- Nice chart (h/t Ritholtz).

- “It took nearly a century for the flush toilet to approach 80% household penetration. Electricity took 30 years to get to 80%; Refrigerators 20 years; cell phones 15 years; Social media 12 years.“

Misc

Miscellaneous is often where the gems are.

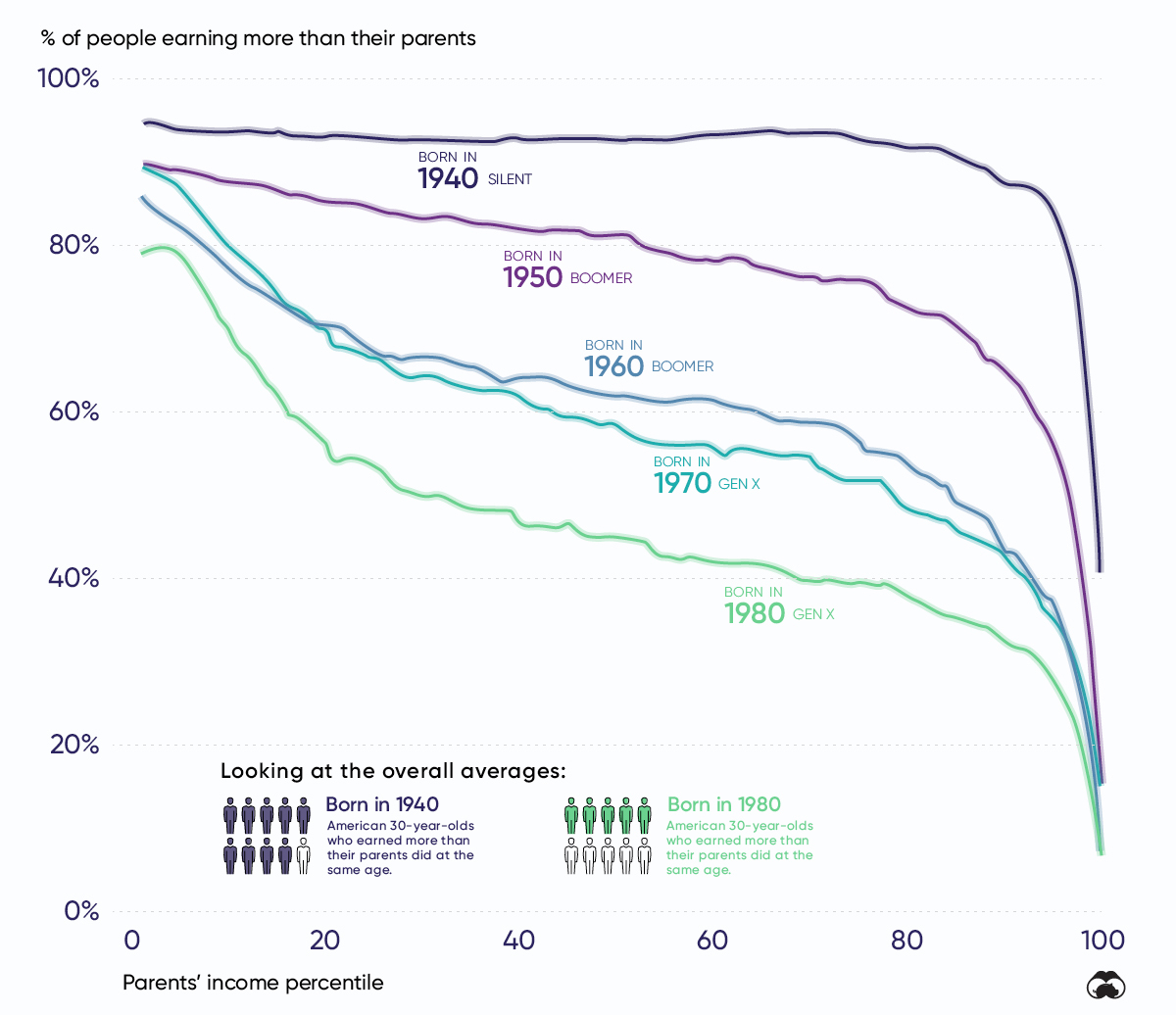

Income Mobility

- Interesting chart on income mobility in the US.

