- “Below, we can see the number of acclaimed scientists (in blue) and artists (in red), divided by the effective population (total human population with the education and access to contribute to these fields).”

- Full data source. h/t Astral Codex

Misc

Miscellaneous is often where the gems are.

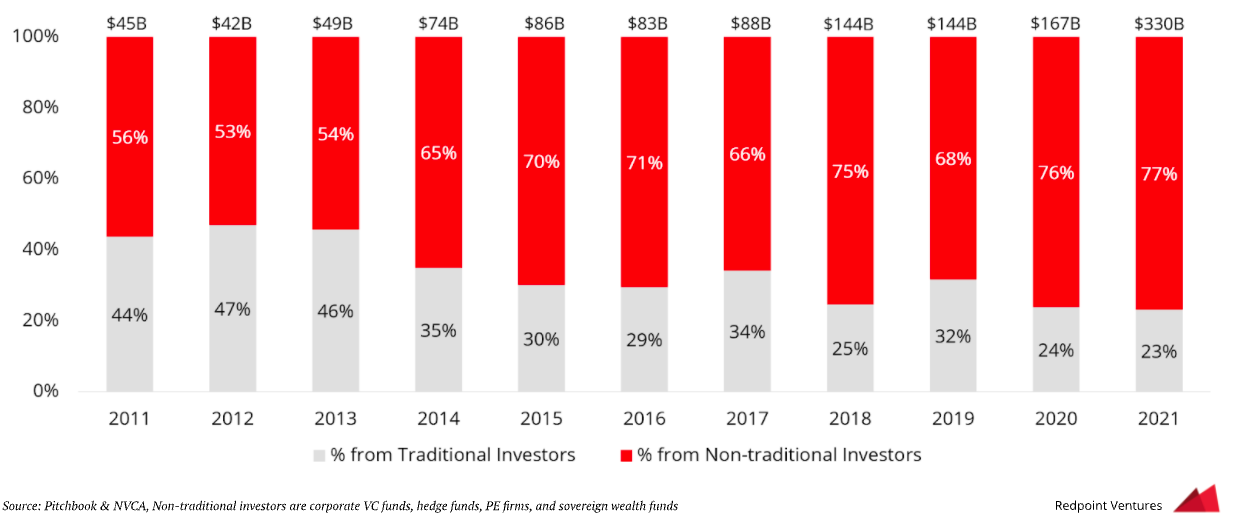

Non-Traditional VC Investors

- These investors – corporate VC funds, hedge funds, PE firms and sovereign wealth funds – have slowly been taking over.

- In a way this is hot money and it will be interesting to see how it behaves in a downturn.

Sustainable Infrastructure

- Beautiful read about Kyoto, Japan and the idea of building for the very long term.

- In 1610, a single family (Suminokura) decided to build a canal connecting the port of Fishimi to central Kyoto.

- The article talks about how powerful this decision was – the weight efficiency ratio increased 22.5x, the agricultural footprint was a fraction (no need to feed all those ponies), and there was no noise or other pollution. The list goes on.

- Building should be for the long term – for example did you know that the cobble stone streets of Copenhagen haven’t been resurfaced in 500 years.

Roelof Botha of Sequoia

- Great profile of Roelof Botha, one of three Sequoia partners who steward the firm.

- He is also the man behind the firm’s latest transformation – into effectively a permanent capital vehicle investing cross the company life-cycle whether private or public.

The Technology Bribe

- “Nearly 50 years ago, long before smartphones and social media, the social critic Lewis Mumford put a name to the way that complex technological systems offer a share in their benefits in exchange for compliance.“

- This “bribe” makes it clear that “this is not an offer of a gift but of a deal“

- “the bargain we are being asked to ratify takes the form of a magnificent bribe.”

- A fascinating theory and tool to understand the current world.

- “The danger, however, was that “once one opts for the system no further choice remains.”

