- “I came across this guy, Sean Ellis. Now, Sean ran growth in the early days at Dropbox, LogMeIn, and Eventbrite. He even coined the term “growth hacker.” Now Sean found a leading indicator of product to market fit, one that is benchmarked and predictive. Just ask your users this. How would you feel if you could no longer use the product? And measure the percent who answer, very disappointed. After benchmarking hundreds of startups, Sean found that the companies that struggle to grow always get less than 40% very disappointed. The companies that grow most easily almost always get more than 40%, very disappointed. In other words, if more than 40% of your users would be very disappointed without your product, you have initial product to market fit. Now, this metric turns out to be more objective than a feeling. It predicts success better than net promoter score, and it’s not only the best way to measure product to market fit”

- Source.

Misc

Miscellaneous is often where the gems are.

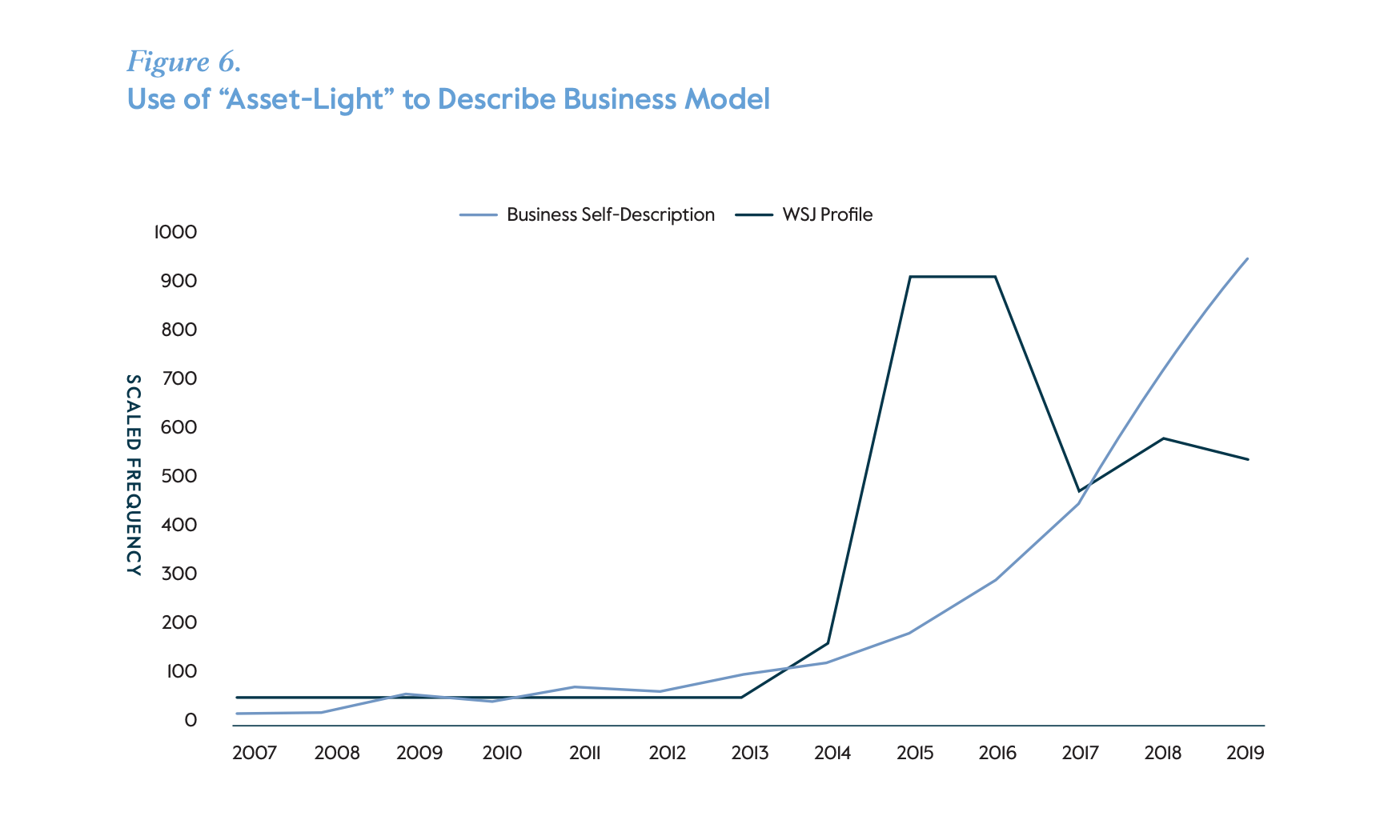

Asset Light

- Suddenly, “size,” “footprint” and “incumbency” came to be understood as an expensive legacy rather than a competitive advantage. Investors wanted companies that were smarter instead of larger, as reflected in the new patois of sell-side flipbooks which now marketed businesses as “agile,” “disruptive,” “nimble” and – especially – “asset light”.