- “This graphic plots the probability that a 30-year-old American has to out earn their parents (vertical axis) depending on their parent’s income percentile (horizontal axis). The 1st percentile represents America’s lowest earners, while the 99th percentile the richest.“

- Take the 50th percentile (“middle class”) – the probability of someone out-earning their parents has fallen precipitously – it was 93% for people born in 1940 and dropped to 45% for those born in 1980.

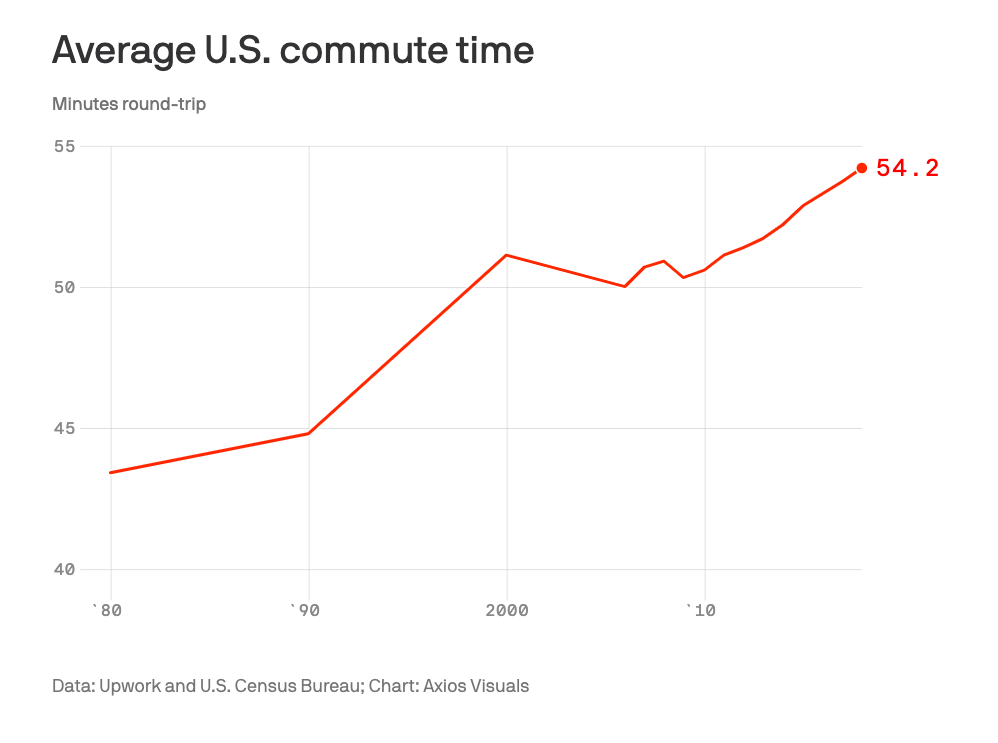

Commuting

- Average commute times in the US have crept up 11 minutes since the 1980s, equal to nearly two whole days a year lost.

