- “Crossover investors have become more active in Europe (e.g. Tiger Global, BlackRock, RA Capital, Coatue).

- While in 2019 only 2 made the top 15 investor league table, now, as at the half year, 4 of these (all from the US) are part of the top 15, with the number 1 overall being Tiger Global.”

- Source: Lazard.

Misc

Miscellaneous is often where the gems are.

UK Politics

- UK Conservative Party no longer has a lead required for majority.

- Source: Pantheon Macro.

US is bad at Payments

- The US, despite being the key player in the global financial system, is woefully behind when it comes to its own payments system.

- Frictions abound.

- For example, It costs $10-$35 to wire money same-day between major banks, something that in the UK is free, 24/7 and takes seconds.

- A staggering 34% of companies rely on paper checks for the majority of their payments (costing $4-$20 per transaction).

- This is a great paper covering all these frictions and more. A sobering read.

- NB paper written by individuals associated with Diem (formerly Libra).

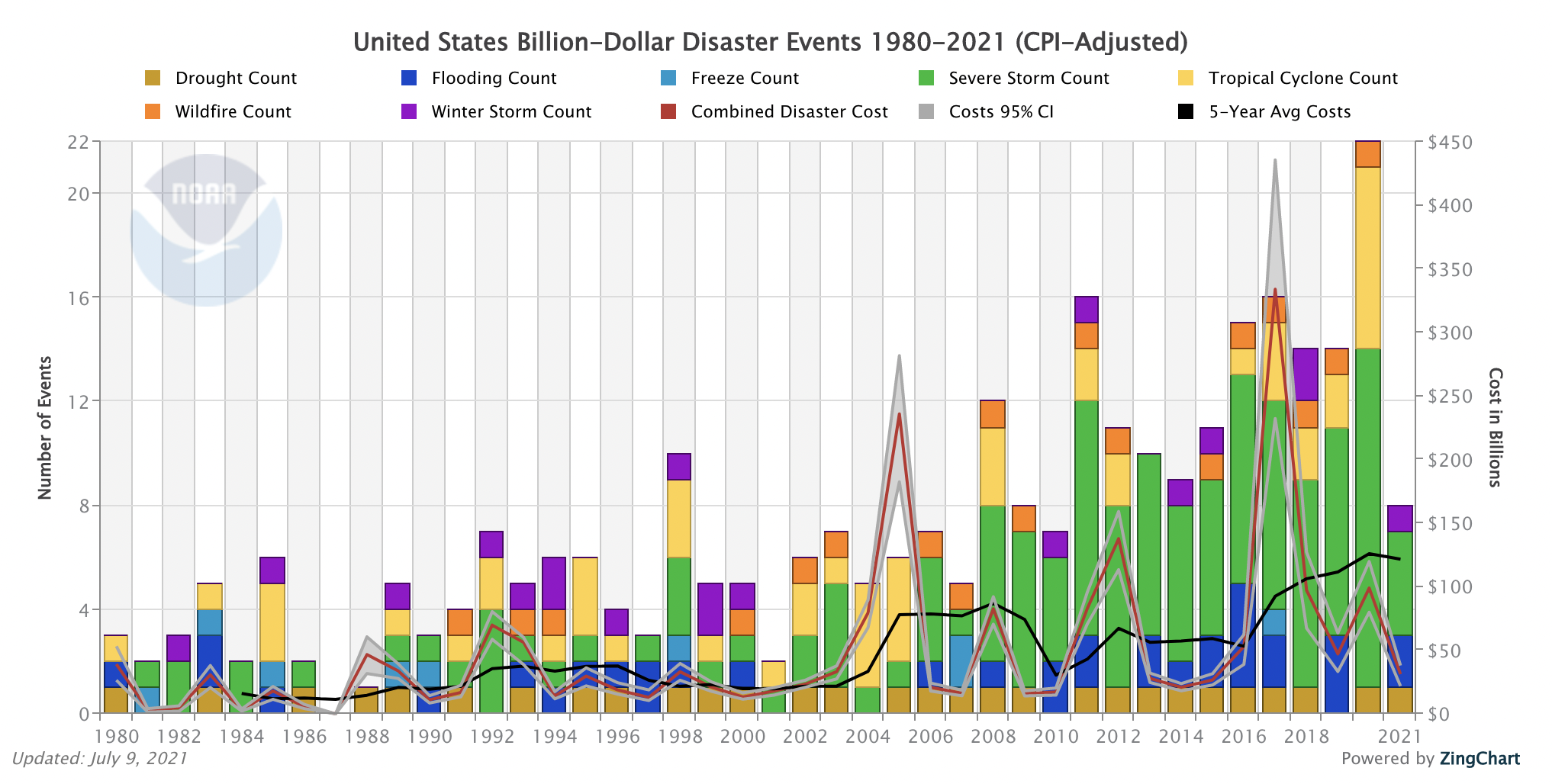

Climate and Weather Disasters

- Billion-dollar (consumer price inflation (CPI) adjusted) weather and climate disasters in the US have been on a rise in both count and cost.

- Source: NOAA. h/t: The Big Picture.

Online Platforms are Bad for News

