- Nice mapping of the world’s payments landscape.

- “There remains significant country-level dispersion in revenue per transaction, driven by a variety of factors, including transaction pricing dynamics and payment instrument mix“

- Source.

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

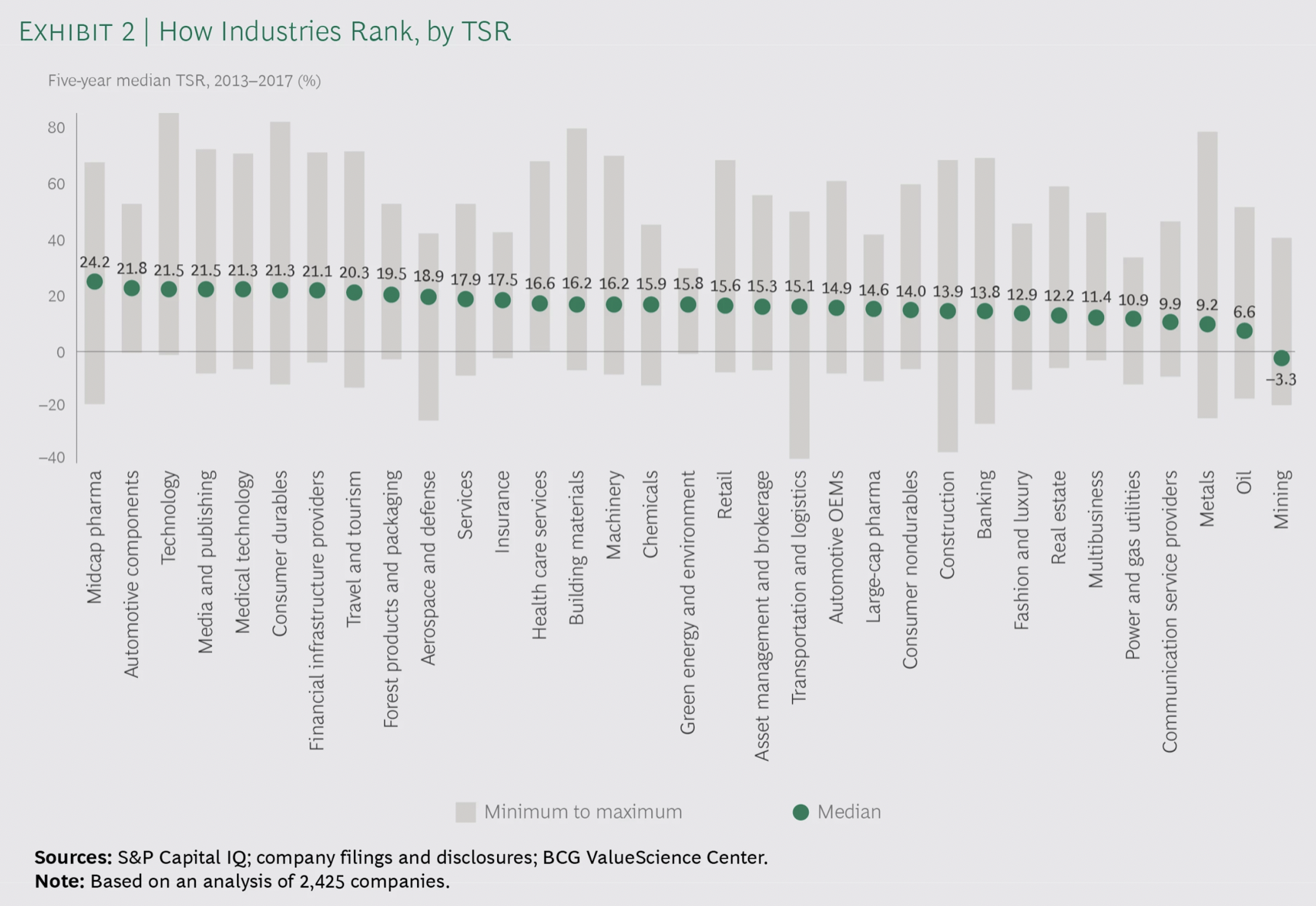

TSR across industries

- Interesting chart from BCG.

- It looks at TSR (Total Shareholder Return) over a 5-year period (2013-2017) across industries.

- “The median TSR of the top ten companies in each industry was higher than the industry’s median by 9 percentage points (in insurance) and 32 percentage points (in media and publishing as well as metals).“

- “The lesson is this: being in a sector whose market performance is below average is no excuse. TSR is a relative—as well as an absolute—metric, so whether an industry is under pressure or accelerating, every company has the opportunity to outperform its peers.”

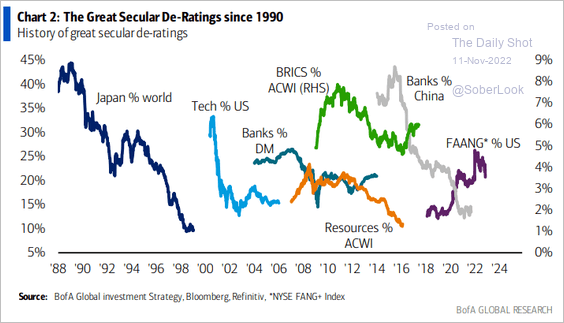

Secular de-ratings?

- Interesting chart from ML via Daily Shot.

