- Flows into funds with low fees have always been positive.

- Interestingly, only the recent period has seen strong outflows from the most expensive funds.

- Source.

Misc

Miscellaneous is often where the gems are.

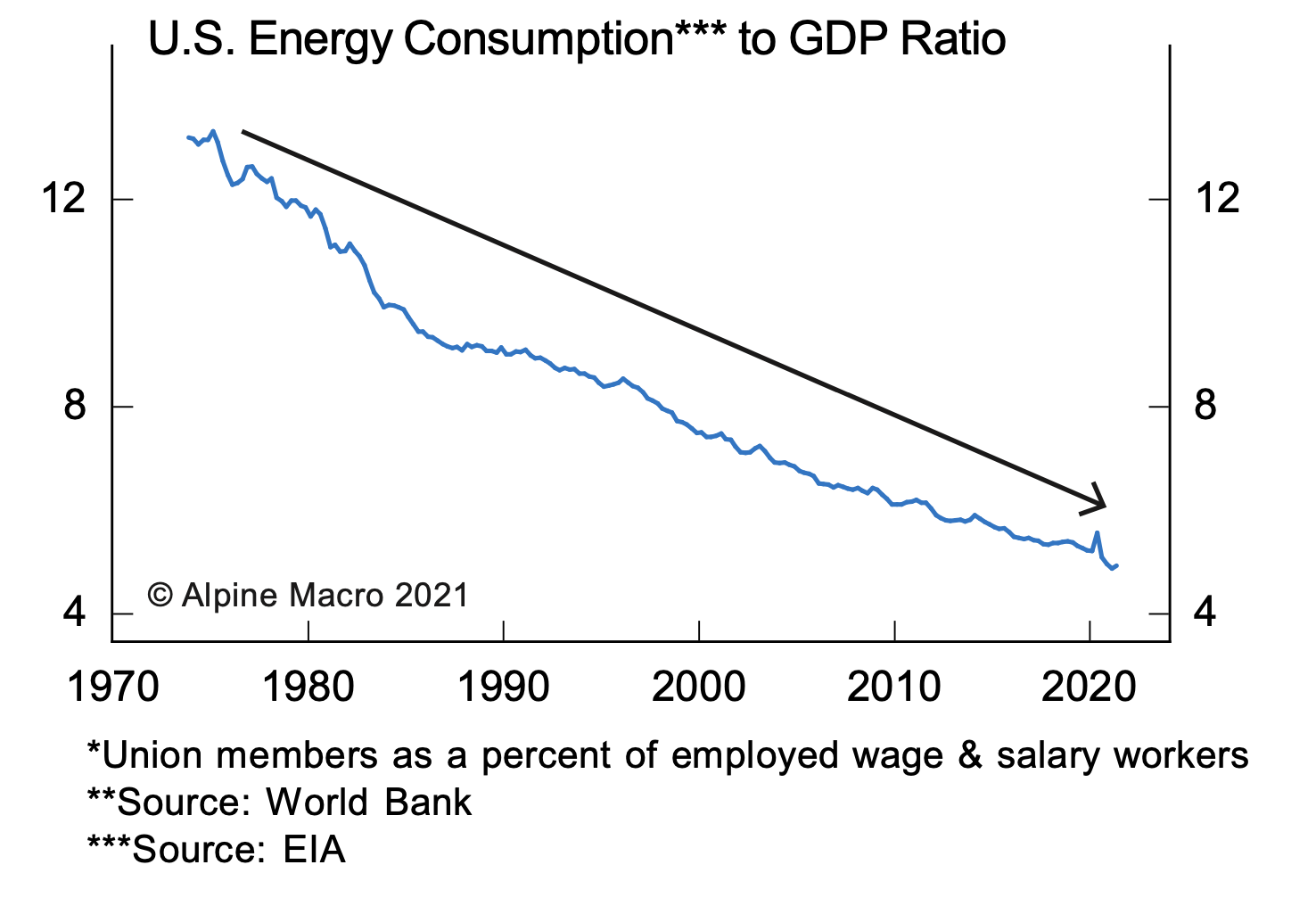

US Energy Consumption

- The US is a far less energy intensive economy than it used to be in the 1970s.

