- Interesting take on Shiller’s cyclically adjusted price earnings ratio (CAPE).

- The analysis argues that one should be using today’s tax rate and adjusting for buybacks.

- This leads to a CAPE 2.0 of 28x – far below the current CAPE of 38x and nowhere near the Dotcom peak.

- This is the “basic” version and for those interested there is a more advanced (and more controversial) version that results in “the last 20 years go from being an expensive aberration to a typical investment period“.

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

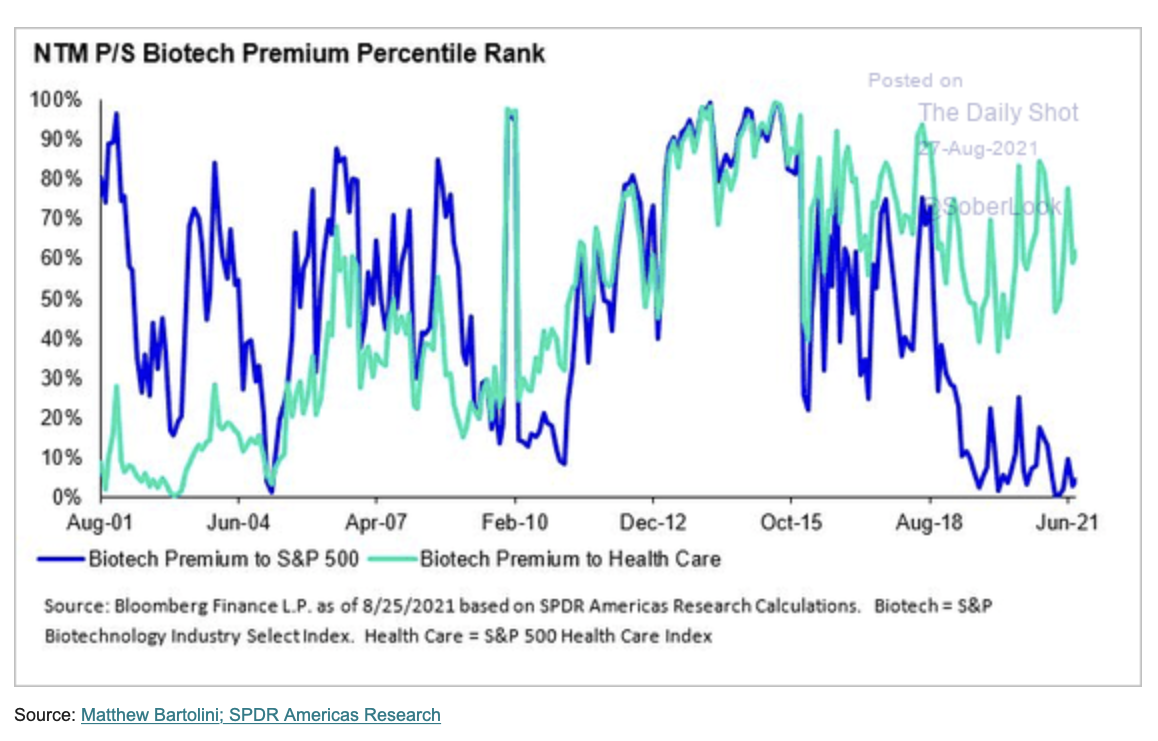

Biotech discount

- Biotech is trading only at a 5th percentile premium to the broader market.

- Source: The Daily Shot.

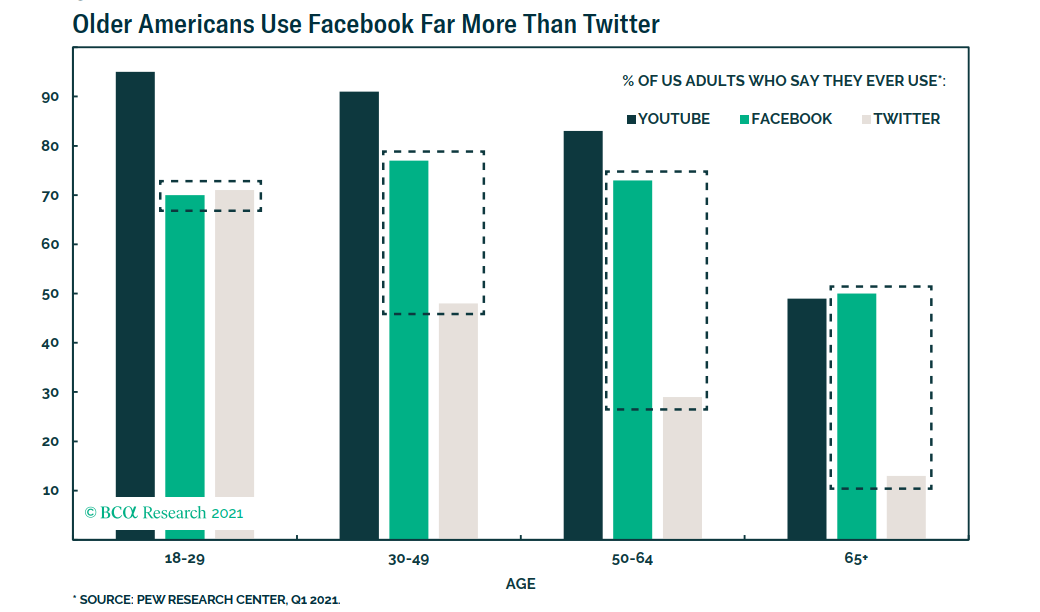

- Facebook is used far more than Twitter among older Americans.

