- Periods of active underperformance tend to be followed by periods of outperformance.

- Source.

Misc

Miscellaneous is often where the gems are.

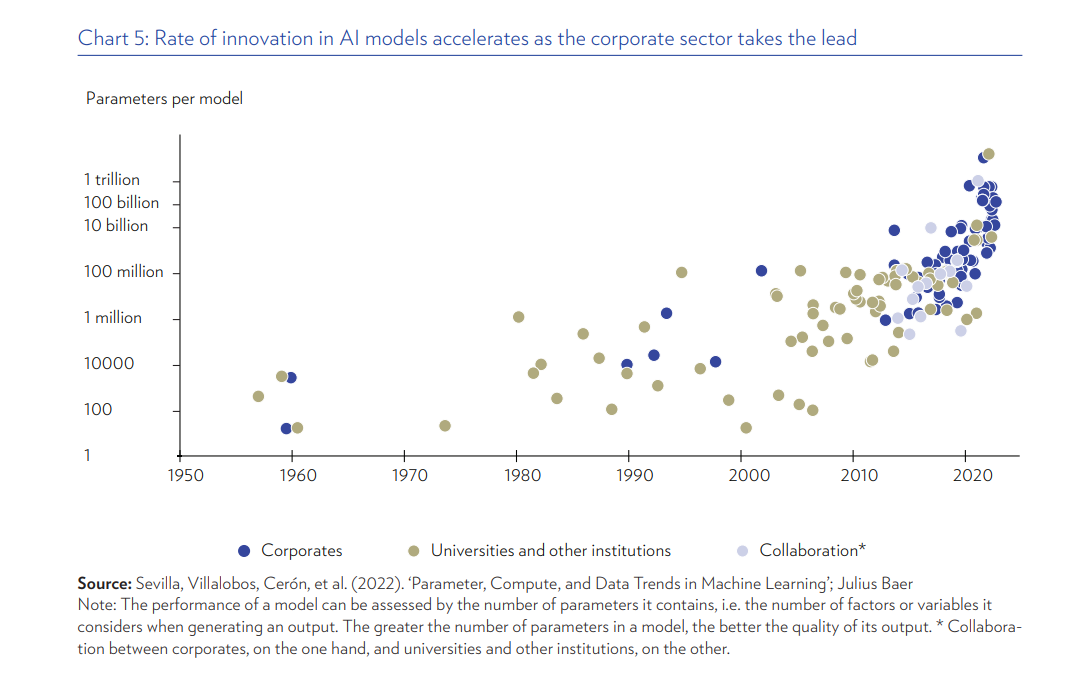

AI Innovation

- Nice chart showing the acceleration of innovation in AI as measured by parameters per model.

- Source: Julius Baer.

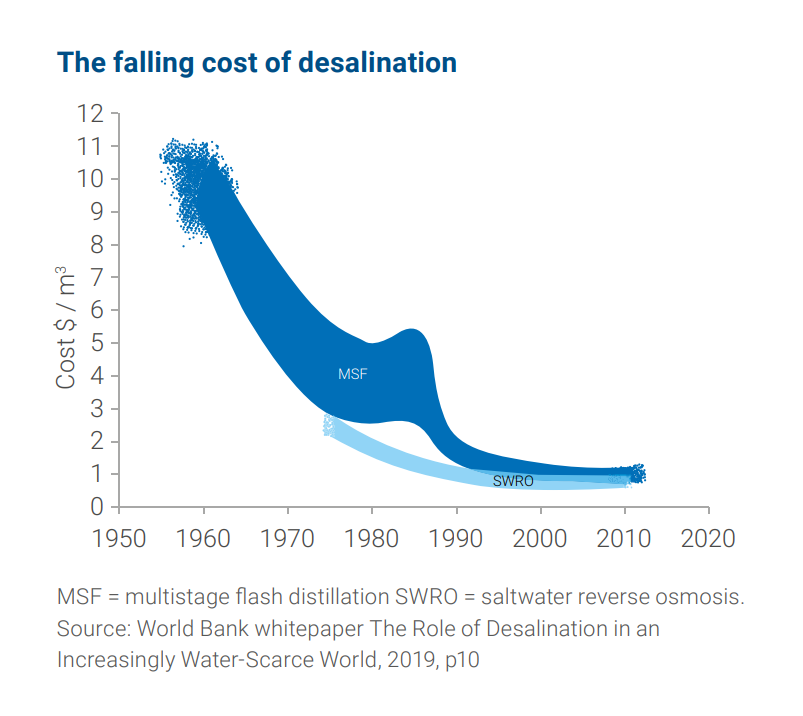

Desalination Costs

- Seems like a big deal.