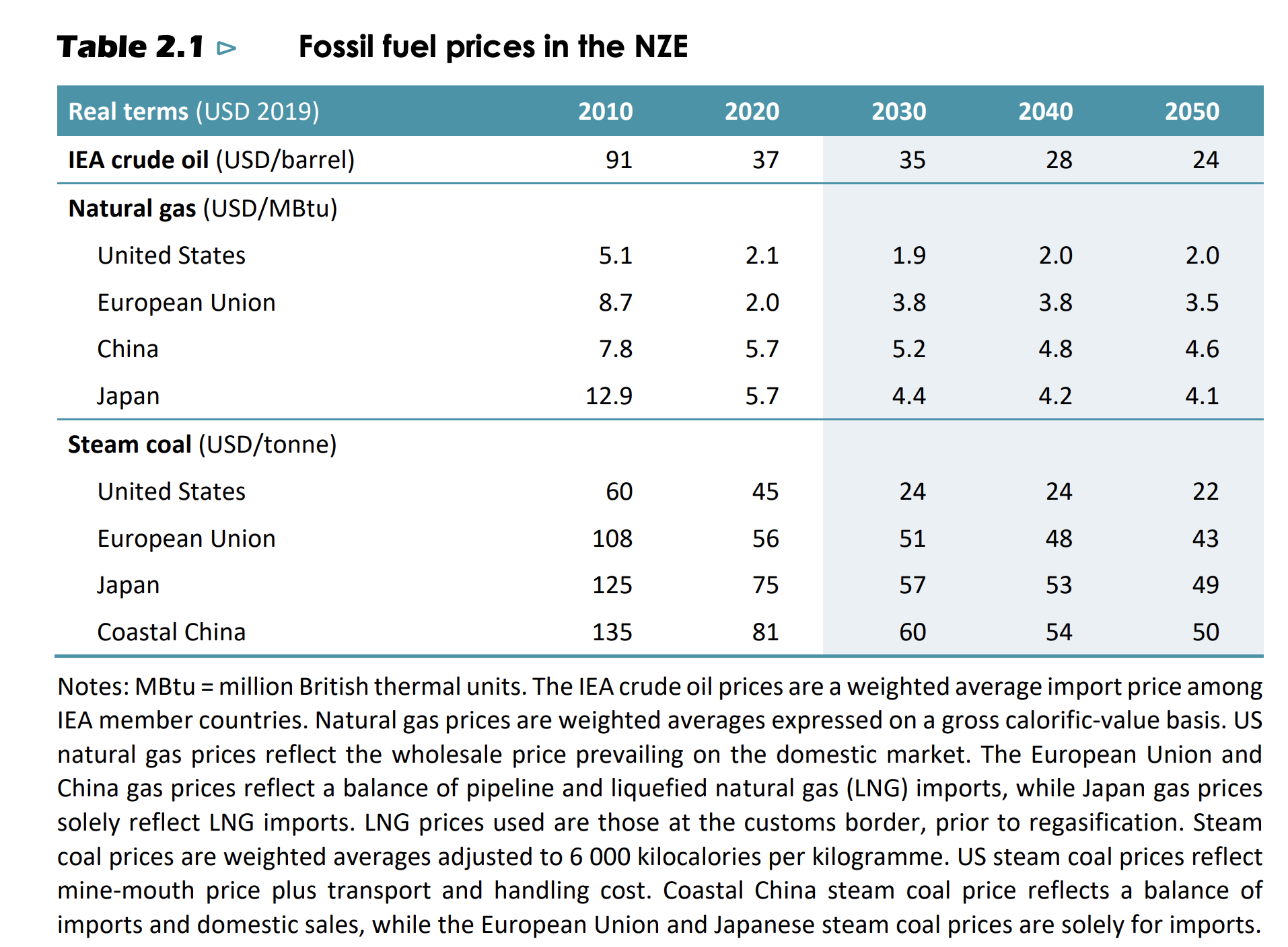

IEA Net Zero Forecasts

- IEA forecasts of various fossil fuel prices in a net zero carbon emissions scenario.

