- Big slide deck about the biggest areas of innovation.

- A lot of lofty growth predictions but interesting charts throughout.

- This one graphs monetisation of various media.

- They argue that even a 20% increase in cost per hour for gaming still leaves it a bargain.

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

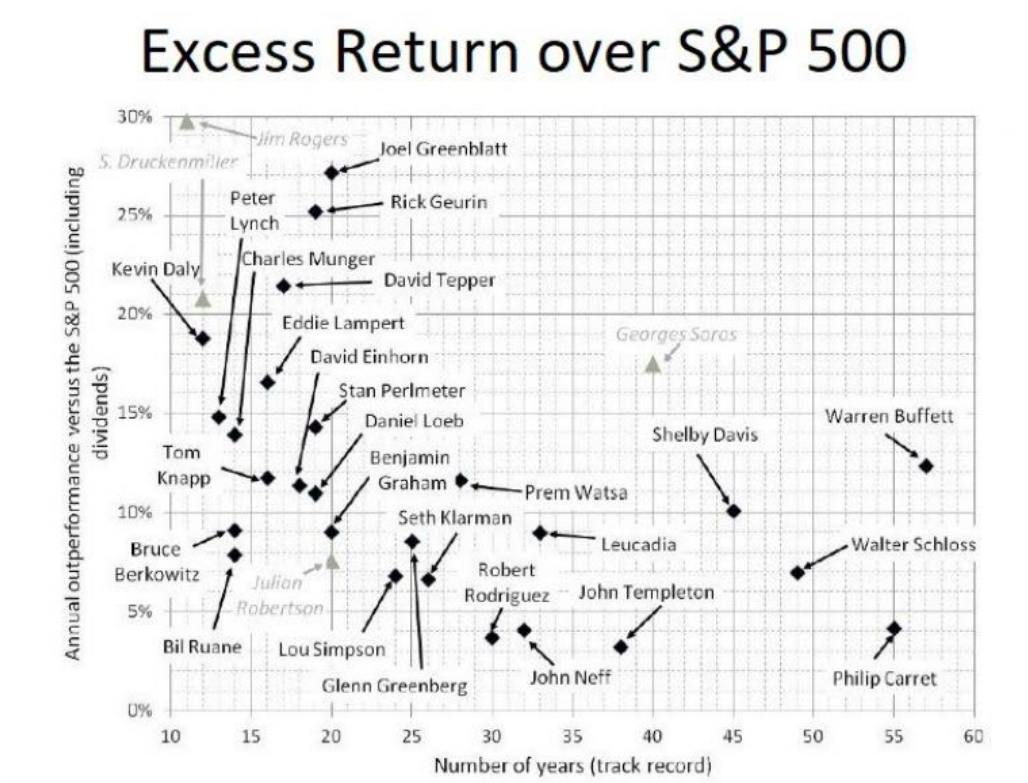

Fund Performance

- Interesting chart plotting excess returns of various managers against the durability of this performance.

Streaming Retention

- Interesting chart showing that Disney Plus now has market leading customer retention.

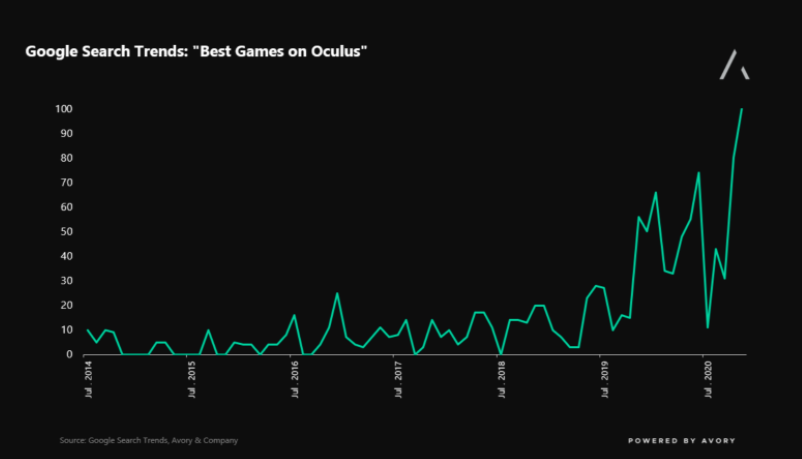

VR

- VR is taking off.