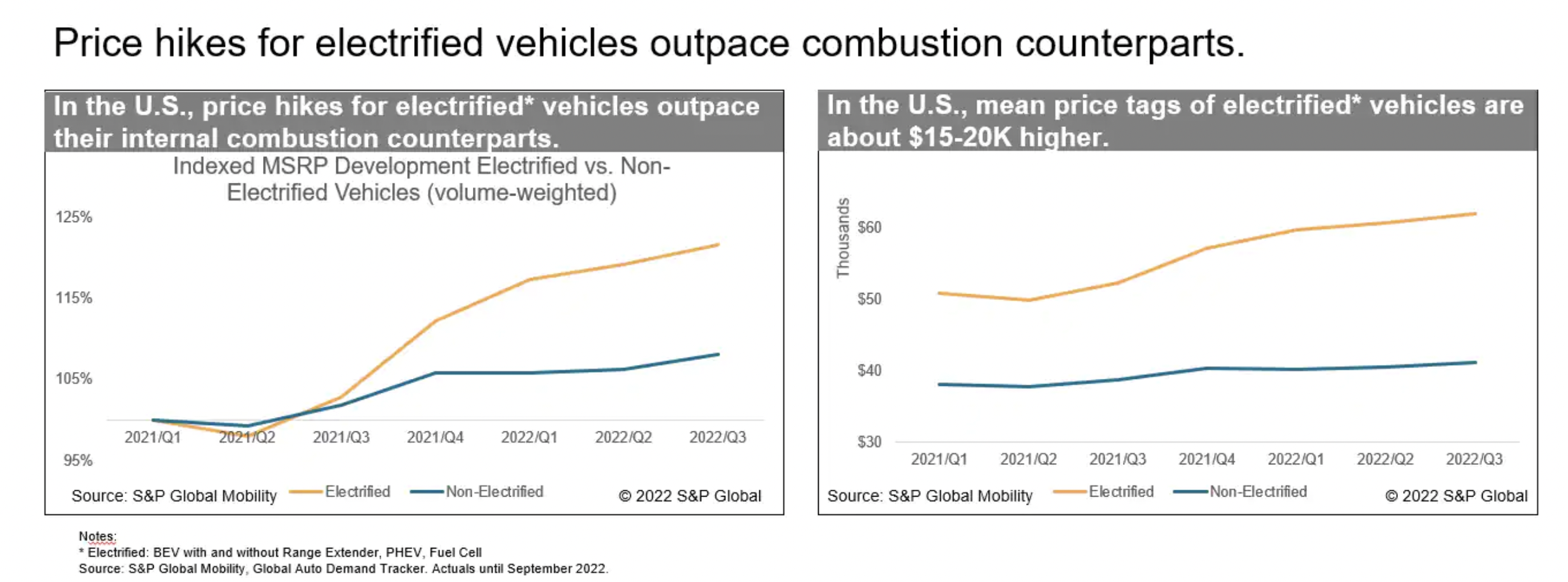

Electric Vehicle Pricing

- “Since about 2021-Q4, prices for electrified vehicles significantly outpaced their internal combustion counterparts, largely owing to battery material prices.“

- These vehicles are “on average about $15-20K higher than their internal combustion counterparts.“

- This is probably the opposite of what one expects to see for a new technology – but TCO considerations still drive most purchase decisions.

- Source.

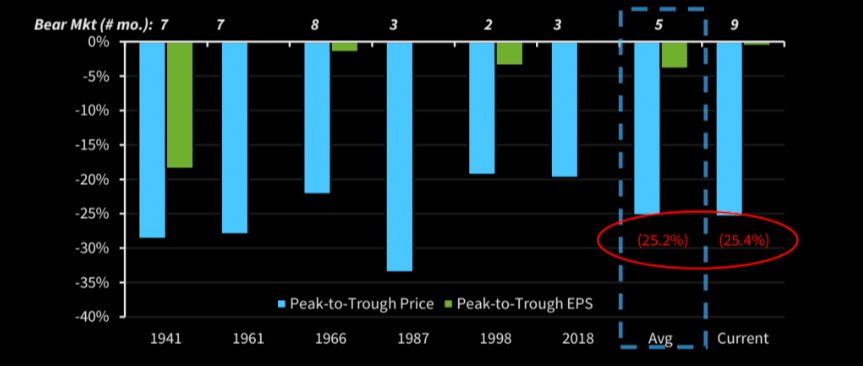

Bear Markets

- Presented without comment.

- Source: themarketear.com.

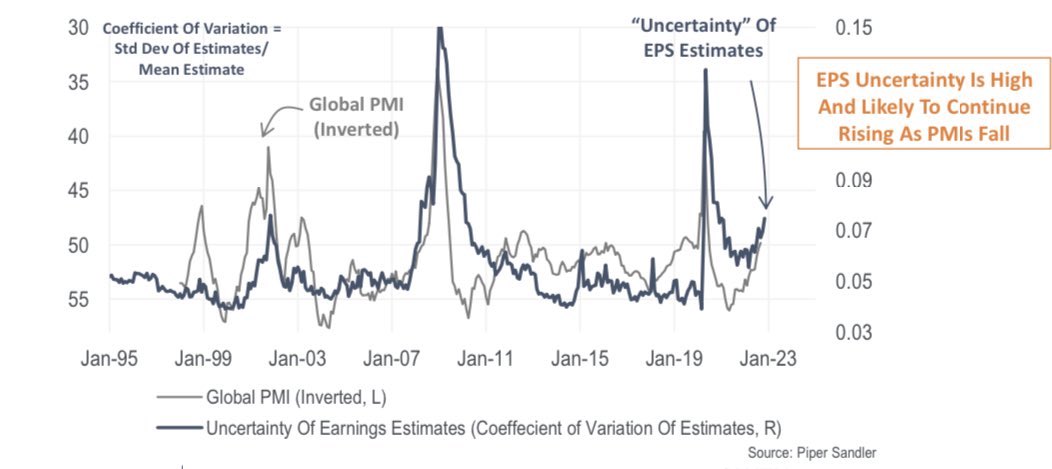

Falling PMIs and EPS Uncertainty

- One consistent feature of falling PMI regimes is a rise in uncertainty of EPS estimates.

