- Nice, though self-serving, chart from Terry Smith’s 2021 annual letter.

- It shows that firms with high returns tend to hang on to those returns, while firms with poor returns also stay that way.

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

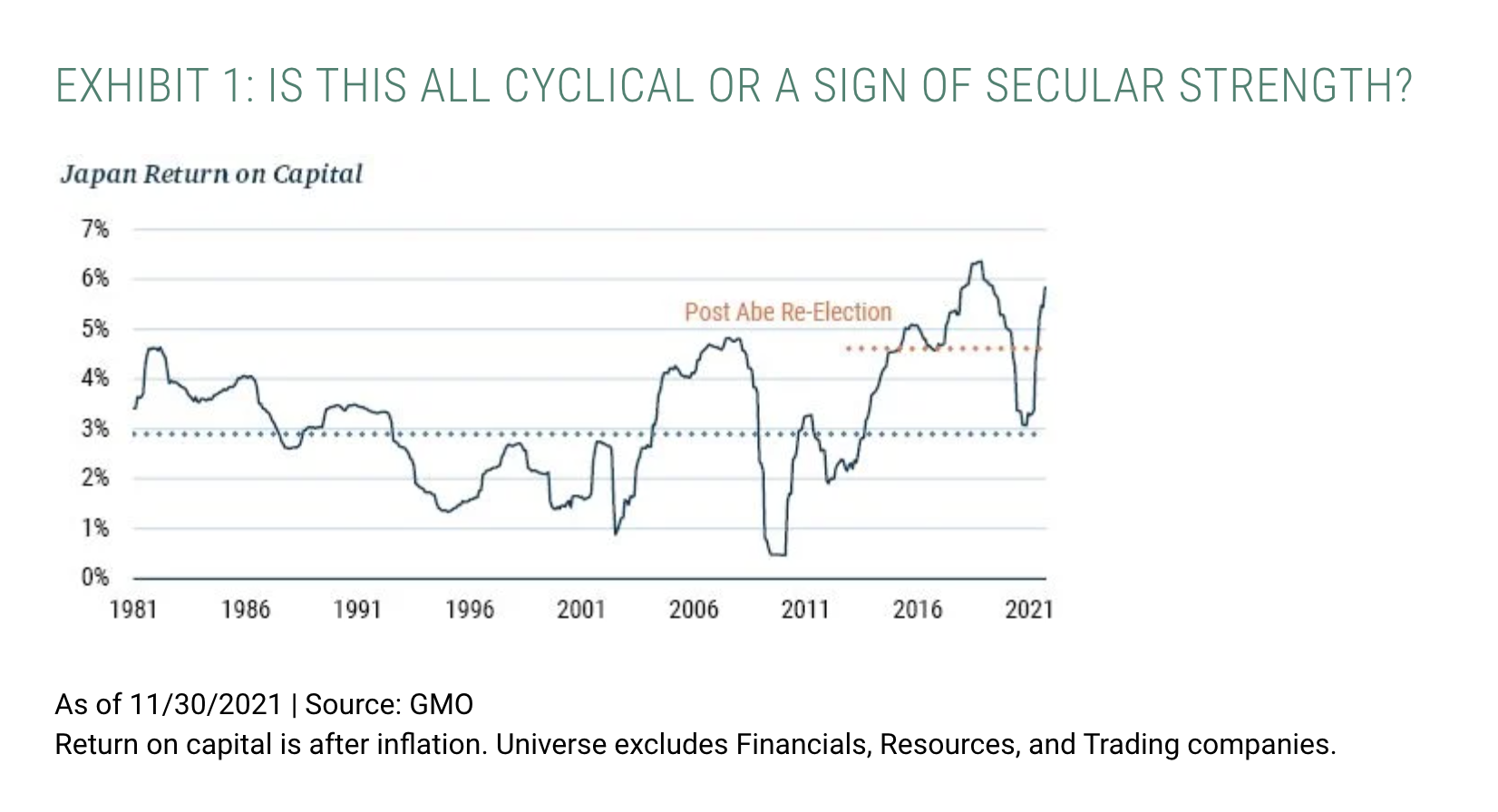

Japanese Equities

- Fundamentals in Japan are improving.

- Japanese companies bloated their balance sheets with low-yielding cash and unproductive assets. This has meant that companies delivered just 3% return on capital compared to 6% fo the developed world for the majority of the past four decades.

- Returns look to be improving according to GMO, the change is structural and not cyclical, and the result of improving margins and not improvement in inefficient balance sheets.

Spotify’s TikTok Problem

- 63% of TikTok users (1bn worldwide) discover new music on TikTok before any other platform.

- This is worrying for SPOT.

- TikTok has already launched a competing service – Resso – in key emerging markets (Brazil, Indonesia and India).

- iOS App download rank data for the recent 90-day period from App Annie (pictured, link) shows it still hasn’t hit Spotify’s dominance (it has only reached 2nd place in Music category in Indonesia, and lingers in 4th for the other two launch countries).

Archegos

- Credit Suisse, who suffered $5.5bn in losses in the Archegos debacle earlier in 2021, have published a full report of what happened by an external firm.

- Nice read for those interested in the inner workings of the Prime Brokerage business.

- If you aren’t familiar with it, this is a brilliant introduction and history (paywalled).

Moderna

- Two part investigative report into Moderna.

- The first part looks at the company pre-Covid – “From 2016 right up until the emergence of COVID-19, Moderna could barely hold it together, as it was shedding key executives, top talent, and major investors at an alarming rate.”

- The second part covers how the Covid crisis “bailed” the company out and the circumstances around this.

- A very deep and in places troubling read.