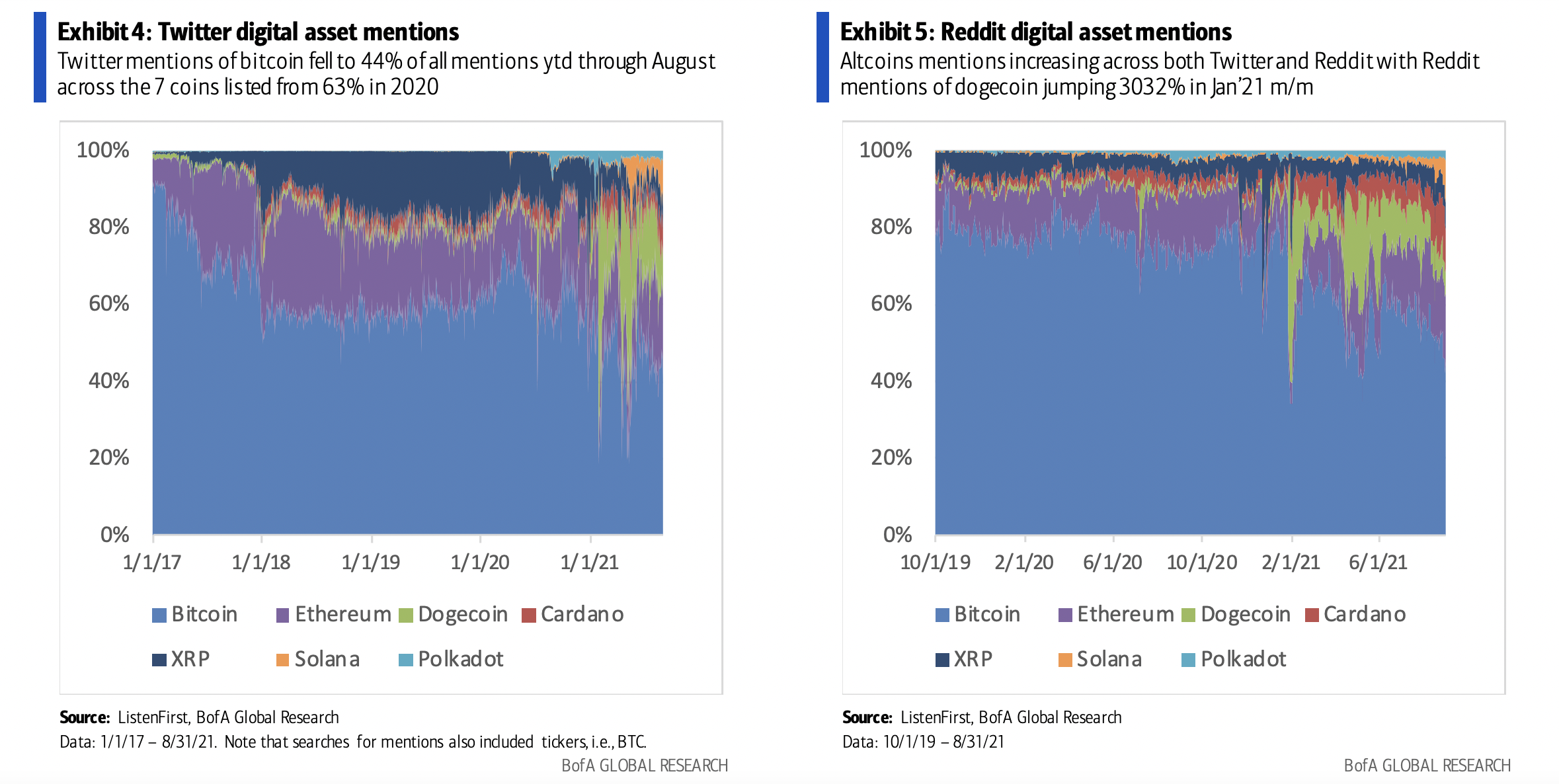

Digital Asset Mentions

- Social media conversations around digital assets are diversifying away from bitcoin.

Wang Huning

- Must read profile of Wang Huning.

- “A member of the CCP’s seven-man Politburo Standing Committee, he is China’s top ideological theorist, quietly credited as being the “ideas man” behind each of Xi’s signature political concepts, including the “China Dream,” the anti-corruption campaign, the Belt and Road Initiative, a more assertive foreign policy, and even “Xi Jinping Thought.”“

- “Wang Huning is arguably the single most influential “public intellectual” alive today.“

