- There has been a “seismic shift” in global financial markets – “the use of collateral, notably in the form of government securities” becoming “ubiquitous” at the cost of directly assessing borrower cash flow.

- Pushed along by policy this switch from relationship to transactions banking has resulted in an unprecedented broadening and deepening of financial markets, especially derivatives.

- Yet, this has also created huge vulnerabilities in financial markets, according to a new BIS article.

Misc

Miscellaneous is often where the gems are.

How to write like Malcom Gladwell

- It’s not just simple and clear – his writing, like that of Dickens, is rich and dense with information.

- Or at least that is what this brilliant article argues.

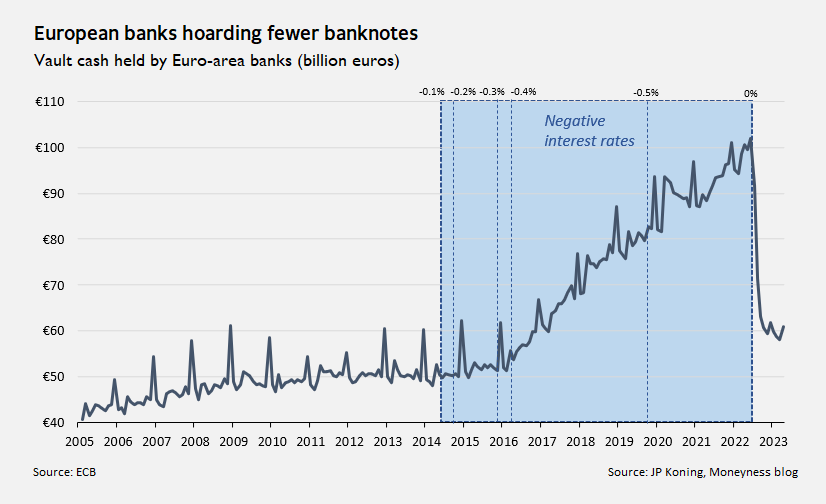

Hoarding Cash

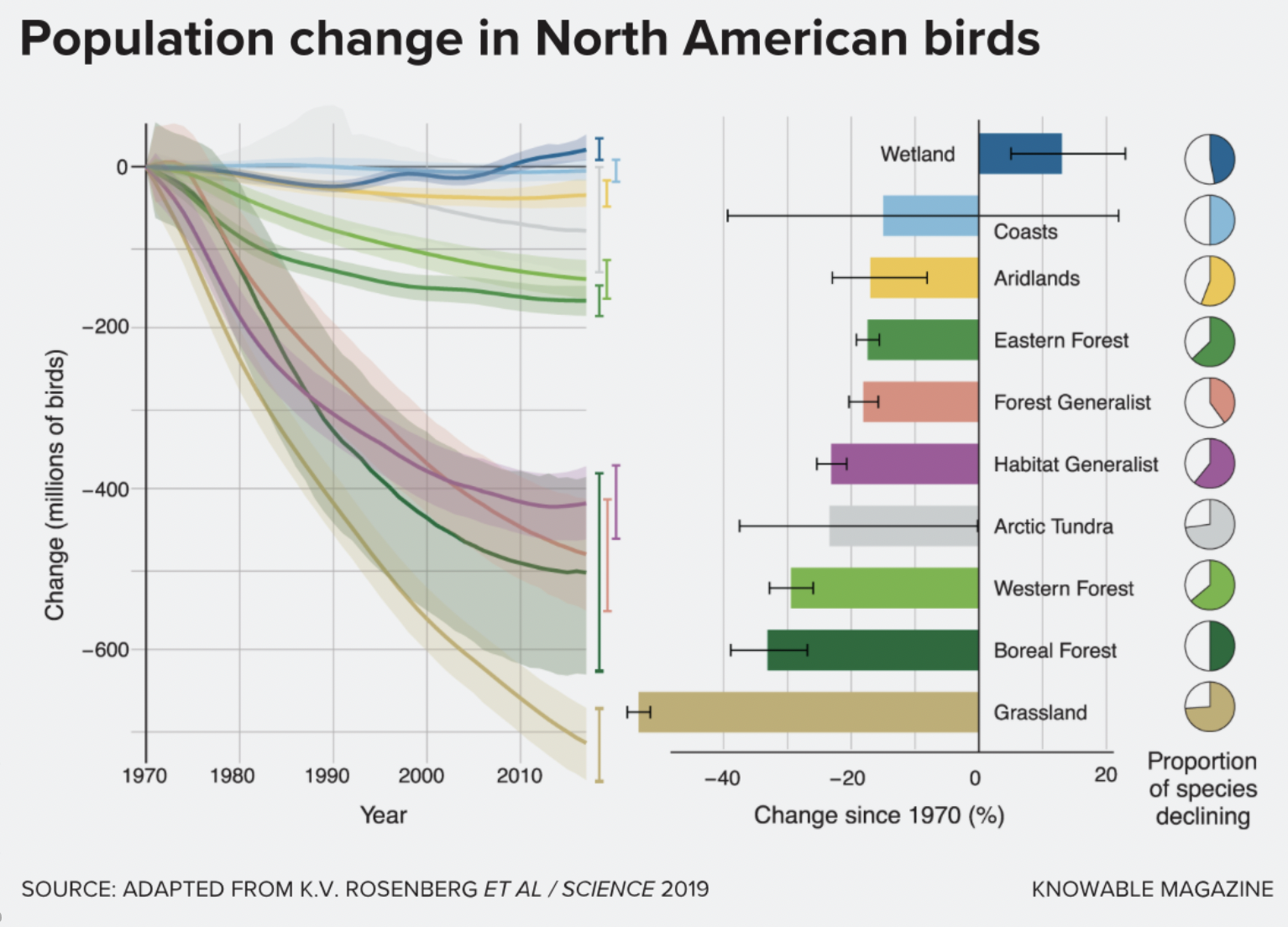

Birds

- “Since 1970, the team reported in Science in 2019, the number of birds in North America has declined by nearly 3 billion: a 29 percent loss of abundance.“

