- The UK equity risk premium is one of the most attractive in the developed world.

- It is also near the highest it has been vs. its own history.

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

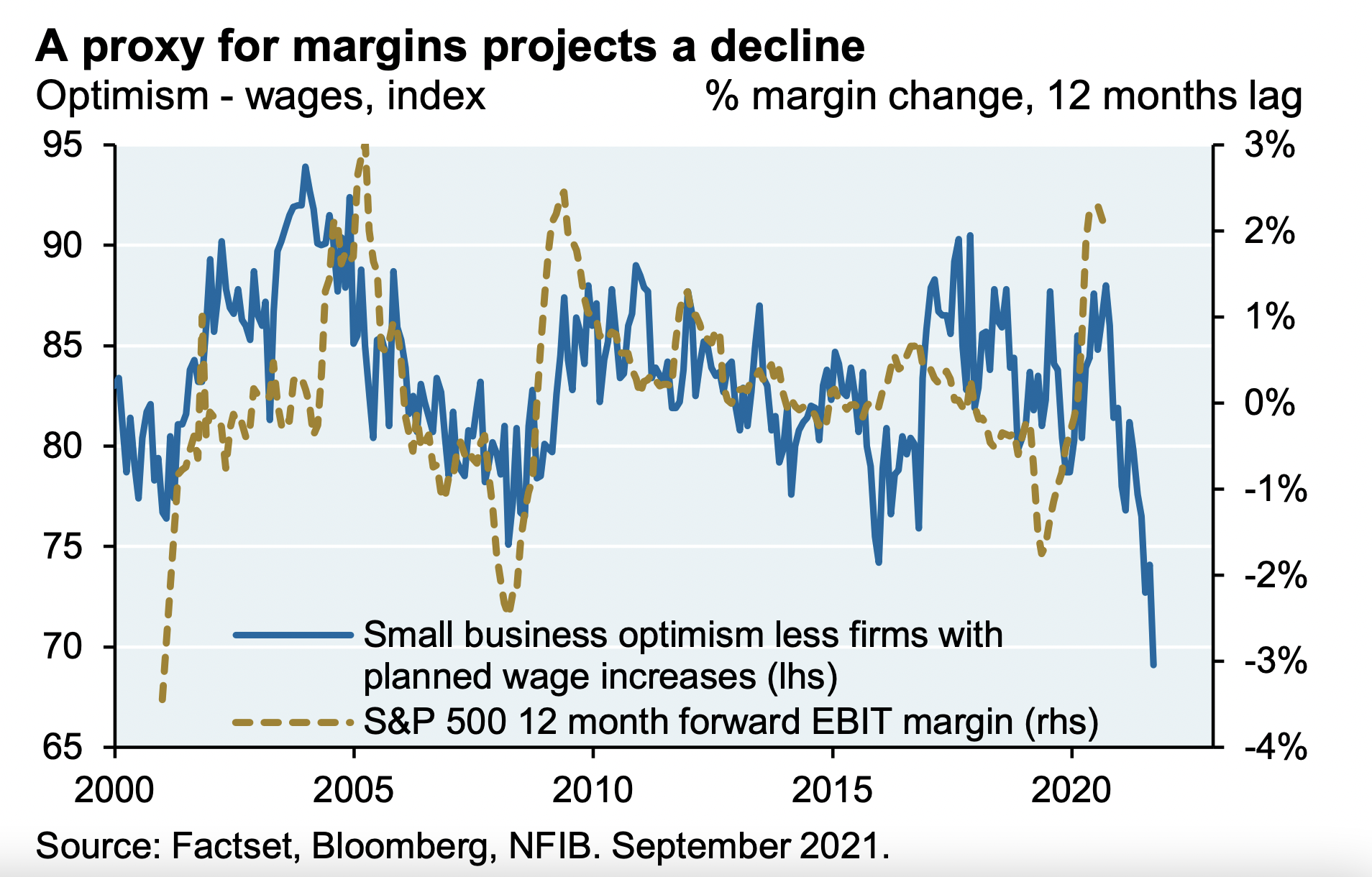

Margins

- Small business survey data suggests margins could come under pressure.

- Source: JPM AM.

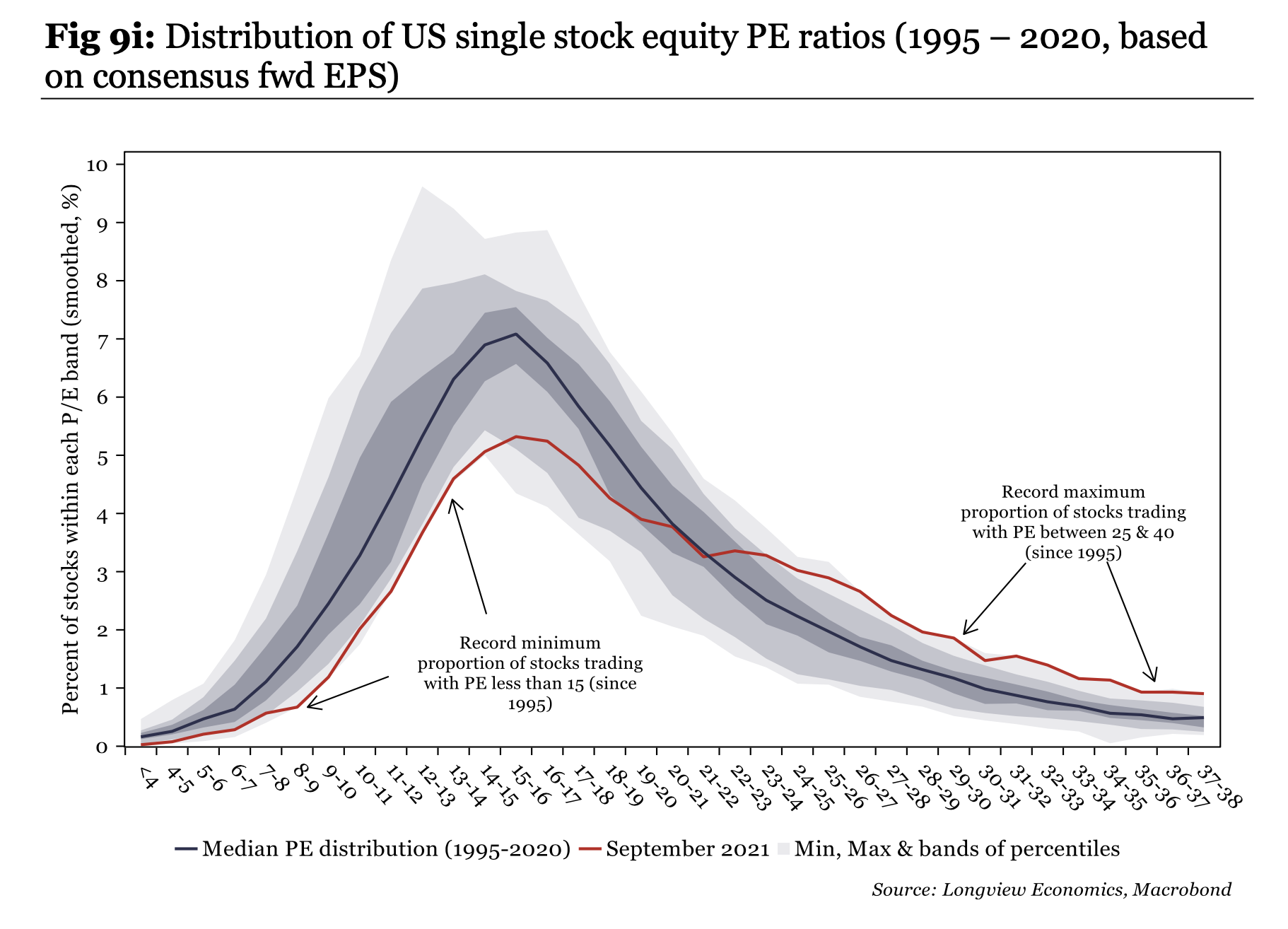

Valuation Distribution

- Single stock price to earnings ratio (PE) distribution.