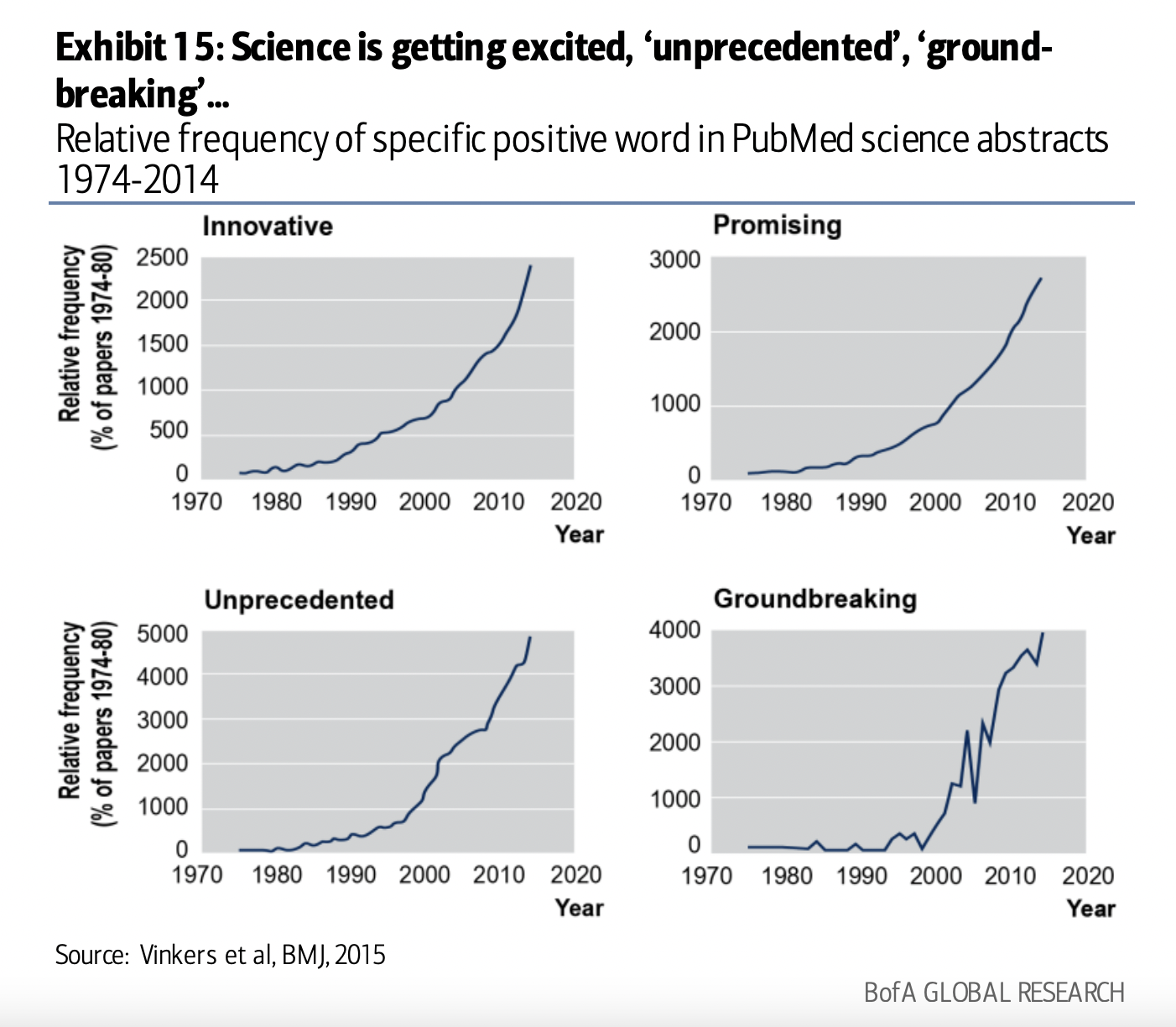

Science is Getting More Exciting

- “Innovative”, “promising”, “unprecedented” and “groundbreaking”.

Industrial Property

- 2020 was the 8th year where industrial property (which includes warehouses) was the top performing real estate sector.

- Longest run by any property sector in the last 30 years.

The Monty Hall Problem

- 🚪🚪🚪Three doors.

- Behind one is a car 🚗. Behind the other two are goats 🐐.

- You pick a door. The gameshow host opens another, revealing a goat.

- You can choose to stay with your original choice or switch. What should you do? [Give it a try!].

- The Monty Hall problem became famous when a columnist, Marilyn vos Savant, known as the world’s smartest woman, said you should switch, resulting in hundreds of letters, including from the brightest minds in mathematics, arguing she was wrong.

- This engrossing article by Steven Pinker shines a bright light on this dilemma.

- “People’s insensitivity to this lucrative but esoteric information pinpoints the cognitive weakness at the heart of the puzzle: we confuse probability with propensity.”

- “A propensity is the disposition of an object to act in certain ways. Intuitions about propensities are a major part of our mental models of the world.“

- Probability is “the strength of one’s belief in an unknown state of affairs“

- “The dependence of probability on ethereal knowledge rather than just physical makeup helps explain why people fail at the dilemma.“

- “They intuit the propensities for the car to have ended up behind the different doors, and they know that opening a door could not have changed those propensities. But probabilities are not about the world; they’re about our ignorance of the world. New information reduces our ignorance and changes the probability.“

- Surely there is an analogy here to investing.

Lab Grown Meat

- Lab-grown meat is all the hype right now.

- Yet according to this article, reality is very far away, if not unachievable.

- First, you need a bioreactor facility – even one that is equivalent to 1/3 of all the volume of the entire biopharmaceutical industry today would only yield 22m pounds of lab-grown protein or 0.02% of US meat production.

- To get to 10% of global meat consumption in 2030 you need 4,000 of these at a cost of $1.8 trillion.

- The bigger problem is these are live animal cells and hence are very vulnerable to any contamination. Bacteria would crush these cells as they grow much faster, while viruses would infect as the culture has no immune system. These cascade shutting down entire production facilities.

- The solution – clean rooms – are very expensive.

- Full paper on the topic and h/t NZS Capital (which lists many other problems from the article).

Remystifying Supply Chains

- A really beautiful must read piece written by a self-professed supply chain nerd.

- Weaving in analogies that bounce in time – from the internet age to husbandry – supply chains are brought to life.

- “Supply chains are a new class of engineered-emergent artifact, one that includes a few other globe-spanning things like the internet, the air travel system, and low earth orbit, that exist at a level of Gaian phenomenology, terraforming, and planet-scale husbandry. We only ever catch local glimpses of these things.”

- “We have to understand these beasts, in all their evolving, learning glory, while living within their bellies.“