- Source: BCA Research.

Technology Transformation

- Company IT systems are vital but understudied by investors (e.g. here).

- This is a great post on how Fox went about setting up its technology capabilities after the deal between 21st Century Fox and Disney.

- To whet your appetite – “we left almost all of our systems and infrastructure behind and embarked on a two-year journey and radical transformation“

- What follows is a set of principles that is fascinating to read for investors and corporate insiders alike.

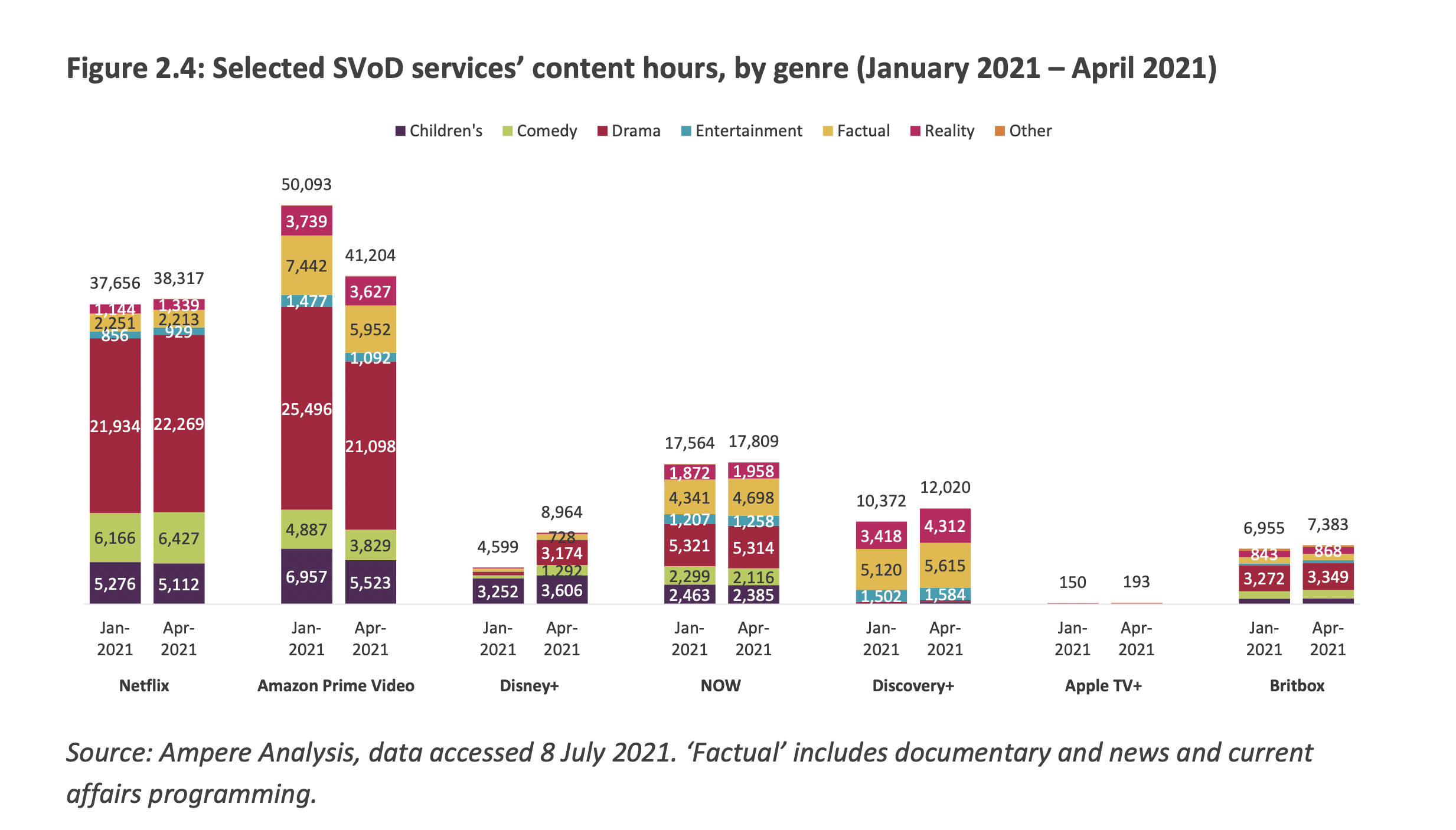

SVOD Content Hours

- Nice chart from Ofcom report tracking hours of content by various streaming services in the UK.

- Interesting to see Amazon in the lead but trimming its library recently.

- Disney+ is seeing the biggest growth (addition of the Star channel).

- NOW set to get a big boost in H2 from addition of 7,000 hours from parent NBCUniversal’s Peacock.

