- This was the Natural Science Division of the Rockefeller Foundation which operated during the 1930s – 1950s, under the leadership of Warren Weaver.

- A must read history full of lessons for today’s science funders.

- “Weaver saw himself, instead, as a “manager of science.” He led his small team of program officers in a highly opinionated grantmaking process that focused on the organizational and social environments of research institutions over the specifics of any individual project. And once his team selected a field to focus on, it funded people over specific ideas.“

Jane Street

- Outstanding write up on Jane Street.

- “at the end of Jane Street internships: interns get a stack of 100 poker chips and spend half a day getting asked brainteasers and then betting on their confidence in the answers … This would actually be a pretty fun way for a math-minded person to spend a few hours, if it weren’t so high-stakes: the winners get a job from which people routinely retire rich in their 30s, and the losers… don’t.“

Startup M&A

- Few contrarian buyers out there, and for many startups there is plenty of cash in the bank.

- “In 2021, there were more than 3,000 M&A deals globally involving a VC-backed company getting bought, according to Crunchbase. Halfway through the third quarter of this year, just under 1,600 startups have found a mate in the market.“

- The picture is worse in the US.

- Source: Crunchbase.

ETF Innovation

- Some interesting things are going on in ETF land.

- First the rise of single stock ETFs – offering anything from -1x to +1.5x.

- NB these aren’t new in the UK but only recently launched in the US.

- This idea is also spreading to bonds – with single bond ETFs becoming popular including single-year, bullet bond ETF trackers.

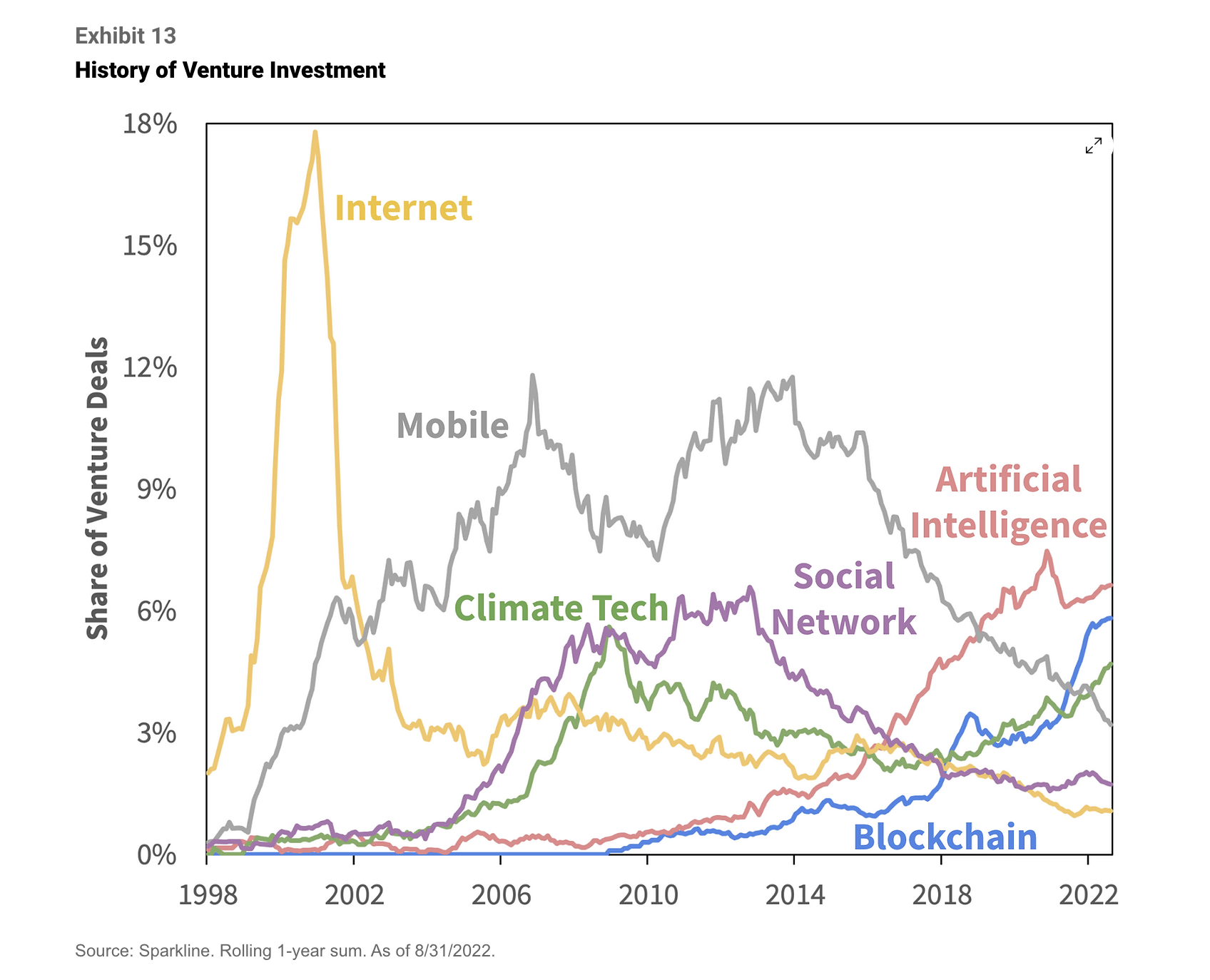

Venture Technology Clusters Over Time

- Using a machine learning model Sparkline Capital were able to cluster firms in similar technologies and then look at how venture investment in these tech clusters evolved over time.