- “The chart shows how the cost of desalination has fallen over the long term. This has been driven by technological advances, larger plants translating into greater economies of scale, and project development choices such as colocation of desalination plants with power plants.“

- Source.

Charlie Munger Quotes

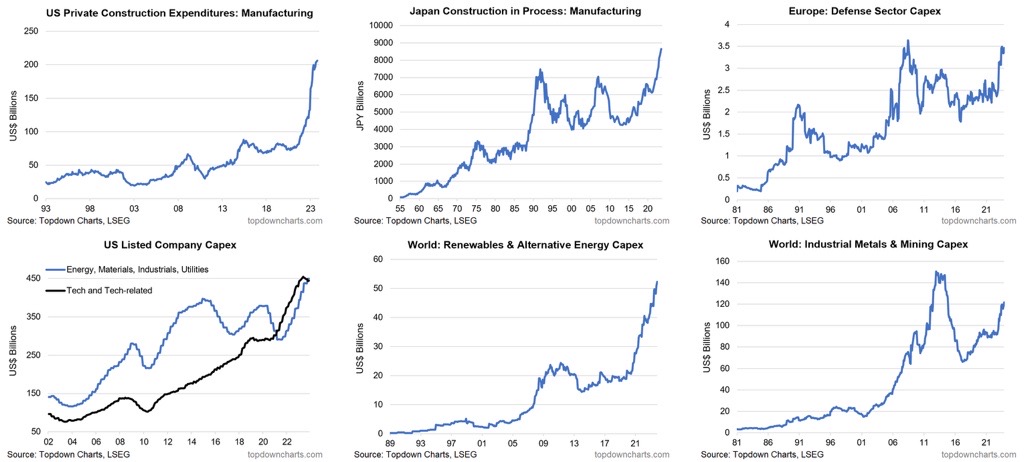

Capex Booms

- From US manufacturing construction to European defense – “2023 saw a multi-faceted global fixed asset investment boom“.

- Source: Top Down Charts.

Enlightened Concepts

- A list of thirty useful principles that offer delectable food for thought.

- Beginners bubble effect – “You cannot learn what you think you already know.”

- Benford’s law of controversy – “We tend to fill gaps in information with emotion.“

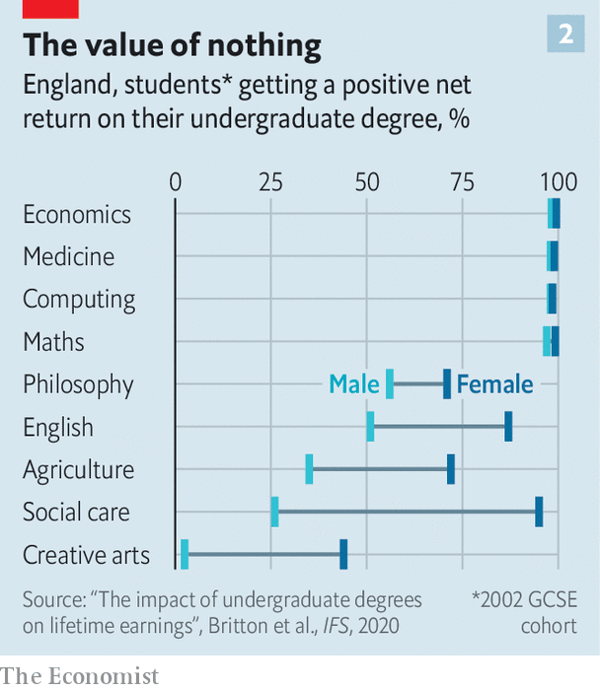

Return on Degrees

- This DoE/IFS study examined the return on undergraduate degrees in the UK.

- Interestingly, degrees where the percentage getting a positive return is low, are much worse for men than women.

Tom Whitwell 52 Things

- The annual list is always full of interesting facts.

- “The US Defence Department earns $100m/year operating slot machines used by soldiers on their bases.“

- “In the 19th Century, champagne was sweetened depending on local tastes. Russians had 300 grams of sugar added, the British just 50 grams. In 1842 Perrier-Jouët introduced unsweetened champagne. It failed and people called it ‘Brut’, but that’s how all champagne tastes today.“

- “In 2004, it took one year to install 1 gigaWatt of solar power. In 2023, installed 1 gigaWatt of solar power every day.“

Closed-End Funds

- “For a firm that eats, sleeps, and breathes discounted CEFs, this is the most compelling entry point we’ve seen in 15+ years,” Matisse’s Nik Torkelson, whose firm invests in and researches closed-end funds, wrote in a note.

- Full Bloomberg articles here.

