Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

Paying for Journalism

- Brilliant article by the Columbia Journalism Review on the process that led to Google/Facebook paying Australian news companies.

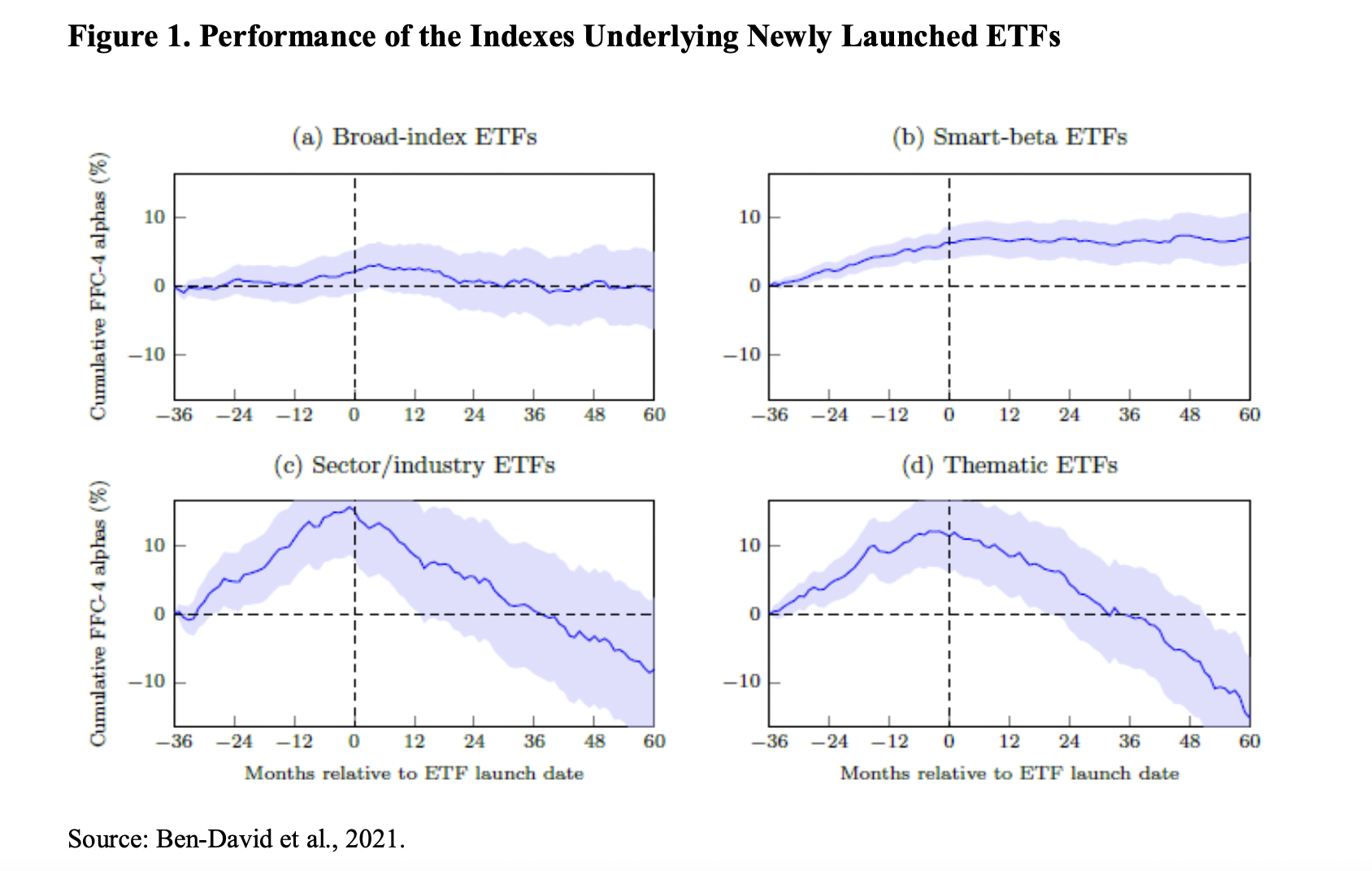

ETF Performance Post Launch

- Ben-David et al. (2021) tried to ask a simple question.

- How did the model portfolios on which ETFs are built fare five years after launch when compared to three years before? measured relative to the benchmark selected by the managers themselves.

- The results aren’t pretty.

- Thematic strategies that added 3-5% a year pre-launch, lost 4-5% a year in the five years after.

- It seems that hype in various areas, leads to a launch of ETFs which then don’t add any alpha.

- So be careful when you invest in the next hot thing via ETF.

- Note this is just the model portfolio performance (e.g. index) and NOT the ETF itself (though it should track very closely after costs).

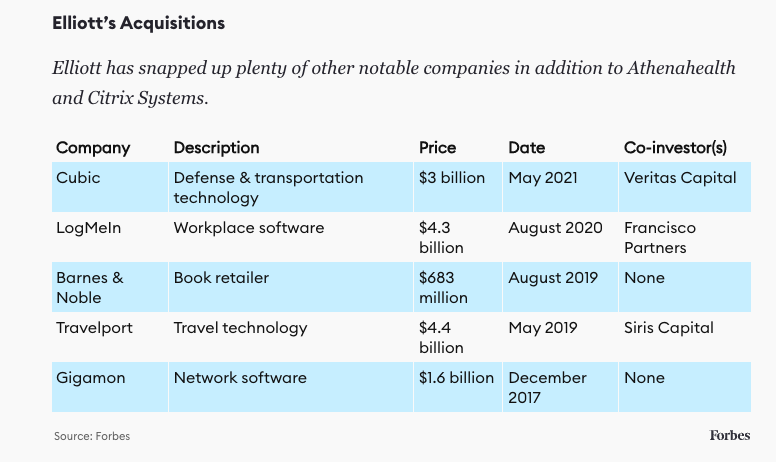

Elliott’s Changing Nature

- If taking a minority public stake and pushing an activist agenda doesn’t work? … why not just take the company private.

- This is the transition that has been going on at Elliott, the famous hedge fund, over the past several years.