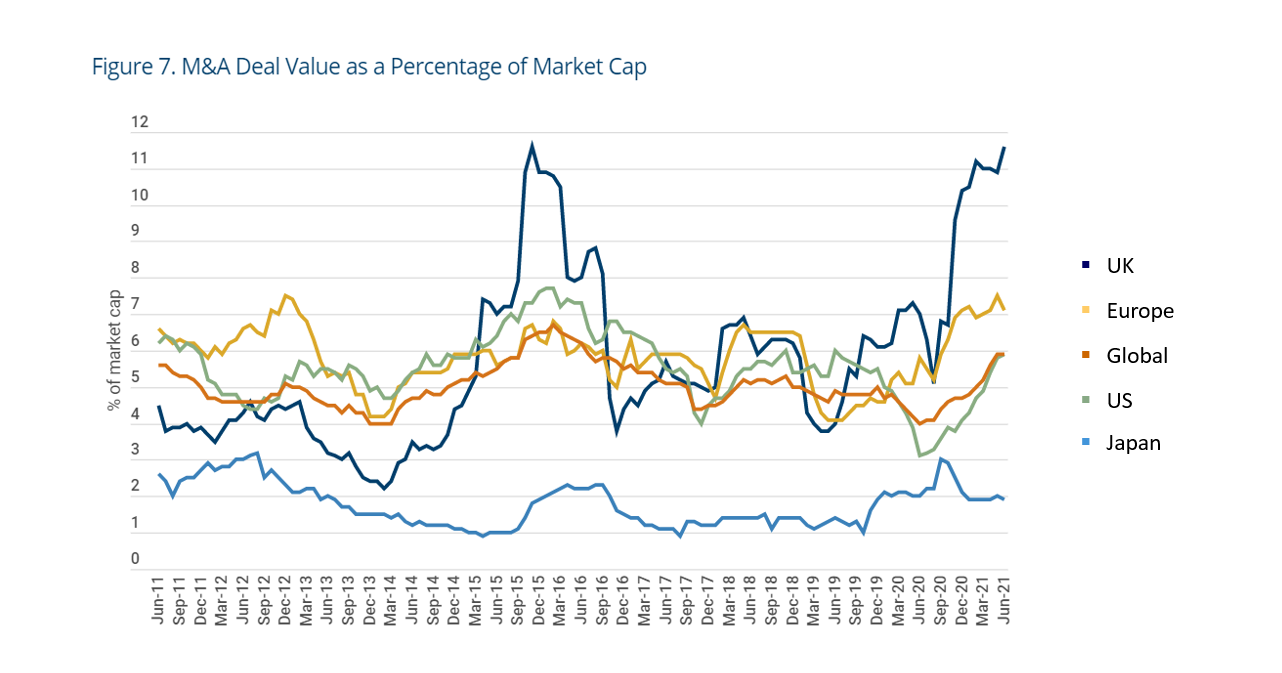

UK M&A

- Mergers and acquisitions (M&A) activity has spiked to 12% of market cap in the UK, double the global average.

- This is driven by cheapness of UK listed firms, stabilisation post Brexit, and record private equity dry powder.

- Interestingly this spike is driven by a larger number of deals (25) when compared to the previous spike in 2015 (where mega deals for SAB Miller and BG Group dominated).

- Source: Man Group.

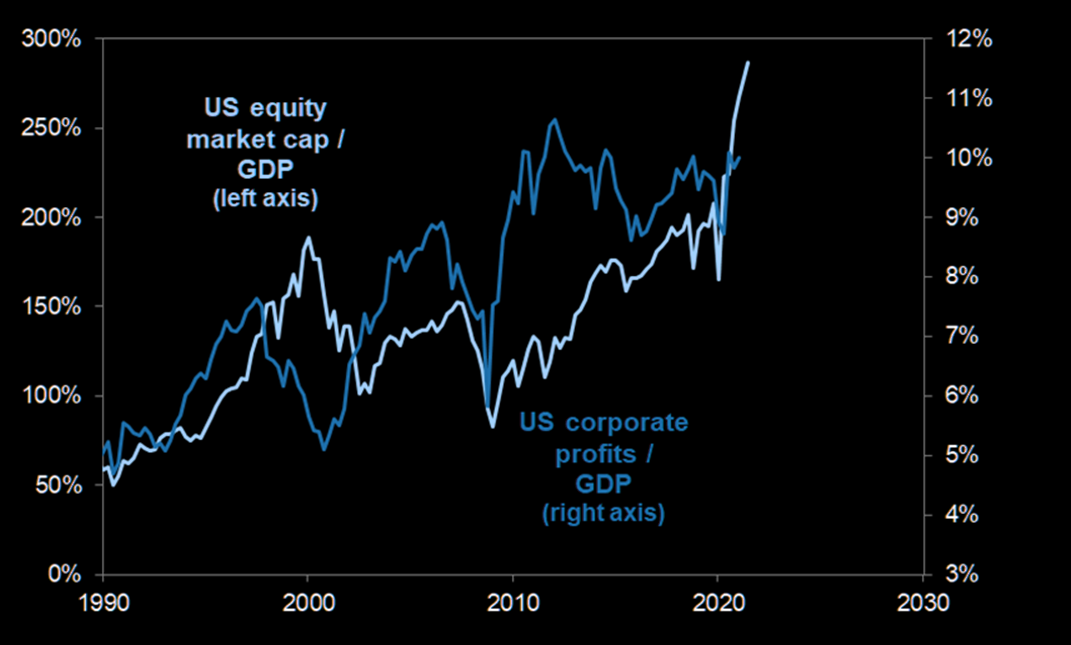

Profits to GDP vs. Equity Market to GDP

- It is well documented that the Warren Buffett indicator, which measures equity market cap as a ratio of GDP, is at an all time high, surpassing the dotcom boom.

