- Starship, the fully reusable rocket under development by SpaceX, is a revolution the industry grossly under-appreciates. So goes this fascinating blog post.

- “Starship matters. It’s not just a really big rocket, like any other rocket on steroids. It’s a continuing and dedicated attempt to achieve the “Holy Grail” of rocketry, a fully and rapidly reusable orbital class rocket that can be mass manufactured. It is intended to enable a conveyor belt logistical capacity to Low Earth Orbit (LEO) comparable to the Berlin Airlift.“

- “Consider the two critical metrics: Dollars per tonne ($/T) and tonnes per year (T/year) … Starship is intended to reach numbers as low as $1m/T and 1000 T/year for cargo soft landed on the Moon. Apollo achieved about $2b/T and 2 T/year for cargo soft landed on the Moon.“

- It is developing in leaps – “Two years ago Starship was a design concept and a mock up. Today it’s a 95% complete prototype that will soon fly to space and may even make it back in one piece.“

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

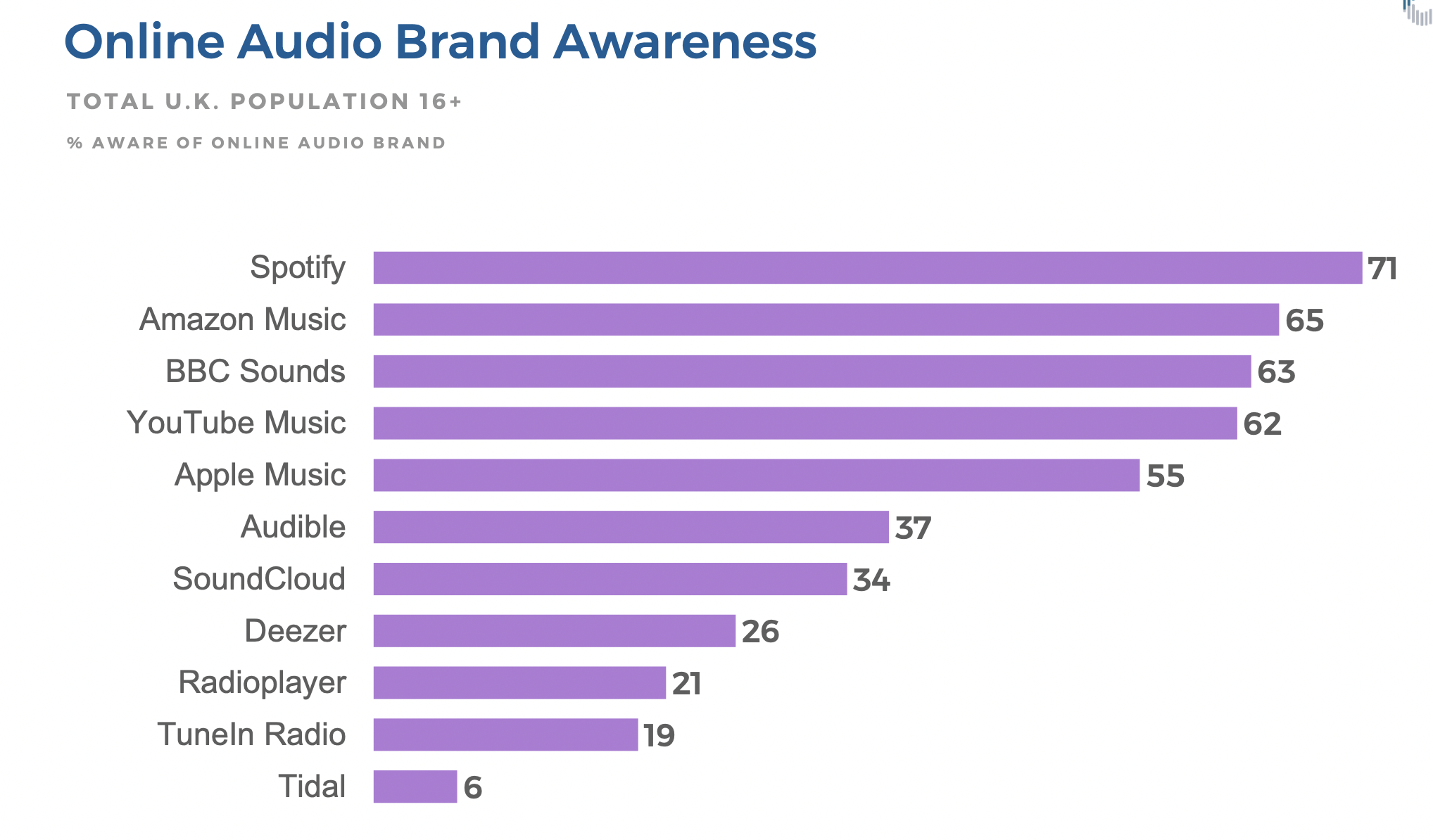

Online Audio Brands

- Awareness of online audio brands in the UK.

- Source: The Infinite Dial (lots of other useful data).

Biotech Year in Review

- Excellent review by Bruce Booth, partner at Atlas Ventures, of 2021 Year in Biotech.

- It covers the impact of the pandemic (both good and bad), current pipeline (5,000 compounds, $180bn of R&D spend), policy picture, the abundance of capital against constrained talent (here and 25:30) and so much more!

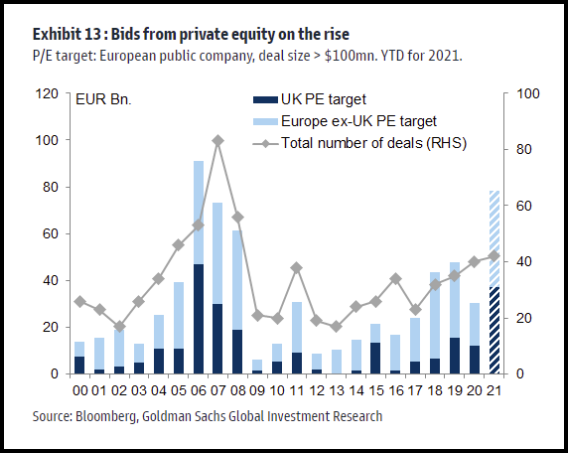

UK Inbound Private Equity

- Bids from private equity into Europe, and especially the UK, are on the rise with 2021 seeing a record year (almost rivalling 2006 in value terms).

- H/T 361 Capital.

