- The Global Financial crisis 14 years ago ushered in a new era of attempting to understand the pipes of the global financial system – especially incorporating the shadow banking world.

- One big node point is pledged collateral and so called collateral velocity. The world expert on this is IMF senior economist Manmohan Singh.

- This latest post on FT AV by Singh is absolutely worth a read to understand what is going on now.

- These charts are one part of the picture – showing how pledge collateral has grown but also moved around.

- “As you might expect, a lot has changed since 2007, with the disappearance of Lehman Brothers and Bear Stearns, the reshuffling of business models by UBS, Credit Suisse and Deutsche Bank, and the rise of JPMorgan and Barclays.“

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

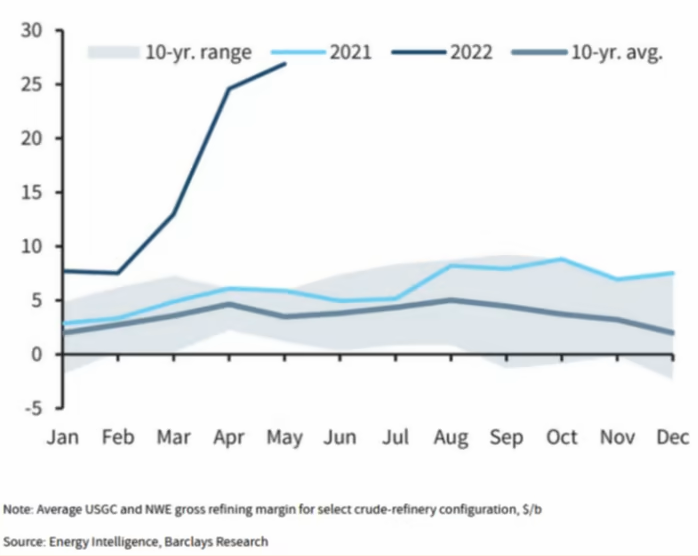

Refining Margins

- Spectacular pop in refining margins.

- “Permanent refinery closures since the start of 2019 reduced global capacity by around 4.7mn barrels per day, Barclays estimates, and new refinery capacity such as at Kuwait’s Al Zour can’t be brought quick enough. As a result, US and European refinery gross margins are least four times the long-run average“

Tyre Pollution

- Tyres are an order of magnitude worse source of particles pollution than exhausts.

- “We came to a bewildering amount of material being released into the environment – 300,000 tonnes of tyre rubber in the UK and US, just from cars and vans every year.”

- Whereas “Tailpipes are now so clean for pollutants that, if you were starting out afresh, you wouldn’t even bother regulating them.”

- Listed tyre companies (GT, ML) are generally ranked low on ESG risk.