- Nice chart demonstrating this.

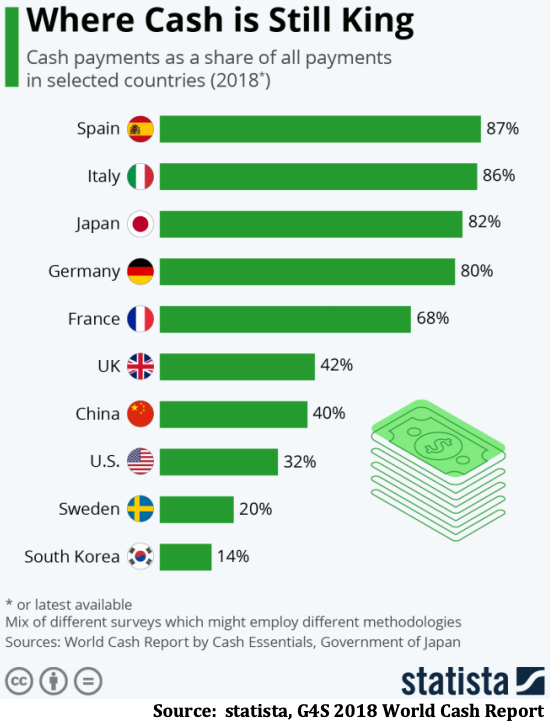

Cash Payments

- Interestingly Cash payments still dominate in many countries.

Active Concentrated Portfolios

- A thought-provoking piece (first one in the link) arguing against concentrated equity portfolios – the orthodoxy of the day.

- Concentrated portfolios are built on the idea of “analytical certainty” which lends itself easily to “overconfidence” and “overweighting hubris”

- Institutions that hold several such concentrated portfolios, thereby diversifying, might find instead they suffer from other forms of correlation – in terms of stock size (large cap) and style (quality or growth).

- They will also find that the higher fees charged by concentrated active portfolios add up and don’t average down.

- Most interestingly concentration “underweights luck” – that term most fund managers have pushed deep into their subconscious.

