- “Since 2000, the number of professionals working in the field has tripled, with finance companies paying six figures or those at the top of their game. Manicurists, human resources managers, event planners and massage therapists have all proliferated more quickly (according to the Bureau of Labor Statistics) but compliance officers are not far behind.“

- Source.

Misc

Miscellaneous is often where the gems are.

Flying is Getting Safer

- A New MIT study recently found that things keep getting better.

- “The risk of a fatality from commercial air travel was 1 per every 13.7 million passenger boardings globally in the 2018-2022 period — a significant improvement from 1 per 7.9 million boardings in 2008-2017 and a far cry from the 1 per every 350,000 boardings that occurred in 1968-1977, the study finds.“

- This improvement curve has been called “aerial version of Moore’s Law“.

Marginalia

- An age-old way to take notes is to write in books.

- Here is a nice post on the topic with many examples.

- It serves as yet another reminder that reading and note-taking are quintessential bedfellows.

Bad Fintech Ideas

- Finance is perhaps unique of all the industries that venture capital has set its sights on in one way – it has been around a very long time and therefore seen its fair share of disruption attempts.

- Here is a list of fintech business models that the author thinks are bound to fail – some interesting lessons there.

Understanding Russia

- In understanding Russia today, it helps to understand what World War II meant for the country.

- “In the Soviet Union and later in Russia, reference to World War II played a central role in the decades after 1945. The reference has never lost any of its intensity and is currently reaching a new climax.“

Changing Market Structures – WallStreetBets

- Market structures are changing all the time and even staunch fundamental investors need to pay attention.

- The list is long right now – passive, pod shops, short volatility, options trading boom.

- This is a good read on the rise of WallStreetBets (founded in 2011) and the culture of the millions of retail traders that have joined the market during and after the pandemic.

Private Credit

- Interesting paper on the rise of the now $1.5 trillion private credit market.

- “In equity, the two great trends have been the shift from public markets to private ownership and the consolidation of American companies’ stock in the hands of powerful investment funds. In debt, by contrast, the great trends have been a shift from private loans to quasi-public markets, democratization and dispersed ownership. In this Article, we chronicle the recent and dramatic reversal of these trends in the debt markets. Private investment funds executing a “private credit” strategy have become increasingly important corporate lenders, bringing into corporate debt the same forces of de-democratization and consolidation that have been reshaping the equity markets.“

Start-up Failures

- Are rising sharply according to Carta (just one data source).

- This is hurting VC funds of certain vintages “Only 9 per cent of venture funds raised in 2021 have returned any capital to their ultimate investors, according to Carta. By comparison, a quarter of 2017 funds had returned capital by the same stage.“

