- Altos Labs has come out of stealth and announced record breaking funding ($3bn) from Bezos and Milner and poached CSO from GSK – Hal Barron.

- This was a great article from the Atlantic surveying the rise of various new science funding approaches and labs, backed by Silicon Valley $.

- The US has a long history of the wealthy backing science. (h/t The Diff)

- Web 3.0 is also getting in the game with for example VitaDAO.

Misc

Miscellaneous is often where the gems are.

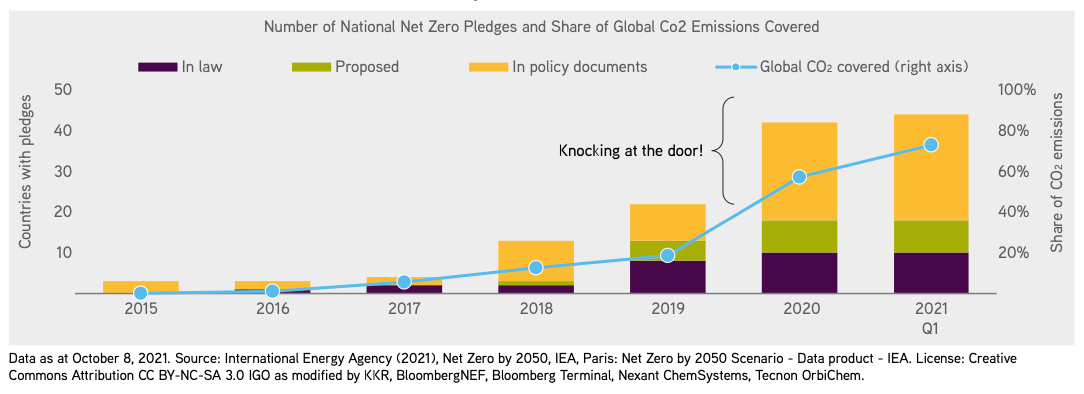

CO2 Pledges

- Governments are getting serious about reducing CO2 emissions – with over 80% of global CO2 emissions “pledged” to be eliminated if we include what is currently in policy documents.