- Right now there is a record proportion of stocks with P/Es between 25 to 40x.

- And a record low proportion of stocks less than 15x.

- Source: Longview Economics.

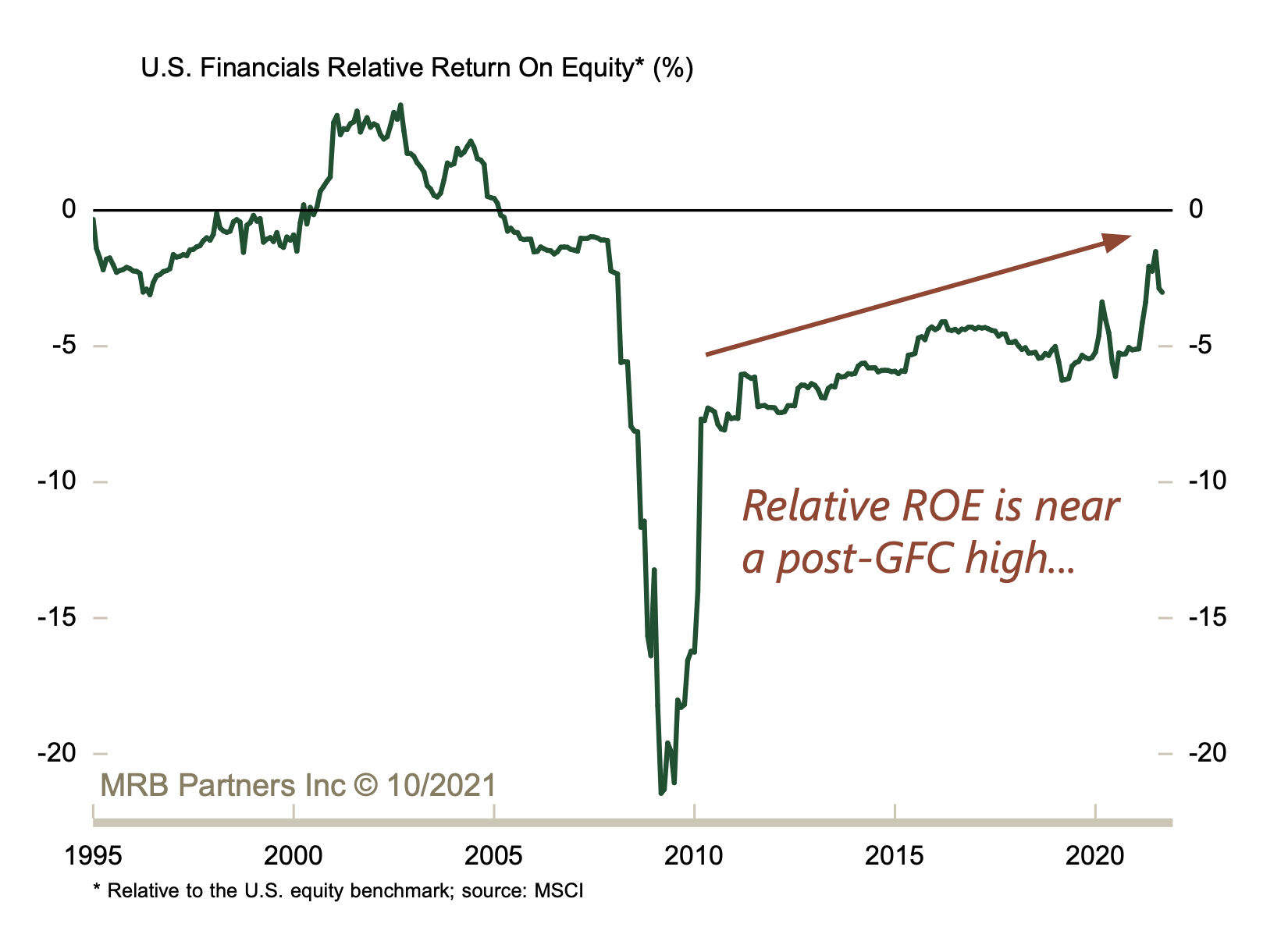

Financials ROE

- The US financial sector return on equity (ROE) has almost closed its relative gap to the market.

- Despite this the relative price to book ratio is still below pre-covid levels.

- h/t MRB Partners.