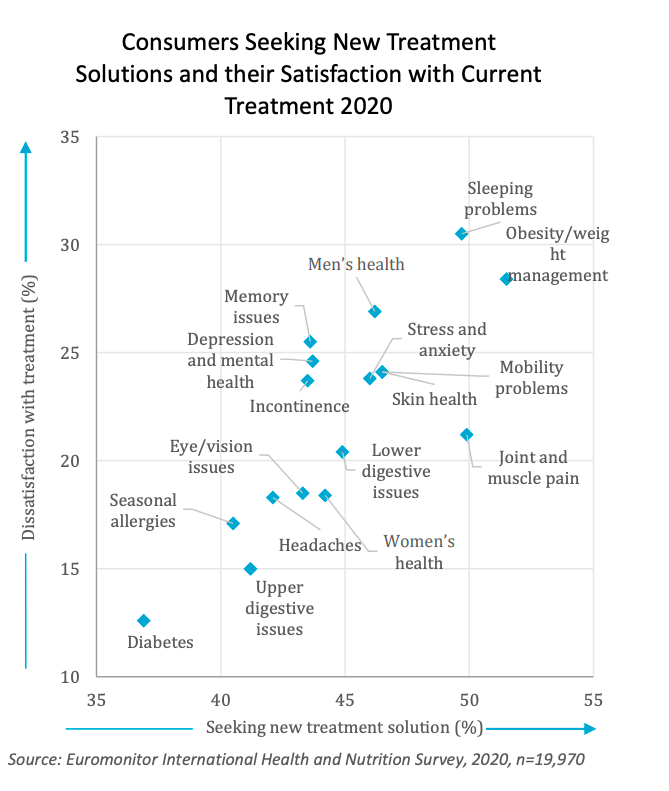

Consumer Health

- Nice chart from Euromonitor on what could be the big growth areas in consumer health.

- Euromonitor expects demand for conditions such as sleep, stress, digestion, mood/depression, memory/cognition, and weight management to surge in 2021.

FundSmith 2020 Letter

- A good read as always.

- “What are the similarities between a forecaster and a one-eyed javelin thrower? Answer: Neither is likely to be very accurate but they are typically good at keeping the attention of the audience.“

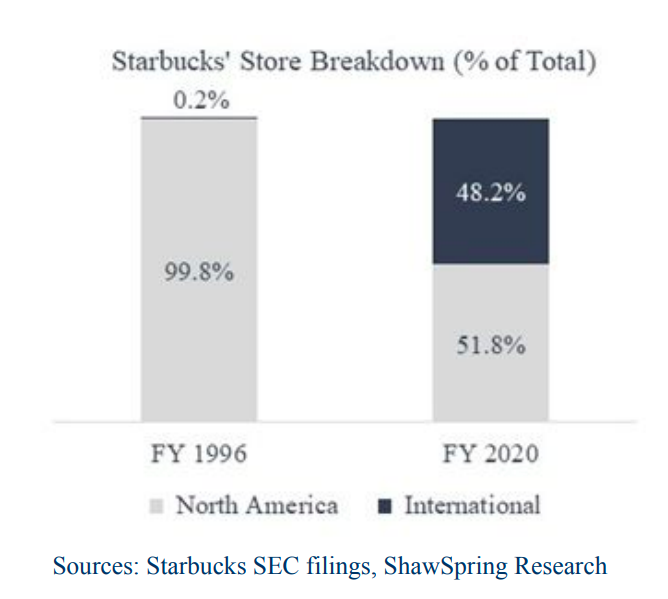

Starbucks

- It is really astounding how SBUX business has evolved from nearly 100% US focussed to a global business.

Lemonade

- Interesting short report on the hot insurance company Lemonade Inc.

- The section on the Lemonade Foundation and ESG is worth reading as a new form of “manipulation”.