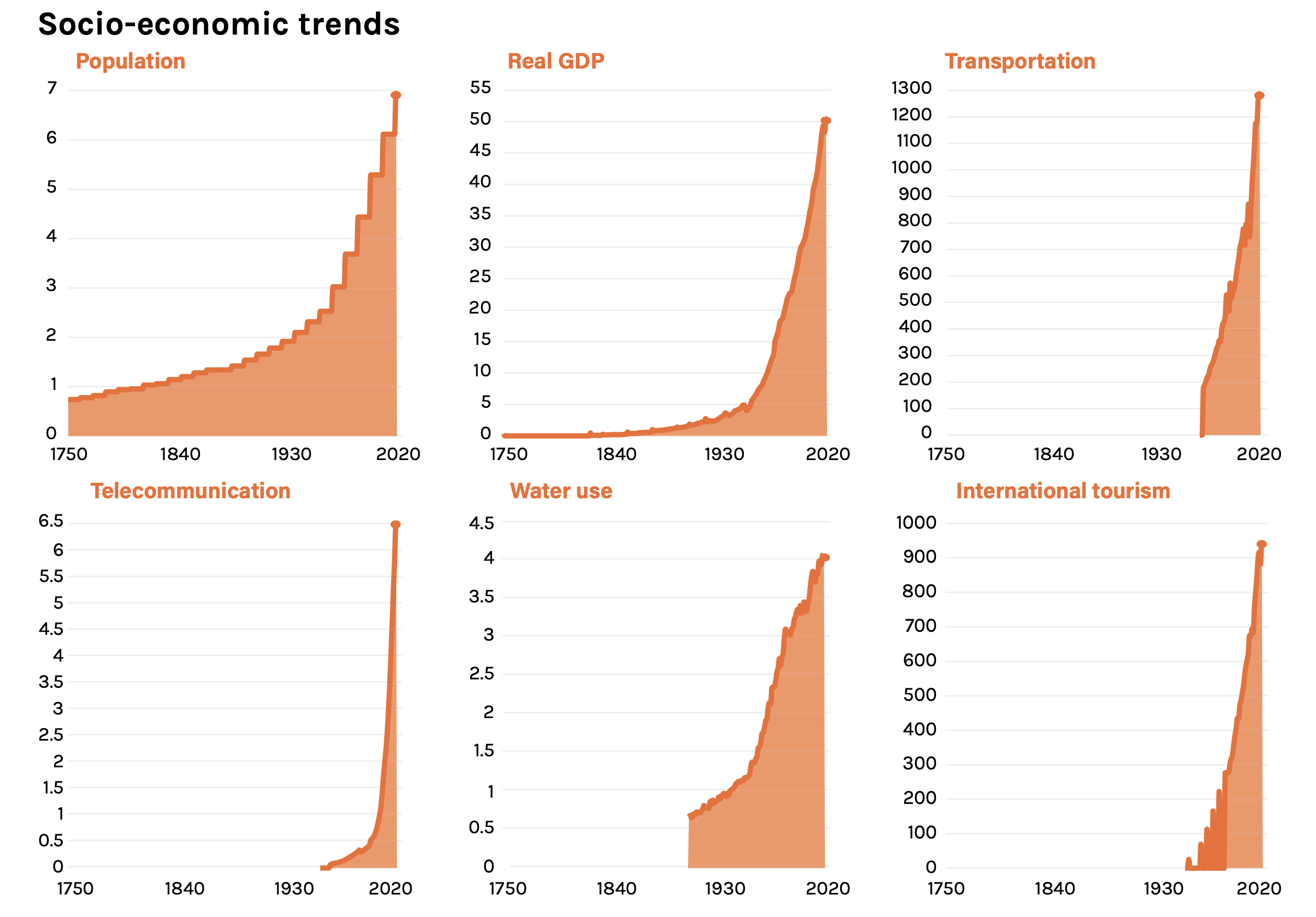

Exponential Trends Pt 2

Exponential Trends

- The second half of the 20th century has seen a massive acceleration of all socio-economic trends.

- Source.

Obesity Paradigm

- What if I told you that the idea that “People get fat because they take in more calories than they expend” is wrong?

- That is exactly what this post does (in the Snippet tradition of contrarian ideas like here and here).

- “Consider using the identical logic to describe, say, why people get wealthy. Economists would (I hope) be embarrassed by a money-balance theory of wealth: People get rich because they take in more money than they spend. Clearly wealthy people did. We know that because they’re wealthy. The increase in wealth is the positive money balance. But this says nothing about how or why they accumulate such wealth. In obesity research, this tautological logic — saying the same thing in two different ways but offering no explanation for either — was allowed to become the central dogmatic truth.“

- Then what does cause obesity? “People don’t get fat because they eat too much, consuming more calories than they expend, but because the carbohydrates in their diets — both the quantity of carbohydrates and their quality — establish a hormonal milieu that fosters the accumulation of excess fat.“

Trained by AI

- You probably know, AlphaGo, the 2016 AI program that dominated the game of Go.

- Soon after, a software implementation called Leela was made available, to train human Go players.

- Data from 750k Go moves from 1,200+ players between 2015-2019 shows a significant improvement in move quality – especially among younger players (see chart) who are likely more open to learn from Leela.

- Source: State of AI report (an excellent slide deck!).

Russian Military Logistics

- Fascinating and important read about Russian military logistics and what it means for various strategies in Europe.

- “No other European nation uses railroads to the extent that the Russian army does.“

- “The rub is that Russian railroads are a wider gauge than the rest of Europe. Only former Soviet nations and Finland still use the Russian standard — this includes the Baltic states.“

- Interesting side note – Russia can thank the US for this standard, namely George Washington Whistler (father of the famous painter!). The US was looking out for its European allies all the way back in the 1840s.

- In summary – “they are not capable of a sustained ground offensive far beyond Russian railroads without a major logistical halt or a massive mobilization of reserves.“

UPS

- A fascinating read about Jim Casey – the man who built UPS.

- “On August 28, 1907, nineteen-year-old James Emmett “Jim” Casey and his friend Claude Ryan borrowed $100 and founded the American Messenger Company in a six-foot by seven-foot basement office below a Seattle saloon.”

- From this grew one of the largest transportation companies – delivering 6.3bn packages globally in 2020.