- Craigslist, the world’s largest classified ads platform, was rolled out in a staggered fashion from 1995 to 2009.

- This created the perfect testing ground for its impact on 1,500 US daily newspapers.

- Researchers found that:

- As one would expect local newspapers reduced staff by 6% (14% for those that relied more heavily on classified ads).

- There was also a sharp decline in circulation which isn’t made up by other sources of news consumption.

- Most fascinating though, there was a significant decline in political content of newspapers (see chart) while things like sport, entertainment and crime didn’t change.

- This has very stark implications discussed in the link.

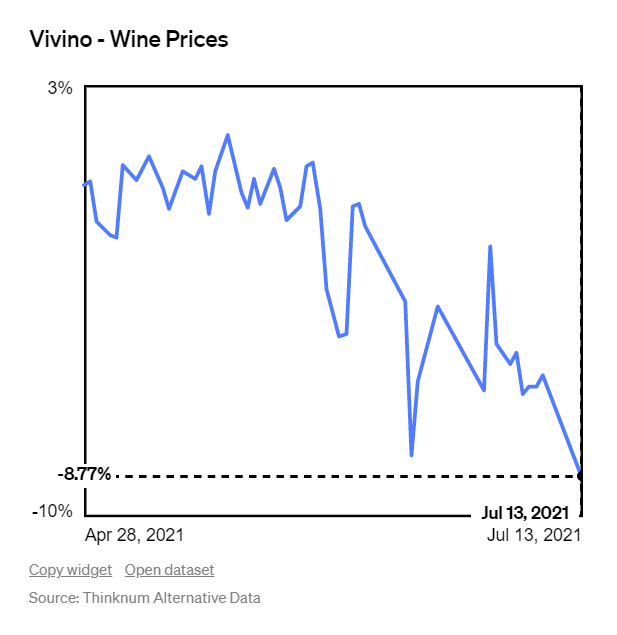

Wine Prices

- Wine prices have started to go down.

- Thinknum data from Vivino shows that the last three months have seen prices of seven major brands drop 8.7%.

Right to Repair

- FTC has voted unanimously to enforce laws around Right to repair.

- There is a big movement towards this – supported by Biden’s broad executive order – to put the power to repair everything from electronics to tractors to cars back in the hands of consumers.

- This could be a big issue across the board for companies like Deere, Apple etc. who all make high margins on after market servicing and repairs of their original products.

- The full FTC report on the matter is worth a flick.