- Interesting opportunities in closed-end funds as discounts have blown out. This is the case in the UK as well which has a large investment trust industry.

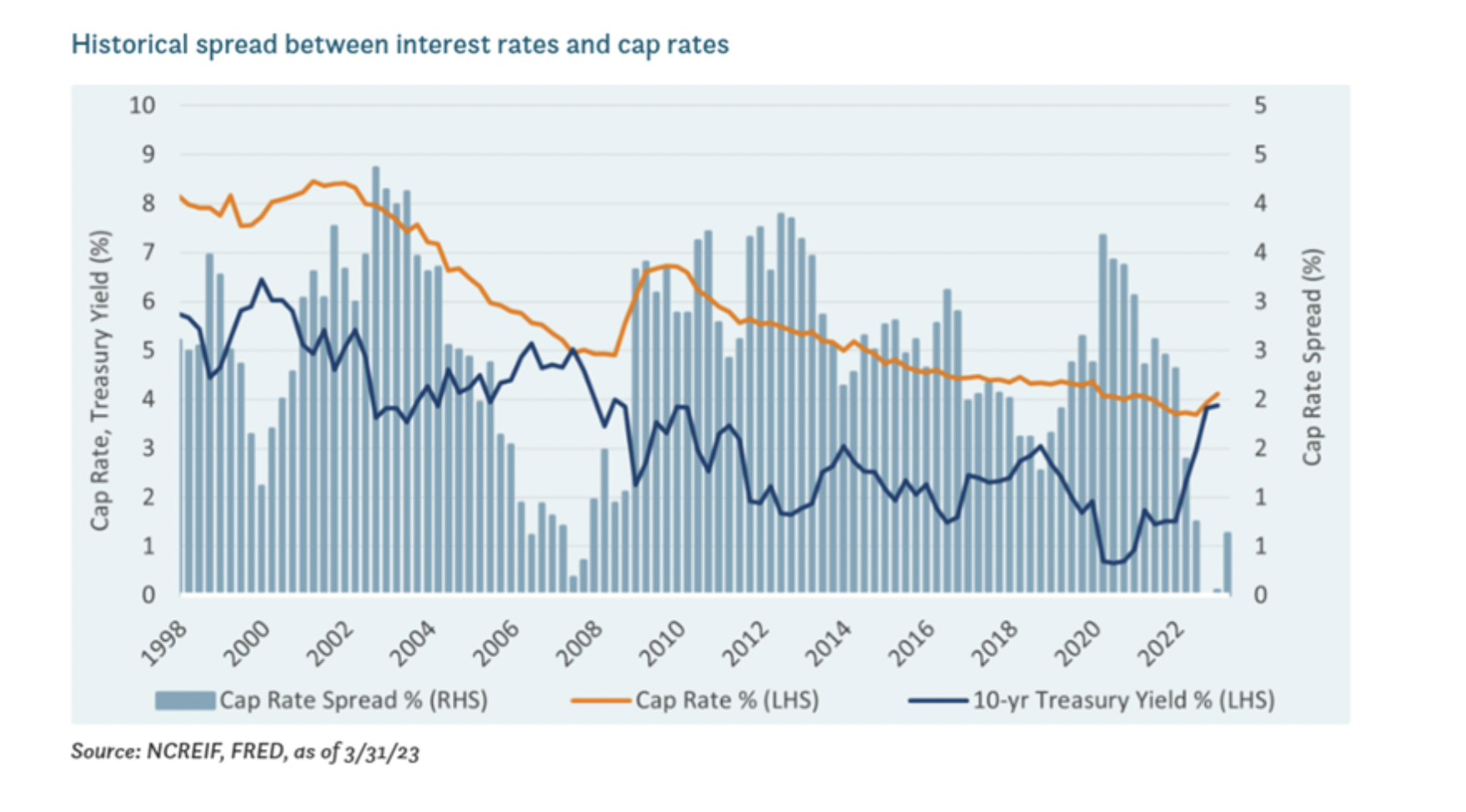

Cap Rates and Interest Rates

- Q: How do real estate cap rates move with interest rates?

- A: Directionally and imperfectly.

- Source: Verus.