- As with all histories there are some fascinating anecdotes

- “Merchants Parcel [an earlier name] considered painting their cars and vans bright yellow to attract attention, or even painting them different colors to make people think the company was larger than it was. But Charlie warned that they should not try to show up their retail customers, who were proud of their brightly decorated delivery vehicles. He had studied the more subtle Pullman brown, the color used on railroad sleeping cars to minimize signs of dust and dirt. Thus the partners decided to go with brown—only slightly modified in today’s UPS brown.“

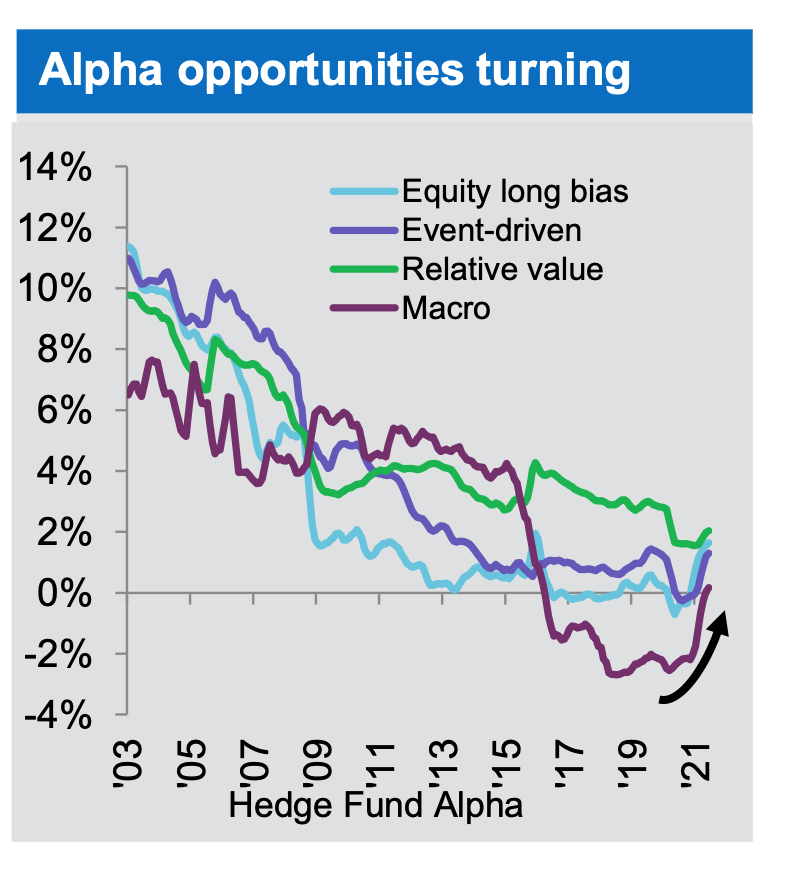

Alpha

- After years of declining it appears that hedge fund alpha, across strategies, could be turning.

MBAs and Unicorns

- Stanford Business School leads the way in terms of number of unicorn founders per 1000 alumni.