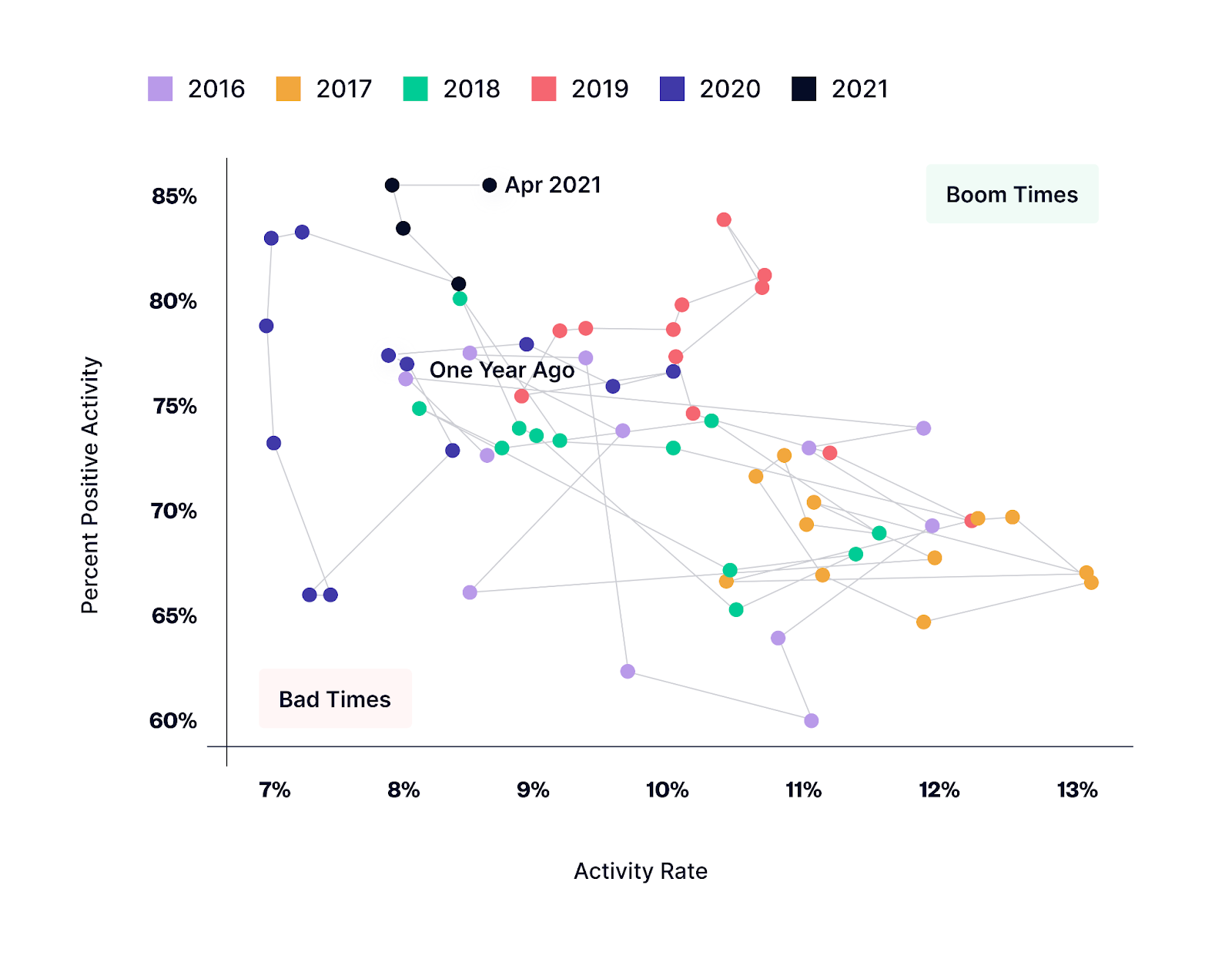

Unicorns

- “We analyzed over 2,600 seed-stage startup investments made on AngelList dating back to 2013 to determine the likelihood of any startup achieving unicorn status today.“

- The answer – 1 in 40 shot or 2.5%.

- A 2018 study put that number at slightly more than 1%.

- One reason for the increase is the pictured chart – “The first quarter of 2021 was the “best quarter ever” for early-stage startups in terms of rates of markups and positive exits. Just over 85% of the events reported by startups on AngelList during that period were positive ones—an increase of 5% from just one quarter before.“

- Source.

