- 206 slides on the state of tech and media.

Misc

Miscellaneous is often where the gems are.

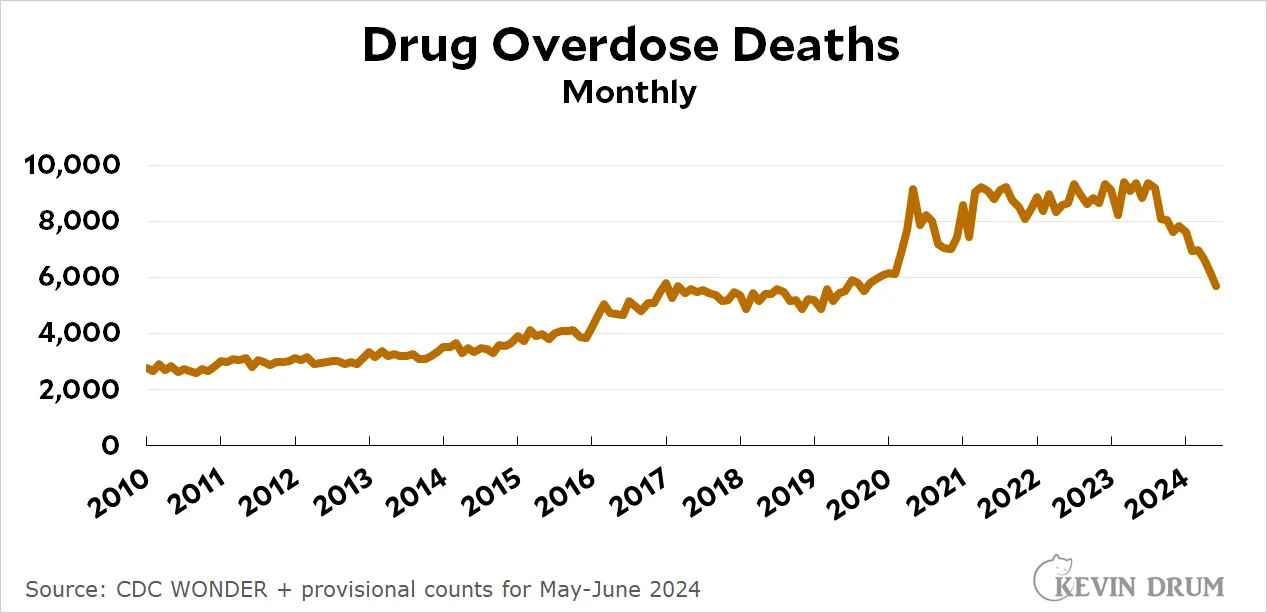

Drug Overdose Deaths are Declining

- This is an encouraging fall after years of unwelcome increase.

- Source.