- Source.

Index Monsters

- The big three are increasingly dominant, even more so in small cap stocks.

- “Last year, the big once again became even bigger. At the end of 2021, Vanguard, BlackRock and State Street, the three biggest index fund providers, together control on average 18.7 per cent of S&P 500 companies, according to Lazard. Their ownership of smaller companies is even more concentrated. By the end of last year, they held 22.8 per cent of shares in the midsized S&P 400 index, and 28.2 per cent of the small-company S&P 600 benchmark.“

- Source: FT.

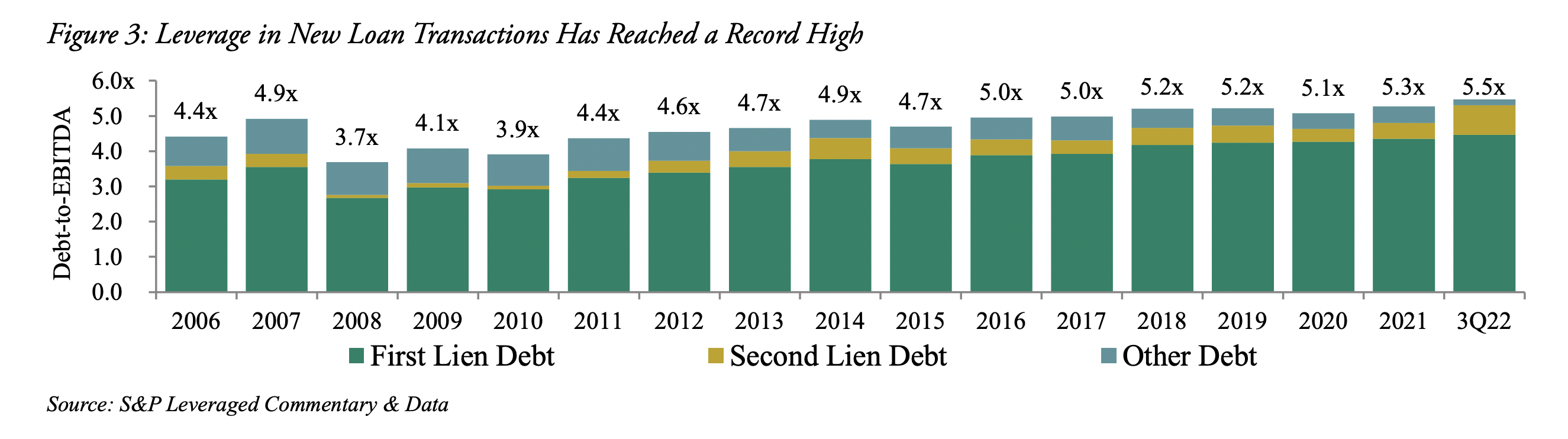

Leverage at Record Highs

- “This risk is particularly noteworthy given that many companies with loans outstanding are carrying significant debt loads. The average debt-to-EBITDA ratio in new U.S. loan transactions hit a record-high 5.5x in 1Q2022, above the 4.9x recorded just before the Global Financial Crisis.“

- “Importantly, companies involved in these transactions were often more highly levered than they appeared on paper, as many used aggressive EBITDA adjustments (e.g., for synergies, cost cuts, etc.) when making these leverage calculations.”

- Source: Oaktree.