- Apart from Citrix and Athenahealth (the recent sale made them $5bn of profit) they have done a bunch of other deals (see table).

- Interestingly, this is all being done out of one fund. The lines between private and public markets continue to blur.

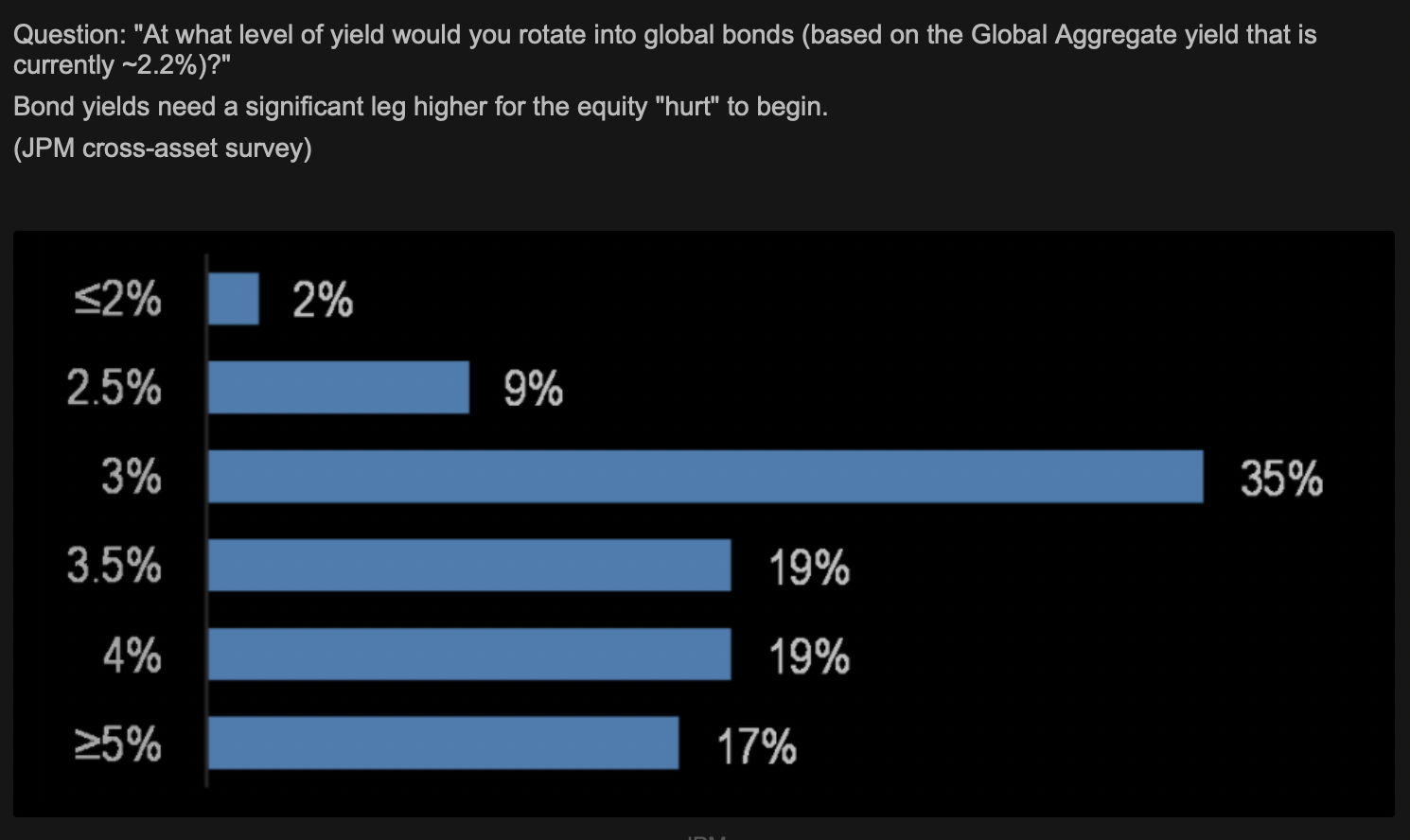

From Equities to Bonds

- Looks like bond yields have to go significantly higher before cross-asset managers begin to switch out of equities.

- Chart below is a JPM survey based on the global aggregate yield – which today stands at 2.2%.

- Source: themarketear.com

History of Semiconductor Cycles

- Semis are notoriously cyclical and it pays to study historic cycles.

- This is exactly what this post does – looking at the 1980s and trying to draw lessons about the industry.

- A key thread is probably how strong domestic support tips a geopolitical in-balance (Japan vs. US then). Something eerily similar is happening today.