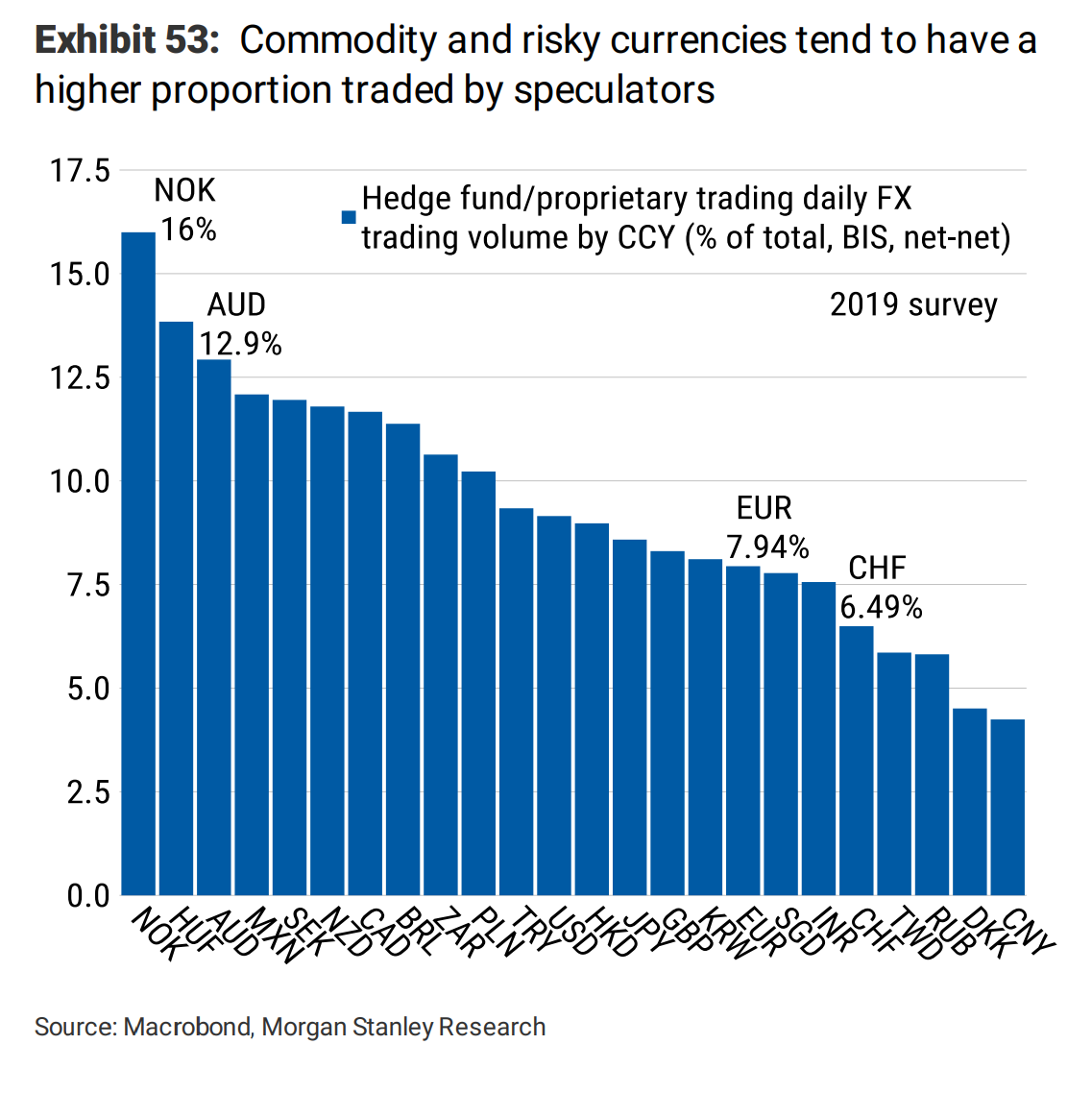

Speculation and Currencies

- Hedge funds and prop traders prefer to trade commodity and risky currencies.

