- Notable acceleration in startup layoffs.

- Data is from a tech startup layoff tracker that uses public data.

- Lots of interesting pivots on the data as well.

Misc

Miscellaneous is often where the gems are.

Chris Hohn Profile

- Great profile of the hedge fund titan Chris Hohn.

- “What’s the point of making lots of money if not having the joy of giving of service, meaning, and purpose? I still stick to the original goal: Do well for investors and encourage philanthropy through example.”

Jim Chanos Interview

- Great interview with the famous short seller, useful listen given what is going on in the markets.

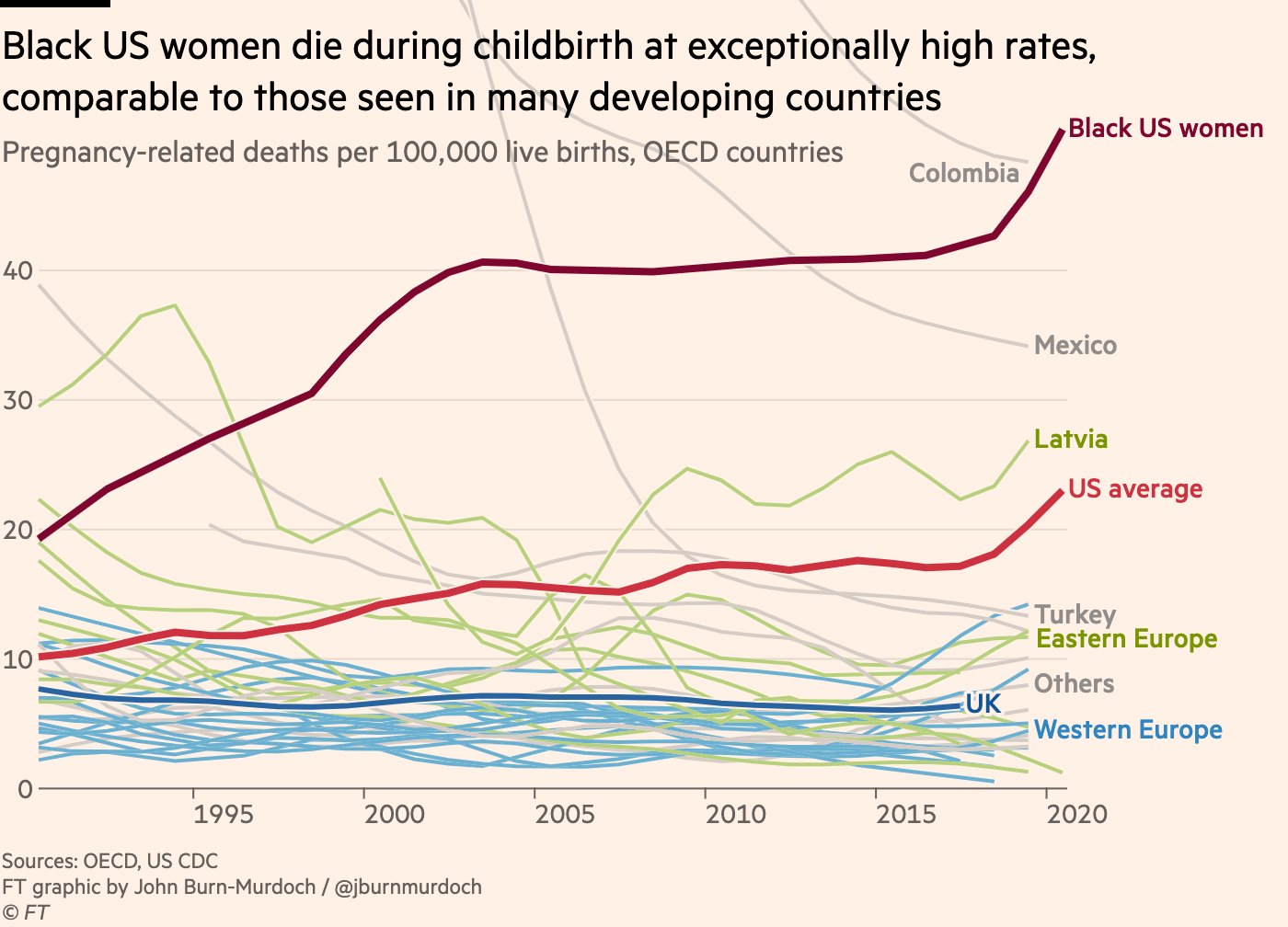

Death at Childbirth

- This is the US’s “most shameful statistic”.

- Source.