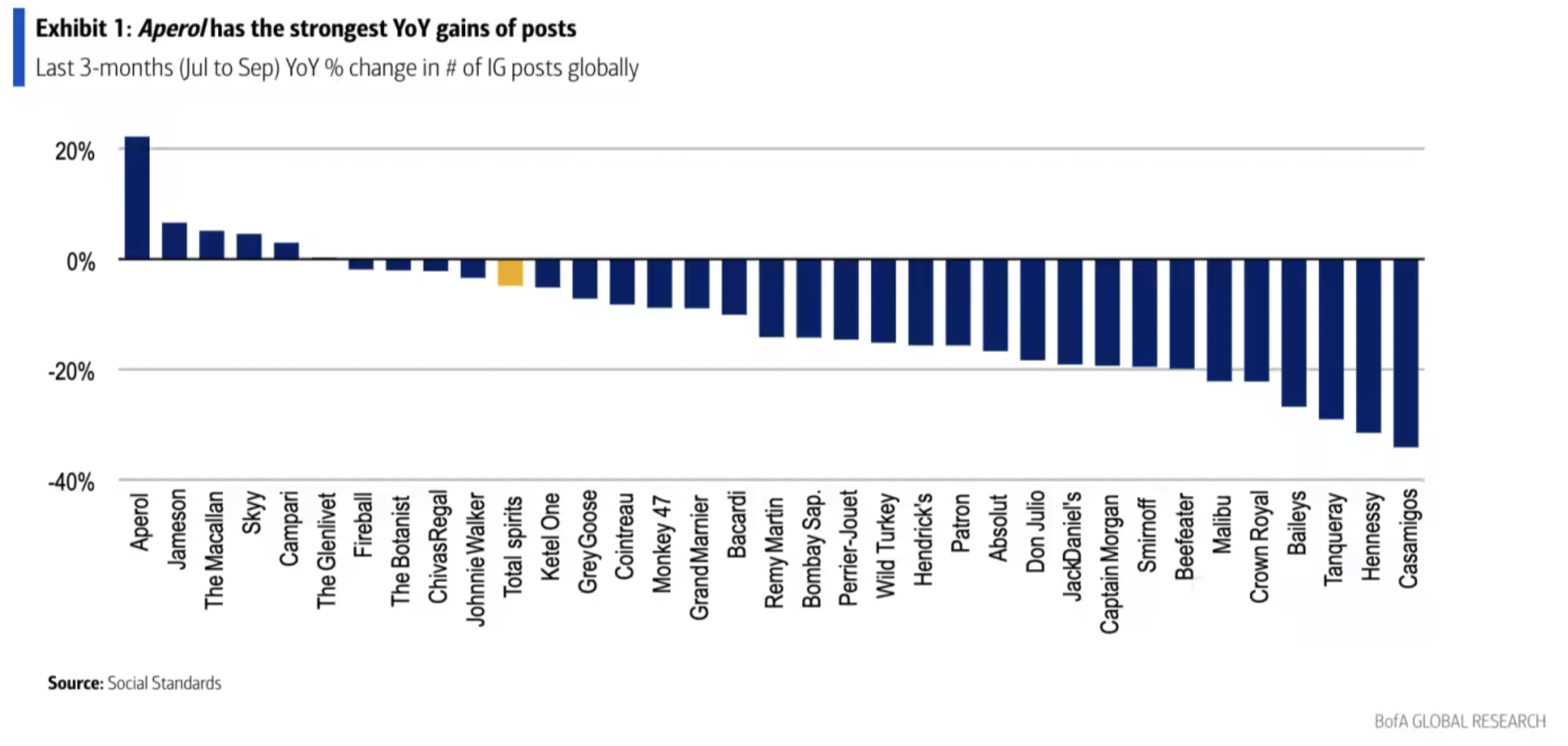

Tracking Brand IG Posts

- BAML track Instagram posts to see how popular various alcohol brands are.

- Article on how they do this (including anecdote about not tracking Corona for obvious reasons).

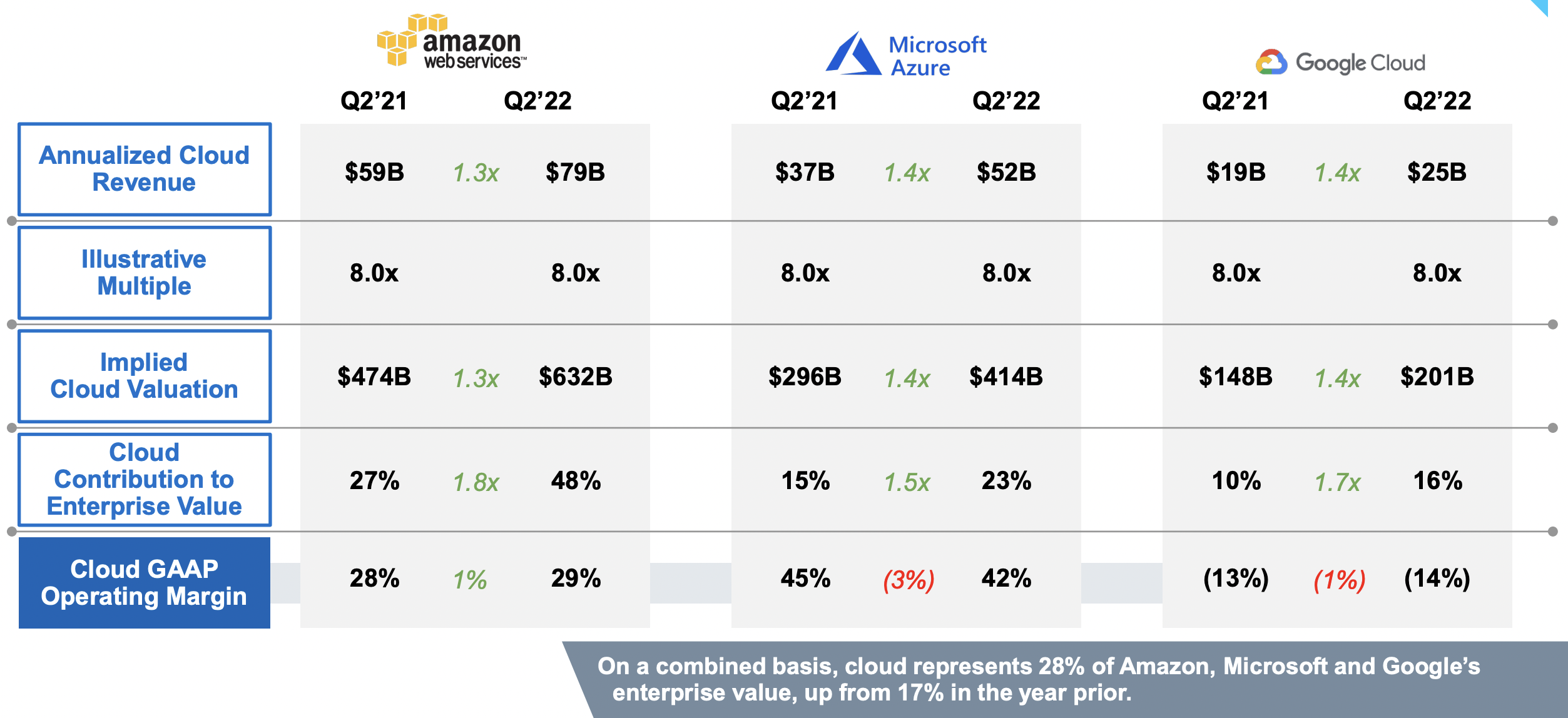

Cloud Vendors

- Cloud Vendor market was $159bn annual run-rate market in Q2, still growing 37% (though slowing).

