- This chart “displays a strong cross-country correlation between men’s contributions to childcare and housework and the total fertility rate. In all countries with a fertility rate below 1.5 (blue dots), men do less than a third of the work in the home.“

- Source.

Misc

Miscellaneous is often where the gems are.

Some Things to do

- A delightful list “of things you’re allowed to do that you thought you couldn’t, or didn’t even know you could.“

- Especially like the idea of hiring a researcher or expert consultant – and how to go about doing that.

- Really has something for everyone.

University Spinouts

- Spinout.fyi is a handy database – “an effort to crowdsource and openly publish spinout deal terms across every university”.

- Useful for any venture investors or university entrepreneurs out there.

What if reading is bad?

- You are reading text right now. It engulfs our lives.

- “Between 1900 and 1990, the amount of time the average American spent reading and writing remained broadly consistent: somewhere between one and two hours a day.”

- With the advent of the internet and text messaging – this more than doubled to four to five hours.

- It is estimated the average internet user sees 490,000 words per day (more than War and Peace!).

- As this wonderful contrarian article argues – this might not, as many argue, be all good.

- “Every time we read, we inevitably conceptualize the world, in perhaps an ever-increasingly abstract way. And it’s conceivable that we may reach a point where those abstracting effects go too far.“

- Article sourced from The Browser – a brilliant resource.

Are things getting better?

- This collection of charts tries to present some cheerful evidence that things in the US have gotten better.

- For example, this chart shows that “people in every age group are less likely to die of heart disease, in any given year, than they were in 1990.”

- Interestingly, the all-age death rate has improved more slowly. Why? Because we are living longer (pushing the proportion of the 70yrs+ bracket up).

- The question, on whether humanity’s best days lie ahead, is fascinating.

- One of the best discussions on this topic was this debate – between Pinker, Gladwell, Ridley, de Botton.