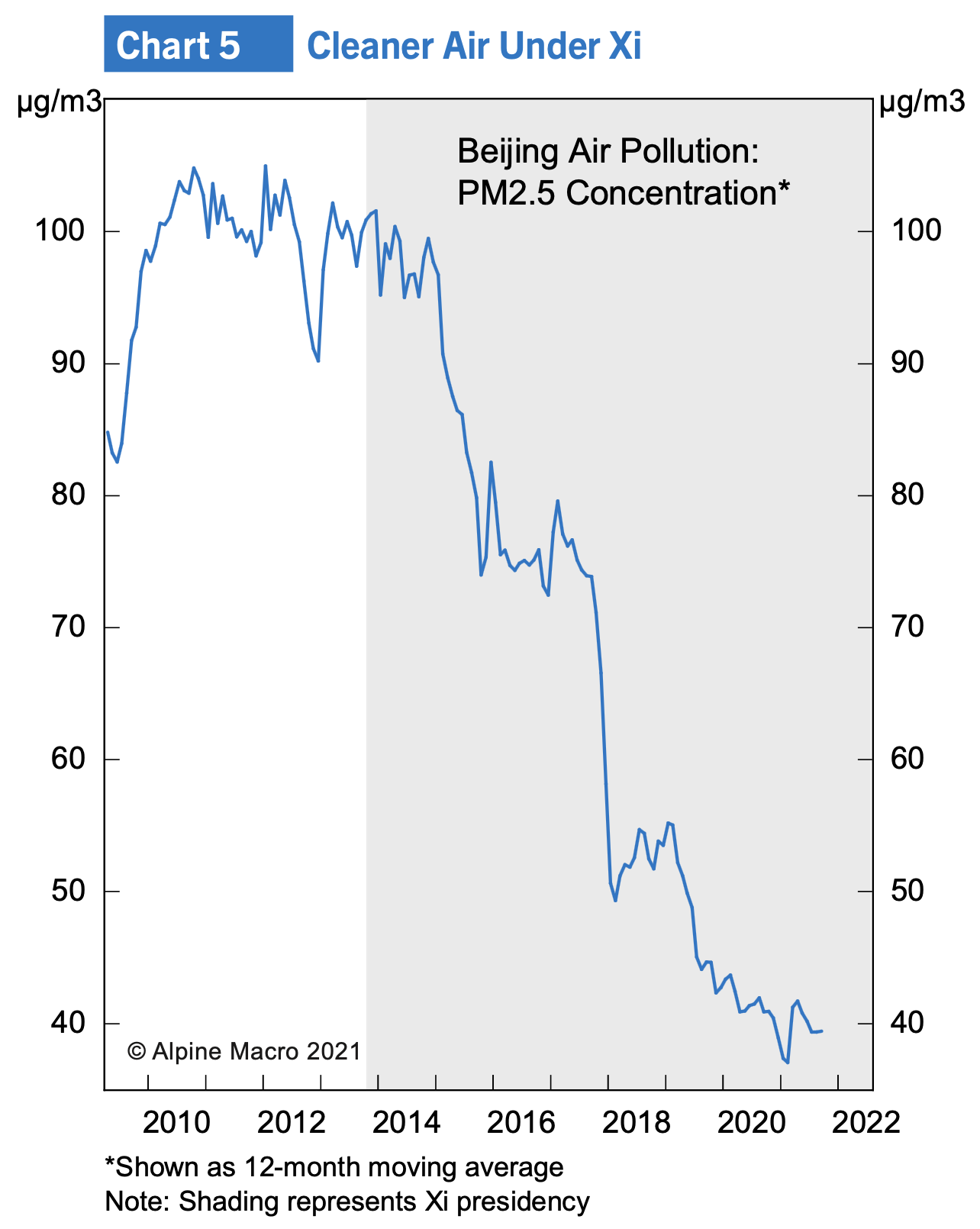

Beijing Air Polution

- Remarkable how Beijing’s air has been cleaned up.

- h/t Daily Shot.

AntiLibrary

- “Tsundoku (積ん読) is a beautiful Japanese word describing the habit of acquiring books but letting them pile up without reading them.“

- So starts a sublime essay on the antilibrary – “a private collection of unread books”.

- What is a digital version of that?

Does X causes Y?

- A neat deconstruction of the state of social science research.

- Can one ever really believe studies that claim something (X) causes something else (Y)?