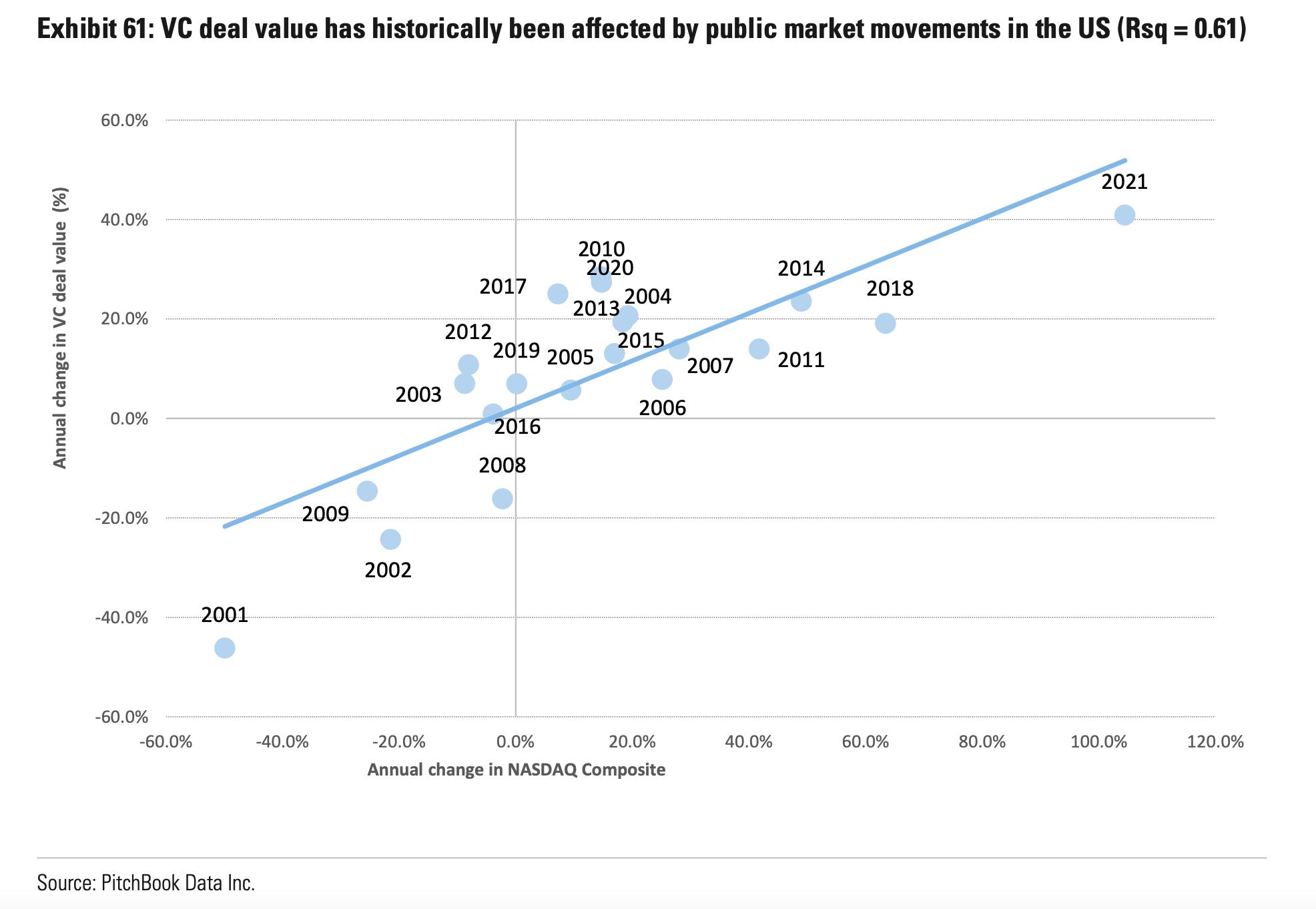

Venture Value and Public Markets

- Venture Capital (VC) deals are not immune to public market wobbles.