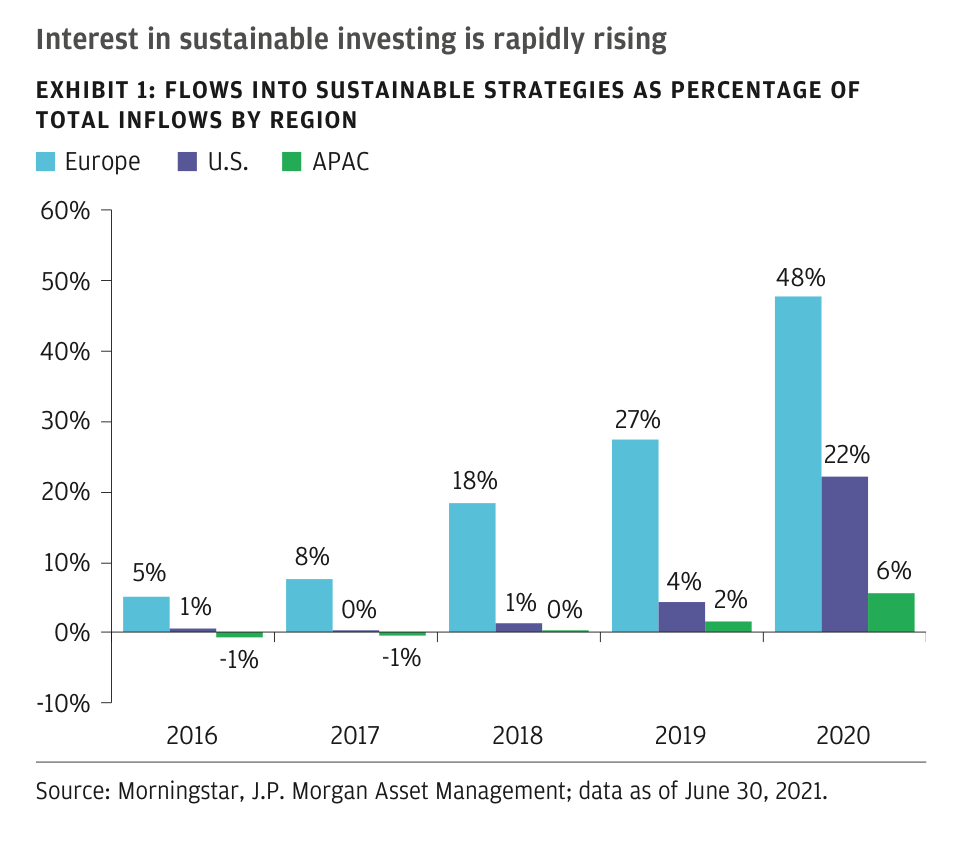

Sustainable Flows by Region

- Interestingly, but not surprising, Europe leads in terms of sustainable strategies as a percentage of inflows.

- US is starting to catch up but Asia lags well behind.

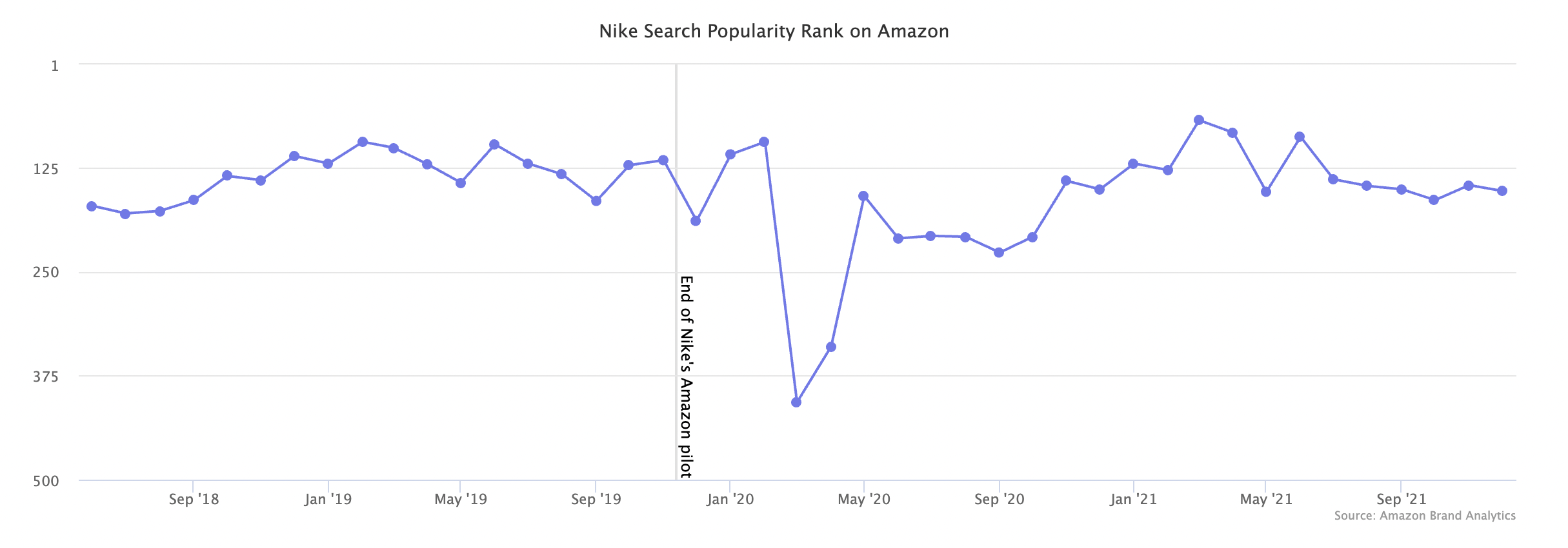

Nike Amazon Searches

- This is a testament to the power of Amazon as the start of product searches, as well as the recognition of Nike’s brand.

