- The SEC rulemaking has been under legal siege under Gensler – here is one reason why.

- “A recent study by Harvard Law School professor John Coates found that Wall Street has rushed to the 5th Circuit. Coates, who served as Gensler’s first general counsel at the SEC, says firms are challenging the regulator’s rules in court more often under the chair than his immediate predecessors. He said that, as of February, 80% of those challenges during Gensler’s tenure were in the 5th Circuit.“

Misc

Miscellaneous is often where the gems are.

Chevron Deference – What Does it Mean?

- The overturning of the so-called Chevron doctrine has huge far-reaching ramifications (Claude.ai summary via MR) in how the US writes, interprets, and implements administrative laws.

- Here is a great detailed analysis (before the ruling) of its implications and path forward.

Archegos Story

- The timeline. JEF CEO comes out on top.

Transformers

- The story of how eight Google employees wrote the most consequential paper in modern technology today.

Shape of Information

- You are gifted 100 bottles of wine, but one is poisoned. You have 7 tests available.

- Is there any way to identify the poisoned one?

- A lesson here for how we build information.

A few short stories.

- Great read.

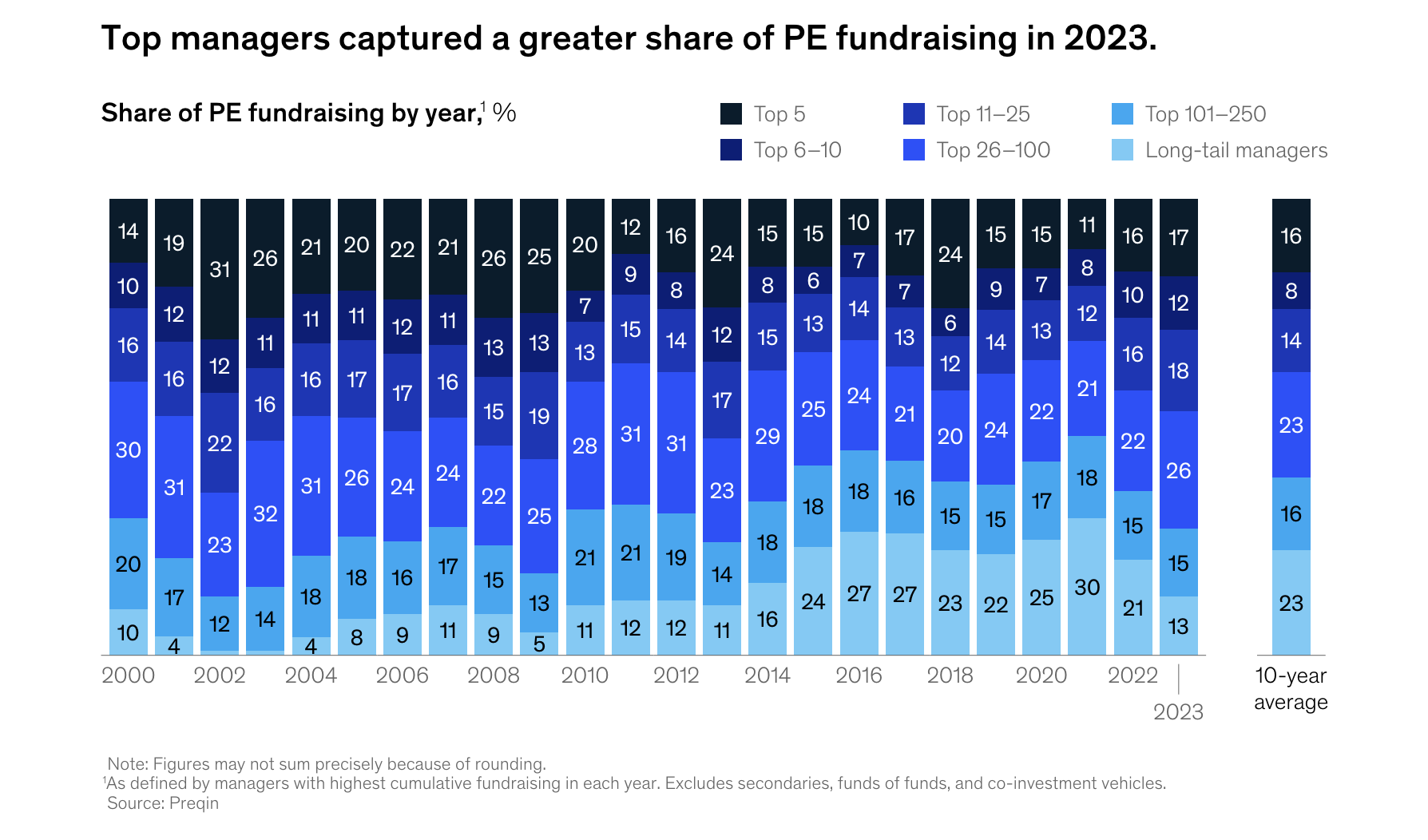

PE Fundraising Concentration