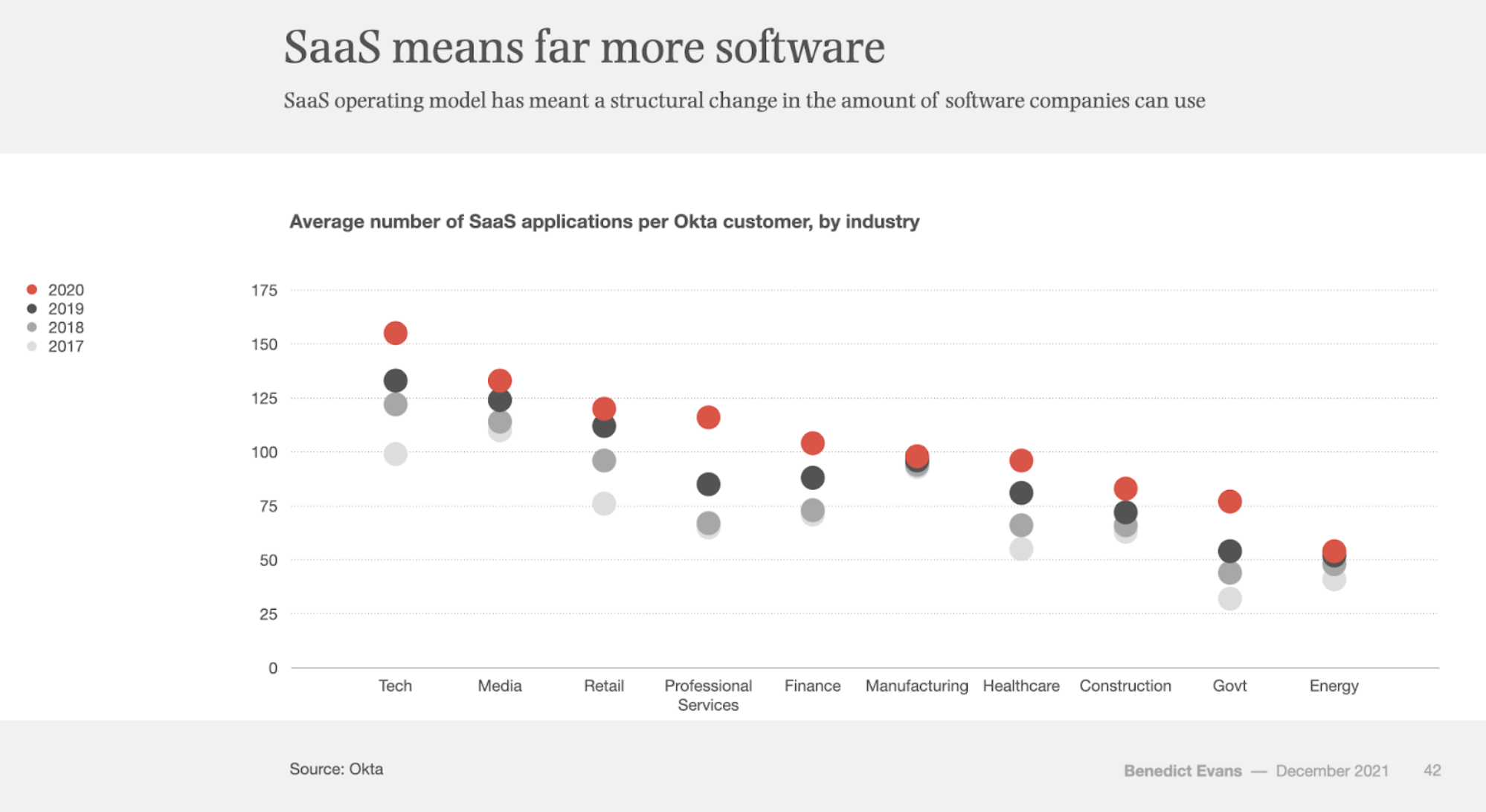

SaaS Unlocks Software Use

- Latest annual presentation is out from Benedict Evans.

- Absolutely worth a look as it nicely covers macro and strategic trends from the tech industry.

- This chart shows how software as a service (SaaS) has pushed up the amount of software companies can use (as there is no need to get IT to install/support/configure new applications).

- The move to cloud delivery for software has miles to go (it is just 10-15% of enterprise IT spend and 20-30% of workloads).

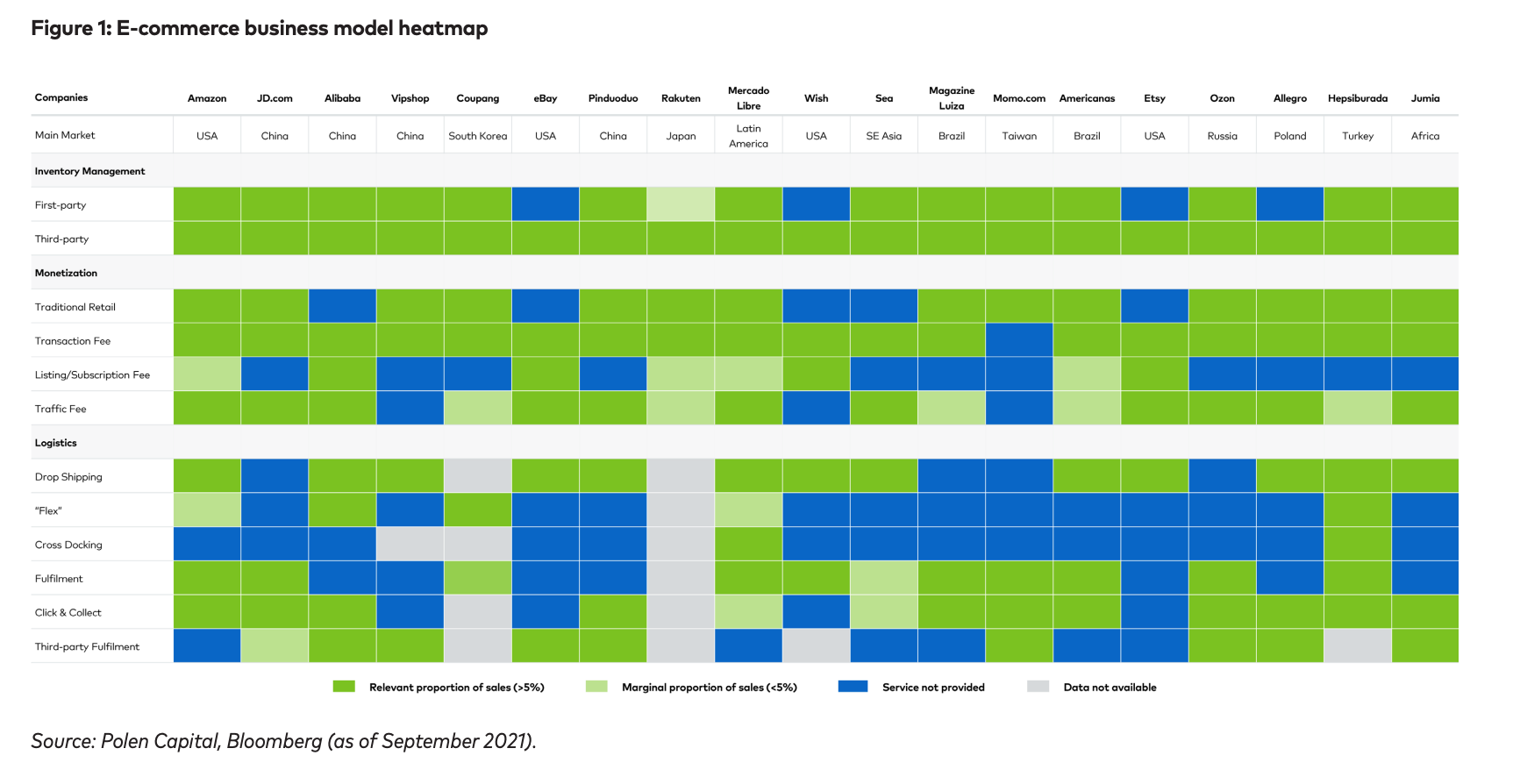

E-commerce Heat Map

- Nice heat map of the various business models employed by the world’s largest e-commerce companies.