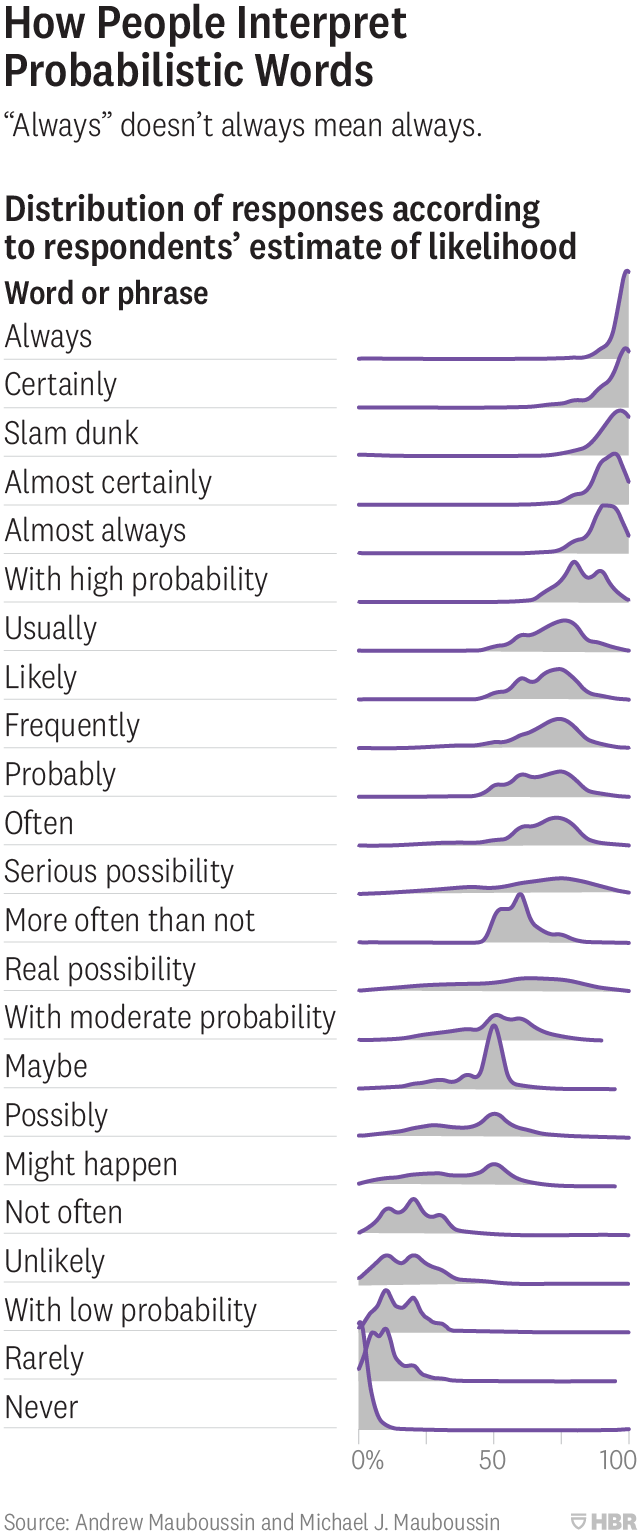

Probabilistic Words

- People use words to describe probabilities all the time.

- Yet this leads to a huge amount of confusion, especially in financial press.

- In this great article, Mauboussin (two of them) lay out learnings from a survey they did on this topic.

- Take this chart – the term “real possibility” was taken to mean anything from 20%-80% by 1,700 people surveyed – a huge range.

- Lots of interesting ideas inside on how to “combat” this bias.

Movie Leads by Age

- The leading actors in movies are getting older.

- Source.