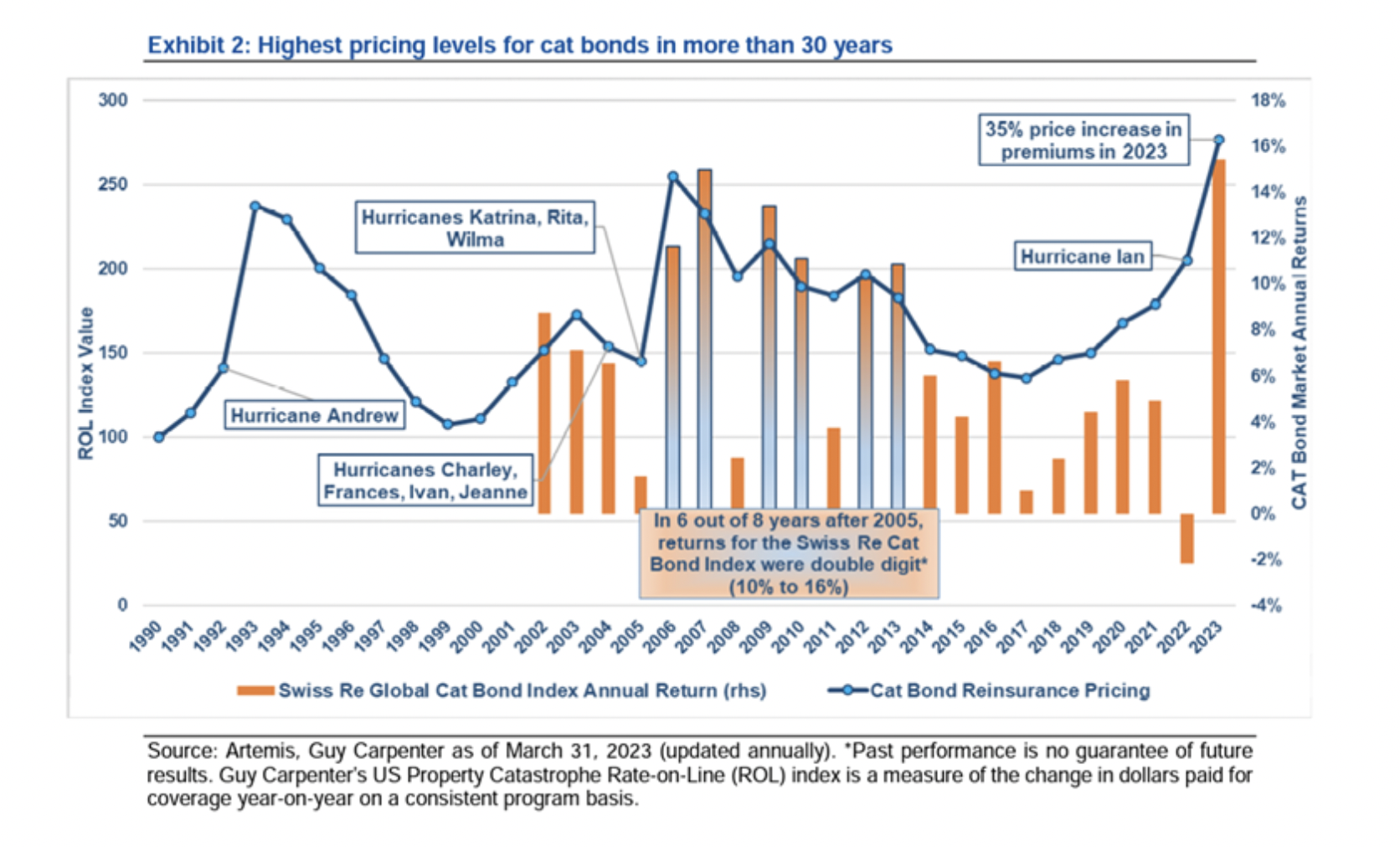

Cat Bonds

- Pricing levels of Catastrophe Bonds (explained here) have hit a 30-year high.

- “According to estimates by Guy Carpenter, a global risk specialist and provider of ILS sourcing and pricing information, the premium, or rate on line, of cat bonds increased by an annual rate of approximately 30% in January 2023, only the third time in three decades prices have reached such a level.”

- Bloomberg article here.

- Source: Amundi h/t bpsandpieces.

U.K. Covid Inquiry

- The full transcript of the testimony given by Lee Cain and, especially, Dominic Cummings for the inquiry into the government’s handling of the Covid emergency makes for long but utterly fascinating reading.