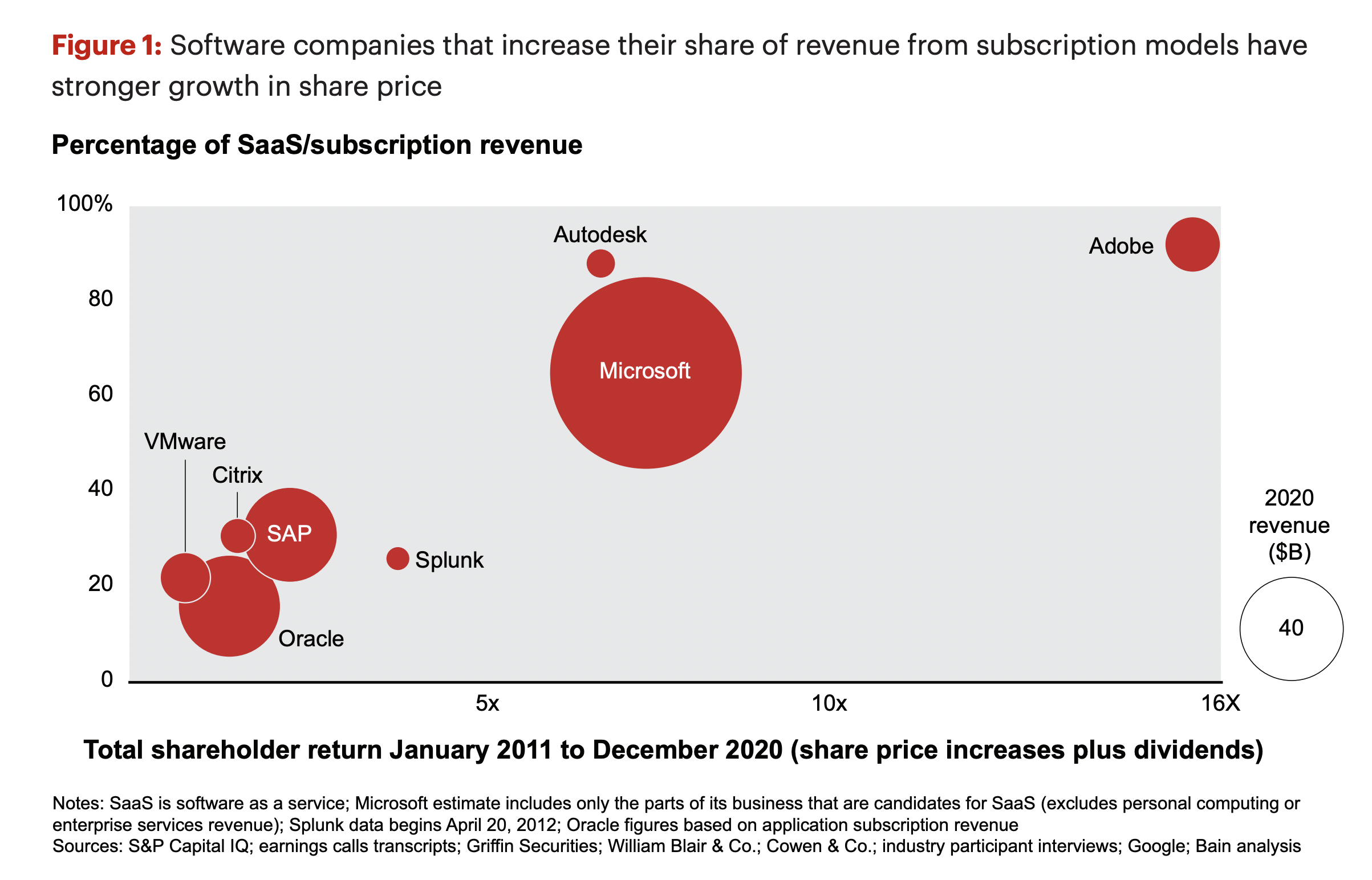

Subscription Mix and Returns

- Mature software companies that move to more subscription based business, tend to have strong share price returns.

- Source.

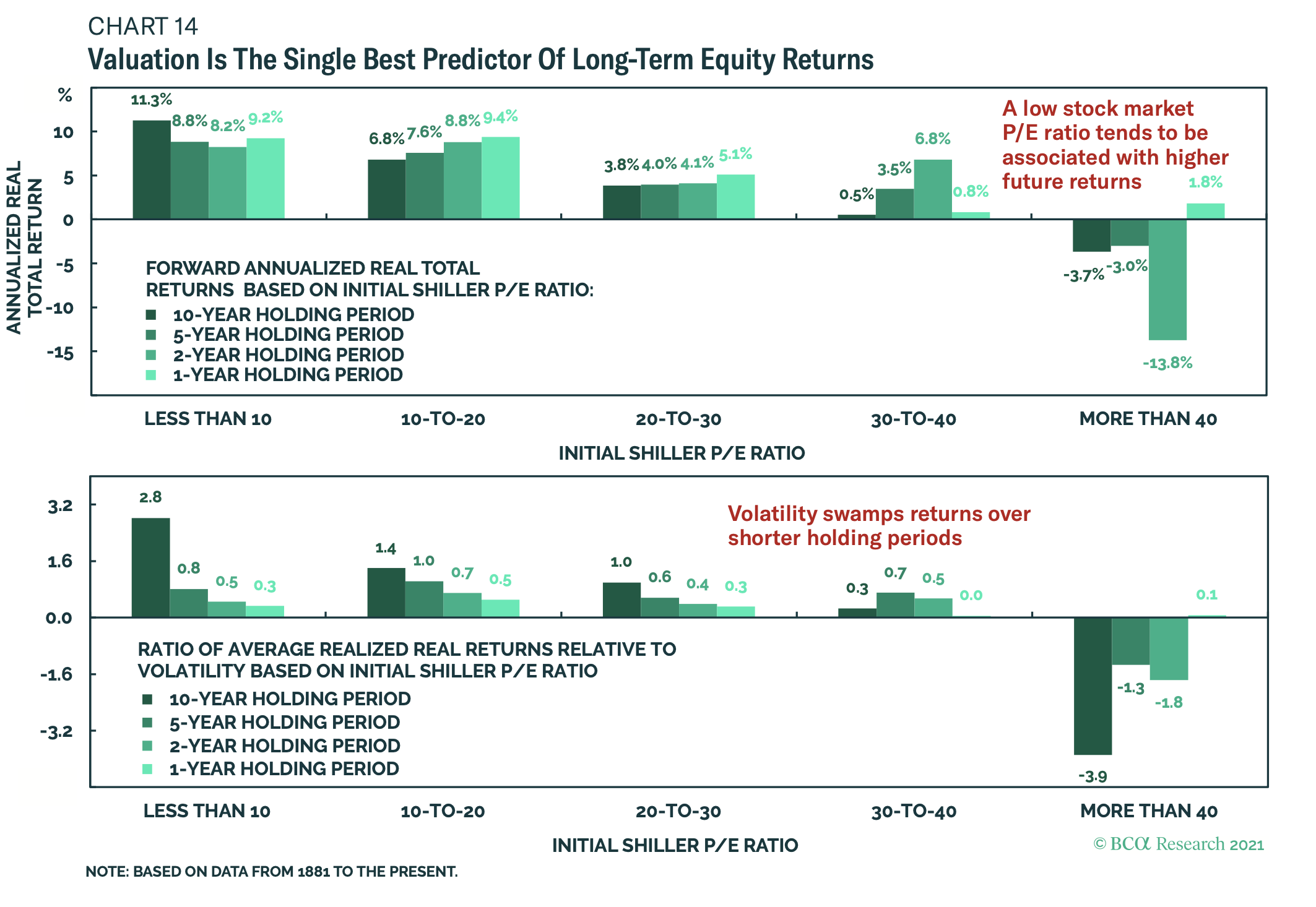

Valuation and Long Term Stock Returns

- Over the long-term valuation is the best predictor of stock returns.

- However, volatility dominates over shorter holding periods.

- h/t BCA Research.