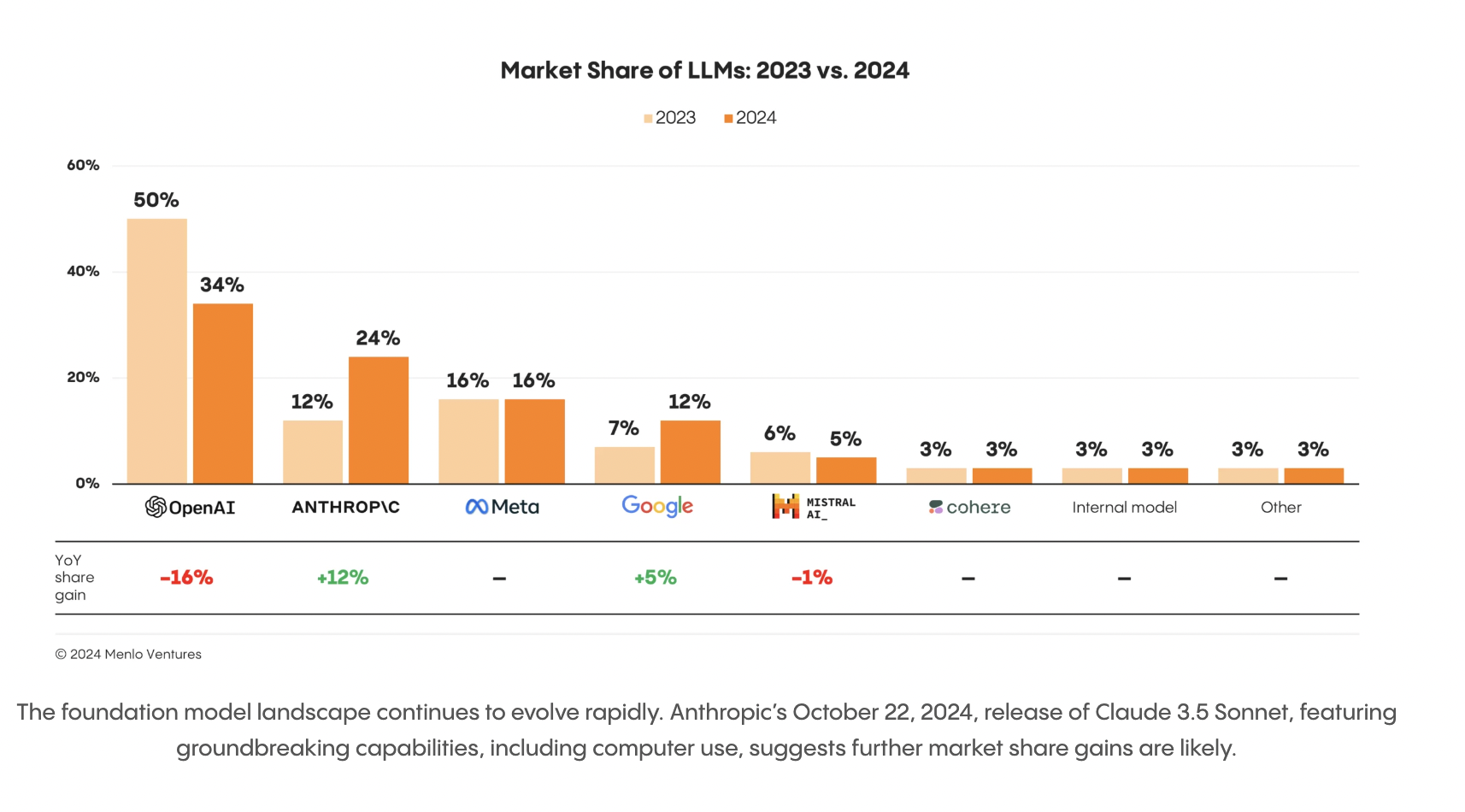

State of Gen AI in Enterprise

- Results from surveying 600 US IT decision makers.

- Plenty of stats and analyses inside.

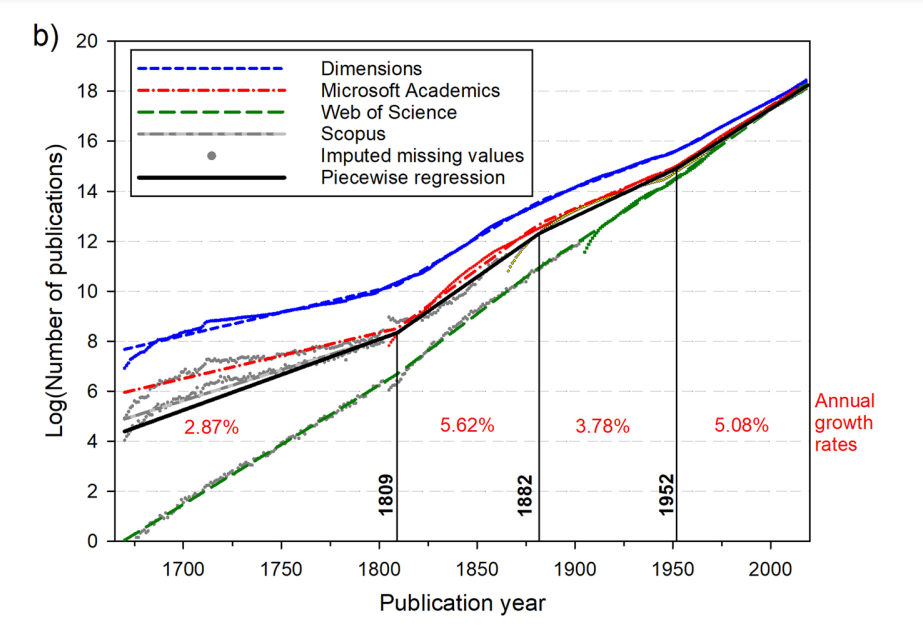

Scientific Progress

- Scientific publications have grown 4.1% pa since 1675, accelerating in the most recent phase to 5.1%.

- Source.