- Source.

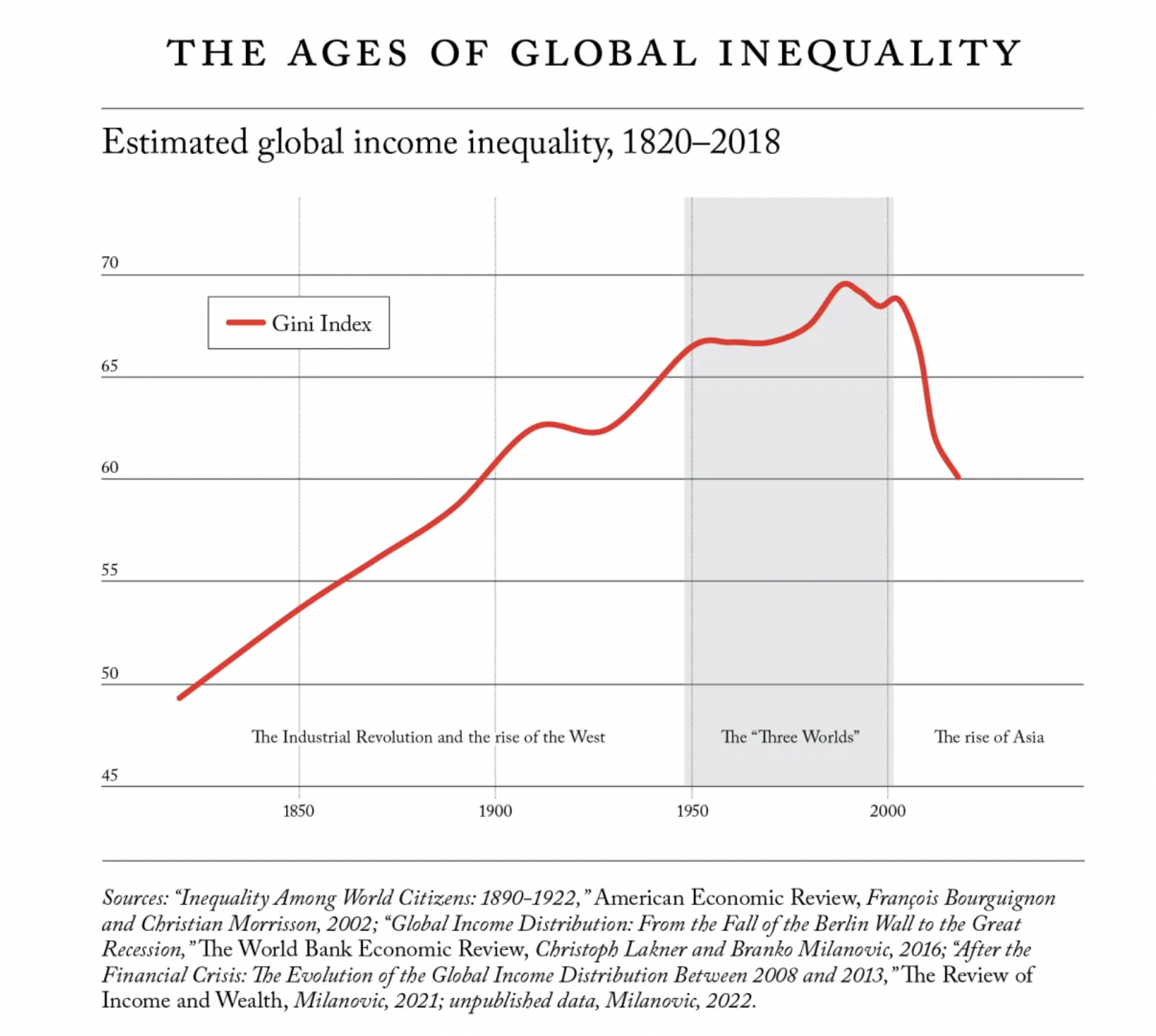

Inequality Narrative Violation

- “The world is growing more equal than it has been for over 100 years.“

- That might surprise many.

- Source.

Algorithms and AI

- AI is now being applied to finding better computer science algorithms.

- For example, Deepmind just cracked making a better sorting algorithm.

- This is a big deal. Why?