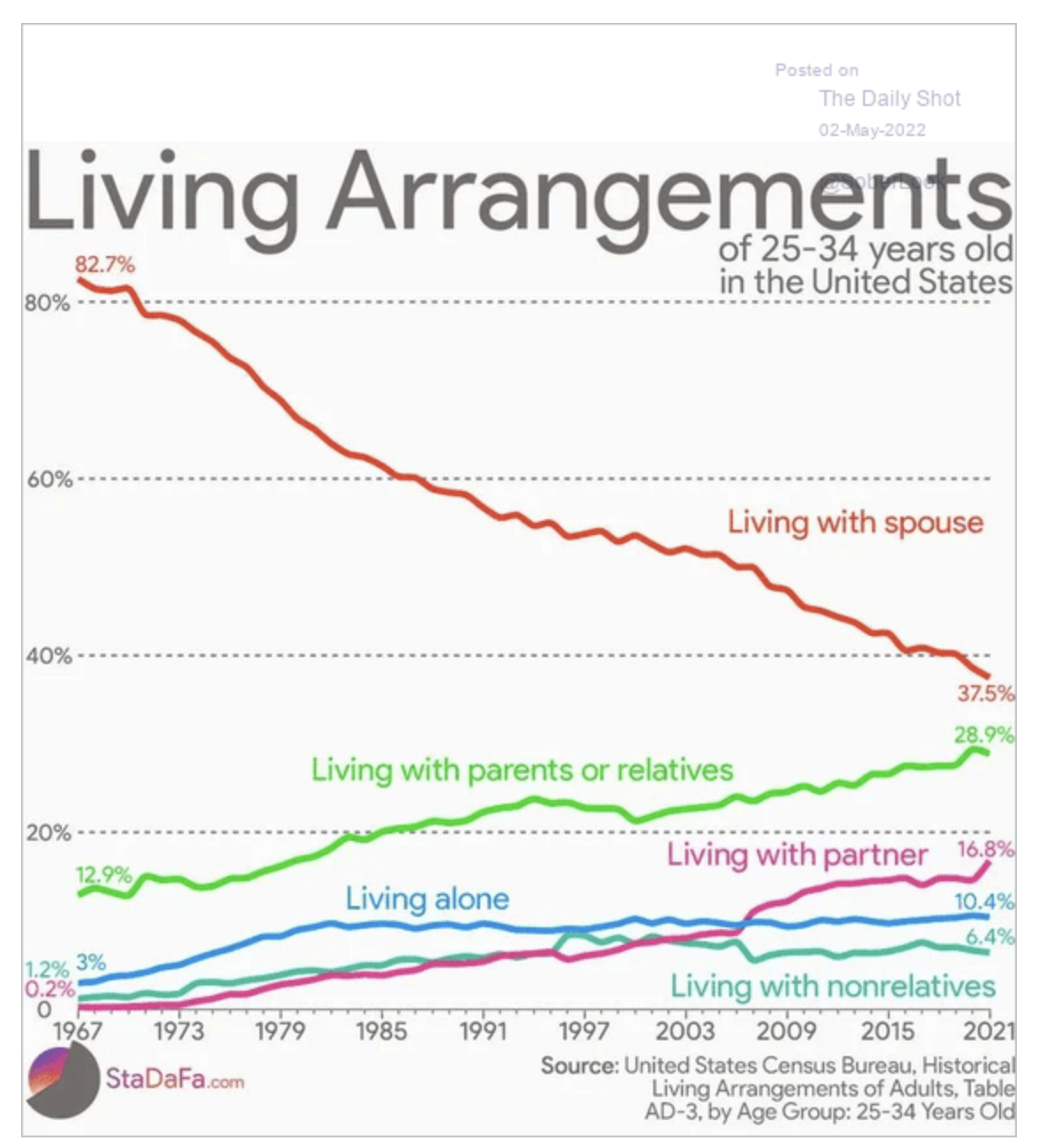

Living arrangements

- A really profound long term change.

- h/t The Daily Shot.

The First Financial Engineer

- Robert (Bob) Merton is a giant of modern finance science.

- He is also, as argued by Andrew Lo in this really outstanding talk, the first financial engineer.

- It is in this combination – being both a scientist and engineer that his true astounding contribution surfaces.

- “I believe that a body of knowledge only becomes a science when a corresponding field of engineering emerges from it.”

