- Bloomberg analysed how well companies fared against their 2020 climate goals (set in 2015).

- “The good news is that most of these pledges—138, so far—have already been met or appear on track by year-end, in part because many companies set modest goals.“

- Worryingly, data disclosure remains a big issue as many companies either don’t report or do so unevenly.

- Looking forward many are now making stand out statements.

- Microsoft has not just committed to going carbon negative (by 2030) they will, by 2050, remove from the environment all the carbon the company has emitted either directly or by electrical consumption since it was founded in 1975.

Misc

Miscellaneous is often where the gems are.

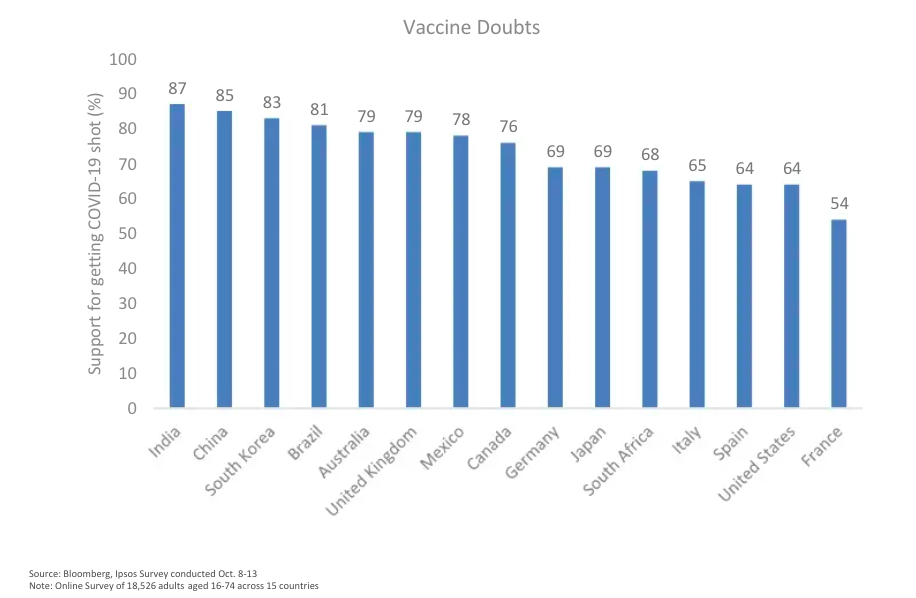

Vaccine Doubters

- Intriguing to see how support for the Covid-19 vaccine varies by country.