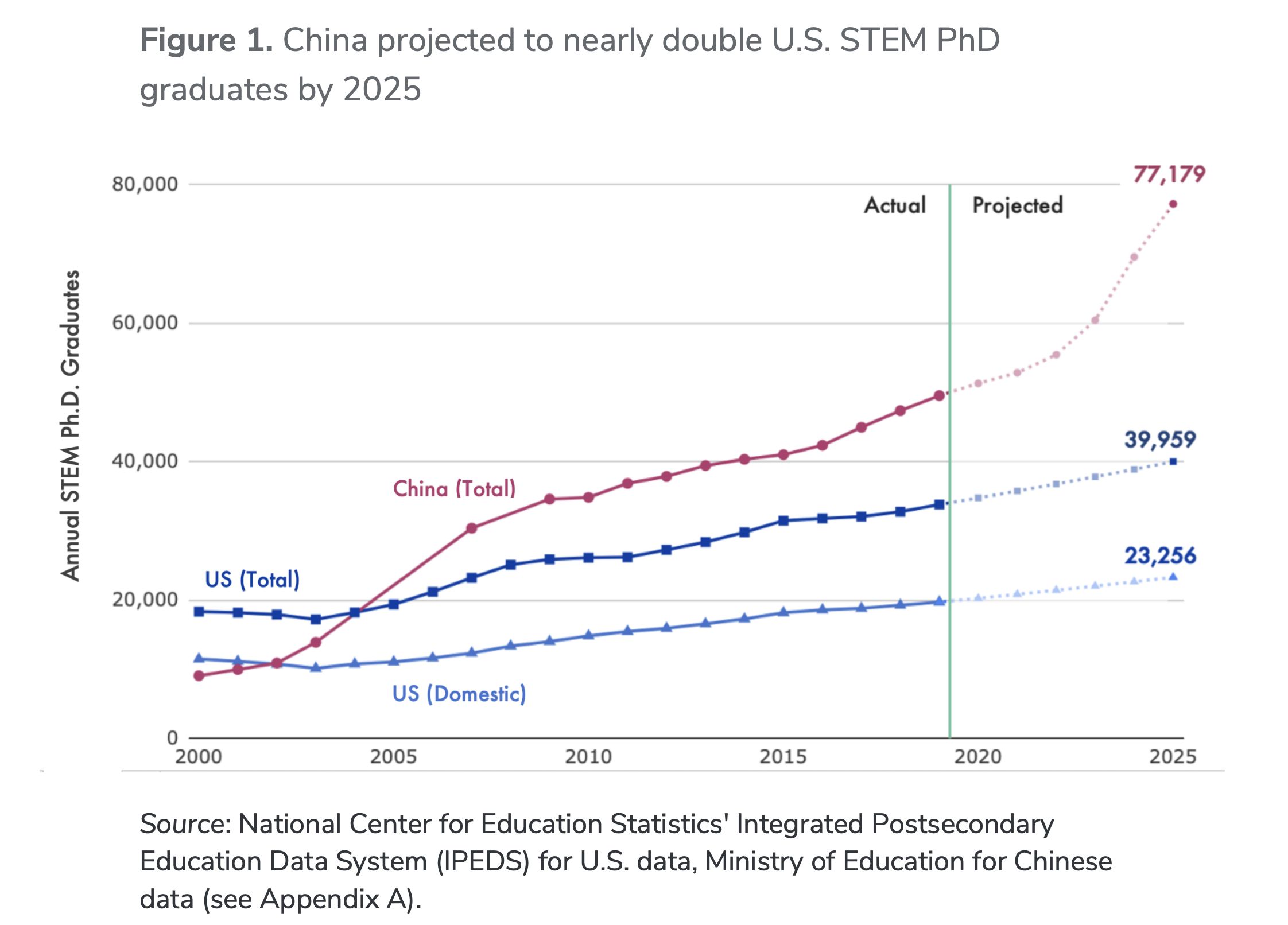

China’s Scientific Lead

- According to these numbers China will have twice as many STEM (Science, Technology, Engineering, Maths) graduates as the US by 2025.