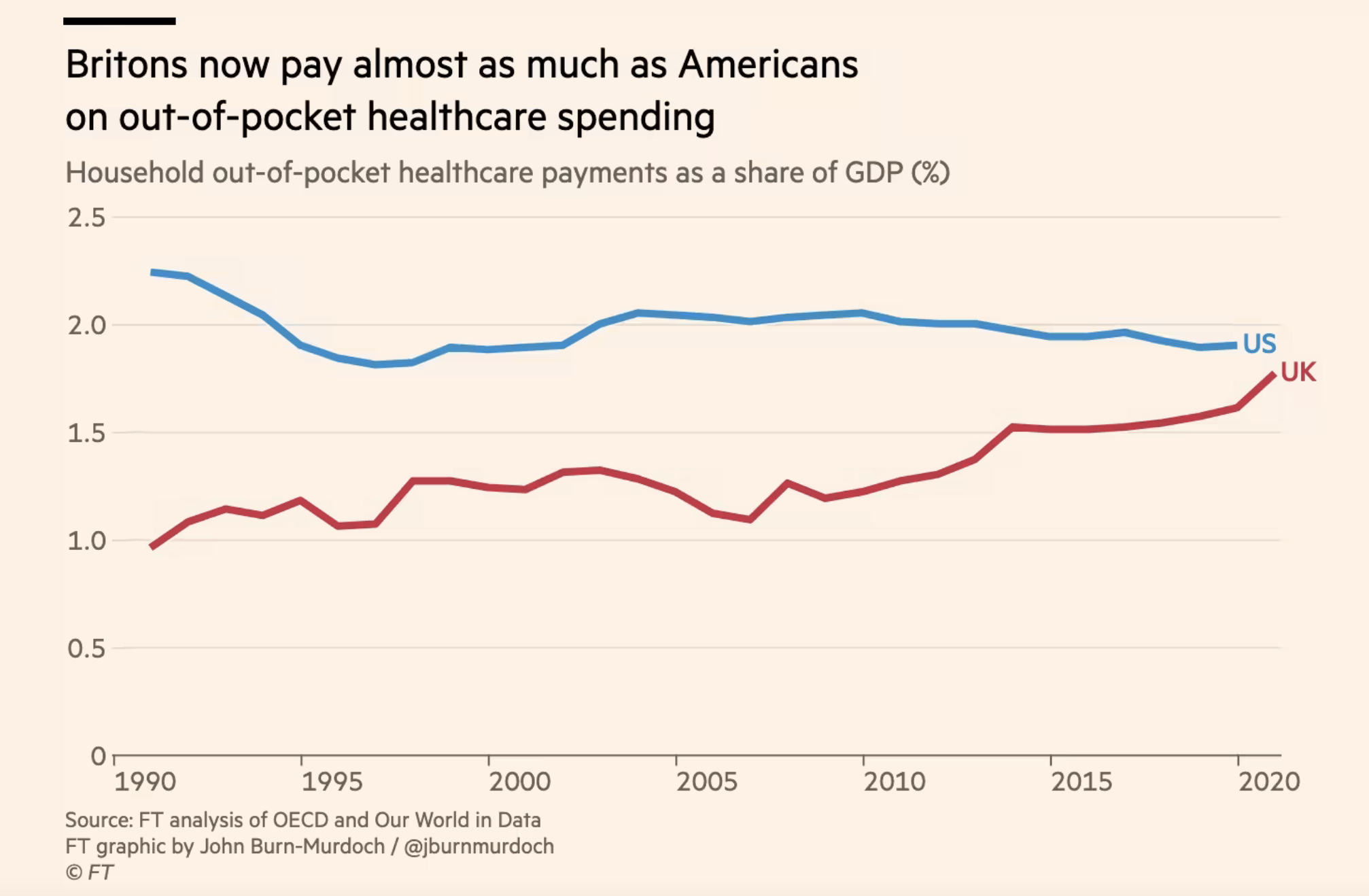

UK vs. US Out of Pocket

- UK healthcare is already privatised.

- Source.

Barry Diller – Learn to Unlearn

- I have posted a few interviews with Diller before (here and here).

- One of the best podcast interviews with the legend was done by Reid Hoffman.

- It is in two parts – the first is called infinite learner and the second learn to unlearn.

- Diller has an almost uncanny ability to change and adapt to a fluctuating world, something that has helped him stay on top for so many years.