- This has already started to happen.

Are you Smart enough to work at Google?

- 10, 9, 60, 90, 70, 66 … what is the next number in this series?

- Give it a try.

- This is a question asked during an interview at Google.

- So is this one “You are shrunk to the height of a penny and thrown into a blender. Your mass is reduced so that your density is the same as usual. The blades start moving in sixty seconds. What do you do?”

- Both of these interview questions are taken from this brilliant book which is about difficult interview questions at top companies.

- Once you tried those questions – hit this preview link for the answers.

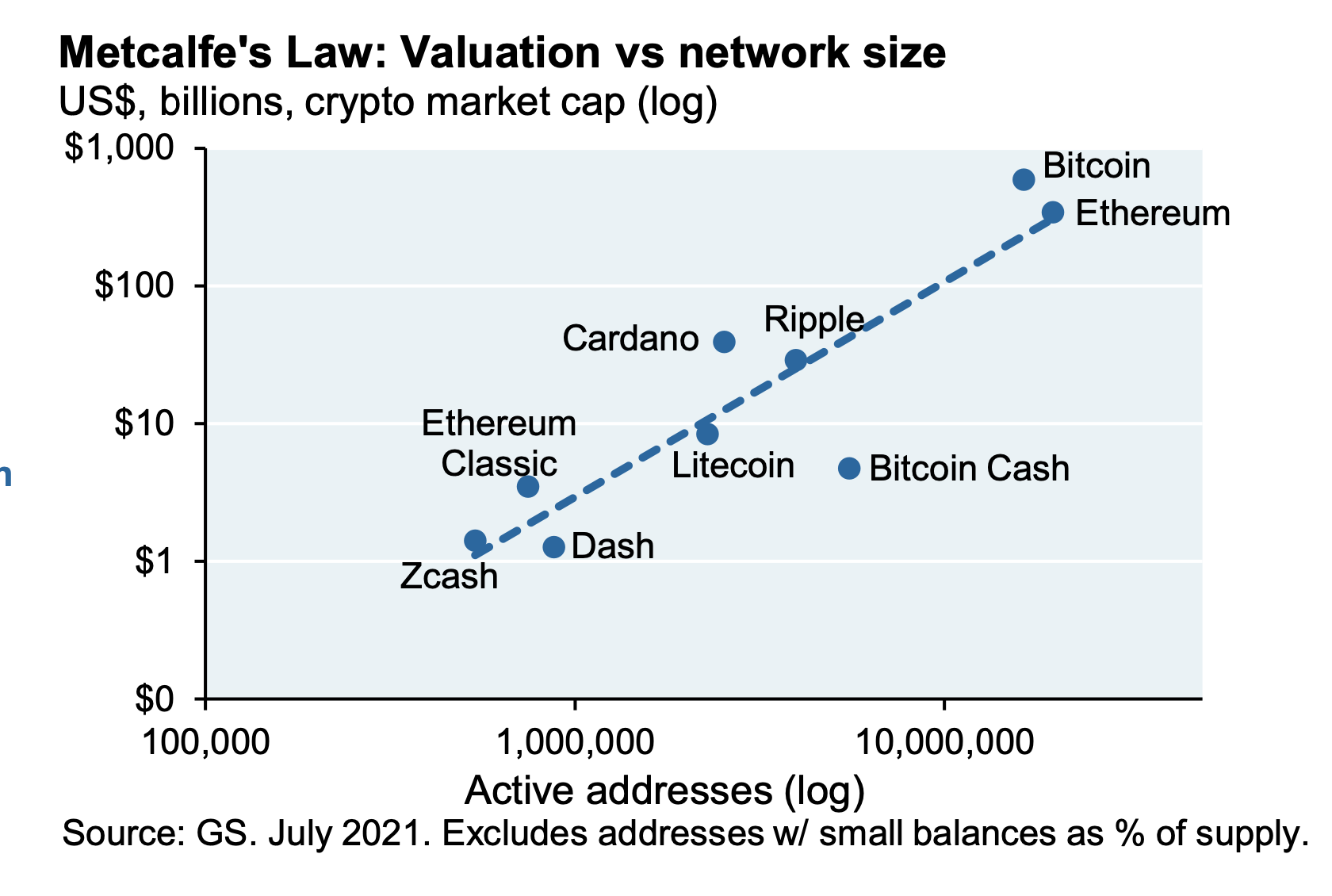

Crypto network vs. valuation

- Metcalfe’s law – which states that the value of a network increases with the square of the number of users or nodes – works very well in comparing relative valuation differences across cryptocurrencies.

- Source: JPM.

Another 52 Things List

- In the tradition of Tom Whitwell and Snippet Finance, here is another 52 things list.

- For example:

- “The number of people born in Antarctica (11) is fewer than the number of people who have walked on the Moon (12).“

- “Humans have evolved to out-drink other mammals. “Many species have enzymes that break alcohol down and allow the body to excrete it, avoiding death by poisoning. But about 10 million years ago, a genetic mutation left our ancestors with a souped-up enzyme that increased alcohol metabolism 40-fold.”“

- “It takes about 200 hours of investment in the space of a few months to move a stranger into being a good friend.”

Corruption and Parking Tickets

- Tim Harford writes about a study by Fisman and Miguel of corruption.

- The two economists looked at the behaviour of diplomats in New York City (in the area around the UN building in midtown Manhattan, where many consulates are located).

- Remember, diplomats then had immunity so can happily ignore parking fines. So whether any were left unpaid can be reasonably hypothesised to be down to purely to cultural attitudes to rules.

- By looking at parking violations between 1997 and 2002, Fisman and Miguel found a strong and significant correlation between unpaid tickets and corruption perception.

- The worst offenders – Kuwait, Egypt, Chad, Sudan and Bulgaria. “One Kuwaiti diplomat managed to accumulate two unpaid parking fines every working day for a year.“