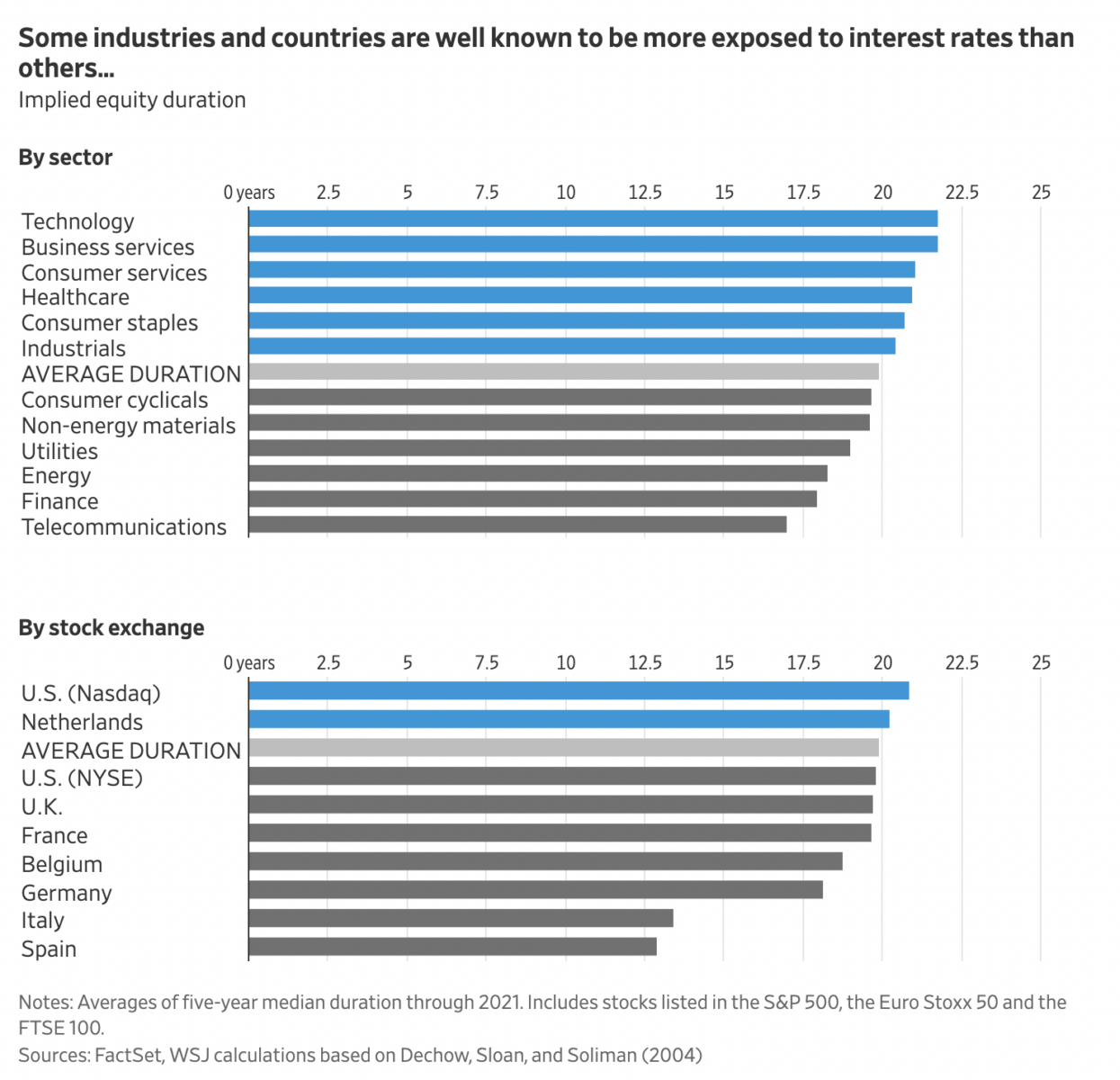

Equity Duration

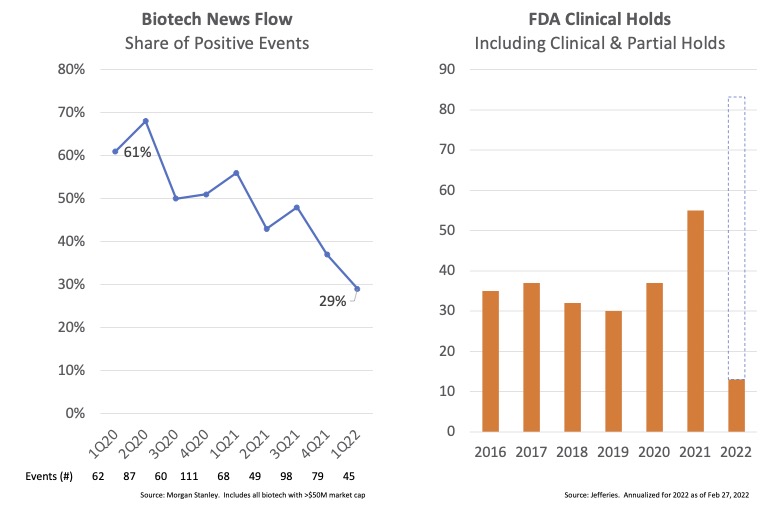

Biotech Bearishness

- Fundamentals have been bad in biotech land, something that is reflecting in share prices and IPO performance (XBI has halved since peak).

- Positive news flow among small and mid-cap biotechs, which hit 60% in 2020, has just fallen below 30%.

- “But it’s not just small caps, it’s across the sector: Jefferies’ Michael Yee said of 45 major clinical readouts from large and small players, only 20% were positive.”

- Clinical holds have also spiked – 2022 is off to a bad start (13 holds in 8 weeks) and could surpass the already bad 2021 (>50 vs. 30 average historically.

- The full article offers some explanations of what is going on.