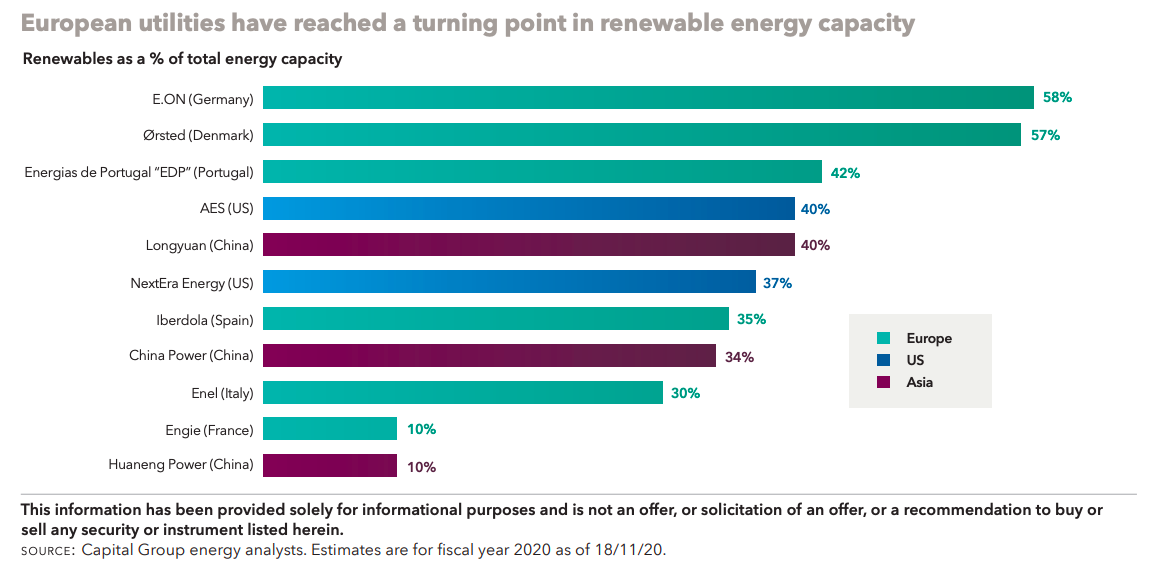

Utilities

- Pretty amazing transitions at some European Utilities – reaching turning point in terms of renewable energy.

