- A new measure of customer satisfaction – the delight score.

- On this measure Disney+ scores very well.

- “88% of customers were likely to recommend Disney+ and, perhaps more impressively, 74% of Disney+ customers did recommend the product to someone in their social circle.“

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

L’Oreal Making Shows

- L’Oreal has started making TV shows.

- Interesting to see how they adapt to a world of less linear TV especially among younger generations.

- Streaming competition for content is helping this trend along.

Airbnb Recovery

- Interesting how much better Airbnb has fared than traditional hotels coming out of the pandemic.

- “As of April 2021, Airbnb’s sales were 182 percent higher than January 2019 sales, while sales volumes for the majority of traditional hotel companies were down an average of six percent compared to January 2019.“

- Only some Casino hotels (Caesers, Boyd) have done better.

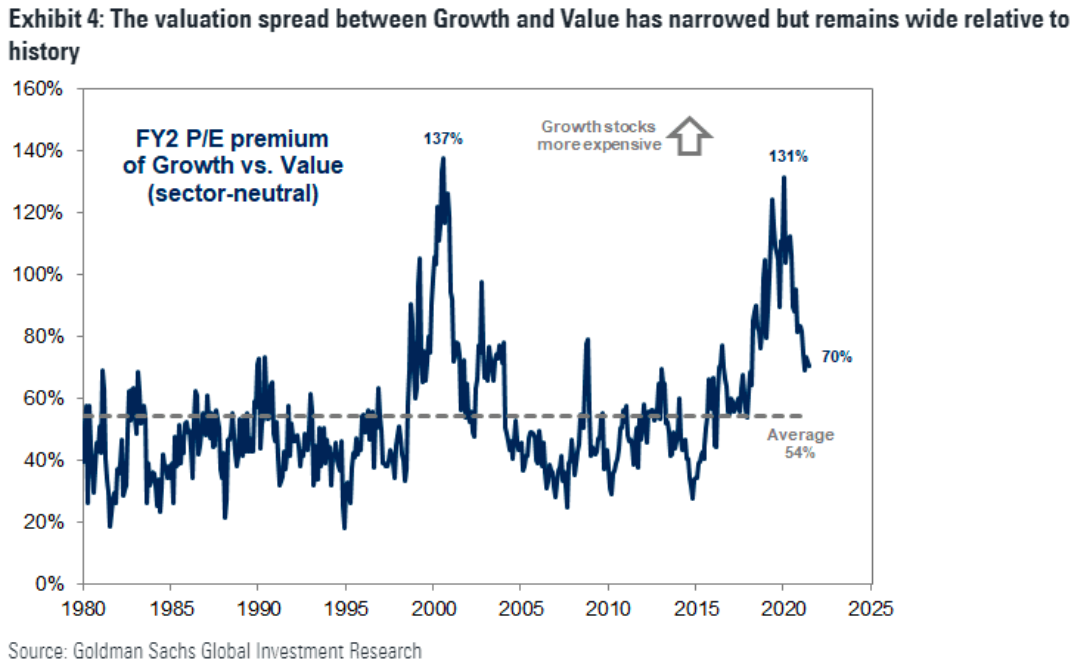

Growth Premium

- The valuation premium at FY 2 for growth stocks vs. value has come down a lot but is still above long-term average.

- Source.