- It is less well documented that the ratio of profits to GDP is also strong and has been trending up.

- h/t The Market Ear.

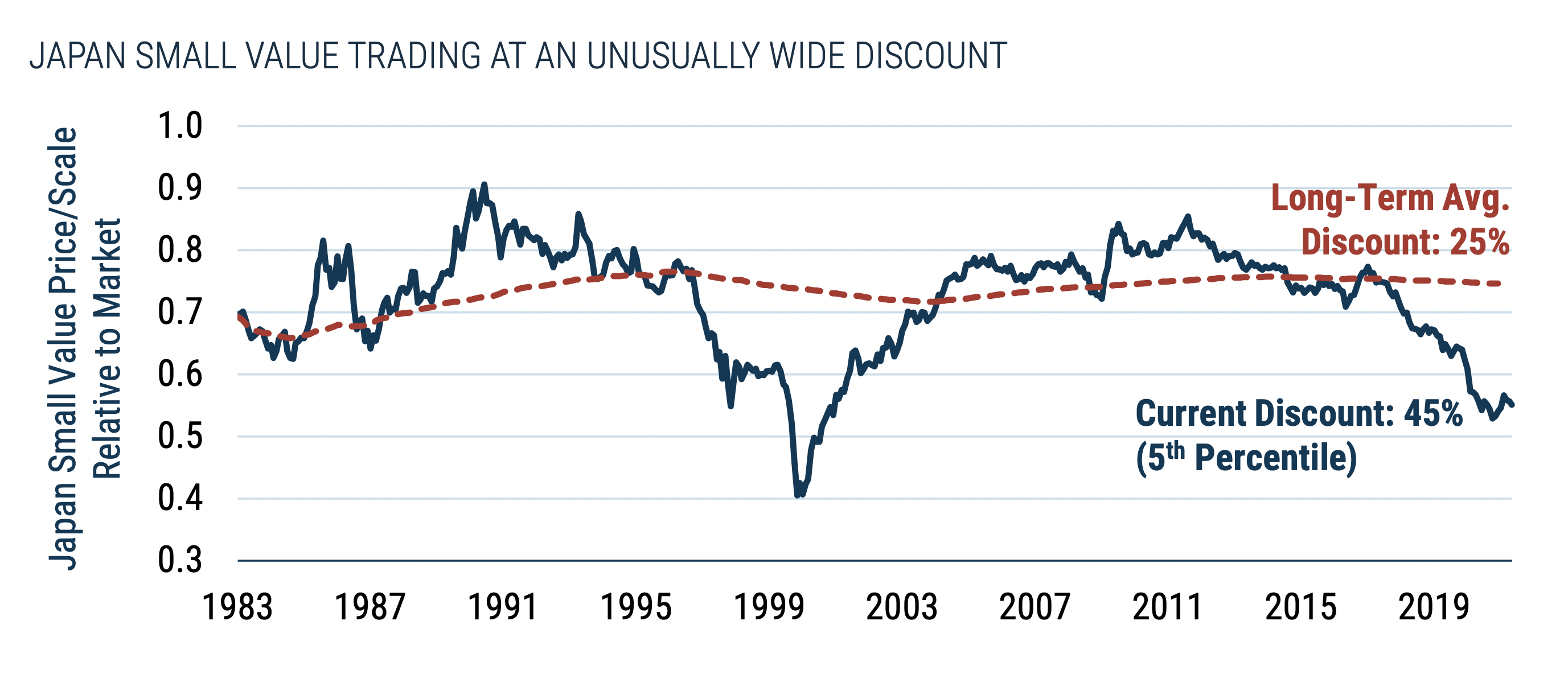

Japanese Small Cap Value

- Small cap value stocks in Japan are very attractively priced relative to the broader Japanese market.

- NB value defined as cheapest half of market, size defined as smallest third. Multiple valuation metrics used.

- Source: GMO.

EM vs US Equities

- Emerging market equities are approaching a near 20 year low relative to S&P 500.