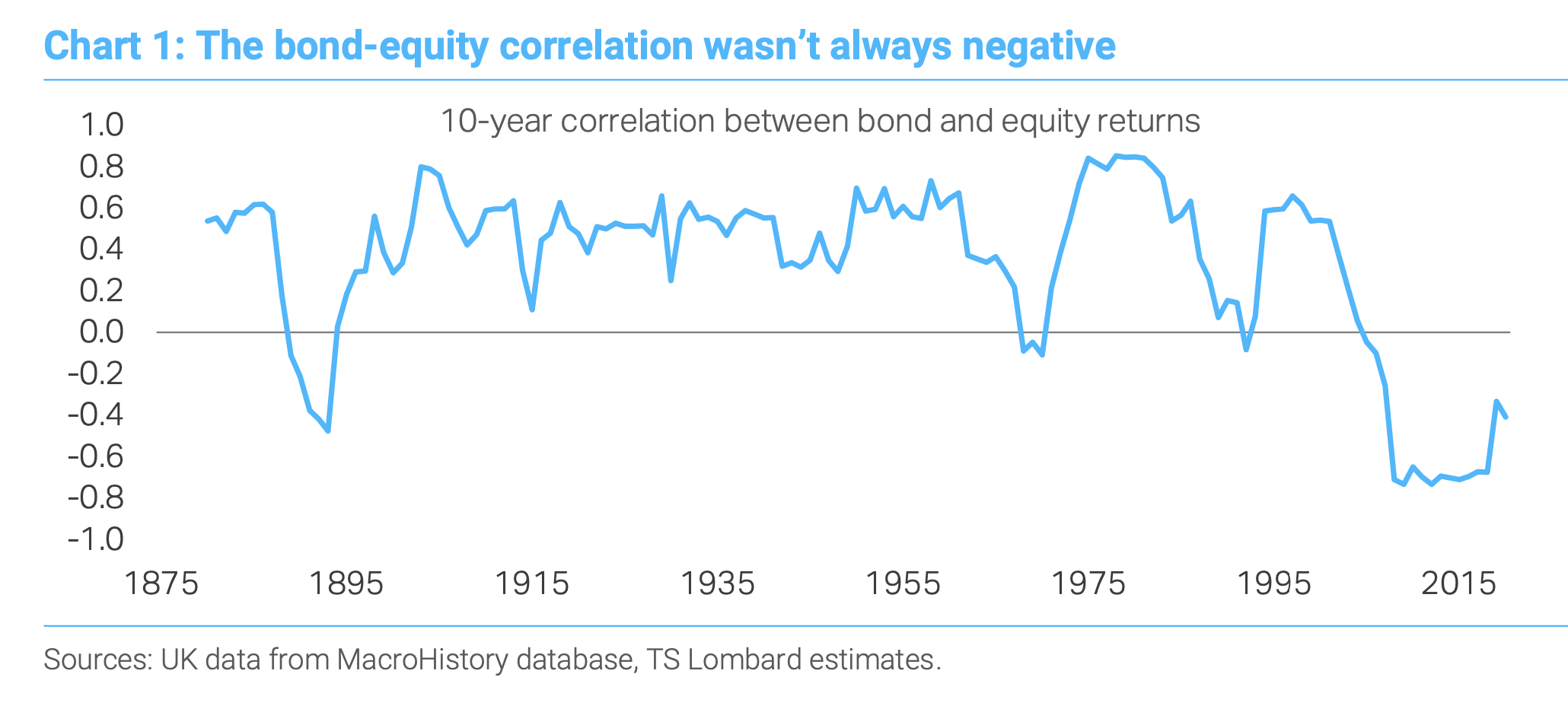

Bond Equity Correlation

- The negative correlation between bonds and equities, as demonstrated by UK data, is actually a feature of the last two decades.

- Historically bonds and stocks moved together more often than they didn’t.

Dying Wells

- Interesting article about a company you probably haven’t heard of, but one that owns far more onshore oil and gas wells than Exxon.

- The strategy is one of buying old “dying” wells to squeeze more life out of them.

- The company isn’t short on controversy – the environmental cost of such wells is high (they leak gas) and once done they need to be plugged, which the company seems to do at a fraction of the cost of others.

- Interesting contrast in a world of rising energy costs.

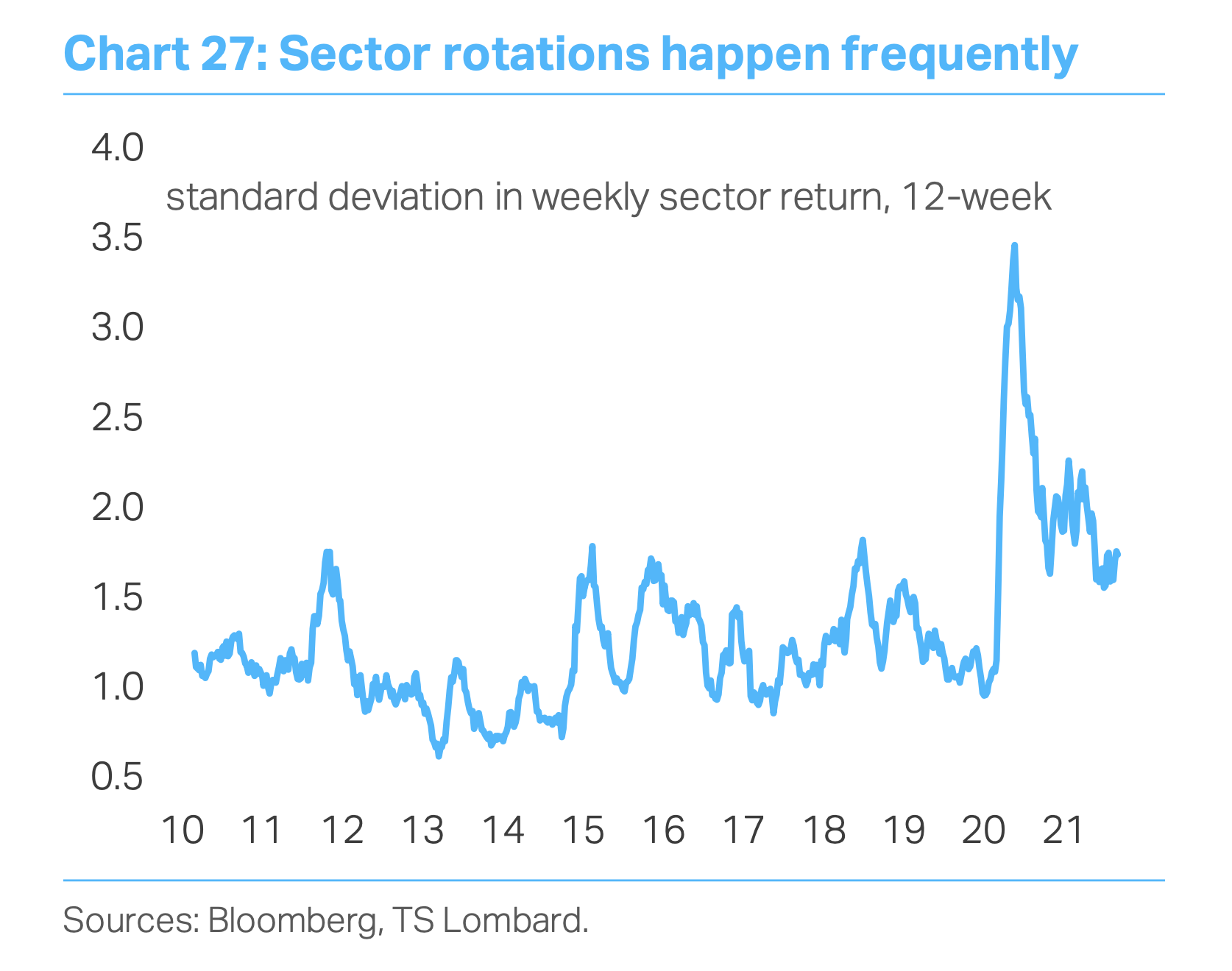

Sector Rotations

- 2020-2021 have seen an unprecedented level of sector rotation under the surface.

- h/t Daily Shot.