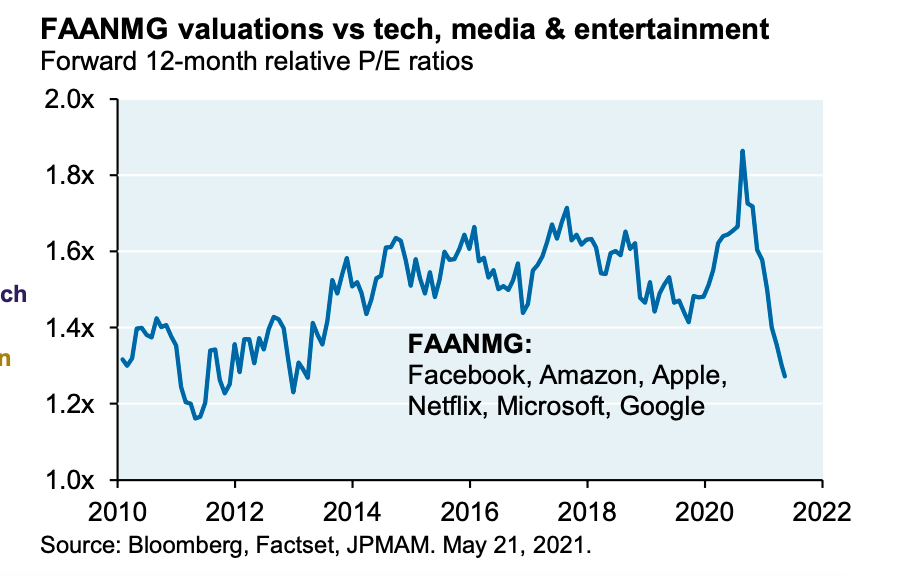

FAANMG

- FAANMG premium to the rest of tech sector has come down a lot.

- Source.

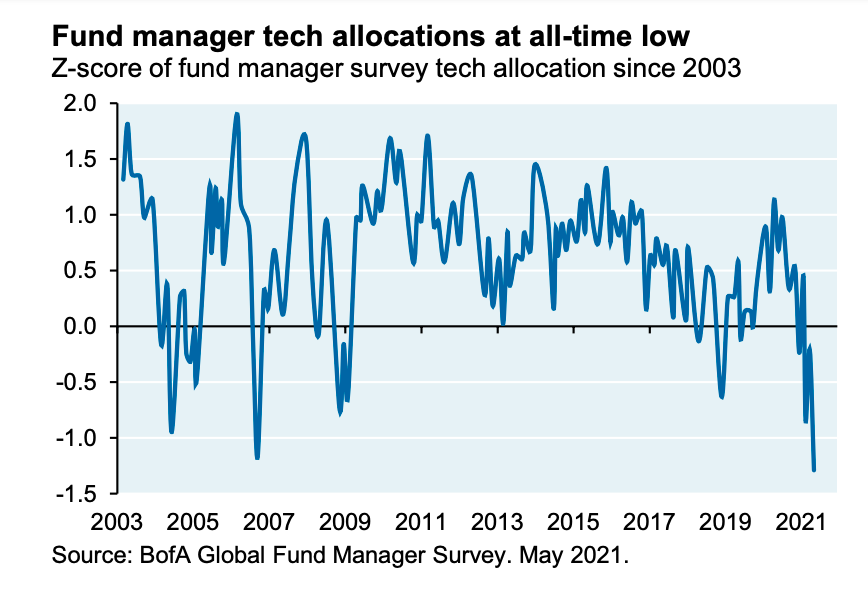

Tech Positioning

- According to the May BofA Global Fund Manager Survey allocation to tech is at an all time low.

- NB these surveys are self reported so actual positioning might be different.

- Source.