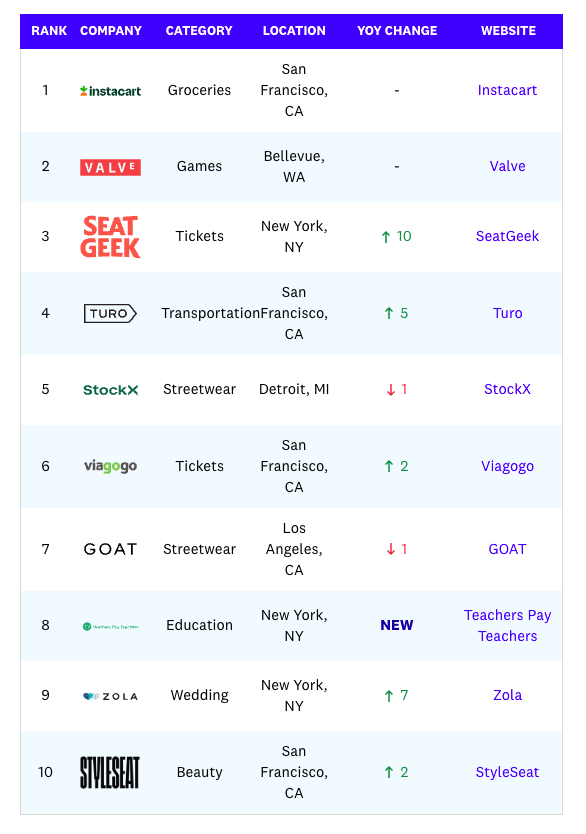

a16z Marketplace 100: 2022

- Latest ranking of the largest consumer-facing marketplace startups/private companies is out from a16z.

- Activity picked up – 19 companies graduated (IPO, SPAC, acquisition) and 37 new companies joined the list (+48% from year before).

- Lots of other interesting observations, just follow the link.

Minsky Moments & Venture Capital

- Minsky cycles are a concept that has seen its star rise since the financial crisis.

- The idea, often summarised as “stability breeds instability”, is now incorporated into policy maker playbooks around the world.

- This was a brilliant piece bringing the concept to venture.

- “The key Minsky idea is that increasing capital inflows reduce perceived risk“.

- Venture is going through this, driven by “shortening time” which boosts IRR, and the key question is whether true risk has actually decreased, or, we are in classic cycle.

100 ways to slightly improve your life

- Nice fun piece from the Guardian on 100 ways to easily slightly improve one’s life.

- Highlights include:

- “If you’re going less than a mile, walk or cycle. About half of car journeys are under two miles, yet these create more pollution than longer journeys as the engine isn’t warmed up yet.“

- “Don’t look at your phone at dinner.”

- “Make a friend from a different generation.“

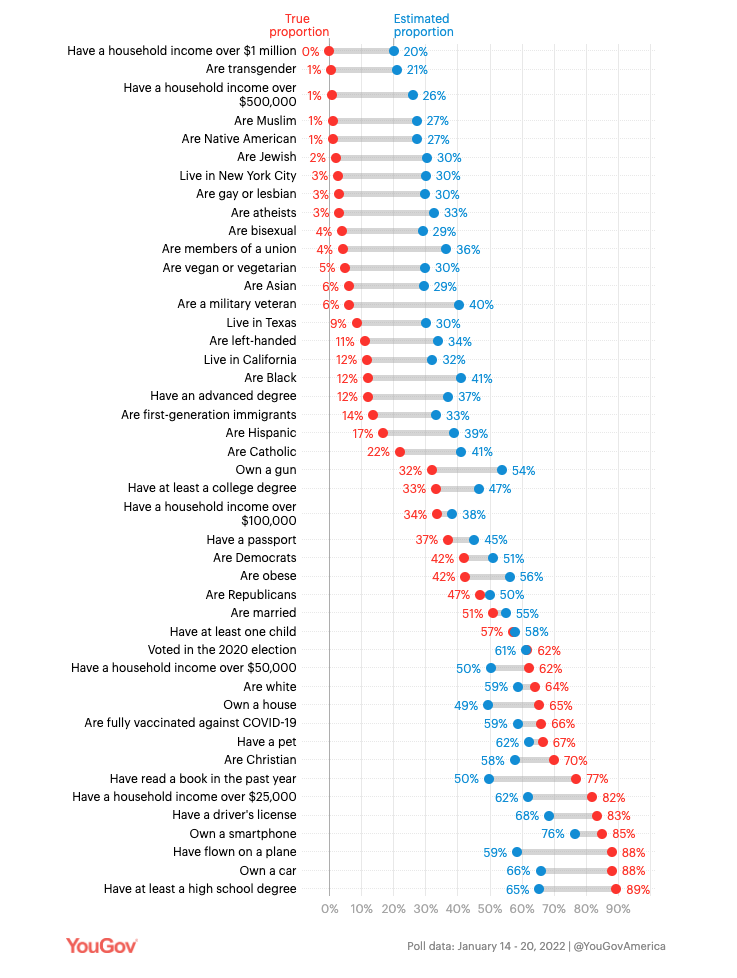

Perception vs. Reality

- YouGov neatly demonstrate how Americans see small subgroups as much larger than they actually are, while large subgroups are systematically underestimated.