- “Fundraising in 2023 was more concentrated than in any year of the prior decade, with 47 percent of all dollars raised accruing to just 25 managers“

- Source.

Remote Jobs

- “Two things on remote jobs is really fascinating right now. So pre-pandemic, there’s — at any given time, there’s 15 million, 20 million jobs that are posted on LinkedIn actively. And pre-pandemic, it was roughly 2% of all jobs on the platform were remote jobs. If you go back 2.5 years ago, it peaked. 20%, 21% of all jobs on LinkedIn were remote jobs, which is pretty insane to see that jump from 2% to 21%. And now that number is back to 8%, so it kind of peaked up and now it’s starting to come back down again. So we pay a lot of attention to kind of how the labor market is shifting through remote work, and it seems like that trend is coming down” Linkedin CEO.

- Source: The Transcript.

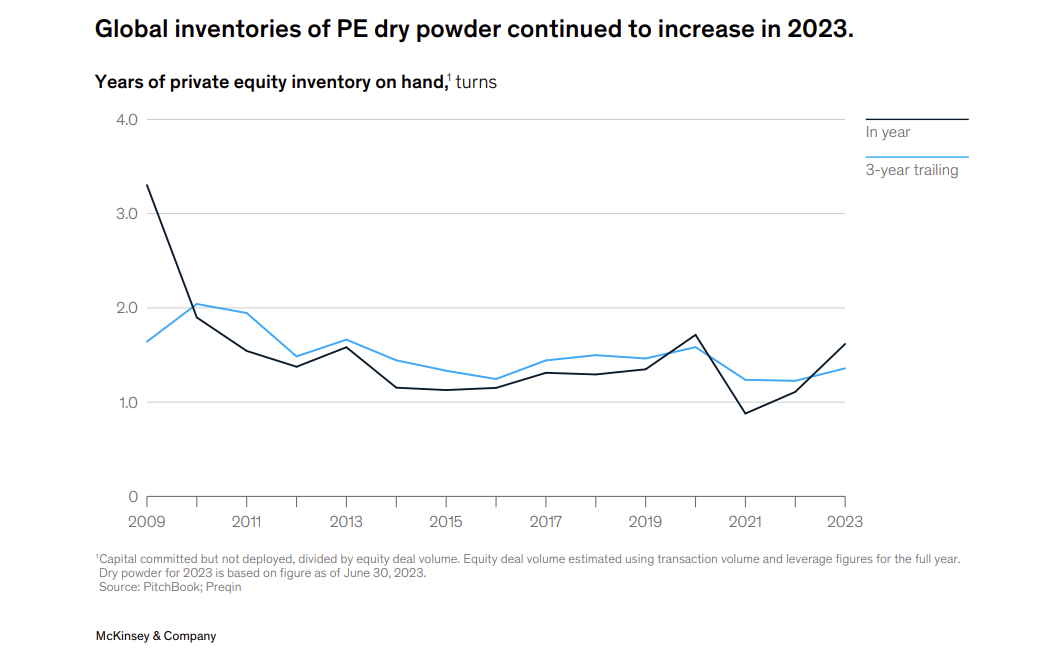

PE Dry Powder

- Many people talk about the absolute value of PE dry powder. Indeed this hit a record last year of $2.2 trillion – fundraising continued (at a slower pace) against a dramatic slowdown in dealmaking.

- However “Dry-powder inventory (the amount of capital available to GPs expressed as a multiple of annual deployment) increased from 1.1 years in 2022 to 1.6 years in 2023 but remains within the metric’s normal historical range“.

- Source.

95 Theses on AI

- Interesting list.