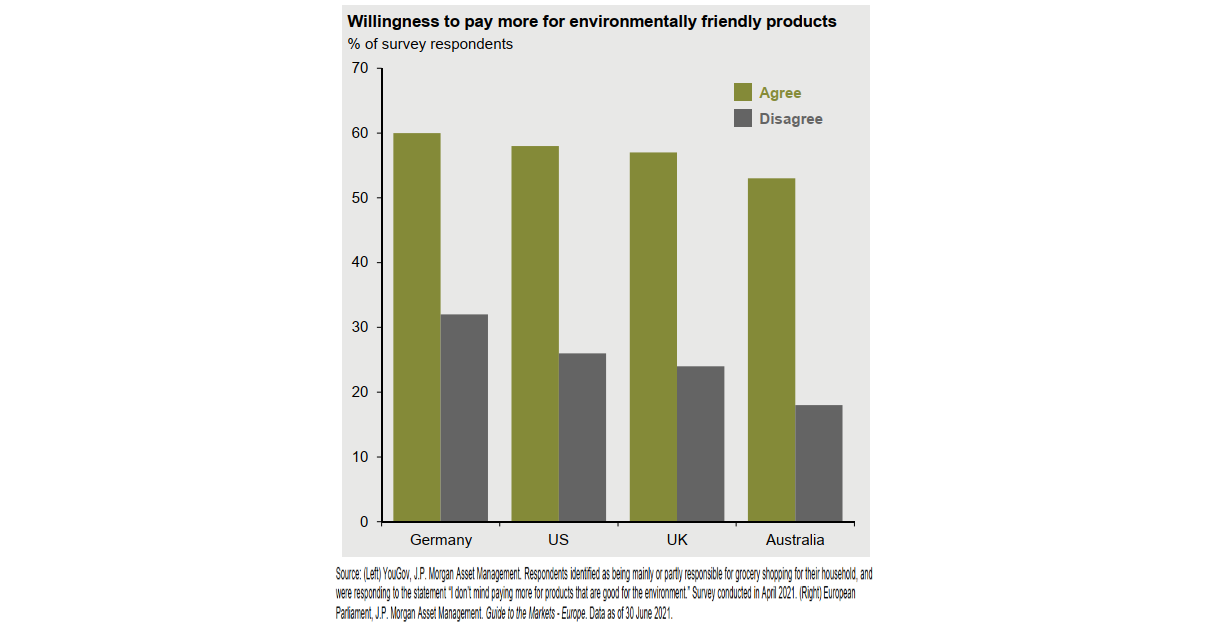

Environment and Consumer

- Pretty clear survey showing that customers would pay more for environmentally friendly products.

China Tech Regulation

- “China’s anti-monopoly laws were first passed in 2007, almost a century after the US Sherman Act of 1890, the Clayton Act of 1914 and the Federal Trade Commission Act of 1914. It’s also worth noting that Alibaba was founded in 1999, Tencent in 1998 and Baidu in 2000 — all ahead of anti-monopoly laws. Laws themselves also aren’t enough, and the State Administration of Market Regulation (SAMR) was established in April 2018 with holistic coverage to enforce the legislation.”

- Great article on what to make of the regulatory crackdown drama going on in Chinese tech – from education firms being forced to go non-profit to the botched listing of cab-hailing firm Didi.

Distribution of Private Strategy Returns

- Interesting chart showing the performance dispersion of various private alternative strategies (Source).

Crypto Assets UK

- FCA has done another survey of crypto assets and UK consumers.

- About 5.7% of people (3m) hold or have held a cryptocurrency, with the average current holding of £300.

- By comparison 17.3m people hold some form of investment product.

- 78% of adults are aware of crypto assets, up from 74%.

- Source.