- Source: Ilya Strebulaev

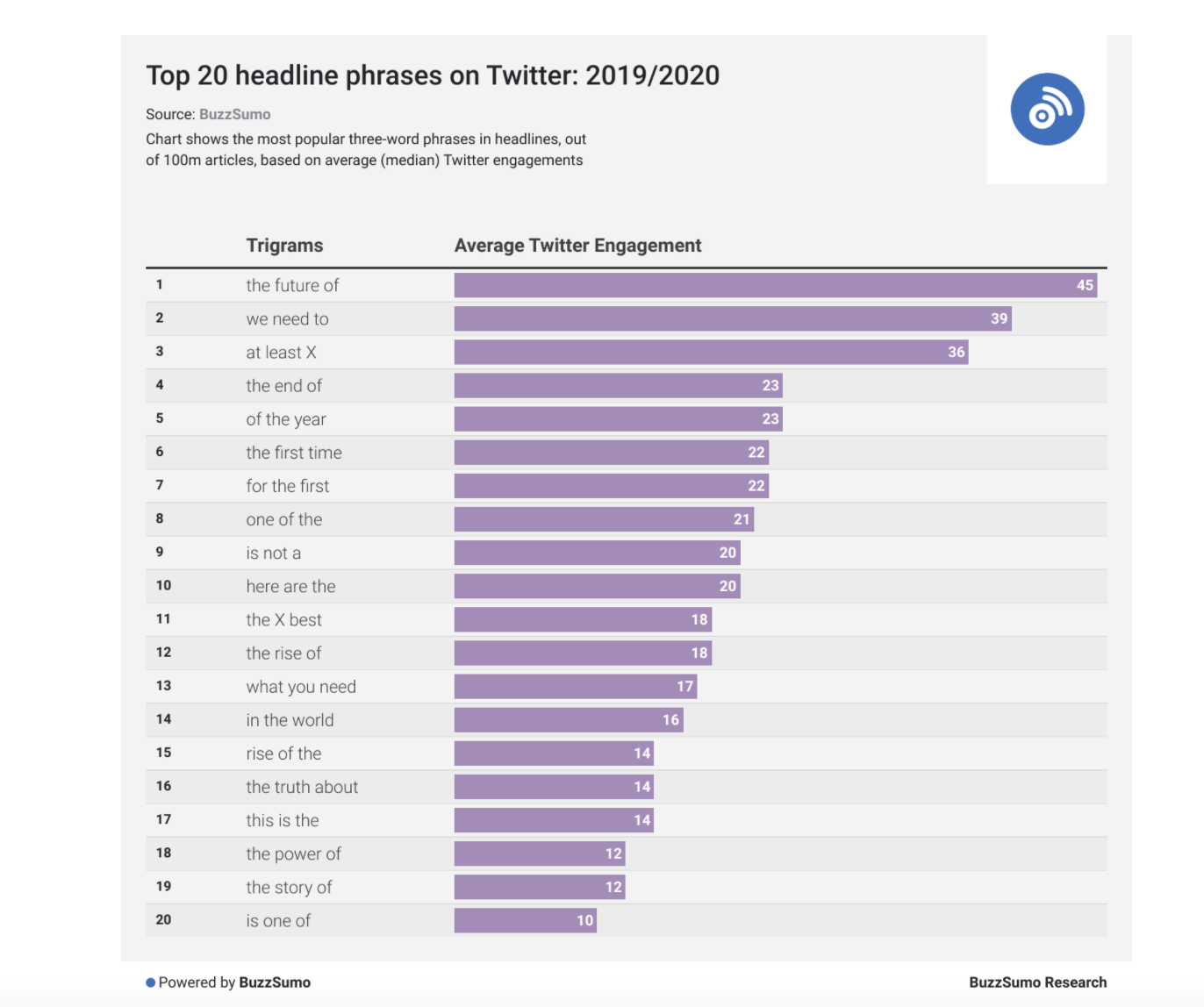

“The Future Of”

- The most popular three-word phrases in twitter headlines by engagement.

- It is based on analysis of 100m articles.

- From a great report on what works in social media (including how this has changed over time).