- “Decisions made in the next decade are more highly levered to shape the future of humanity than at any point in human history.“

- “Technological transitions are packaged deals, e.g. free markets and the industrial revolution went hand-in-hand with the rise of “big government” (see Tyler Cowen on The Paradox of Libertarianism).“

- “Natural constraints are often better than man-made ones because there’s no one to hold responsible.“

Sports League Investing

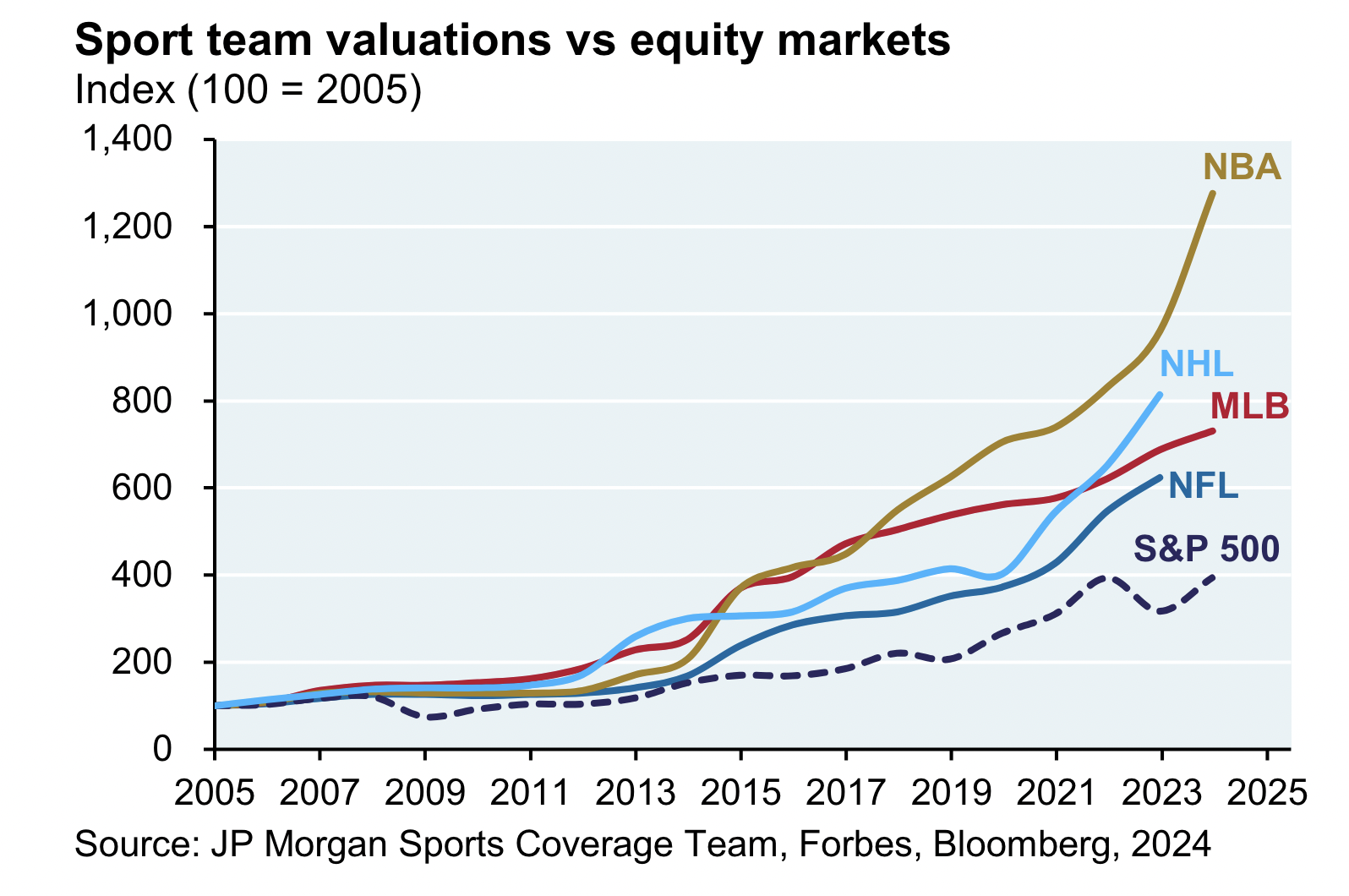

- A nice report on investing in sports teams, leagues, and related businesses from JPMAM.