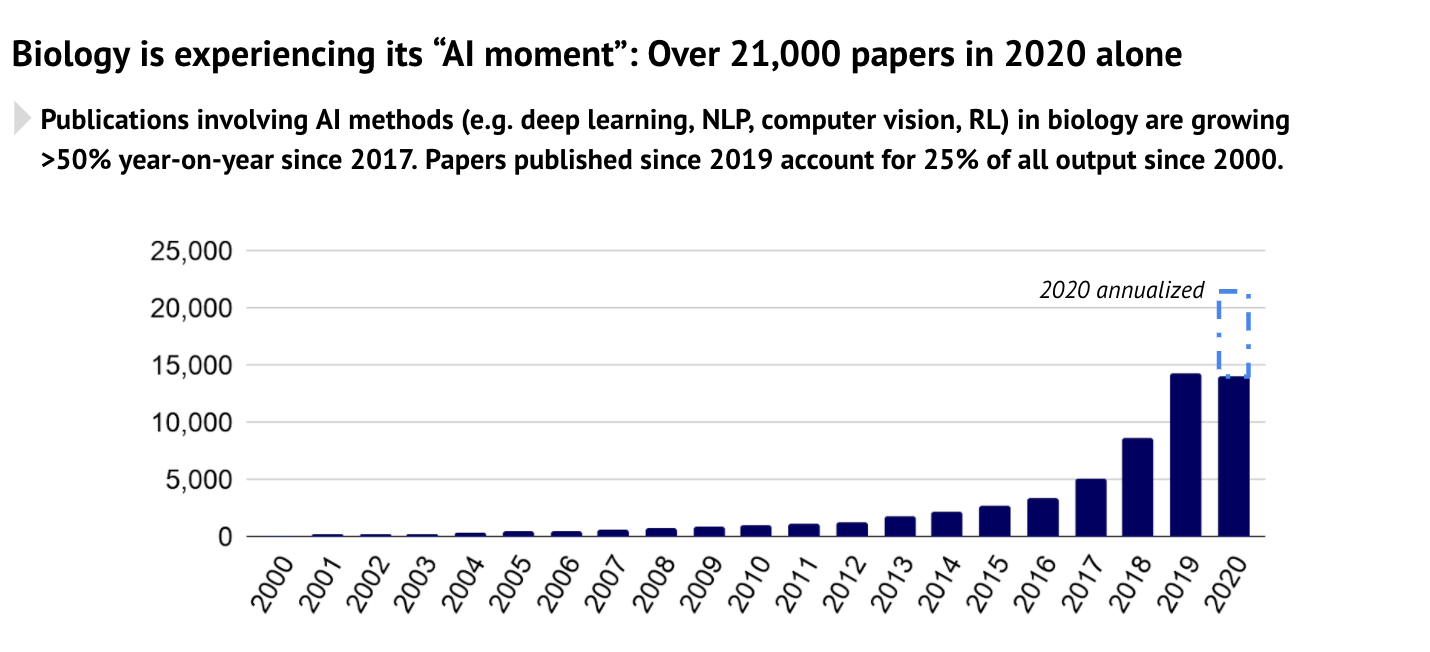

AI 2020

- A long, detailed and technical presentation on the state of AI in 2020.

- This is an interesting chart showing how AI research/use is exploding in biology. Slides 30-36 and 83-92 cover this topic in depth.

- h/t Ben Evans.

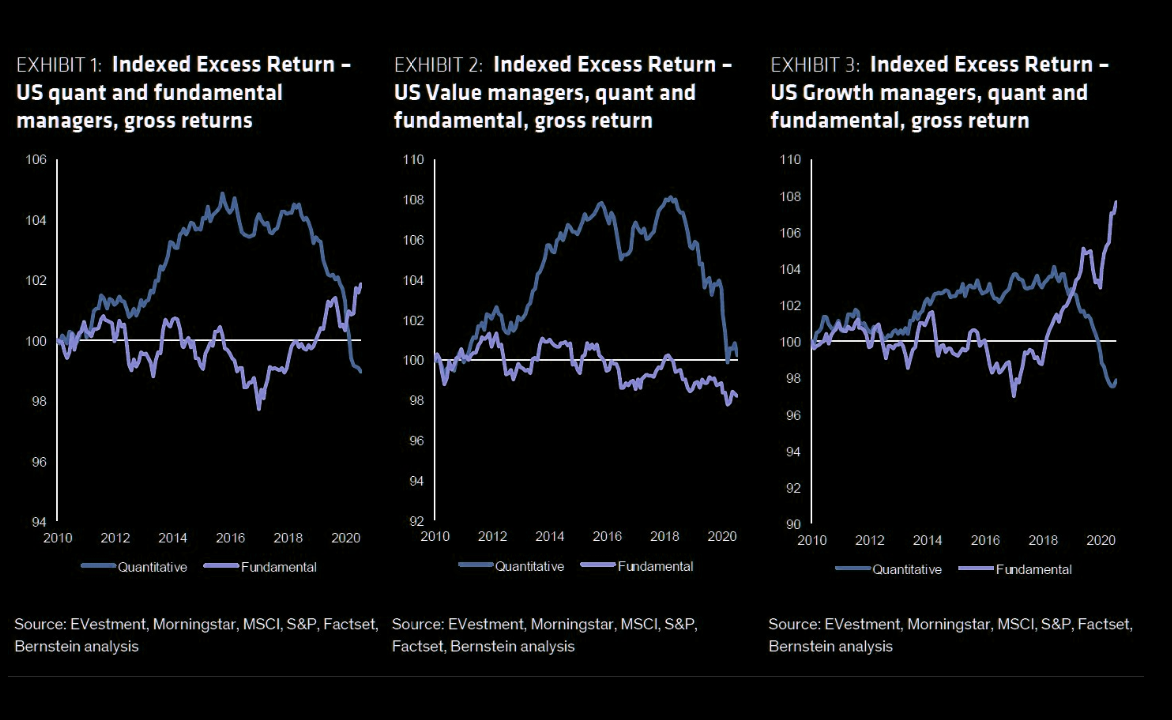

Quant Funds

- Comparing US Quant fund returns vs. fundamental managers, overall and split by style (value and growth).