- Despite Nike stopping selling any products directly on Amazon, its search rank on Amazon has not changed.

- From the always excellent Marketplaces Pulse – Market Places Year in Review 2021.

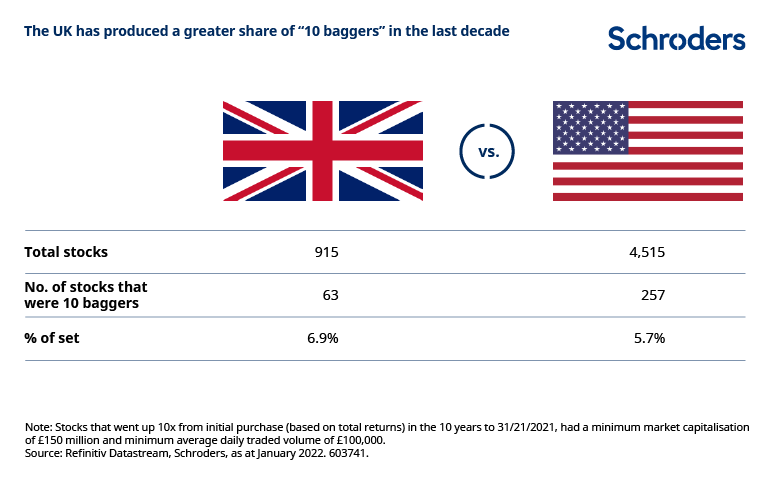

10 Baggers – UK vs US

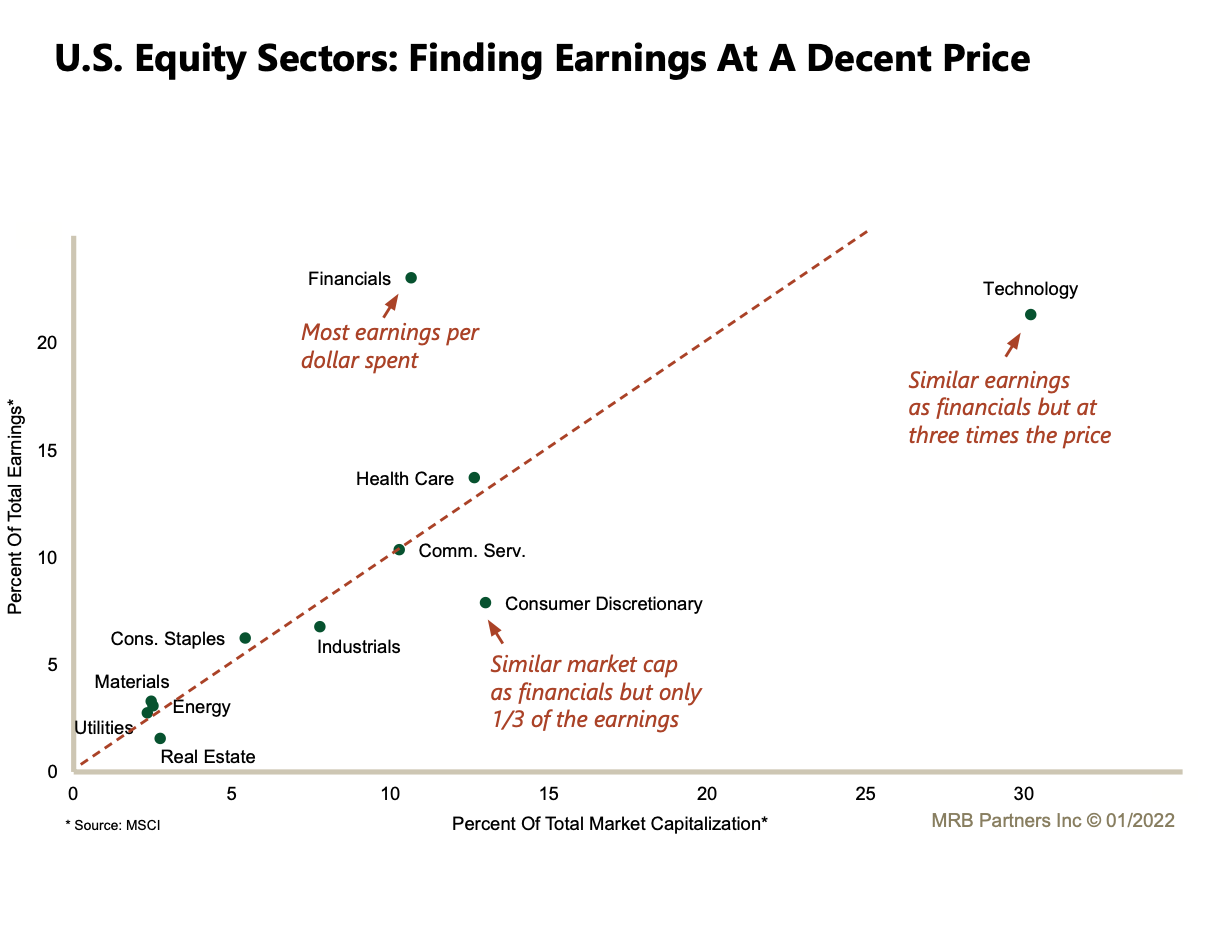

Earnings and Market Cap Share

- Useful chart from MRB plotting a sector’s percent share of total US market capitalisation on the x-axis and percent share of total market earnings on the y-axis.

- It of course misses a lot of elements (e.g. growth of earnings, returns etc) but is still worth thinking about.