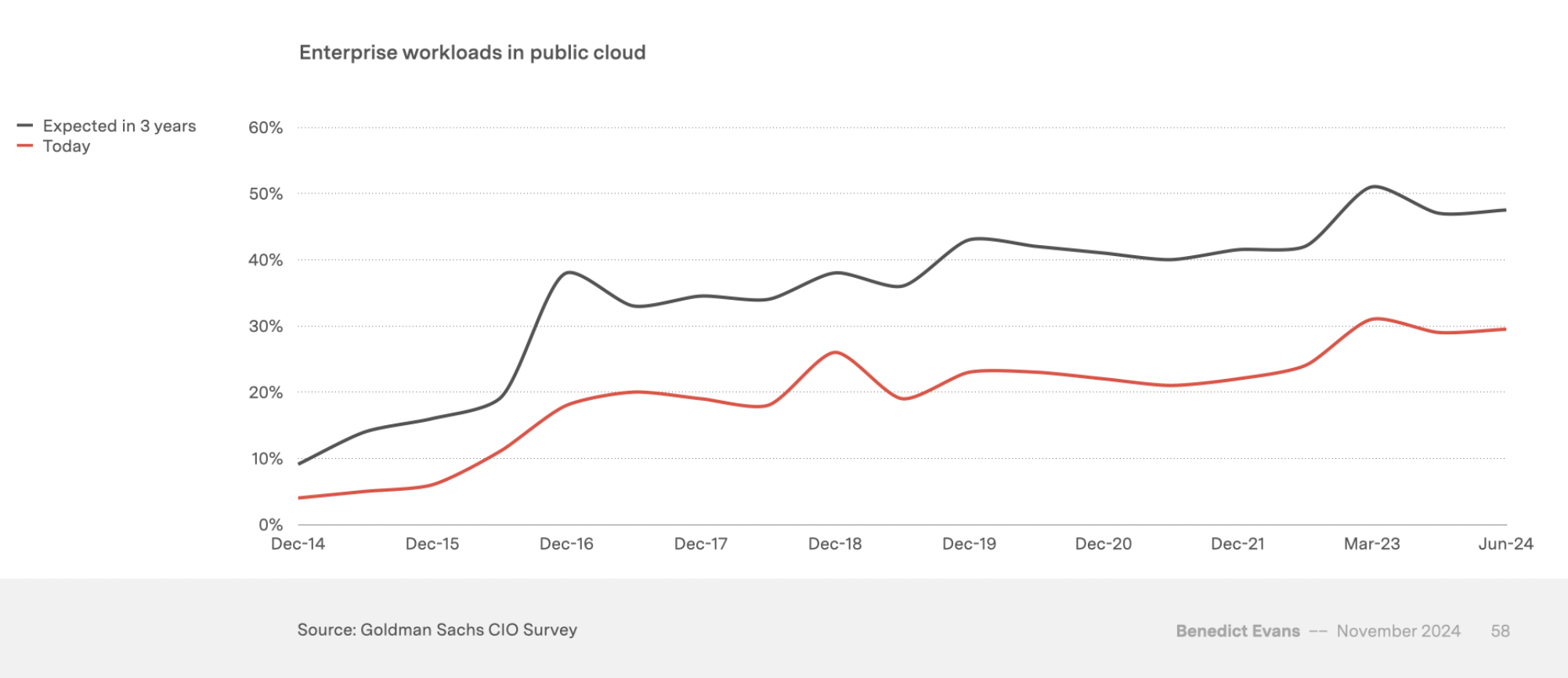

Benedict Evans’ Latest Deck

- A tour of the frontiers of tech through slides.

- AI will take time – even cloud, after all the talk and years, is still only 30% of workloads.

On the Cover of Science

- “Evo is a genomic foundation model that enables prediction and generation tasks from the molecular to genome scale. Using an architecture based on advances in deep signal processing, Evo is trained on 7 billion parameters with a context length of 131 kilobases at single-nucleotide resolution. Evo captures two fundamental aspects of biology—the multimodality of the central dogma and the multiscale nature of evolution.“

- Source.

The Concrete Impact of AI

- In the US there are 5,000 data centers today, with 450 being added every year to 2030.

- Data centers need a lot of concrete, more so due to AI’s need for bigger servers.

- This concrete causes a lot of emissions, throwing a spanner in big tech emission targets, and leading to high demand for so-called green concrete.