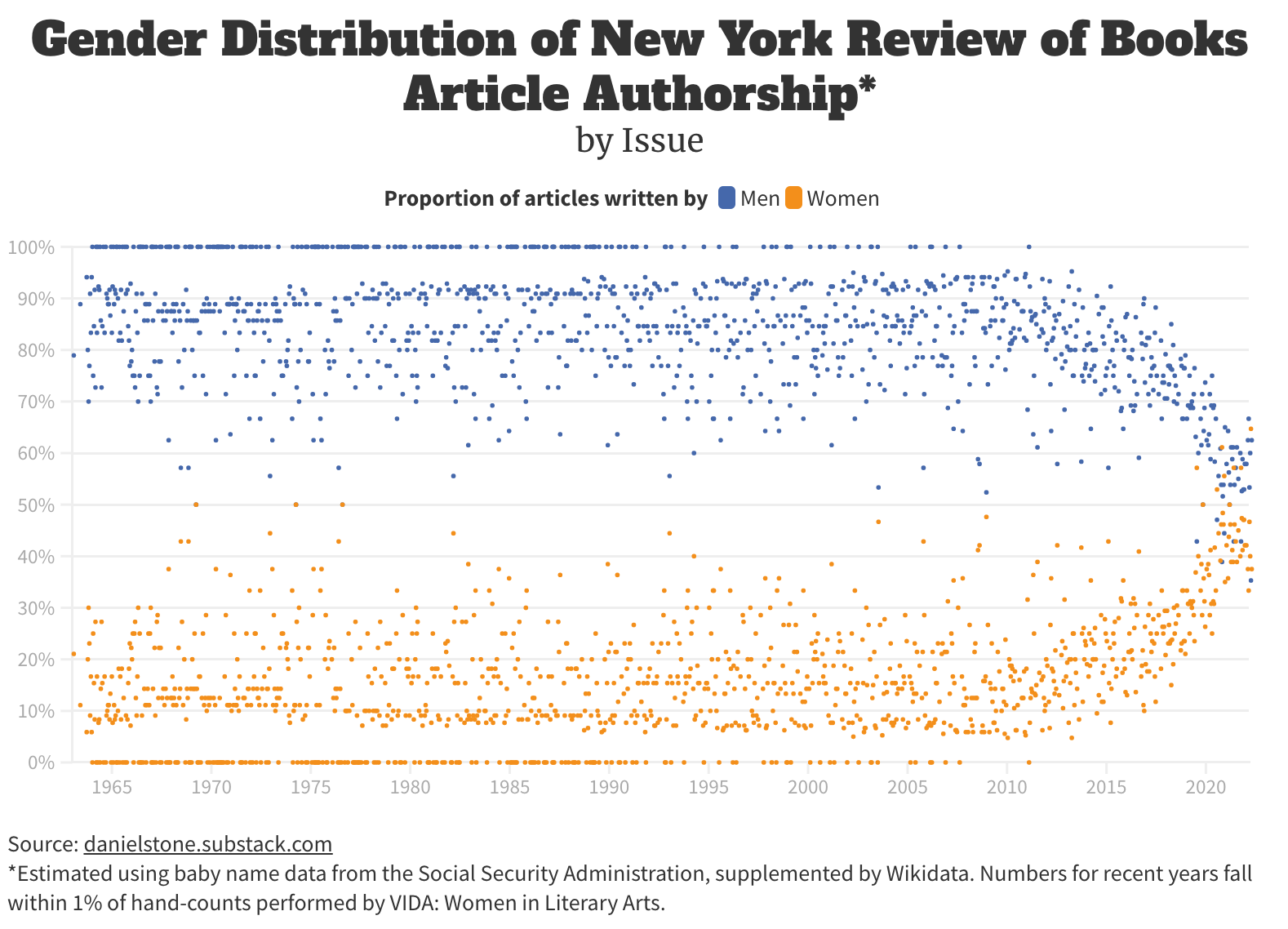

Gender and NYRB

- Interesting chart via The Browser (a must subscribe) plotting each issue of the New York Review of Books (NYRB) by the gender mix of authors.

- “What you are seeing is that there are only twelve issues out of 1228 (1%) to which women have contributed half or more of the articles. Nine of them have appeared within the past three years. Meanwhile there are about 196 issues (16%) to which not a single woman contributed an article.”

- Source (more stats inside).

Soros and Reflexivity

- Many have heard of George Soros’ idea of reflexivity.

- This idea is important especially as we look at the current market situation.

- To understand it more deeply it is worth reading Soros’ own writing on the subject – especially this piece from the Journal of Economic Methodology (2014).

- Here Soros lays out his full framework which is actually based on two propositions – reflexivity but also human fallibility – together the siamese twins that form “the human uncertainty principle”.

- “My conceptual framework deserves attention not because it constitutes a new discovery, but because something as commonsensical as reflexivity has been so studiously ignored by economists.”

Ten Commandments by Bertrand Russell

1. Do not feel absolutely certain of anything.

2. Do not think it worthwhile to proceed by concealing evidence, for the evidence is sure to come to light.

3. Never try to discourage thinking for you are sure to succeed.

4. When you meet with opposition, even if it should be from your husband or your children, endeavor to overcome it by argument and not by authority, for a victory dependent upon authority is unreal and illusory.

5. Have no respect for the authority of others, for there are always contrary authorities to be found.

6. Do not use power to suppress opinions you think pernicious, for if you do the opinions will suppress you.

7. Do not fear to be eccentric in opinion, for every opinion now accepted was once eccentric.

8. Find more pleasure in intelligent dissent than in passive agreement, for, if you value intelligence as you should, the former implies a deeper agreement than the latter.

9. Be scrupulously truthful, even if the truth is inconvenient, for it is more inconvenient when you try to conceal it.

10. Do not feel envious of the happiness of those who live in a fool’s paradise, for only a fool will think that it is happiness.

Kalshi

- Nice read from Bloomberg about Kalshi – the CFTC approved prediction market.

- Especially interesting is the long journey to getting regulators on board in the US (after years or resistance).

- “One day during their time at Y Combinator, Lopes Lara and Mansour say, they cold-called 60 lawyers they’d found on Google. Every one of them said to give up”.