Energy Intensive Investment

- Nice chart comparing the level of investment by industry forecast for 2022E against its ten year average (Source: JPM).

- Energy-intensive industries have seen a collapse in investment.

- This sort of data is supportive of Einhorn’s thesis and the capital cycles idea popularised by Marathon Asset Management (here and here).

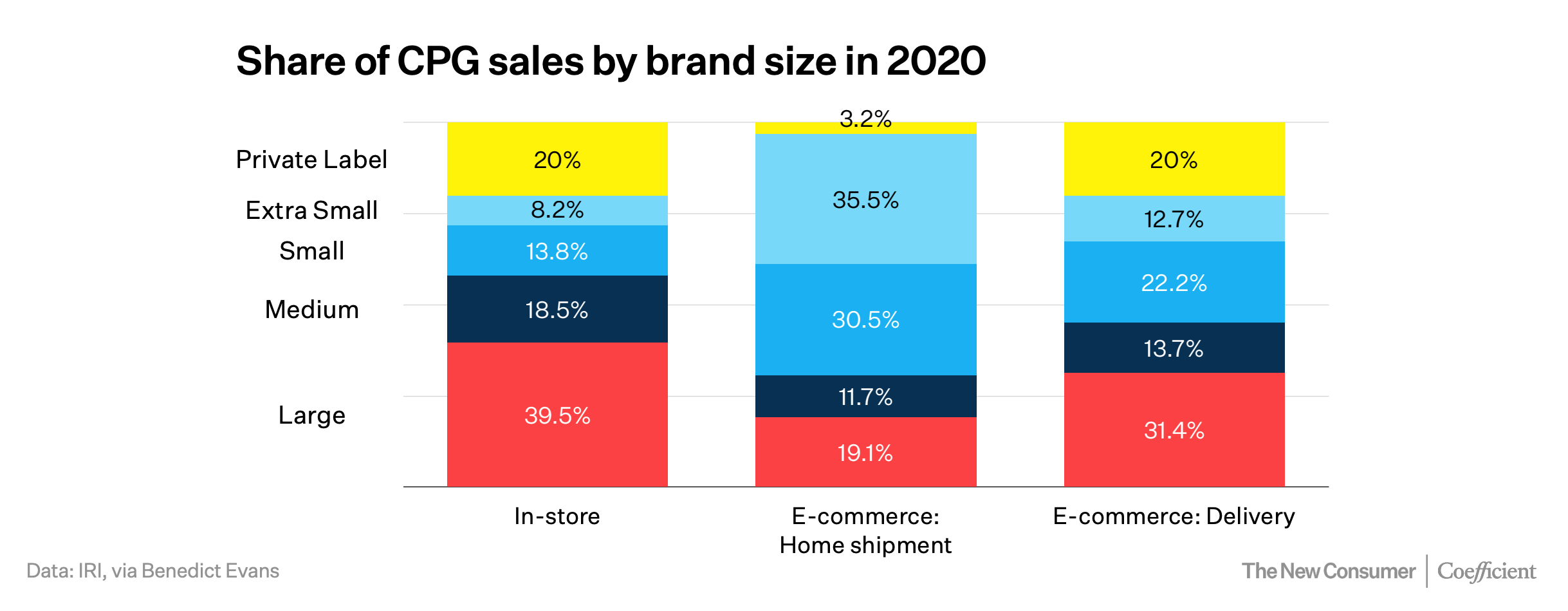

Small Brands

- Small consumer brands tend to beat large brands in the online world.

- Source: The New Consumer 2022 Report (lots of good slides here).