- Source.

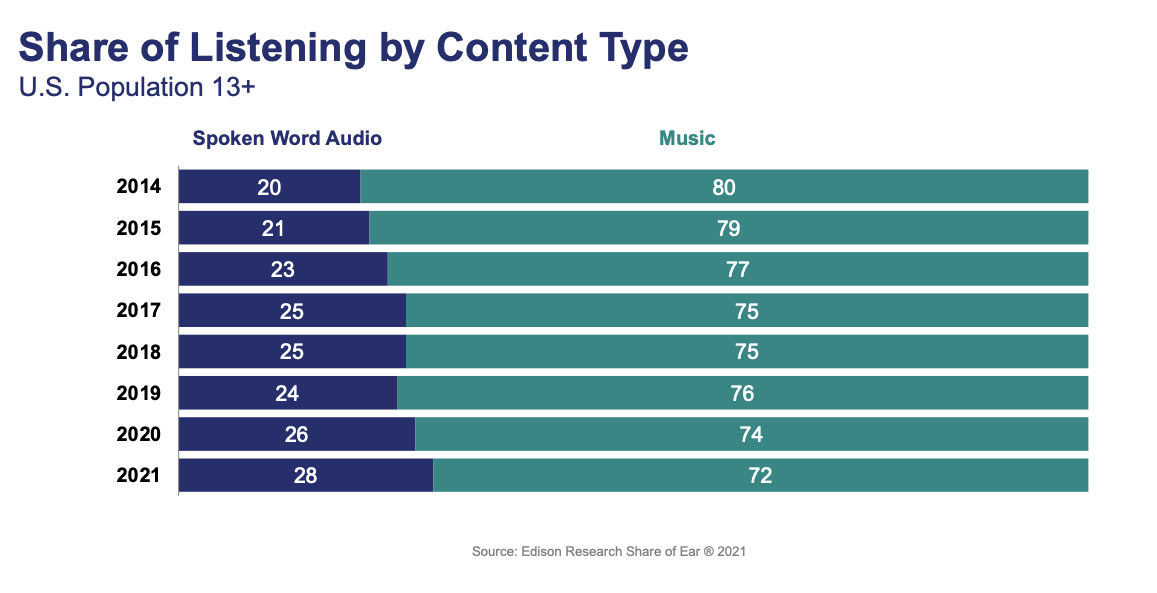

Spoken Word

- Spoken word audio (think podcasts, audiobooks etc) is taking share of listening away from music.

- 22m more people in the US are listening to spoken word than seven years ago.

- The biggest growth driver has been podcasts – which represent 22% of spoken word, up from 8% in 2014.

- Lots more stats in this NPR/Edison Research report.

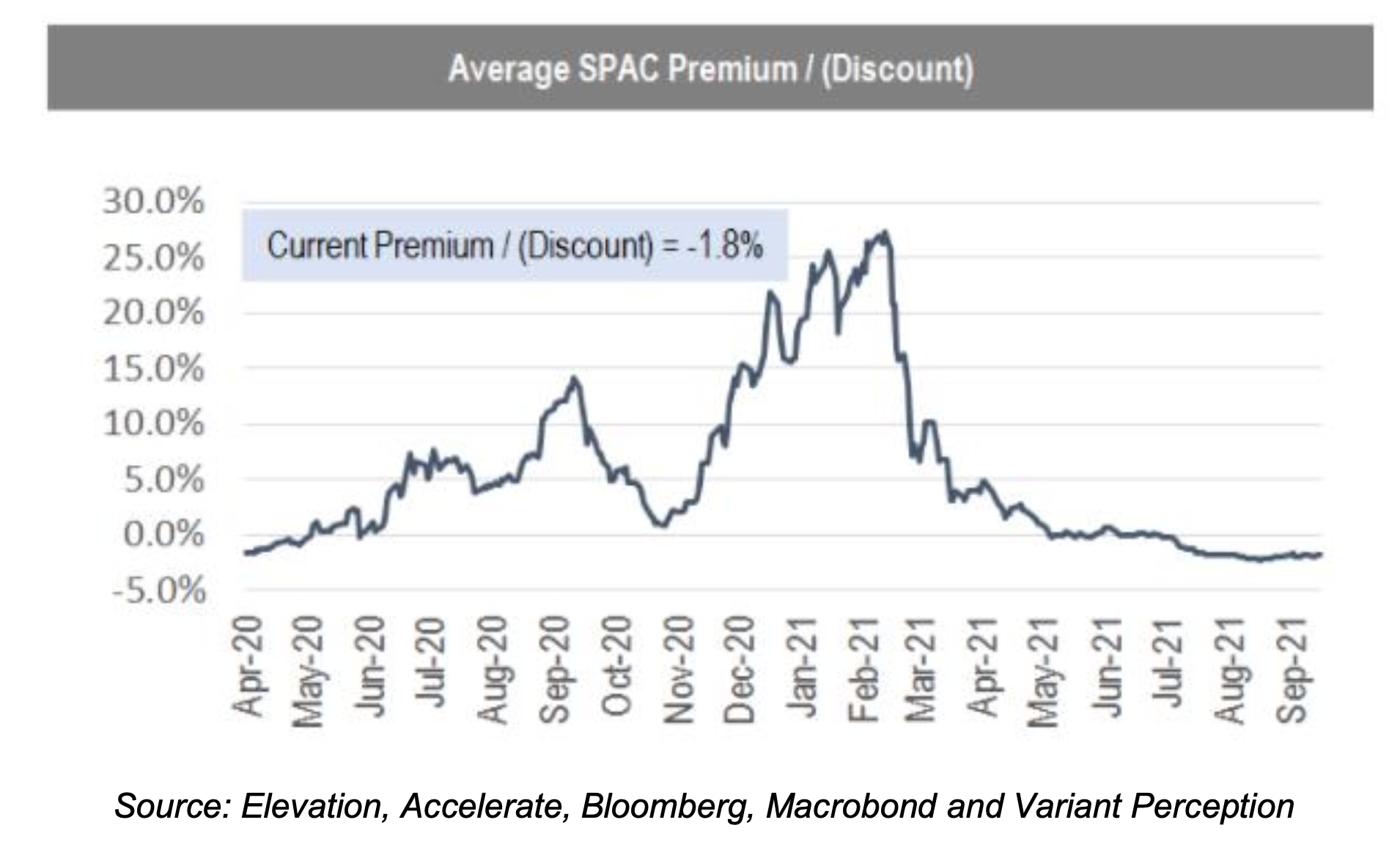

SPACs Pt 2

- Time to look at SPACs?