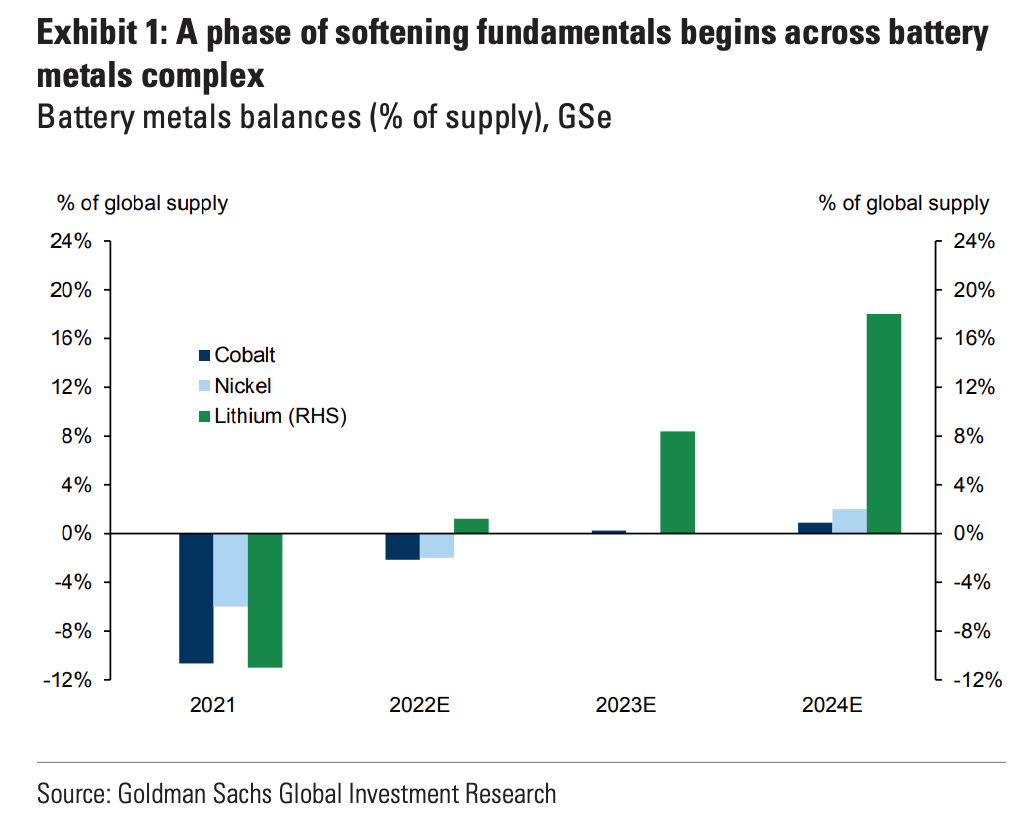

Cure for High Prices

- As the saying goes – the best cure for high prices is high prices.

- According to GS this is now coming to battery metals (cobalt, lithium and nickel).

- In other words, despite an exponential demand profile, the surge in prices is bringing on a huge supply response.

- “We forecast all three metals to shift into sustained surplus over the next 1-2 years” (see chart).

- “Lithium is the most prominent in this trend, where we expect supply growth to average just over 30% per year over 2022-25, reflecting the ramp-up of new projects in Australia, China and Chile in particular.”

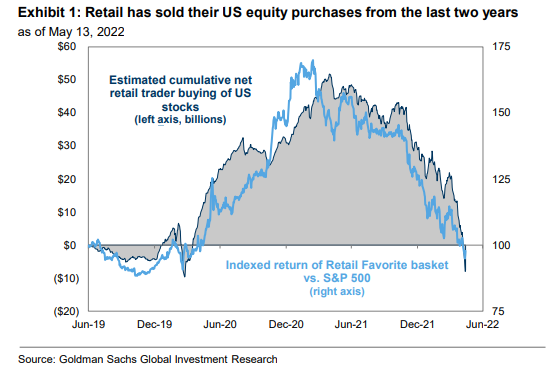

Retail has Sold

- Retail has sold all their US equity purchases from the last two years, according to GS.

- Source.

Biotech Sector

- Technical chart showing huge multi-year support level for the biotech index (XBI).

- Source: Koyfin.