- For example on average people thought that muslims made up 27% of Americans when the true proportion is 1% or that gays and lesbians made up 30%, when the true number is 3%.

- On the other hand “we find that people underestimate the proportion of American adults who are Christian (estimate: 58%, true: 70%) and the proportion who have at least a high school degree (estimate: 65%, true: 89%).”

- Full results here.

Do Founders make good VCs?

- Nearly 7% of venture capitalists (VCs) were previously founders.

- This paper, using the VentureSource database, asks if this group is any good at investing?

- Successful founder-VCs have investment success rates that are 6.5% higher than professional VCs.

- If you are an unsuccessful founder-VC your investment success is actually 4% lower than professionals.

- The reason isn’t down to deal quality but value add – “Using an instrumental variables approach to separate unobservable deal quality from value-add, we find that the outperformance of successful founder VCs is consistent with them adding more value post investment.“

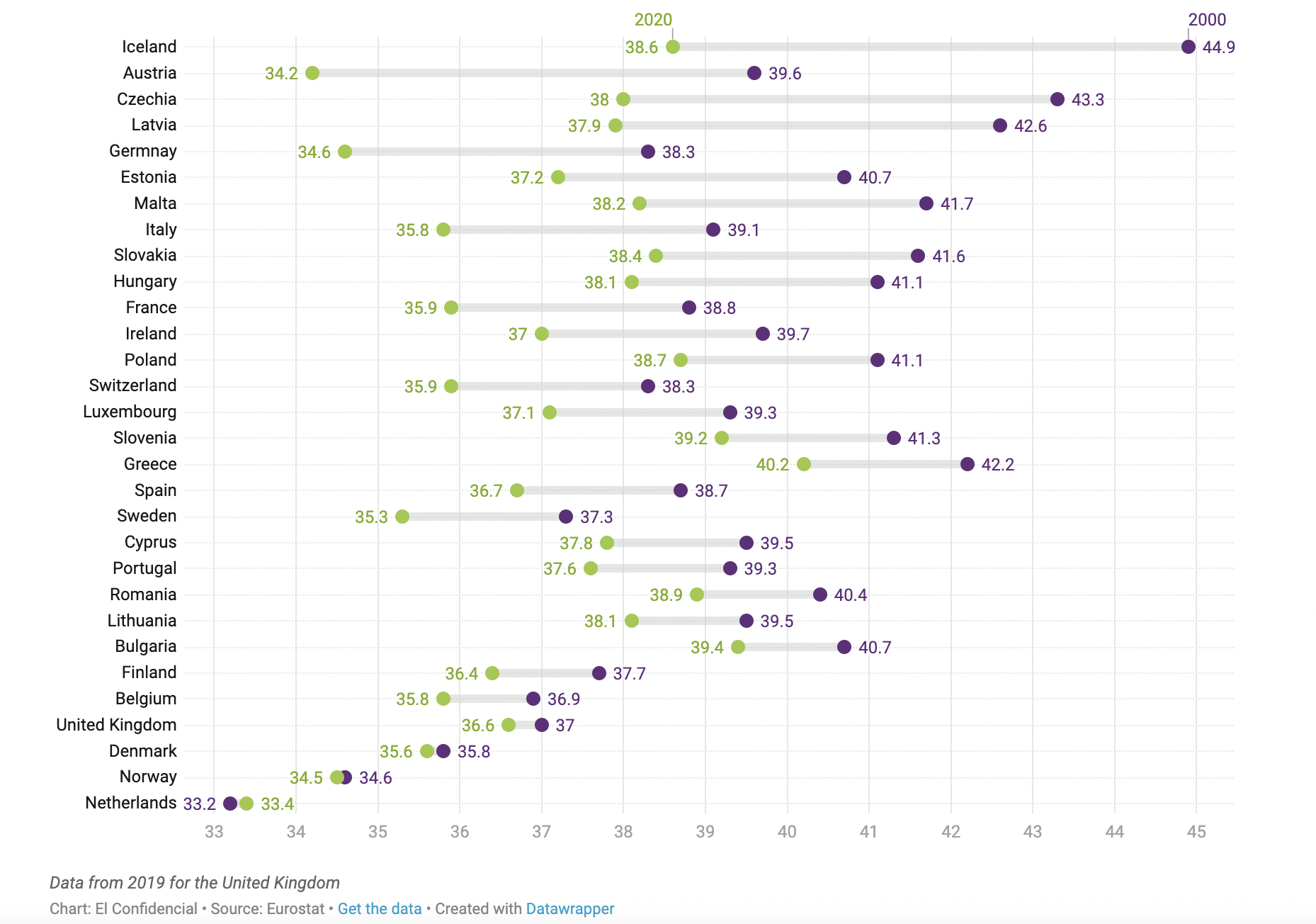

Working Week

- In Europe the average working week has shortened since 2000.

