- Informative post on what is going on in automotive semiconductor markets.

- Shortages in the short term – mainly because the pandemic wrong-footed car makers.

- Growth in the long term – driven by the amount of semi-content in a car (an electric vehicle has 110% more content than a conventional vehicle, autonomous driving doubles that).

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

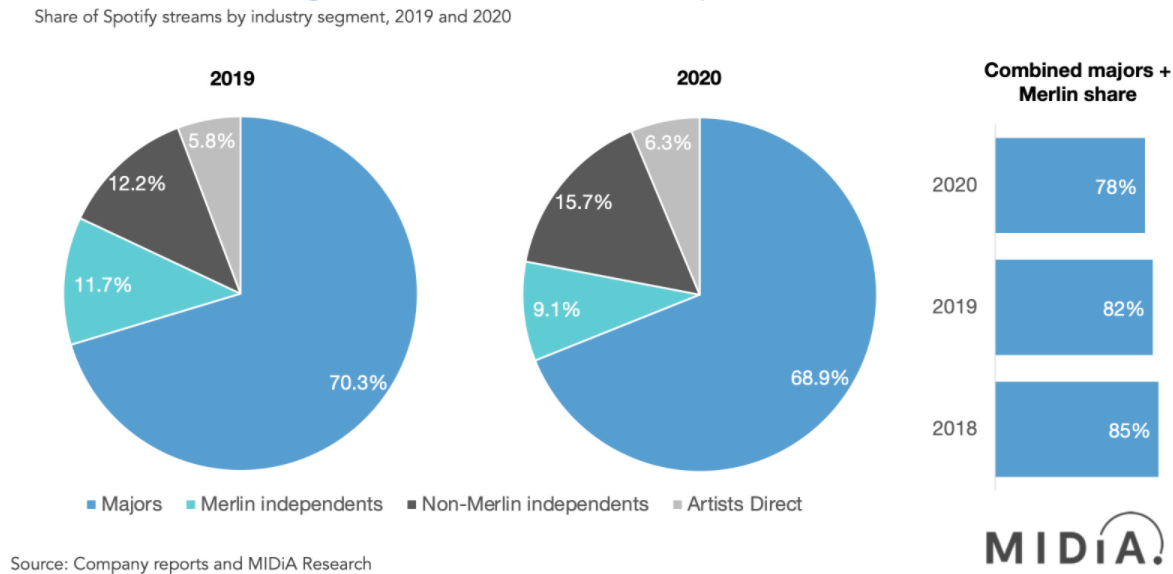

Major Labels Share

- Independents gained share of streams again in 2020. Major labels continue to lose share.

- They (Major Labels + Merlin independents) now account for 78% of all streams on Spotify down from 85% in 2018.

- Interestingly most of the share gain came from non-traditional independents.

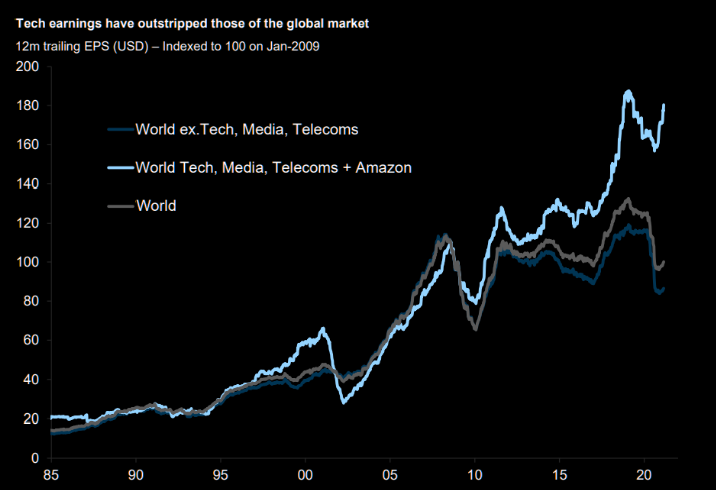

Tech Earnings

- Tech earnings have meaningfully outstripped the rest of the market.