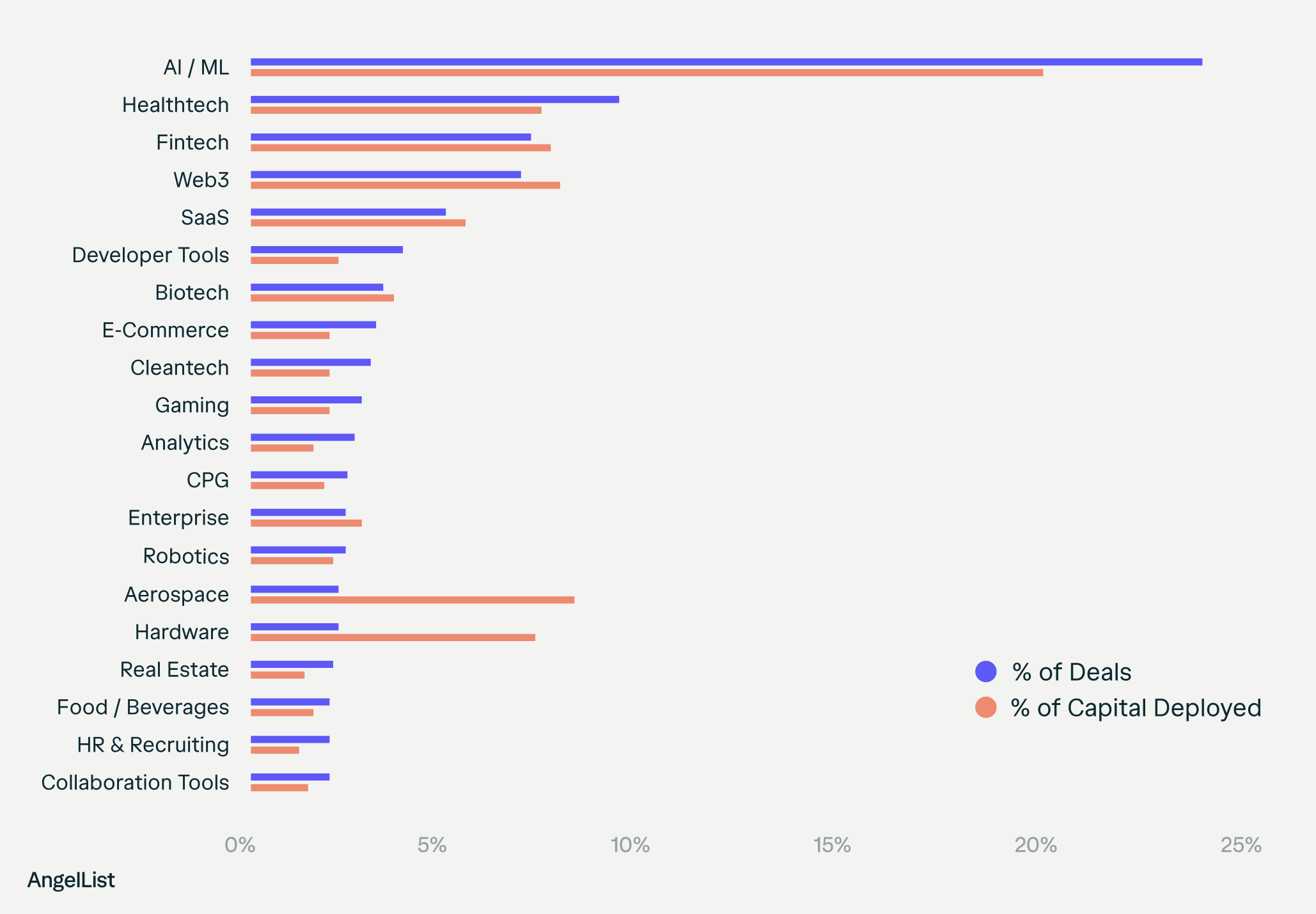

Where is Venture Investment Going?

- A useful chart from the Angelist state of venture report for Q3 2023 showing what areas venture dollars are going.