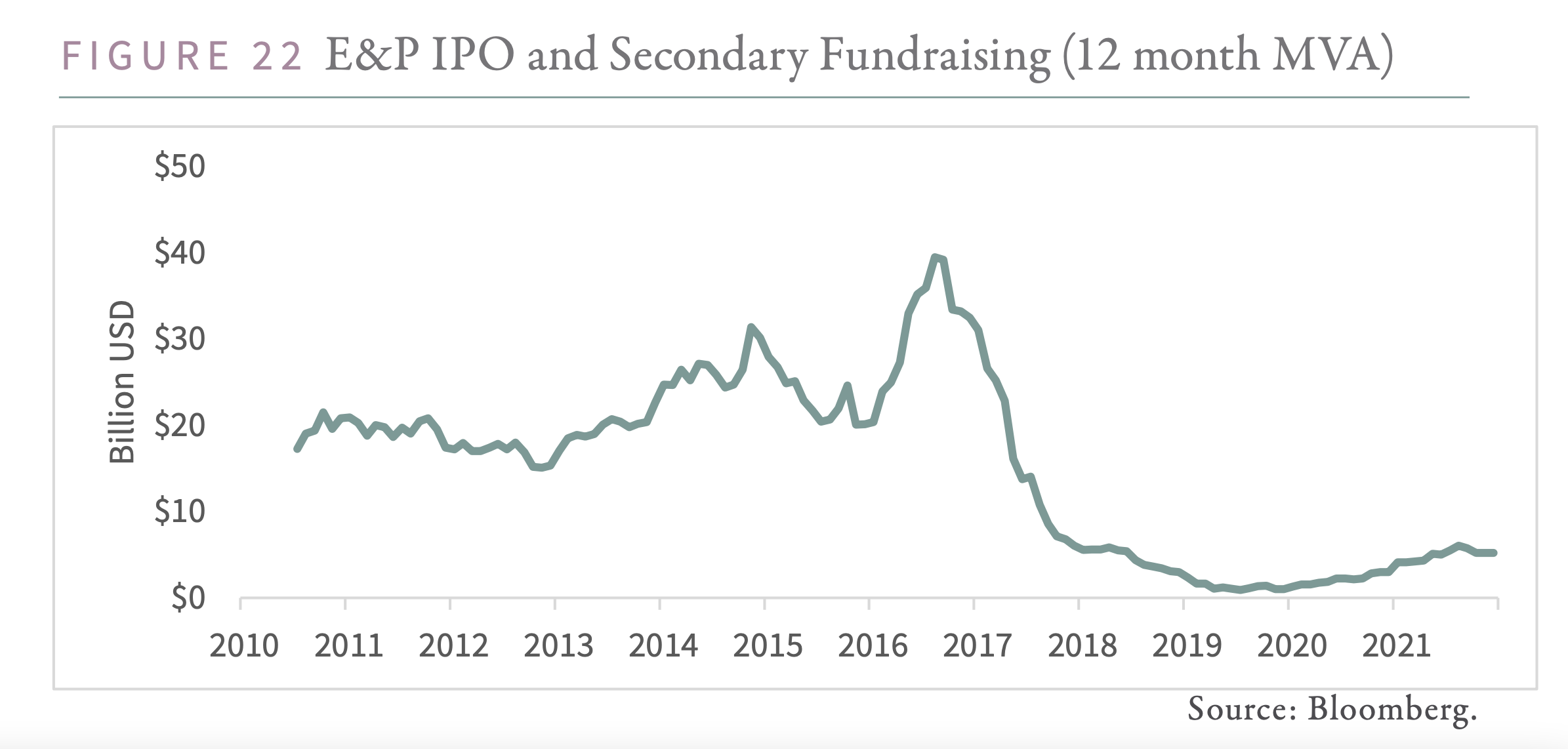

Energy Capital

- Despite high energy prices, capital remains unavailable for the Energy sector.

- Source.

Alpha = Pick the Right Stocks

- According to new data analysis – the alpha generated by professional fund managers comes from one major source = research process.

- Inalytics studied 752 portfolios, with at least three year performance data.

- The average alpha was 308bps.

- Stock research added on average 319bps while position sizing led to average alpha loss of 11bps.

- Only 46% of participants delivered any positive alpha from sizing.

- “Stock picking is the primary area in which managers demonstrate skill”

- Source.

Future of Music Biz

- Great contrarian podcast about the future of music streaming with Economist Will Page.

- “Page believes the music industry is transitioning from a “herbivore market” to a “carnivore” one. In other words, future growth will not come from brand-new customers — it’ll come from the streaming services eating into each other’s market share. Not only has subscriber counts possibly tapped out in Page’s opinion, but streaming services have also put a ceiling on revenues by charging only $9.99, a price that hasn’t budged in 20 years despite giant leaps in technology and music catalog size.”

Keep Score with Football Clubs

- Nice write up ($) from The Diff on Football Clubs or as he calls them “Meme stocks for the 0.01%”

- The collective value of the top 20 clubs in the Premier League has risen from £50m in 1992 to £16.11bn in 2021 (Sportico has a neat interactive tool for this). A stand out return.

- Part of the reason is the huge audiences they attract. Spotify recently signed up to sponsor FC Barcelona citing their own data that the team has 700m unique viewers per year.

- KPMG actually publish a very interesting report on the value of football clubs with detailed analysis – unsurprisingly showing a Covid-related drop in value/revenues.

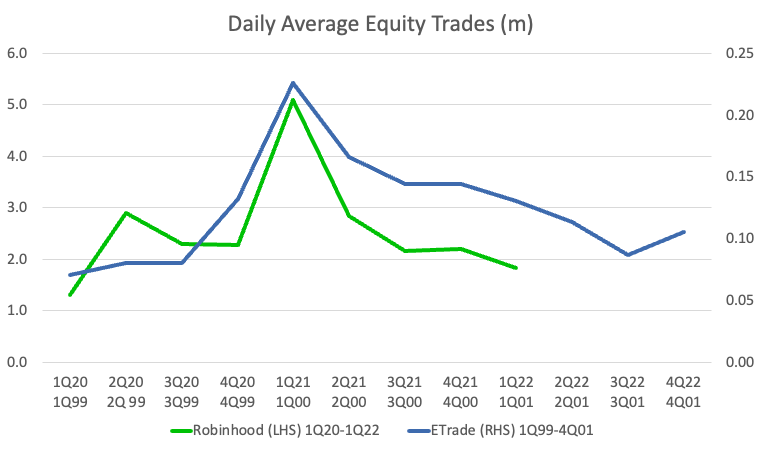

E-Trade vs. Robinhood

- Interesting chart from Net Interest piece showing Robinhood trading volumes today vs. E-Trade back during the dot-com bust.