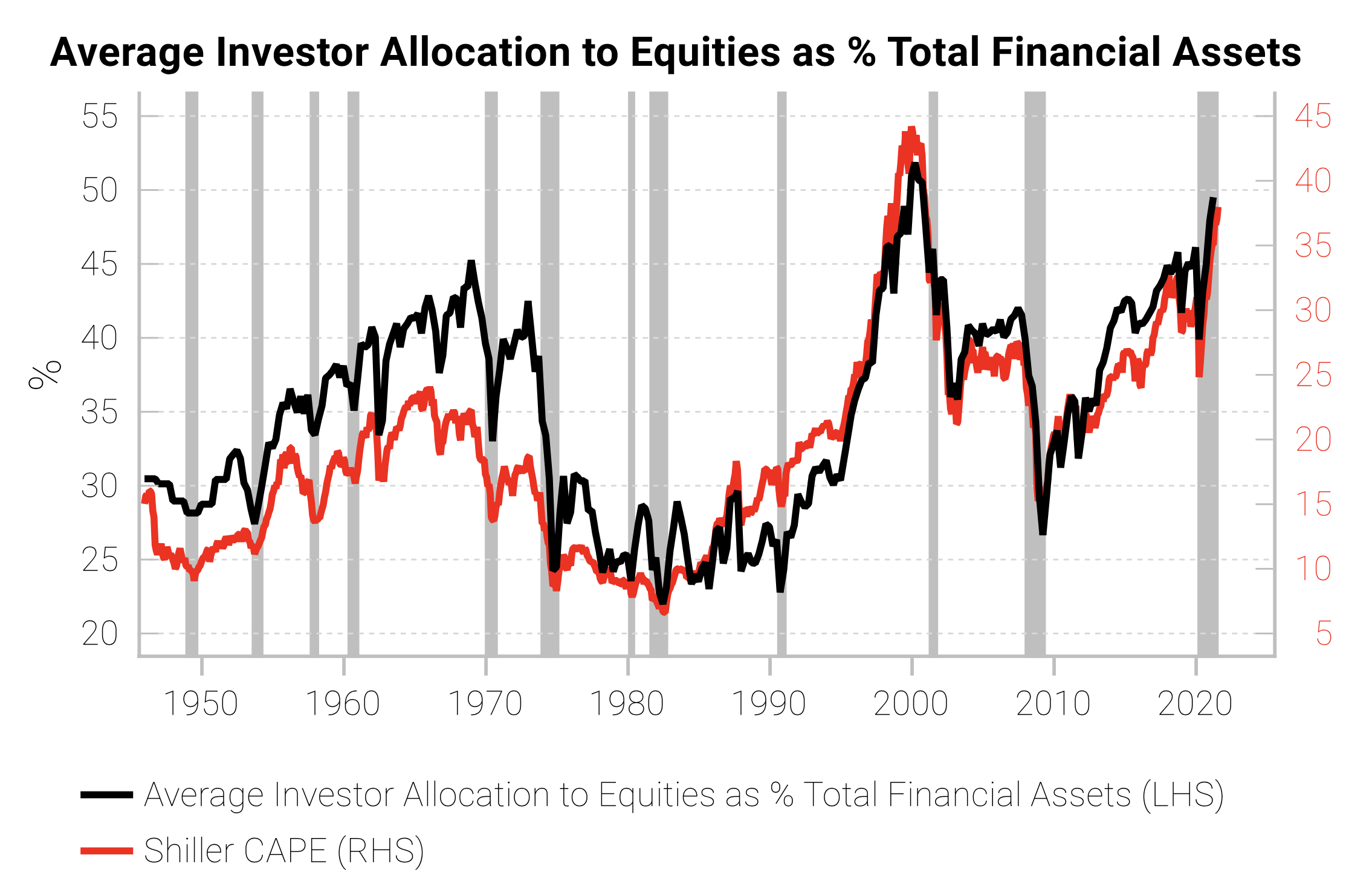

Chasing CAPEs

- Allocation to equities since the 1950s by the average investor has moved in tandem with the cyclically adjusted P/E ratio (CAPE).

- Both measures are near records set during the dotcom boom.

- Food for thought.

- h/t Variant Perception via Daily Shot.

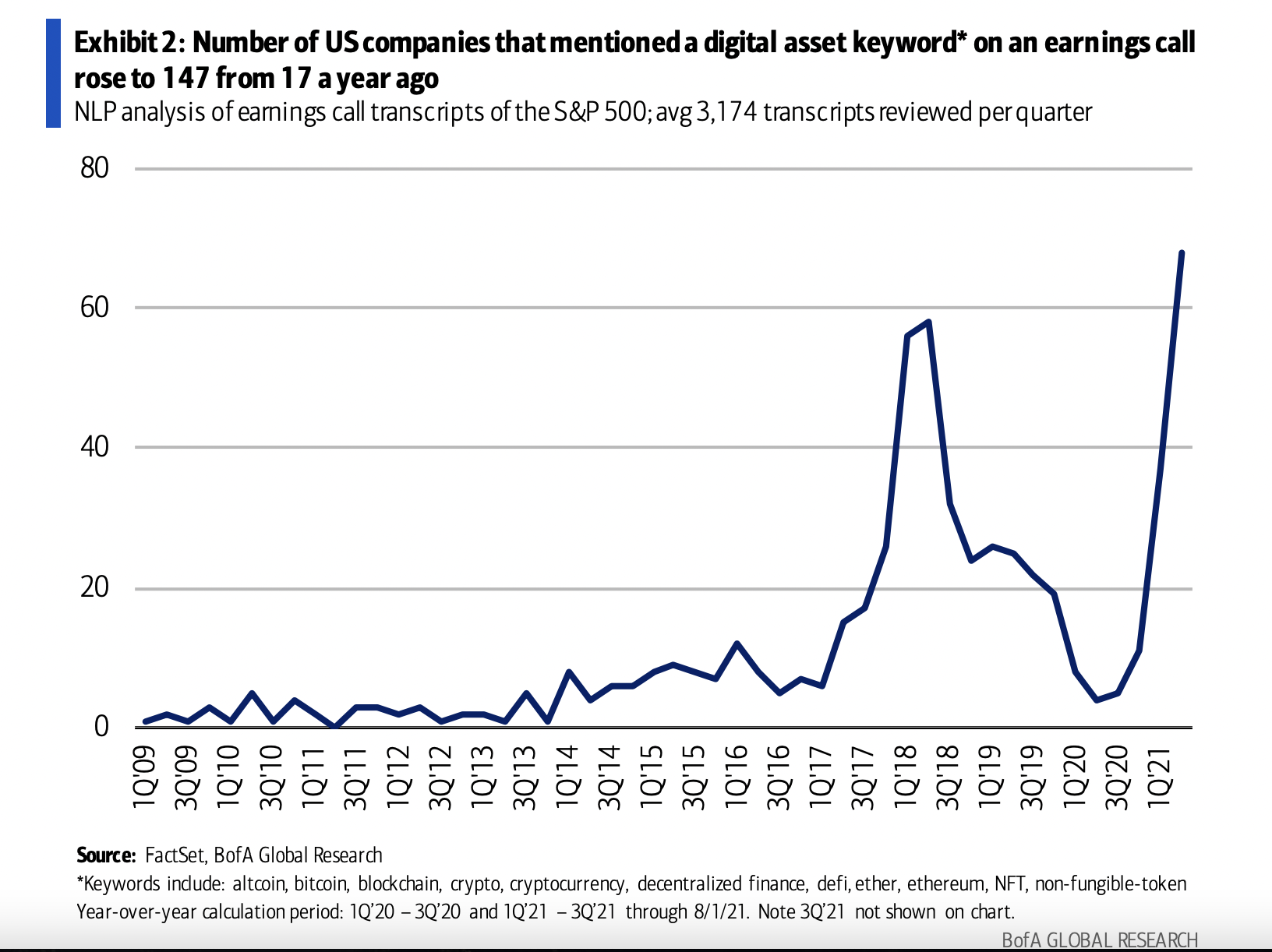

Digital Assets

- Companies mentioning a digital asset keyword (e.g. bitcoin) on conference calls is back above the previous peak.

- Classic second stage of hype cycle?

