- A long term chart of portfolio turnover for US based mutual funds.

- 1975 saw a big rise as trading commissions were de-regulated and bid-ask spreads were moved from 1/8th basis.

- The next 30 years has seen a precipitous decline.

- NB. Turnover is defined as the lower of the total amount of securities purchased/sold divided by total net asset value of the fund.

- Source.

Misc

Miscellaneous is often where the gems are.

Peter Thiel

- A fascinating article about Peter Thiel.

- “Wherever there’s a major shift in the American landscape in the past half-decade—be it political or cultural—there, somewhere on the donor list of the political campaign, or among the investors in the controversial technology, is Peter Thiel.“

Marc Andreessen Interview

- Brilliant interview with Marc Andreessen.

- Full of insights on a multitude of topics.

- On investing he says – “It’s really, really, really hard to be a good poker player. And if you’re kicking yourself every time you have a bad hand, the bad habits just simply happen. You just need to be able to have a system that lets you think through the process…“

Doing Business in Japan

- If you have ever invested in Japanese stocks it can feel like learning all over again.

- This is a really great article written by a westerner fluent in Japanese who has spent his whole professional career in Japan including starting a business.

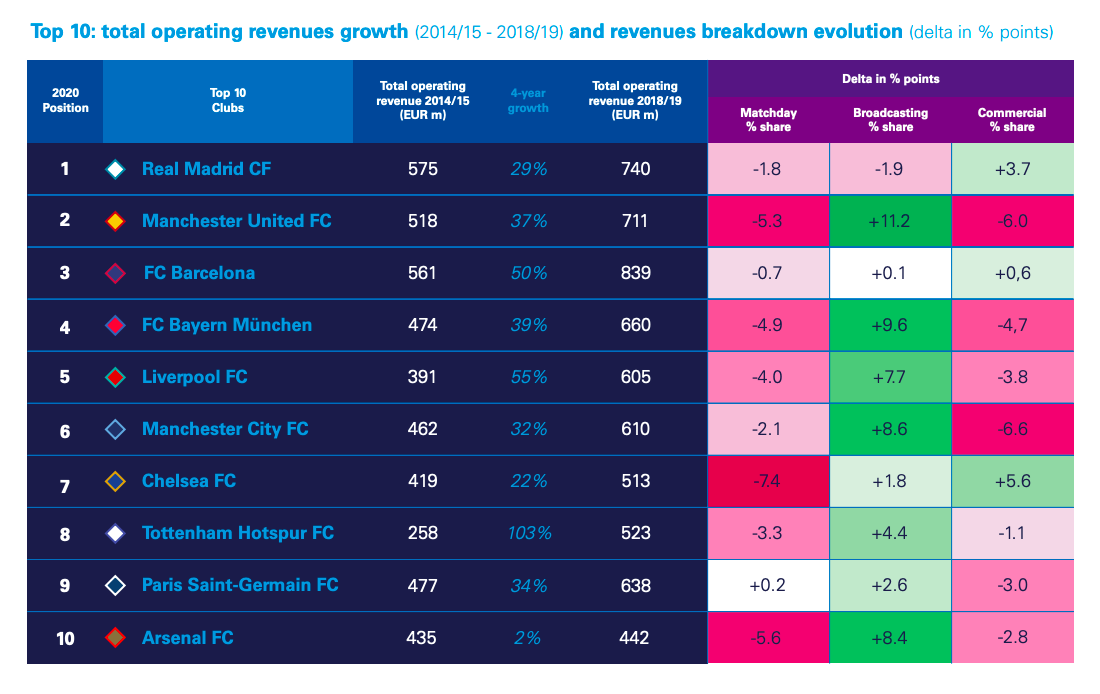

Football Clubs

- Interesting report from KPMG on valuation of football clubs.

- There are actually several listed football clubs – Manchester United, AS Roma, Juventus, Borussia Dortmund, Celtic, Lazio to name a few.

- Attached is an interesting table showing operating revenue evolution as well as how the revenue split between matchday, broadcasting and commercial has evolved.