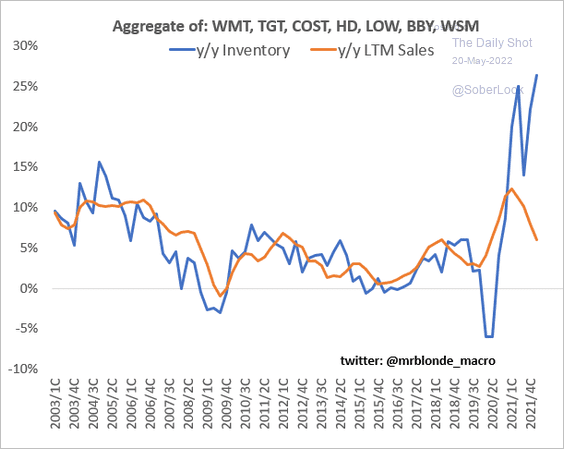

Inventory Glut

- Managing supply chains is hard – it looks like the big retailers over ordered and over paid for inventory.

- h/t Daily Shot.

Social Media and Efficient Markets

- Does Twitter make sell-side analysts better?

- The answer, according to a new study, is yes.

- Analysts are generally overly optimistic when presenting earnings forecasts (largely due to incentives).

- As information technology has proliferated, the competition for information production has increased.

- Negative and positive information are treated differently by human psychology – the former being valued more highly.

- Analysts looking at Twitter succumb to this asymmetry, biasing their forecasts downwards i.e. negating their over optimism.

- These are fascinating results (there a few others in the article).