- “They underpin everything from ranking online search results and social posts to how data is processed on computers and phones.“

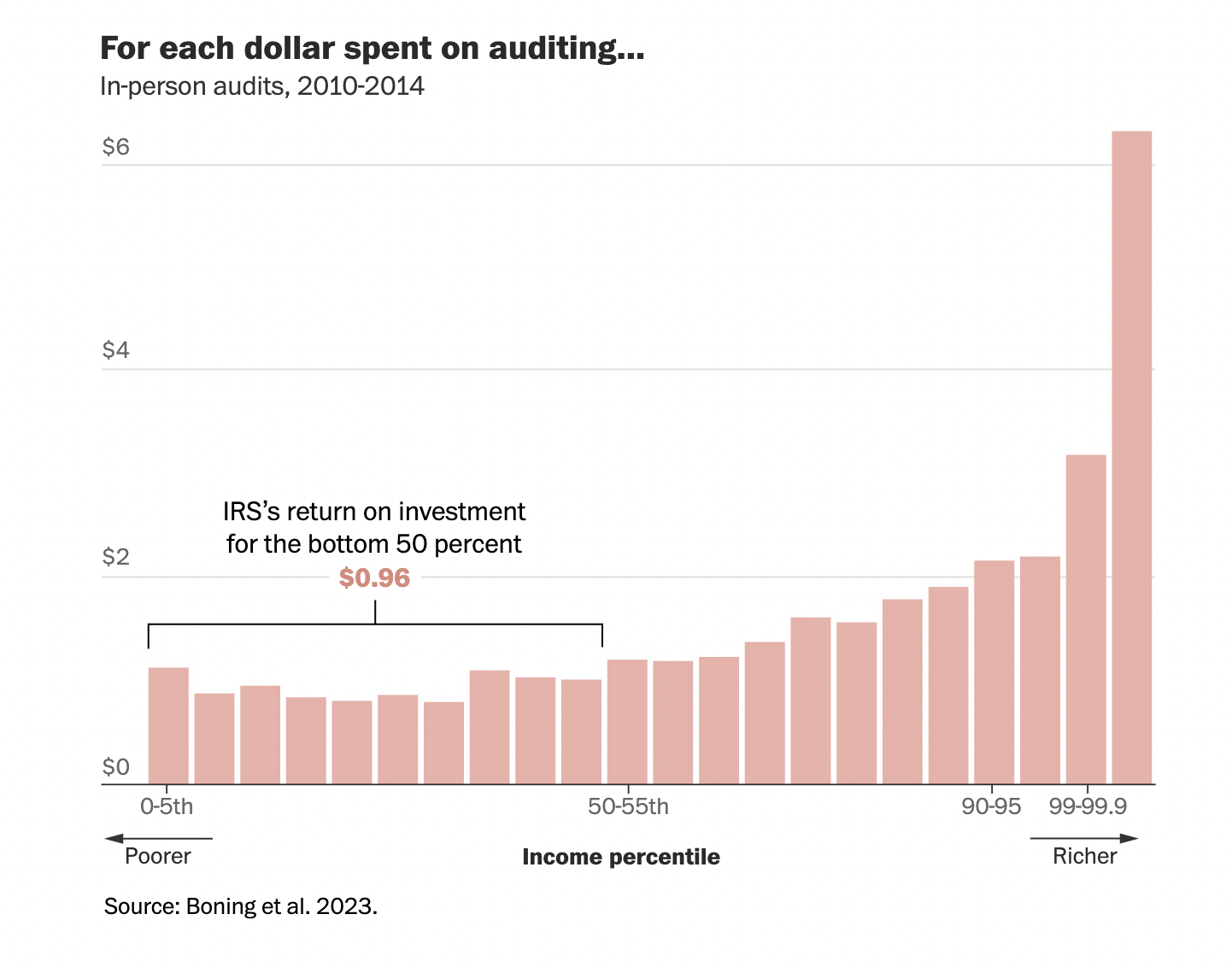

IRS Auditing Returns

- On average the IRS makes 2x return on audits.

- However, this varies greatly by income.

- Source.

Patient Capital with High Active Share

- High active share – where portfolios differ markedly from the benchmark – does well (+2% pa outperformance) but only if holding periods are over two years.

- So having high active share isn’t enough if the fund trades a lot.

- Being patient isn’t enough – as those with low active share do worse.

- Full paper here.

Understanding AI

- Economics says change happens in the adjustment of prices and relative prices.

- “Thanks to GPT, every programmer has the potential to be 10x more productive than the baseline from just 2 years ago.”

- This means:

- (1) The data-software combined price is collapsing opening enormous “volume growth”.

- (2) Within it the relative value of software vs. data, especially unique data sets, is changing in the benefit of the latter (Media companies?).

- (3) New scarcity is arising – likely in hardware and energy.

- Full article here.