- The best – Denmark, Norway and Sweden and, to everyone’s collective sigh of relief, the British – who did not have a single unpaid parking ticket over the six year period.

- “The same may not be true for all British politicians. A certain Boris Johnson once worked as GQ magazine’s motoring correspondent. His editor noted that Johnson had cost GQ “£5,000 in parking tickets”, but he wouldn’t have him any other way.“

Ukraine

- The tragedy in Ukraine is why Snippet took a short pause earlier this week.

- Here are a few interesting articles on how and why we got where we are today.

- This is an excellent, well documented piece from Spiegel on the subject of NATO’s eastward expansion. Did the West cheat? As usual – it is complicated.

- This was a good talk by the brilliant Russian journalist Vladimir Pozner recorded three years ago (2018), who tried to give a point of view not well expressed in Western press. The whole thing is worth a listen.

- The five books series is always great on any topic and this one on Ukraine by Serhii Plokhy, professor at Harvard in Ukrainian History is worth a read.

- This was also an interesting read on the history of Ukraine and Bolshevism and the idea of a nation.

Crypto Future

- Digital assets, crypto, or, as it has been rebranded, Web 3.0, is absolutely worth looking into, not least because of the VC money going into it.

- The number of developers working in Web3, as seen in this chart, is exploding and doesn’t fall with falling prices (full slide deck worth a flick).

- To stay one step ahead this was a good piece from the Generalist, where Mario goes around asking those in the know what the next trends and most exciting projects are.

- Some really cool, deliberately slightly out there stuff.

Prediction Markets

- Google has been running an internal prediction market – Gleangen, and Astral Codex Ten has a great write up on the topic.

- This is the second iteration of such a market (the first was called Prophit).

- Google claims that anyone can now build a prediction market on Google Cloud.

- Prediction markets are fascinating as a tool but have struggled to get really big and more importantly to solve the three key issues (real money, easy to use, easy to create own markets).

- Metaculus is a community dedicated to making accurate predictions (they have a great resource page) as is Manifold. Neither use real money.