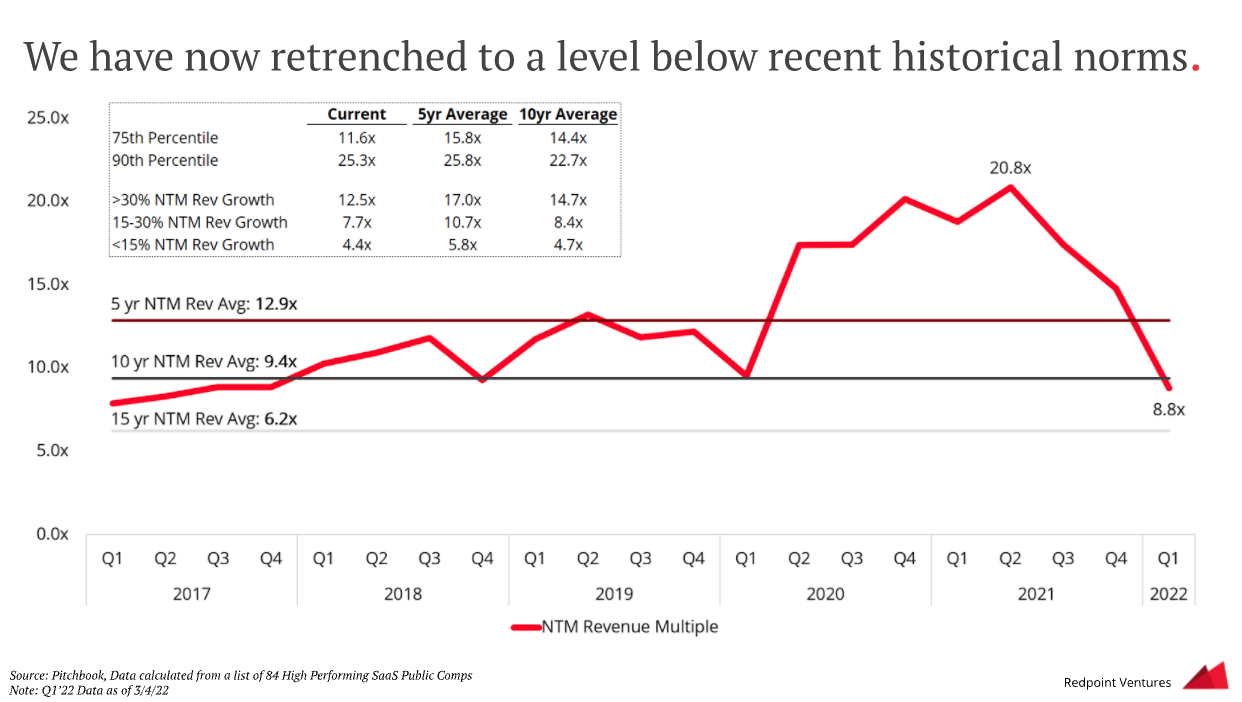

Venture Landscape

- Thoughtful analysis of the venture landscape given the current state of public markets from Redpoint ventures.

- The background is – public high performing SaaS firm valuations have fallen below their 10 year average now (see chart).

- Past public market corrections led to 10 quarters of decline in venture dollars invested of varying severity. The great recession, for example, saw a 30% fall.

- “Currently many companies in private markets (particularly at late stage) are in “price discover” mode in fundraises with everyone trying to figure out market price – rounds are taking longer to get done and “willingness to pay” spreads are wide“

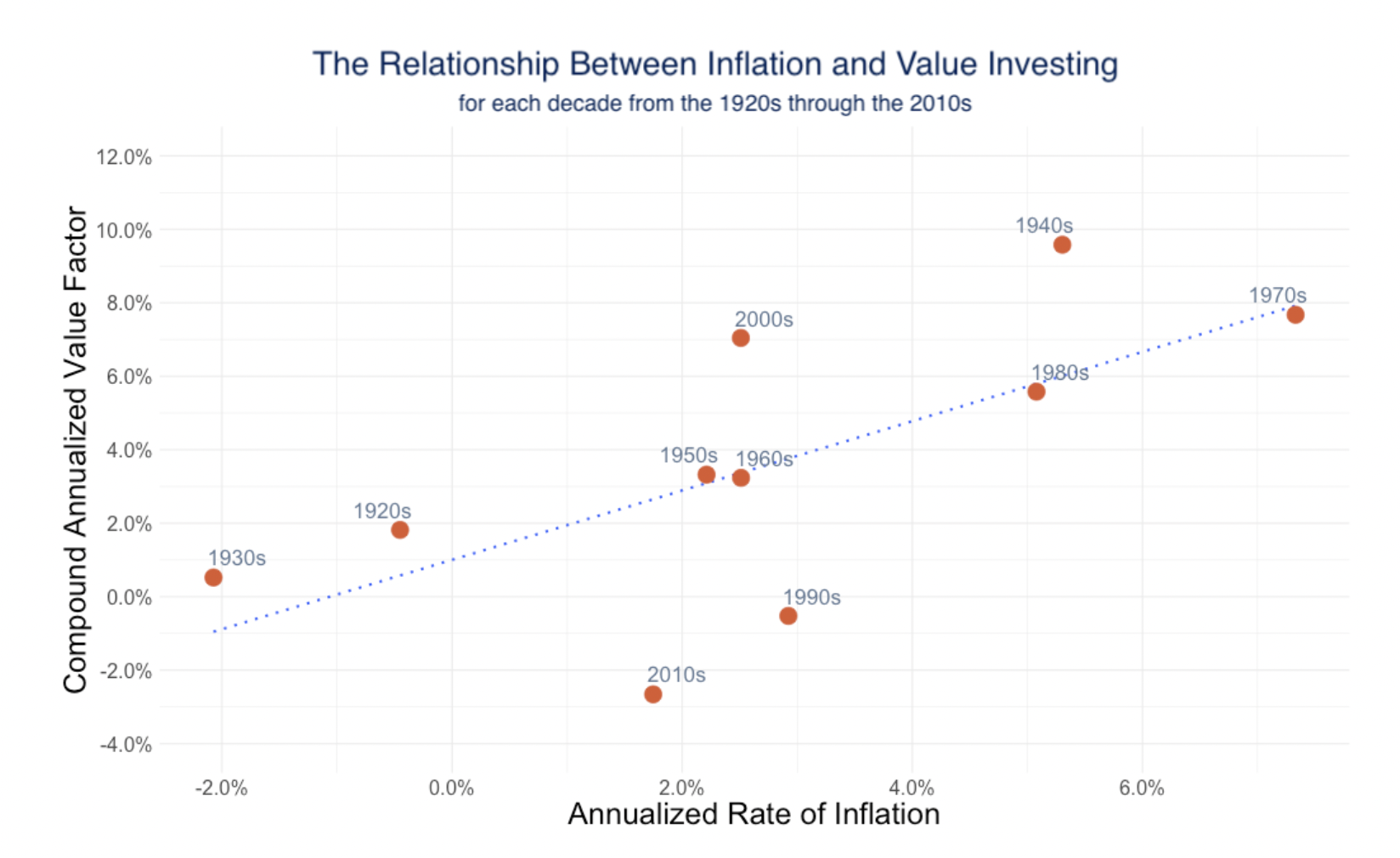

Inflation and Value Investing

- Value, on average and generally, performs well during inflationary periods.

- This relationship goes back far.

- Source and Data explanation.