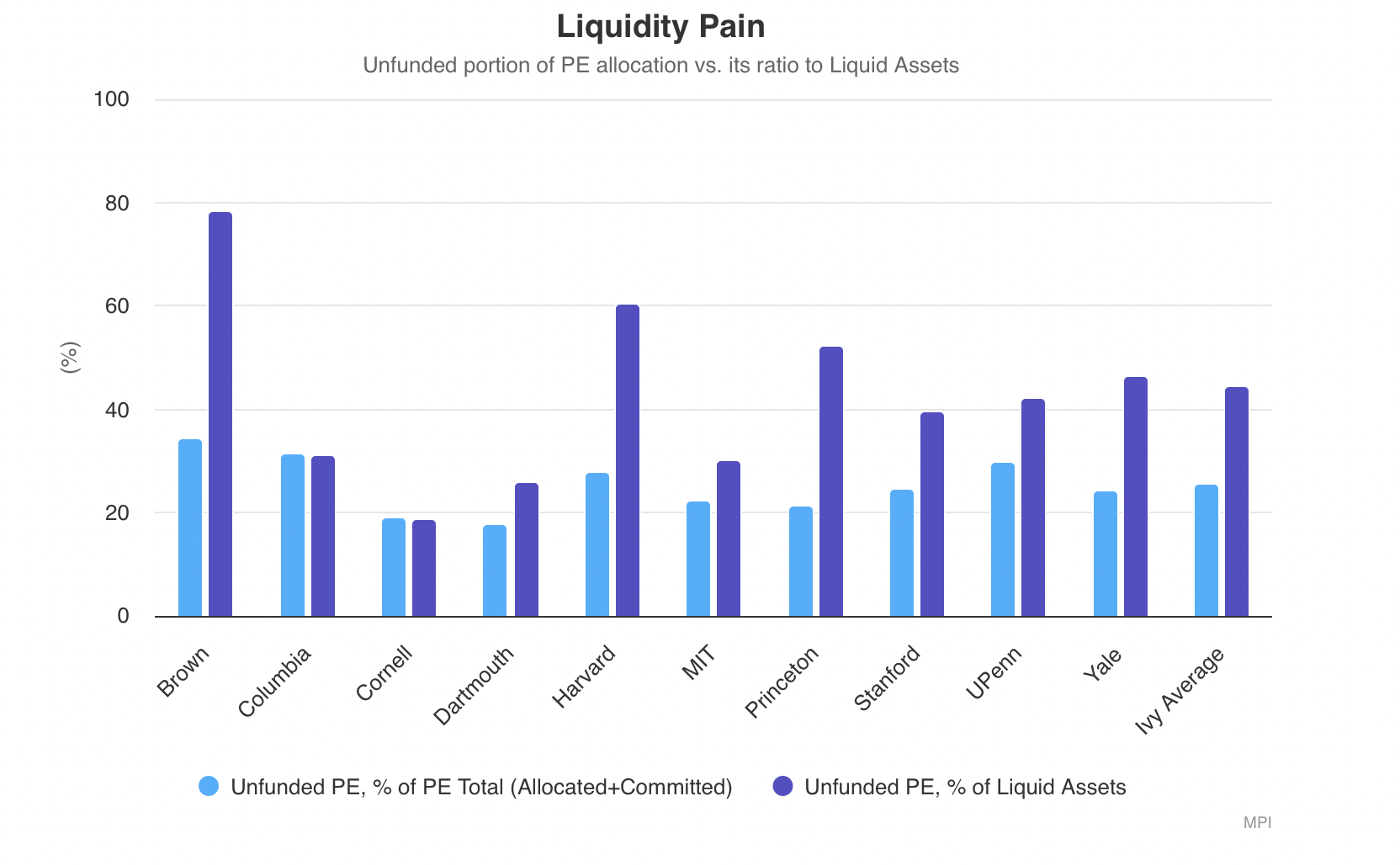

Endowment Liquidity

- By over allocating to private alternatives, large US endowments have gotten themselves into their worst ever liquidity crisis.

- This is largely driven by unfunded PE allocation/commitments.

Slack

- This blog post argues that tech monopolies are good, short lived, and ultimately “fund” the next disruptor.

- Within it is an interesting concept of Slack – “Some group of people must exist who are educated, aware, motivated, and at the bleeding edge of a field…who nonetheless have some spare hours in the workweek to spend innovating on something instead of slavishly executing a task.“

- “It’s necessary to be slightly underemployed if you are to do something significant.“

- This is called slack.

- A monopoly is a way to create this slack.