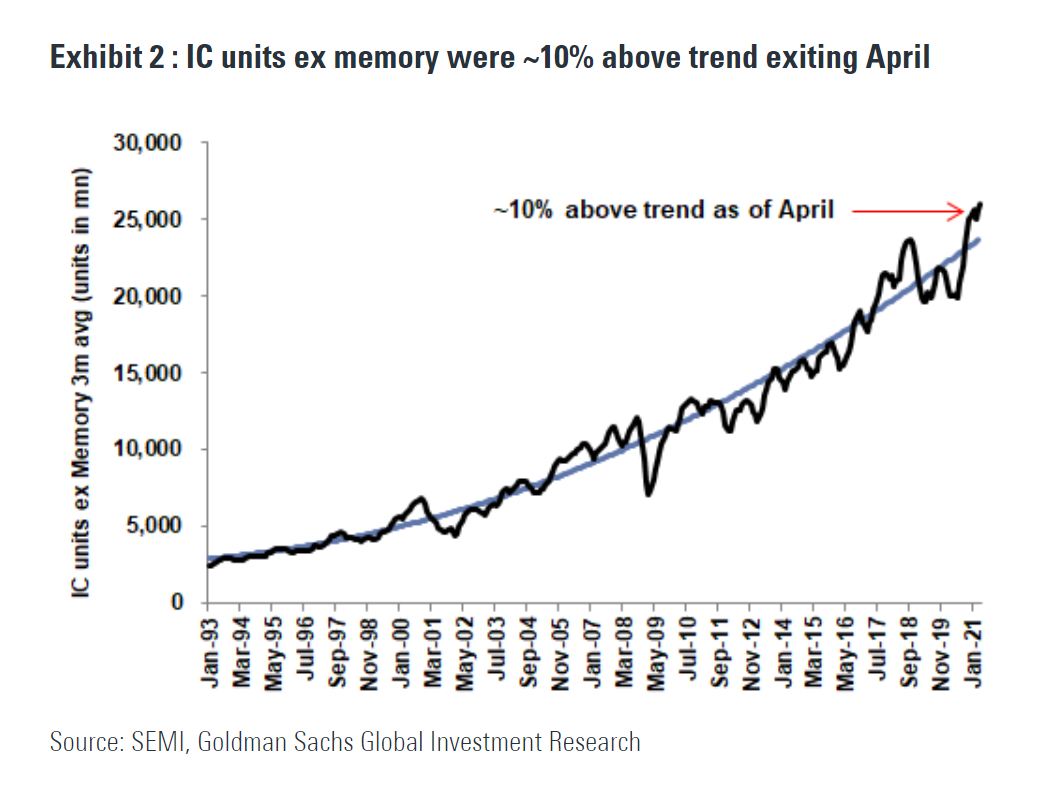

Semiconductor Market

- Neat demonstration of a structurally growing cyclical market – integrated circuit (IC) units excluding memory chips over time.

- Currently we are above trend but inventories are generally low.

Shared Branches

- Interesting trend of big UK banks sharing branches in smaller towns.

Apple Wearables

- Pretty stunning how far Apple is ahead in wearable technology.

- This was a good article discussing their lead.

- Start by watching the AssistiveTouch for Apple Watch video – truly science fiction come to life.

- The article attributes Apple’s success to (1) being early (2) voice controlled devices distracting competitors (3) wearables requiring hardware design expertise (4) ecosystem synergies (5) and no price umbrella.

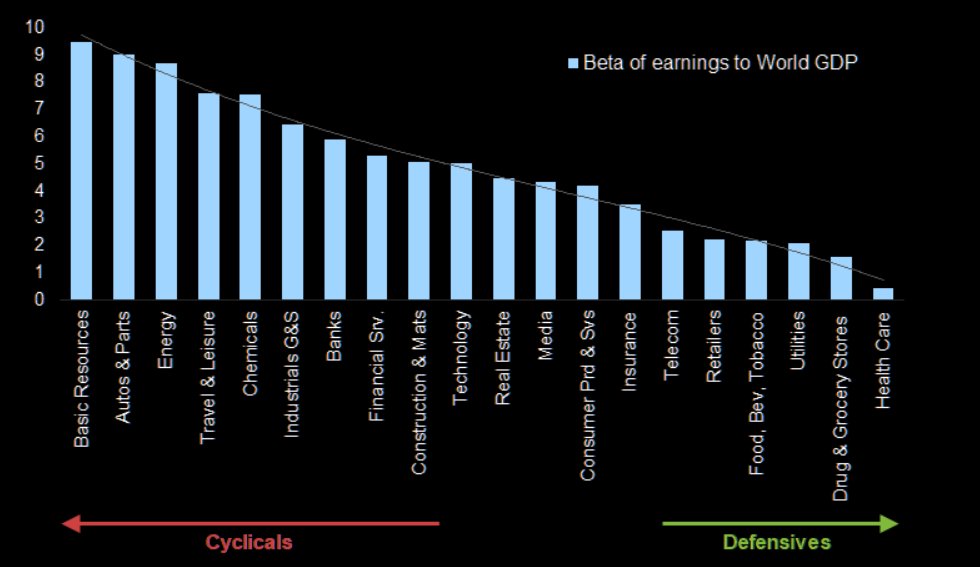

Defensives vs. Cyclicals

- In the current environment – with PMIs at highs and economic surprise indices flirting with zero – it is worth keeping this chart in the back pocket.

