- This chart, from FTAlphaville, shows the distribution of the number of words used to describe adjusted EBITDA by different companies.

- In some cases running longer than the Declaration of Independence text.

Misc

Miscellaneous is often where the gems are.

Creative Idea Generation

- This is an interesting list from Rory Sutherland’s new book.

- The concept is how one should let go of logic in order to generate brilliant ideas.

- An interesting exercise is to think how these ideas can help in investing.

- “Being logical makes you predictable, and your competitors will know what you’re going to do before you do. This is because using logic will very likely land you in the same place as everyone else, and sharing a market space with competitors this way creates a race to the bottom. Instead, figure out the logic model of your competitor, find where their use of it is too narrow and exploit this.“

- h/t The Browser.

Quant Private Equity

- The quant hedge fund Two Sigma is moving into private equity.

- They have raised a $1.2bn fund.

- Will be interesting to see if quant methods can be applied to private markets.

Guiding Principles

- A bit off topic for Snippet but these guiding principles from Jim Simons, the founder of one of the most successful funds ever – Renaissance Technologies, are worth a quick absorb.

FundSmith Letter

- The latest letter from FundSmith is worth a read.

- Wide ranging discussion including thoughts on trading charges (see table page 5), tirade against value investing (page 7), and comment on Woodford (page 10) .

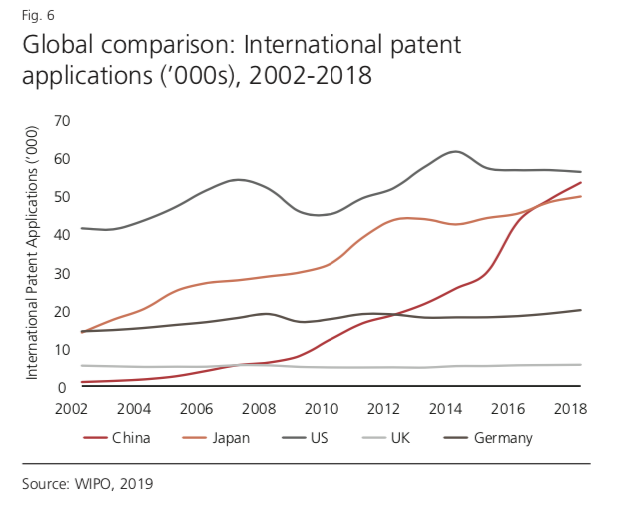

Global Patent Applications

- We showed how research spending in China now rivals US.

- China is also on its way to overtaking US in patent applications.

Last names

- Most popular last names in every country and what they mean.

- Picture shows Europe but link has the entire world.

How Things Change

Free Coding Classes?

- Check out 42 Silicon Valley.

- “42 Silicon Valley is a college-level, tuition-free, computer programming school with a peer-to-peer learning environment. Learn the skills you need here to begin your career as a Software Engineer, for free.“

- It was started French billionaire Xavier Niel.

How to Invest in Start-ups

- A really great article by Sam Altman.

- An interesting perspective on how to invest in winners.

- “There is a lot of advice about how to be a good startup founder. But there isn’t very much about how to be a good startup investor. Before going any further, I should point out that this is a particularly hard time to invest in startups—it’s easier right now to be a capital-taker than a capital-giver.”

- h/t The Browser.

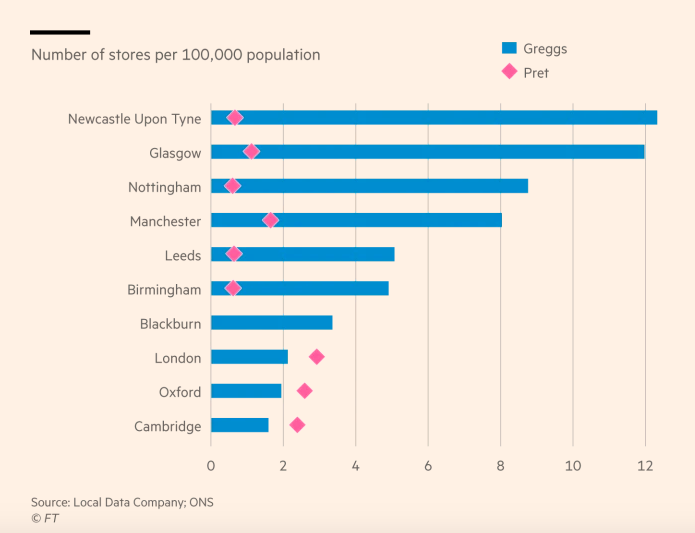

North vs South of England

- Funny chart from FT giving us a way to tell the North from the south of England.

Genetic Diversity

- We all know about the cost of inbreeding.

- As a result it is generally accepted that species should outbreed as much as possible – but did you know there is a cost of outbreeding as well?

- “To produce healthy children, you should marry a third or fourth cousin. Farther out, the genetic costs of outbreeding begin to outweigh those of inbreeding. That was what a cohort study found in examining Icelanders born between 1800 and 1964. Fertility was lower if the woman’s husband was either closer in or farther out (Helgason et al. 2008).“

Animals

- Amazing article on the human impact on animals.