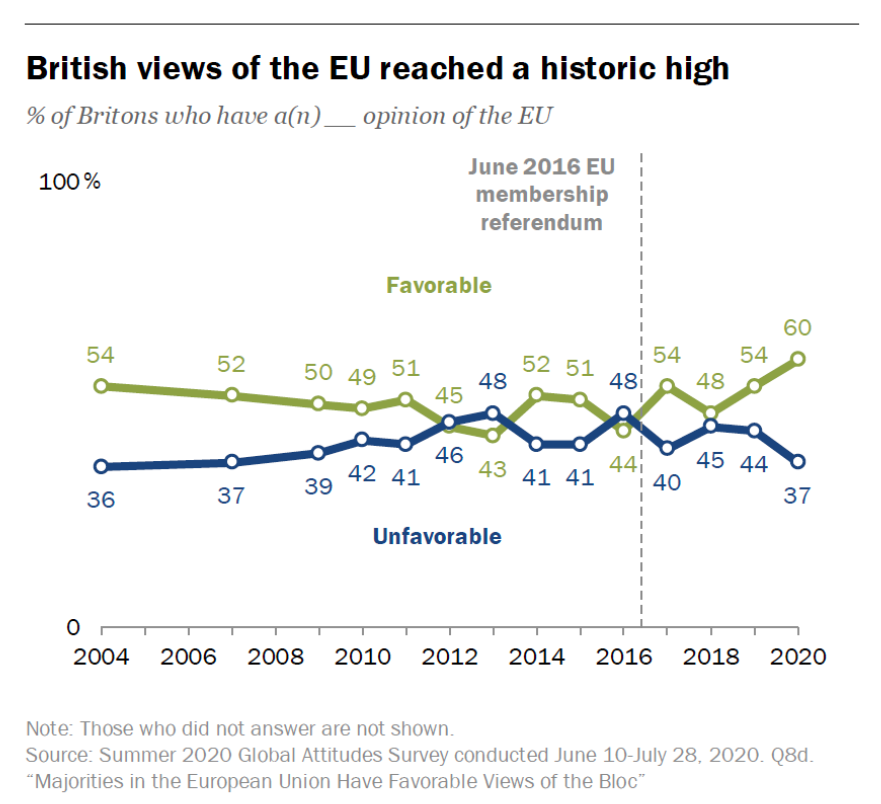

Brexit

- “In Pew Research Center’s first survey in the UK after Brexit, 60% of British adults said they had a positive view of the EU, up from 54% the year before and the highest percentage in surveys dating to 2004”

The Brain

- This story of how brains evolved, while admittedly just a sketch, draws attention to a key insight about human beings that is too often overlooked. Your brain’s most important job isn’t thinking; it’s running the systems of your body to keep you alive and well. According to recent findings in neuroscience, even when your brain does produce conscious thoughts and feelings, they are more in service to the needs of managing your body than you realize.

- Interesting thought for investors.

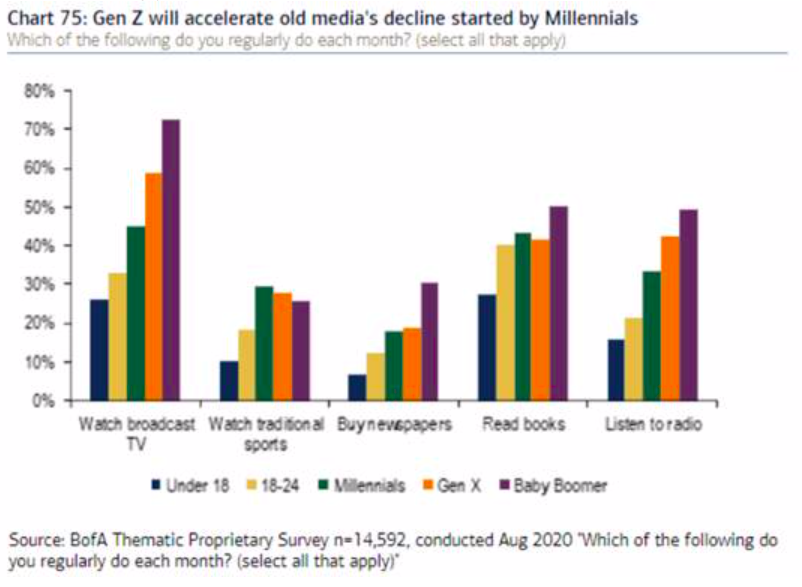

Gen Z and Media

- Generation Z is now more likely to read a book than to listen to radio or watch a traditional sport and as likely to watch broadcast TV.

- h/t Redburn.

NBA and Start-Ups

- Just as in tech companies, many sports franchises are trying to answer a basic question: what do the numbers today tell us about the possible outcomes of tomorrow — and what (or who) do we need to get to a winning outcome?

- In basketball and tech in particular, a deeper understanding of efficiency — both in how to measure it and how to leverage that to build winning teams — and usage has changed the game in the last decade.

- A great piece applying NBA sports metrics to Start-ups.

Magic Mushrooms

- A fascinating read on the journey of psilocybin from Mexico to the stock market, via western consciousness, politics and the lab.