Octahedron Capital Slides

- Titled “A few things we learned in Q4 2020” this deck is a 97 slide tour of what is going on in digital advertising, gaming, payments & fintech, on-demand and e-commerce and software.

- It largely consists of quotes from management calls and latest company data points.

- Worth a flick.

John Lewis Results

- Results from John Lewis are out.

- This is a great post from Stephen Clapham pulling out the key insights.

- Interestingly – “Given the pronounced shift to digital, we reassessed how much shops contribute to whether our customers buy online with us or not. Before the pandemic we believed that shops contributed around £6 of every £10 spent online but we now think that figure is £3. John Lewis shops are now held on our balance sheet at almost half the value they were before the write downs recognised in 2019/20 and 2020/21“.

Repairability Index

- France has introduced something very interesting.

- From this month on, makers of certain electronic devices, like phones and laptops, will be required to give them a score on how repairable they are.

- This will allow consumers to chose devices that are easier to repair and incentivise durability.

- Other countries (including the EU) are looking to follow.

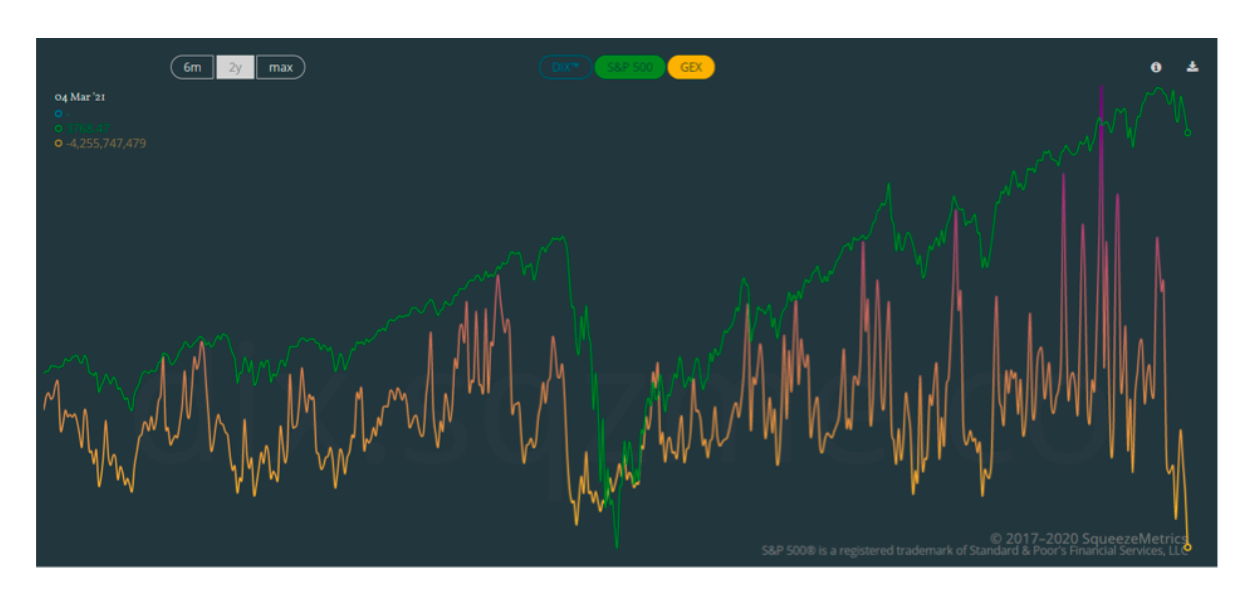

Dealer Gamma

- This chart shows the S&P 500 (green line) vs. dealer gamma exposure (yellow/purple line).

- “The read is simple: positive dealer gamma means that dealer flow attenuates market flow (i.e. the brakes are on); negative dealer gamma means that dealer flow amplifies market flow (i.e. pedal to the metal).”