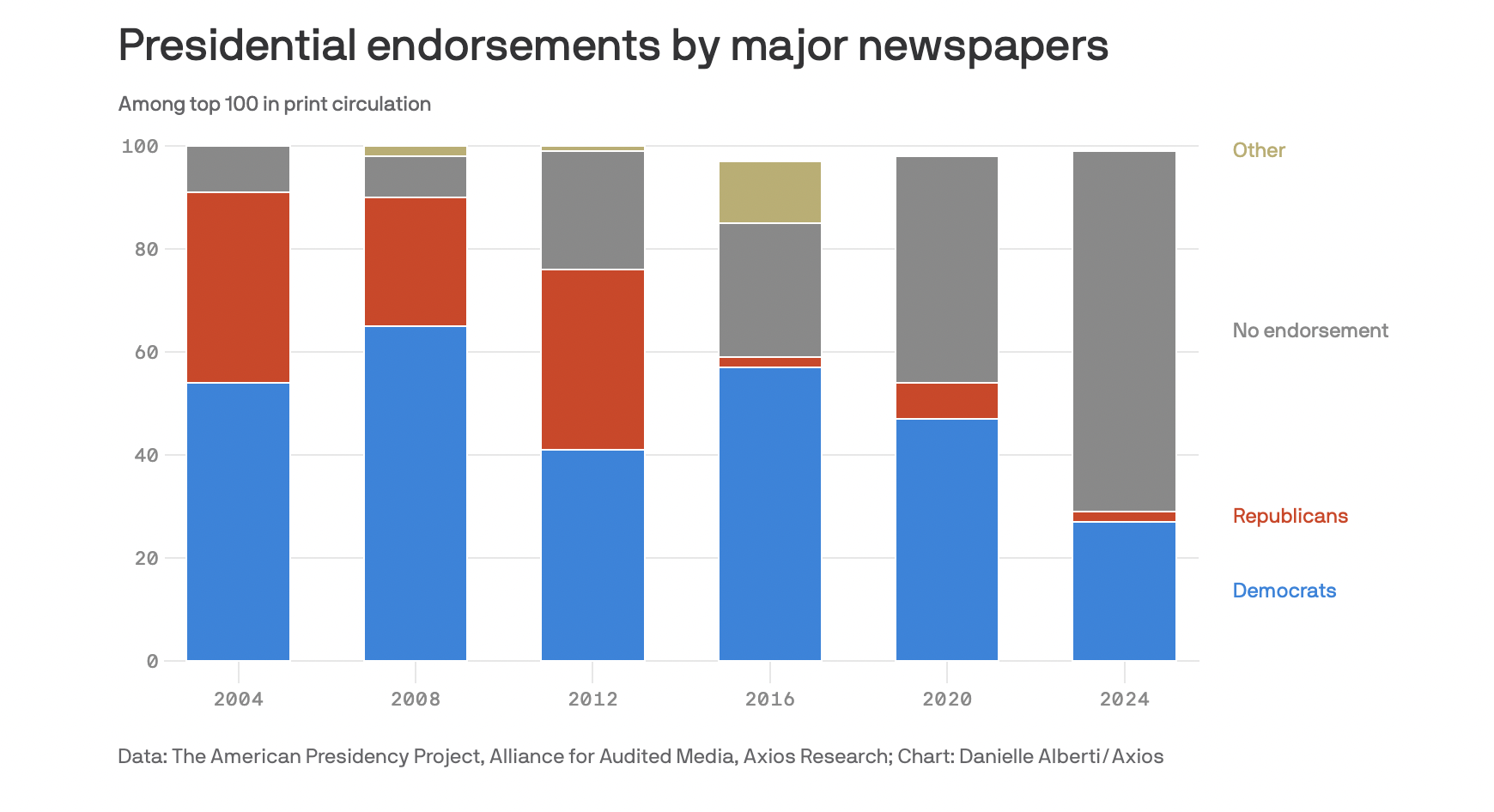

Newspaper Presidential Endorsments

- Are no longer a thing, perhaps a function of the social media age.

- Source.

You don’t Own Anything

- The transformation of technology to the -as-a-service model has led to many positives, yet it has led to a situation where users don’t own anything.

- This creates vulnerabilities – “years ago websites were made of files; now they are made of dependencies.”

- “If the current trend of technology is sweeping us in a direction of “everything is amazing, but nothing is ours”, Technology that’s Actually Yours could be the next great counter-trend.“

State of Venture

- A discussion on how venture capital just isn’t what it used to be.

- Large rounds for companies lead to perverse incentives – the speakers estimate just 5% of the 1,400 pre-LLM unicorns would raise an up-round today.

- These round sizes continue today (though in part explained by the increased capital intensity of AI based startups).

- Large funds could also lead to a reshaping of portfolio return curves, with consequences that are yet to be seen.