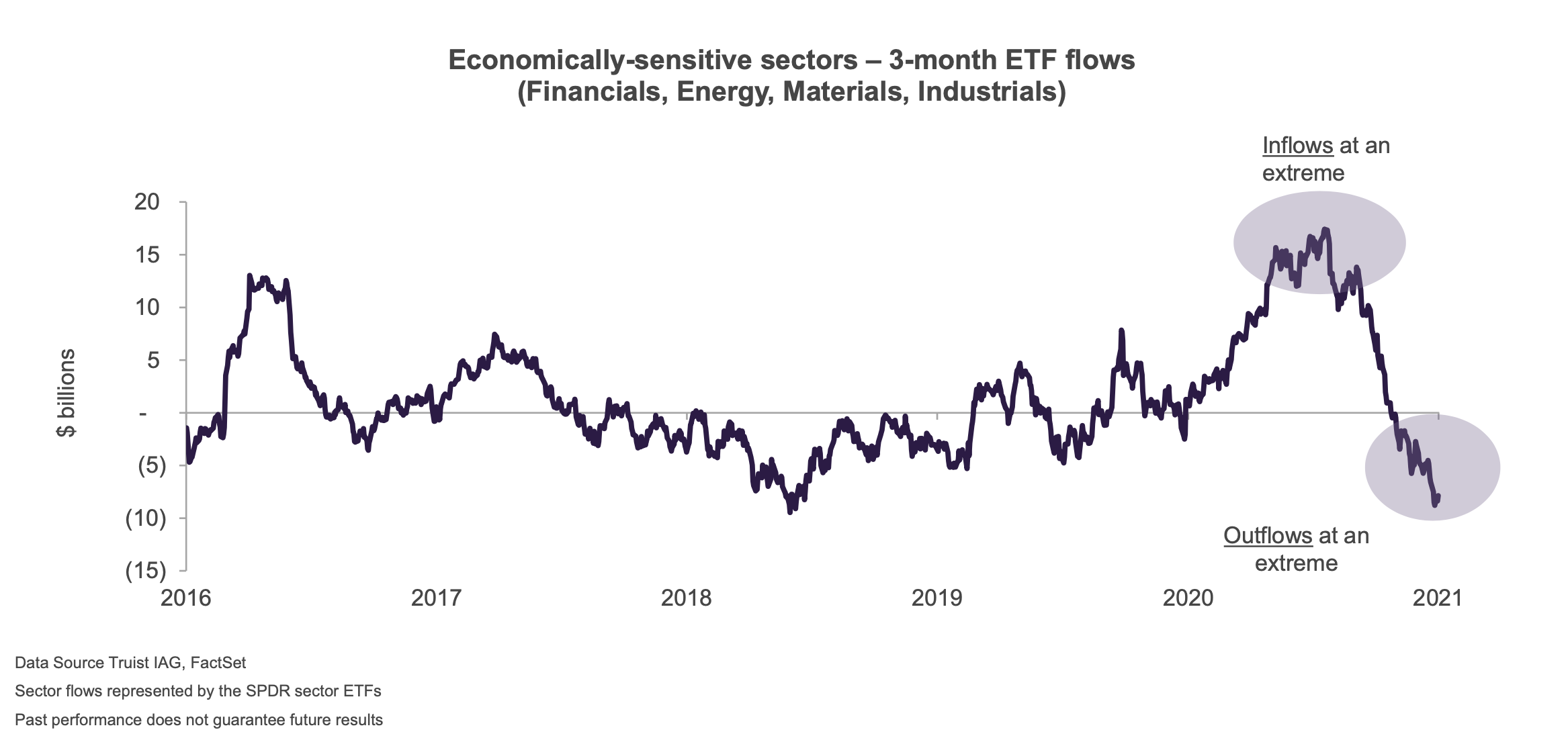

Economically Sensitive Flows

- Nice chart showing flows into ETFs of economically sensitive sectors (Financials, Energy, Materials and Industrials).

- It went from extremely strong inflows to extreme outflows.

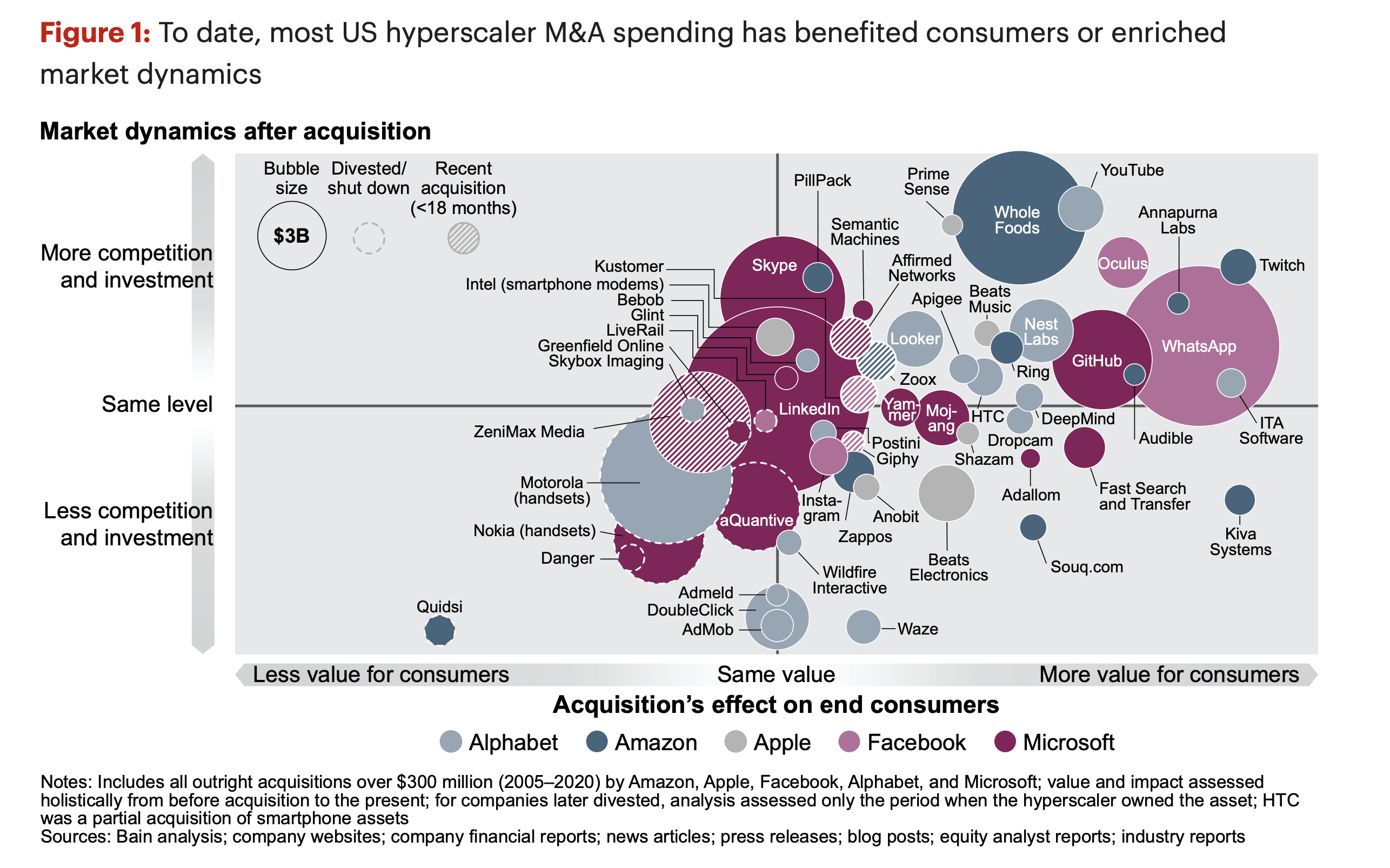

Big Tech Acquisitions

- Provocative chart from latest Bain technology report.