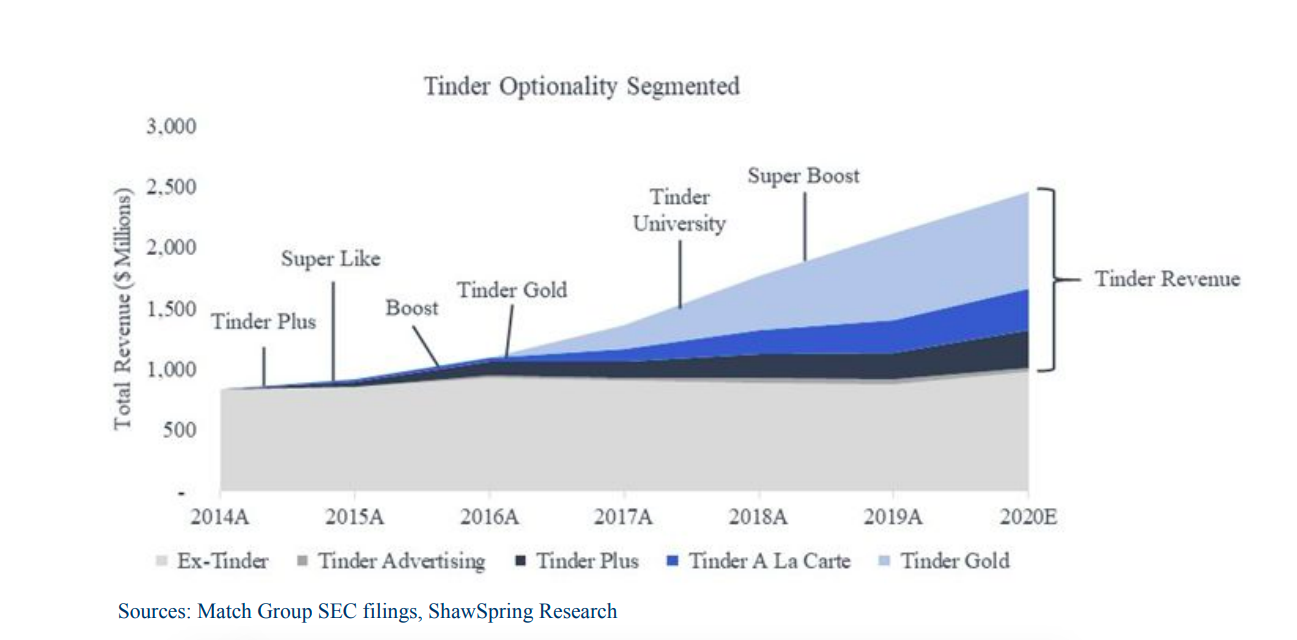

Match Group

- Great chart showing how Match Group revenue evolved over time and the power of optionality of new business lines (like Tinder).

- Could Hinge and Pairs layer on top like this from a de minimis contribution now?

Chip Wars

- There is a lot being written about China’s push for self-reliance.

- One of the biggest parts of this story over the next decade is likely to be the battle for semiconductor technology of all kind.

- The electronic design automation (EDA) industry is controlled by three firms and are all US. China is now making first moves into this industry., crucial for semiconductors.

- Europe is also getting involved and has just signed a €145bn declaration to develop a next generation processor and 2nm technology.