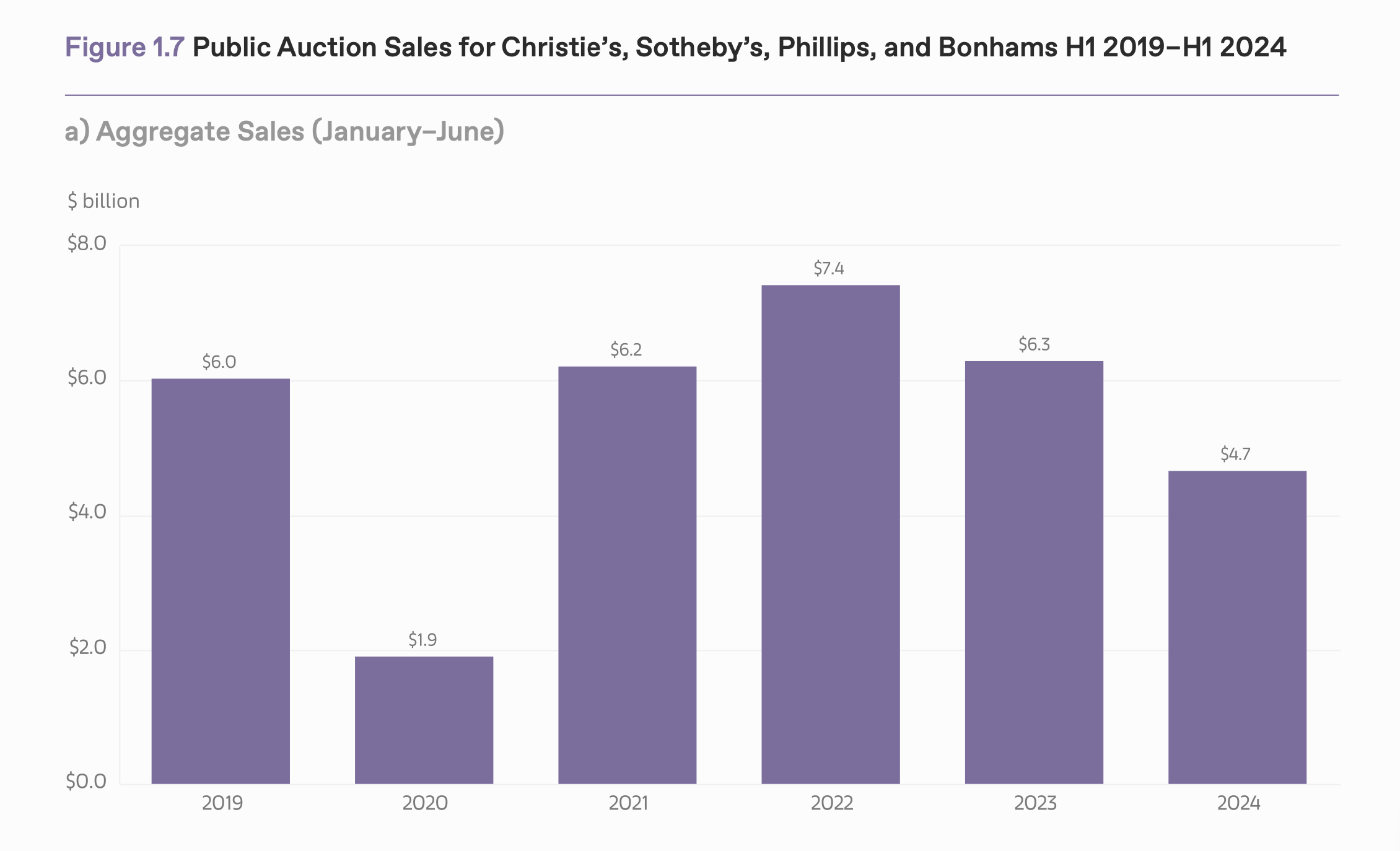

Art Market Update

- The art market continues to struggle, as public auction sales are declining for a third year in a row.

- Source.

Containers Full of Air

- 75% of containers that come from overseas to the US return to their origin empty.

- Source.