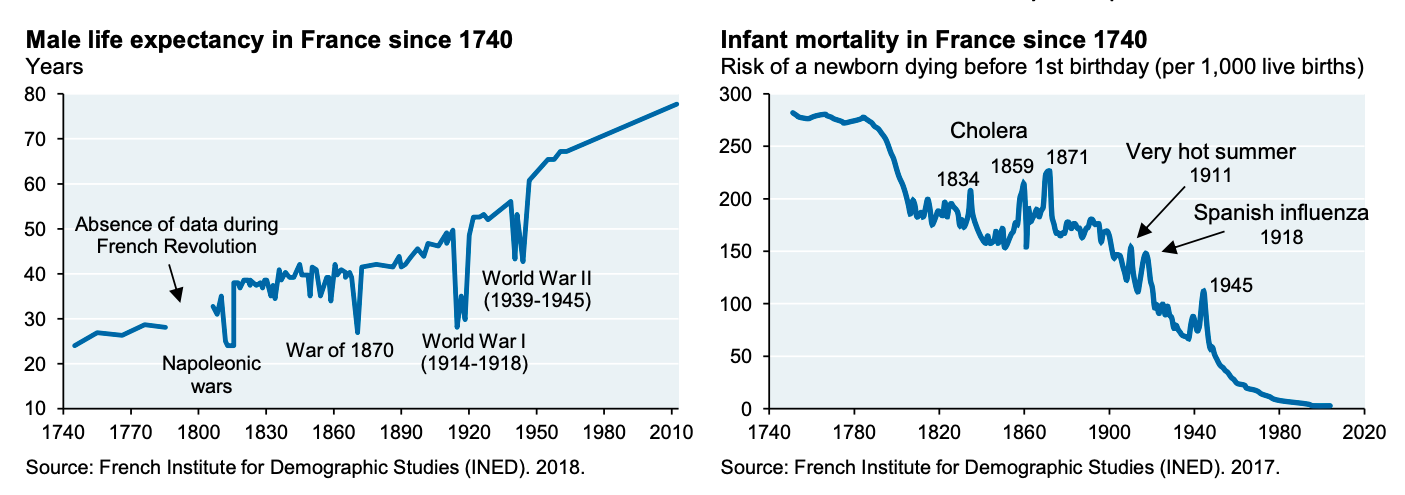

Progress

- Scientific progress has achieved tremendous gains in life expectancy and infant mortality.

- The question today is – do humankind’s best days lie ahead?

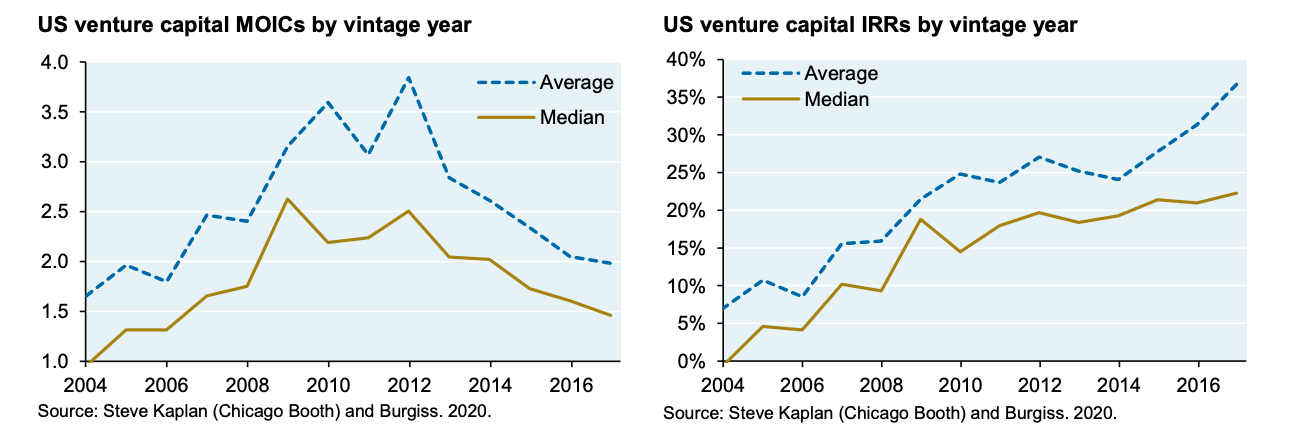

US Venture Returns

- VC managers have seen falling MOIC (multiple of invested capital) returns while IRRs, just like those in private equity buyout, have been rising.

- This can be explained by use of subscription lines and faster distributions.

- Notice the difference between median and average – VC tends to have some very high return/size funds.

- Source.