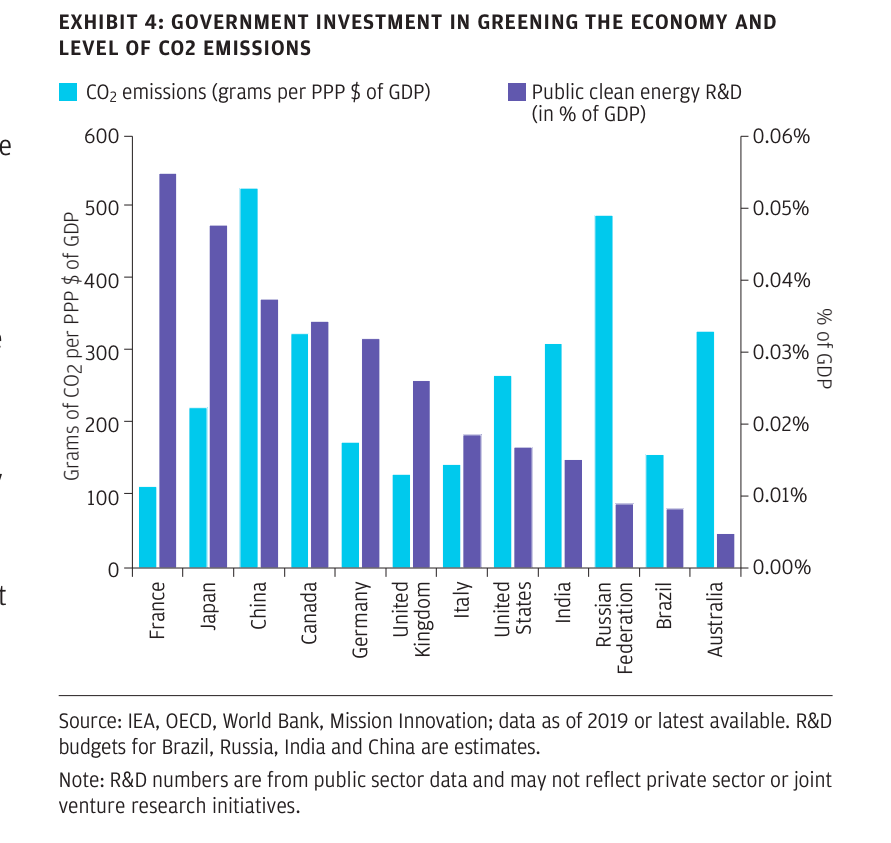

Clean Energy Investment

- Nice chart showing CO2 emissions (blue bars) by country against how much that country spends on public clean energy R&D (% of GDP, purple bars).

- Source.

52 Things 2020 Edition

- We previously covered this brilliant list of 52 things learnt for 2019 and 2018.

- Here is the 2020 edition – full of gems. A few choice examples:

- Most cities plant only male trees because it’s expensive to clear up the fruit that falls from female trees. Male trees release pollen, and that’s one of the reasons your hay fever is getting worse.

- For VC companies in 2004, the average time from first contact to funding was 90 days. Today, it’s just nine days

- Car safety laws in the US make it more expensive to have three children — women in states with mandated car seats are 0.7% less likely to have a third child. The safety measures may have saved 57 car crash fatalities each year, but caused 145,000 fewer births since 1980.

- Developing and launching the iPod in 2001 took just 41 weeks, from the very first meeting (no team, no prototype, no design) to iPods shipping to customers.

- References to each found in the link.

Probability Errors

- “Gaining a better understanding of probability will give you a more accurate picture of the world and help you make better decisions. “

- Great list of common mistakes associated with not understand how probability works. A must read.