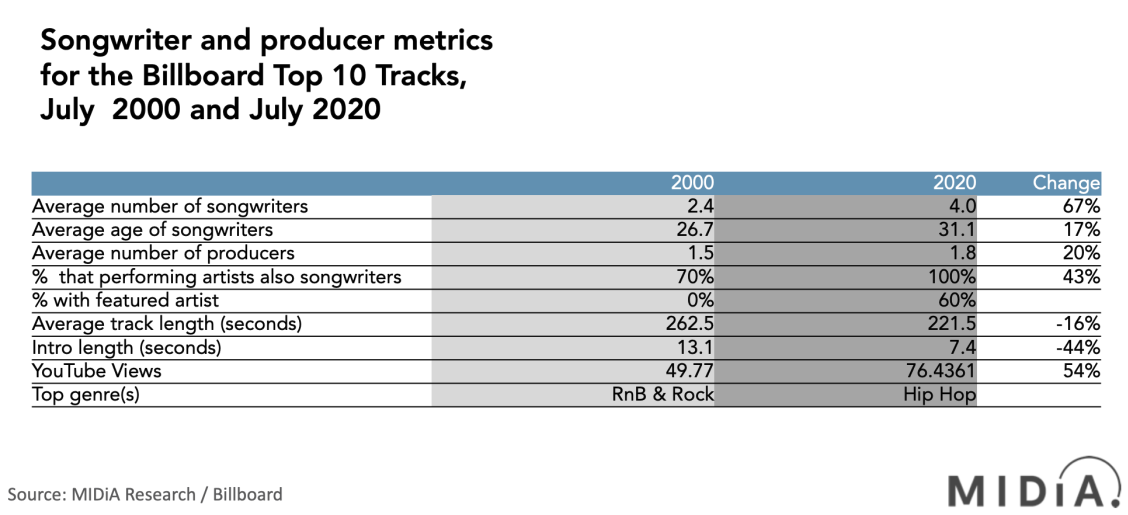

Two Decades of Hits

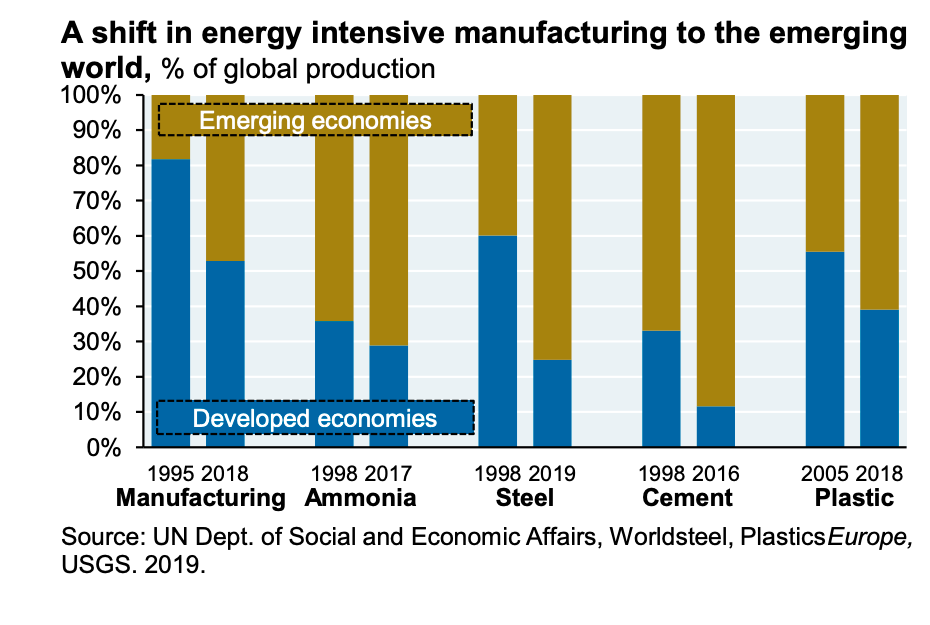

Emissions and Emerging Countries

- It is well documented that the CO2 intensity (CO2 per unit of economic growth) of the world has improved.

- However the level of emissions keeps going up, with recent increases mostly coming from emerging economies.

- The reason? These countries have taken the burden of de-industrialisation by the developed world over the last 25 years.

- As the chart shows – this has taken the form of a shift of carbon-intensive manufacturing of steel, cement, ammonia and plastics.

- These goods are produced both for domestic needs but also for export to the developed world.

- Sourced from the brilliant JPM Energy Outlook note.

History of Fraud and Short Selling

- A fascinating post on the history of fraud and how short sellers and the media uncover it – with clear parallels to Wirecard today.

- As Jim Chanos put it – “It is short sellers who are the real time financial detectives, whereas the regulators are often financial archaeologists.”