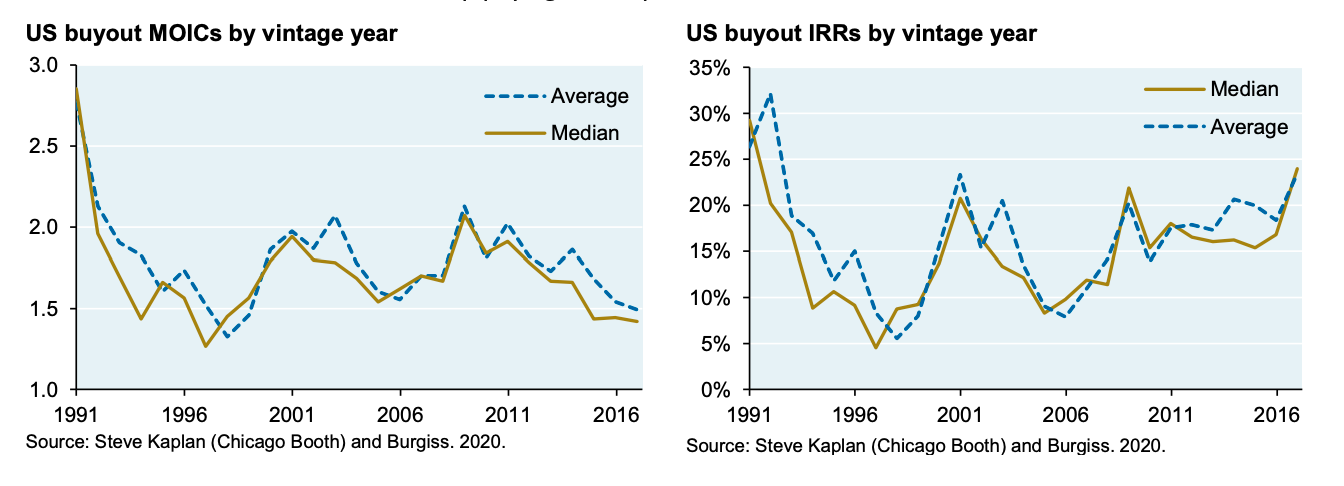

US Buyout Returns

- Private Equity buyout returns measured by multiples on invested capital (MOIC) – a simple cash-in vs. cash-out metric, have been falling since 2009.

- Interestingly internal rate of return (IRR), a time-weighted measure of return, has been rising.

- The reason is the increased use of subscription lines – managers financing investment with bank loans delaying capital calls to LPs until later.

- Mercer data suggests their use has grown 6x since 2010.

- Note also average and median returns don’t differ much.

- The note compares returns to public markets showing 1-5% pa excess returns, which have also fallen.

- Source.

Geography and History – the US

- This is a brilliant article on how geography influences history.

- The United States stands out has having some of the best luck when it comes to advantageous geographic features.

- “First, the US is fortunate to have mountains and oceans everywhere for defence.”

- Second it has this – “The US’ Mississippi basin:

- Has mountain ranges on both sides, which concentrate water inwards.

- Has over one million square miles (2.5M km) of extremely well-irrigated land – the world’s largest contiguous piece of farmland.

- Is nearly flat, which is also great for agriculture, but also for building anything for cheap, really.“

- Third it has “more internal navigable waterways than the rest of the world combined!“, which adds a huge cost advantage.

- More interesting analysis in the article including applying these ideas to the rest of the world.