- Fundamental is now winning out for first time in ten years.

- Source.

Airline Industry

- Really good long read from Guardian on the state of the airline industry.

- What it takes to store planes at Schipol is fascinating:

- Fuel tanks were emptied, although not entirely: “You still need some weight in the plane, for the bursting wind we get here in Amsterdam.” The blades of the engine fans were locked into place with straps, so that, on gusty days, they didn’t whirl around endlessly and wear their parts out.

- Every seven days, someone would climb into the plane and run the engines for 15 minutes to keep them functional. The air conditioning was switched on to keep the humidity at bay. “And the tyres – well, it’s the same as a car. If you keep a car parked for more than a month, you get flat tires,” Dortmans said. So a tug pulled the plane forward and back every month, to keep the wheels and axles in shape.

- Still, there were some surprises. In the absence of the roar of jets, birds began to appear around Schiphol again, and one day, a ground engineer told Dortmans that he’d found a bird starting to nest in a cavity in the auxiliary power unit. “I’m hearing all these birds and now I find this,” he told Dortmans. “It feels like I’m out in the woods.”

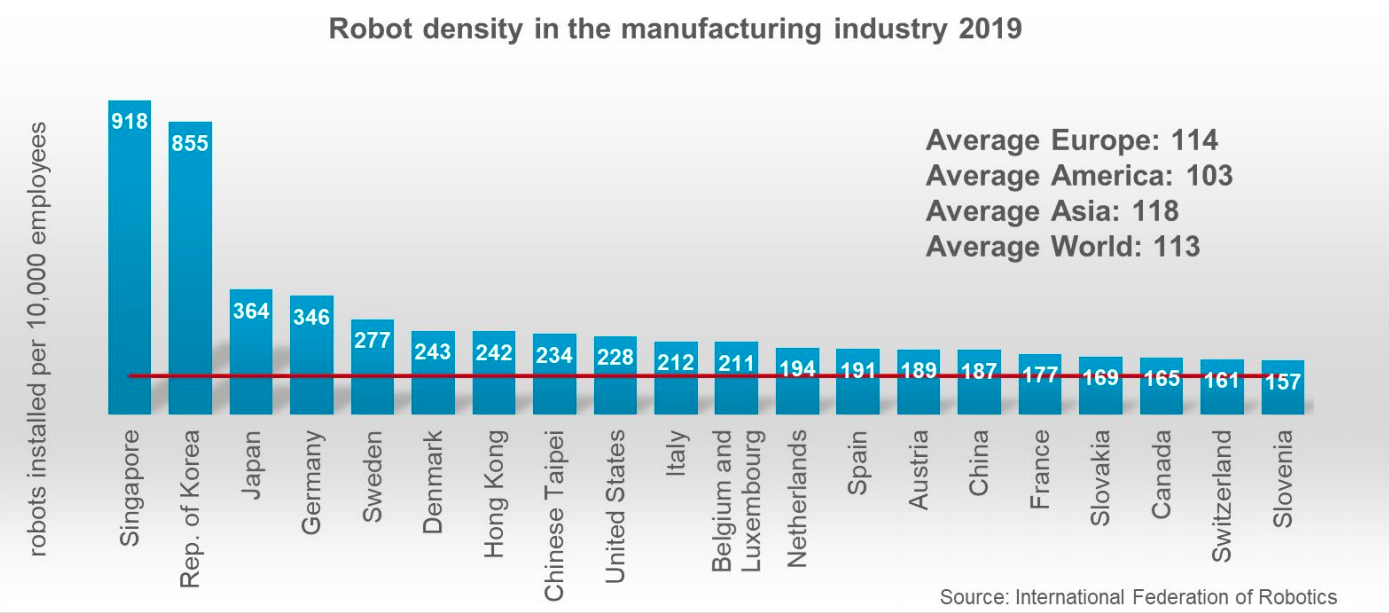

Robots

- A nice chart from a very interesting presentation by the international federation of robotics.