- Spain has seen the smallest drop, while Iceland the biggest (6.4 hours!).

- There is a huge range – “People in some Greek regions work up to 12 hours longer than people in some regions of the Netherlands.“

- Source.

Food’s Environmental Impact

- Chart below (from this paper) is a meta analysis of “globally reconciled and methodologically harmonized” data on the environmental impact (from GHG emissions to eutrophication) of 40 major foods.

- What is interesting is the range – even the best meat farms still outweigh the worst grains.

Compounding

- Compounding is very difficult for human minds to comprehend.

- As the famous riddle goes:

- “Imagine it’s 10:00 AM on a small pond with a single lily pad. If the number of lily pads on the pond doubles every minute, and the entire pond is full of lily pads by 11:00 AM, at what time is the pond half full of lily pads?“

- The answer is here and many get this wrong.

- Morgen Housel brings this up in his conversation with Tim Ferriss (worth a full listen) when he talks about Warren Buffett who’s real talent, when compared to other greats like Jim Simons, was not the level of investment returns (Simons’ are much higher) but their longevity. As he says “if Buffett had retired at age 60, like a normal person might, no one would’ve ever heard of him” (transcript).

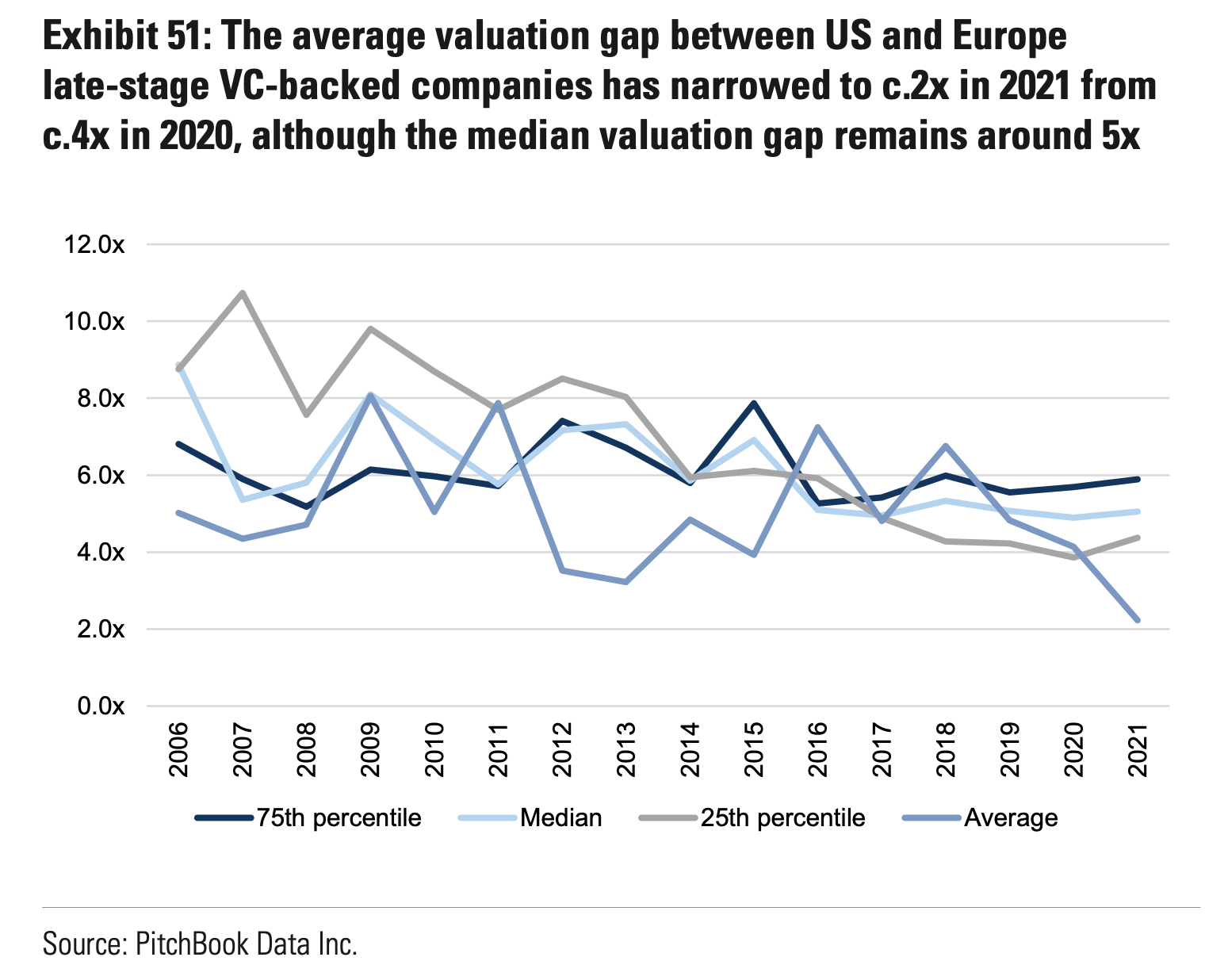

VC Valuations Europe vs. US

- Chart from GS showing late-stage venture valuation gap between Europe and US.

- The average has fallen (from 4.0x to 2.0x) the median has remained 5x.

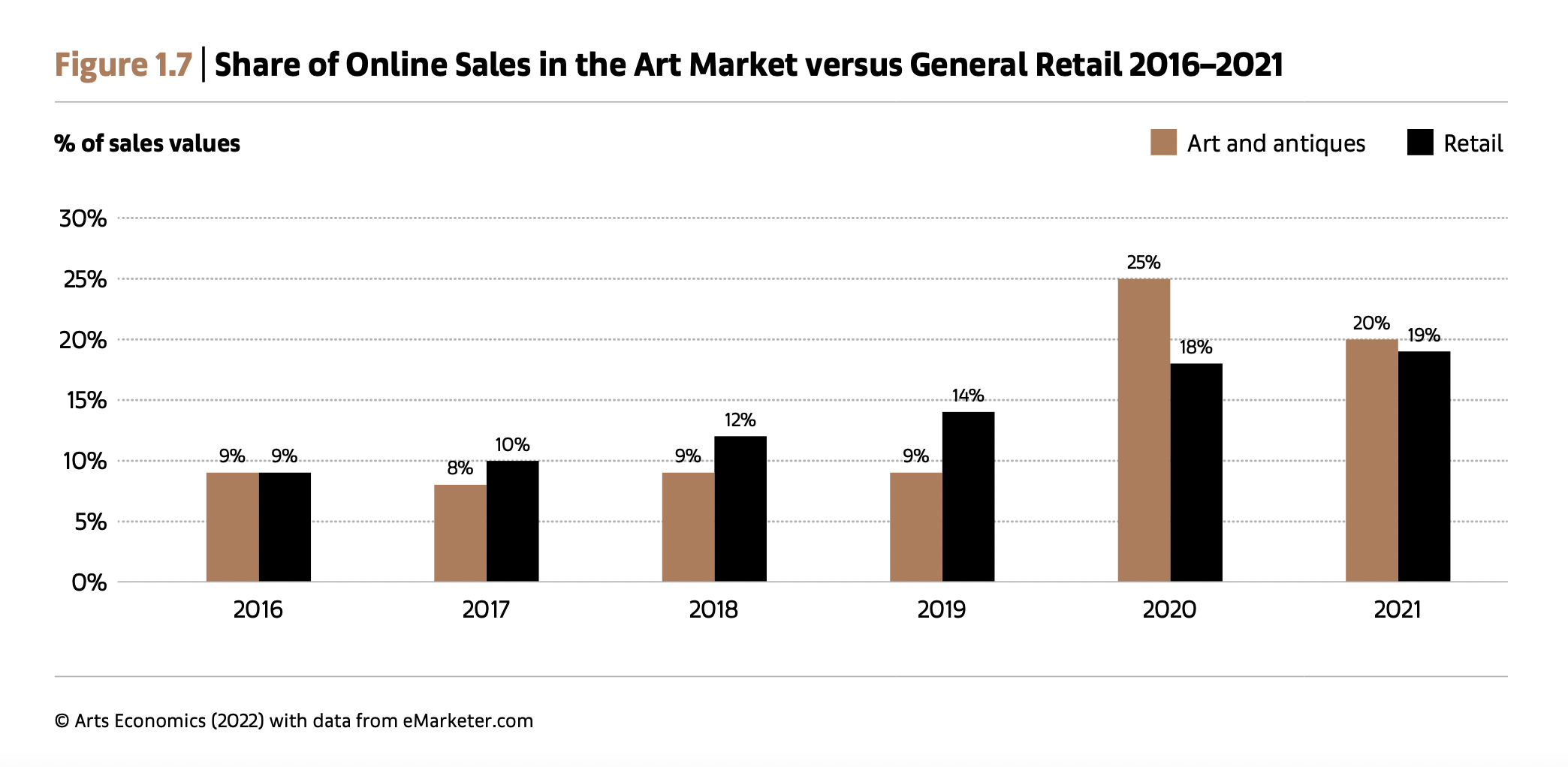

Online Sales Art Sales

- After years of lagging the rest of retail, art is moving online in a big way.