- Source: Variant Perception.

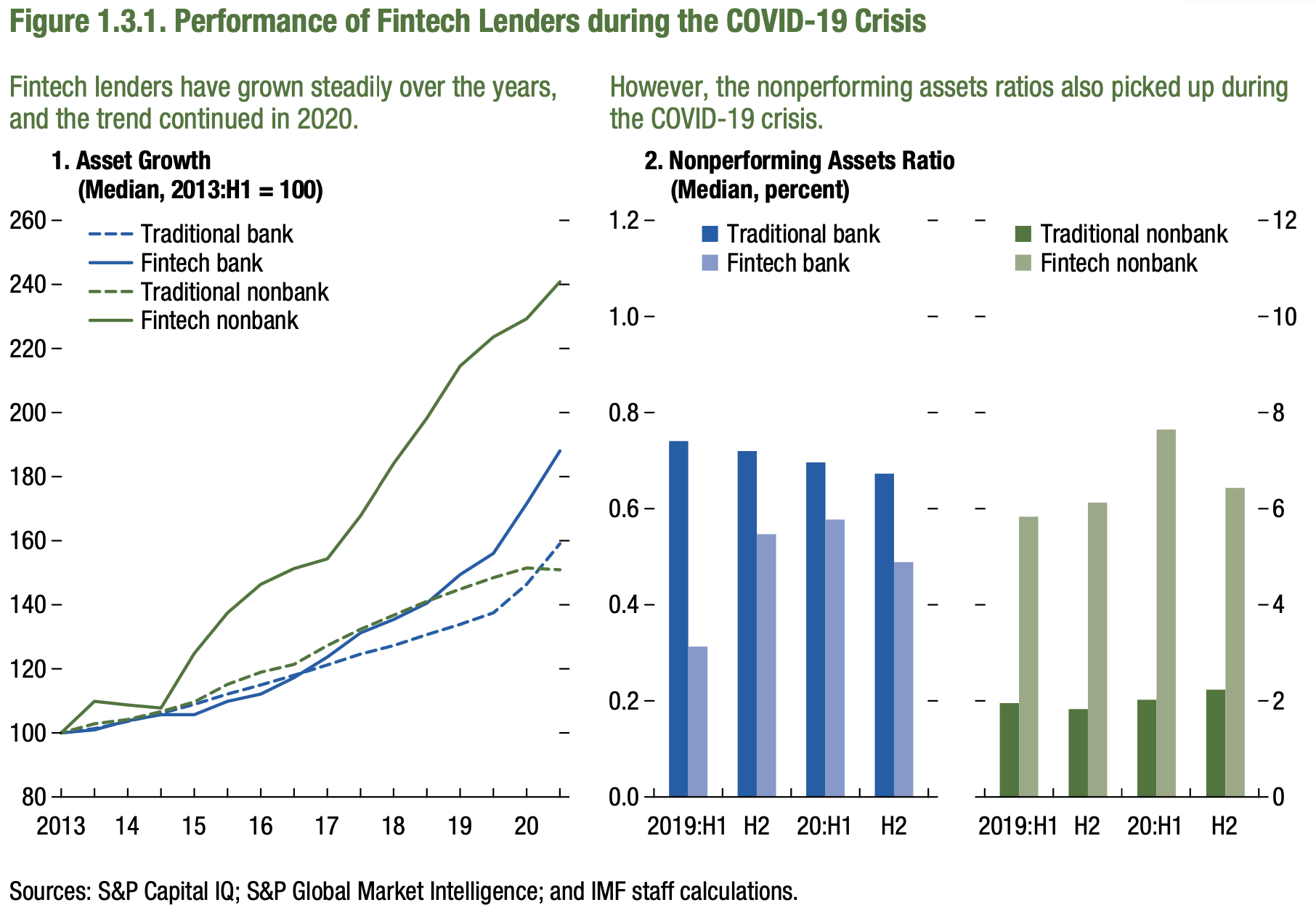

Fintech Lending

- Interesting study by IMF on fintech’s experience during the Covid crisis.

- The chart shows continued strong growth through 2020 by fintech lenders, outpacing traditional institutions.

- But also a pronounced increase in non-performing assets, something traditional lenders did not see.

- This work is based on data from 20 economies and is part of the IMF Global Financial Stability Report.