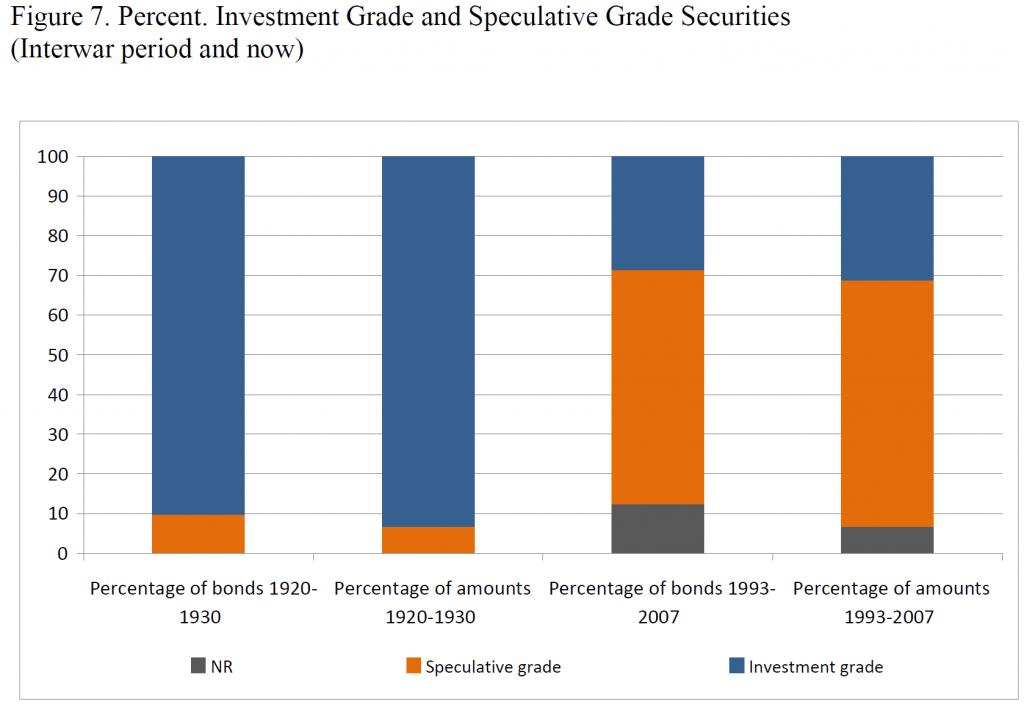

- Interesting chart showing how speculative grade bonds dominated as the role of underwriters changed.

Sellside Economists

- Funny, but often true, ten rules to being a sellside economist.

- How to get attention: If you want to get famous for making big non-consensus calls, without the danger of looking like a muppet, you should adopt ‘the 40% rule’. Basically you can forecast whatever you want with a probability of 40%. Greece to quit the euro? Maybe! Trump to fire Powell and hire his daughter as the new Fed chair? Never say never! 40% means the odds will be greater than anyone else is saying, which is why your clients need to listen to your warning, but also that they shouldn’t be too surprised if, you know, the extreme event doesn’t actually happen.

- Recession watch: … So the best approach is to emphasise the dangers of recession but claim this is at least 18 months away. If it happens sooner, you can say you correctly warned about the dangers. If there is no recession you can simply postpone your forecast and hope nobody remembers.