- Source.

Carson Block

- Detailed and raw profile of the short selling legend behind Muddy Waters Research.

- Block named his research firm Muddy Waters after a Chinese proverb that translates as “muddy waters make it easy to catch fish”.

Impulse Buying

- How do you make online shopping conducive to impulse buying of gum and candy?

- Many food companies are trying to find creative solutions.

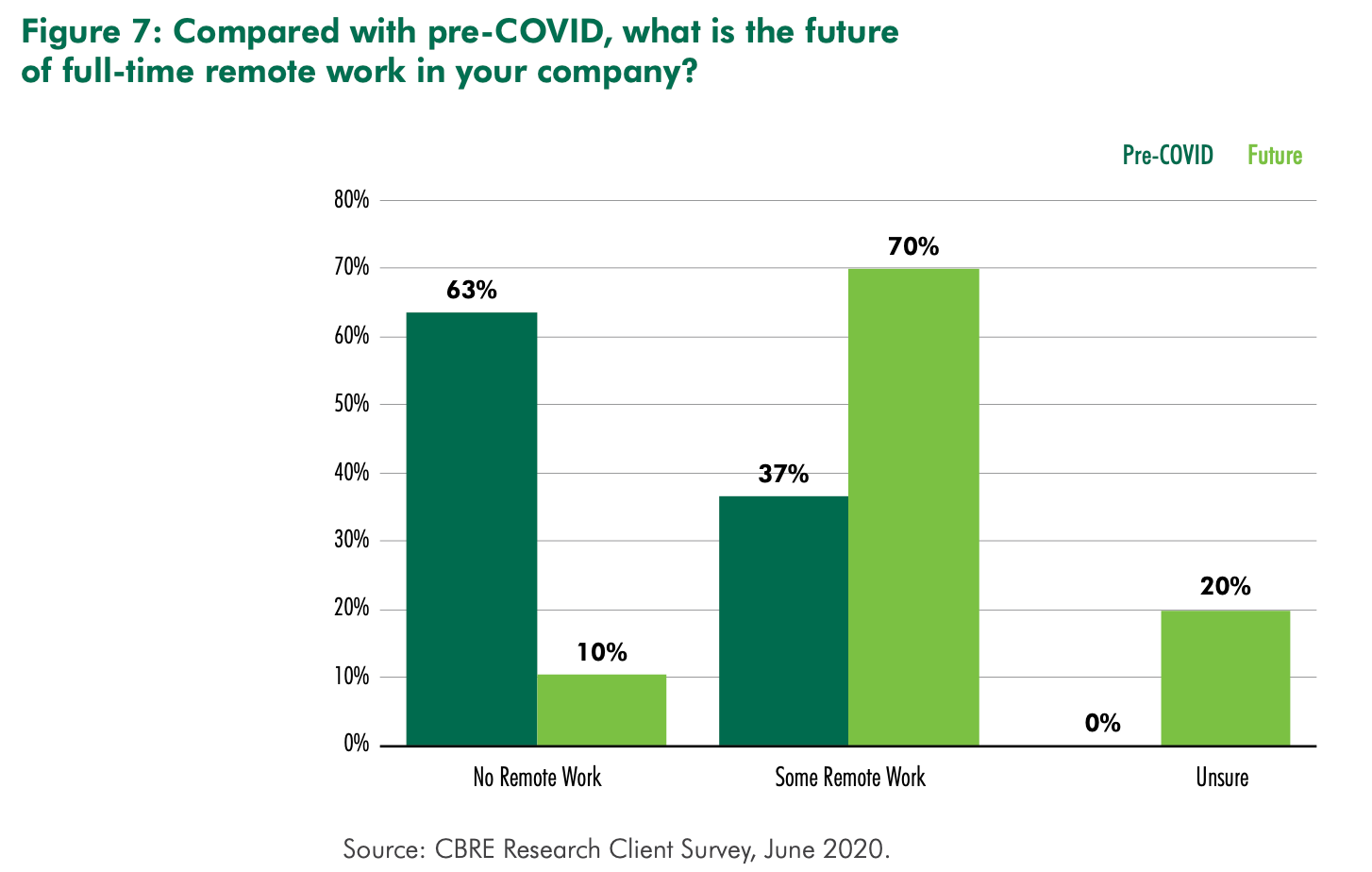

WeWork Resurrection Pt2

- We previously mentioned WeWork‘s resurrection.

- This was a really great bit of analysis which is positive on the stock ($BOWX).

- For one there is this chart from CBRE – flexible work could be the option for lots of companies post pandemic.

- WeWork could also pull off their turnaround ($2bn EBITDA targeted, implying EV/EBITDA of 5.8x vs. peer IWG on 9.5x)

- The market could also look at the company and its community once again as a platform. It has certainly completed the hype cycle.

- Interesting point also on incentives – Management don’t get paid until shares cross $25 and operating cash flow crosses $1.3bn.

- Usual caveats apply.

Hosking Partners on Value

- Interesting latest piece (page 15) from Hosking Partners on why the rotation into value stocks will persist.

- (1) They perform well at the end of recessions (2) stimulus favours value (3) Covid recovery will be long and is only getting underway now in some countries (4) fund managers are entrenched (5) Interesting ESG angle.

- There is also a full webcast that is worth listening to.