- Why now? Historically ownership of sports teams in the US was for the ultra-wealthy, but this is about to change.

- “Forbes also constructs a valuation index for each league. As shown below on the left, these indexes have substantially eclipsed the S&P 500 since 2005. To be clear, sports teams are much more expensive than equities: most teams are now valued at 5x-12x sales compared to ~3x sales for the S&P 500.”

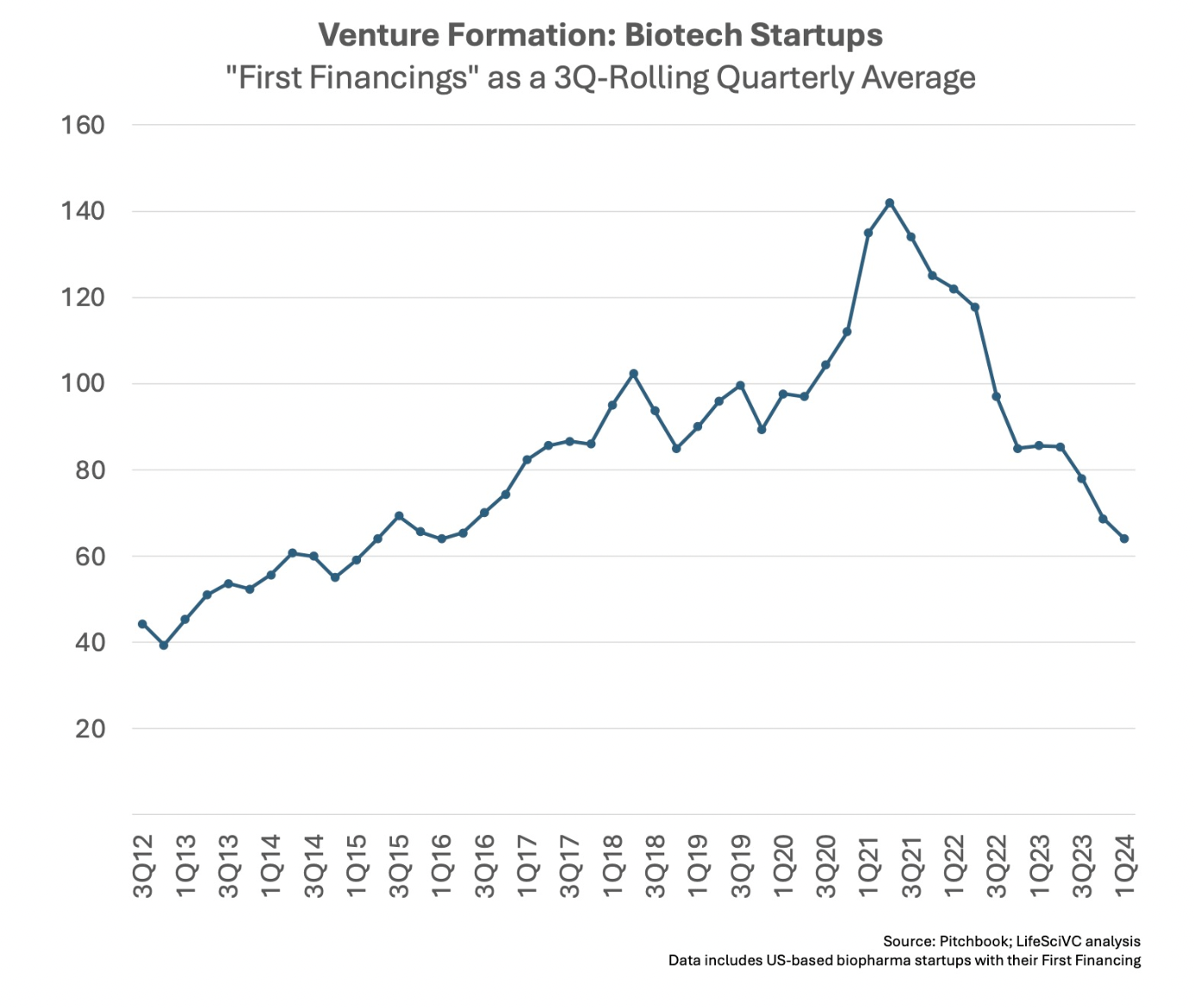

Biotech Startups

- “According to the latest Pitchbook data, venture creation in biotech hit its slowest quarterly pace in eight years during 1Q 2024. With just over 60 new biotechs raising their first round of financing, the sector’s company formation activity has slowed 50-60% from its historic peak in 2021.“

- The piece argues why this is a positive for the health of the sector.