- Kalshi is a new startup ($30m of funding) that is trying to make events into an asset class via a real money prediction market. As is Futuur.

- Polymarket, the biggest such market in the US, was recently fined and forced to shut down in the US (it remains open elsewhere).

- There are a few others as well.

Great Stories

- As ever the Collaborative Fund blog puts out another gem collection of short stories. Each holds an interesting lesson.

- Whether it’s how starting from scratch has its advantages – like when German complete disarmament after WWI meant it had the most modern army for WWII.

- Or how Michael Lewis’ first hit book (Liar’s Poker) was followed by a decade break before his next one – the break allowed him to be patient and “start all over again, start completely fresh as if I’ve never written a book before and give myself at least the option of not writing books.“

Human Environmental Success – Ozone Layer

- “Humanity’s ability to heal the depleted ozone layer is not only our biggest environmental success, it is the most impressive example of international cooperation on any challenge in history.“

- Simply fascinating read on how the confluence of science, politics and industry led to this human triumph.

Why Should Anyone be Led by you?

- Recommended by Quintin Price, head of Alpha Strategies at Blackrock (the $1trn active arm that is making a comeback against the firm’s passive dominance) on this excellent podcast, is an intriguing essay – “Why Should Anyone be Led by you?“

- The authors, two business school professors, find that there are four qualities that make a great leader.

- First, leaders must expose vulnerabilities, revealing their approachability. This builds trust, a collaborative atmosphere, and solidarity. Never reveal a weakness that can be seen as a fatal flaw, jeopardising central aspects of one’s professional role.

- Second, good leaders must be great situation sensors. They can sense unexpressed feelings. This requires a fine balance as it needs to be validated i.e. observations must be grounded in reality and not just projections.

- Third, leaders should care, intensely, about the work employees do, something that is hard to fake. This can’t be soft but requires tough empathy – a respectful “grow or go” mentality.

- Finally, and most importantly, leaders must be different and show that difference. This takes time to discover and can’t be over done.

- Although these sound like rules to follow it is incredibly hard to fake and authenticity is key as the article concludes – ““Be yourselves—more—with skill.” There can be no advice more difficult to follow than that.“