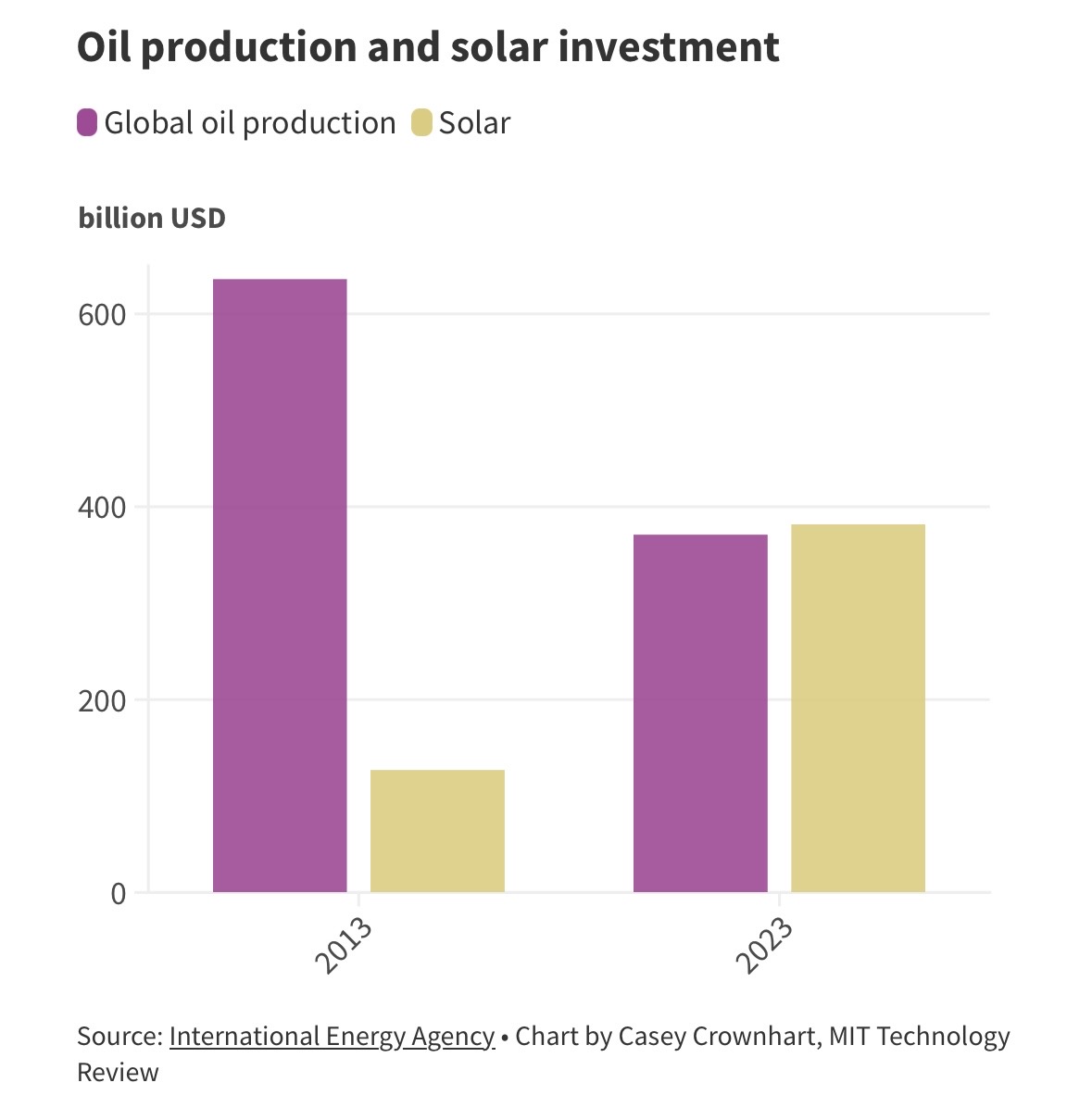

Solar vs Oil Capex

- “In 2023, for the first time, investment in solar energy is expected to beat out investment in oil production. It’s a stark difference from what the picture looked like a decade ago, when oil spending outpaced solar spending by nearly six to one.”

- Source.