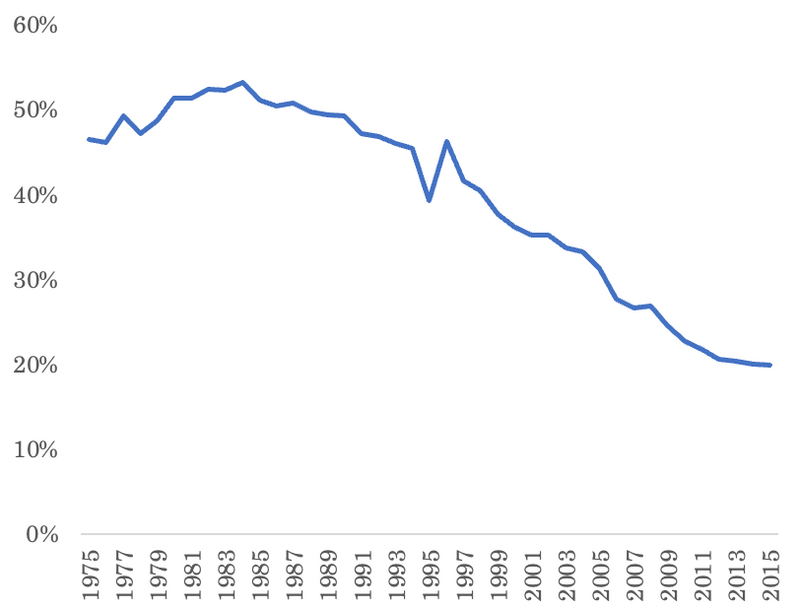

Science is getting harder

- Fascinating read that collects several pieces of evidence to suggest “that it is increasingly challenging to make discoveries that have comparable impact to the ones in the past“.

- Consider this chart, for example.

- It is based on all citations made to academic papers by US patents filed that year (and eventually granted in the next five years).

- The chart shows the percentage of these citations that were papers published in the preceding five years.

- The result – “citations to recent work have become increasingly less common“.

- The rest of the evidence is in this vein, including especially interesting data on how new topics in science are stagnating. This has a nice corollary to this essay here (for progress we need novel things to work on, h/t The Diff).

Substack

- Interesting argument by an ex FT/FTAV journalist, who has recently started her own newsletter, on why she didn’t chose Substack.

- One thing that stood out is legal cover. “As it stands, Substack can shift the biggest risk and cost in all journalism — libel risk — onto the shoulders of individual authors.”

- This ties in with news they have dropped their Series C round (at a valuation of $750m – $1bn).

- The reason is likely down to the fact they made only $9m of revenue last year, suggesting even their previous valuation of $650m is too high.

- The other thing is moderation – as any platform grows moderation becomes an issue, something other publishers have been quick to point out.

Football Transfer Fees

A case for value in technology

- This was a fascinating read on why some technologies linger and hence have a much longer tail than the market often predicts.

- The reason – “cultural forces create market demand even if supply is available more efficiently (even infinitely) elsewhere“. In some cases (not obviously just related to age) the perceived value actually increases.

- Think about movie theaters surviving despite the rise of home cinema. Why? The social value of gathering at the movies.

- Or enjoying the slow deliberate read of a newspaper.

- Or the demand, sometimes sinister, for the near 5 million payphone calls made each year in the UK.

- Decline is inevitable but not in all cases (booming vinyl sales for example).

Nootropics

- Astral Codex Ten picks up on an expanded nootropics recommendation data set.

- The results are in this table and show three things (1) addictive/illegal is preferred to safe (2) difficult but popular > chemicals (3) high tech > normal.

- Full post here.

Interview Questions

- Google has hard ones.

- But what about the really good ones?

- Reid Hoffman used to ask – “What do you plan to do after you leave Linkedin” – brilliant as it acknowledges that people don’t stay in jobs forever and communicates a support for their vision of the future.

- This one from Marginal Revolution is also great – “What are the open tabs in your browser right now?”

Far from Nick Train

- Brilliant podcast interview with the Nick Train of Lindsell Train.

- Nick has an unique grasp of history when it comes to companies, with a horizon that feels 15-20 years longer than others.

- His recommendation to a younger self, right at the end of the podcast, was also excellent.

Africa Part II

- Africa continues to evade both acronym and imagination, attracting only cliches.

- Yet, it is not like any other place on earth right now.

- As this excellent piece from Adam Tooze makes clear, while Asia has taken back its place (see chart) in the historic world order, the same remains elusive for Africa.

- This is despite what is a more than 10x of population since 1914 (124 million to 1.34 billion today) when compared to a “mere” 3-4.5x in Asia.

- But Asia is plateauing in population terms. Africa continues to grow – forecast to reach 2.4-2.5 billion by 2050 and 35-40% of the world’s estimated 9-11 billion population by 2100.

- How confident are we of the former forecast? As Tooze makes clear there is one “dramatic fact” – “a large number of the mothers whose children will drive growth to 2050 have already been born“.

- Demographics are nebulous – long in time and space – but sometimes two decades, like the last two we experienced, are “decisive for global population history“.

- There is so much more in the article culminating in a quote from Howard French – “How Africa’s population evolves, and how the continent’s economies develop, will affect everything people near and far assume about their lives today.”