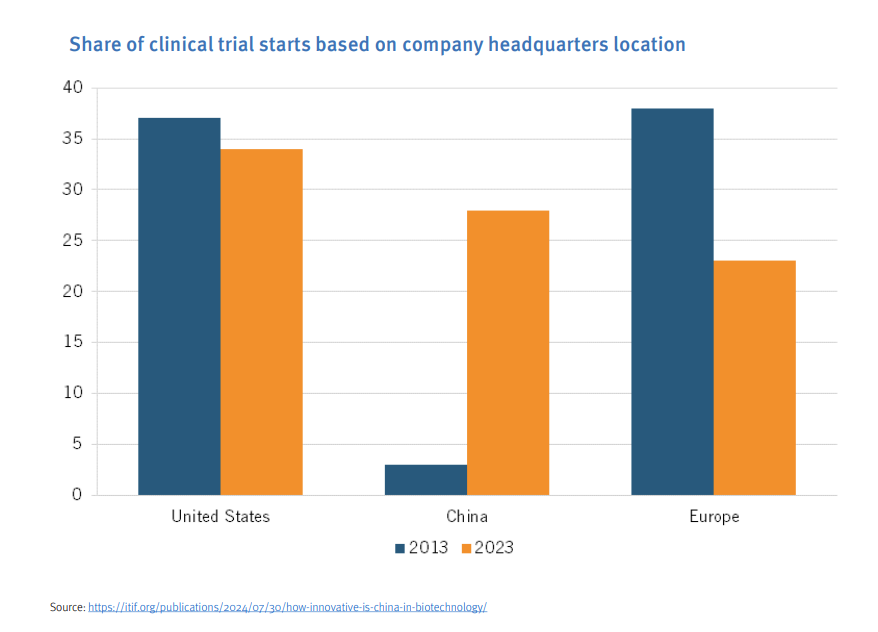

The Rise of Chinese Biotech

- China is making immense progress in many fields. Biotechnology is no exception.

- “A 2024 IQVIA report shows that the share of clinical trials launched by Chinese-headquartered biopharmaceutical companies rose from 3 percent in 2013 to 28 percent in 2023, suggesting a growing involvement of Chinese companies in early-phase drug development.“

- More interesting charts on the topic here.

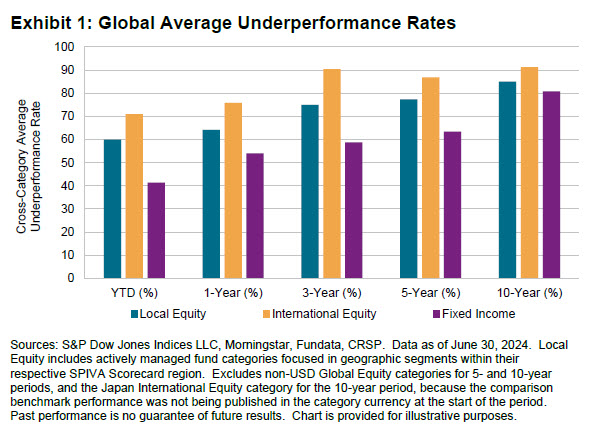

Fund Out(Under)Performance

- “Cross-category summary of the average underperformance rates reported for actively managed funds spanning across regions in the first half of 2024 and longer periods, across local equity, international equity and fixed income categories.“

- Source: S&P Global.