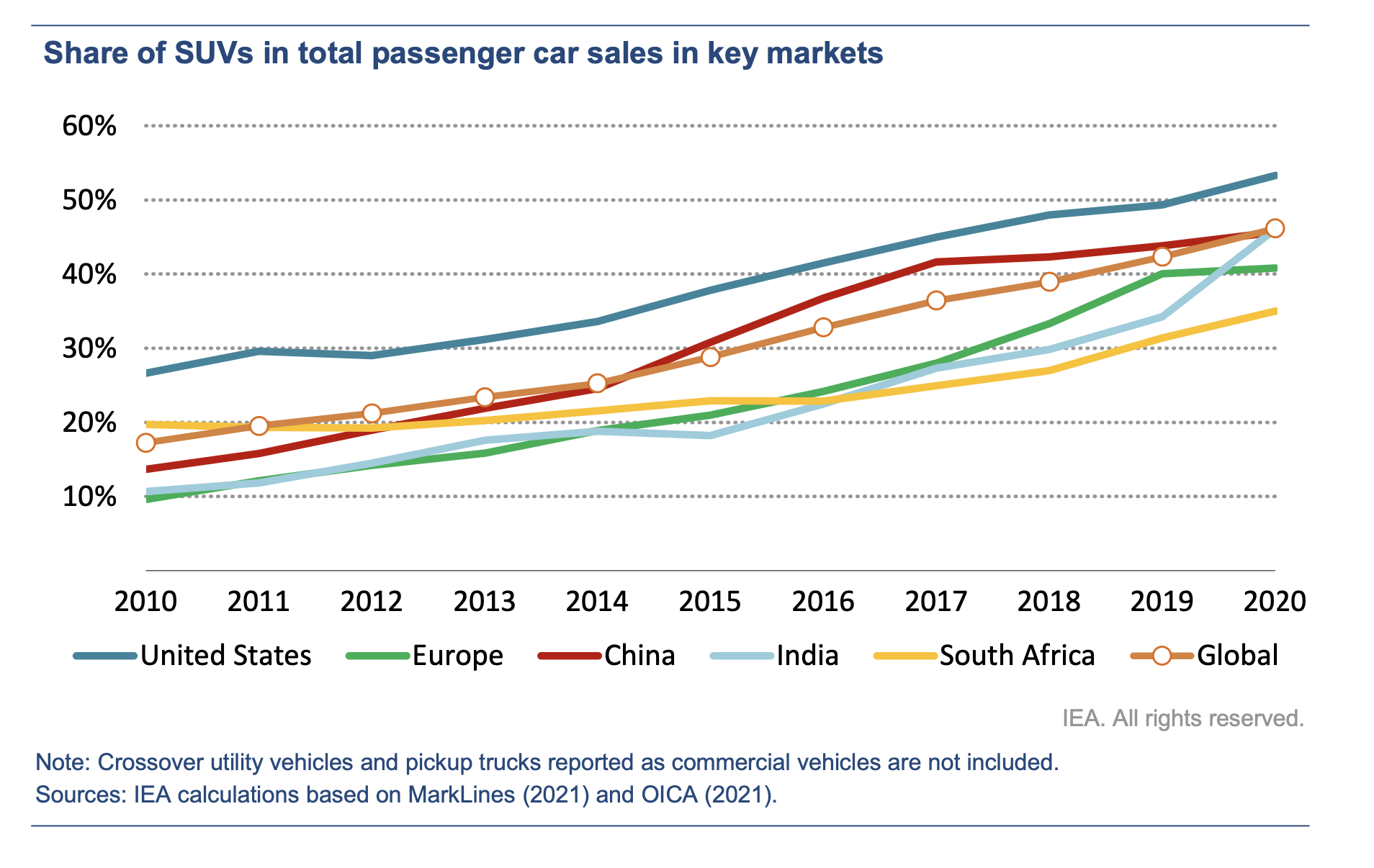

SUVs

- The popularity of SUVs continues unabated.

- This is despite 20% higher fuel cost (which has improved due to increased mix of electric SUVs and improving fuel economy).

Factors

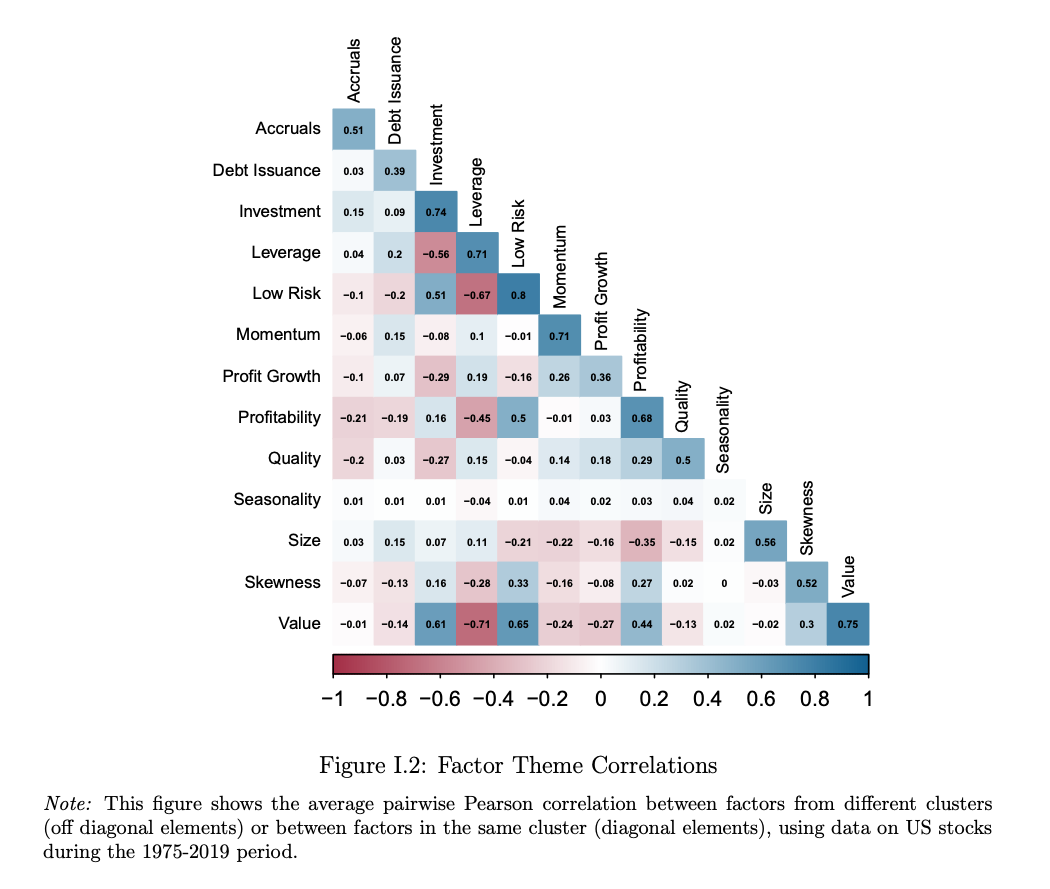

- Since its inception financial research has been on the hunt for factors that can consistently generate positive returns. Most famously Fama and French’s value factor.

- This search has led to a what one author has termed the “factor zoo” – a proliferation of factors – a direct consequence of data mining.

- There is also a replication crisis – that factors are not internally (i.e. the results can’t be replicated within the original sample) and externally (i.e. results can’t be replicated out of sample) valid.

- This paper (summary here) is a rebuttal of these issue – it uses Bayesian updating from a prior that a factor’s usefulness is zero. Their work finds that no crisis exists.

- One idea worth thinking about is that according to the authors the 153 factors explored actually cluster into 13 themes – “possessing a high degree of within-theme return correlation and economic concept similarity, and low across-theme correlation” (as seen in the chart).

- h/t AQR Research.