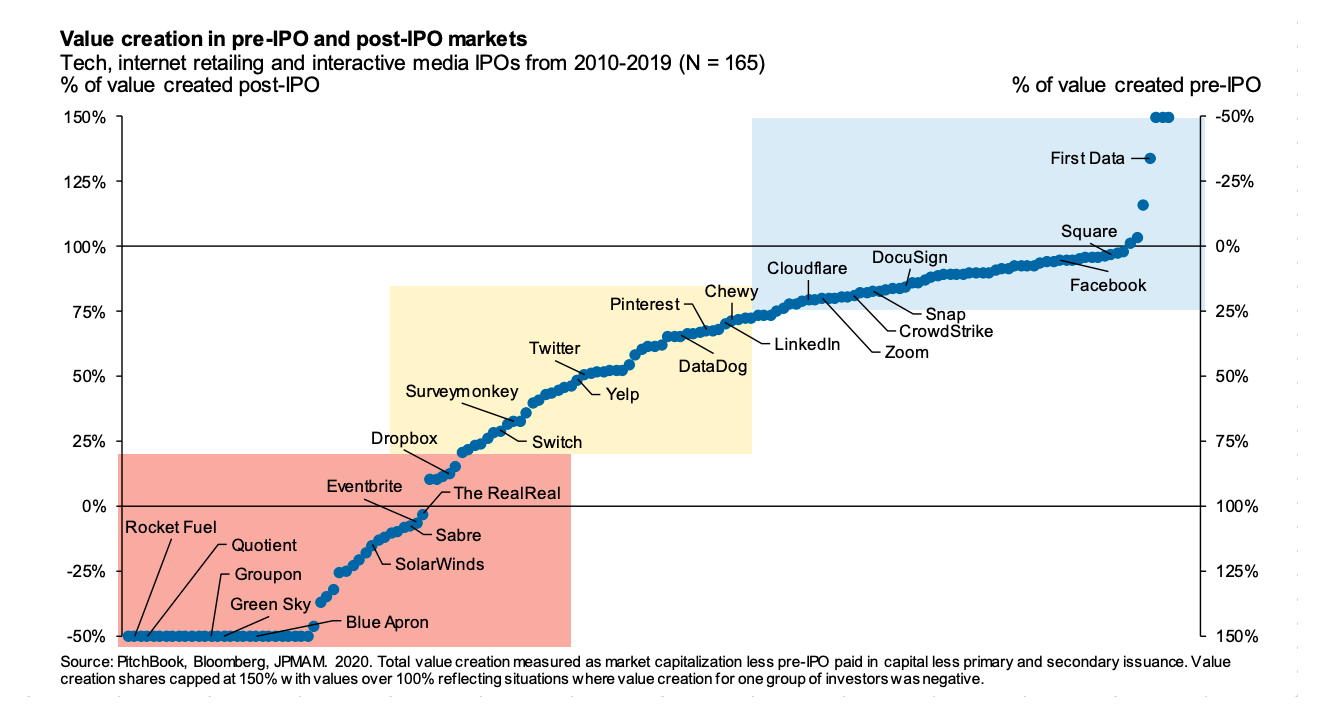

Post and Pre IPO Value Creation

- Who reaps the majority of the rewards from venture backed companies – VC or public markets?

- “Over the last decade when measured in terms of total dollars of value creation accruing to pre- and post-IPO investors: post-IPO investor gains have often been substantial.“

- Of the 165 IPOs analysed – the vast majority had a large share of value accrue to public markets (blue region).

- There are some exceptions (red region), and some shared (yellow region).

- Source.

The Hedgehog and The Fox, revisited

- Many readers will have heard of the famous distinction from the celebrated essay by Isiah Berlin.

- But few have read past the first chapter. Much of the brilliant writing has been overlooked.

- The latest Snippet Blog article is a correction of that omission.

- In Berlin’s words are ideas that give the analogy a much deeper meaning and in the process help guide investors.

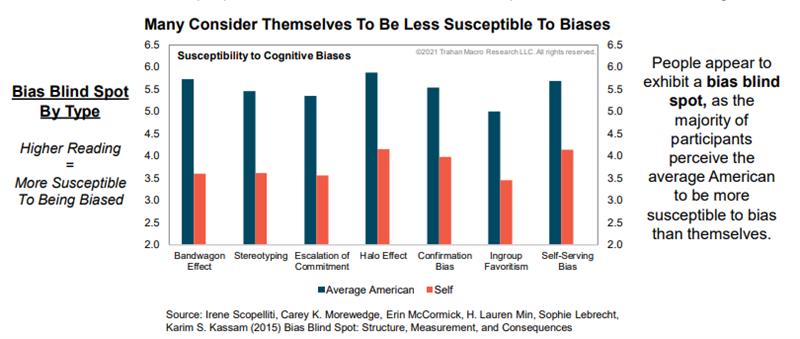

Bias Blind Spot

- “People exhibit a bias blind spot: they are less likely to detect bias in themselves than in others.“

- “Most people recognise that other people are likely to be biased when judging an attractive person, for example, but think that their own judgment of an attractive person is unaffected by this type of halo effect.“

- Clearly, the majority of people cannot be less biased than their peers – hence the blindspot.

- Source.