Content Business

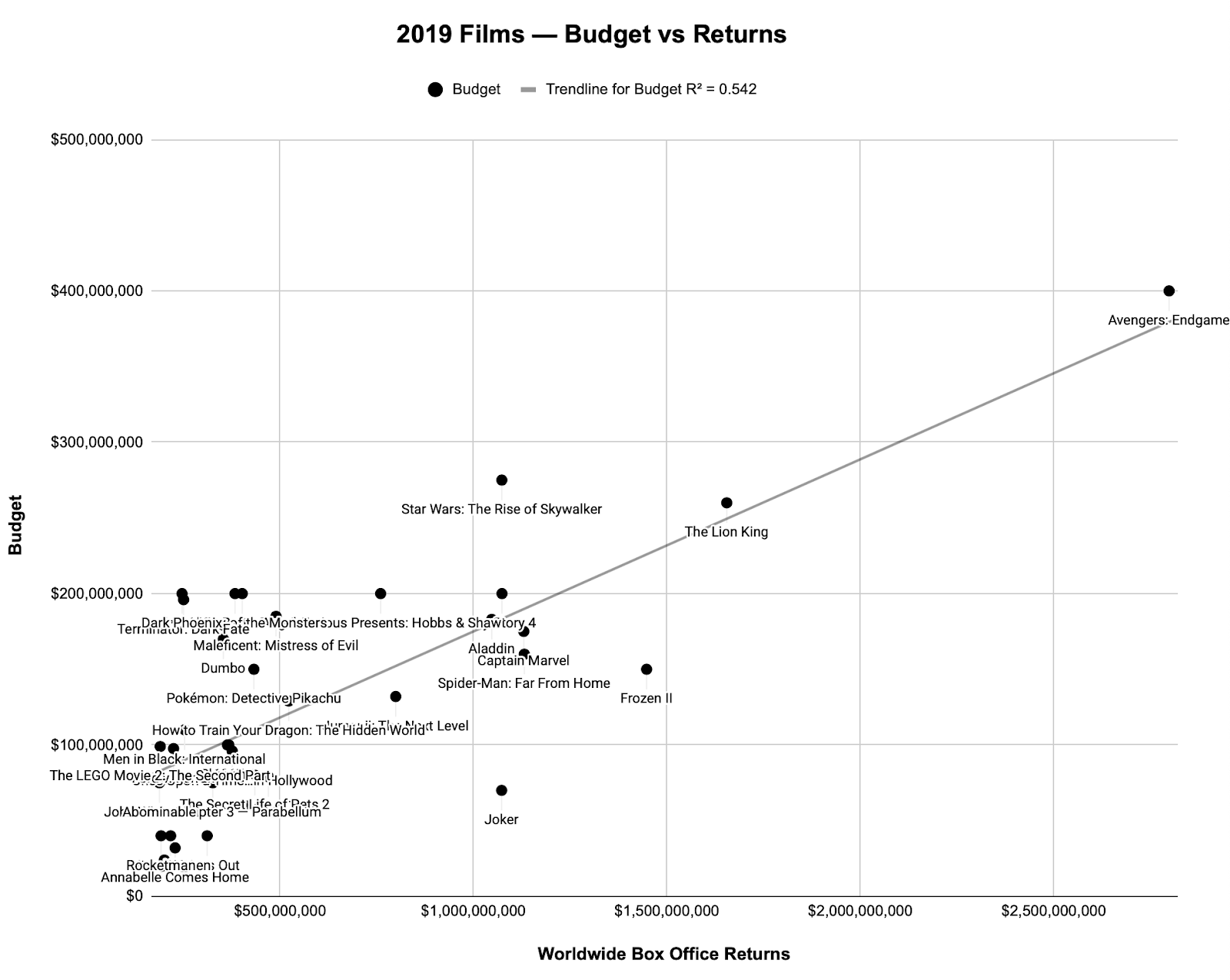

- A great piece of analysis applying Helmer’s 7 powers to the content business in order to establish if content has ability to maintain profitability and resist competition.

- Scale is one such power – this chart shows there is a slight positive linear correlation between size of budget and eventual box office returns.

- Network effects are also interesting – given the social dynamics of shared experience and discussing content. Franchises really shine here.

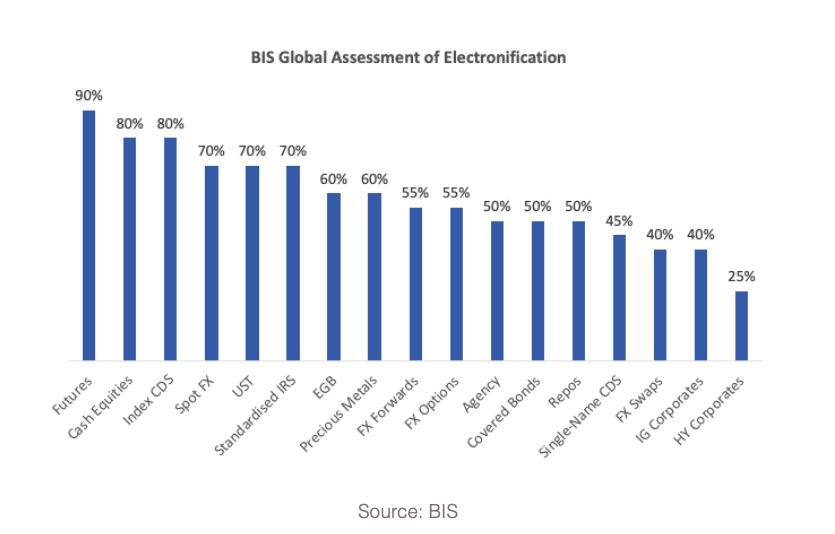

Electronification

- Rather amazing to see that huge parts of many financial instruments are still not traded electronically, especially in the credit markets.

- From a brilliant post on the electronic trading business MarketAxess.

e-commerce Marketplaces

- A brilliant long read on the state of e-commerce marketplaces in 2020.

- Amazon marketplace, which “added eBay’s worth of sales to its GMV this year“, is a key topic.

- The nature of sellers there has evolved, including the new trend of capital raised to roll-up (i.e. acquire) sellers.

- The review also covers other winners like Walmart and Etsy.

Real Options and Valuation

- A fascinating read about the use of real options in valuation analysis by Mauboussin and Callahan.

- They argue it applies to a subset of companies – namely those with adept management, strong competitive position and high asset volatility.

- They also show why 2020 had characteristics (like decoupling of volatility and equity risk premium) that made this type of analysis more attractive.