- Source: Art Basel & UBS Report (full of info on the art market for those interested).

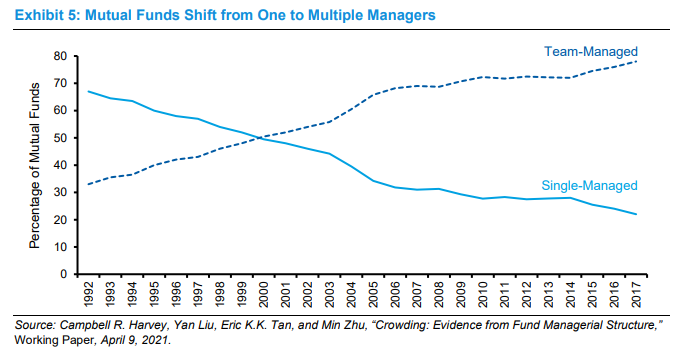

Fund Management Teams vs. Individuals

New AI Companies

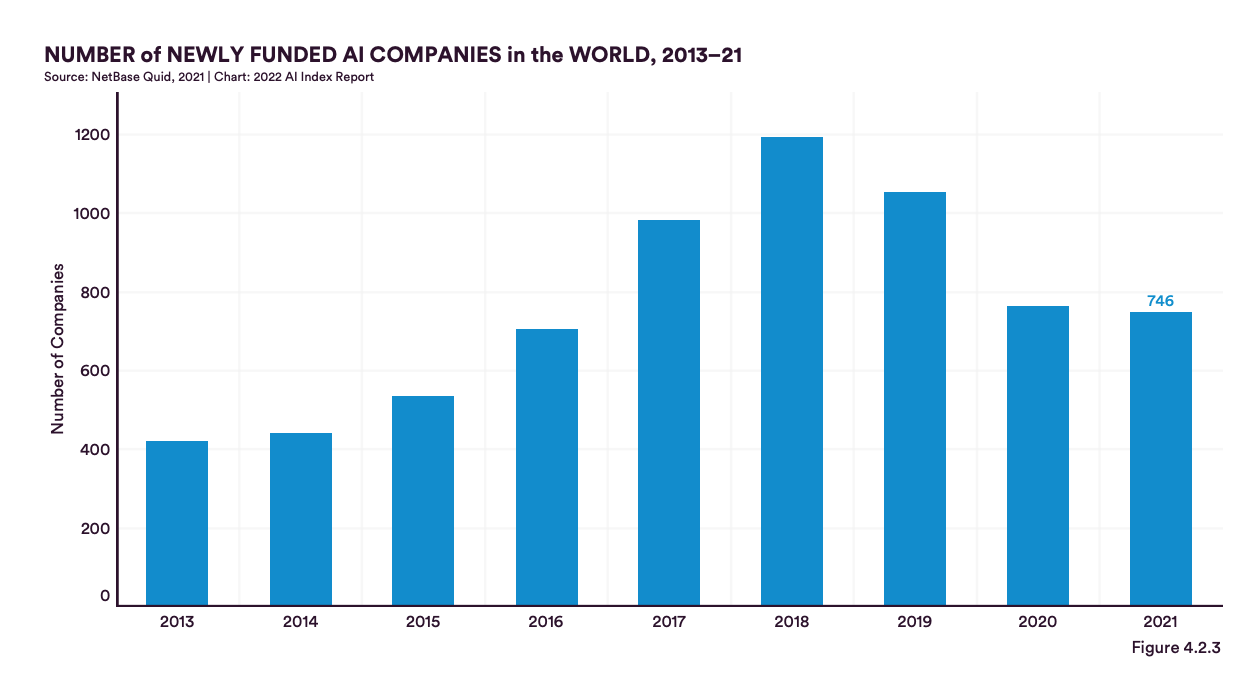

- Did not expect to see the number of newly founded AI firms actually peak in 2018.

- This is despite private investment hitting a huge record in 2021.

- Perhaps a sign of concentration/winner takes all dynamic forming.

- Source.