- This growth has actually come with pretty good economics. (From this Battery VC deck).

- One very interesting feature of these vendors is they also happen to run huge cloud based products (think Xbox for example) which means they are customers of their own infrastructure – utilising it and making it better.

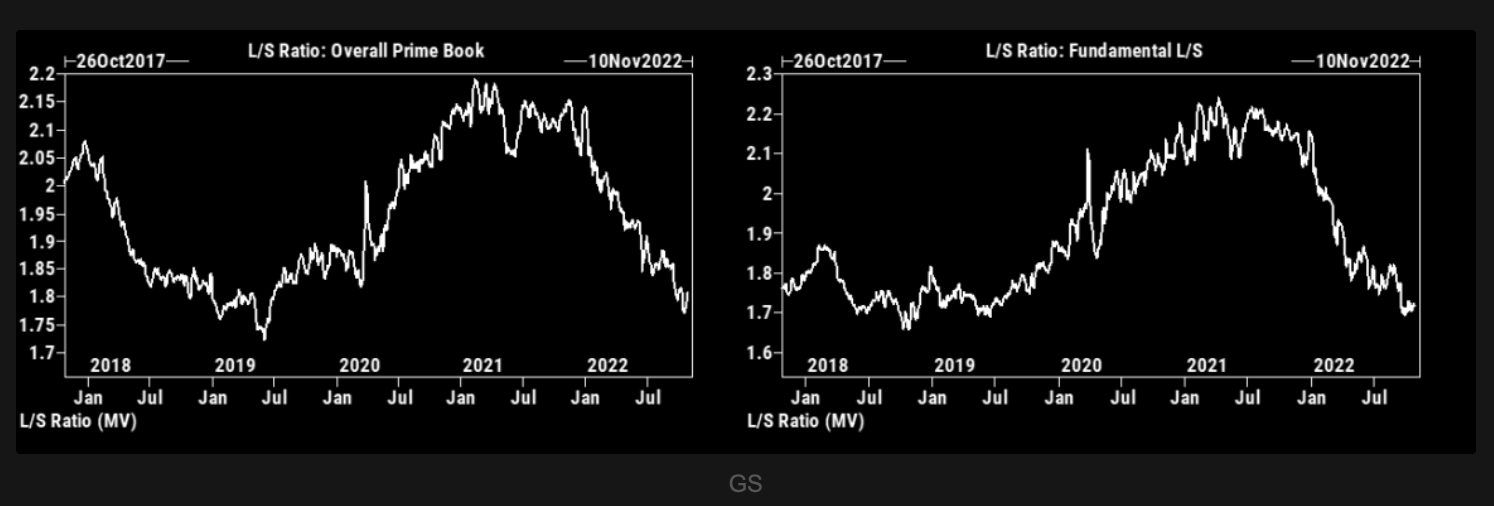

Positioning Lows

- “GS PB long/short ratio stays at longer term relatively depressed levels. This is not to be used as an input for short term trading strategies, but worth having in the back of your head.“

- Source: themarketear

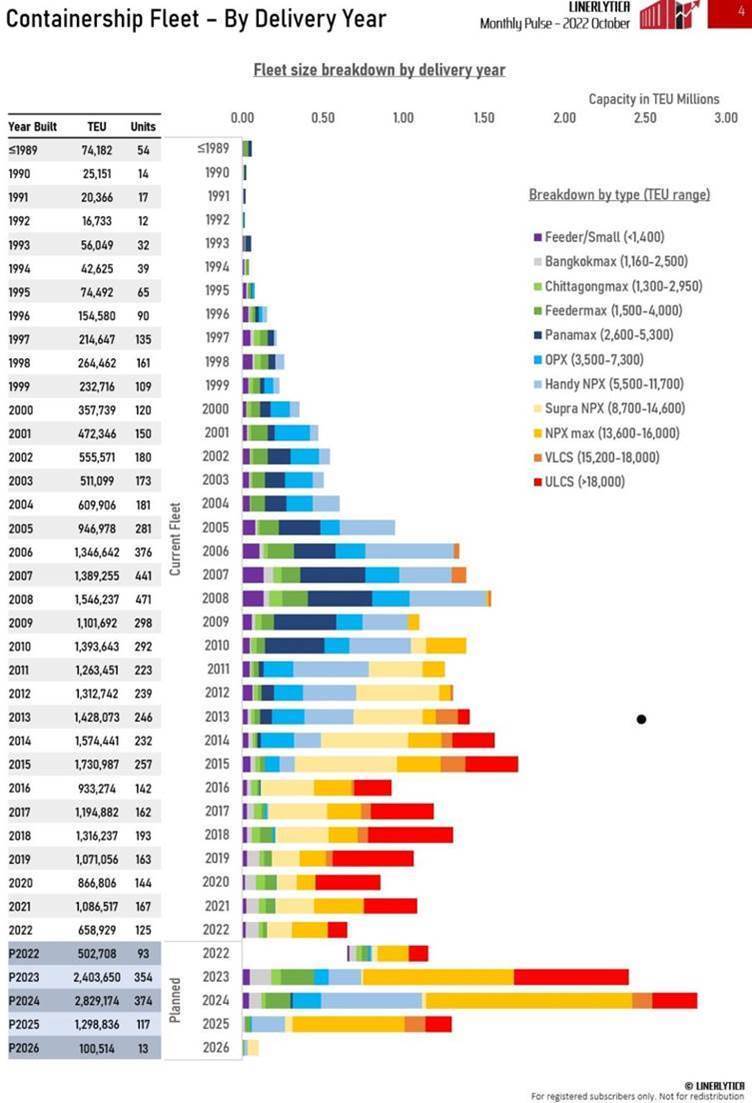

Container Fleet

- Like clockwork the capital cycle kicks in just as prices for containers have collapsed.