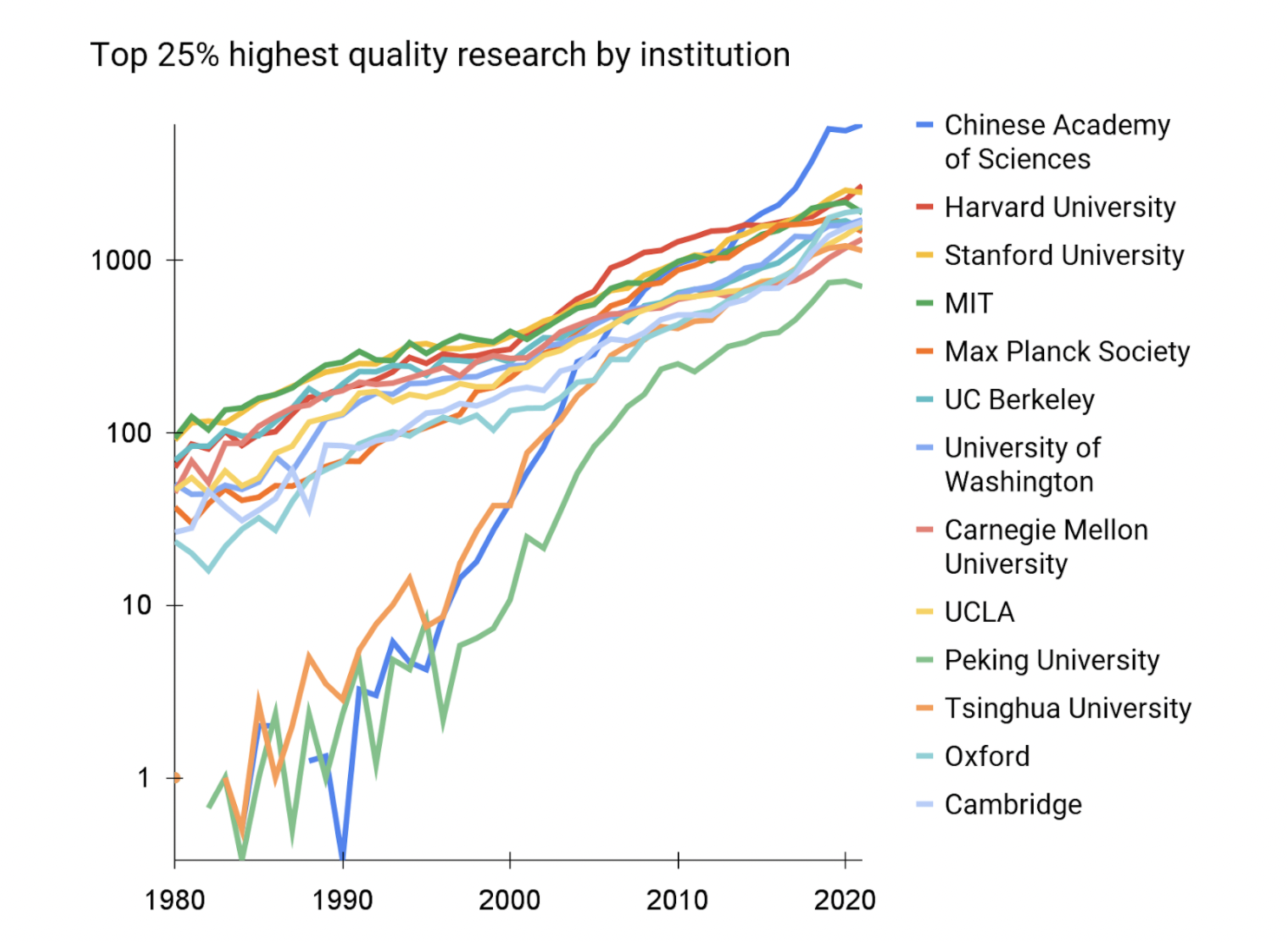

Chinese AI

- From only being founded in 1949 to having no AI publication in 1980, the Chinese Academy of Sciences now firmly has the top spot in quality AI research.

- Truly remarkable catch up, also by the Chinese universities, now publishing on par with Western leaders.

- Source: State of AI Report 2021 (must read report, just overflowing with interesting insights)