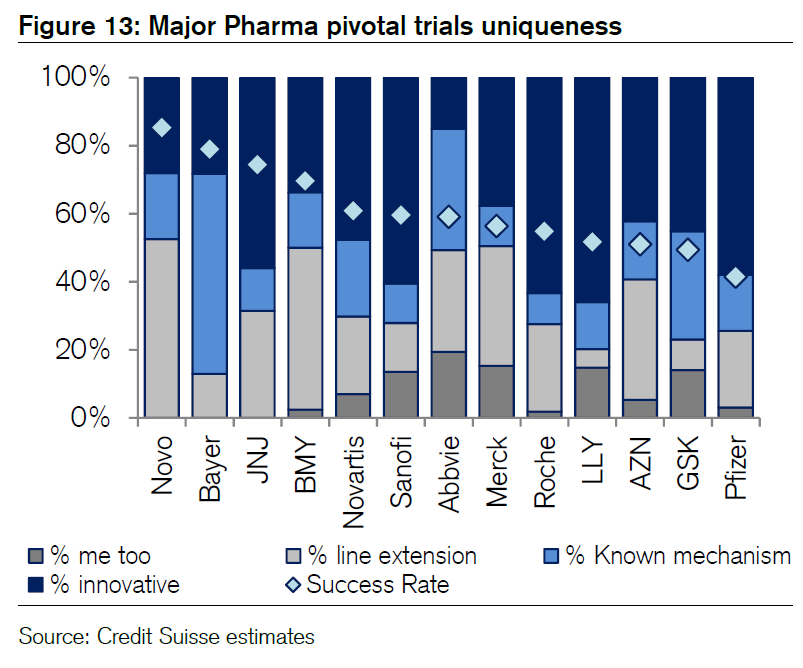

Pharma Pipelines

- Credit Suisse analyse how unique the pipelines of major pharmaceutical companies are.

- LLY, ROG, SAN come out on top.

Terry Smith

- Long profile of Terry Smith of FundSmith.

- The fund is having a tough start to 2022, but as he says himself.

- “The analogy I use is that of the Tour de France, no cyclist has won every stage and they never will. You can’t be a sprinter and win the time trial, they require different physiques. Several times the overall race has been won by someone who didn’t win any of the individual stages. You need to be the best overall, and that’s what we are trying to achieve.“

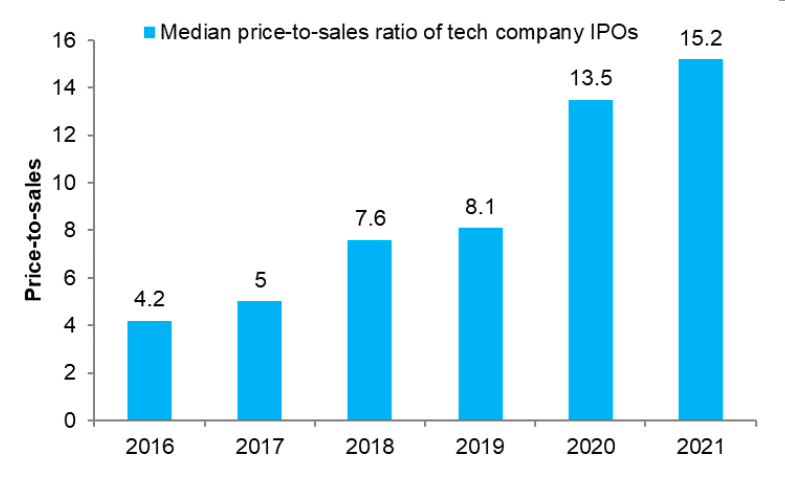

Tech IPO Valuation

- Chart showing the median Price-to-Sales (P/S) ratio of tech company IPOs.

- 2021 saw a record 15.2x!

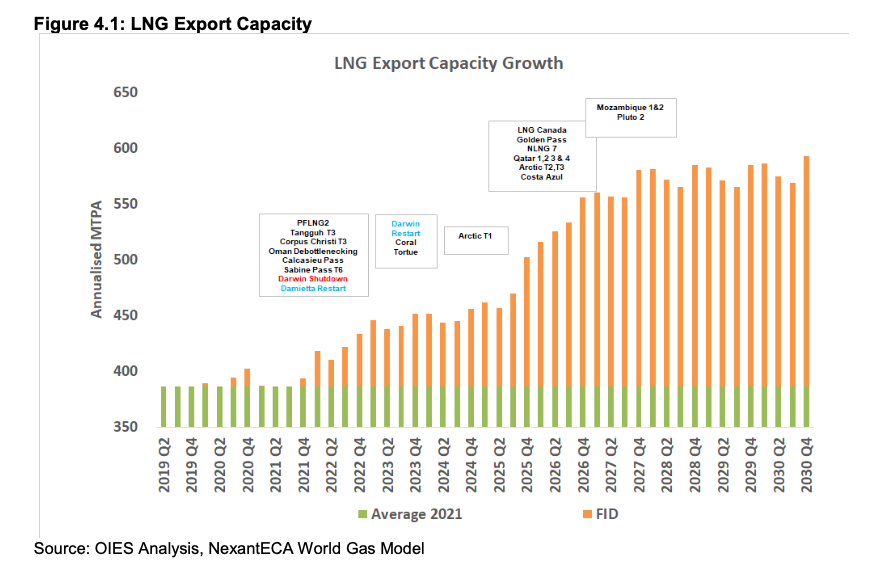

LNG Capacity Growth

- Encouragingly, World LNG capacity is set to increase by nearly 50% in the next 5 years.