- Source: LifeSciVC.

50 Things I Know

- “I know that the legal profession does a great job of identifying competence and rewarding it financially. Cheap lawyers are expensive.“

- “I know that environmental influence is the most effective form of behavioral control. Accordingly, if you want radical change, radically change your environment. Being in the wrong city will cancel out years of self-improvement.“

- More here.

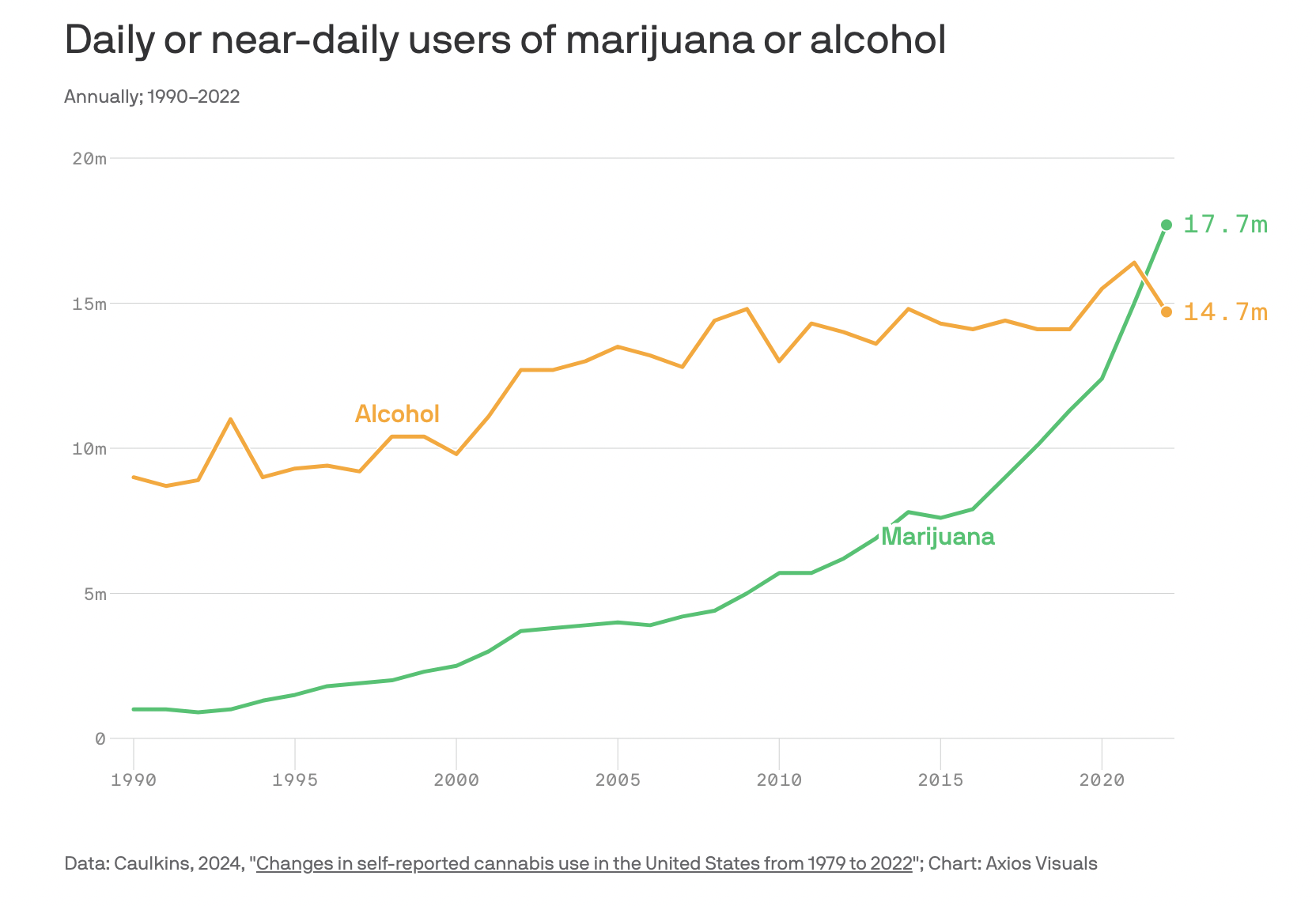

Marijuana Tops Alcohol

- “Daily or near daily marijuana use grew by 269% from 2008 to 2022, according to an analysis conducted by Jonathan Caulkins, a Carnegie Mellon University professor.“

- “Meanwhile, the prevalence of daily or near daily alcohol use fell by 7%.“

- Source: Axios.