- Asian countries stand out in terms of installed robots per capita.

Gen-Z

- Useful presentation for anyone trying to make sense of Generation Z (35% of the global population).

Marketplaces for Assets

- Very comprehensive post on the landscape of companies involved in financialising new asset classes or democratising access to existing ones and creating markets.

- “Whether it’s the long tail of “alternative alternative” assets, venture-backed company shares, software contracts, or sport teams the financialization of everything is on its way.”

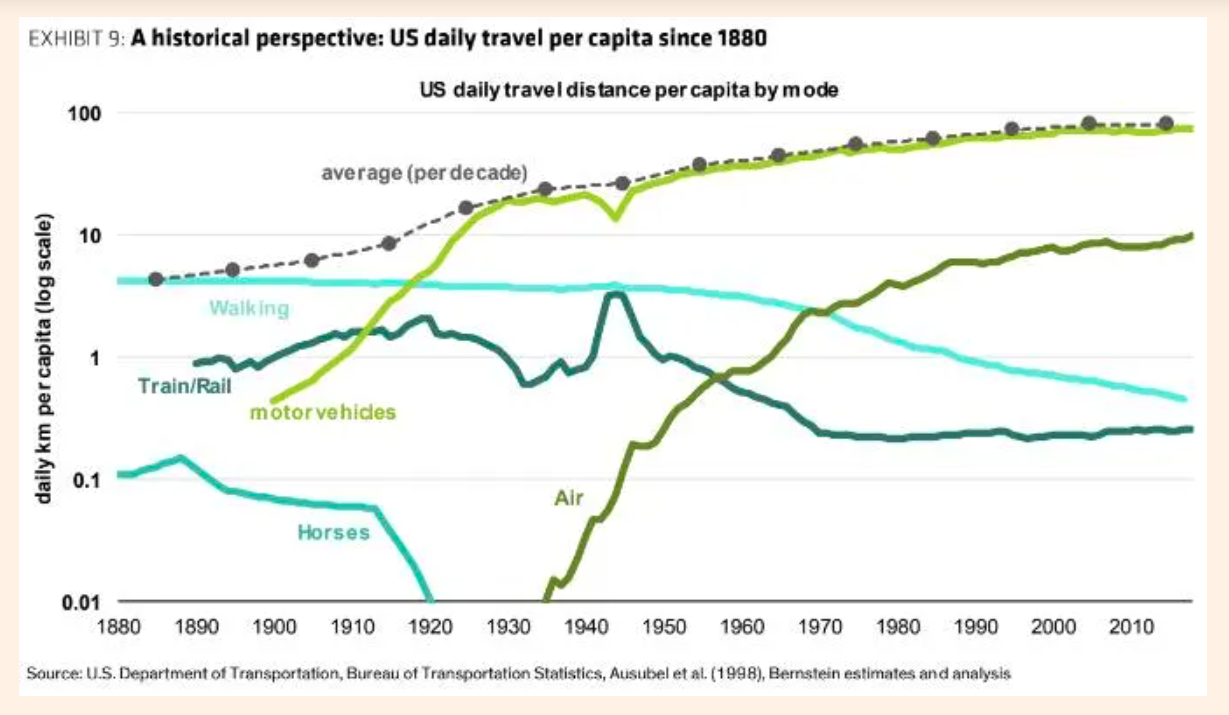

Mode of Travel

- Nice chart showing US daily travel per capita by mode.

- Motor vehicles dominate.