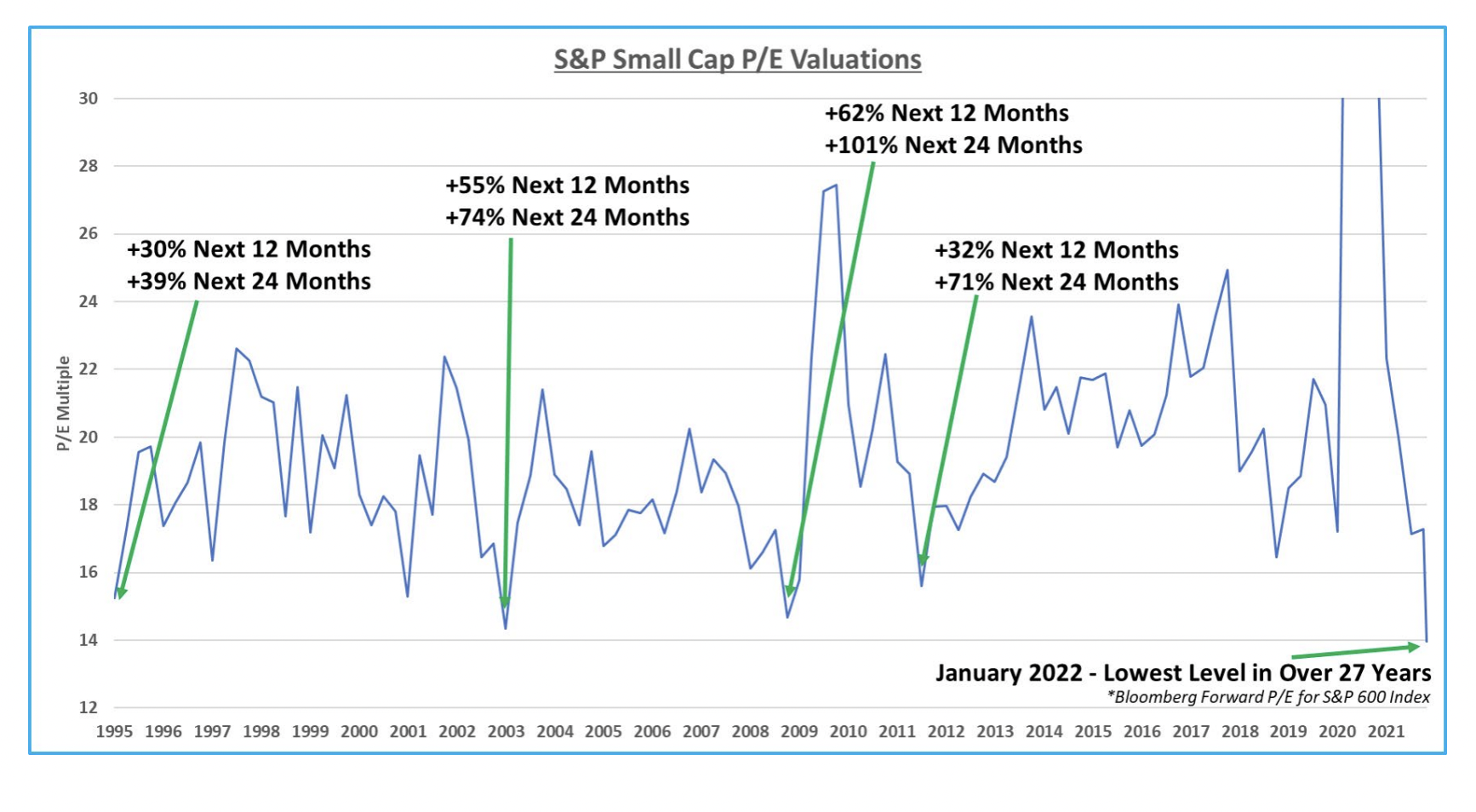

Small Caps

- Chart showing S&P Small Cap forward P/E valuation.

- January 2022 recorded the lowest P/E in over 27 years for this index.

- Historically, as the chart shows, this bodes well for future strong performance.

- Source.

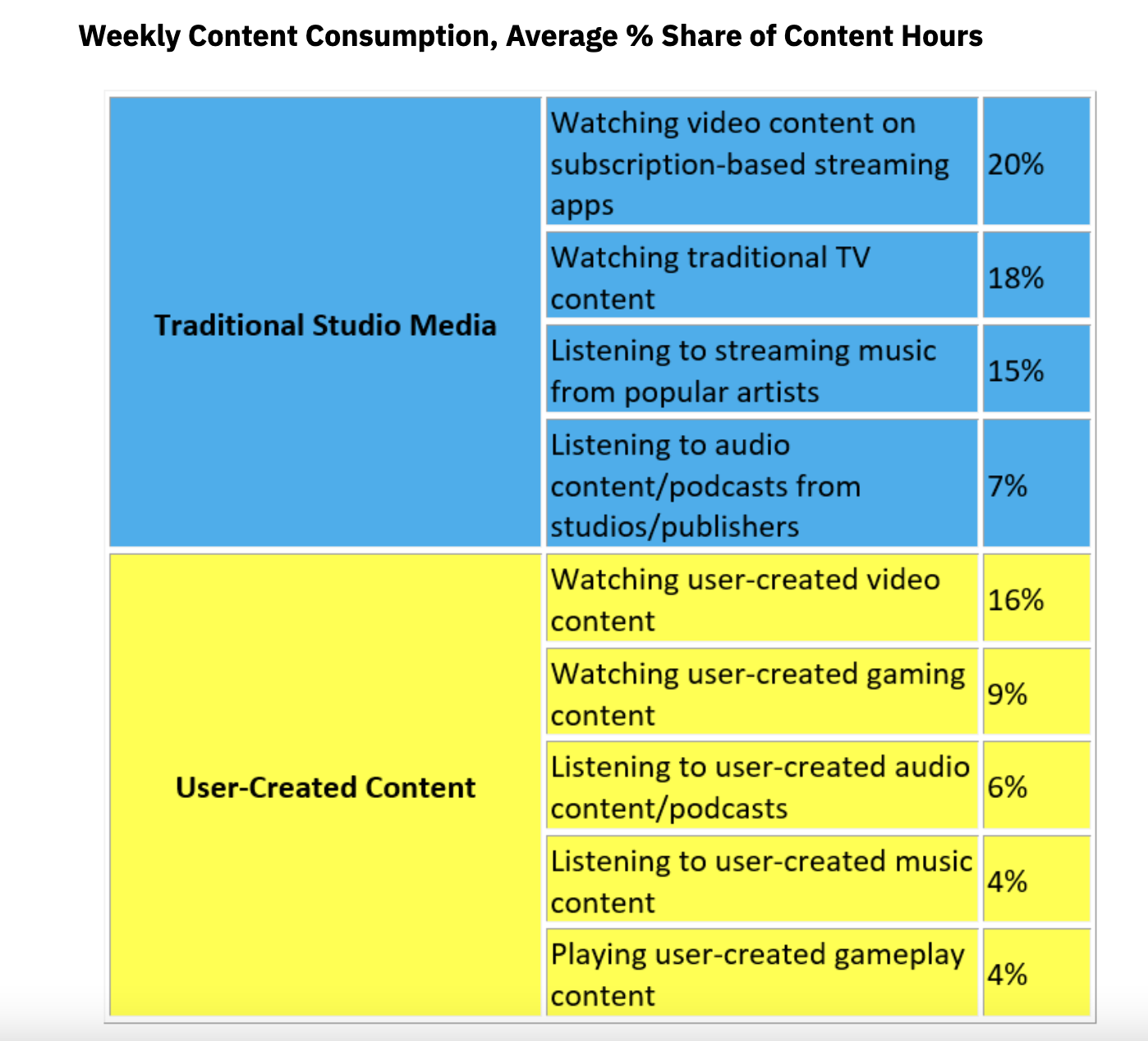

User Generated Media

- We are just about to cross another milestone.