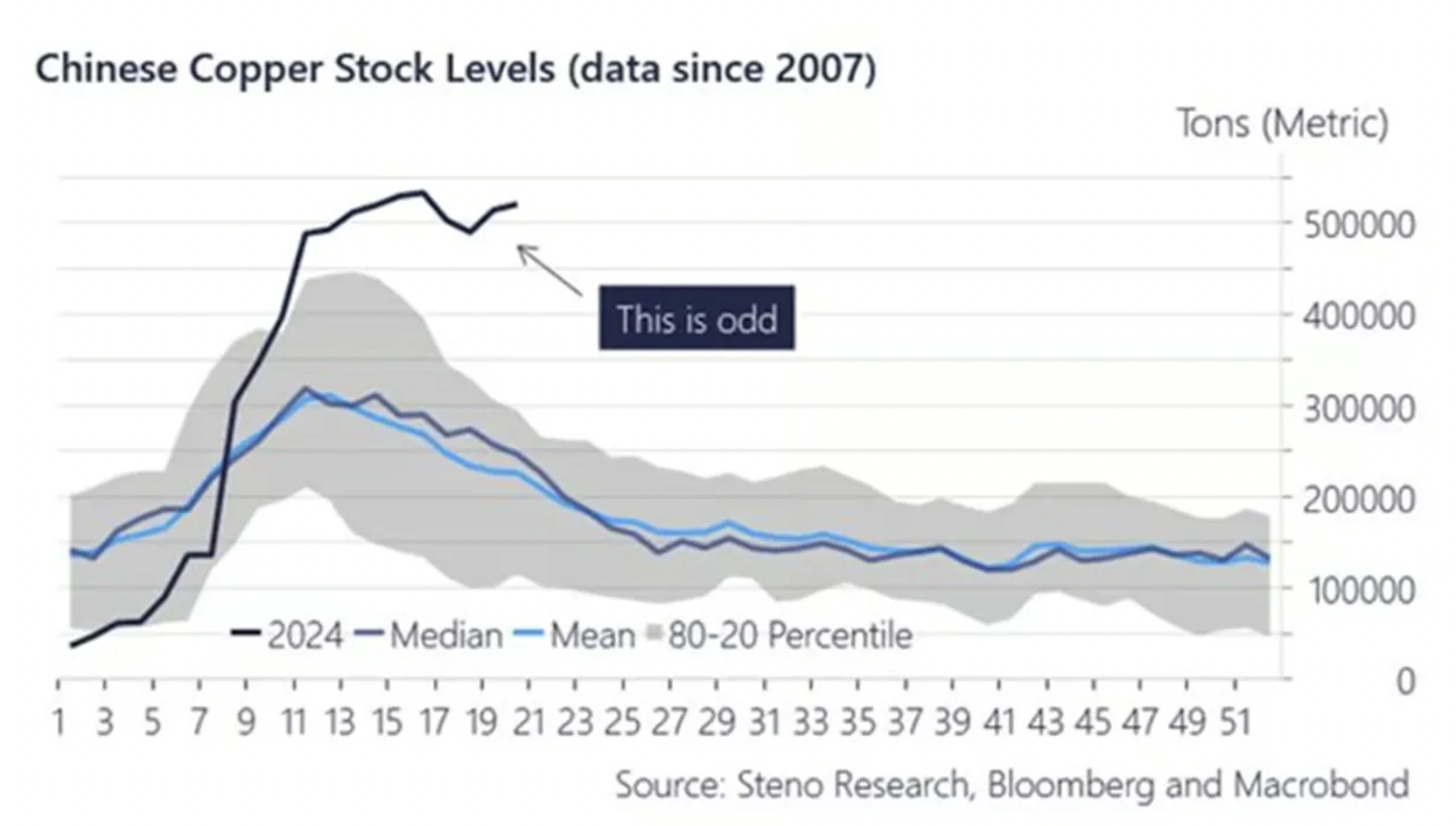

Chinese Copper Stocks

- Despite rising prices, China is stockpiling copper at an unprecedented rate.