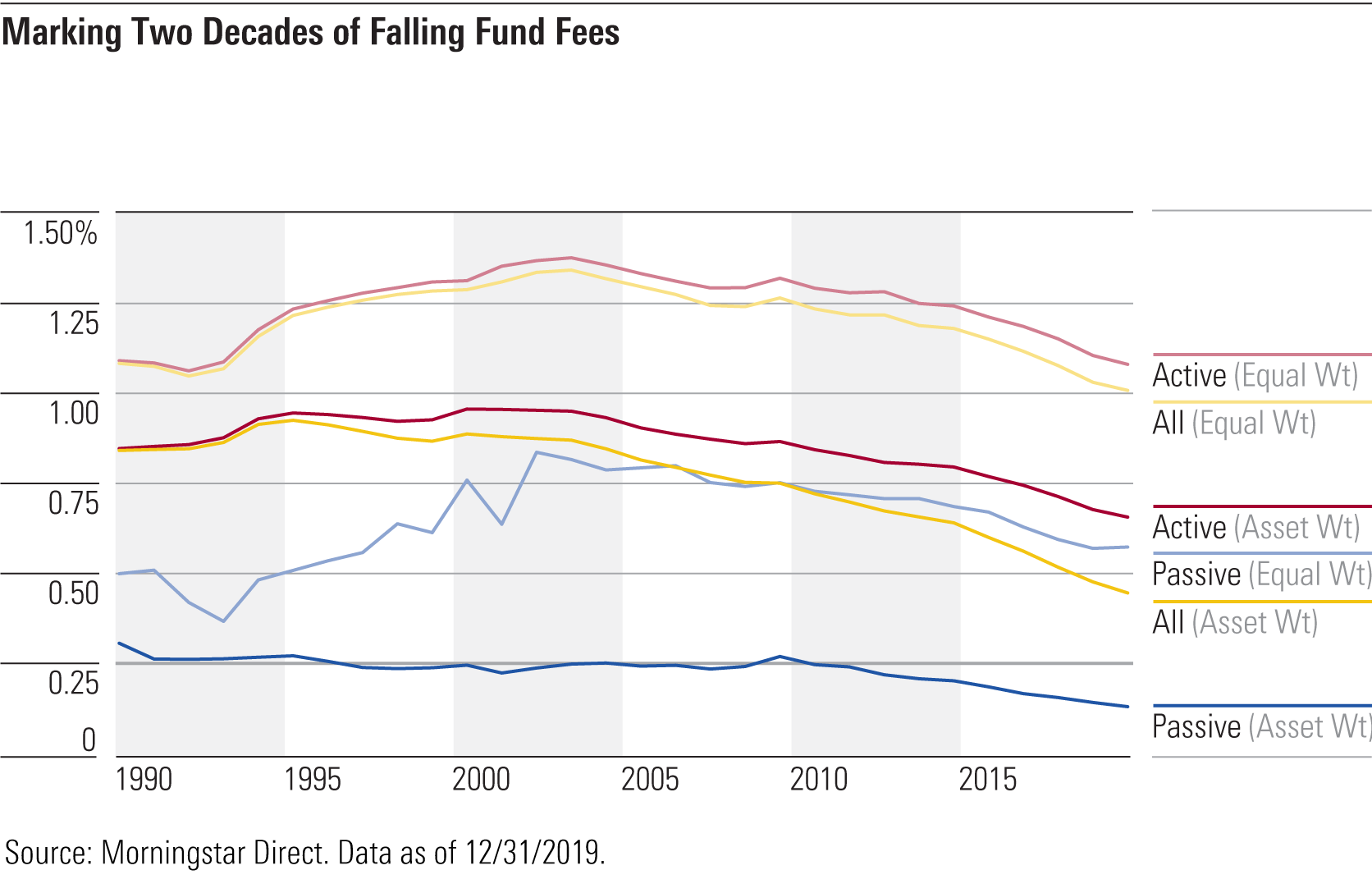

Asset Management Fees

- This is an interesting chart showing two decades of falling fees in the US investment management industry.

- Fees have fallen across the board, particularly for passive funds.

- More data in the Morningstar piece.