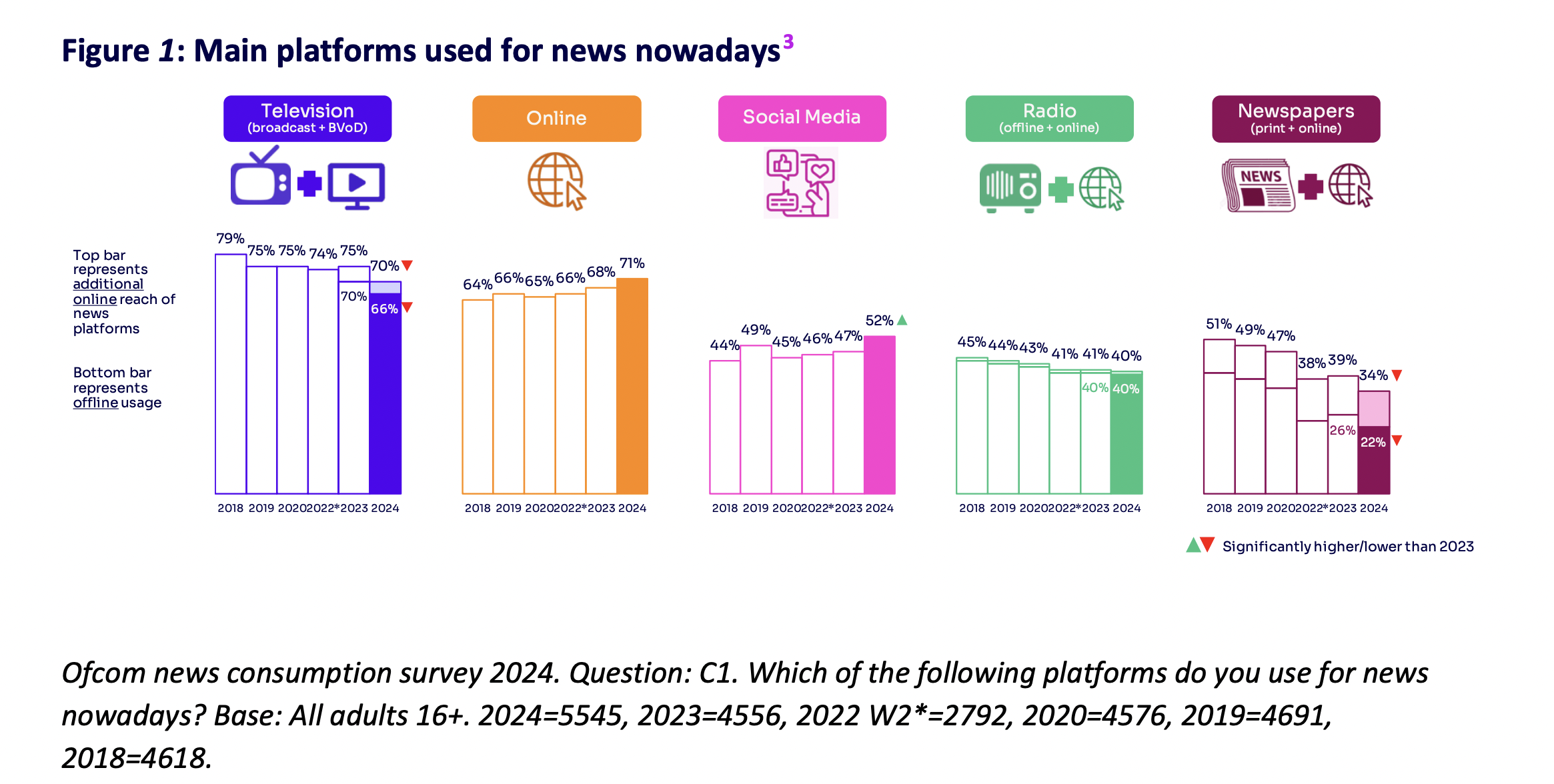

News Consumption

- Online is now on par with TV in terms of how people in the UK consume news – a significant milestone.

- Source.