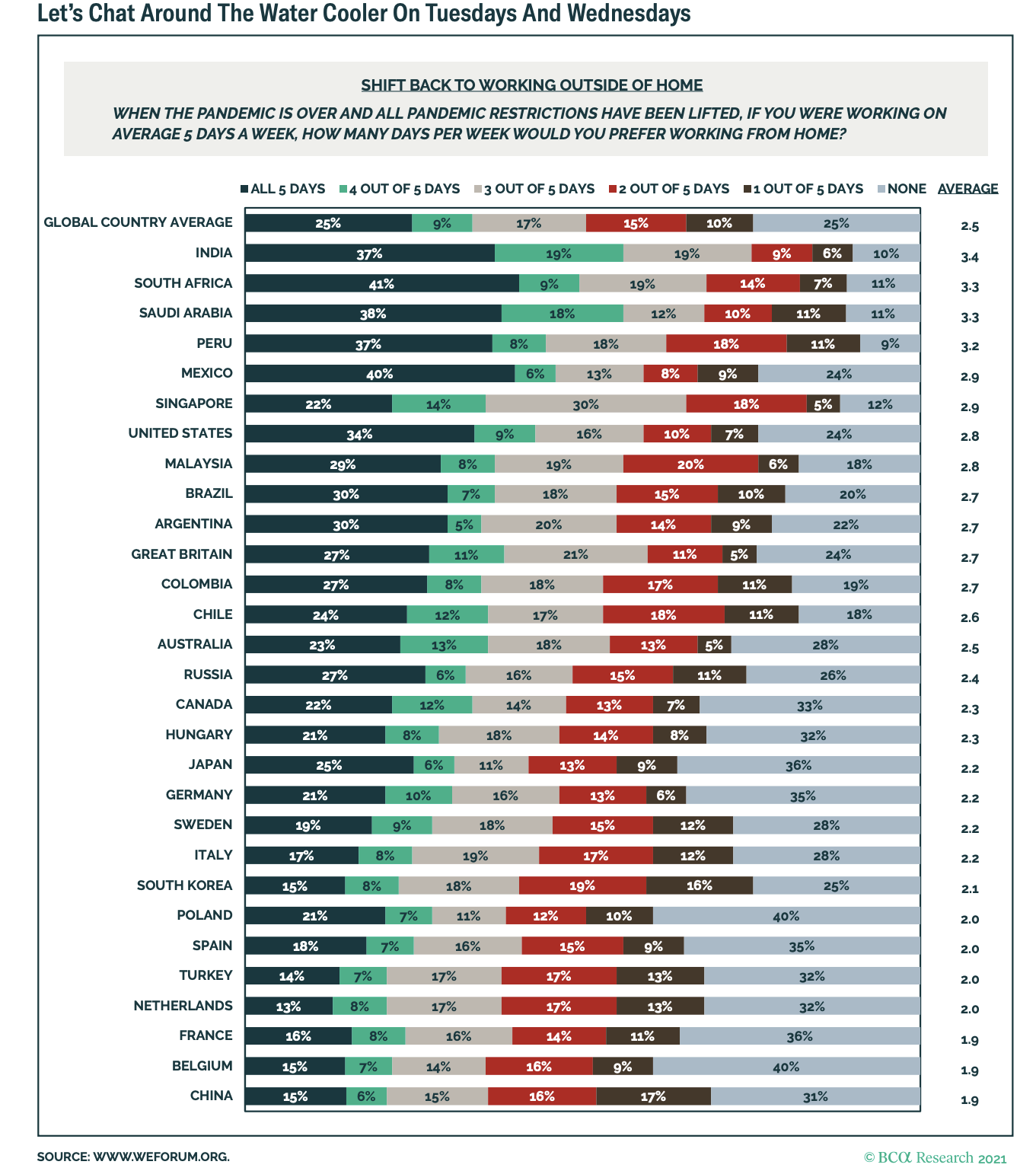

Working from Home

- On average 25% of people around the world would rather work entirely from home once the pandemic is over.

- 41% in South Africa but only 13% in the Netherlands.

- h/t BCA Research.

Lawns

- Grass lawns are really bad.

- How bad? “Forty million acres of land in the US consists of lawns. Maintaining them requires 800 million gallons of mower fuel and three million tonnes of (carcinogenic, endocrine-disrupting) fertilisers a year, and they guzzle up to 60 per cent of fresh water in urban areas.“

- To make matters worse, grass only works as a carbon sink if it is left wild.

- “Maintaining a patch of blank land on which no food grows, no animal feeds and no carbon is stored is as absurd as installing fake plastic grass.“

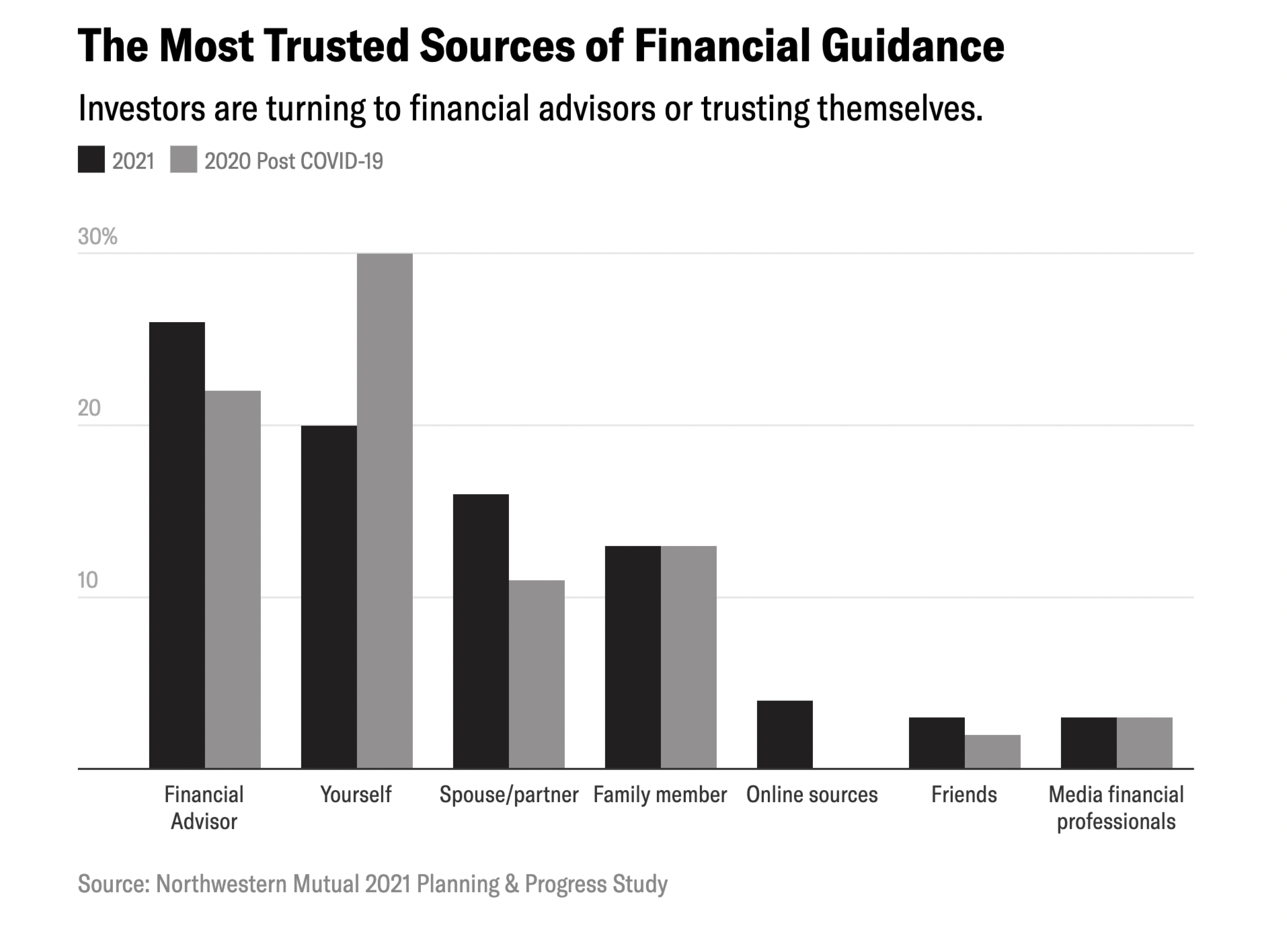

Best Source of Financial Advice

- 2,300 Americans were asked who they think the best source of financial advice is.