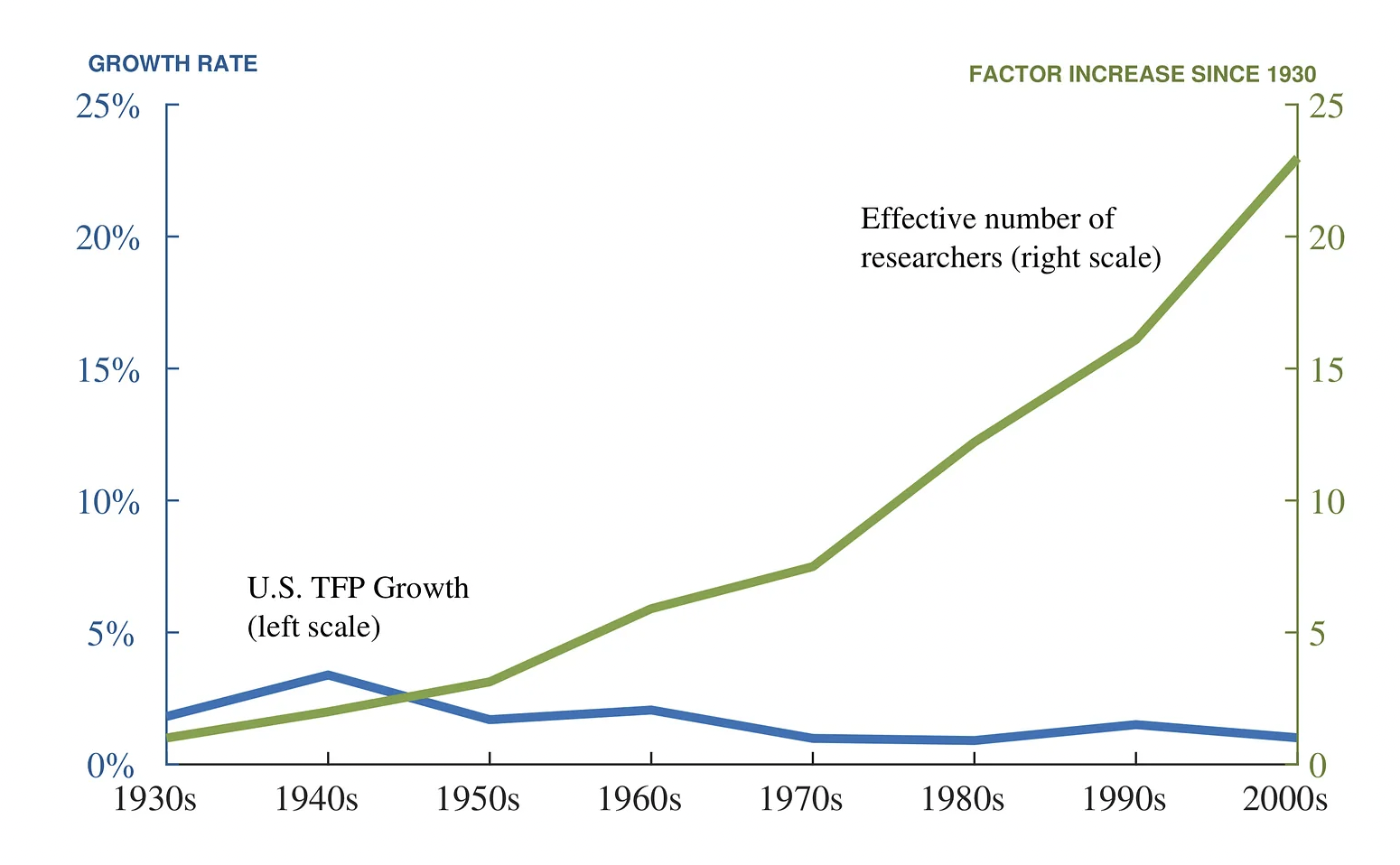

Are Ideas Getting Harder to Find

- Interesting read.

Private Credit

- Fascinating paper on credit markets going dark i.e. the rise of private credit – “We offer new data that illustrates the meteoric rise of the now $1.5 trillion private credit industry and explore the allure and implications of private credit.“

Our Future is Biotech

How to Spot a Bad Argument

- A useful guide from the BBC on tricks used to sound more convincing.

Pricing Data

- Fascinating read on how to price a data asset.

- Relevant especially with the rise of AI. At first quantity matters here but “as training sets grow ever larger, it’s often more efficient to do this than to acquire the next token; beyond a certain point, data quality scales better than data quantity“.

- “So there you have it: 5000+ words on data pricing. We’ve covered use cases and users; quality and quantity; internal and external value factors; pricing axes and maturity curves; table stakes and usage rights; and much more.“

Major Sociological Theories

- Useful list to broaden horizons on one of the most important, yet often overlooked disciplines especially in financial circles.