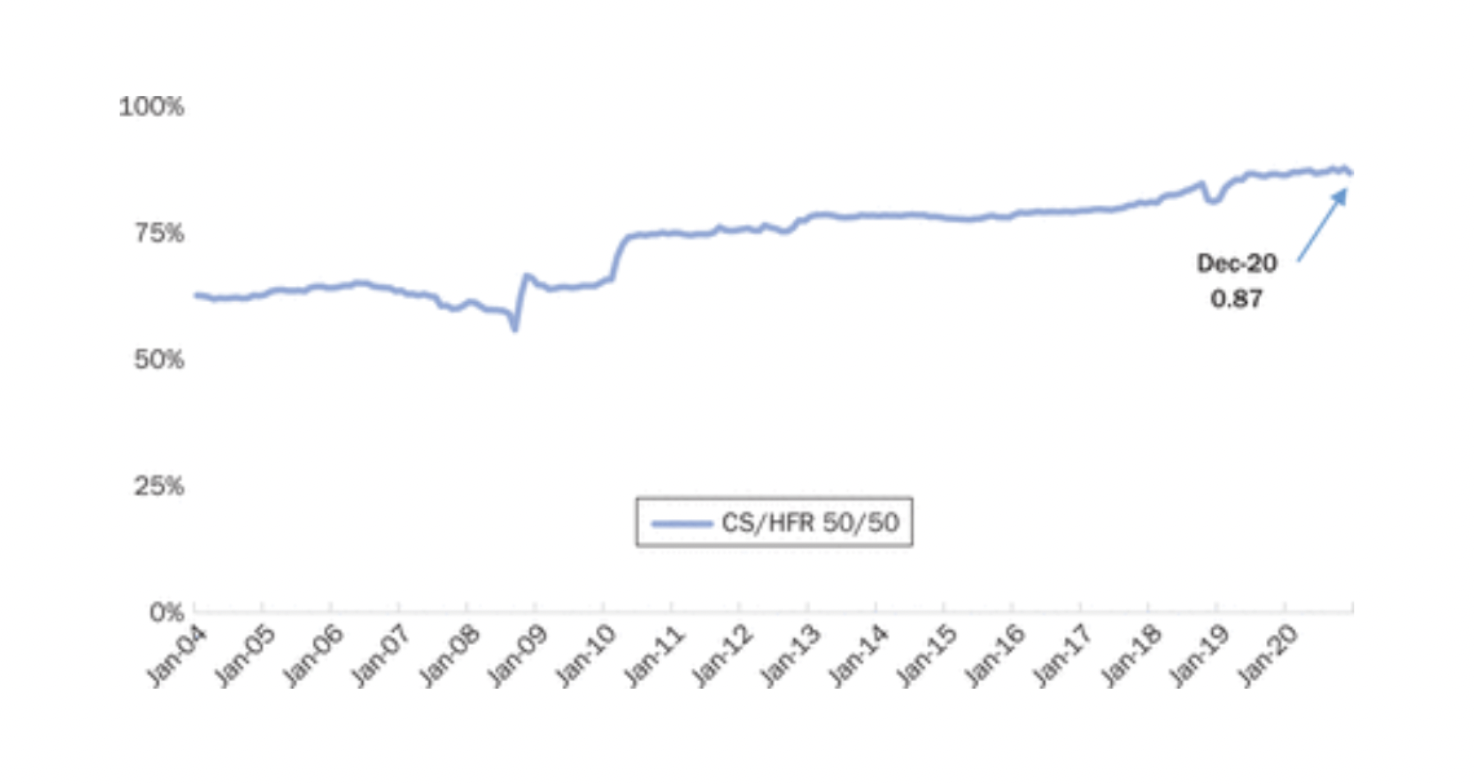

Hedge Fund Correlation

- Hedge fund returns have become gradually more correlated to the S&P 500*.

- This is bad for diversification and when combined with falling alpha, as described in this post, is worrying.

- *This chart shows the 10-year trailing correlation of hedge fund returns (measured by a 50/50 weighted after fee return of Barclay Hedge Fund and HFRI Fund Weighted Composite Indices) vs. S&P 500.