- “When the facts are reviewed, most big tech M&A spending actually benefits consumers and doesn’t hamper competition. That’s according to Bain’s analysis of all $300 million-plus acquisitions, totaling more than $150 billion, from 2005 to 2020 by the five US hyperscalers: Alphabet, Amazon, Apple, Facebook, and Microsoft“

- Overall they find that, excluding Linkedin, 72% of M&A spending created value for consumers, rising to 89% if we exclude Nokia/Motorola.

- For those interested the methodology is in the appendix of the report.

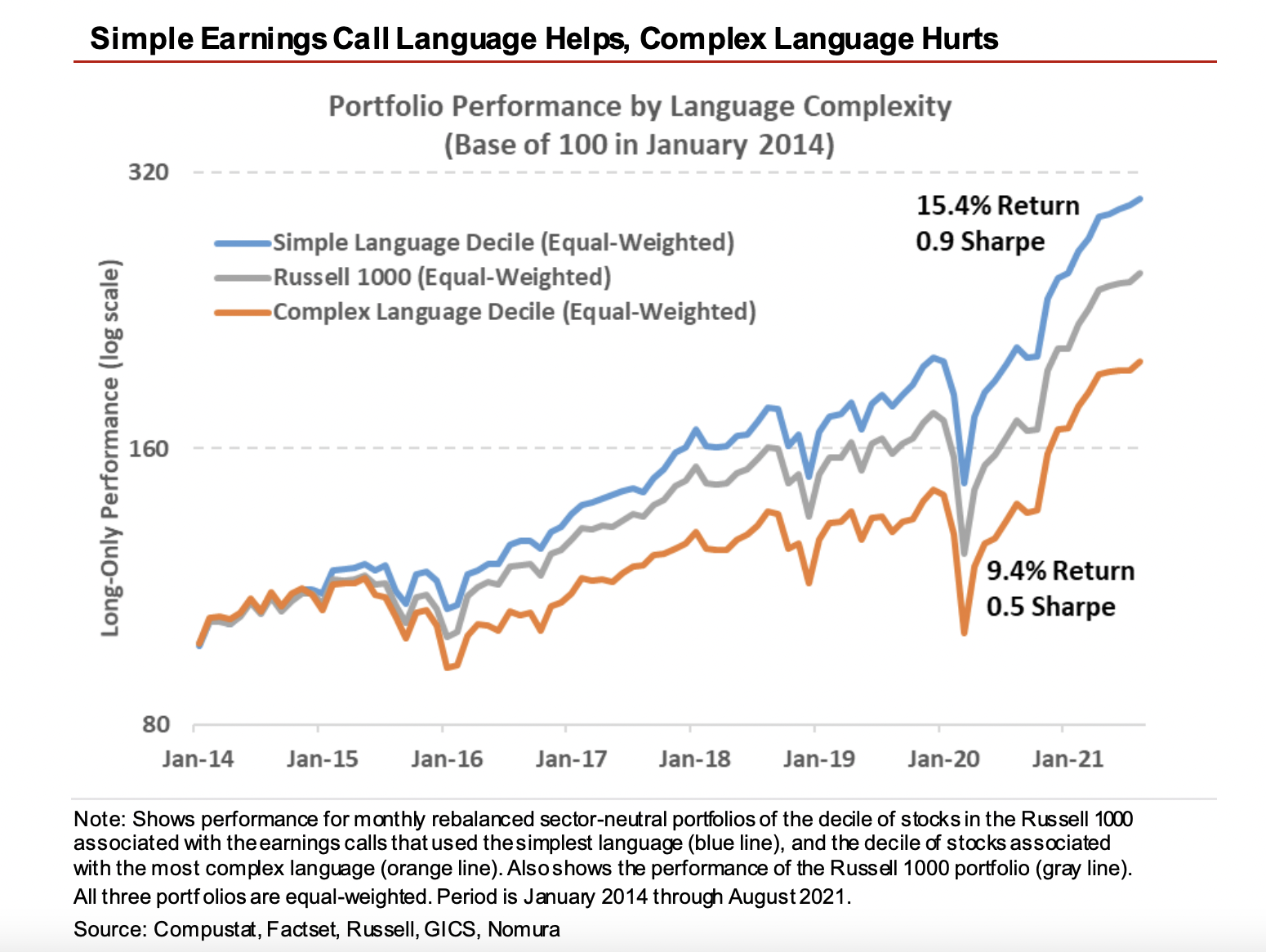

The Value of Simple Language

- The type of language used in earnings calls has a significant impact on stock returns.

- According to Nomura, simple language (as measured using Gunning Fog Index) leads to higher returns and a considerably better Sharpe ratio when compared to complex language.

- This is distinct from earnings call length – which doesn’t correlate to complexity.

- For those interested we previously posted further interesting stats on language in company publications.

Gitlab Handbook

European Banks’ Health

- European banks look a lot healthier than they have for many years.

- Record low non-performing loans (NPLs) and high levels of capital.