Ride Hailing Impact on Emissions

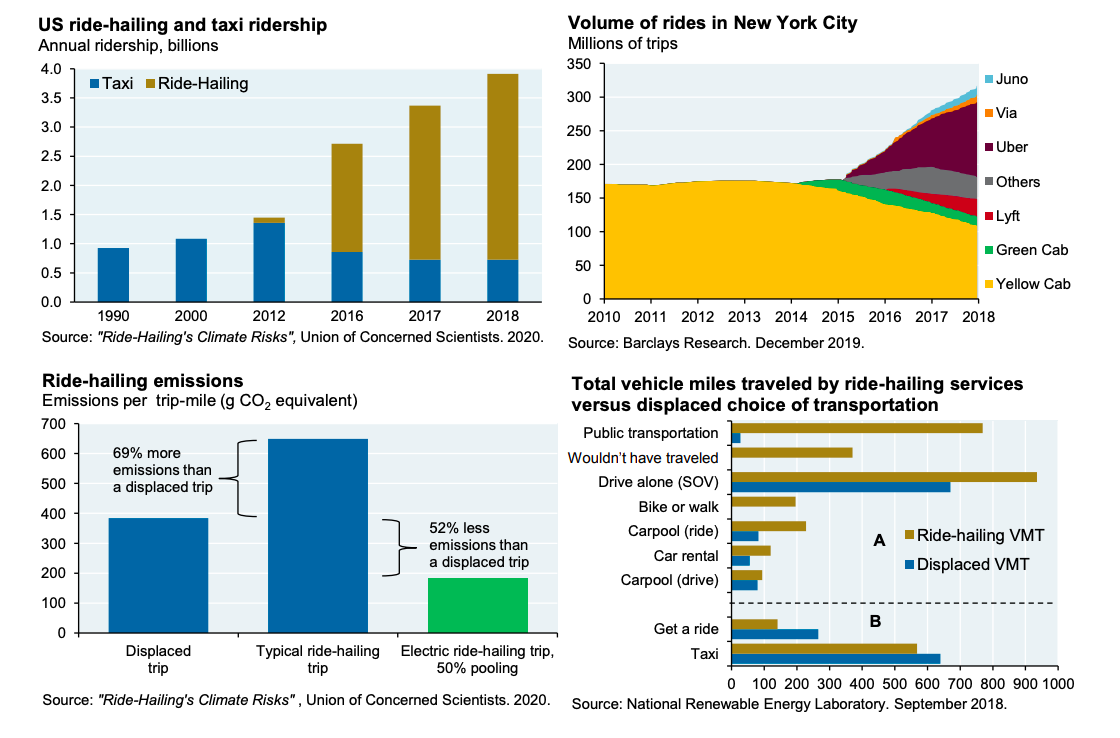

- Is ride-hailing good for the green house gas emissions?

- “The answer from several recent studies is straightforward: after accounting for people who would have taken public transport, biked or walked instead, and those who would not have traveled at all, there’s a substantial net increase in estimated vehicle miles traveled and emissions from ride-sharing, possibly as large as 60%-80% compared to a world with no ride-sharing at all”

- Charts tell this story – (clockwise) a surge in ride-hailing in the US including NYC coupled with increased emissions per trip and miles travelled compared to the category they replace.

- Sourced from this great note on Energy market outlook.

Ten Attributes of Great Investors

- A classic by Michael Mauboussin.

- Many of the ideas are familiar and simple but nonetheless powerful.

- h/t Safal Niveshak.

Patent Power

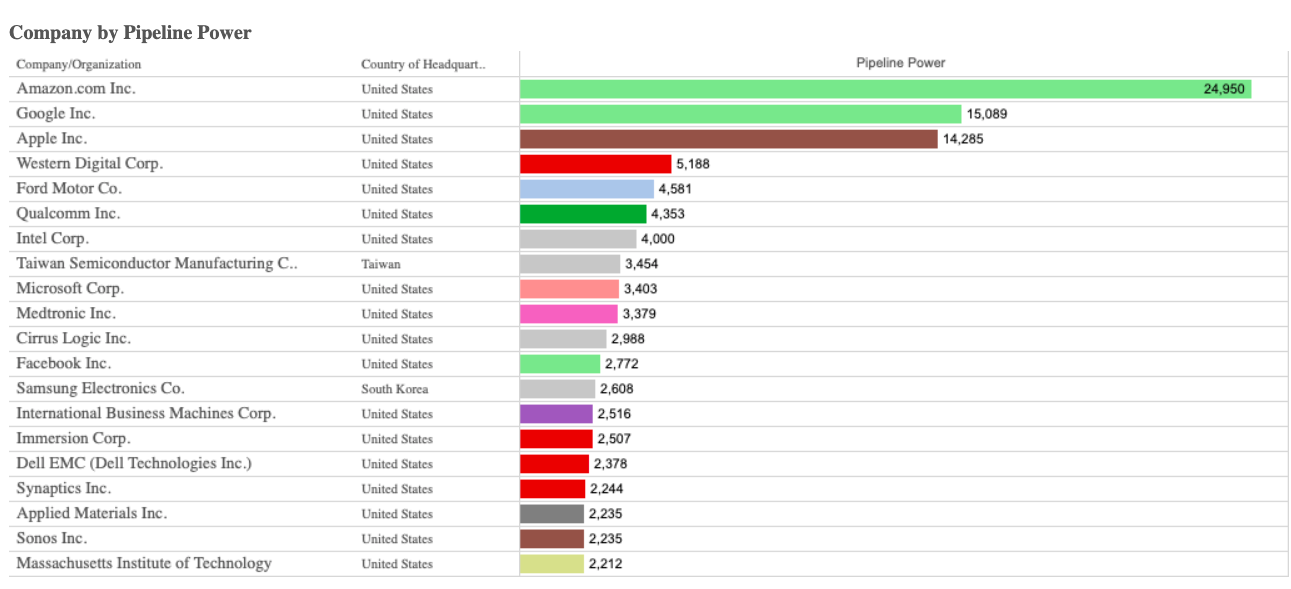

- An interactive table of the tech world’s most valuable patent portfolios.