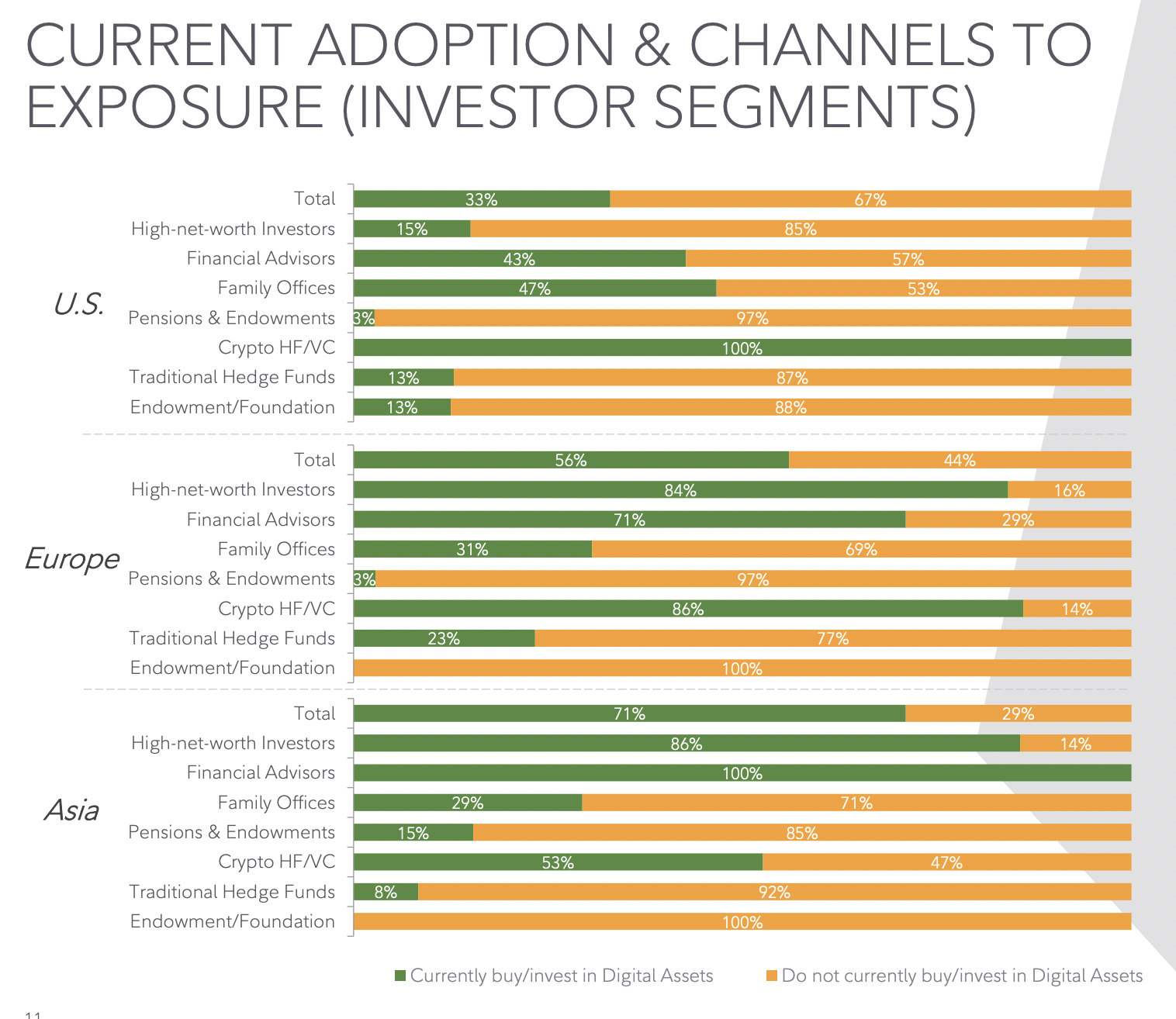

Digital Asset Adoption

- Nice chart from a Fidelity report surveying 1,100 investors on their adoption and attitudes towards digital assets.

- This chart shows adoption by various investor segments/regions.

Dan Loeb

- A belated snippet of this outstanding profile of legendary investor Dan Loeb (I posted his letters several times) – founder of Third Point Capital, a $20bn hedge fund, that compounded over +15% pa for 25 years and pioneered activist investing.

- Third point is named after his favourite surf break in Malibu.

- In the early days of the fund – Loeb posted on forums as “Mr Pink”. Interesting to see further confirmation of media-first investors.

Newsletters

- There is a growing trend of financial newsletters being acquired.

- Abrdn (the newly renamed Aberdeen Asset Management) has acquired Finimize and their 1m subs (40,000 premium).

- Morning Brew went to Business Insider for $75m (ca. 3.8x sales or $25 per each of its 3m subs).

- Robinhood acquired MarketSnacks.

- Others are looking to deploy serious capital into financial media.

- Big media is also noticing (e.g. The Information launched a tech stack for newsletters).

France

- “France is a monarchy that undergoes a succession crisis every five years, by way of an election.“

- Simply fascinating read on the structure of French politics – namely the importance of the presidential seat of power.

- This is all down to de Gaulle and his dislike of parliamentary democracy.

- Through a referendum in 1962 he effectively destroyed the legislative branch.

- “In France the President truly is the Roi-Soleil, the Sun-King, just by virtue of what you may call political gravity. There is a reason why the often petulant Macron calls himself Jupiter. It rings somewhat ridiculous and orotund. It also happens to be correct.“