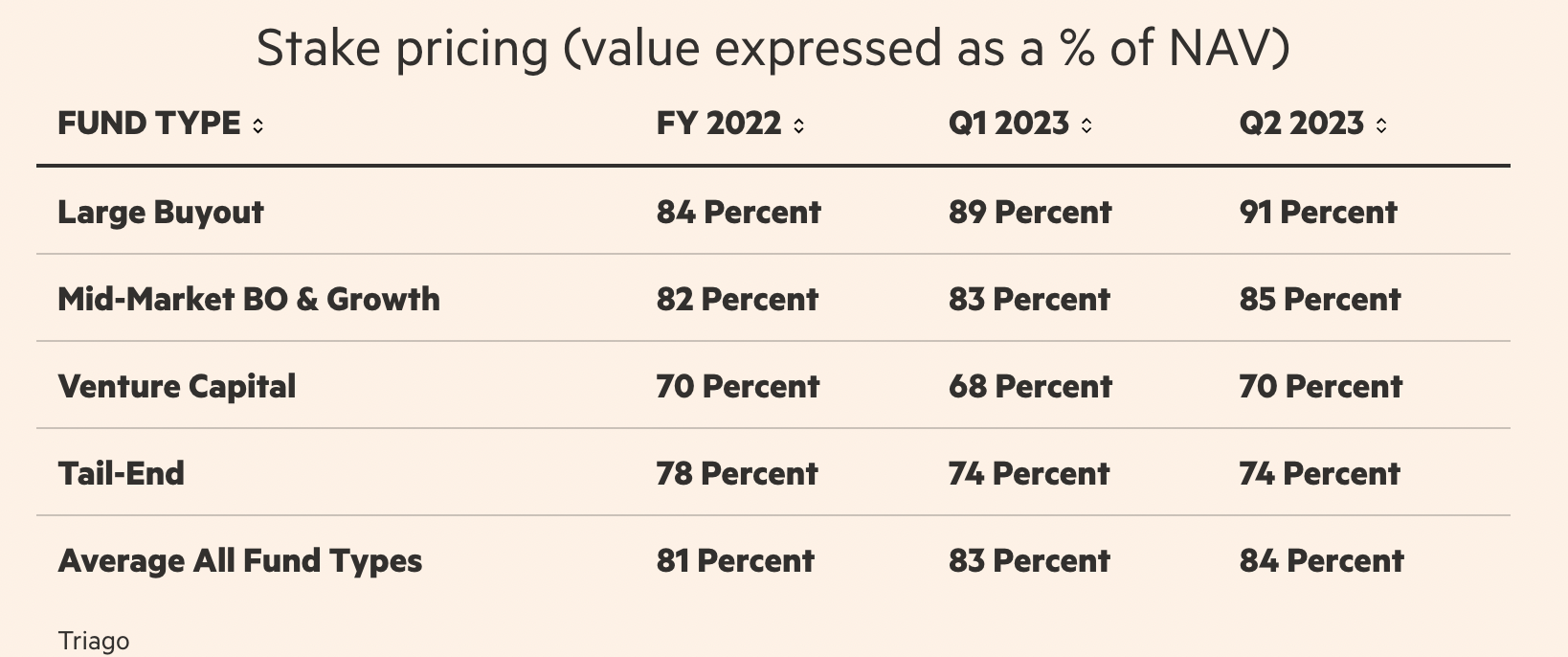

Secondary PE

- Nice table showing at what valuations LP interests in various types of private equity funds are changing hands.

- Source.