Corporate Insider Buying

- Insider Buy/Sell Ratio crossed above 0.14 for the first time in six weeks.

- This is rarely a good timing indicator but a bullish sign.

- Source.

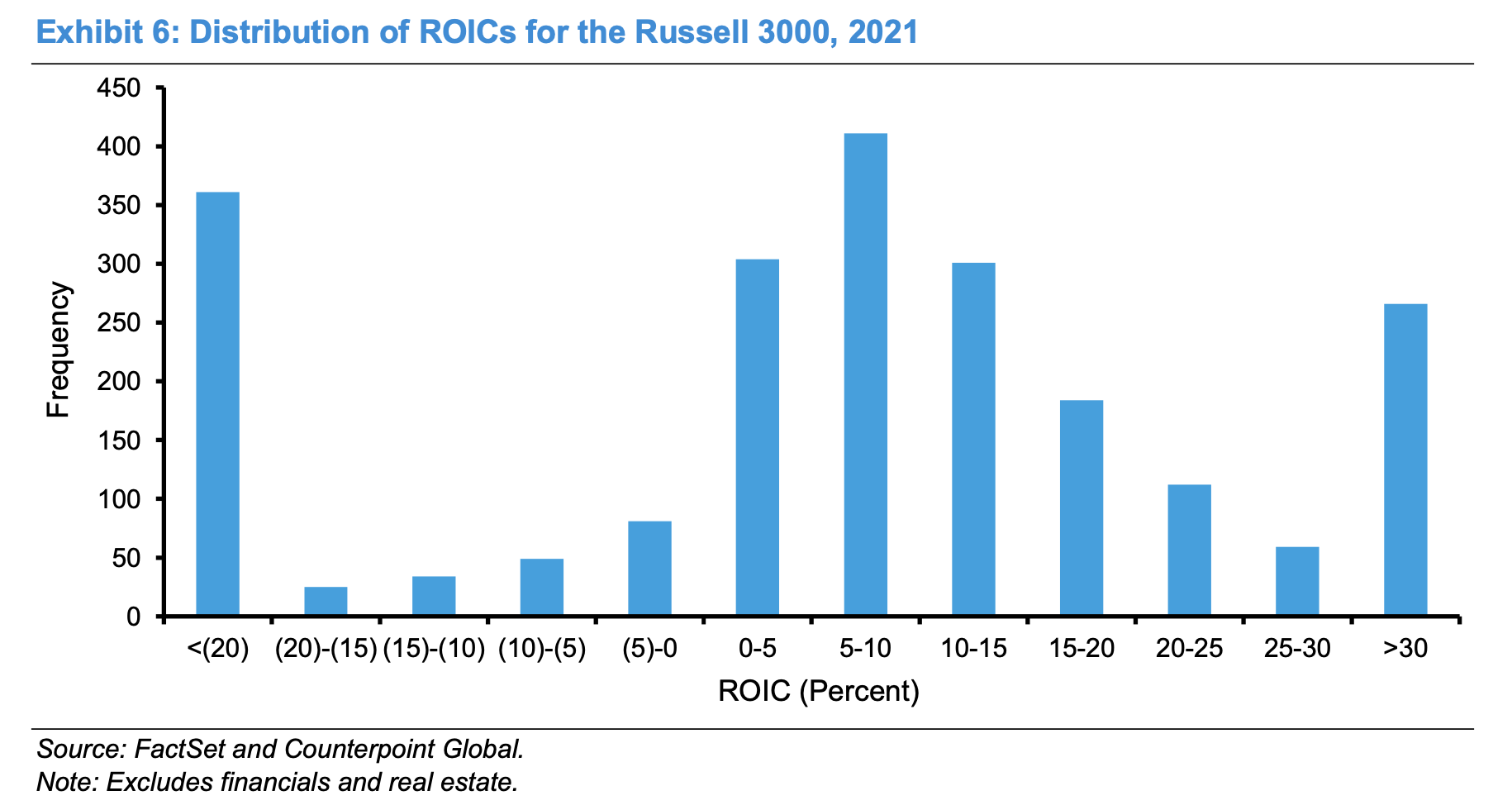

ROIC Distribution

- Interesting chart from Mauboussin showing the distribution of ROIC of the Russell 3000 index.

- “The mode is an ROIC of 5 to 10 percent, and the distribution is shaped like a bell between the tails. But nearly 30 percent of the sample are at the extremes of an ROIC of -20 percent or less or 30 percent or more.“

Password Sharing

- “The average US consumer pays for 2.93 subscriptions and borrows 1.02 accounts.“

- Source: Bain.