- This chart shows the top 20 companies overall. Clicking through it’s possible to rank by industry.

- Usual suspects at the top but interesting to see companies like Cirrus Logic and Sonos making it.

- For an explanation of how the Pipeline Power score – which takes into account the value rather than the raw quantity of patents in a portfolio – is derived click here.

- NB Sadly the data is slightly dated (from 2017) but likely still very relevant.

Illiquid Investments

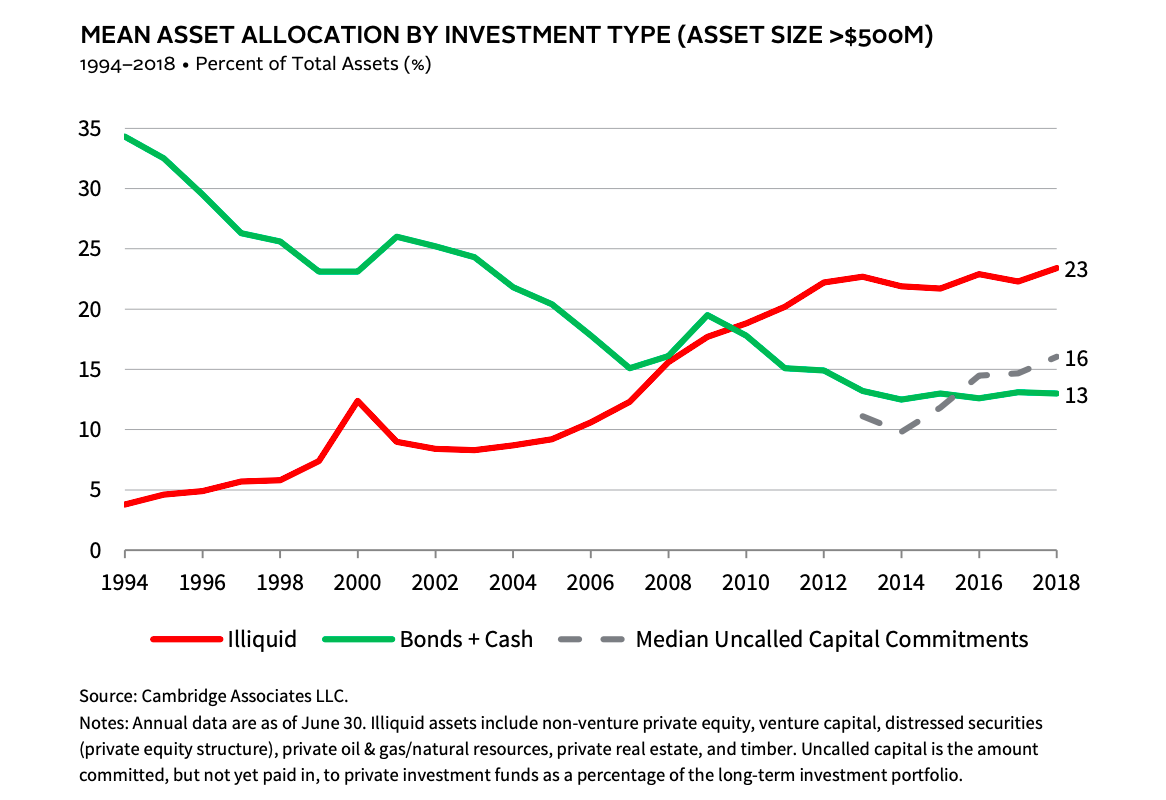

- The popularity of illiquid investments has risen strongly over time.

- As shown in this interesting chart from a Cambridge Associates report.

- It depicts the asset allocation of endowments with greater than $500m assets.

- These entities now hold 23% in private investments up from 8% 15 years ago.

- In addition the median institution also holds 16% of their portfolio in uncalled capital commitments to private investment.

- All this has serious implications in terms of liquidity.

DARPA and Innovation

- It helps to study organisations that have been innovating consistently.

- One such organisation is DARPA.

- Since 1958, it has been a driving force in the creation of weather satellites, GPS, personal computers, modern robotics, the Internet, autonomous cars, and voice interfaces, to name a few.

- This fascinating and thorough article, or more precisely a self describe “collection of atomic notes”, attempts to explain why DARPA works in search of creating a private sector funded “ARPA”.