- The level on the 4th of March is 30% more than this time last year – which ever direction the market moves it will be get an extra boost.

- h/t Squeezemetrics and Threebodycapital.

Andrew Lo

- Andrew Lo is an outstanding academic who’s work uses financial engineering to solve big problems in society.

- We previously covered one brilliant tool to emerge from his lab – Project Alpha – which tracks in real time probability of success for clinical trials.

- This is a good article about him and how his ideas about pooling biotech research into a mega-fund has come to life with BridgeBio (IPOed in 2019).

- He has previously proposed this same idea for Alzheimer’s research, which we critiqued.

Pershing Square

- Pershing Square’s Holdings annual presentation for 2020 is out.

- 2020 really stood out:

- +70.2% annual return (the highest annual tally since inception).

- 36.6%pts of gross return coming from their big CDS bet.

- 13.1%pts from the IPO and appreciation of the world’s largest SPAC (slide 32).

- PSH was also added to FTSE 100.

- Slides cover latest views on their biggest holdings.

Barry Diller

- Engaging podcast with the legend Barry Diller.

- Best bits include description of his thought process behind actions taken during the pandemic (buying MGM stock and raising cash for Expedia).

- And how he describes other executives – Iger, Malone etc.

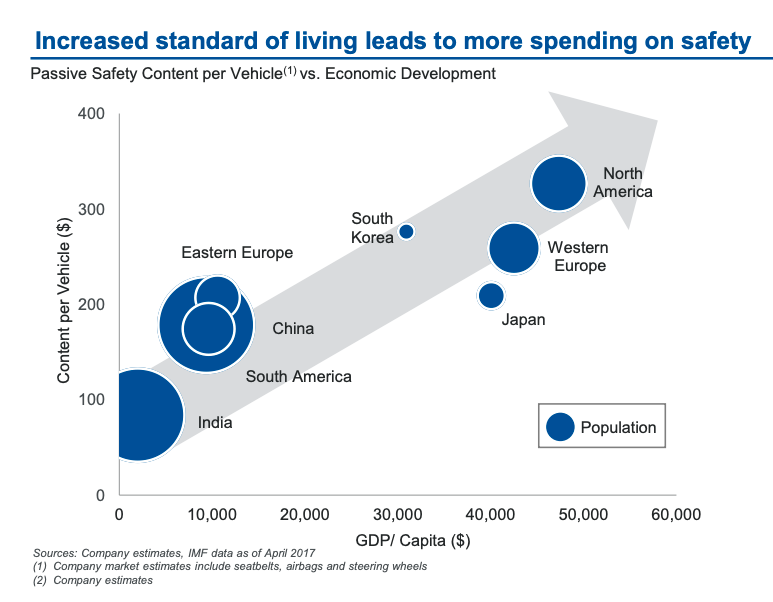

Car Safety and Income

- An illuminating chart from Autoliv investor day.

- Richer countries spend more on vehicle safety.

Company History

- History when it comes to companies is very important – it gives context, culture, strategy, values.

- It tells one a lot about where a company is today.

- We have been big fans posting histories of Boeing, Visa, ICE, Supreme.

- This is a great collection of “The rise of company x” pieces.

- There is a lot going on at Twitter.

- They acquired social podcast tool Breaker, Substack competitor Revue (and cut take rates to 5%), and are developing Clubhouse competitor Twitter Spaces.

- Financial twitter is alight with commentary on the change going on. This was a brilliant thread (liked by @Jack himself) sent to us (thanks Tom!) on the cultural change going on.

- This is a nice (fun) write up on the stock – including the narrative change.