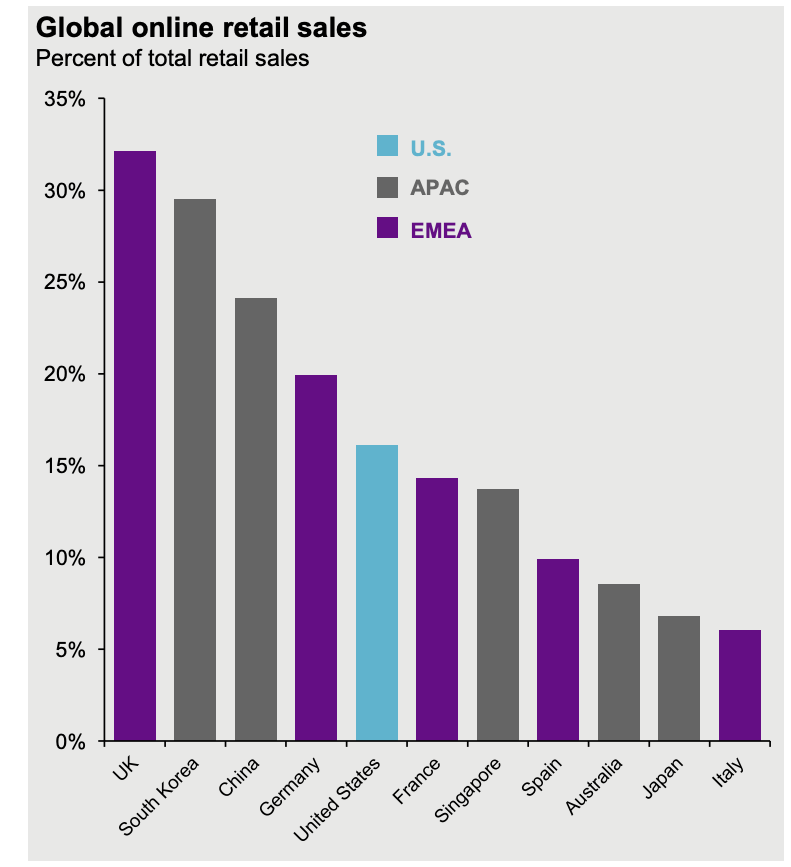

eCommerce Sales

- Percentage of retail sales from eCommerce by country.

- Source.