- The section on program managers is worth a look as the characteristics described there are also those that make good investment analysts.

Lessons

- An absolutely brilliant ten bits of advice by Milton Glaser, the famous graphic designer. Each one a gem.

- “It makes me nervous when someone believes too deeply or too much. I think that being skeptical and questioning all deeply held beliefs is essential. Of course we must know the difference between skepticism and cynicism because cynicism is as much a restriction of one’s openness to the world as passionate belief is. They are sort of twins.”

UK Online Nation Report

- Comprehensive report with loads of stats on “what people in the UK are doing online, how they are served by online content providers and platforms, and their experiences of using the internet, alongside business models and industry trends.“

- 71% of all online time is spent on mobiles now, yet half of over 75 year olds don’t use the internet at all.

- 39% of online time by adults was spent on Google or Facebook owned sites, and these two control 79% of UK online ad revenue.

Quantum Computing Patents

- China is leagues ahead in quantum computing patent filings.

- Source: ML.

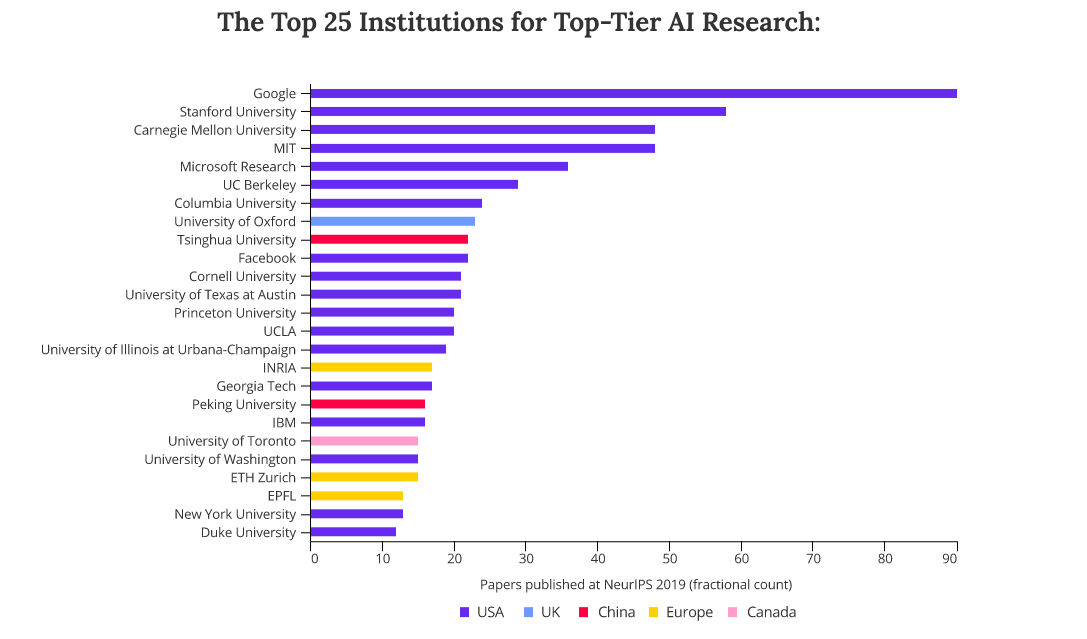

Artificial Intelligence

- This dataset tracks the flow of talent in AI around the world.

- The chart shows the top 25 institutions for AI research.

- “The United States has a large lead over all other countries in top-tier AI research, with nearly 60% of top-tier researchers working for American universities and companies. The US lead is built on attracting international talent, with more than two-thirds of the top-tier AI researchers working in the United States having received undergraduate degrees in other countries.”