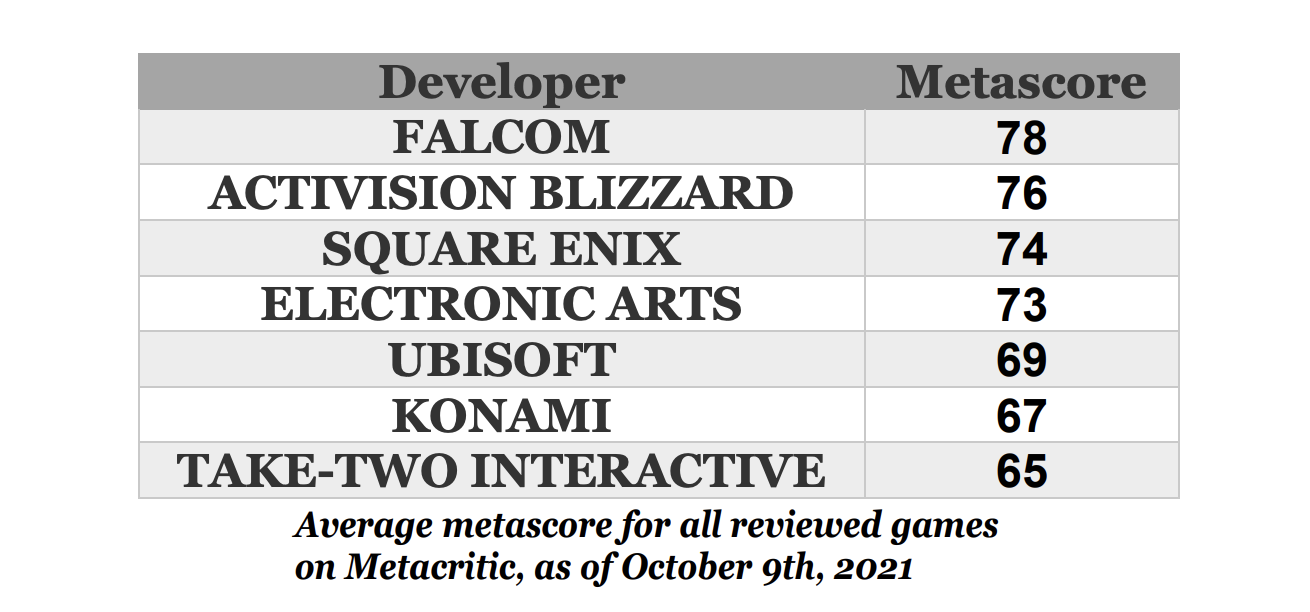

Video Game Developers

- Bet you haven’t heard of the top games developer by average Metacritic score for all reviewed games.

- Source (further reading inside).

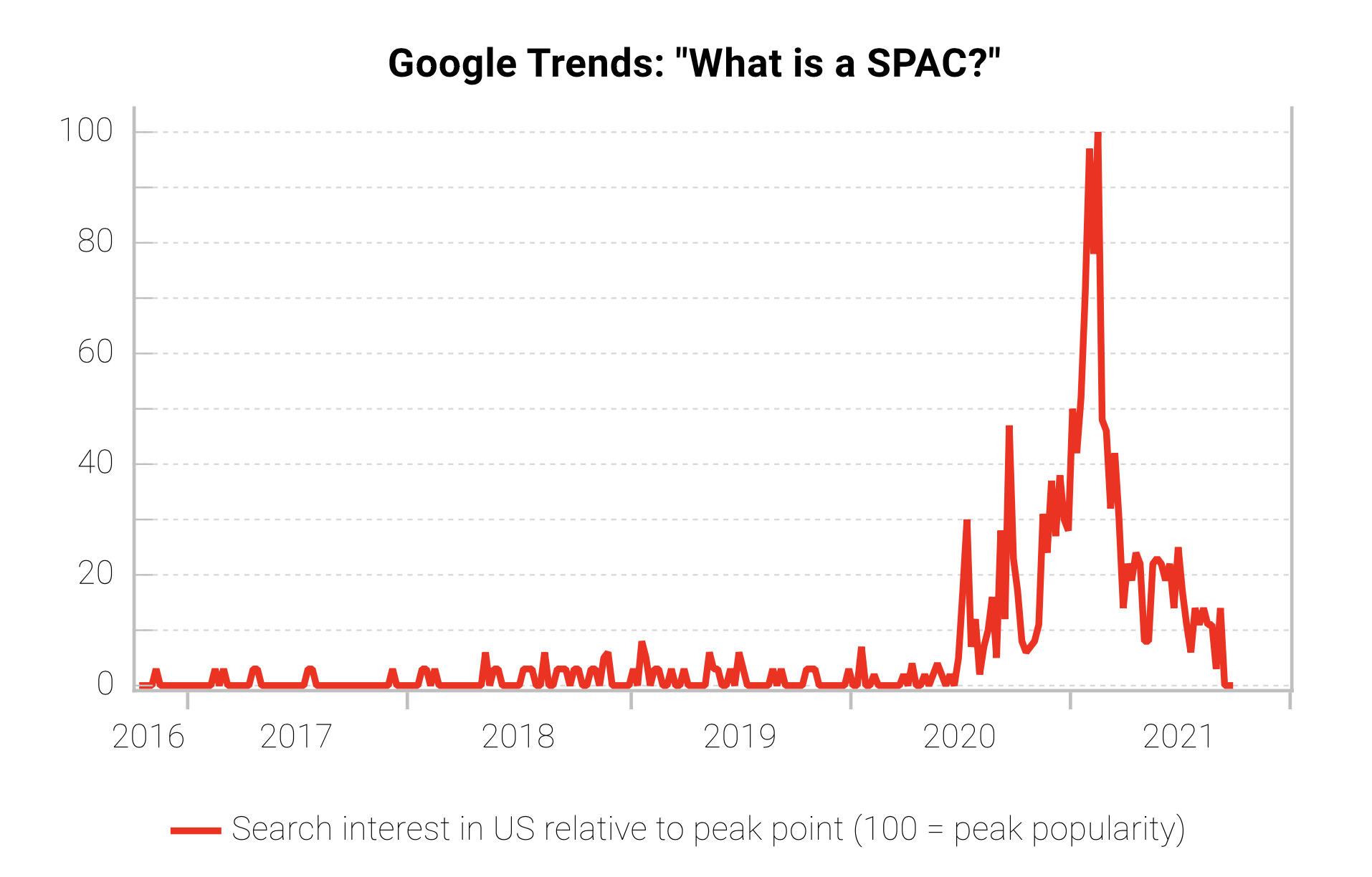

SPACs Popularity

- Time to look at SPACs?

- Source: Variant Perception.