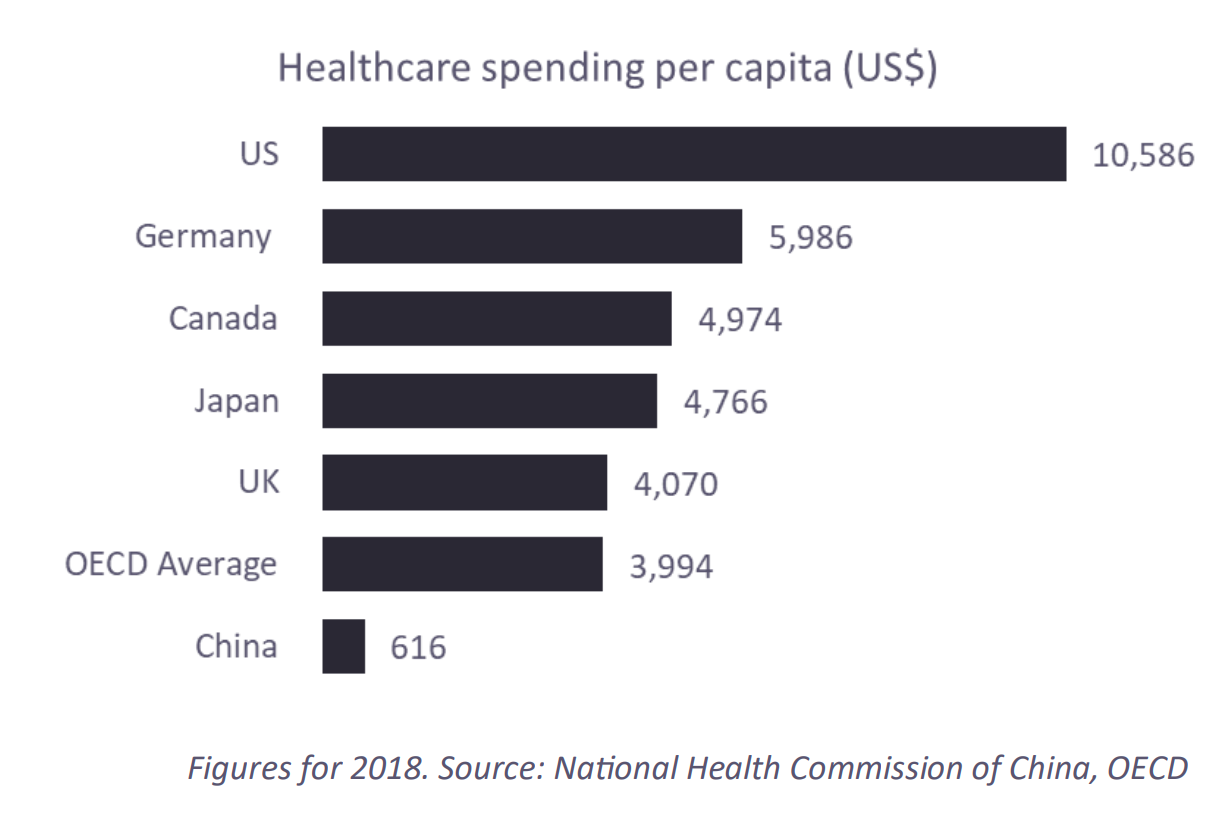

Healthcare in China

- “To say that healthcare in China is a growth story is an understatement: despite the country’s per capita spending growing at 16% p.a. over the past 18 years, it is still only 1/7th that of the UK and1/17th that of the US.“

- “Consider the country’s changing demographics: in 1970, the median age was 19 years; today that figure is 38, and by 2040 it is projected to be 47.“

- “As people age, they tend to experience more ailments, which require more (and costlier) treatments: according to Bernstein, Americans aged 25 or younger use five prescriptions per year, while those aged 65 or older use a whopping 46 scripts!“

- Source.

Pension Funds

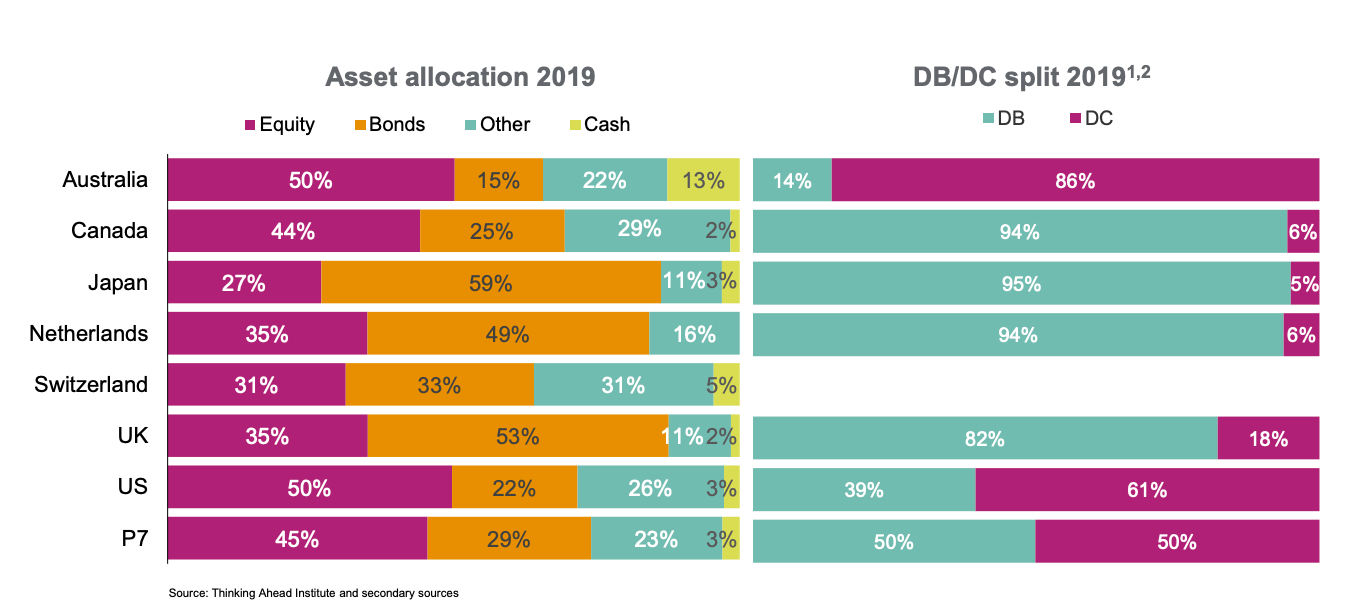

- Interesting chart showing the asset allocation of pension fund assets and the split between defined contribution and defined benefit in different countries.

- The UK really stands out.

- For the top 7 countries (P7) the allocation to equities has been reduced dramatically in favour of “other assets” since 1999.

- Defined contribution has also crossed 50% for the first time last year.

- Source.