- User generated content has almost taken over from traditional TV.

- According to CTA Americans 13 and older spent 16% of their time watching user generated videos (like Youtube and TikTok) while 18% was spent consuming traditional TV content.

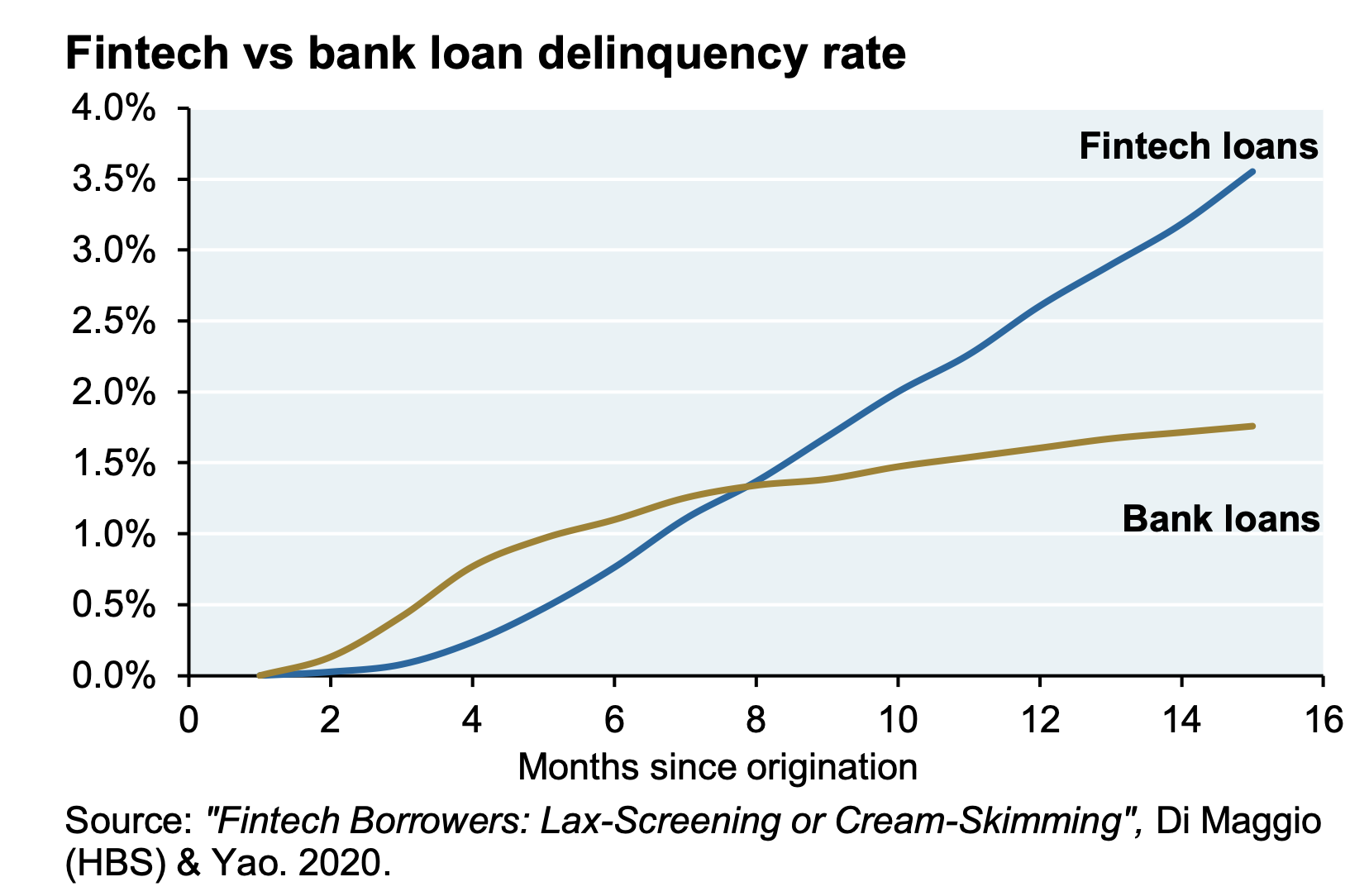

Fintech Delinquency Rate

- Fintechs tend to see worse delinquency rates than bank lenders when it comes to personal loans.

- Source: JPM

- Original Source.