- “In this market, value is dead (jk sorry value folks!), obvious growth is crowded, but finding that inflection point when the narrative around a company switches from dead to very much alive is like finding a magical money printer in a market fueled by a magical money printer. brrrrrr^2”

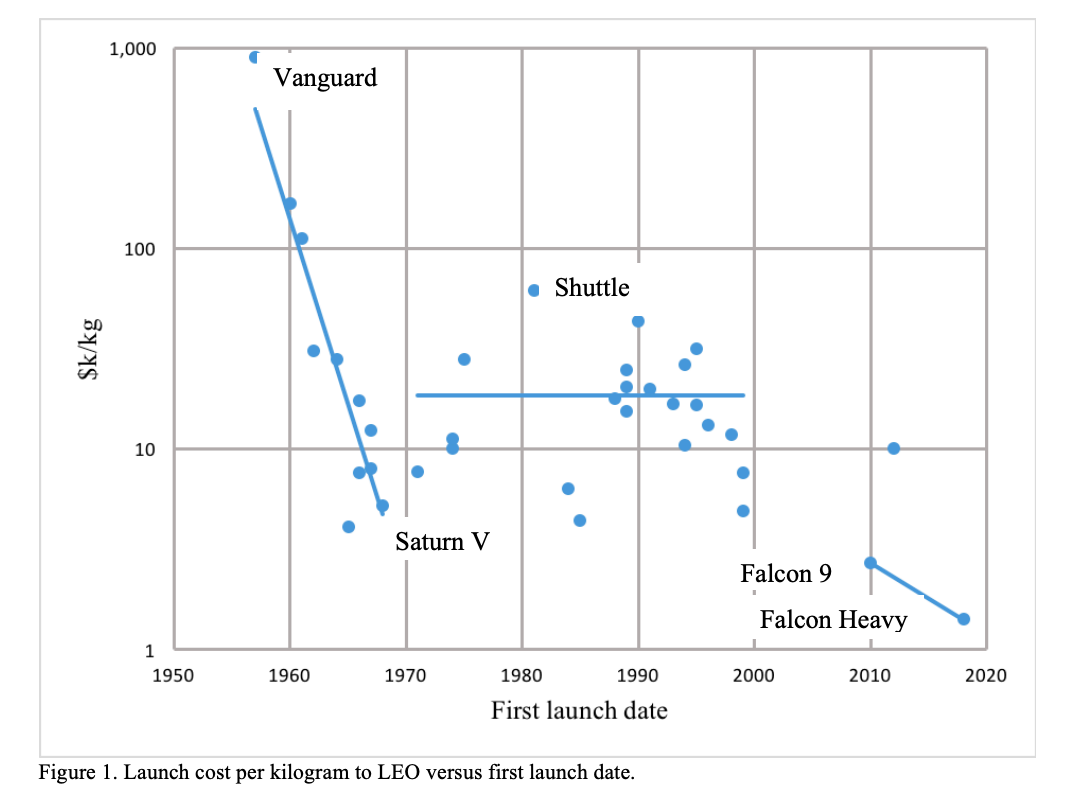

Space Launch Costs

- Thanks to commercial rocket development (SpaceX) space launch costs are falling again.

- “The cost of space launch dropped from very high levels in the first decade of the space age but then remained high for decades and was especially high for the space shuttle. In the most recent decade, commercial rocket development has reduced the typical space launch cost by a factor of 20 while NASA’s launch cost to ISS has declined by a factor of 4.”

- h/t The Diff.