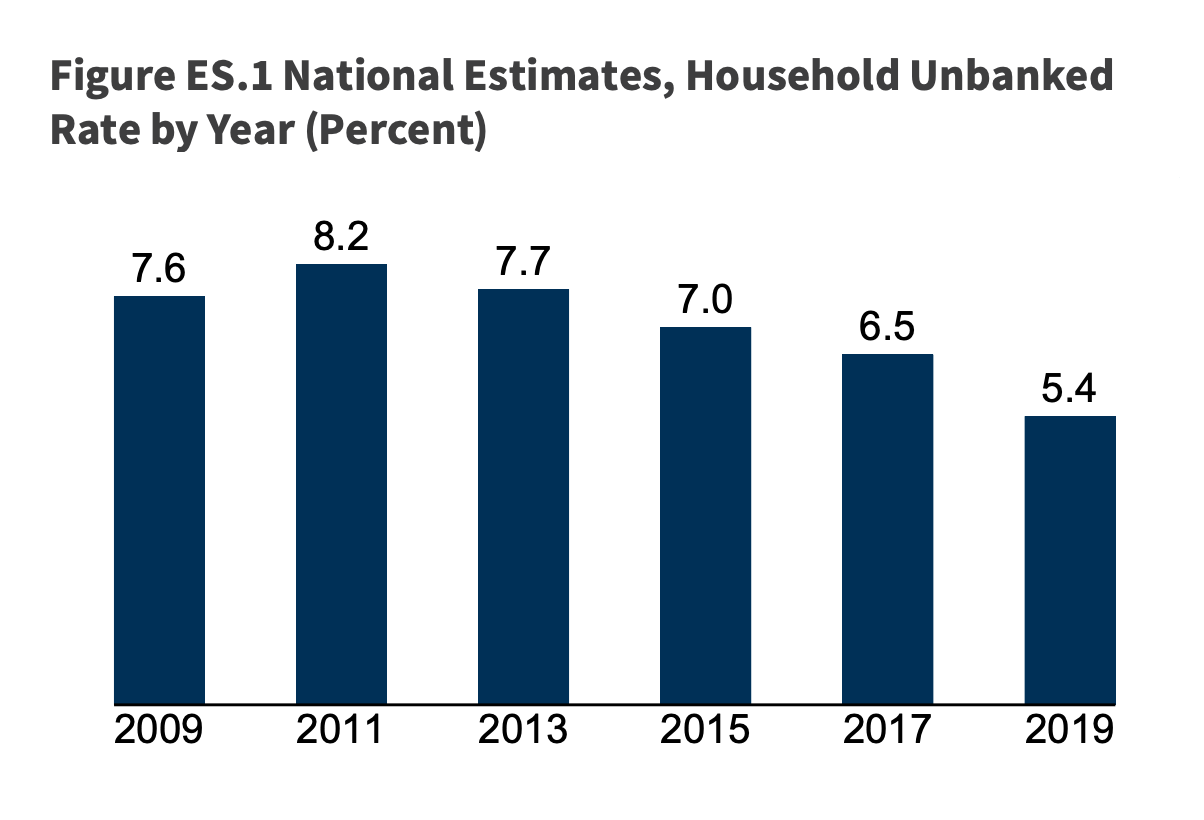

Unbanked

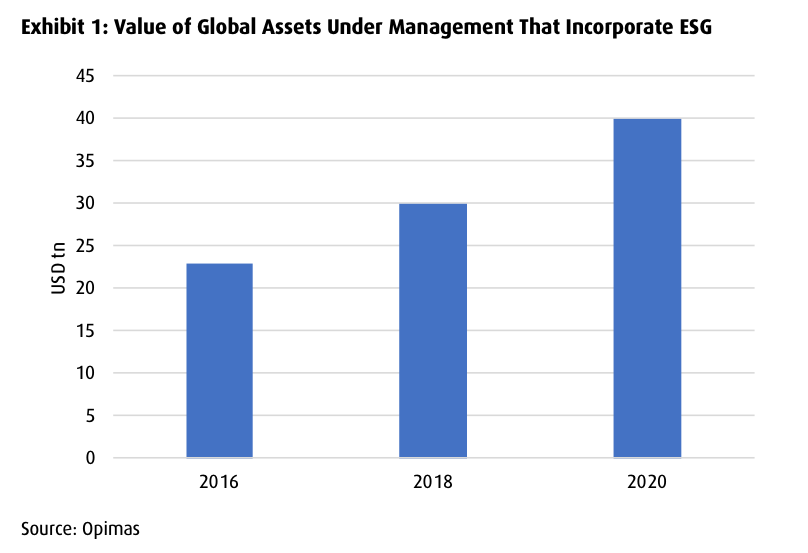

ESG

- Pretty staggering that $40trn of assets incorporate ESG.