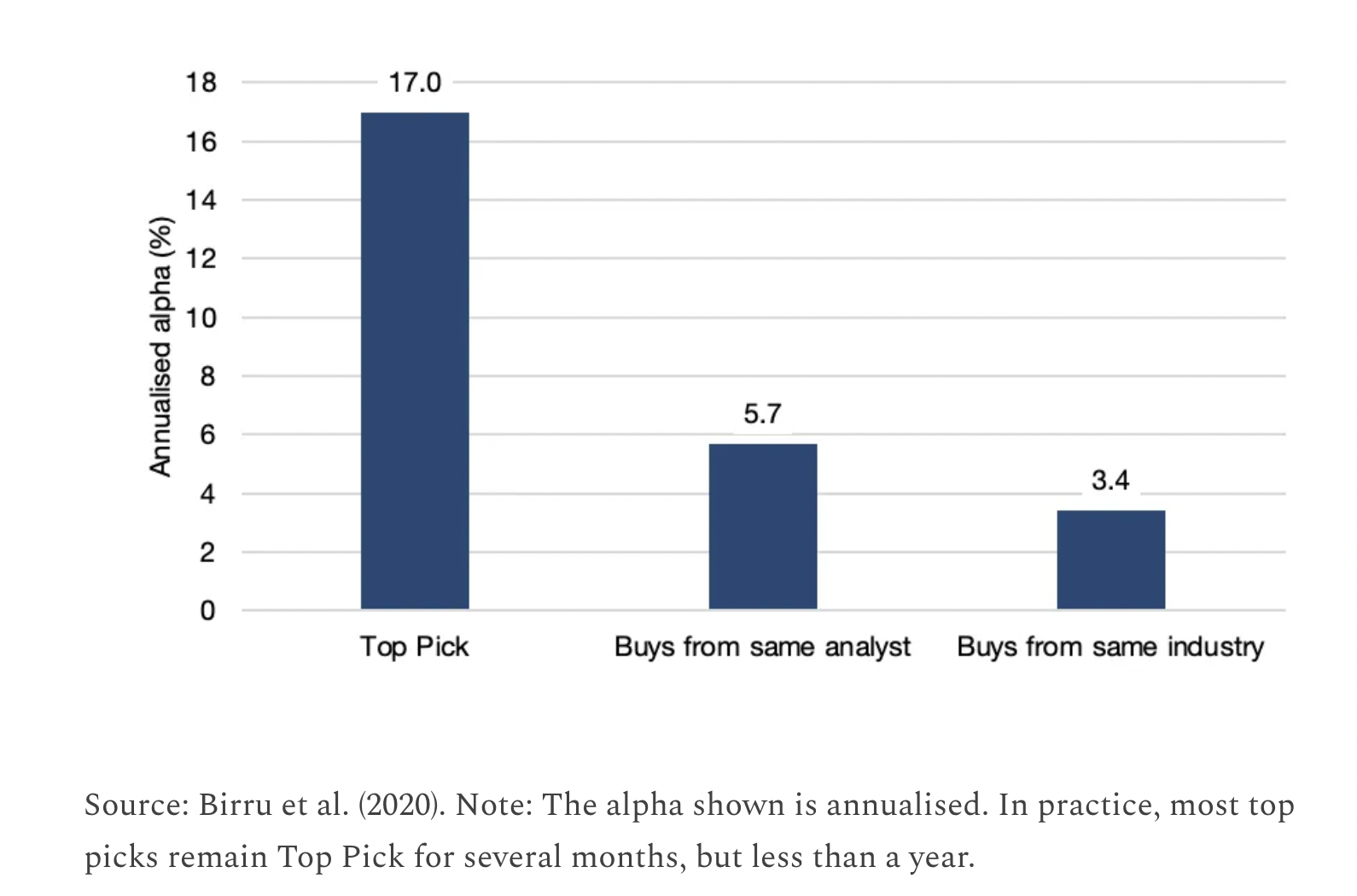

Analyst Top Picks Work

- According to Birru et al. (2020) top stock picks by sell-side analysts tend to outperform (there are nuances of course).

- h/t Klement.

Health Data Liberation

- File this under – things that could radically change the US healthcare market that few are talking about.

- Federal rules, that took effect 6th of October 2022, mean for the first time patients get unrestricted access to their health data and can choose who else does.

- “To think that we actually have greater transparency about our personal finances than about our own health is quite an indictment,” said Isaac Kohane, a professor of biomedical informatics at Harvard Medical School. “This will go some distance toward reversing that.”