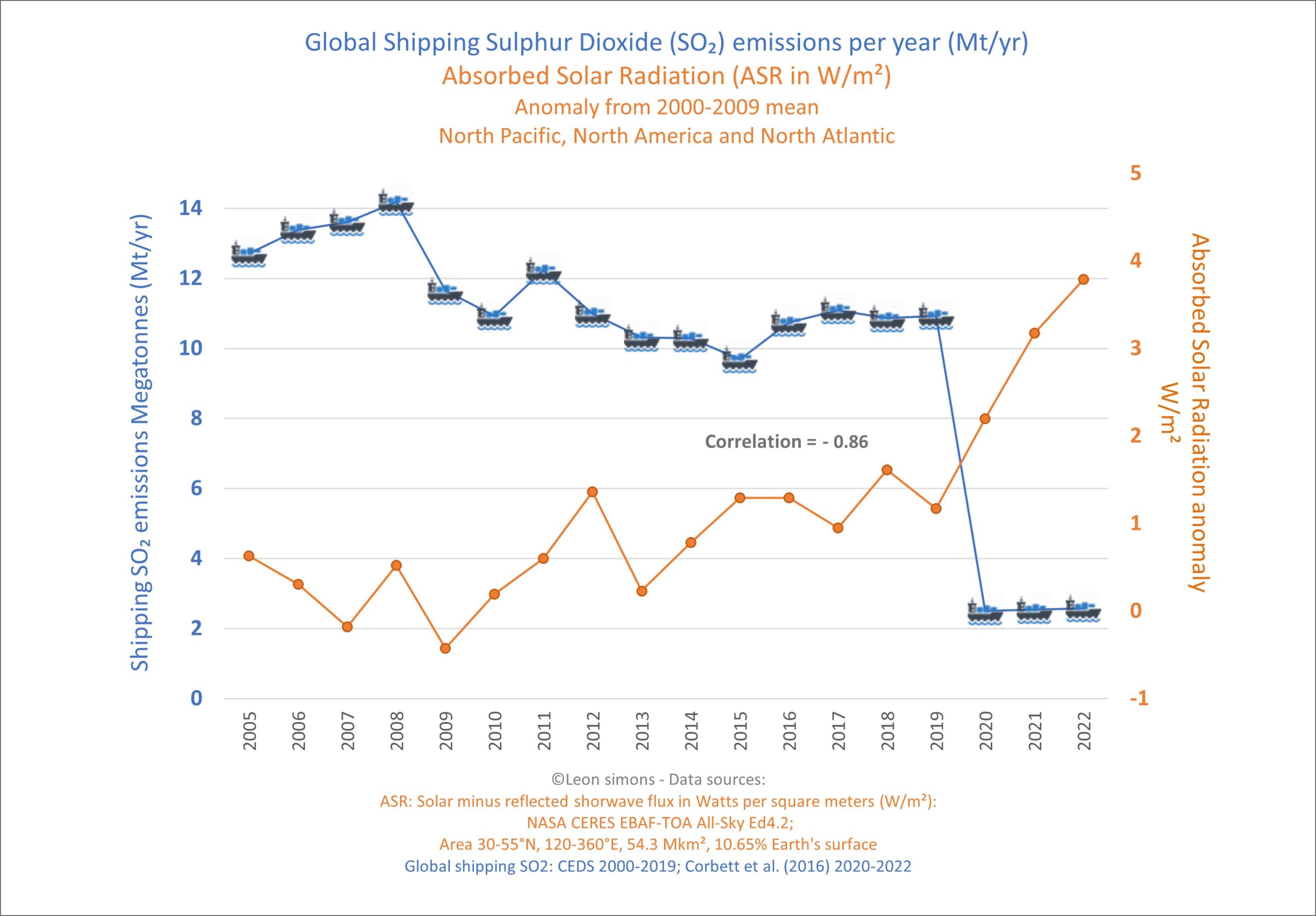

Ship Sulphur Emissions and Unintended Consequences

- From 1st of Jan 2020 ships had to reduce the amount of sulfur in shipping fuels from 3.5% to 0.5%.

- Although intended to reduce pollution, all that sulfur was reflecting solar radiation from the surface of the ocean.

- With it gone, the part of the ocean dominated by shipping lanes is starting to heat up.

- Source.

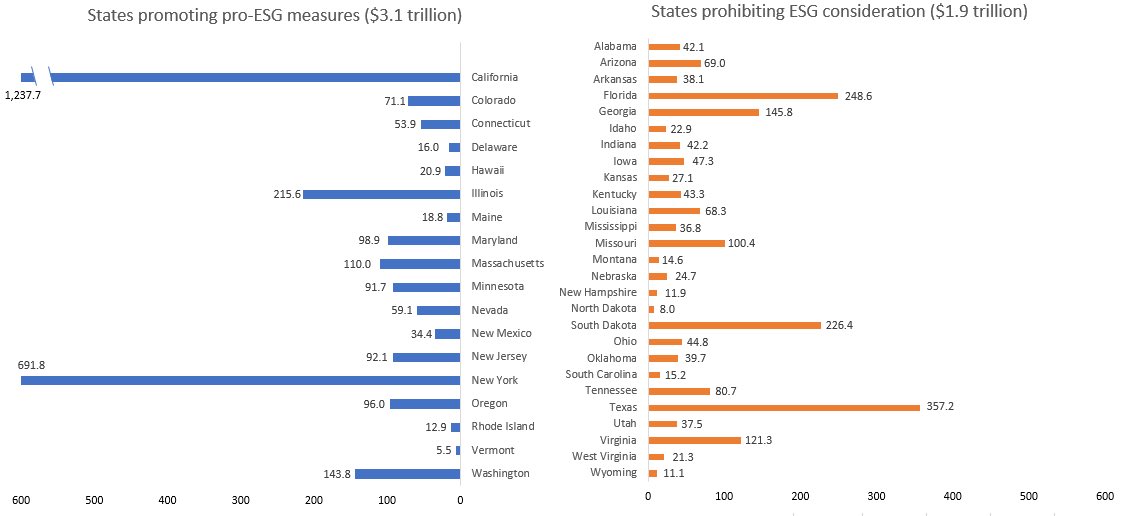

ESG bifurcation

- Chart showing pension assets by states enacting pro and anti-ESG legislation.

- 18 states, representing $3.1tn of assets are encouraging ESG.

- 27 states, representing $1.9tn of assets are opposing it.

- Source: Moody’s h/t Duncan Lamont.

Childhoods of Exceptional People

- Can we draw any conclusions from the childhoods of exceptional people?

- This long essay attempts to do just that.

- Naturally, this sort of analysis is anecdotal but in many ways interesting.