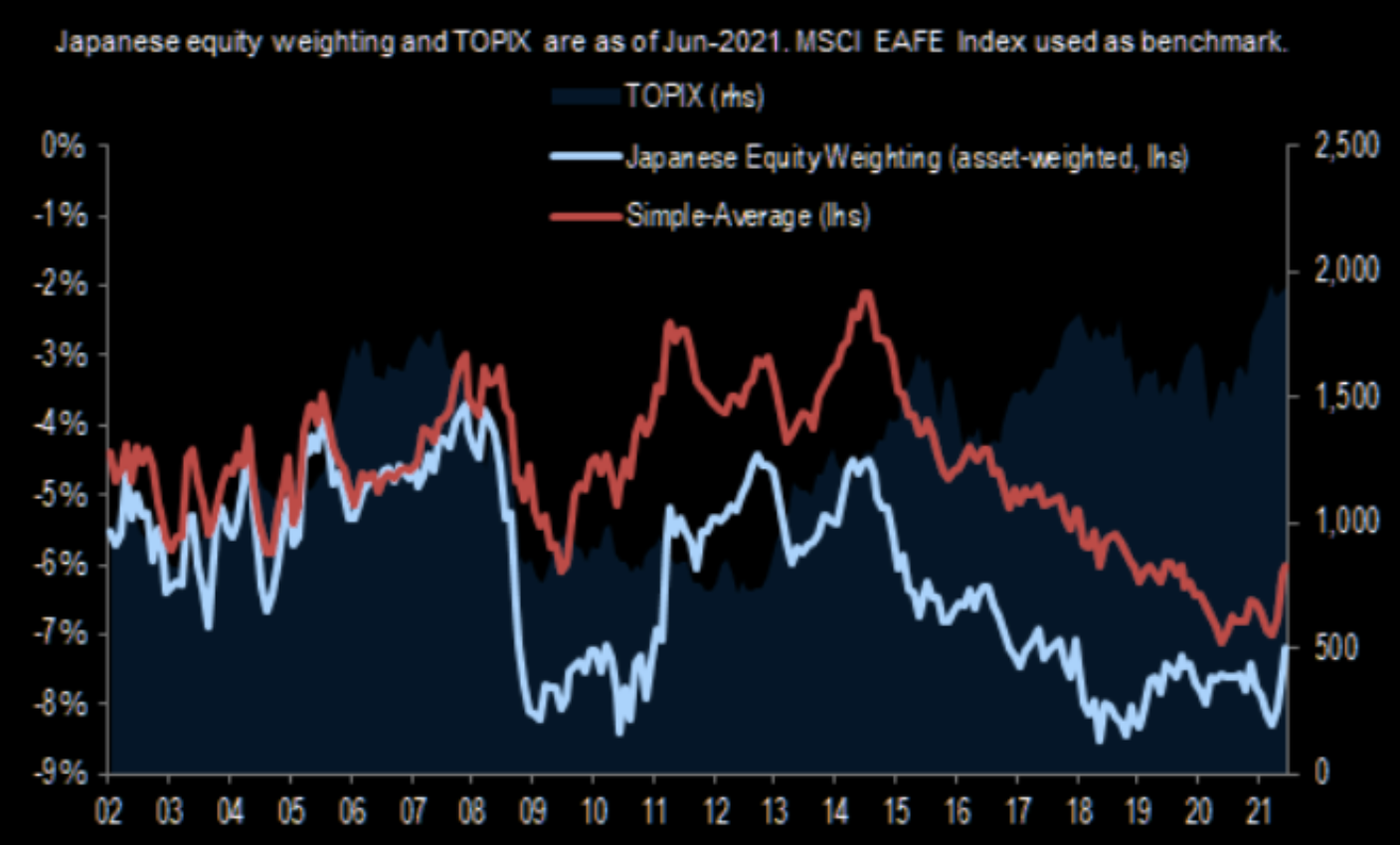

Japanese Equities

- Everyone is underweight Japan.

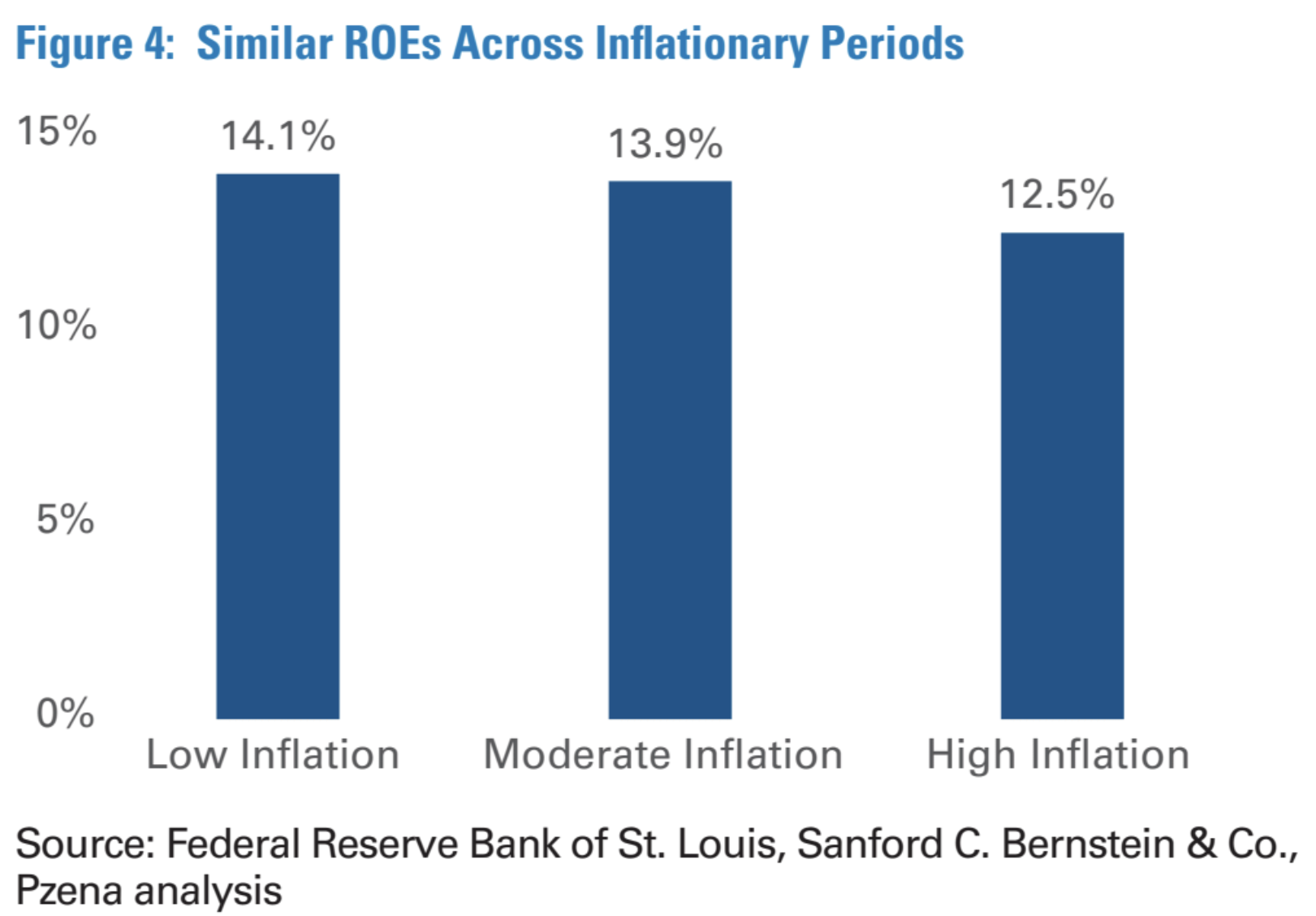

Inflation and ROEs

- According to this analysis, inflation doesn’t have a huge impact on return on equity in corporates.

- Even in a high inflation environment (something not seen for 28 years) it is only 150bps lower.

- Source: Pzena.

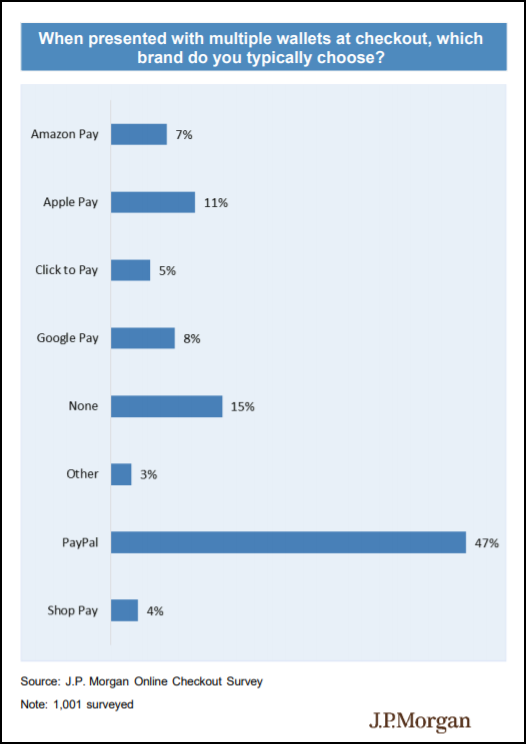

PayPal

- Interestingly the Paypal brand resonates the most.

Healthcare Sector

- Healthcare sector trades at a record discount to the market in the US.

- Source: Broyhill.