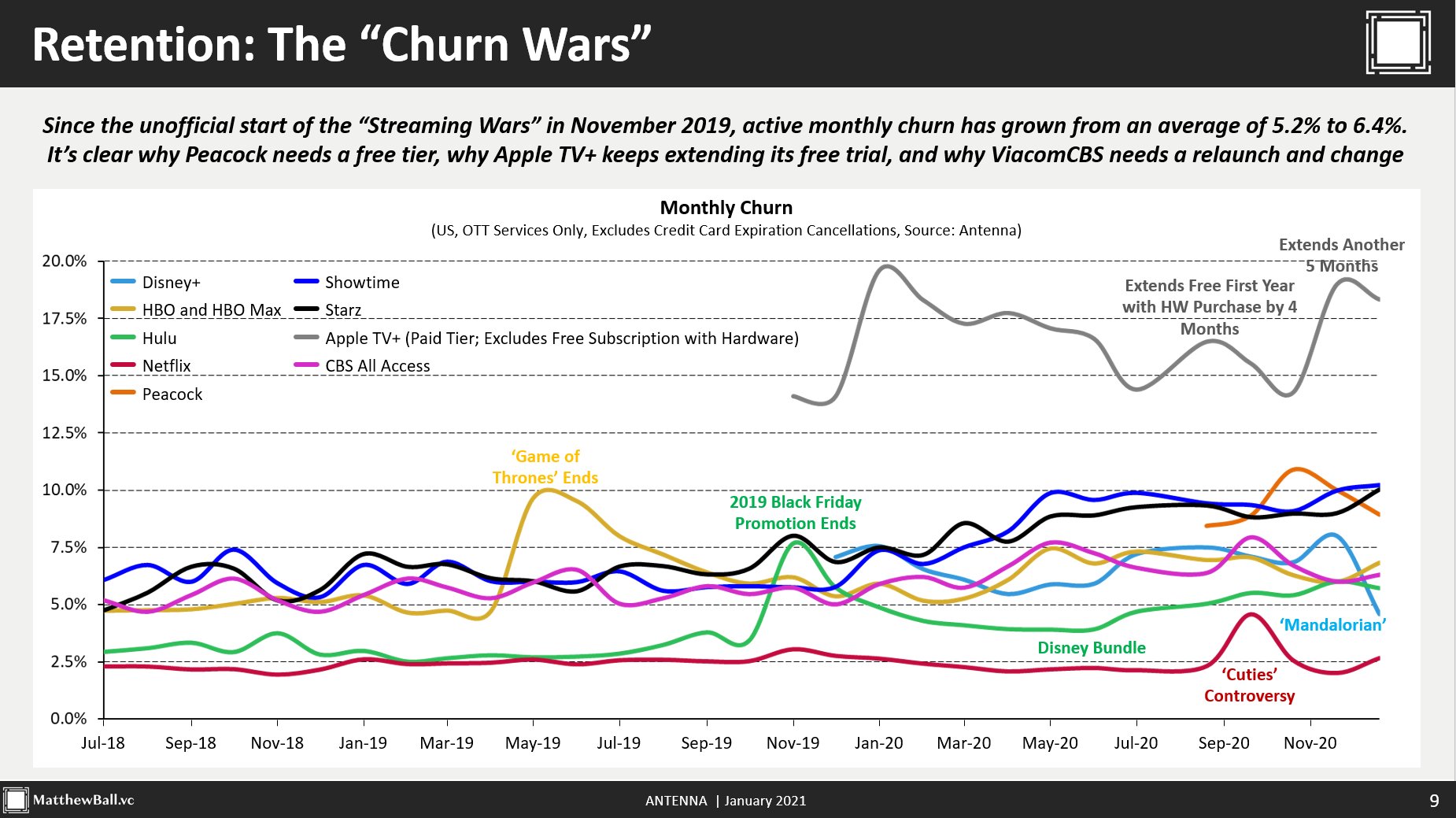

Churn Wars

- A very comprehensive chart of streaming service churn rates.

- The accompanying twitter thread has lots more interesting information.