- “We breed and kill at least 80 billion animals per year for food and at least 115 million per year for research. Fishing kills 1-3 trillion animals per year. Deforestation destroys animal habitats. Leaf blowers and light pollution kill insects. Building and vehicle collisions kill at least a billion animals per year. This year, more than 300 birds were injured or killed in collisions with a building in North Carolina in a single night.“

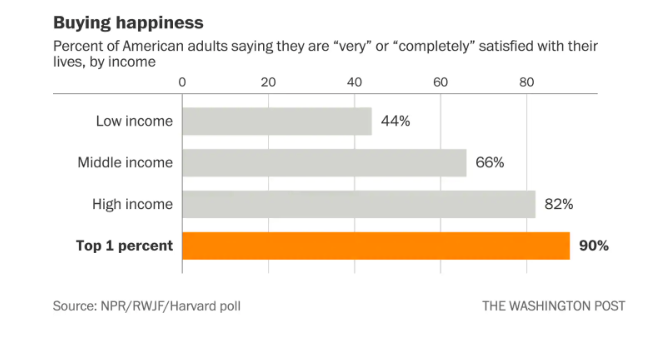

Are the 1% happier?

- Interesting survey from NPR/RWJF/Harvard cited in Washington Post.

- It oversampled those in the top 1% of income distribution and asks about life satisfaction.

- Money does (at least to the $500,000 threshold) correlate to happiness.

- More survey questions in the article.

Latest Howard Marks

- Latest memo from OakTree’s Howard Marks.

- A really interesting read especially in the parallels between investing and gambling.

- A must read.

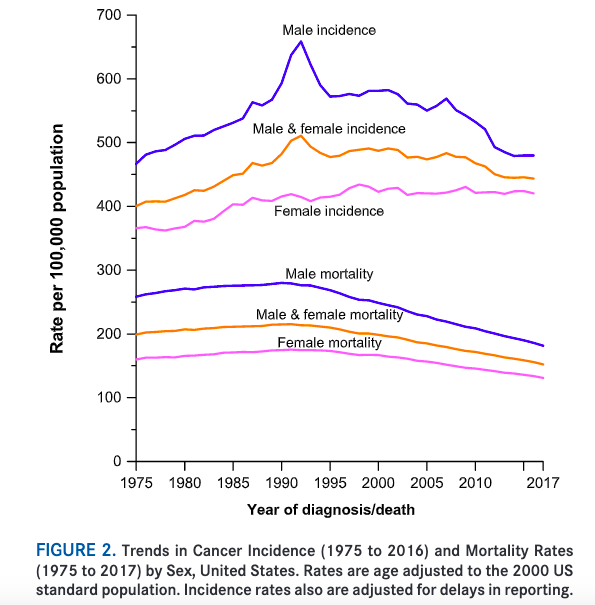

Cancer Mortality Rates

- New stats from the US Cancer Society show that between 1991 and 2017 the mortality rate of cancer has dropped 29%.

- According to the report, this was due to lower smoking rates, improved early detection methods and advances in treatment.

- This trend means more than 2.9m lives were saved since 1991.

- Really amazing.

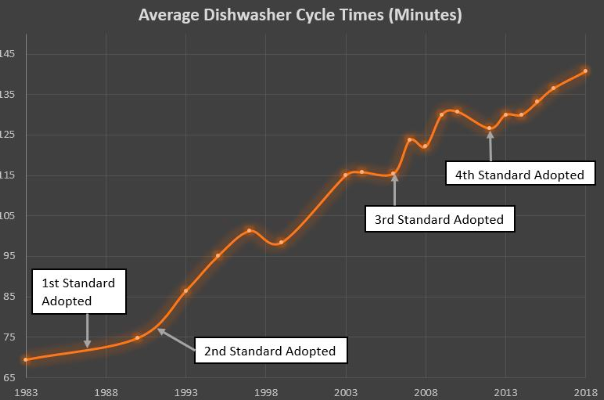

Dishwashers

- Interesting article about what has been going on with dishwashers.

- In summary they have gotten a lot worse.

- In order to reduce water use from the original 15 gallons to 3 gallons, cycle times have increased. The chart (source) is striking.

- The wash results have also gotten a lot worse due to chemical regulation.

- Consumers think that by buying a newer model these problems will be solved but the reality is that an older model will do a better job.

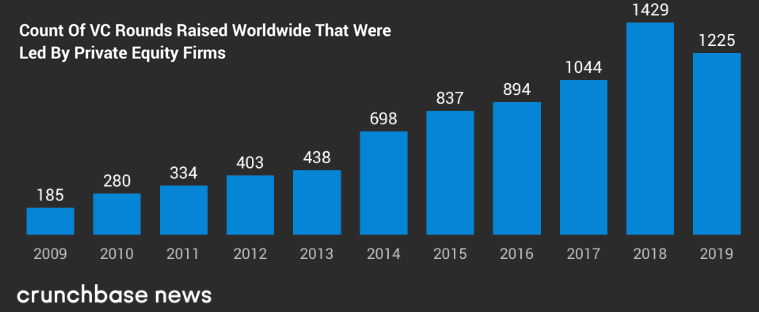

PE getting into VC

- Increasingly private equity (PE) are getting involved in venture (VC).