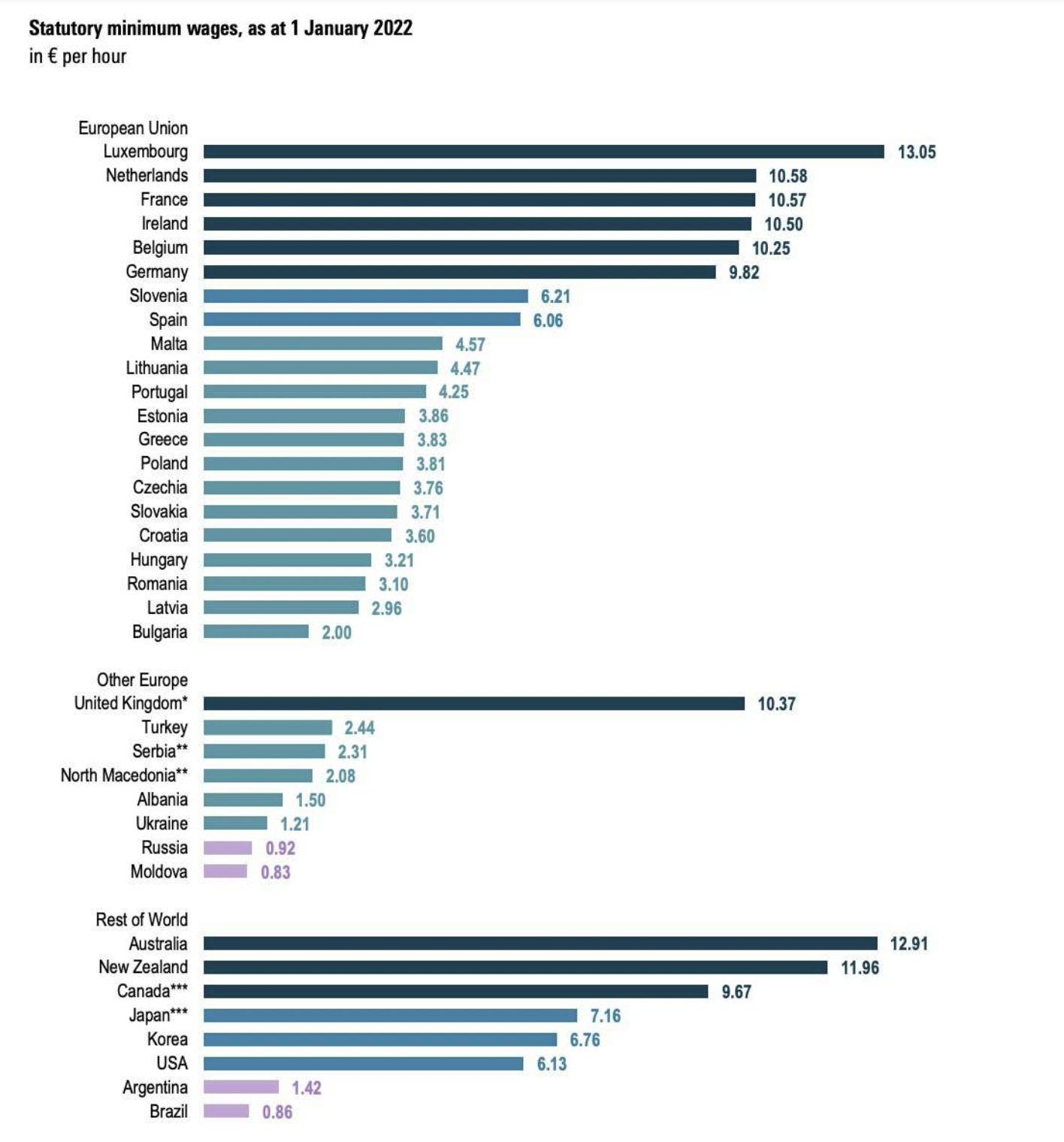

Statutory Minimum Wages

- From around the world.

WebGPU

- Techy development – webGPU will soon let your browser access your computer’s GPU (Graphic Processing Unit).

- This will have obvious applications to AI, which runs on GPU chips.

- Source via Ben Evans.

Autoimmune Disease

- This large (22m records) cross sub-discipline study found that nearly one in ten people (13% for women and 7% for men) have an autoimmune disease – much higher than historic estimates.

- this “research also confirmed that some autoimmune diseases tend to cluster together (for example, one person with a first autoimmune disease is more likely to develop a second autoimmune disease than someone without autoimmune disease), however at a much larger scale and for a much larger set of autoimmune diseases than previous studies.“