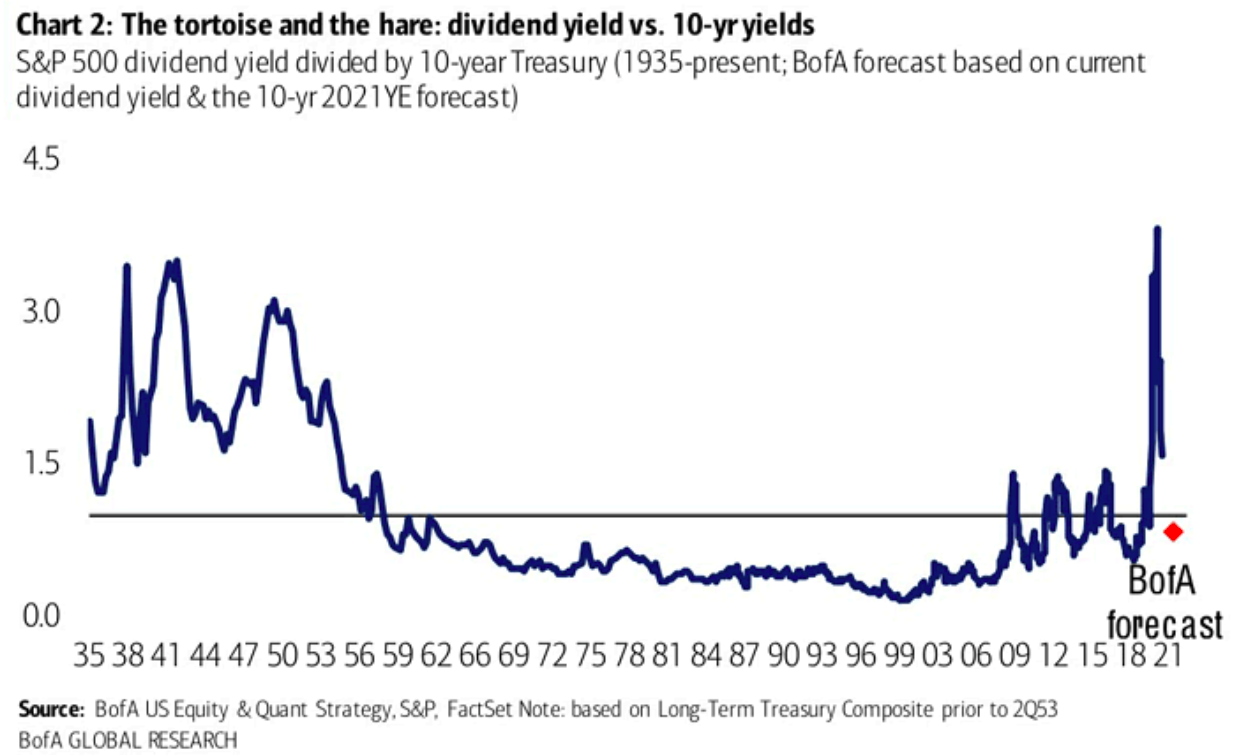

Dividend Yield vs. Rates

- Interesting chart of S&P 500 dividend yield divided by 10-year treasury rate from 1935 to today.

- A further rise in bond yields could make equities less attractive on this measure?

Omni-Channel

- Walmart are taking omni-channel very seriously – converting store square footage to mini-warehouse fulfilment centres.

Diagnostics

- Covid is having one huge positive impact if governments seize it.

- In its results Roche said of diagnostics equipment – “we are installing in one year what we have installed the prior five years. So we are more than doubling our installed base out there of the systems.“

- This huge increase in capacity, they go on to say, could be used to detect HPV (saving 300,000 women’s lives who die of cervical cancer every year), HepC (helping 80 million people who live with this disease), and Tuberculosis (“one-fifth of population has infection of the bacteria of tuberculosis worldwide”).

- “We need to start to recognize what health care systems can do by intervening much earlier. And I have to say, there is such an opportunity and governments need to get going on this. I’m sorry to get a bit emotional on this, but I have been fighting for 10 years with governments to include HPV screening and all the clinical data is out there, and they need to get going, and not just you know let it go, like they have in the past.“

Inflationary Pressures

- Some quotes on the topic courtesy of The Transcript.