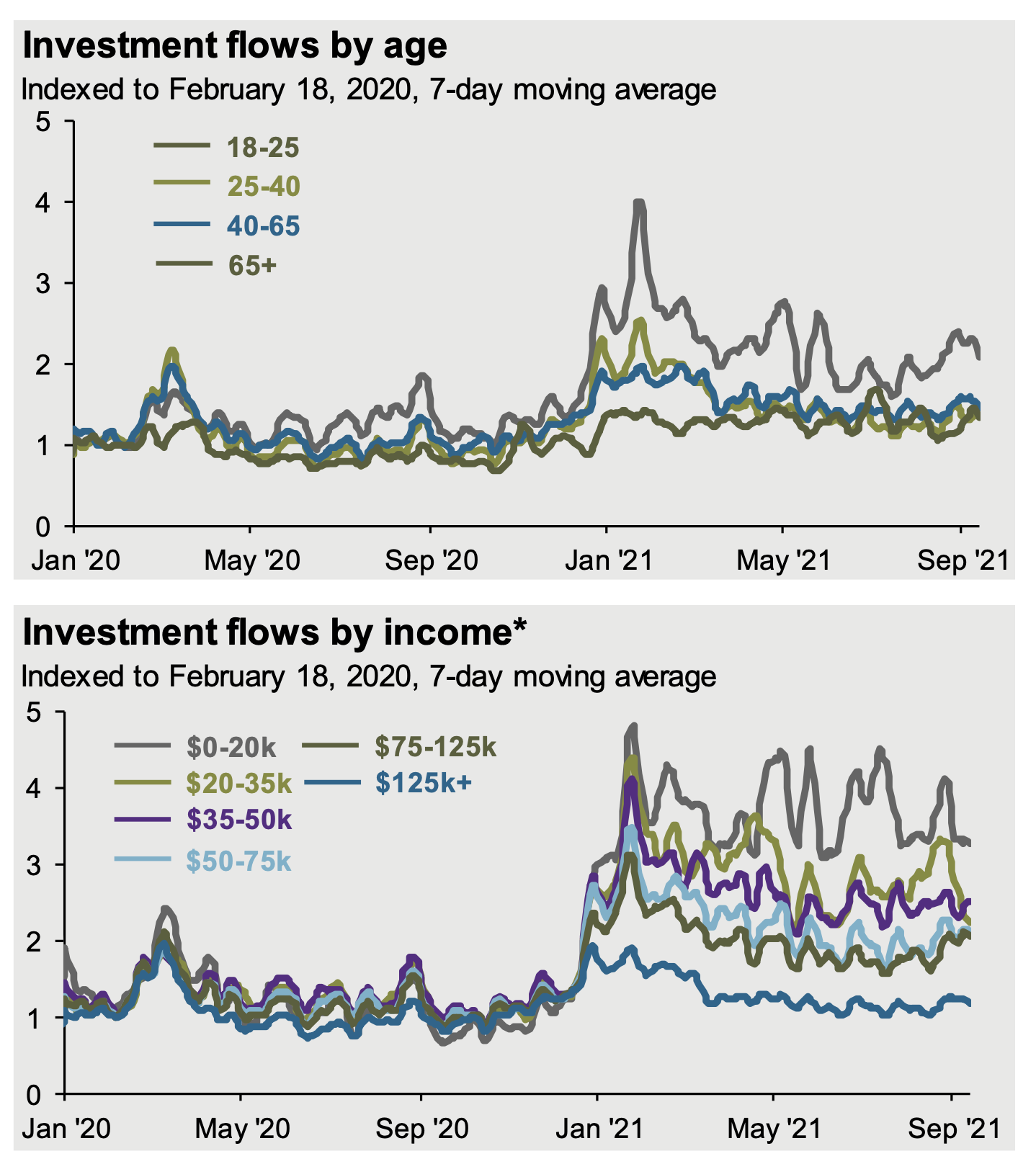

Investment Flows

- Younger and lower income groups have seen the biggest rise in investment flows since the pandemic.

- Women are also increasingly investing more than they used to.

- Source: JPM AM Guide to Markets Q4.

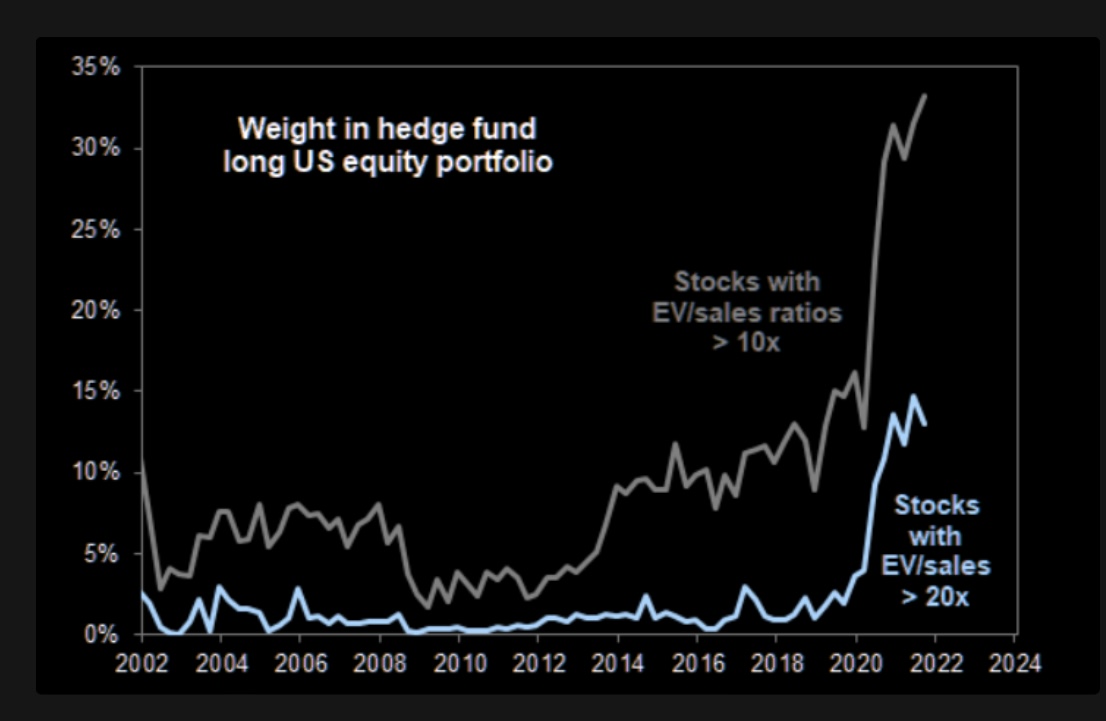

Hedge Fund Holdings

- Hedge funds have had a love affair with expensive stocks since early 2020.

- They have massively boosted their holdings of stocks trading >10x EV/Sales.

- These currently represent a third of US equity hedge fund long portfolios in aggregate.

- Such stocks are 23% of the Russel 3000 market cap.

- h/t themarketear.

Startups Powered by Big Tech

- Big tech powers startups.

- Using real spending data the top vendors are AWS, Intuit, G suite, and Slack.

- Interestingly Q3 2021 saw the rise of Google Ads to second place. Other vendors are largely consistent over time.

- Source: SVB, AngelList State of US Venture Report.