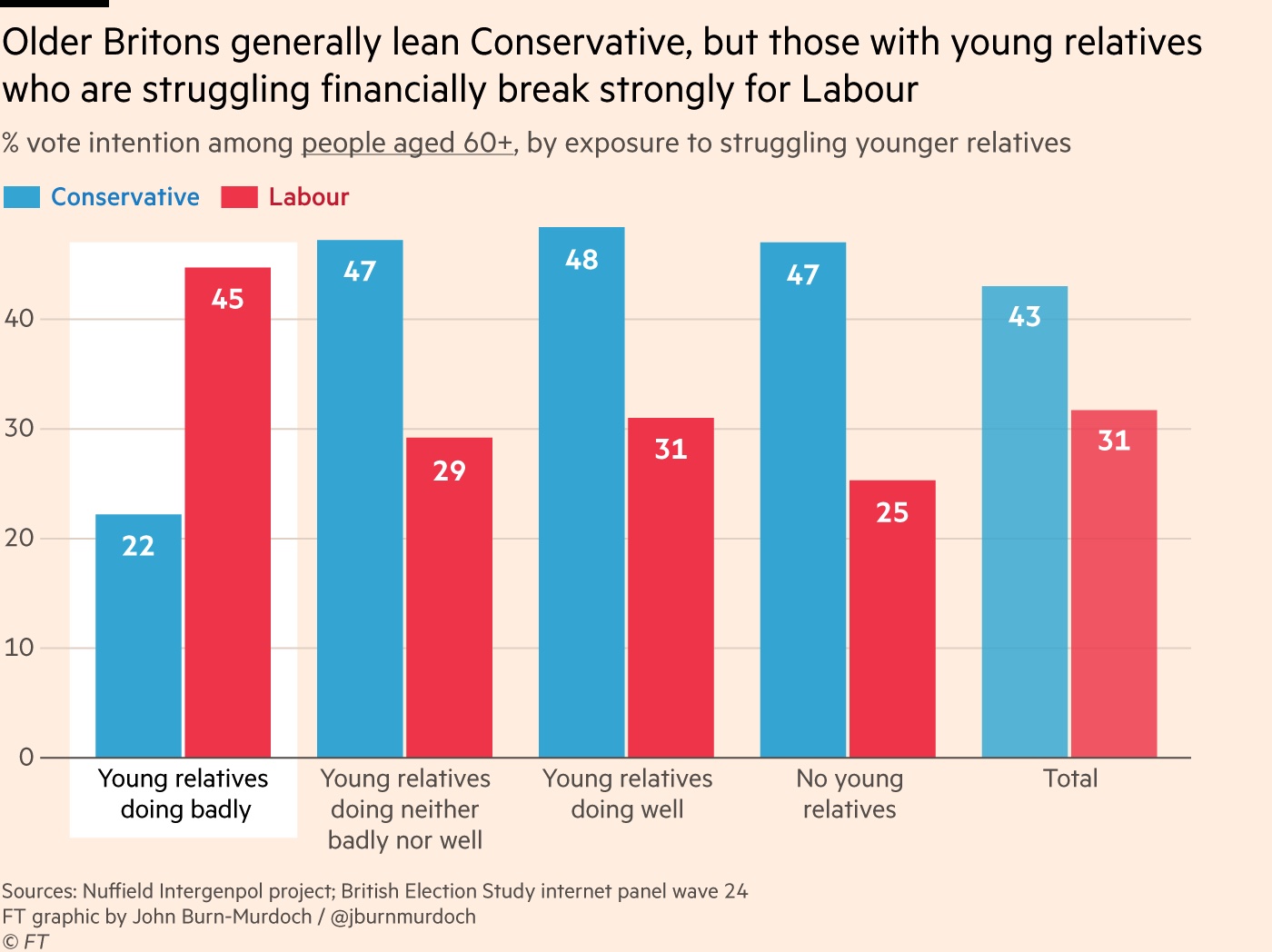

Voting Labour

- Older individuals vote Conservative.

- However, if an older individual has a struggling younger relative, they tend to vote Labour.

Paying Doctors

- CMS requires that any payment over $10 by a drug or medical technology company to a doctor or healthcare provider is disclosed.

- You can actually see all of these payments here.

- One can search by company and even individual doctor.

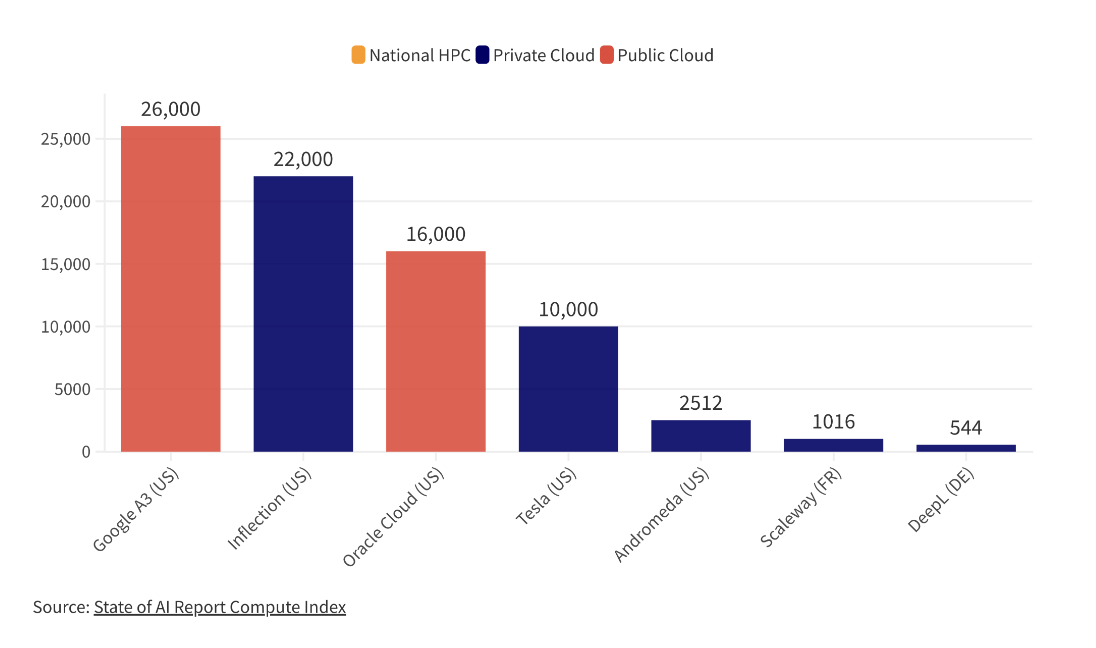

State of AI Report 2023

- We have covered this series of reports before.

- The latest 2023 report is worth a flick (all 160 slides).

- This graph, for example, shows the largest Nvidia H100 chip clusters – interesting to see TSLA there, who also run the 4th largest A100 cluster in the world.

- Or see Slide 76 which suggests that Nvidia’s advantage (the use of its chips in academic papers) continues to increase.

Fundraising

- Essay by Paul Graham on startup fundraising. Interesting observations.