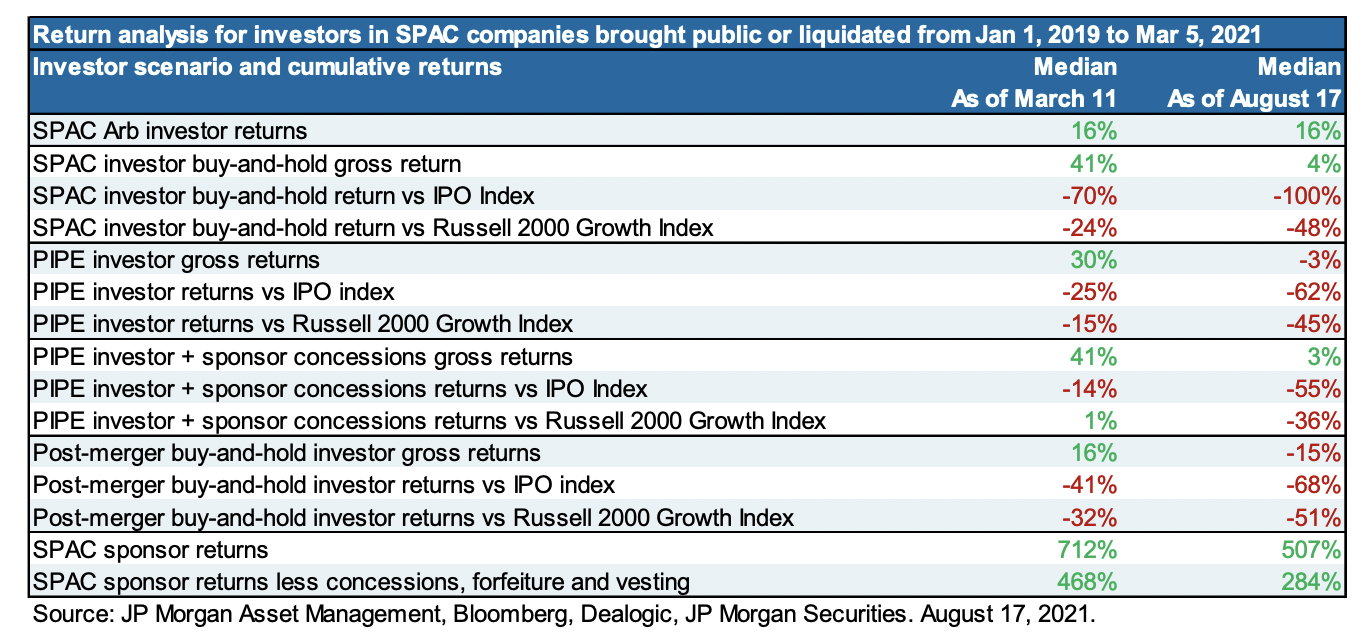

SPAC Returns

- JPM analysed 98 SPAC deals that closed or liquidated from Jan 2019 to March 2021.

- It isn’t a pretty picture – “while SPAC sponsors and “SPAC Arbitrage” investors are still making money, it’s an unsightly picture for everyone else in the SPAC ecosystem“.

- Things didn’t get any better for the 85 SPAC mergers since March 2021 – the same patterns hold.

- This was a great post looking at the crazy things going on recently in the SPAC world.

Pixar

- George Lucas was forced to sell Pixar to fund his divorce.

- Venture capitalists, 35 of them, refused to back the firm as did eight strategic partners, but Steve Jobs agreed.

- “If we’d had any other investor than Steve, we would have been dead in the water.“

- He forced the firm to succeed “He’d berate those of us in management, then write another check”

- Pixar was eventually sold for $7bn to Disney “This is astounding considering they could have had us for free in the 1970s when we approached them on bended knee.”

- The real story of Pixar – a fascinating read.

Dell

- “Splitting a good black jack hand” is a great way to describe how Michael Dell pulled off perhaps the most daring deal of the last decade.

- “Before the LBO, he owned 15.6% of his company, shares worth less than $4 billion. Thanks to the miracles of his financial engineering, he will own 52% of Dell and a 42% stake in VMware. The total value of his Dell holdings is $40 billion.“

- A really great article from Forbes.