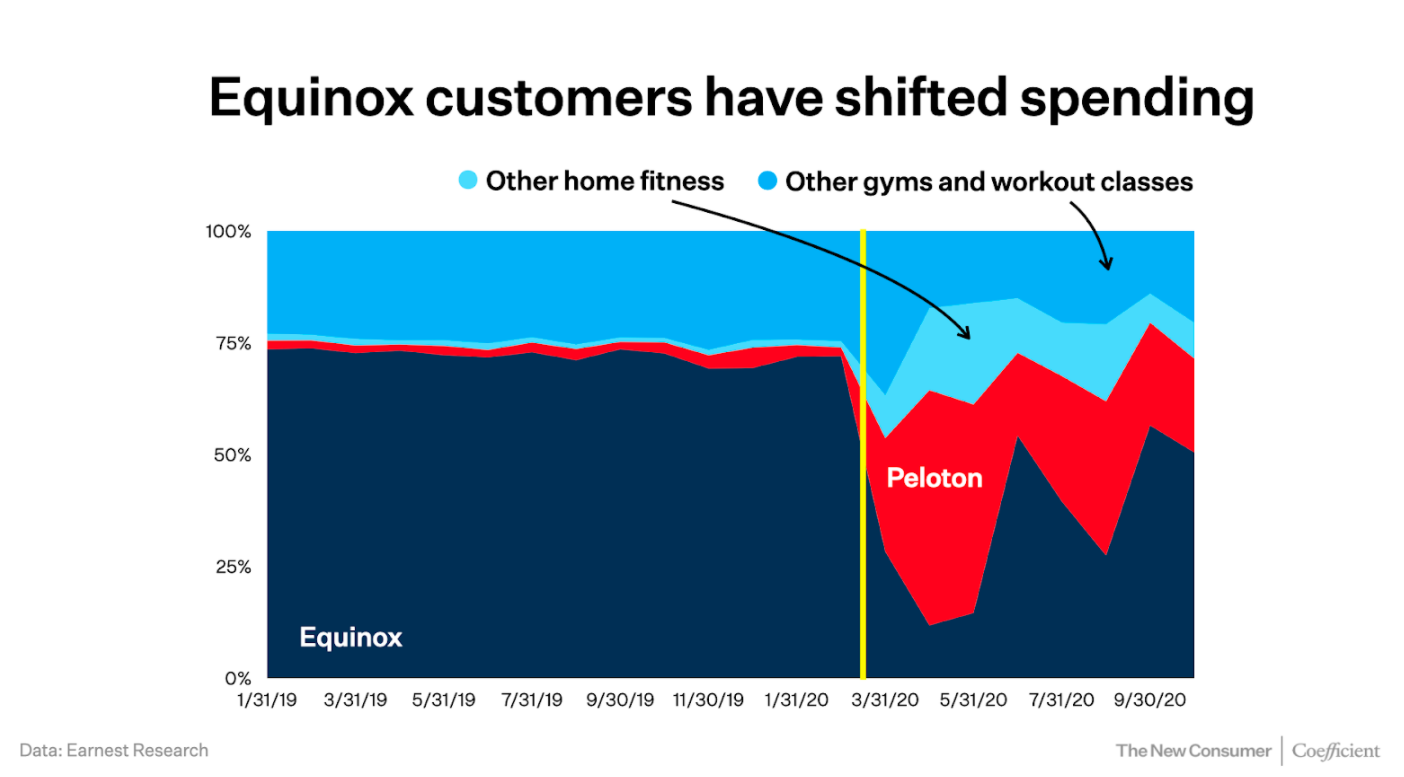

Home Fitness Shift

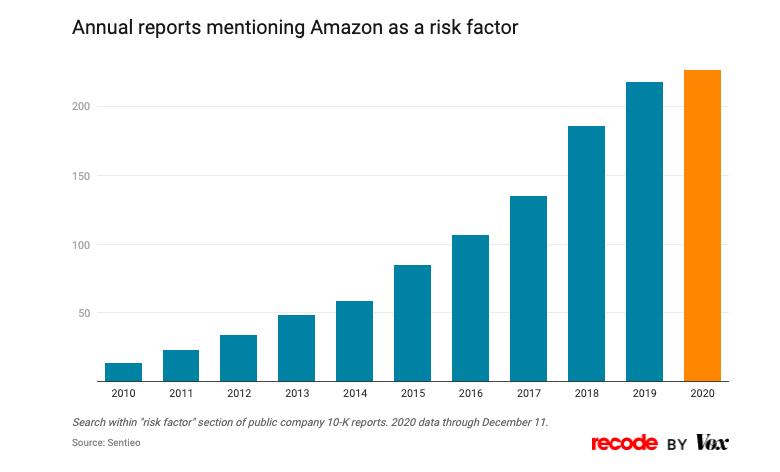

Amazon as a Risk Factor

- Interesting chart showing number of annual reports that mention Amazon as a risk factor.