Old Maps Online

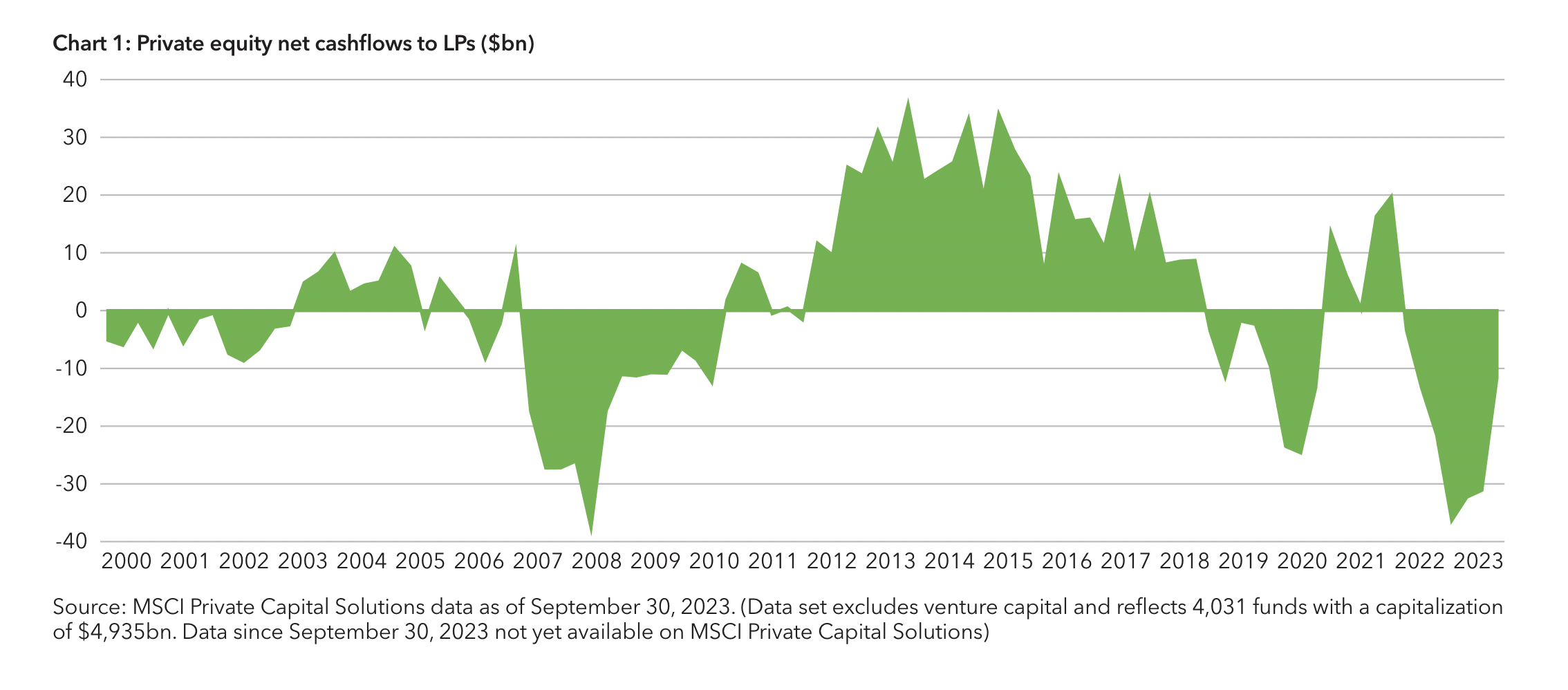

Private Equity Net Cashflows

- PE funds have called far more capital than they have distributed, almost on par with what was seen during the GFC.

- This is a serious issue for LP liquidity.

- Source.

Failure Mindset

“Perfection is impossible. In the 1526 singles matches I played in my career, I won almost 80% of those matches. Now, I have a question for you.

What percentage of points do you think I won in those matches? Only 54%.

In other words, even top-ranked tennis players win barely more than half of the points they play. When you lose every second point on average, you learn not to dwell on every shot.

You teach yourself to think, okay, I double-faulted … it’s only a point. Okay, I came to the net, then I got passed again; it’s only a point. Even a great shot, an overhead backhand smash that ends up on ESPN’s top 10 playlist. That, too, is just a point.

And here’s why I’m telling you this. When you’re playing a point, it has to be the most important thing in the world, and it is. But when it’s behind you, It’s behind you. This mindset is really crucial because it frees you to fully commit to the next point and the next point after that, with intensity, clarity, and focus.

You want to become a master at overcoming hard moments. That is, to me, the sign of a champion. The best in the world are not the best because they win every point. It’s because they lose again and again and have learned how to deal with it. You accept it. Cry it out if you need to and force a smile.”

— Roger Federer (via FS).

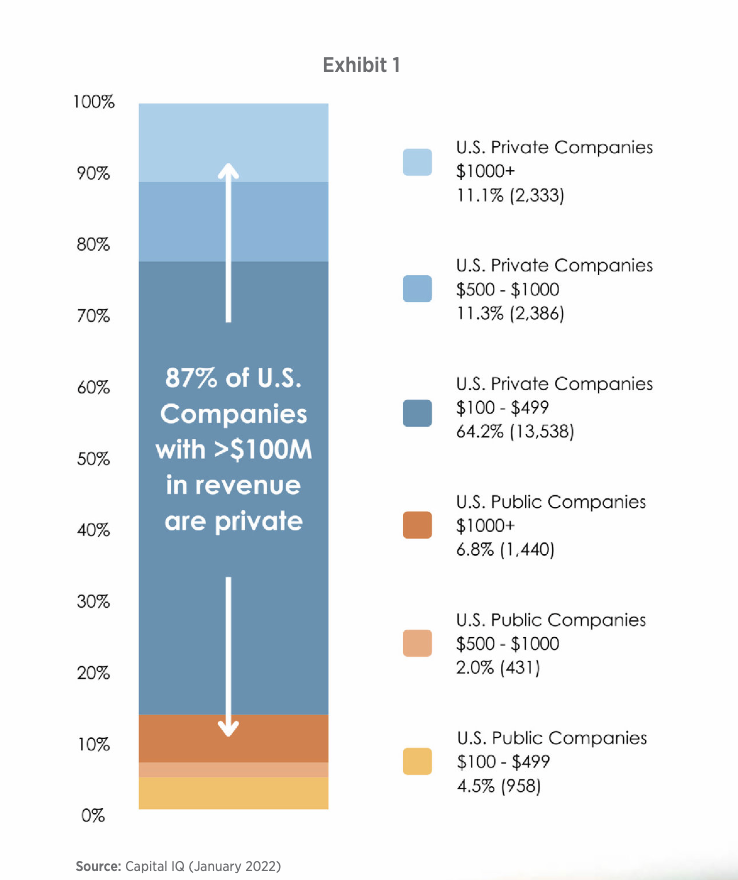

Private Companies

- 87% of companies with revenues above $100m are private.

- Source.