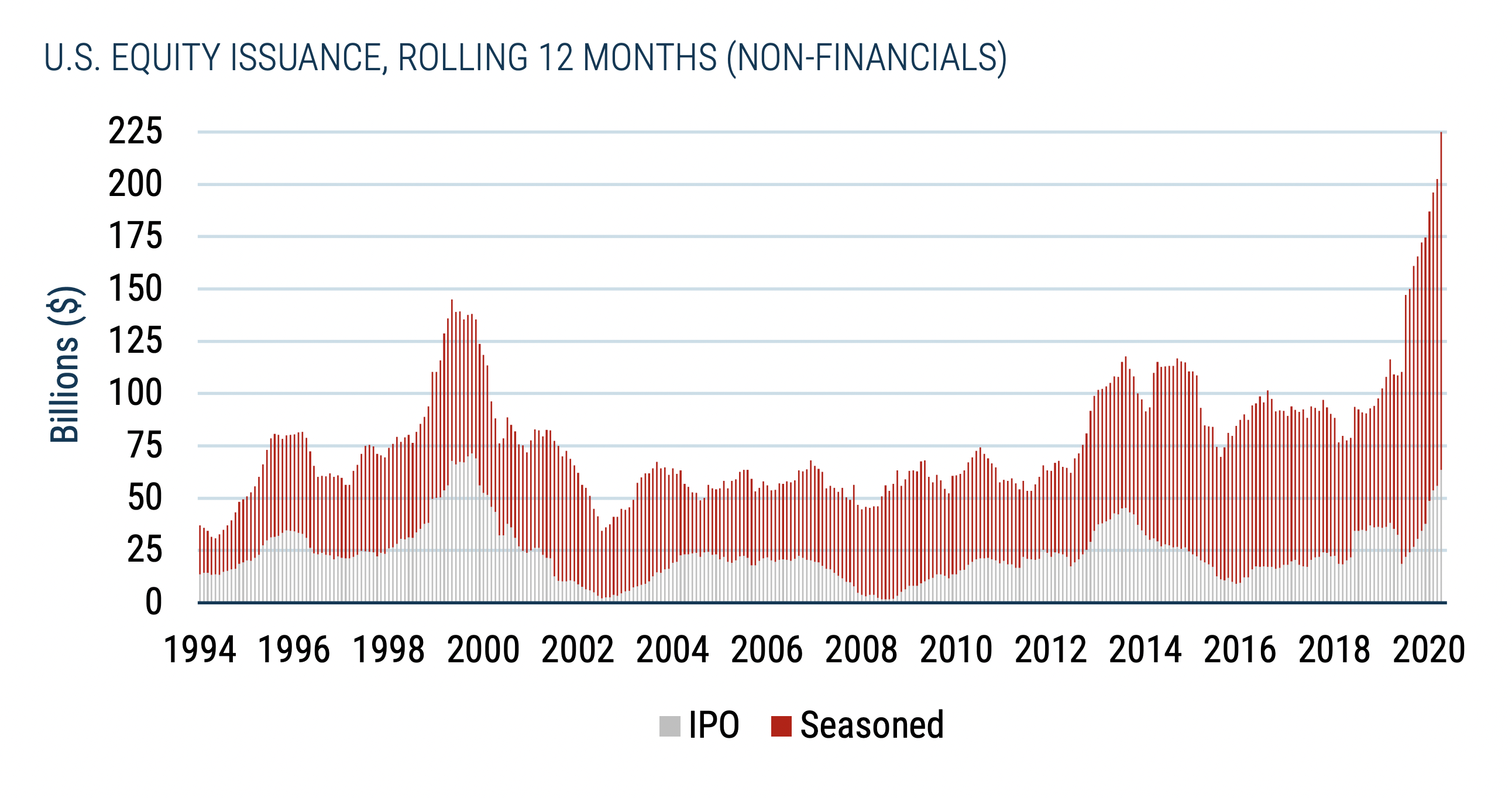

Stock Issuance

- Equity issuance at an all time high. Not a bullish sign.

- Source: GMO.

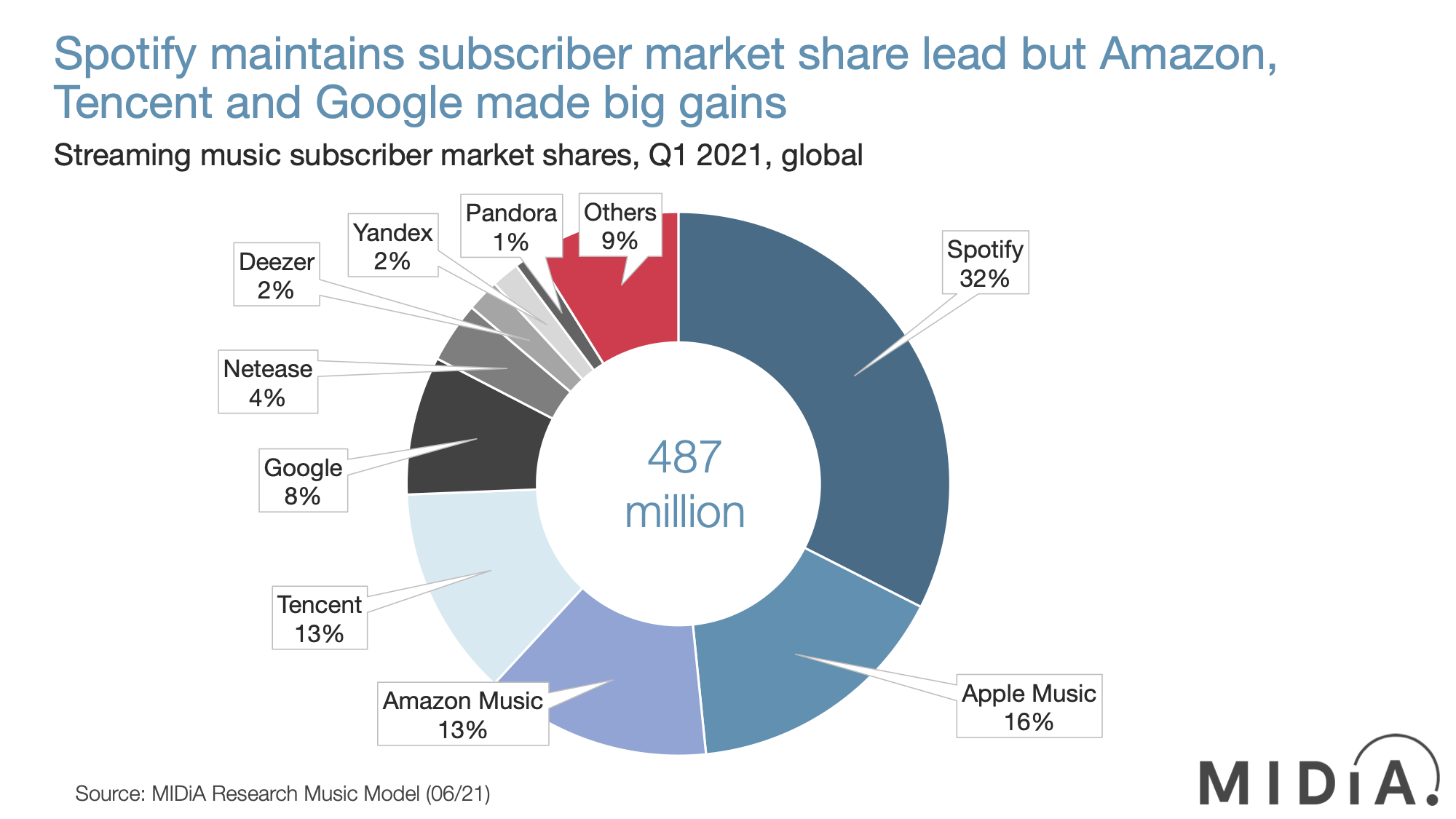

Music Streaming Market

- There are 487m music streaming subscribers globally at Q1 2021.