- Source: Lykeion.

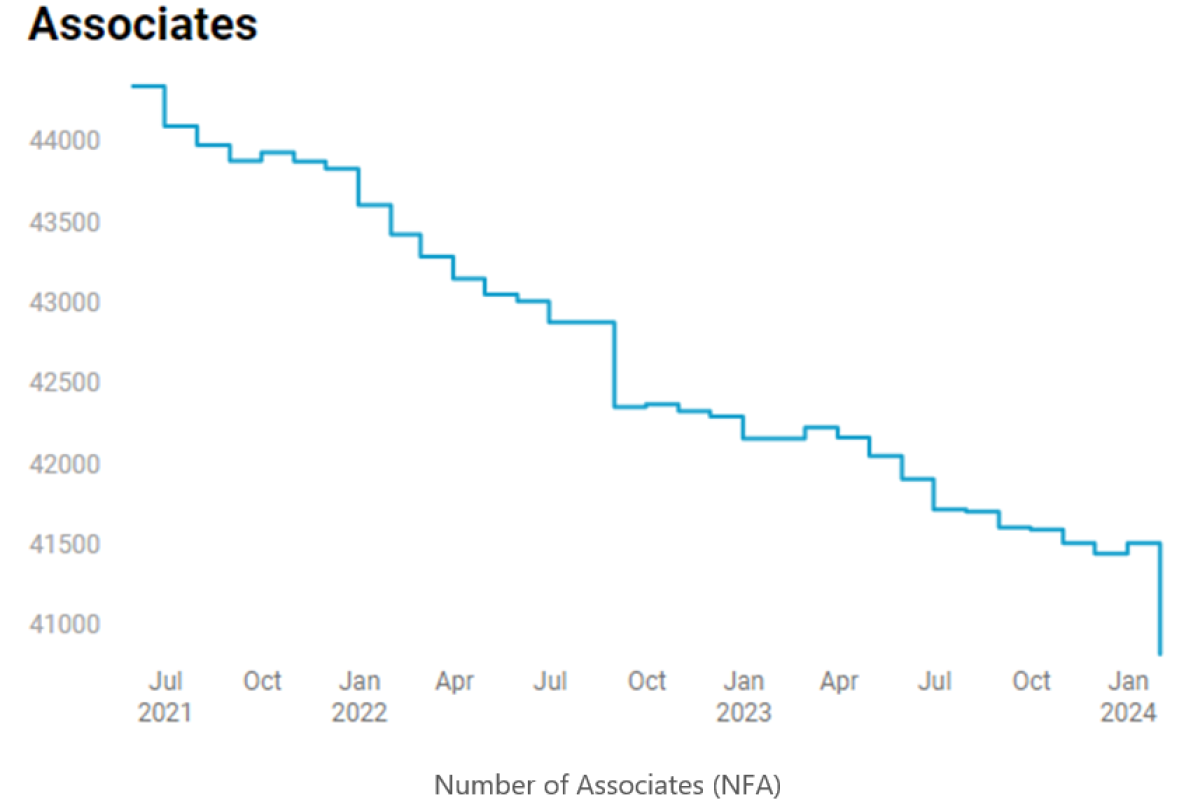

CTA Industry is in Decline

Weak Link vs Strong Link

- “A weak-link problem is where success depends upon the quality of the worst component, whereas a strong-link problem is where it depends upon the quality of the best.“

- Understanding which is which is a useful thinking tool.

Advice

- KK’s latest annual list.

- Admitting that “I don’t know” at least once a day will make you a better person.

- Changing your mind about important things is not a consequence of stupidity, but a sign of intelligence.

- Where you live—what city, what country—has more impact on your well being than any other factor. Where you live is one of the few things in your life you can choose and change.

The Books Business

- Everything you wanted to know about the publishing business from that time Random House tried to buy Simon & Schuster and the DOJ sued making “the head of every major publishing house and literary agency got up on the stand to speak about the publishing industry and give numbers …”.