- “…we do expect some significant cost inflation in the year…The top two inflation drivers for this year are expected to be pulp and polymer based materials. Together those two input costs represent more than half of the inflation outlook.” – Kimberly-Clark (KMB) CFO Maria Henry

- “We expect prices to be positive based on all the inflation that we are seeing.” – 3M (MMM) CFO Monish Patolawala

- “…the transportation market is very tight. Spot market rates have increased by more than 30%…And just a bit more color on commodities…we see headwinds on our major commodities right now. But not only on our major commodities, but some of the smaller purchases of raw and packing materials that we use across the rest of our business.” – Church & Dwight (CHD) EVP-Global Operations Rick Spann

- “…we are starting to see a little bit of inflationary pressure, particularly around freight and a little bit in the supply chain as well.” – Danaher (DHR) CFO Matt McGrew

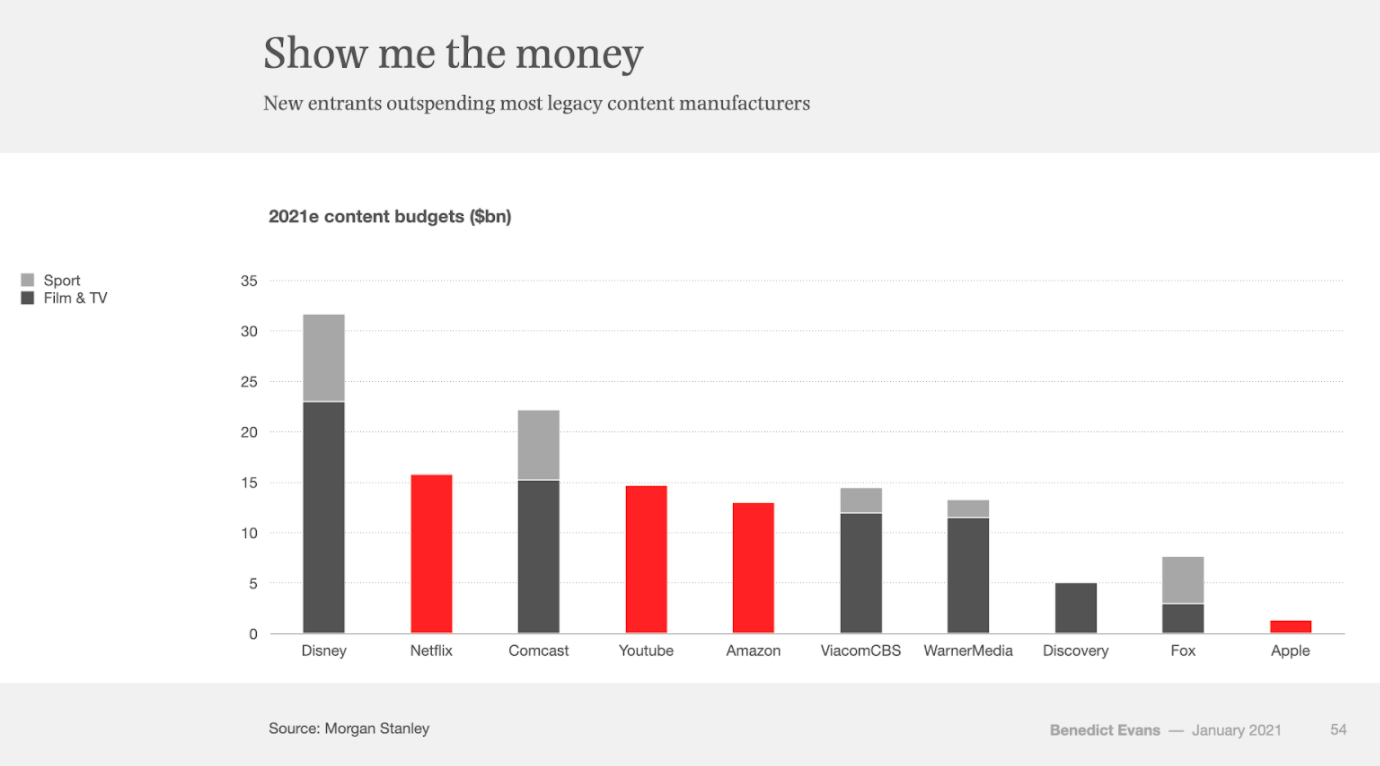

Content Budgets

- The new entrants in media are outspending many incumbents (though not Disney).

- Source.