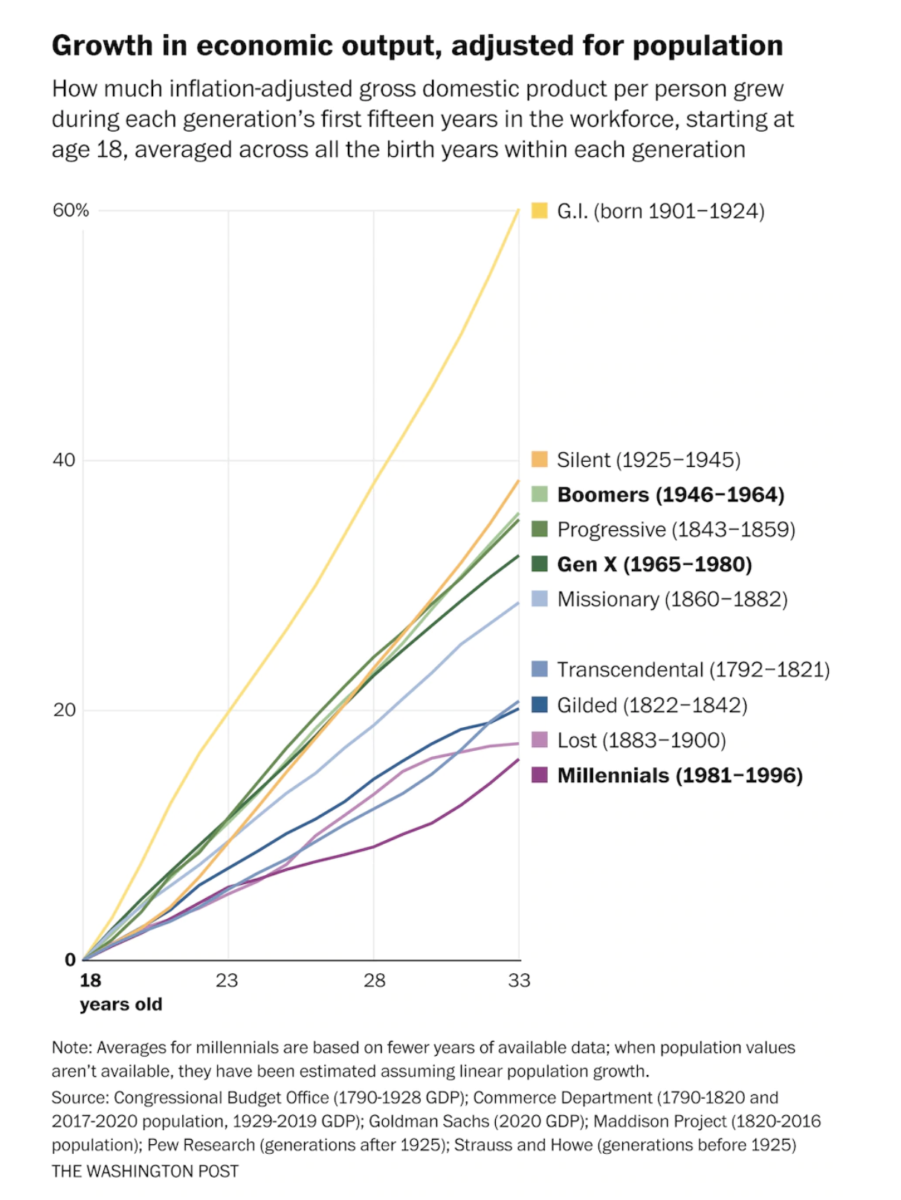

Millennials

- Fascinating article on how millennials have suffered economically.

- “Chart depicts inflation adjusted GDP growth per person for each generations first 15 years in the work force (from age 18) averaged across birth year for each generation“.

- h/t The Big Picture.

George Soros

- An old but fantastic article on George Soros.

- Interesting lessons here on buying into bubbles, reflexivity (that markets can influence the events they anticipate), instinct (the famous back pain he gets) and mistakes.

- “He once asked Byron Wien, an investment strategist and friend, why he went to work every day. Why not work on the days when it makes sense to do so, he asked, when there is something special to be done?

- Wien replied: “George, one of the differences between you and me is you know when those days are and I don’t.”

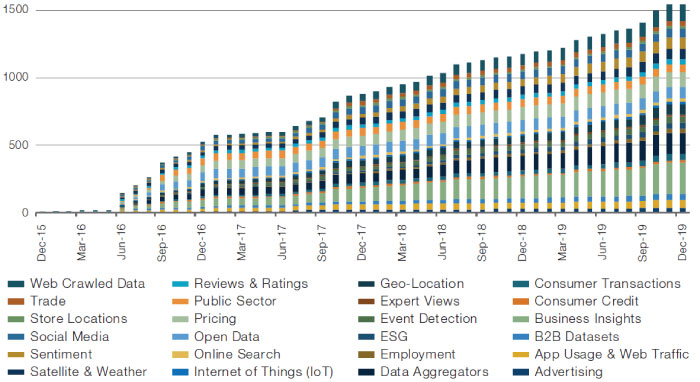

Alternative Data

- A must read article on the rise of alternative data in the investment management industry from the Man Group Institute.