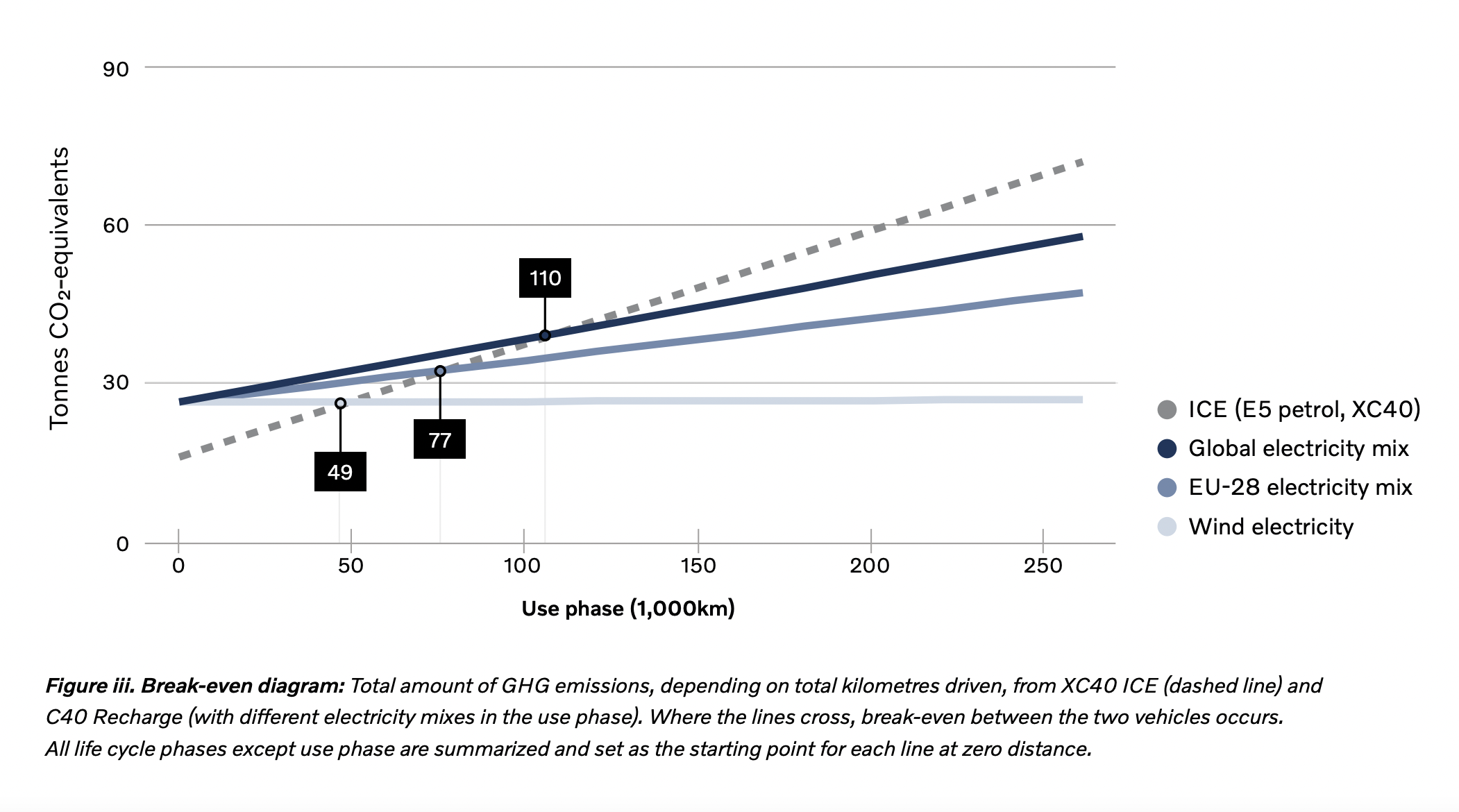

CO2 Breakeven

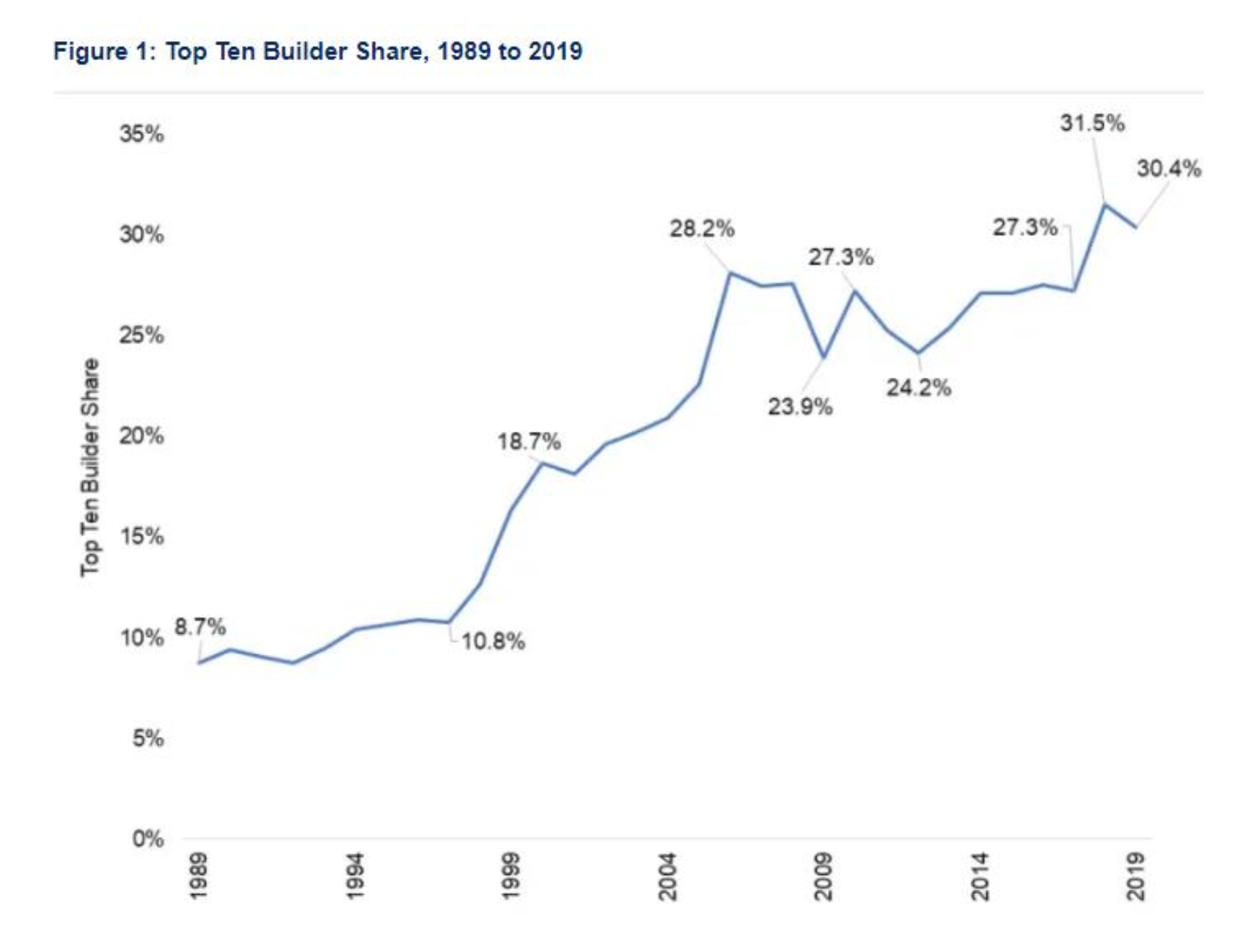

US Homebuilders

- US homebuilder market is really fragmented – the top 10 represent only 30.4% of the market.

- Though this number has been rising for years.

Disney World

- Collection Disney World maps through the years.

- “This enormous land parcel is also unique in that it’s a kind of self-governing municipality, with its own fire department and emergency services. The district—officially known as the Reedy Creek Improvement District—is governed by a five-person Board of Supervisors elected by the landowners in the district. As a result, high-level Disney employees essentially run the entire region encompassing WDW.“

- The area is so vast that “The Magic Kingdom parking lot, for example, is actually larger than the theme park itself.”