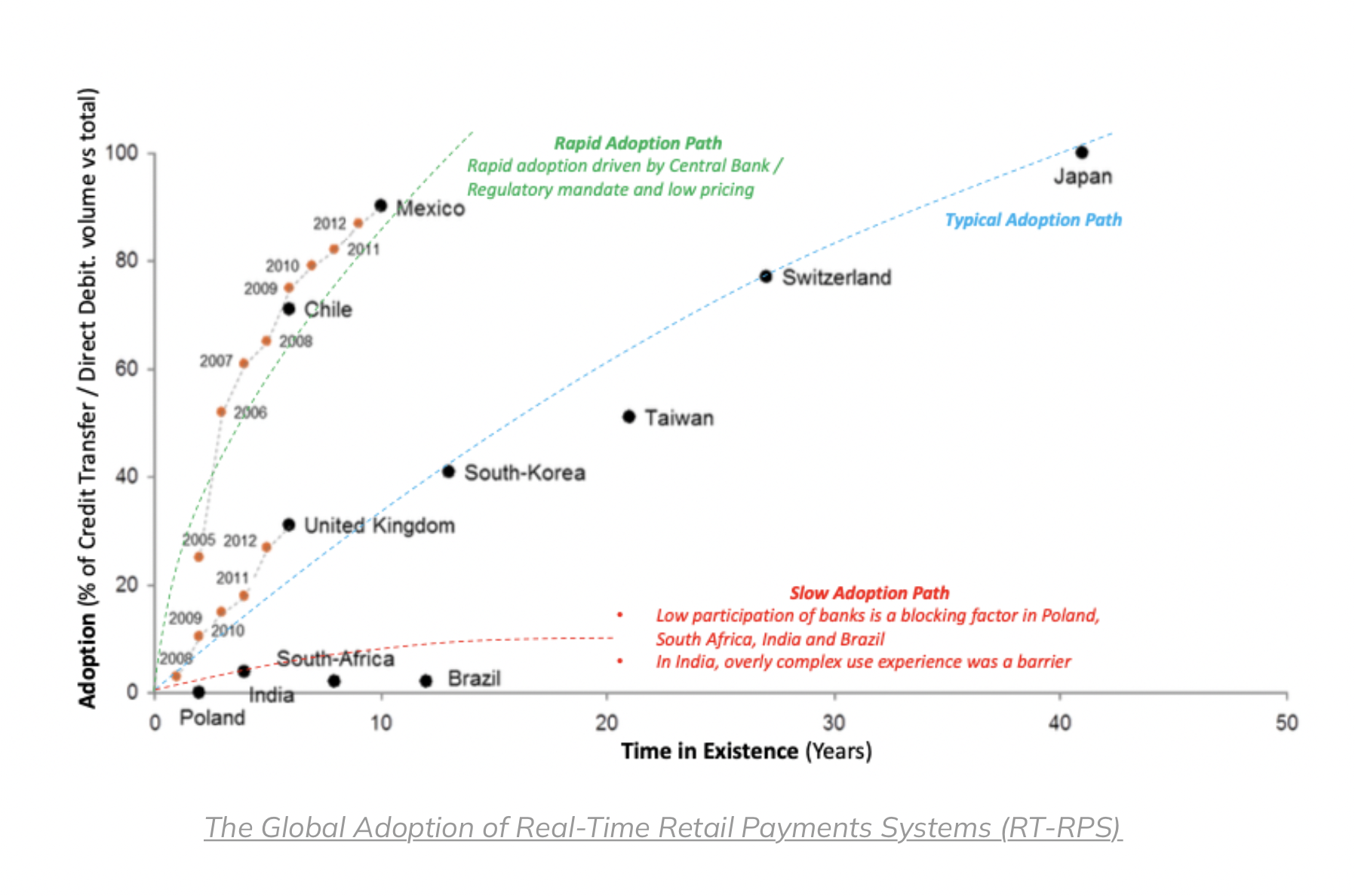

FedNow

- FedNow, a faster payments network designed by the Federal Reserve, is nearing launch in 2023 and this is a great explainer/history post.

- The US lags far behind the rest of the world in faster payments.

- FedNow could change that (or not) – it for one is cheaper than existing competitors.

- There is also this chart, showing adoption rates of faster payment systems around the world – those that launched recently had faster adoption (especially if helped along by regulators).

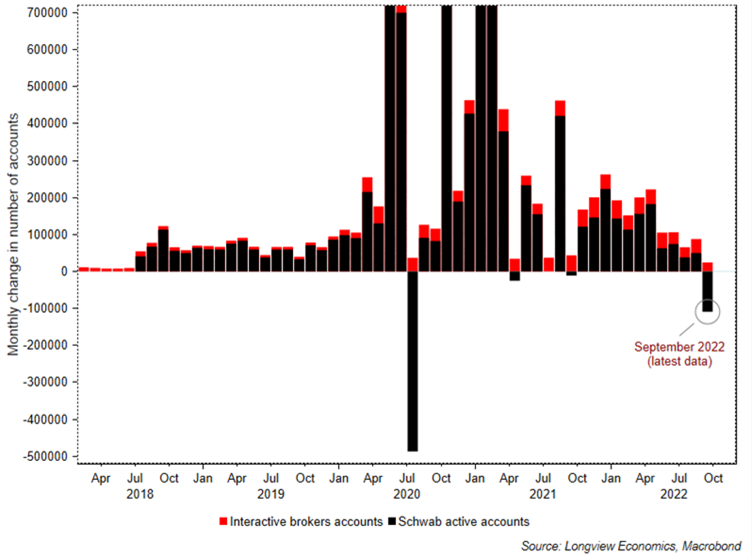

Brokerage Accounts

- People are stating to close brokerage accounts – which is counter the narrative.

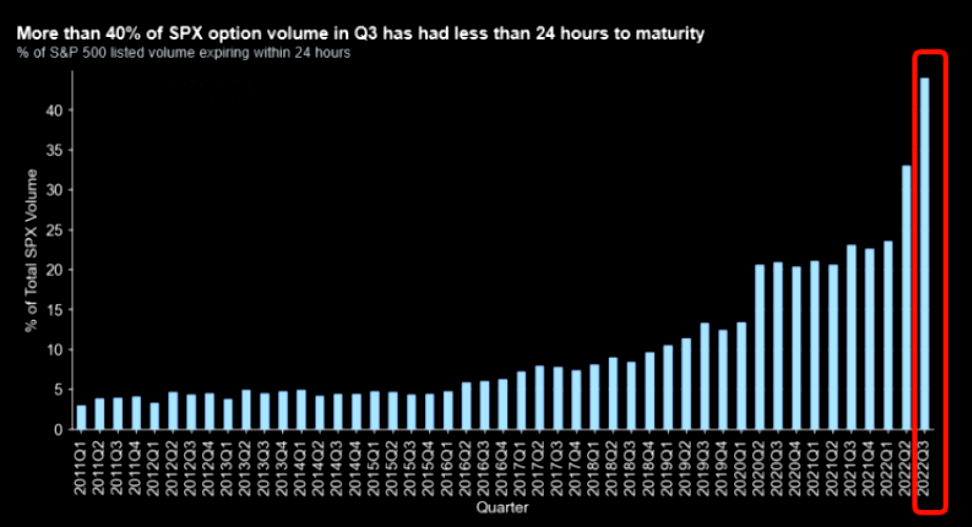

Options Expiry

- More than 40% of SPX options volume in Q3 had <24 hours expiry.

- A sign of the shape of the market, where liquidity is drying up.