- “I think I can sum up what I’ve learned like this: The Big Five publishing houses spend most of their money on book advances for big celebrities like Britney Spears and franchise authors like James Patterson and this is the bulk of their business. They also sell a lot of Bibles, repeat best sellers like Lord of the Rings, and children’s books like The Very Hungry Caterpillar. These two market categories (celebrity books and repeat bestsellers from the backlist) make up the entirety of the publishing industry and even fund their vanity project: publishing all the rest of the books we think about when we think about book publishing (which make no money at all and typically sell less than 1,000 copies).“

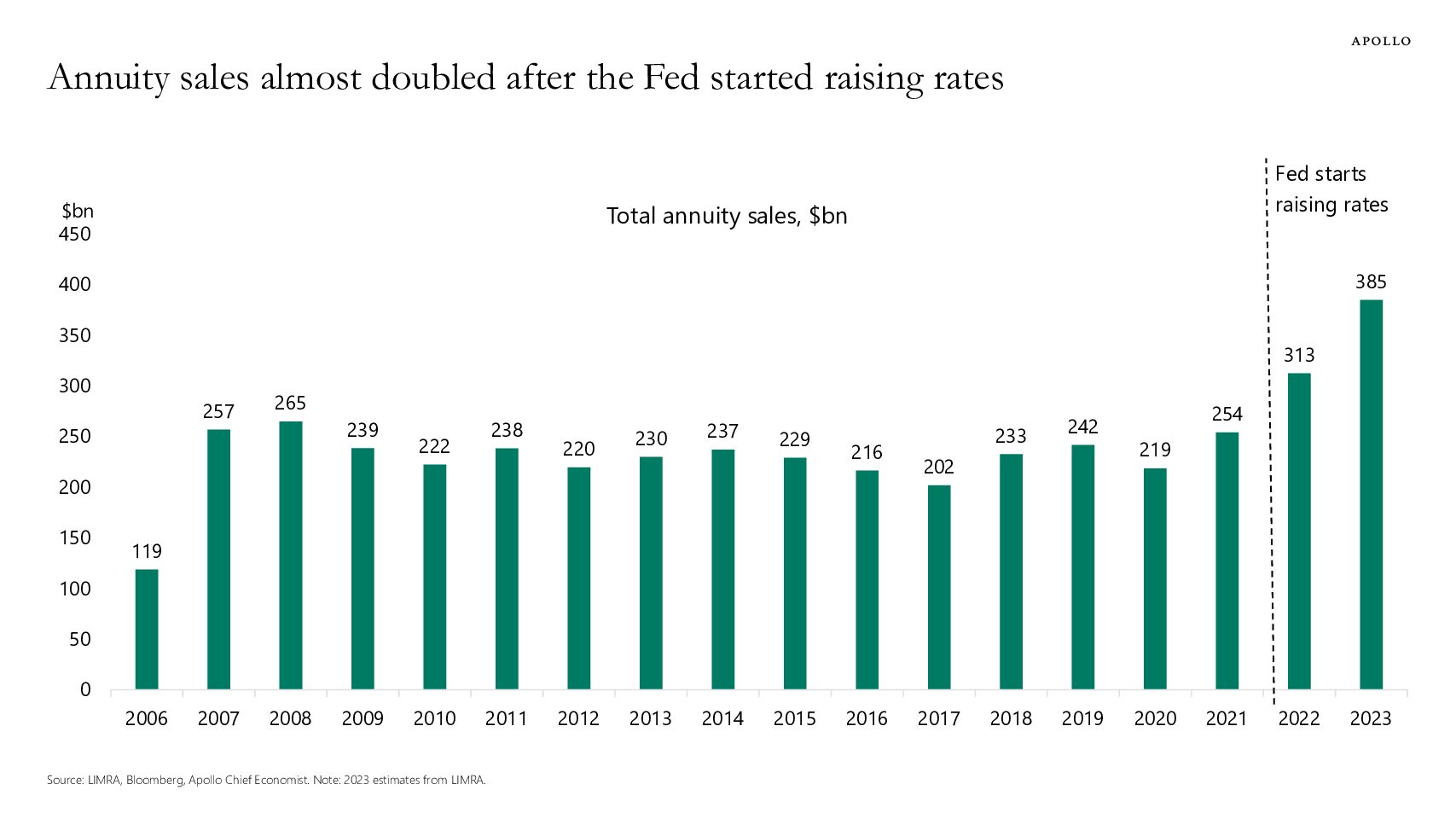

Annuity Sales

- “Annuity sales are almost double their pre-pandemic levels because of higher interest rates. And strong annuity sales create strong demand for credit, see chart below.“