- This chart shows how the supply of this data has exploded.

- Demand has also followed.

- The article contains plenty of warnings and things to be mindful of including – methodology, data quality, historic length, data lag, various biases, scope, governance and crowding.

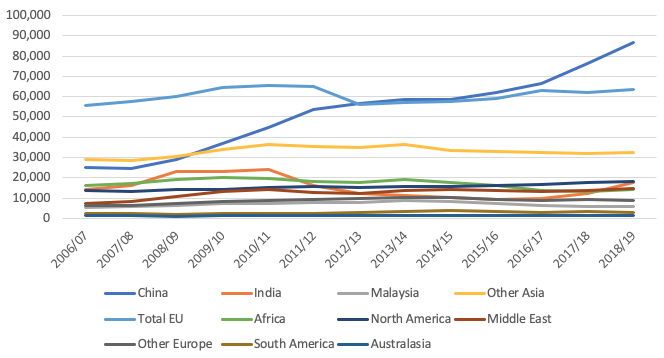

UK Universities

- Good article on the possible future financial difficulties faced by UK Universities as a result of the Covid-19 pandemic.

- This chart shows that from 2006 to 2019 the number of Chinese students (paying full fees) in UK universities increased from 25k to 90k.

- Fees are by far the most important source of income.

- It is unclear what Covid-19 impact will be next year but as suggested it could just be short term liquidity issue for universities.

Making Mistakes

- Making mistakes in investing is normal.

- One of the better investment books around is exactly about that.

- A personal favourite was when Stanley Druckenmiller got himself involved in Tech stocks at the top of the dot-com bubble.

- “Druckenmiller knew exactly what he was doing – he just couldn’t stop himself. ‘I bought $6 billion worth of tech stocks, and in six weeks I had lost $3 billion in that one play. You asked me what I learned. I didn’t learn anything. I already knew that I wasn’t supposed to do that. I was just an emotional basketcase and couldn’t help myself. So maybe I learned not to do it again, but I already knew that.‘”

Planting Trees

- Fascinating article arguing that planting trees is not all that good.

- Trees wreak ecological havoc especially in naturally treeless environments and the species planted is vital.

- They are also not panacea for climate change and in many cases treeless landscapes are actually better for the Earth.

Howard Marks Interview

- Interview with the investing legend Howard Marks.

- Always worth a listen.

- “No amount of sophistication is going to allay the fact that all of your knowledge is about the past and all your decisions are about the future.”

The Investor Game

- An interesting post taking a step back and understanding the investment landscape as a game including appreciating the other players and stages of development.

- “Each year around 100,000 new college graduates apply for internships at investment banks. Around 10,000 get a spot. After three years of banking boot camp, roughly 4,000 of these analysts want to become investors. Add in some analysts from management consulting and accounting firms, plus a handful of lawyers, and you get around 6,000 talented candidates interviewing for buy-side positions. About one in six gets a seat. So imagine a new cohort of roughly 1,000 twenty-somethings joining 15,000 existing analysts and portfolio managers at hedge funds, and another 30,000 long-only investors.”

How to get your first 1,000 users?

- This is an inspiring post on how some of the biggest consumer apps acquired their earliest users.

- Pinterest’s strategy was eye catching and shows real hustle – “We did all kinds of pretty desperate things, honestly. I used to walk by the Apple store on the way home. I’d go in and change all the computers to say Pinterest. Then just kind of stand in the back and be like, “Wow, this Pinterest thing, it’s really blowing up.”

- Snippet Finance – While we are on this topic, I’d like to take this opportunity to thank our subscribers and hope you are enjoying the content. A lot of effort goes into curating and selecting only the most valuable snippets to inform and inspire. The best thing you can do to support the site is spread the word – each of you might have one person you know who could benefit, please do send them a link and tell them about it. Thank you in advance.