- Emerging markets are now central to this market accounting for 60% of all 2020 subscriber growth.

- Spotify is still the leader with 32% but has lost two points of market share since Q1 2020.

- Google’s Youtube Music has been the standout story – “The early signs are that YouTube Music is becoming to Gen Z what Spotify was to Millennials half a decade ago.“

- Source.

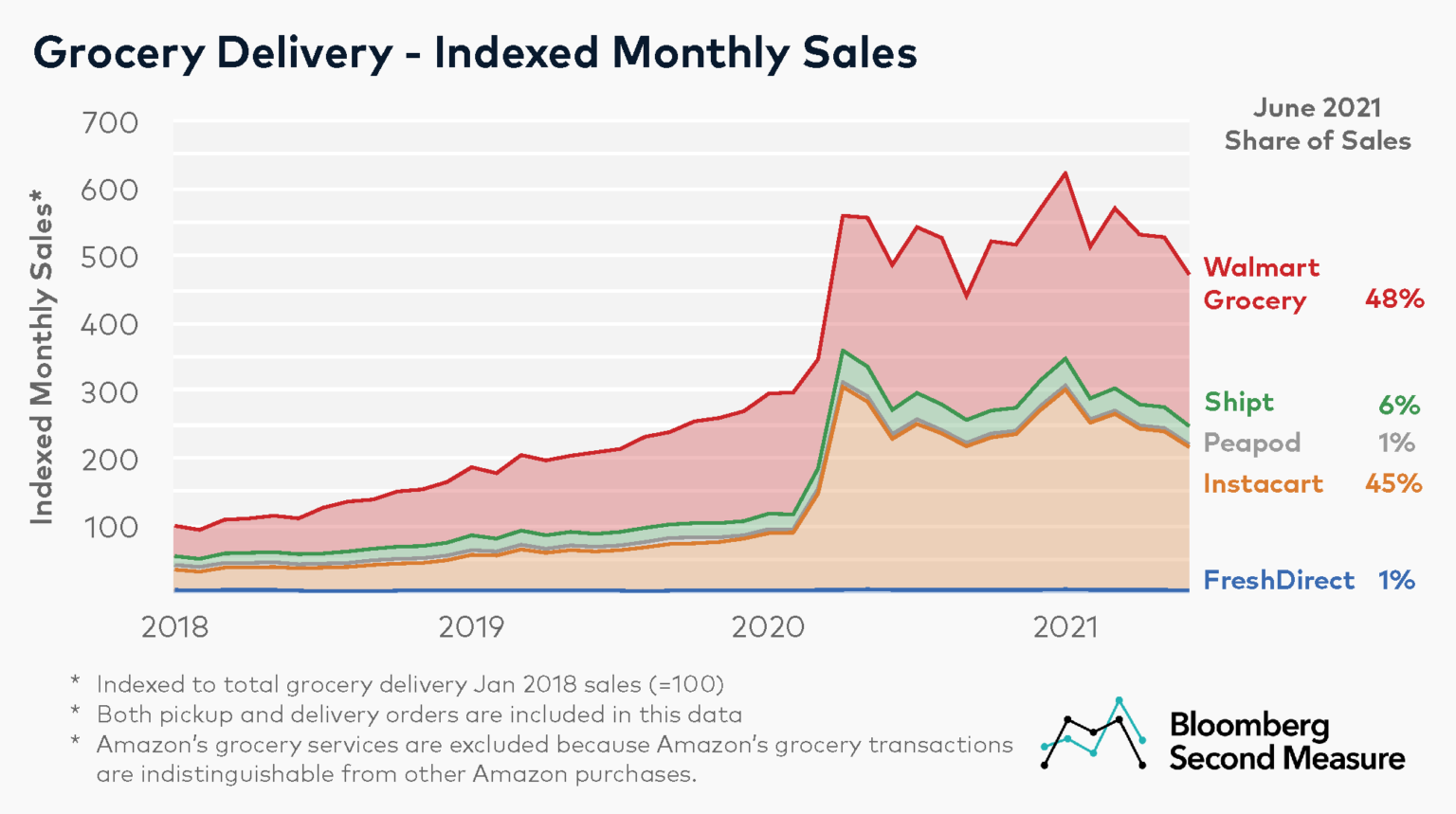

Grocery Delivery Sales

- Grocery delivery did extremely well during the pandemic.

- Walmart dominated pre-pandemic but the first few months of lockdowns its market share was eclipsed by Instacart.

- As of June 2021 it is back in the lead with 48% share while Instacart has 45%.

- Overall online grocery sales peaked in January 2021 and volumes are down 24% to June 2021 (which is -3% YoY).

- NB Amazon is excluded.

- Source.

Aducanumab Approval

CPU Competition

- The world of CPUs is heating up with new competition.

- In his first interview the new CEO of Qualcomm signalled they plan to design their own SoC with their own CPU.