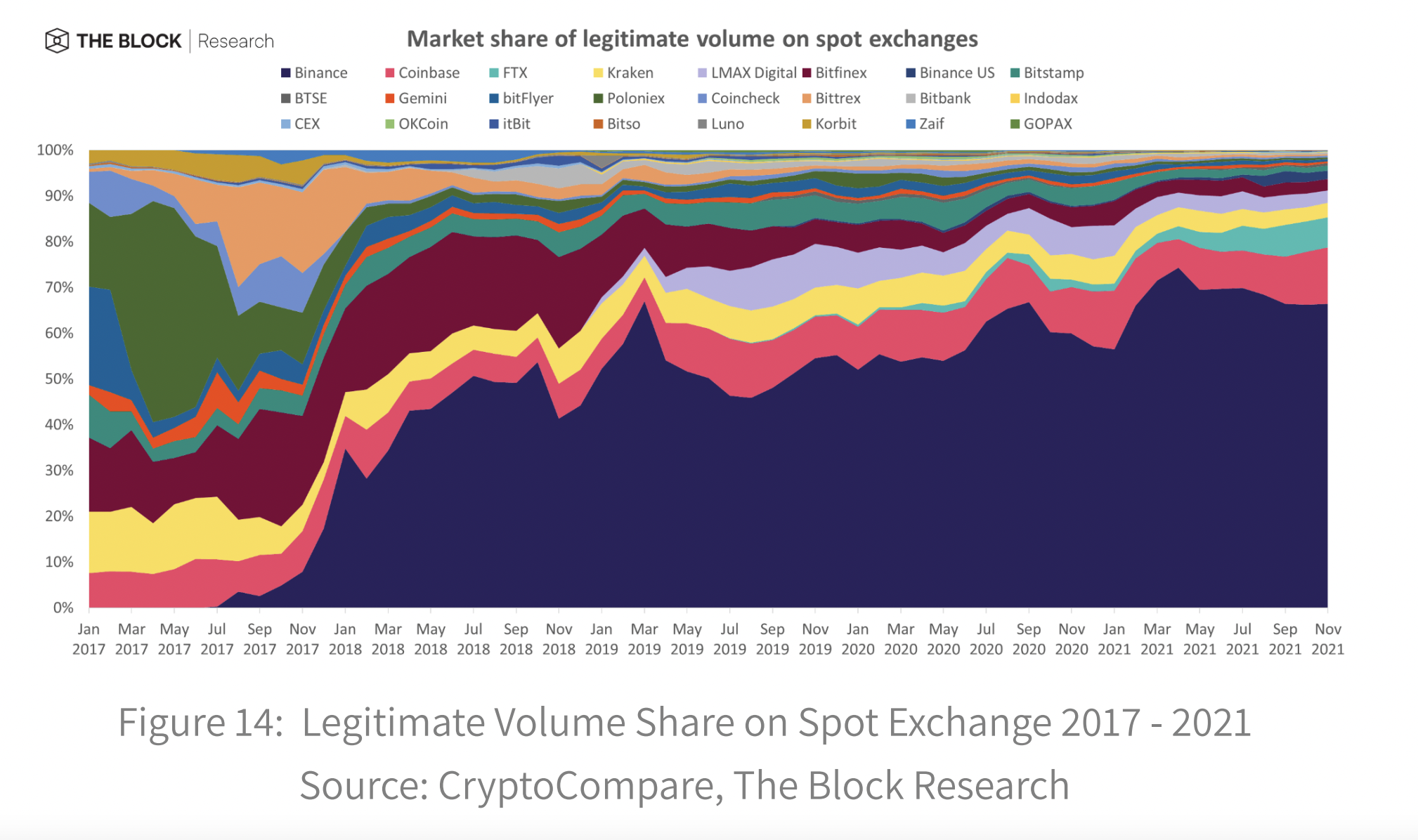

Crypto Exchanges

- Binance dominates spot crypto trading volumes (66%) share and this continues to grow.

- The chart was taken from this excellent Digital Asset Outlook 2022 by The Block.