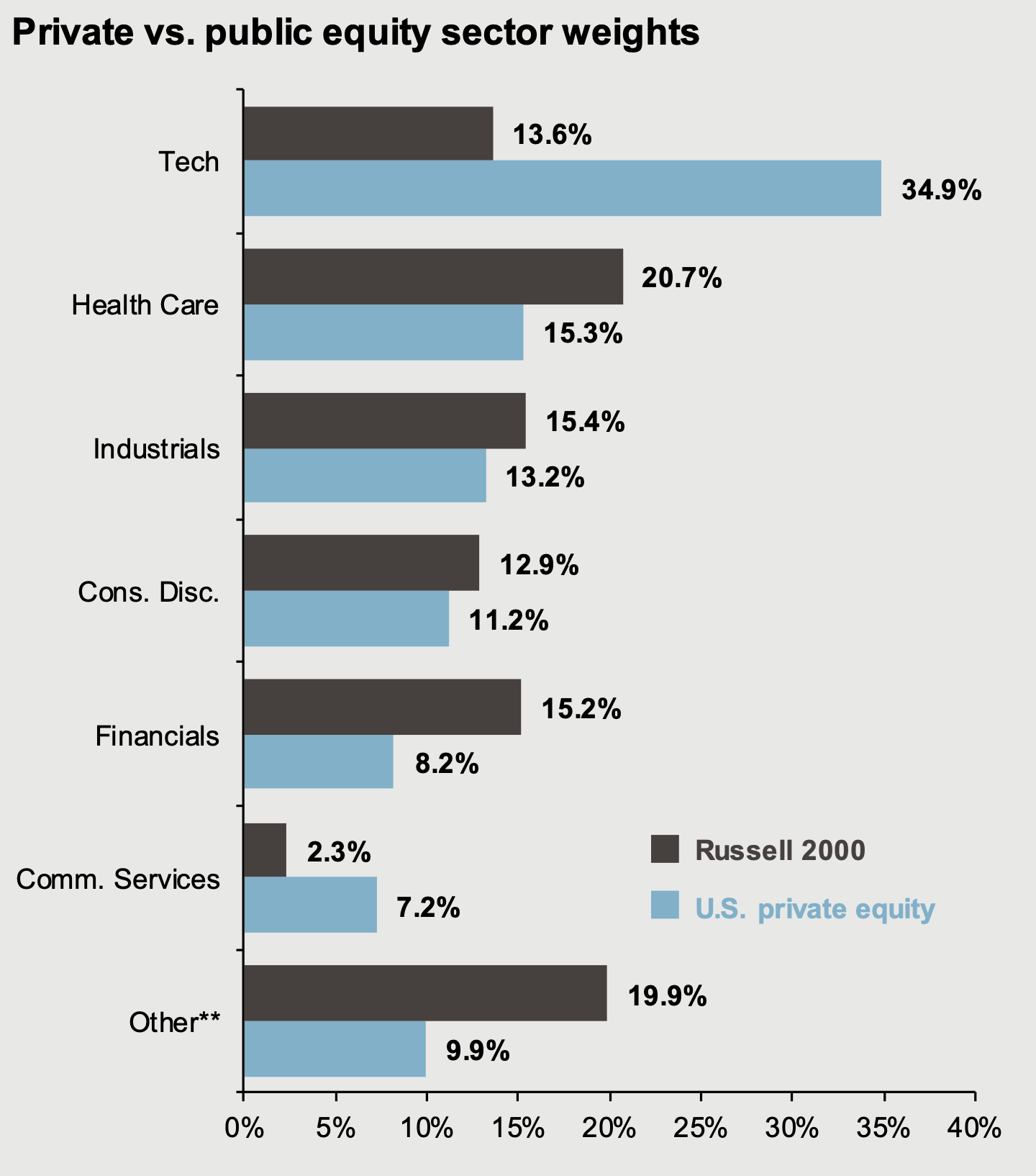

Sector Weights

- Interestingly US Private Equity has a much higher weighting in Tech than the Russell 2000.

- Source: JPM Guide to the Markets Q4 2021.

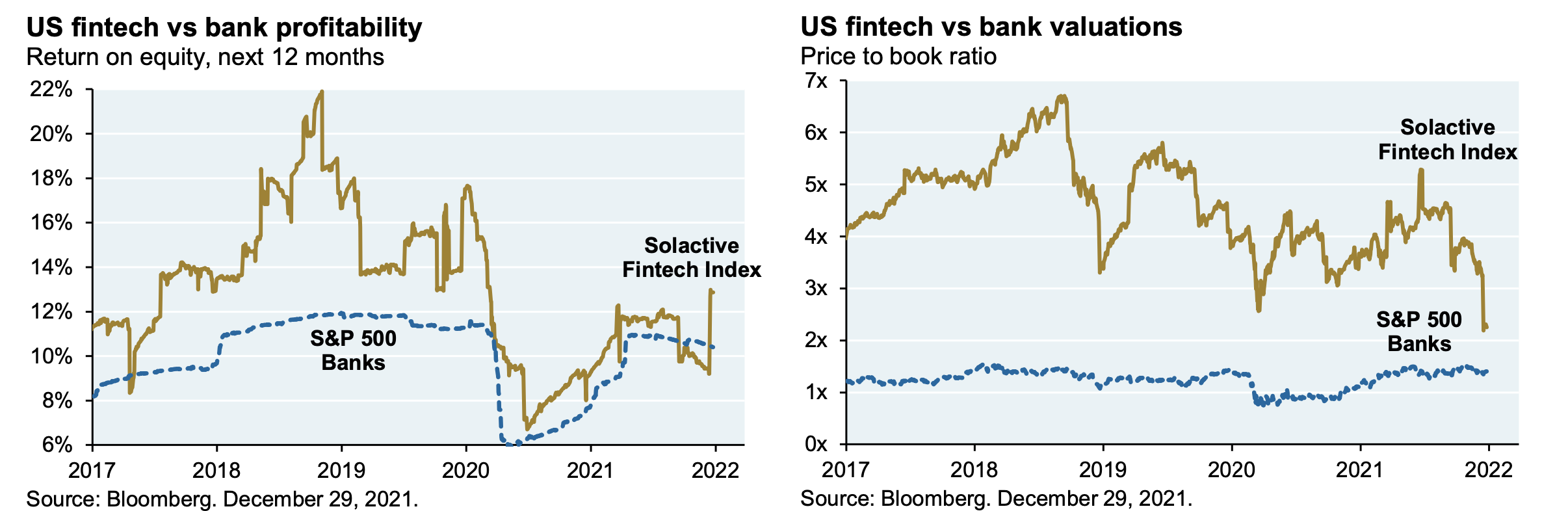

Banks vs Fintechs

DUC Inventory

- Drilled but uncompleted (DUC) well inventory (a form of hidden oil inventory) has almost normalised in the US oil patch.