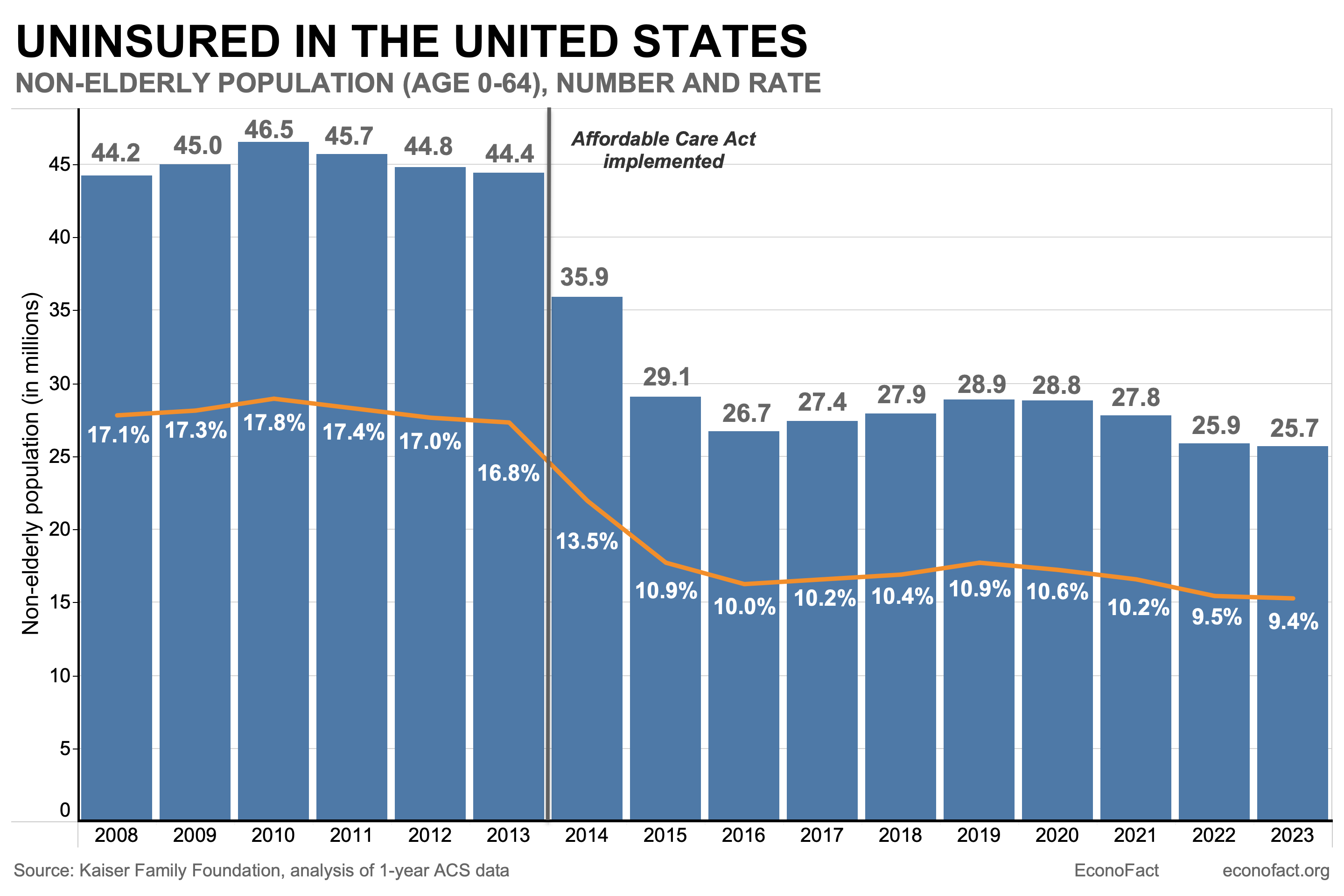

Health Insurance in America

- A remarkable drop in the percentage of uninsured in the US.

- However, 26m people are still uninsured.

- Source.

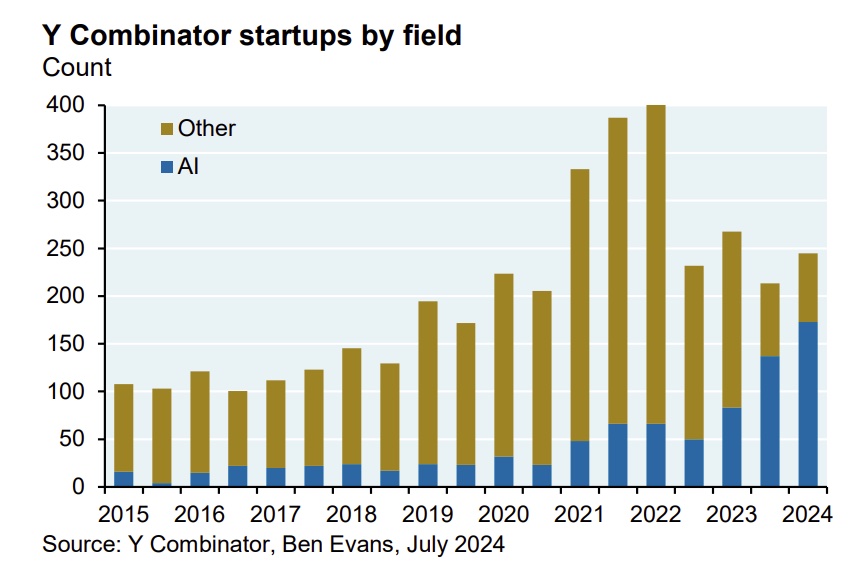

Y Combinator Startups

- All in on AI.

Myth Busting – Oragnic Food

- Claims debunked in this article include: Organic farms don’t use pesticides, organic food is healthier and better for the environment.

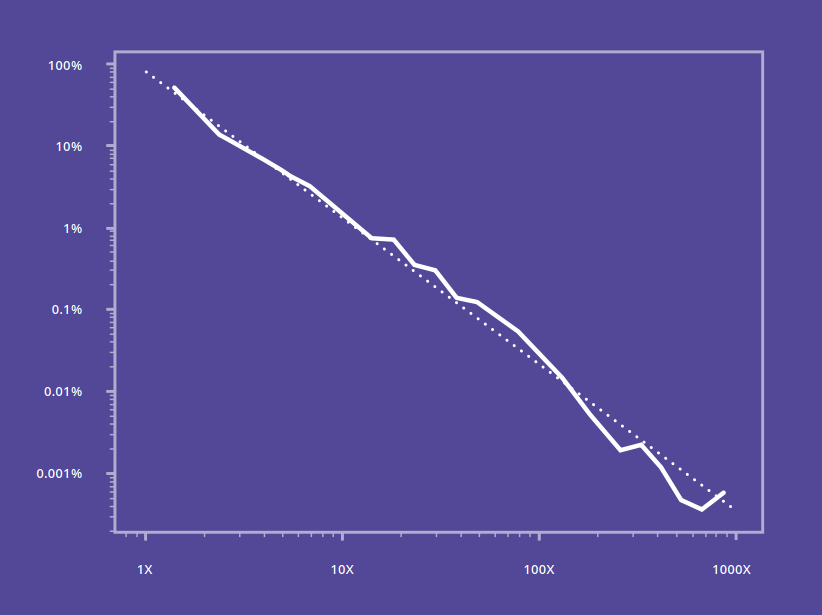

Power Law – UK Edition

- Comprehensive data set on UK startup returns from SyndicateRoom.

- It shows that the returns do indeed follow a power law.

- Full whitepaper here.