- This will be based on their acquisition of Nuvia ($1.4bn) which was founded by Apple employees who worked on the M1 chip design.

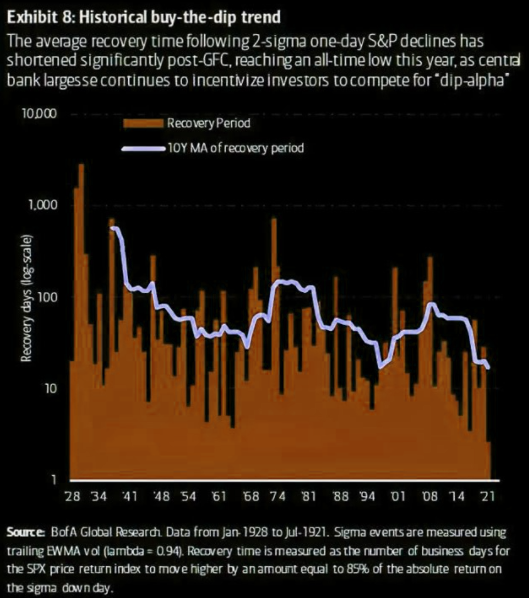

Bounce Backs

- The time it takes for the stock market (S&P 500) to recover from a 2-sigma one day decline is at a historic low.

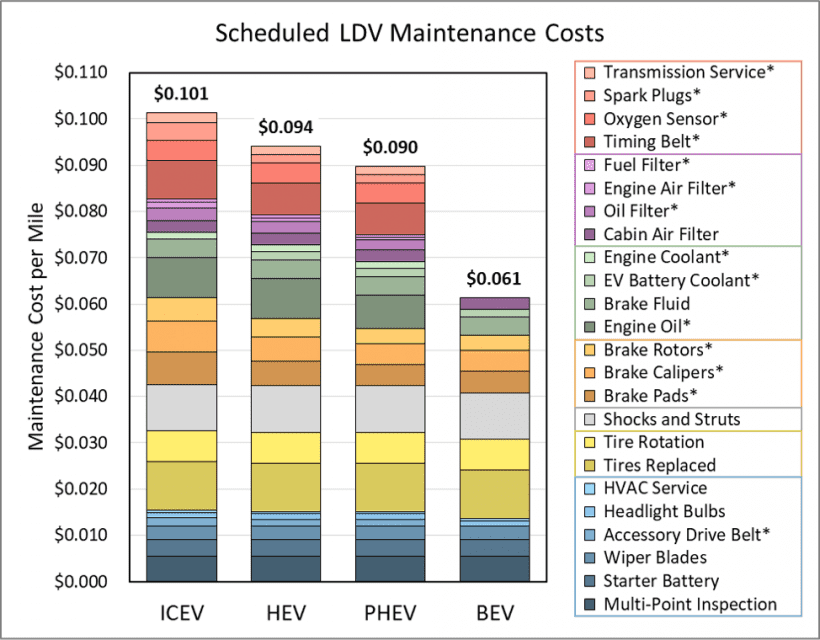

EV Maintenance Costs

- The US government estimate of fleet maintenance costs found that battery-electric vehicles (BEV) have about 40% lower cost when compared to internal combustion engine vehicles (ICEV).

- Hybrids (HEV) and plug-in hybrids (PHEV) also save money.

- NB this 4c per mile difference across the nearly 2 billion miles federal government vehicles covered in 2019 equates to $78 million a year in savings, and that doesn’t account for fuel costs.

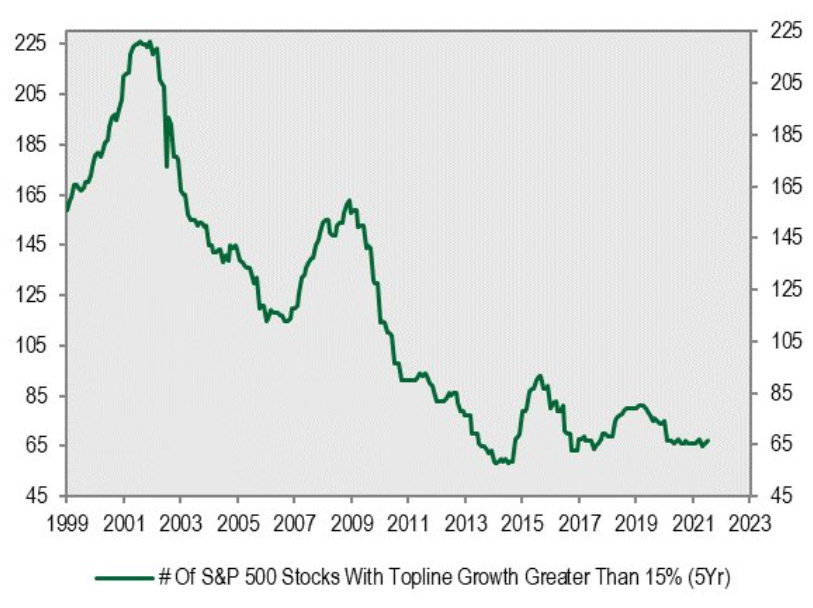

Growth Scarcity

- Back in the early 2000s half of the stock market would be classified as a growth stock.

- Today only 67 companies have a top line 5-year growth rate of >15%.

- Growth is scarce.

- Source.