- This leads to the following chart of cycles.

- “In the dot-com bubble, venture capital firms threw money at internet companies. Next, Blackberry and iPhone ushered in the mobile age. Then, Facebook’s success sparked a wave of investment into social networks. Artificial intelligence grew steadily over the past decade, while blockchain burst on the scene a few years ago. Climate tech investment faded after an initial burst but is now seeing a resurgence.“

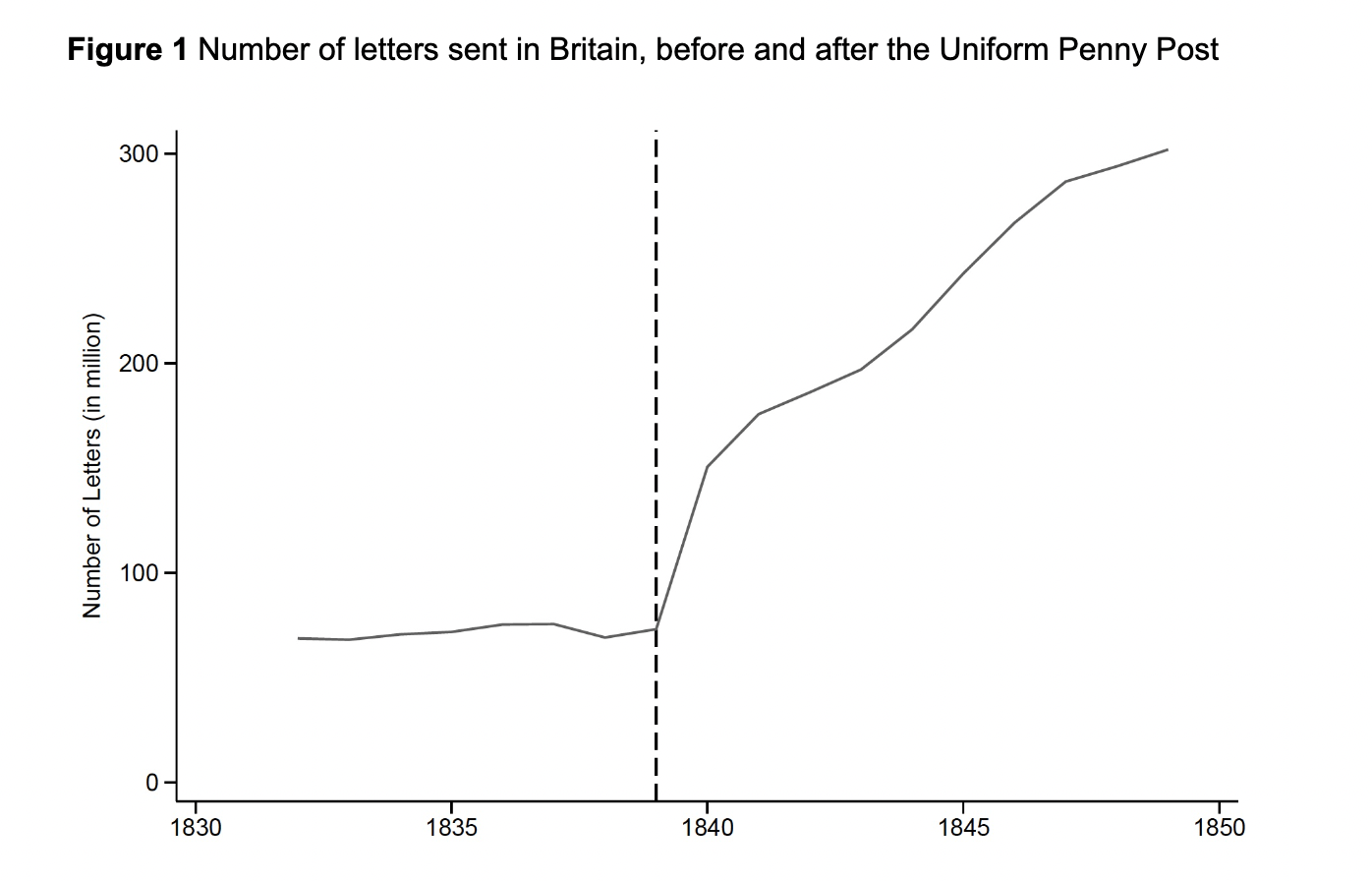

Communication Cost History

- Meet one of the most dramatic changes in communication costs in history.

- The introduction of the first modern postal system in Britain in 1840.

- A 1839 Act of Parliament created the Uniform Penny Post – a single low postage rate and the first adhesive postage stamp, replacing a complex distance based system.

- The results were monumental and, as this paper finds, also improved innovation.

- Today, 73% of people in the UK consider post as essential or fairly important.

Or are things going to get a lot worse?

- Here is a counter to a collection of positive charts posted a few weeks back.

- The article takes a pessimistic position that, if nothing changes, we have already crossed the point where it is certain things will get worse.

- Megafires, inflation, pandemic, heat – all could be signs of extinction.

- Alarmist but nonetheless sober reading.