- Right after financial advisor, a staggering proportion said either themselves or their partner.

- Interestingly dead last, at just 3%, was financial professionals in the media.

Inequality and Polarisation

- One of the most important long term charts in the US right now.

- Source: BCA Research.

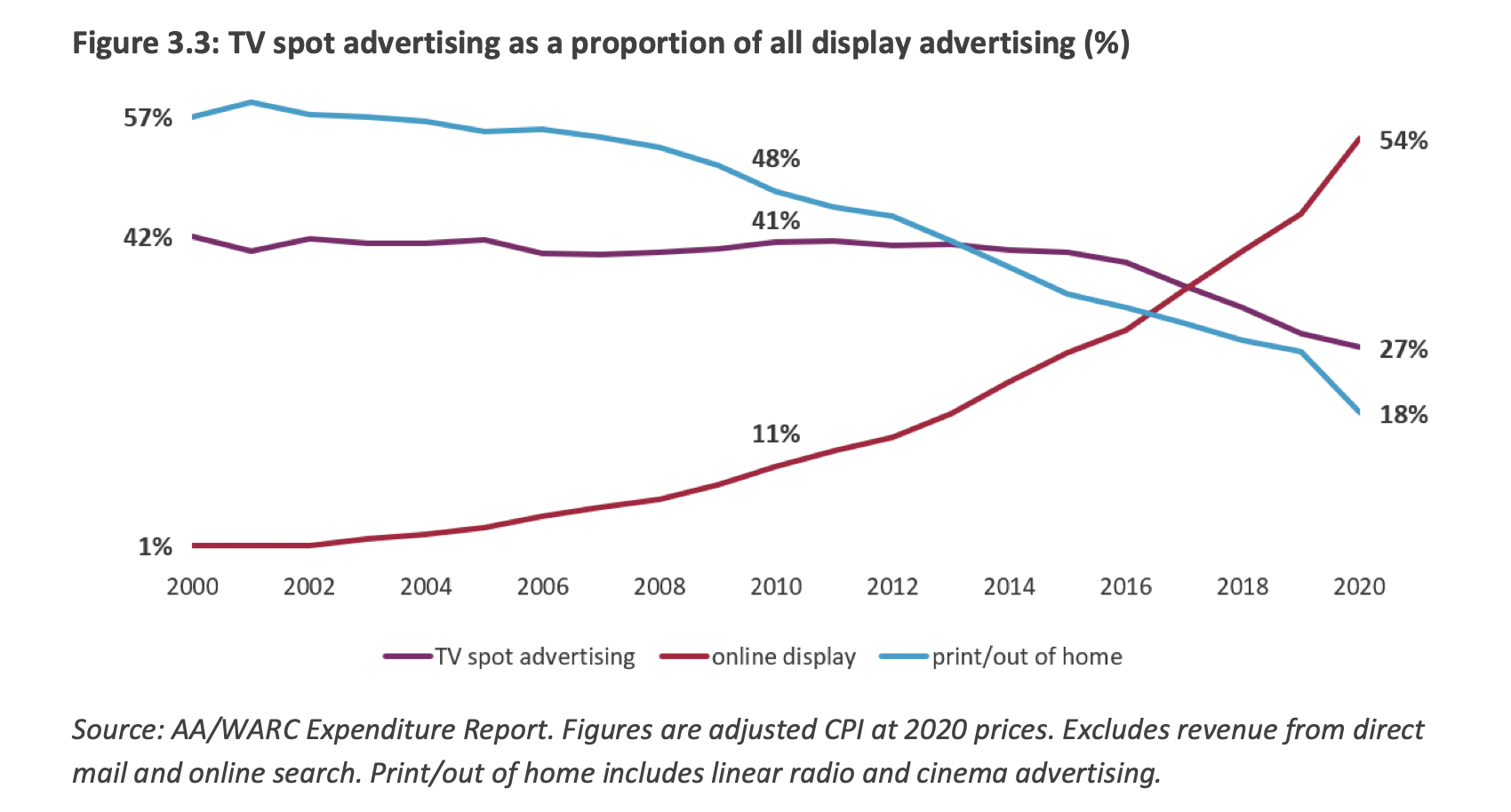

Online Display Eating TV

- Online display advertising is rapidly displacing TV in the UK.

- “However, despite the increase in online, TV advertising remains the medium of choice for big brands wanting to reach an audience quickly and at scale, with advertisers citing TV’s ability to drive both short-term sales and longer-term brand equity as a major advantage.”

- Source: Ofcom.

Investing Aptitude

- “Aptitude is the rate at which you level up, by changing the nature of the problem you’re solving (and therefore how you measure “improvement”). The interesting thing is, this is not purely a function of raw prowess or innate talent, but of imagination and taste.“

- This is a nice way to think about learning in investing – as returns to a particular area diminish, it is key to open a new front.