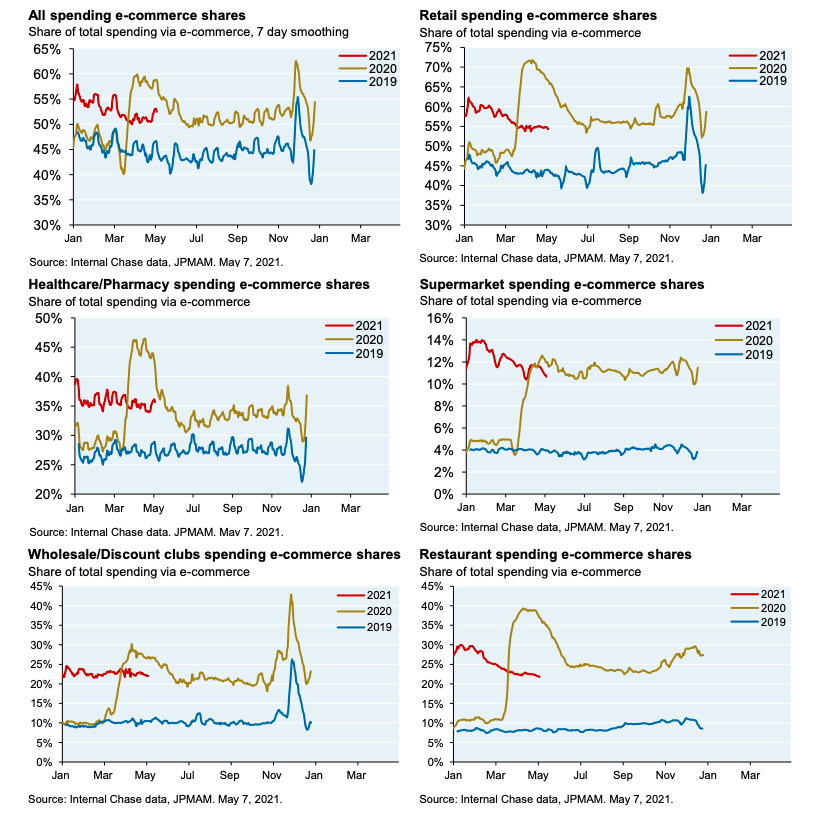

Ecommerce Share

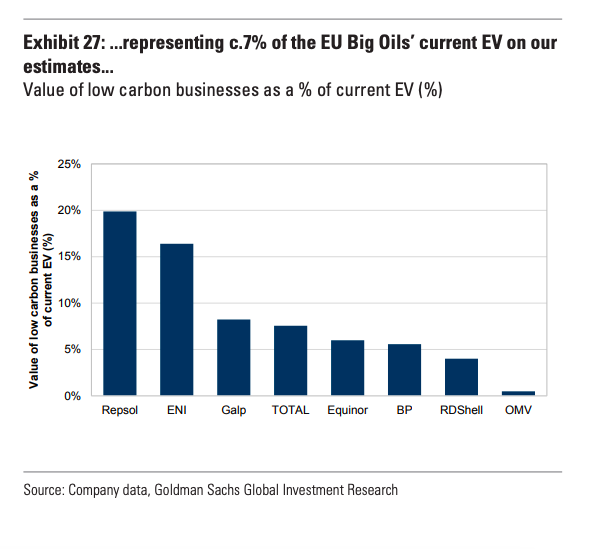

Big Oil and Renewables

- Low carbon businesses (renewable power, retail power and bioenergy) represent an estimated 7% of EU big oil enterprise value (EV) on aggregate with Repsol and Eni leading the pack.

- Investment in these areas has really accelerated in the last four years.

- This analysis excludes future technologies like hydrogen and electric vehicle charging, that are not material today but are a big part of the transition at these companies.

- This surge in investment has meant the energy sector is now a leading consumer of minerals.

iOS 14.5 App Tracking Opt-in Rate

- This site tracks daily the number of users* opting in for App Tracking with the new iOS 14.5 update.

- Useful for those invested in Facebook and other players in the mobile advertising industry.

- Here is the chart from May 14th for the World, the figure is 5% for the US.

- *they count app users not individuals users. So it is for every app.

- Good article on what participants are doing in the early days.