- Although this uses the broadest possible definition of ESG it does still confirm the tremendous growth in the sector.

Analysing Impact of Covid – Habits

- One interesting approach to understanding if things will change is to look at scientific research.

- In this paper – How are habits formed: modelling habit formation in the real world – researchers measured how long it took to form a habit.

- They found that the median time was 66 days ranging from 15 – 254 days.

- Exercise habits took longer to form.

- The longer it took to form the stronger the habit was.

- With lockdowns now lasting longer than 66 days real habit change is likely.

Shareholder Activism

- For those interested in activism nice summary report on the state of the investment strategy in Q3 2020 by Lazard.

- After peaking in 2018 it looks like the strategy has seen less activity in terms of capital and new campaigns.

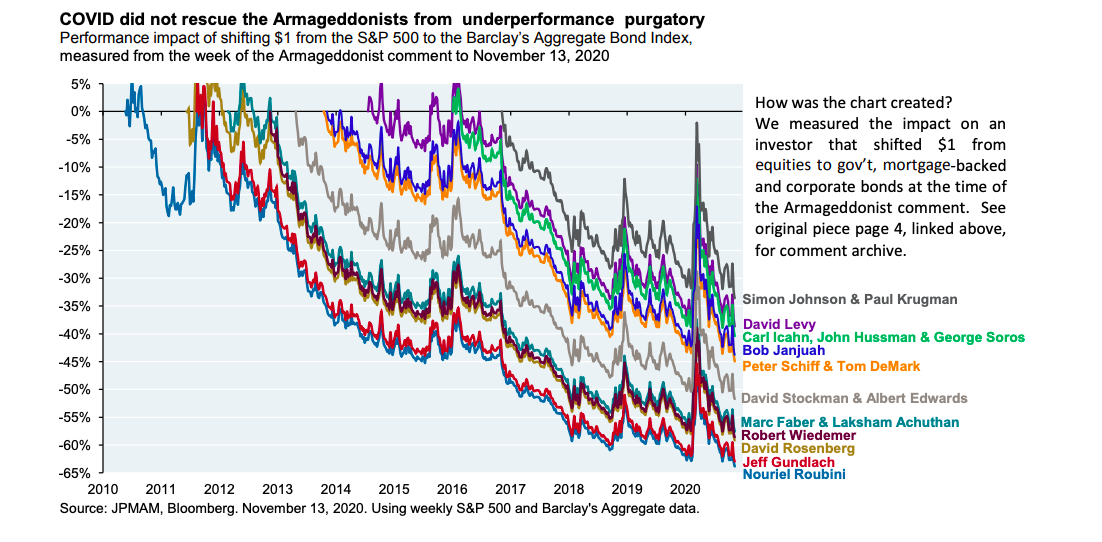

Armageddonists

- Armageddonists (“the market-watchers, forecasters and money managers whose apocalyptic comments spread like wildfire in print and online financial news”) haven’t been bailed out from underperformance by COVID in 2020.