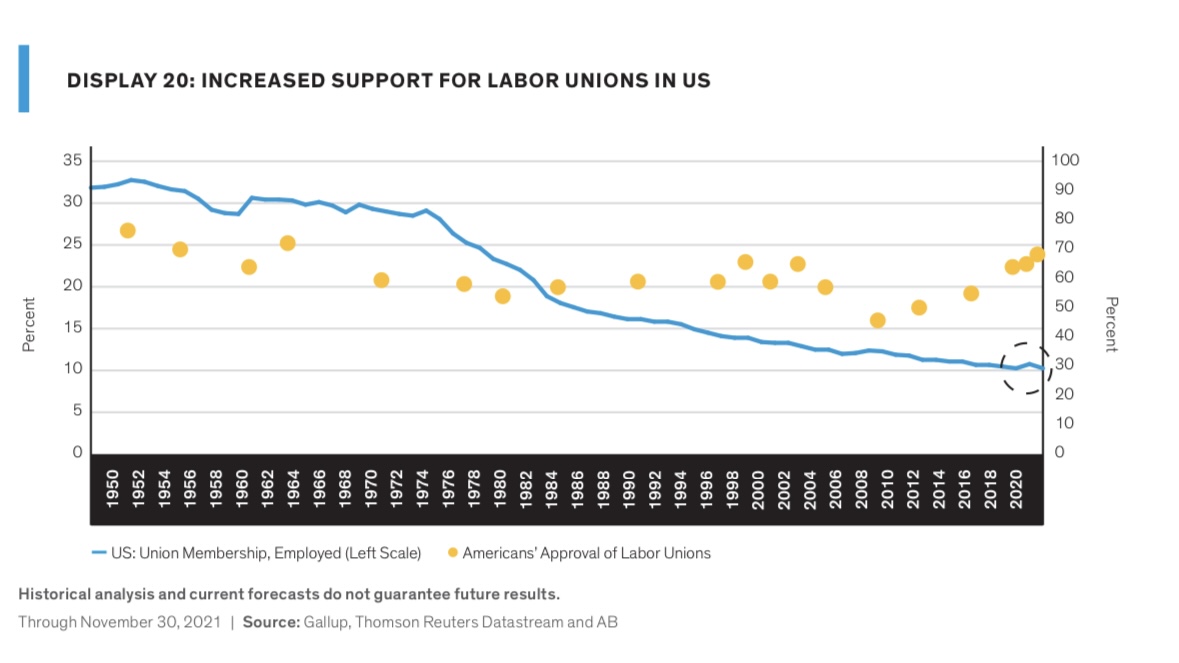

Labour Union Support is on the Rise

- Quite the divergence as membership of US unions continues to fall.

- Source: Bernstein.

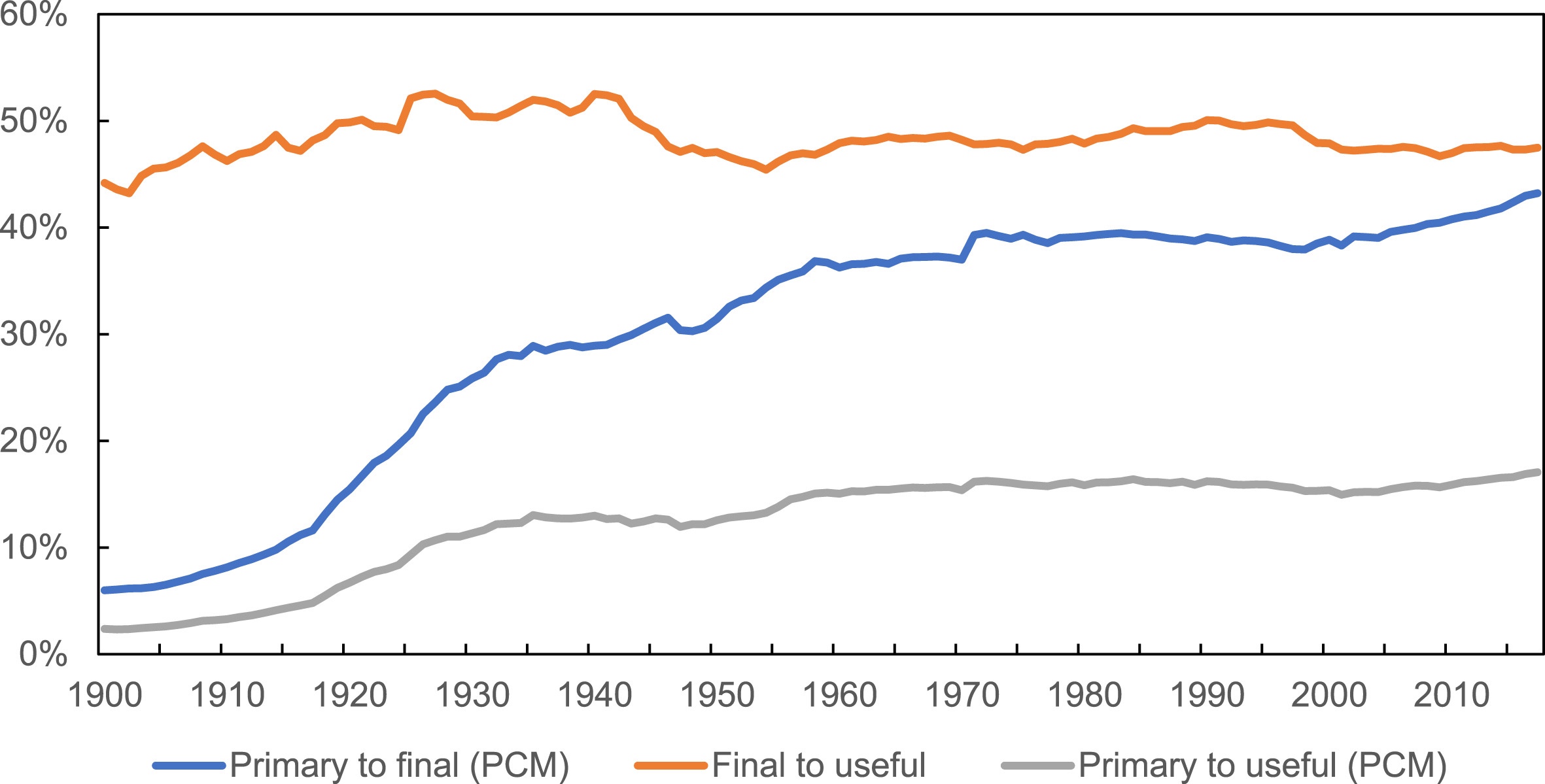

Electricity Exergy Stagnation

- “The most striking finding is that world electricity energy efficiency (measured as overall primary-to-useful exergy efficiency) has stalled, rising dramatically from 2% in 1900 to 15% in 1960, and remaining nearly stable for the last 50 years, only reaching 17% by 2017.”