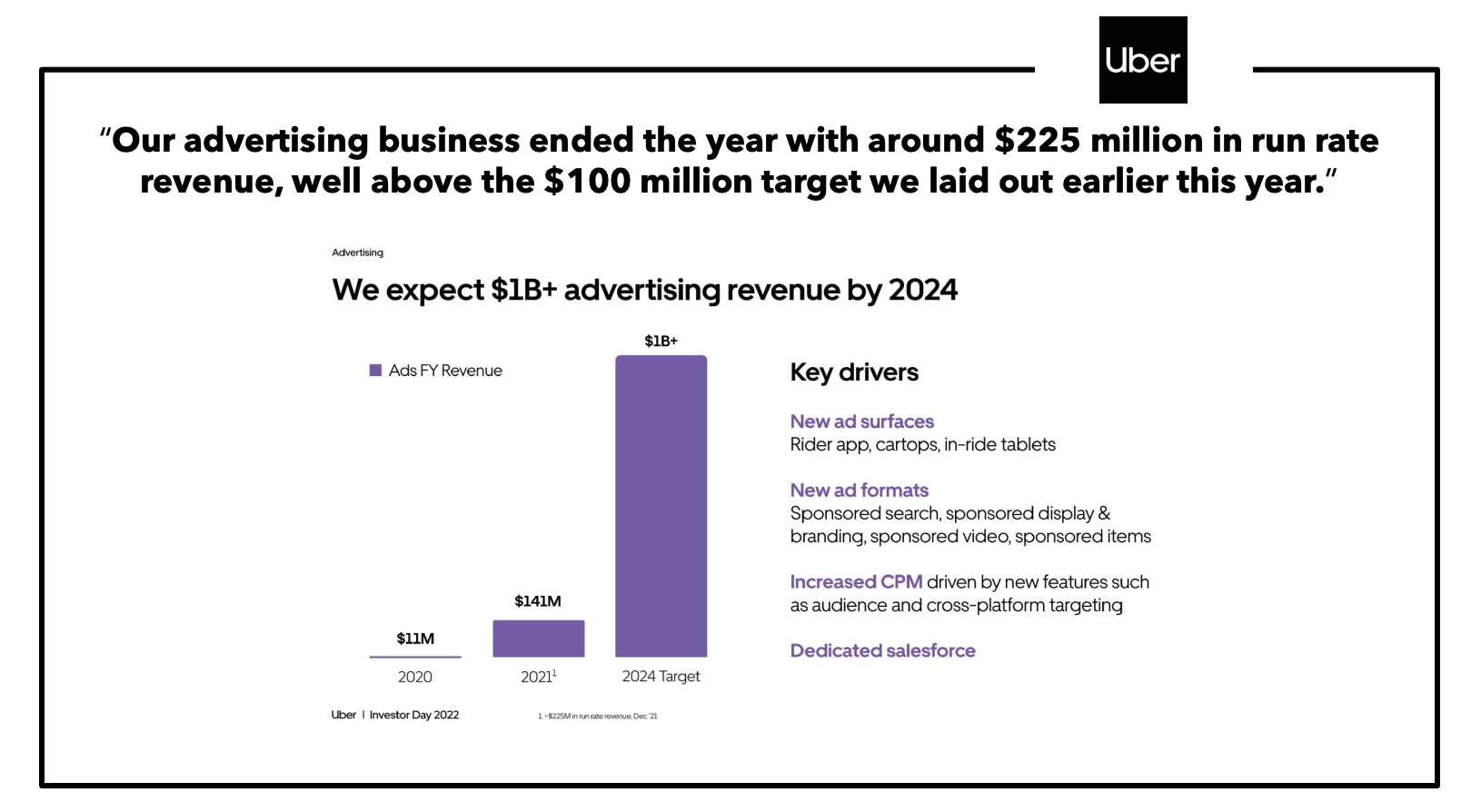

Everything is Advertising Now

- Uber edition.

- Source.

Oil – Equity vs Commodity

- “Despite record 1Q 2022 results and continued capital discipline, the disconnect between the energy sector weighting in the MSCI Wold Index relative to the oil market value is at its widest level since 2000“.

- Source.

EV and Gas Stations

- The electrification of cars will have a big impact on gasoline stations.

- This was a nice piece analysing this impact.

- It is from Harding Loevner, using Circle K (owned by Alimentation Couche-Tarde) in Norway (which has electrified faster than other countries) as their case study.

- Positives – charging takes a lot longer = higher conversion to spending customer + longer in store.

- “About 15% of gasoline customers venture inside to make additional purchases during their car’s few minutes at a Circle K pump, while 40% of EV drivers do so during the 20–30 minutes their vehicle is charging.“

- Negatives – three quarters of charging is done at home.

Top of Book Liquidity

- Market liquidity is dire.

- This chart from GS looks at top of book (this is the highest bid and lowest ask) depth.

- It is very low and at levels, as the bank says, consistent with extreme volatility.

- Source.

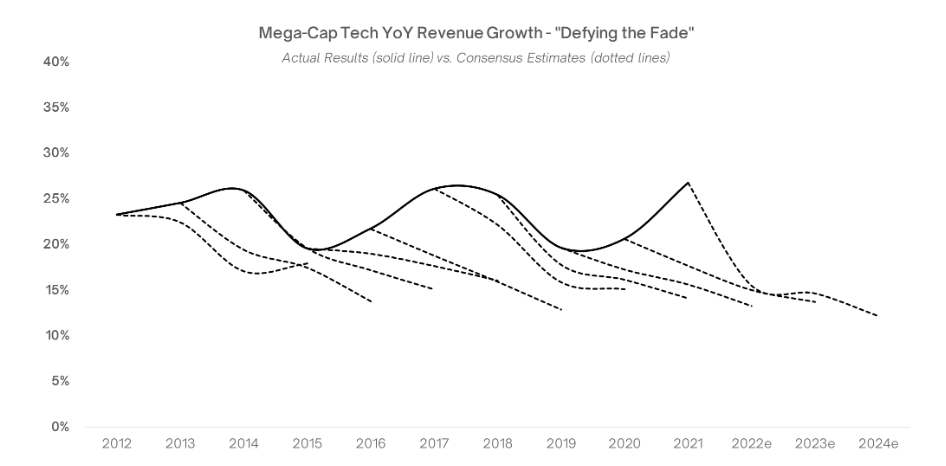

Mega-Cap Tech Growth

- It may seem simple but often the main thing that makes stocks go up is defying the fade in forecasts.

- This is true of mega-cap tech stocks.

- Despite consistent forecast for deceleration they have maintained 20-30% growth for over a decade now.

- NB solid line is actual revenue growth average for AMZN, AAPL, CRM, FB, GOOG, MSFT, NFLX and the dotted lines are average sell-side forward forecasts at those points in time.

- Source.

Charting

- Many fundamental investors don’t believe stock charts hold any value.

- Yet technical analysis does have useful signals even for bottom up investors.

- This was a pretty good basic introduction to charting – especially understanding the dynamics of participants and the so called “tug of war”.