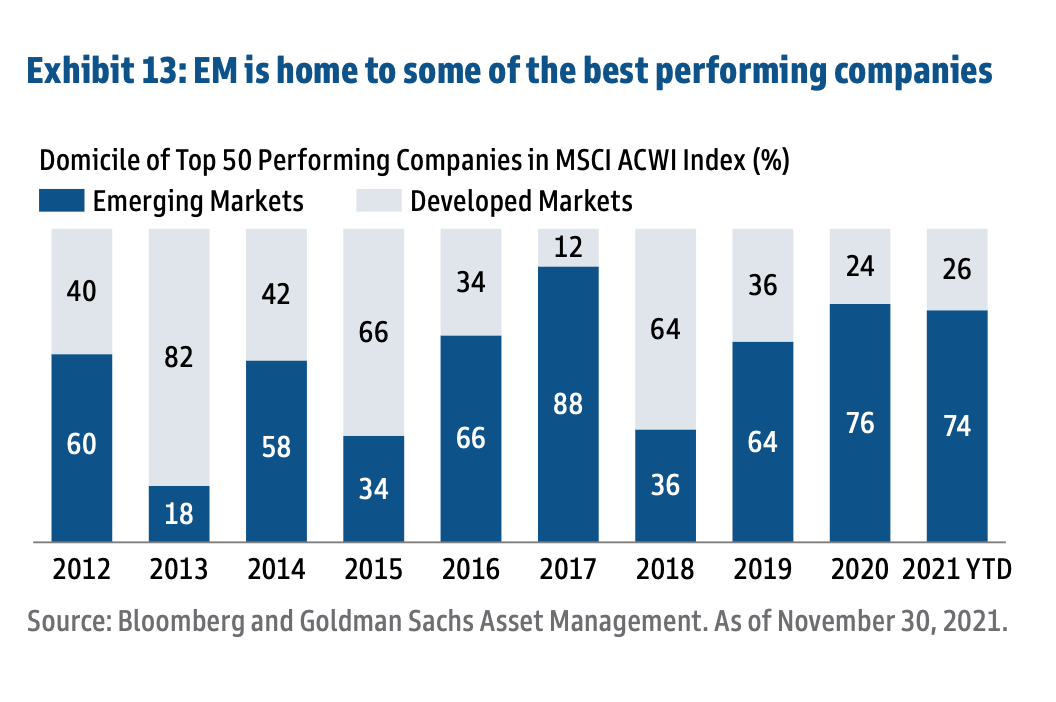

Emerging Market Stocks

- Surprisingly, EM stocks make up the majority of the top 50 best performing stocks in the MSCI All Country World Index (ACWI).

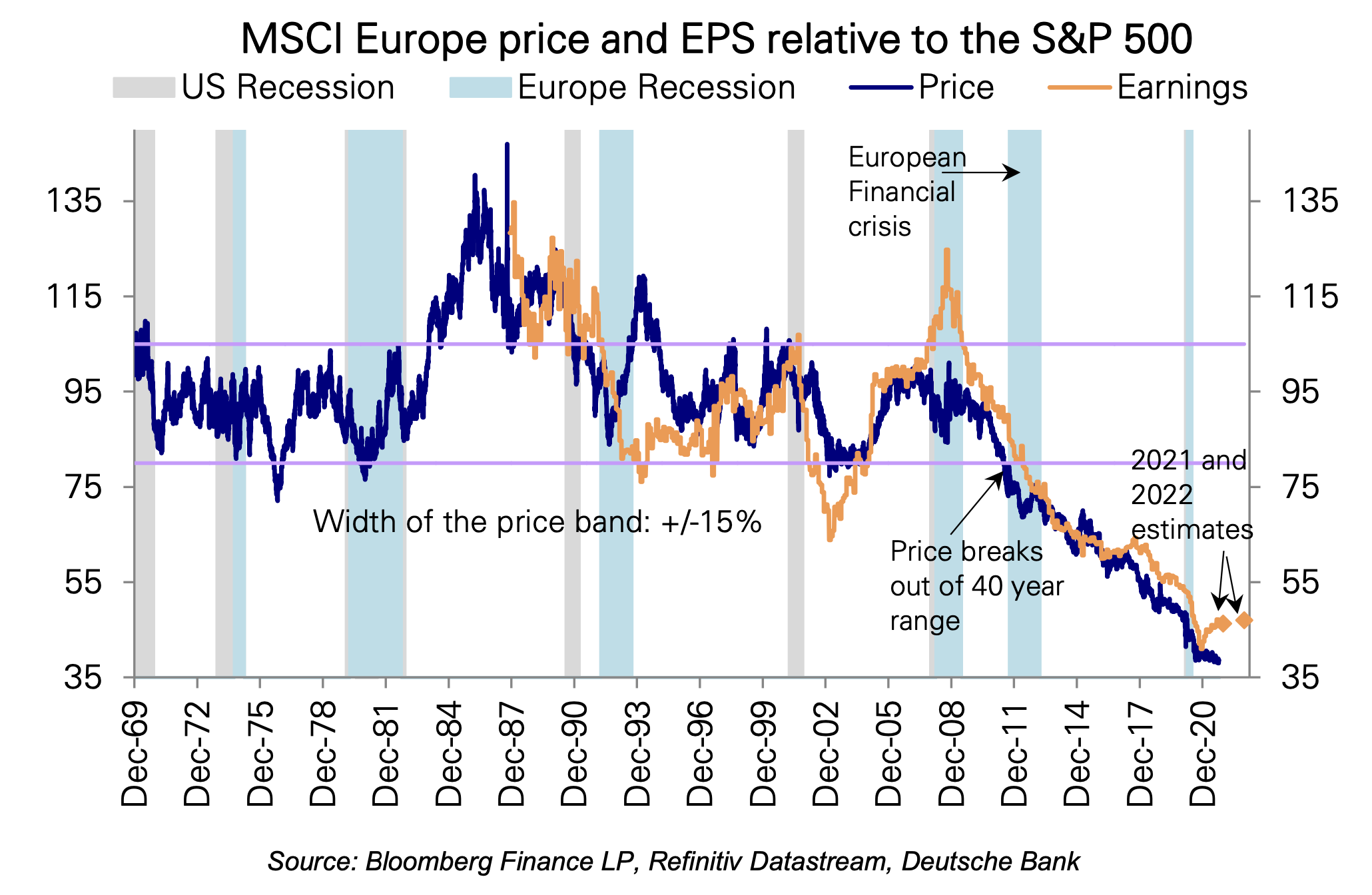

Europe

- European equities relative to the US (blue) have largely followed relative earnings (orange).