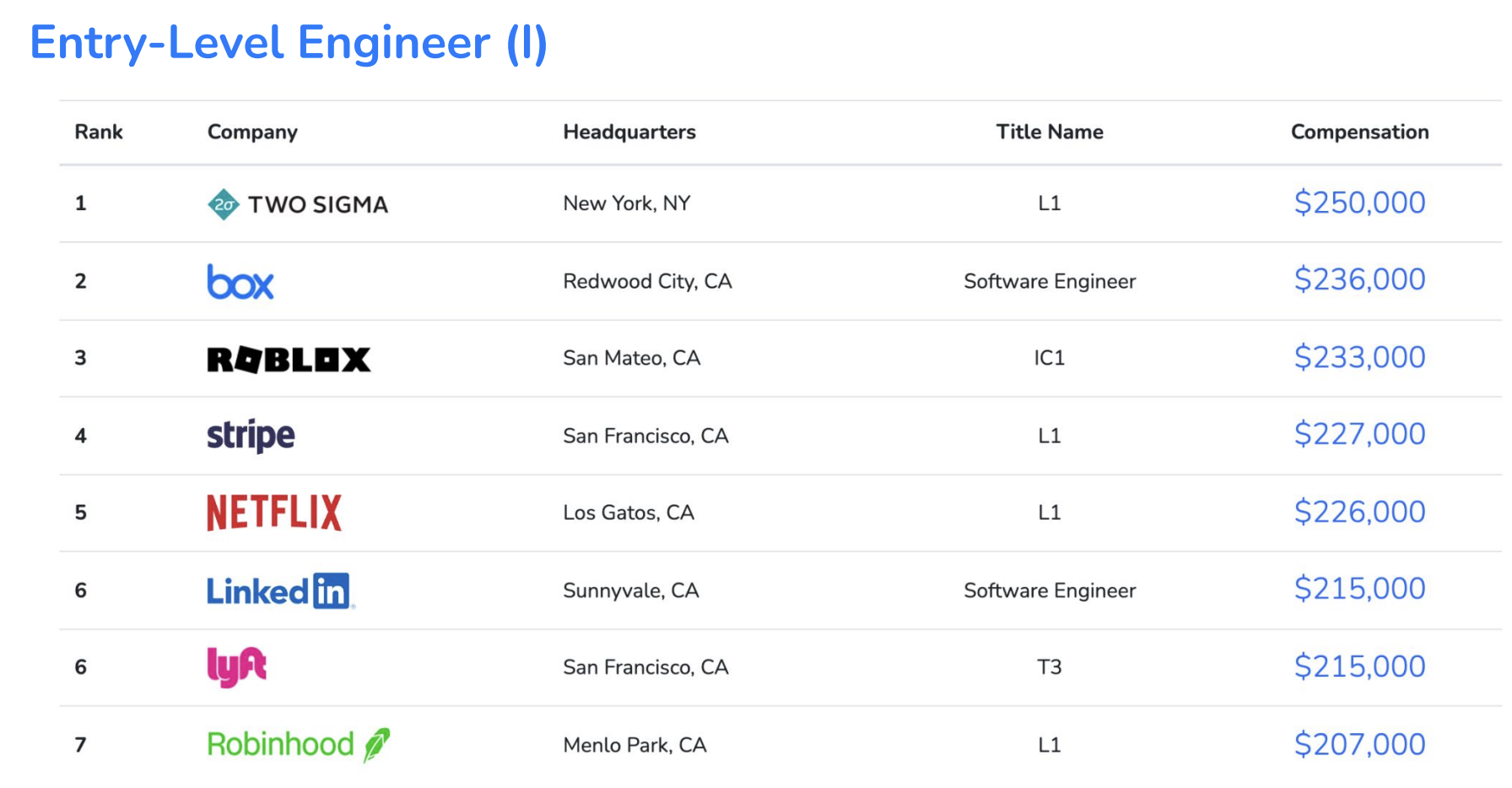

Tech Salaries

- Meet levels.fyi – they collect actual like for like data on salaries, benefits, levels etc. for the US tech industry.

- They use this to help people negotiate salaries (how they monetise).

- Levels recently published a report for 2021 that has some fascinating data (h/t The Diff).

- The table attached shows entry level engineer salaries.

- Lots of other interesting stats – comp has been rising (generally highest entry-level salaries are growing +3.4% annualised since 2019) and the Bay Area still wins (40% higher than LA for example).

Sales Tactics

- John Foley, founder of Peloton, was so determined that “one of his sales techniques was to have customers test out the bike; he’d give them headphones and turn up the volume so when they talked to him about how much they liked the product they’d end up shouting an endorsement to passersby.“

- In the early days of Salesforce “when a competitor was holding an event at Cannes, they booked all the taxis in Nice for the night and had sales reps stationed in each one to pitch their product to people going to the competitor’s event” (h/t The Diff).

- These remind me of an old Snippet on how some major consumer apps got their first 1,000 users – often in surprising ways.

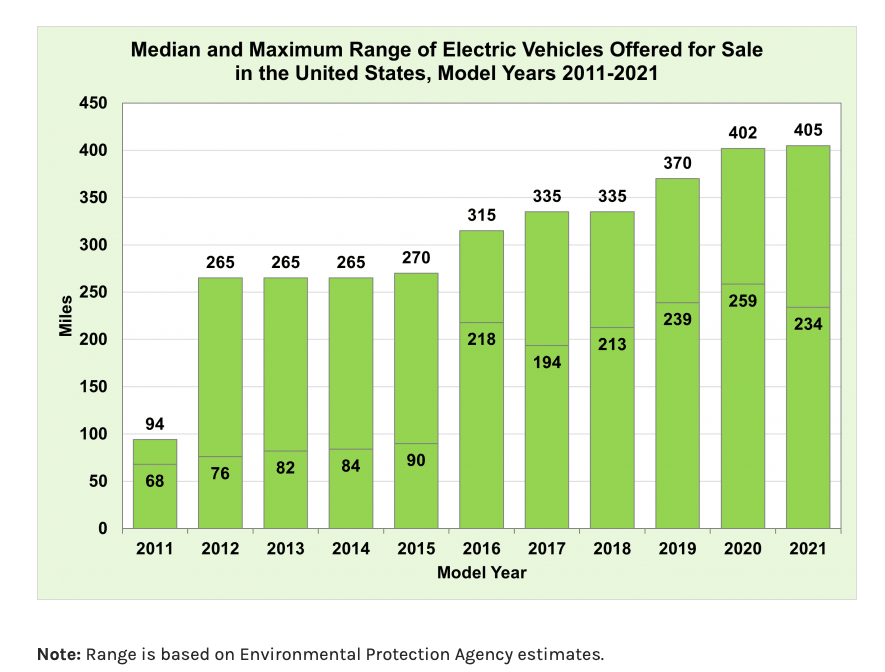

EV Range

- Electric vehicles (EVs) have come a long way in terms of range.

- In the US, for model year 2021 the maximum range for an EV has quadrupled to 405 miles on a single charge,

- The median range, at 234, is up over three times.

- Source: Office of Efficiency & Renewable Energy.