The Art of Execution – Review

- Really interesting review of Lee Freeman Shor’s “The Art of Execution”

- “Shor’s most powerful point is that investment performance is largely dictated by what an investor does after they buy a stock, specifically by how they deal with both losing and winning positions over time.”

- The book uses a dataset of 30,874 trades made by 45 top managers who ran money as part of Shor’s “Best Ideas” fund from June 2006 – October 2013.

Market Expected Return on Investment

- Intangible assets matter more and more in the stock market.

- Yet, they are generally poorly accounted for and valued.

- This is a useful paper on a new metric – the market expected return on investment – that aims to give a more accurate view of returns in a world increasingly dominated by intangible assets.

- Though technical it is worth a careful read.

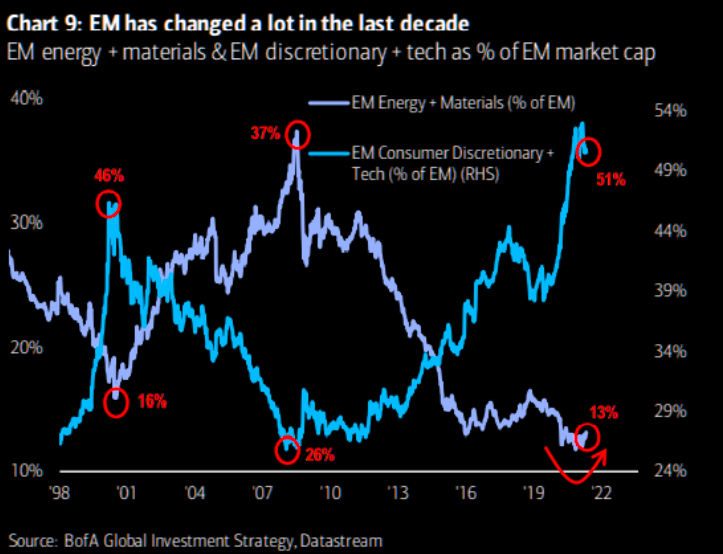

Emerging Markets

- Staggering change in the composition of Emerging markets indices.

- They are now over half Tech/Discretionary vs. being nearly half Energy and Materials.

- Always look under the surface.