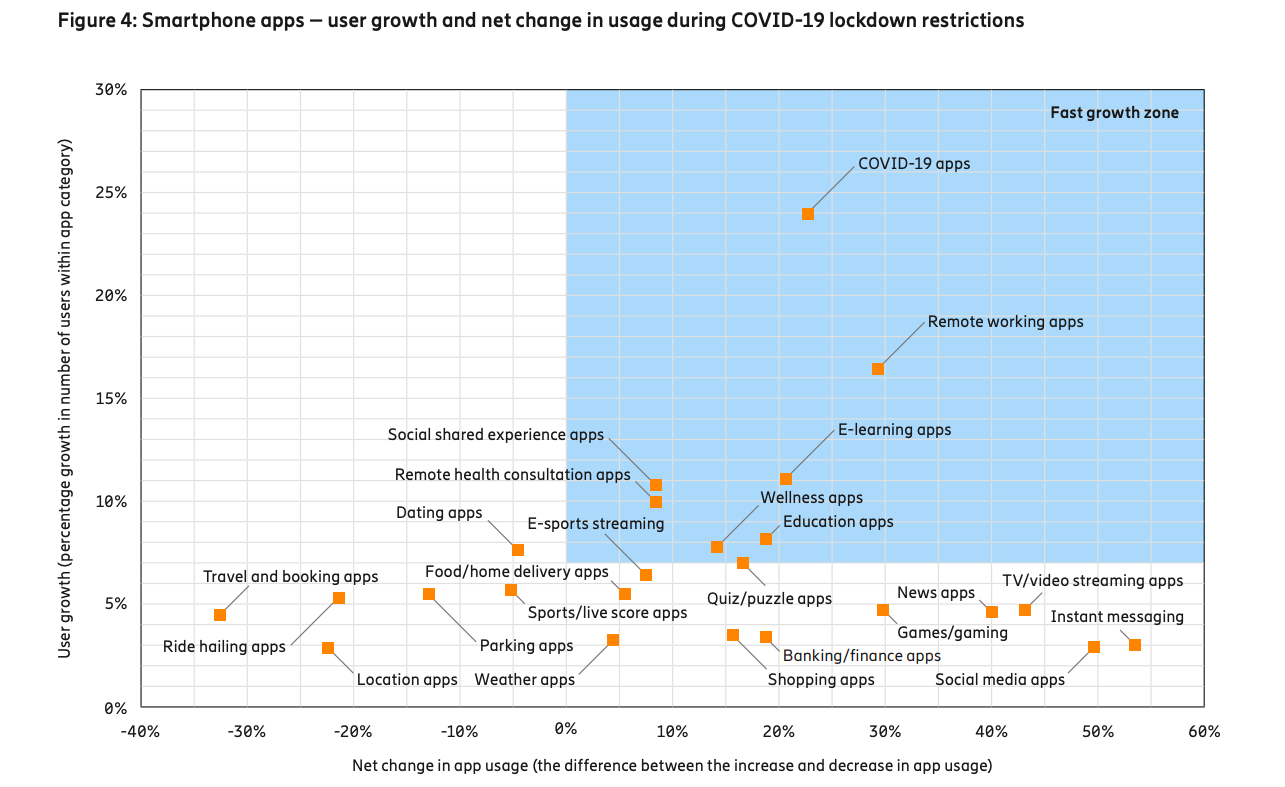

App Usage and Covid

- Neat chart that shows smartphone apps by user growth and usage.

- Some apps are managing to both attract new users and increase usage.

- Source.

Passion Economy & Disruption

- An insightful post about how the passion economy will disrupt traditional competitors.

- Passion economy is the ability of “new digital platforms enable people to earn a livelihood in a way that highlights their individuality.“

- Disruption happens as “these workers can develop new products/services that serve previous non-consumers and over-served consumers. This means that across different industries, new Passion Economy platforms have the potential to disrupt incumbents.“

Forecasting is Hard

- Phil Tetlock has spent 30 years studying forecasting and has written a must read book on the subject.

- It turns out that there are characteristics that make a better forecaster. One needs to be like a fox (these ideas are explained in detail here).

- This is a fascinating article that, in five steps, brings to life Tetlock’s work in the current Covid environment.

Poker Psychology

- As opposed to some video games, where probabilities are tweaked to psychologically hook players, in poker “the probabilities are what they are: they don’t accommodate. Instead, they force you to confront the wrongness of your intuitions if you are to succeed. “Part of what I get out of a game is being confronted with reality in a way that is not accommodating to my incorrect preconceptions,””

- This from a brilliant article by a psychologist learning to play poker.

- Our beliefs are skewed because small samples don’t mirror large ones, that this leads to the emergence of the gamblers fallacy, but perhaps this bias actually has positive advantages through an internal locus of control and our understanding of luck.

- All have clear relevance to investing.

- For a full 1 hour podcast from the author – head here.