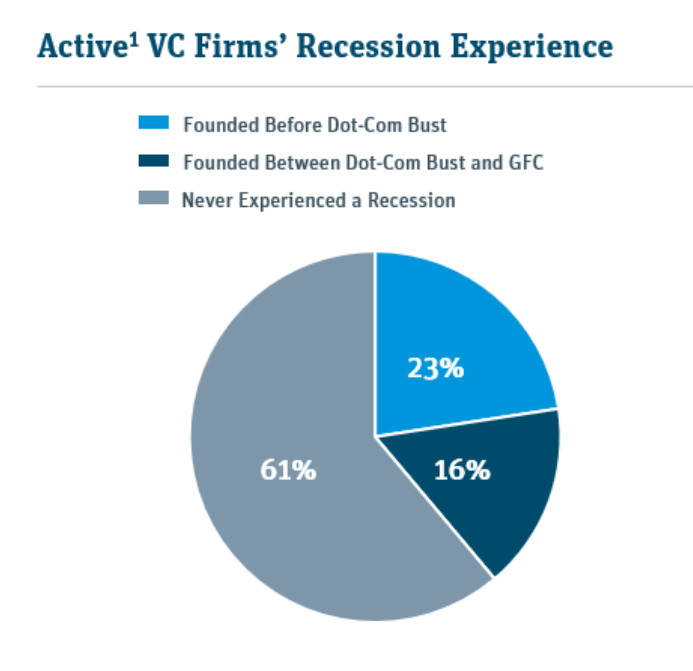

Venture capital & experience

- Experience matters in venture capital.

- Venture capital funds who were founded before the dot-com bust had a much lower variation in performance during the financial crisis of 2009.

- Worryingly, the majority (61%) of today’s crop of VCs have never seen a recession or economic trouble.

Commencement Address

- A really great commencement address (h/t Farnam Street)

- Part of a series commissioned by the Atlantic for students missing their’s due to the pandemic.

- It describes “the theory of maximum taste” … read for yourself to discover what that is.

- On the topic of commencement addresses, this is a brilliant one from J.K. Rowling given to the Harvard class of 2008. A must see.

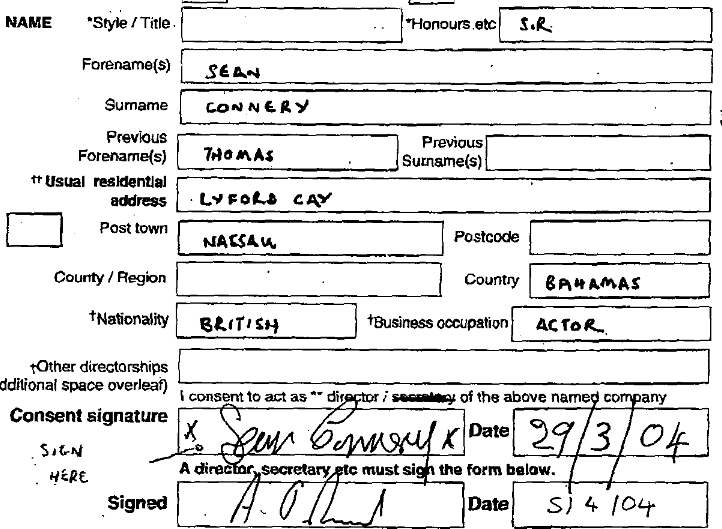

Autographs

- Really fun blog post where a blogger went through Companies House to find autographs of famous people signing corporate documents.

- Here is Sean Connery.

- For more check out the link.

Commodity ETFs

- This is a great article explaining why you should be very careful when investing in commodity ETFs.

- For a more in-depth analysis of the most recent action in USO specifically worth reading the last few articles in FT Alphaville’s ETF series.

- Always use common sense when investing money – read the fine print.

68 Bits of Unsolicited Advice

- Really fantastic list of 68 bits of advice.

- Some choice quotes.

- “Rule of 3 in conversation. To get to the real reason, ask a person to go deeper than what they just said. Then again, and once more. The third time’s answer is close to the truth.”

- “Separate the processes of creation from improving. You can’t write and edit, or sculpt and polish, or make and analyze at the same time. If you do, the editor stops the creator. While you invent, don’t select. While you sketch, don’t inspect. While you write the first draft, don’t reflect. At the start, the creator mind must be unleashed from judgement.”

- h/t The Browser.