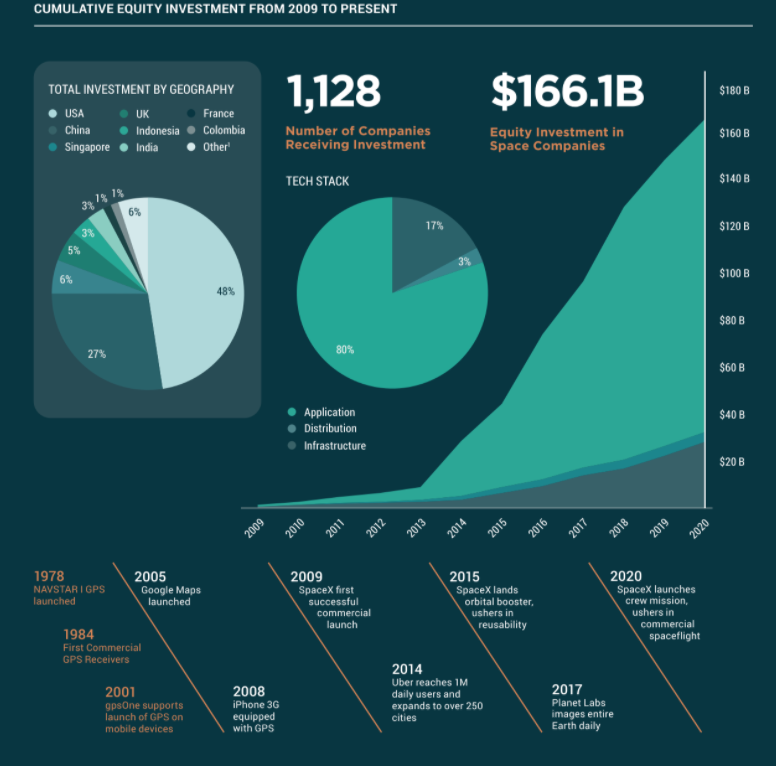

Space

- Interesting report on the state of investment in Space.

- Space has seen $166bn of cumulative investment since 2009 and there are now over 1,000 companies.

Games

- A brilliant extract from a podcast with Shopify CEO Tobi Lutke quoted by Alex Danco in his newsletter (after joining the company).

- “I’m a card-carrying member of the “video games are actually good” club. I’ve learned so many things in my life through video games … I tend to point out a few I think are extremely valuable. Factorio is one of those. It’s the one game that anyone at Shopify can expense. .. We’re building supply chains for our customers; logistics networks; and Factorio makes a game out of that kind of thinking.

- The reason why I think video games are good is because of transfer learning. There’s a good book called The Talent Code that talks about this. There was a famous story about people analyzing why Brazilians became so much better at soccer than anyone else. And there were many reasons – it’s a system that’s reinforced by all these things – but people hadn’t found the key reinforcing mechanism that made this true.

- It turns out, in Brazil there was a culture of playing a pickup game, a version of soccer that was played in a much smaller space and with fewer players. And the players did all the things you need to be good at soccer, but they did them significantly more often, because there was more ball contact per person. Just because that’s a different game than soccer doesn’t mean people won’t learn soccer skills. They had way more ball contact than someone who went through the British system, by the time they entered the Premier league, for instance.

- But if I sit down for an evening of poker, I make these decisions every hand. And then you look at a game like Starcraft, which I think is very good, or Factorio, and in a very compressed, fun environment, follow a certain activity over and over and over again which otherwise comes around only rarely. And doing that will change your mind, and your brain, and help you be prepared for situations you could never predict.“

Healthcare

- US clearly stands out as it spends far more on healthcare than any other rich country in the world yet has little to show for it in terms of life expectancy improvement. Source.

Danish Mink and Covid

- Last week Denmark sounded the alarm on potentially dangerous developments related to SARS-CoV-2 virus.

- The two worrying elements are (1) a mutation in the spike protein which could render the upcoming vaccines and antibody immunity of those already infected useless (2) a jump from animal (mink) to human.

- This is a good summary and the press release from the Danish Serum Institute (use Google Translate) is also worth reading.

- STAT news have a more sanguine take – arguing that there is nothing to suggest the mutated virus could have higher transmission rates or risks for humans and single mutations rarely are cause for alarm.

Ikea

- Ikea are masters of digital marketing.

- In the 2014 catalogue “approximately 75% of the photos were built with detailed, digital 3D models.”

- They are now taking digital ads to new levels – where even the main protagonist is CGI.