- Why? Power generation got very efficient from 1900 to 1960 but we started to use the electricity in uses that aren’t efficient (mainly switching use to heat and cool buildings).

- Source.

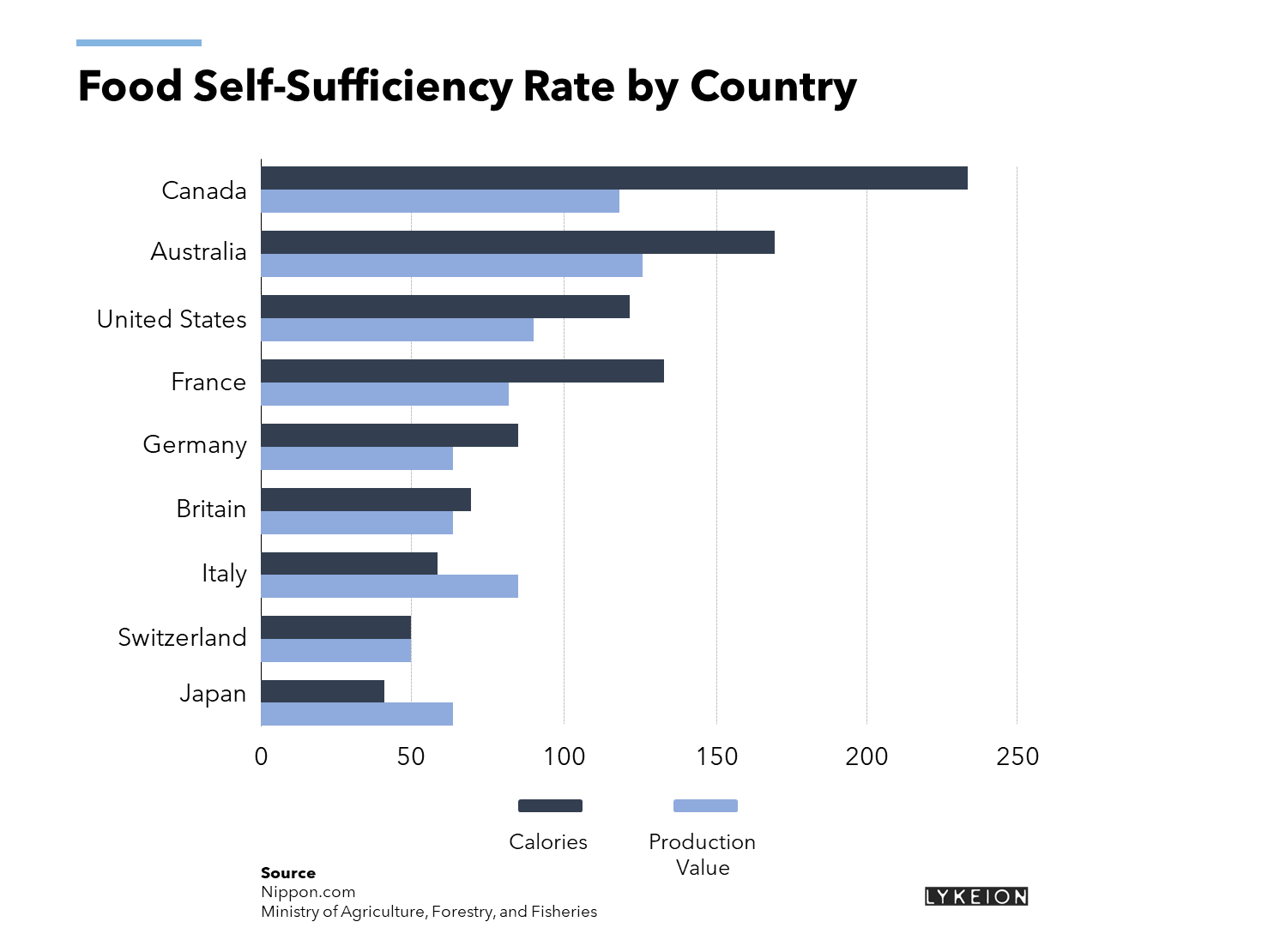

Food Self-Sufficiency

How does ChatGPT work?

- In the spirit of Feynman this superb blog post, by none other than Stephen Wolfram, gives a lucid explanation of what is going on under the hood of the latest tech phenomenon.

- The short answer is “it’s maths”.

- “But in the end, the remarkable thing is that all these operations—individually as simple as they are—can somehow together manage to do such a good “human-like” job of generating text. It has to be emphasized again that (at least so far as we know) there’s no “ultimate theoretical reason” why anything like this should work. And in fact, as we’ll discuss, I think we have to view this as a—potentially surprising—scientific discovery: that somehow in a neural net like ChatGPT’s it’s possible to capture the essence of what human brains manage to do in generating language.”