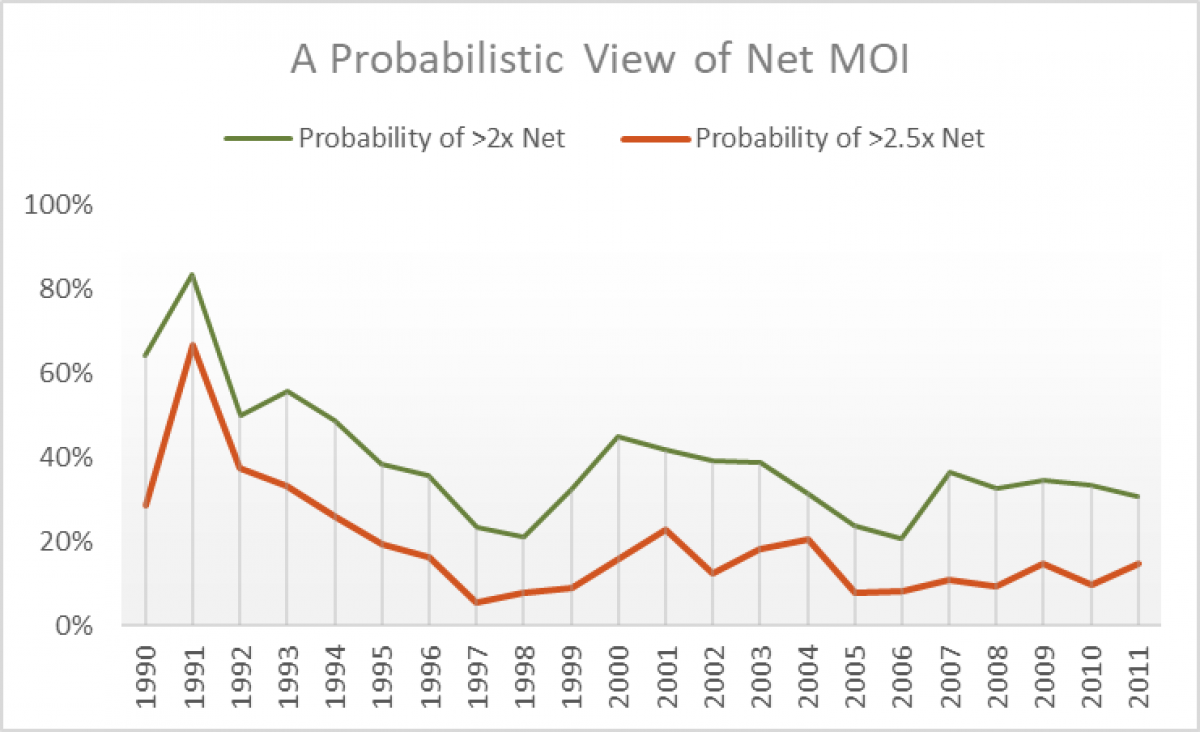

Probabilistic View of Private Equity

- The probability that a mature private equity fund will deliver 2x on investment fell in the 1990s and has since held steady at 30-35%.

- In other words the probability of NOT achieving 2x is 65-70%.

- For >2.5x the probability of NOT achieving is nearly 90%.

- The data uses North America and EU strategies, >$100m, across buyout, growth and turnaround. 2011 vintage year is used to eliminate non-mature funds. This filter led to 1,200 funds.

- Source.

Impact Investing

- Pretty cool historic visual review of Impact Investing from Collaborative Fund.

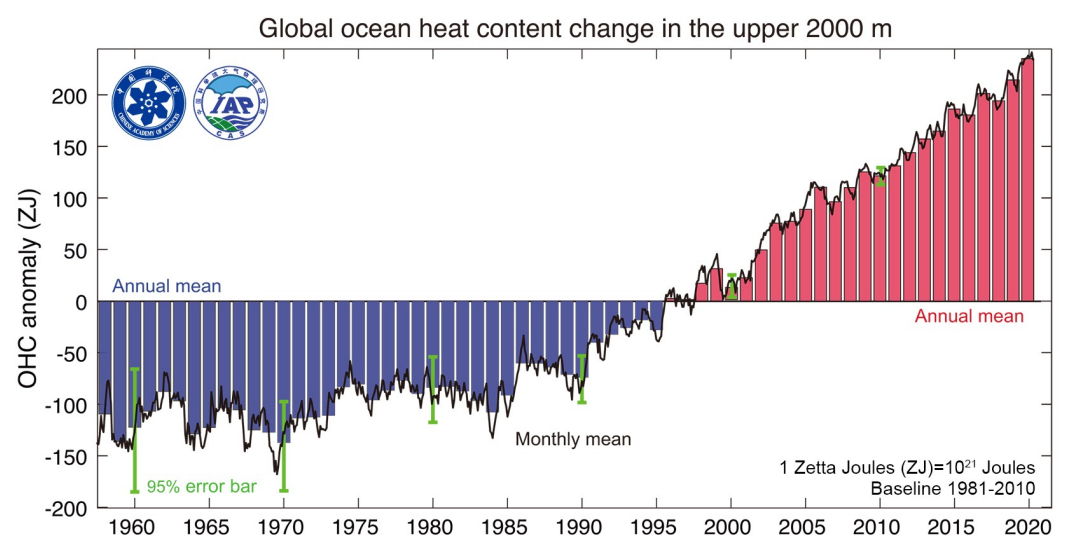

Ocean Temperatures

- Global oceans continue to warm (measured by OHC).

- Source: Advances in Atmospheric Science.