Fedex ShopRunner

- Interesting acquisition by Fedex buying the ShopRunner platform – vertically integrating forward.

- Sign of more to come?

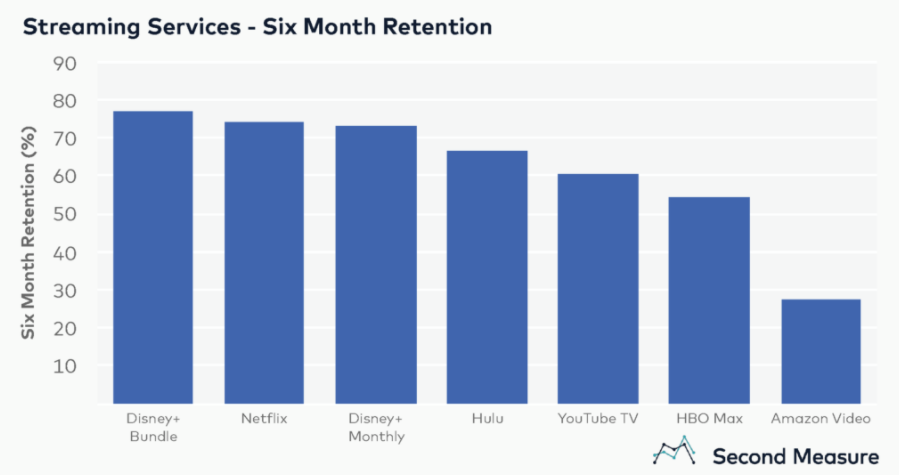

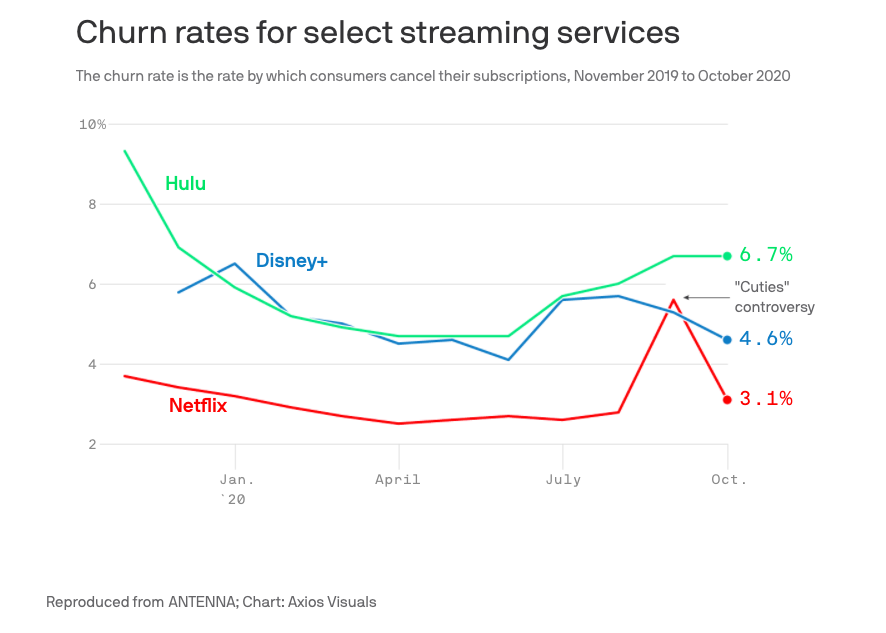

Churn Rates

- A key variable to the life time value of streaming businesses is churn rate.

- This interesting chart shows the churn rate of NFLX vs. Disney services.

- There is a lot of room for improvement in the latter.

ARKK

- ARKK is the ETF that represents the latest rally.

- It is seeing a lot of flows and discussion.

- This table shows the top 10 holdings as of 31/12/2020.

- Always worth knowing the composition of ETFs that are seeing strongest flows.