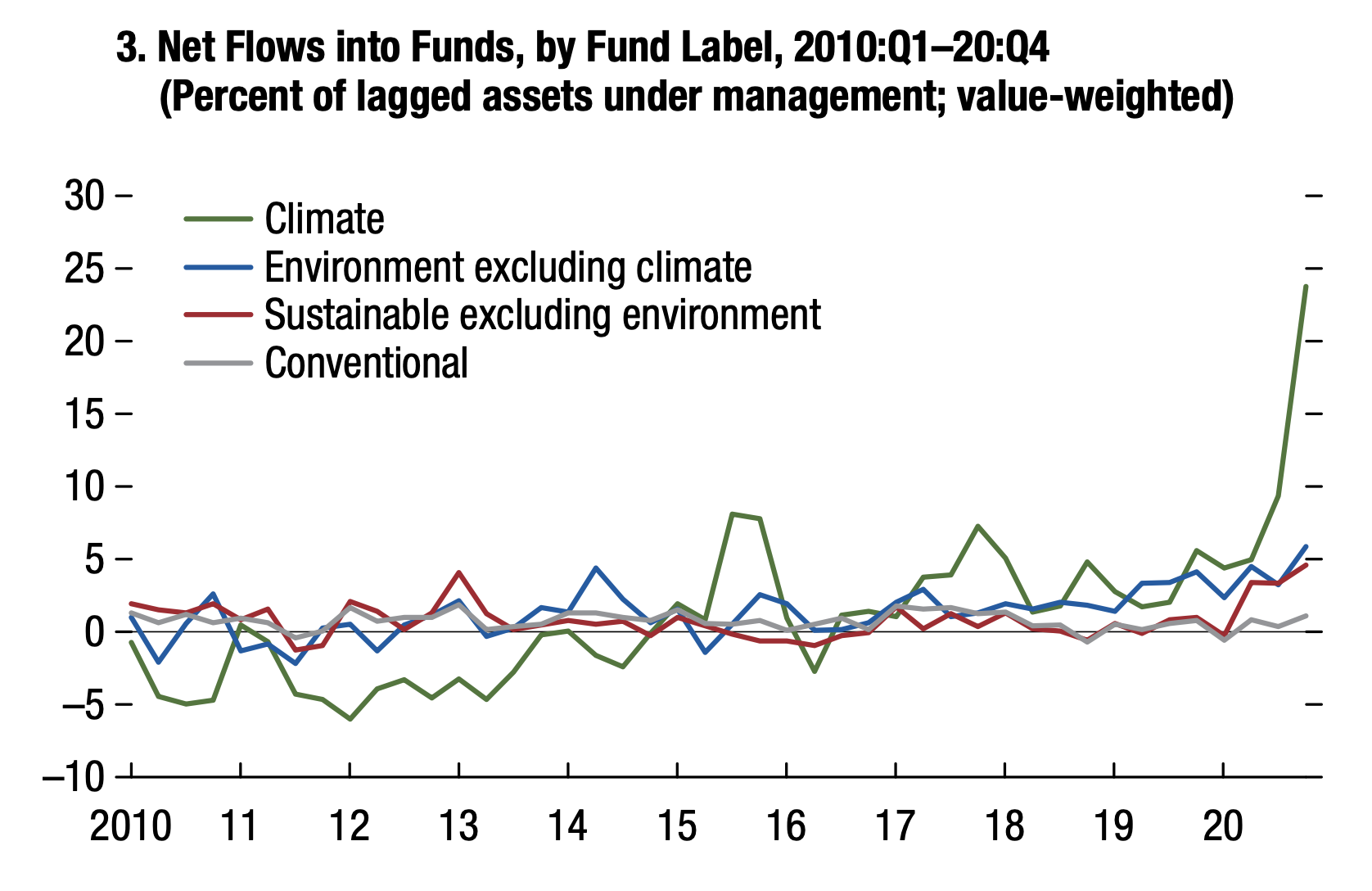

Climate Fund Flows

- Flows into sustainable funds started to break away from conventional funds only in the last few years.

- 2020 changed this with a substantial acceleration of flows, especially into climate funds.

- Source: IMF.

52 Things I learned – 2021 edition.

- We previously covered this brilliant list of 52 things learnt for 2018, 2019 and 2020.

- Here is the 2021 edition – full of gems. A few choice examples:

- “Social media headlines are evolving fast. Since 2017, they’ve got shorter (11 words vs 15 words), and many clickbait phrases like “…will make you…” or “things only … will understand” no longer work.” [BuzzSumo].

- “Adding nature imagery (grass, trees, rainbows) to a pitch document seems to increase the likelihood of investment a little.”

- “Baileys Irish Cream was invented in 45 minutes in 1973 by two ad creatives in Soho.“

COBOL

- COBOL is the programming language that underpins the entire financial system.

- “Over 80% of in-person transactions at U.S. financial institutions use COBOL. Fully 95% of the time you swipe your bank card, there’s COBOL running somewhere in the background.“

- “The second most valuable asset in the United States — after oil — is the 240 billion lines of COBOL”

- The language is old (from the 1960s) and runs on huge machines (mainframes), yet it is extremely suited to the task of processing billions of transactions very fast.

- A fascinating read.