Software and Fintech

- Interesting post from a16z on how SaaS software companies are adding financial services – thereby greatly expanding revenue opportunities.

- Intriguing to see it going from reselling to embedding financial services.

The Box

- A great podcast on how container shipping started and revolutionised the world by a historian who wrote the book on the subject.

- “Container didn’t just happen. Its adoption required huge sums of money, both from private investors and from ports that aspired to be on the leading edge of a new technology. It required years of high-stakes bargaining with two of the titans of organized labor, Harry Bridges and Teddy Gleason, as well as delicate negotiations on standards that made it possible for almost any container to travel on any truck or train or ship. Ultimately, it took McLean’s success in supplying U.S. forces in Vietnam to persuade the world of the container’s potential.“

Forecasting

- A nice post reminding us, with supporting studies, that most forecasting isn’t very good whether it is recessions, GDP, interest rates, exchange rates etc.

- And yet we persist – “To understand the extent of our forecasting fascination, I analysed the websites of three management consultancies looking for predictions with time frames ranging from 2025 to 2050. Whilst one prediction may be published multiple times, the size of the numbers still shocked me. Deloitte’s site makes 6904 predictions. McKinsey & Company make 4296. And Boston Consulting Group, 3679. In total, these three companies’ websites include just shy of 15,000 predictions stretching out over the next 30 years.“

Bessemer Memos

- Bessemer Venture Partners are famous for publishing their anti-portfolio.

- Recently they took to learning from their success and published a series of memos from some of their most successful venture investments.

- “One pattern that consistently emerges is that Bessemer’s best investment decisions centered on people. In retrospect, the early products themselves are barely recognizable today. Rather, passionate, analytical and relentless founders zigged and zagged their way to that elusive “product-market fit”, and these memos provide a glimpse of those winning entrepreneurs before they were famous.“

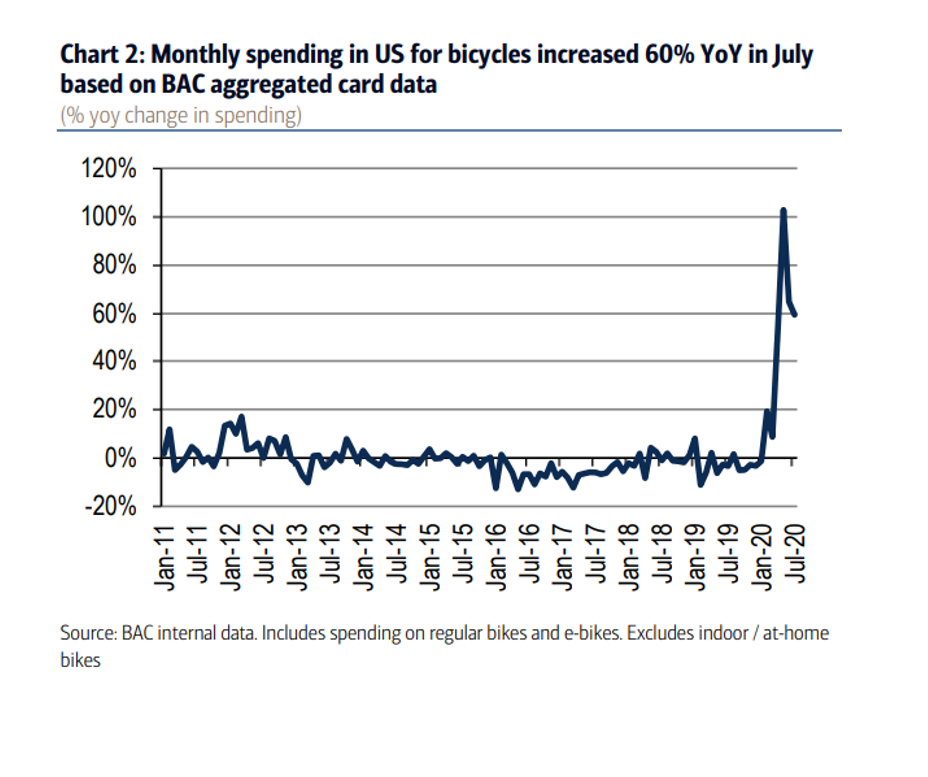

Bikes

- Spending on bikes, using Bank of America (BAC) aggregate card data, has roofed it.