- It is always a no until it is a yes – investors lead you on.

- Have multiple plans to fit multiple investor types (and sizes).

- Valuations don’t matter that much.

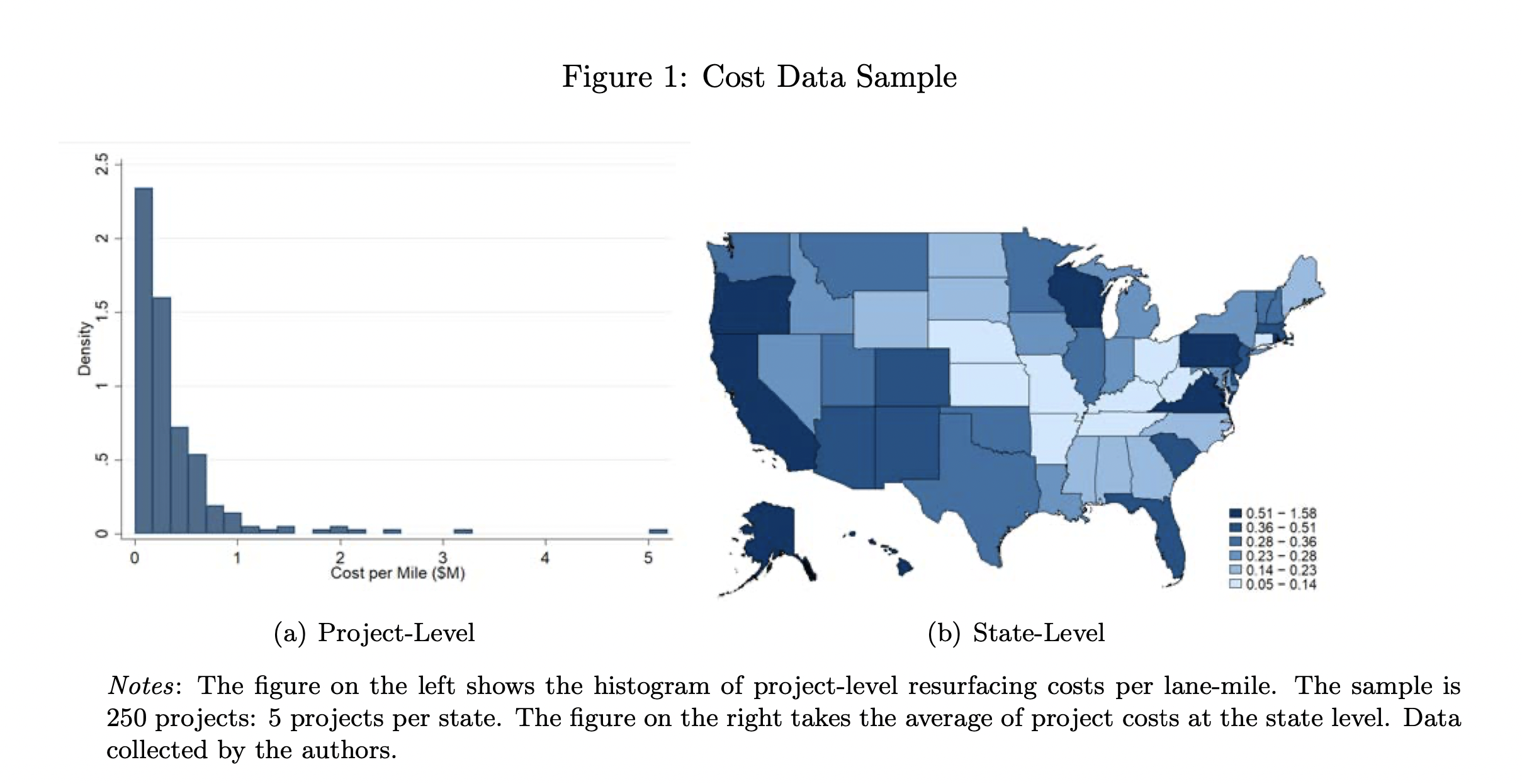

State Level Infrastructure

- There is substantial variation in the cost of infrastructure (here road resurfacing costs per mile) across states.

- Why? This paper explores the reasons using a unique dataset.

NAV Loans

- Borrowing by private equity firms at the fund level.

- Ted Seides argues it is an end-of-cycle phenomenon.

- “NAV loans strike me as a canary in the coal mine signaling the end of the private equity boom. According to Preqin, 645 firms have not raised a new vehicle since 2015. With interest rates higher and the fundraising environment tighter, credit is scarce. NAV loans feel like the “extend and pretend” activity we saw after the GFC. For every Vista NAV loan, there are probably ten used to cure the woes of a GP.”