- The latest readings suggests we should see an improvement in price action.

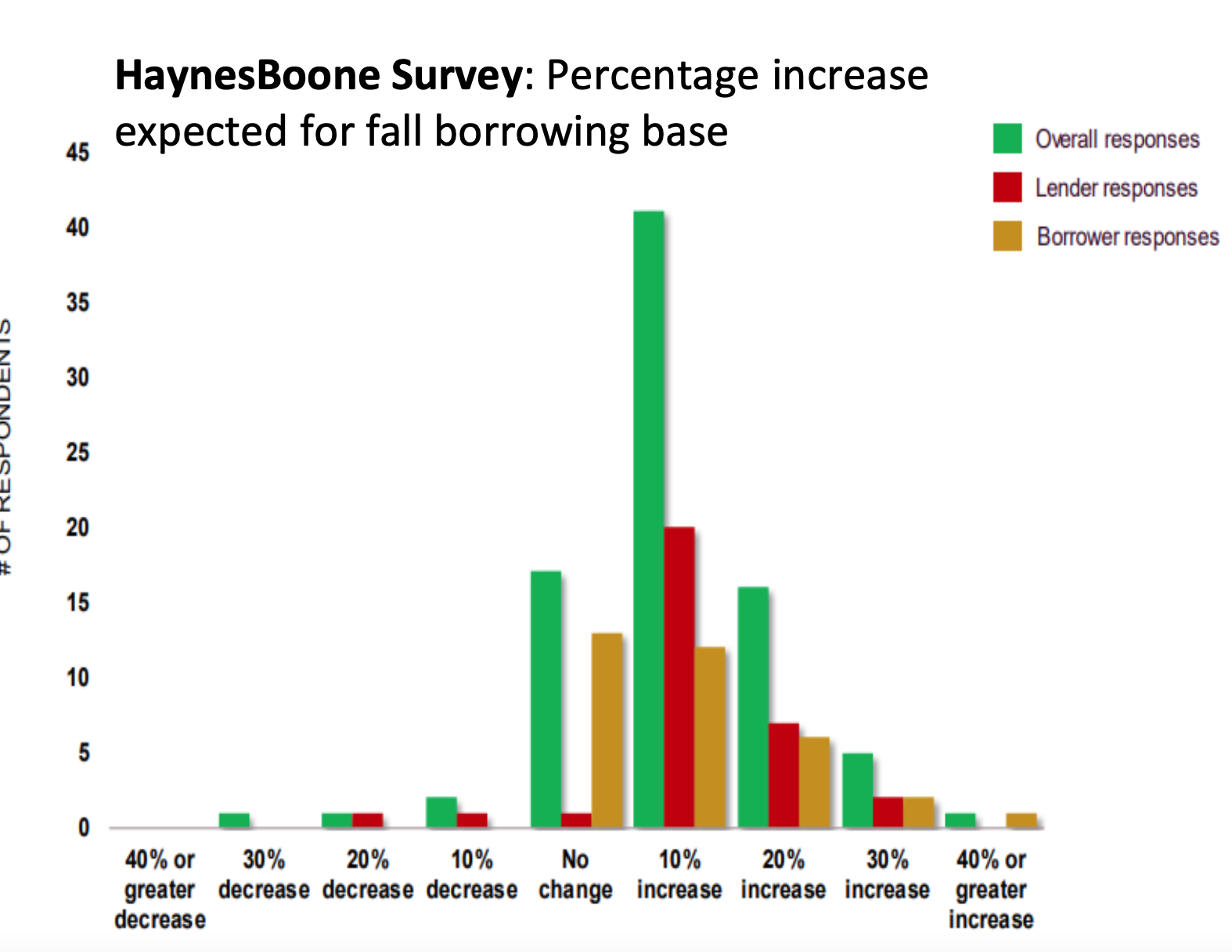

Oil Patch Borrowing Base

- Another key variable holding back capital expenditure in the US oil patch – lenders.

- Although borrowing bases are increasing it is only by 10-20%, likely not enough to recover the pandemic related drop.

- Source: HaynesBoone Survey.

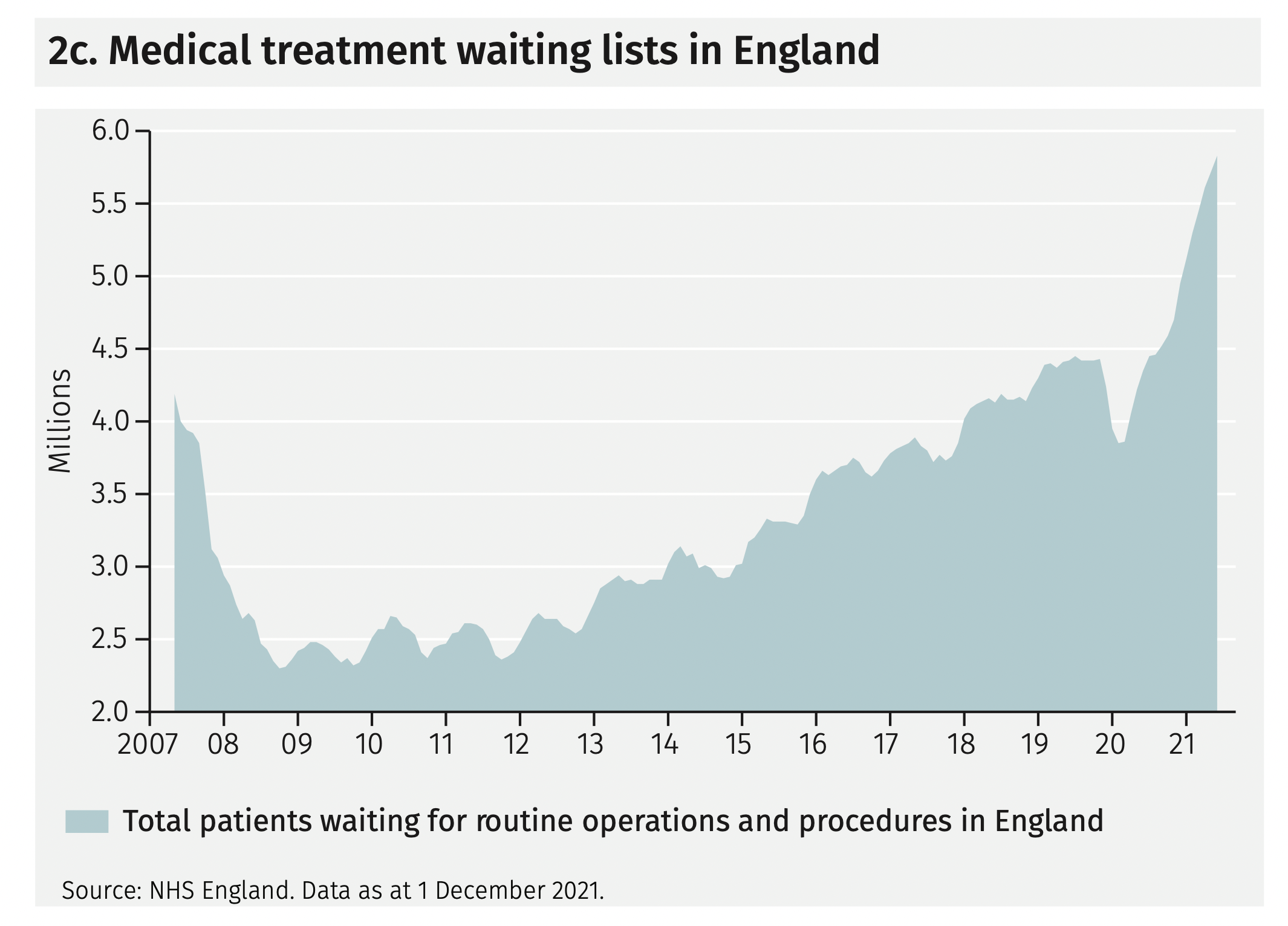

Medical Waiting Lists England

- Treatment waiting lists have ballooned thanks to the pandemic – suggesting a lot of pent up demand for healthcare.

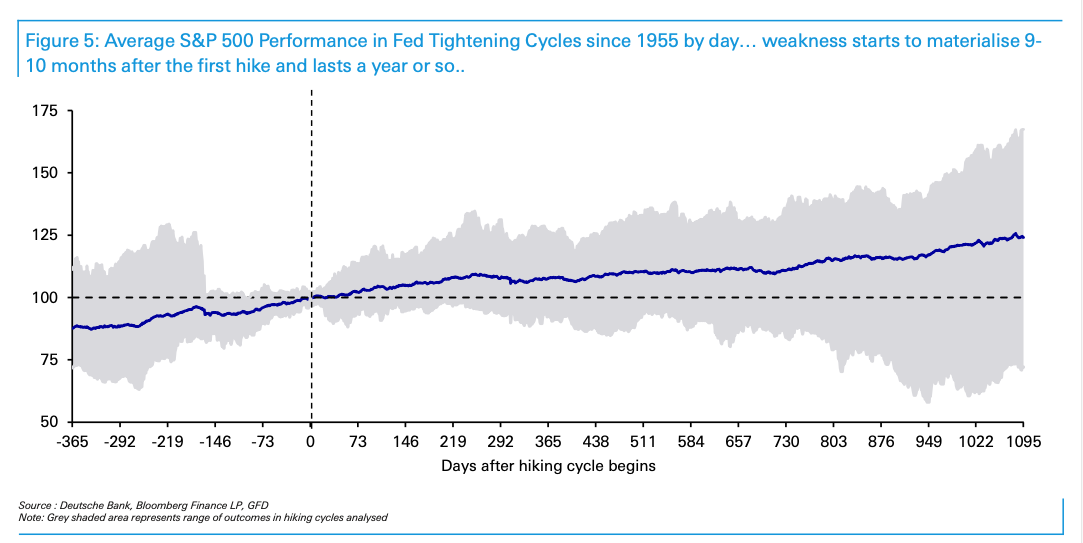

SPX around Hiking Cycles

- Historic stock performance of the S&P 500 around hiking cycles.

- Market usually softens 9-10 months after the first rate hike and lasts ca. 12 months.

Starship

- Starship, the fully reusable rocket under development by SpaceX, is a revolution the industry grossly under-appreciates. So goes this fascinating blog post.

- “Starship matters. It’s not just a really big rocket, like any other rocket on steroids. It’s a continuing and dedicated attempt to achieve the “Holy Grail” of rocketry, a fully and rapidly reusable orbital class rocket that can be mass manufactured. It is intended to enable a conveyor belt logistical capacity to Low Earth Orbit (LEO) comparable to the Berlin Airlift.“

- “Consider the two critical metrics: Dollars per tonne ($/T) and tonnes per year (T/year) … Starship is intended to reach numbers as low as $1m/T and 1000 T/year for cargo soft landed on the Moon. Apollo achieved about $2b/T and 2 T/year for cargo soft landed on the Moon.“

- It is developing in leaps – “Two years ago Starship was a design concept and a mock up. Today it’s a 95% complete prototype that will soon fly to space and may even make it back in one piece.“