- The partnership is an investment success story, outperforming the index by +14.3% per annum for thirteen years (2001 – 2014).

- Although all are worth your time, this is nice blog post that pulls out some of the most interesting quotes and ideas. There are many.

- “One trick that Zak and I use when sieving the data that passes over our desks is to ask the question: does any of this make a meaningful difference to the relationship our businesses have with their customers? This bond (or not!) between customers and companies is one of the most important factors in determining long-term business success. Recognising this can be very helpful to the long-term investor.”

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

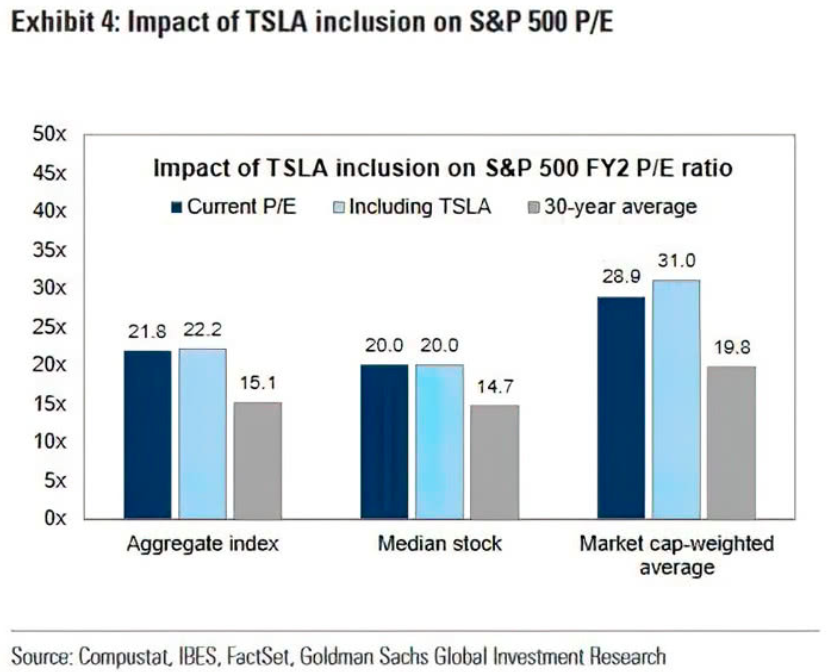

Tesla and SPX Valuation

- Inclusion of Tesla adds 2x turns to 2 year forward P/E of S&P 500 index.

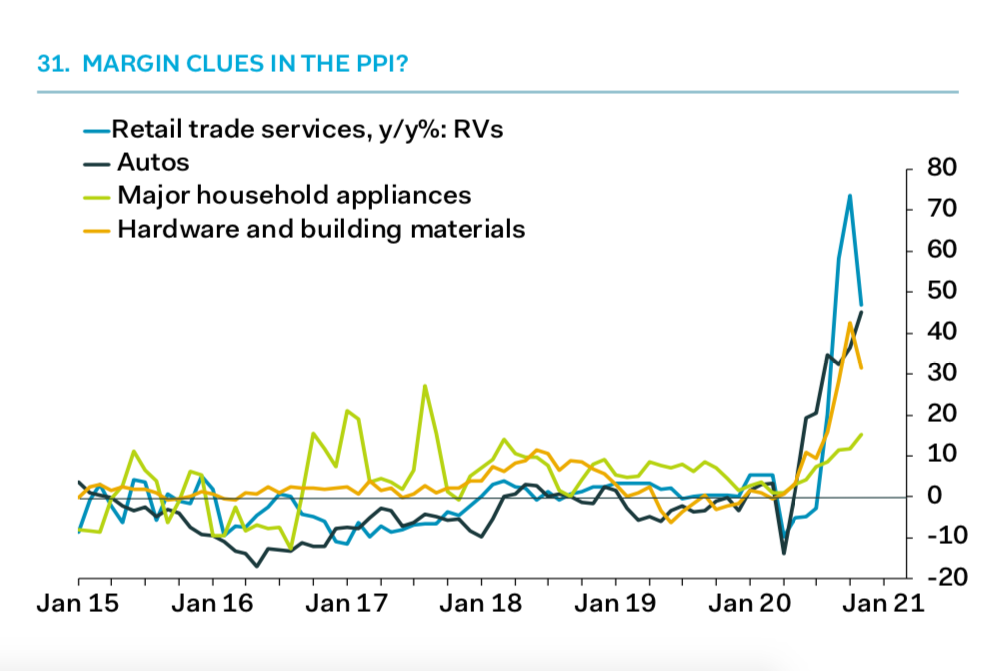

PPI Squeezing Margins

- Chart suggesting that certain industries might see margin compression from spike in purchasing price index (PPI).

- Source: Pantheon Macro.

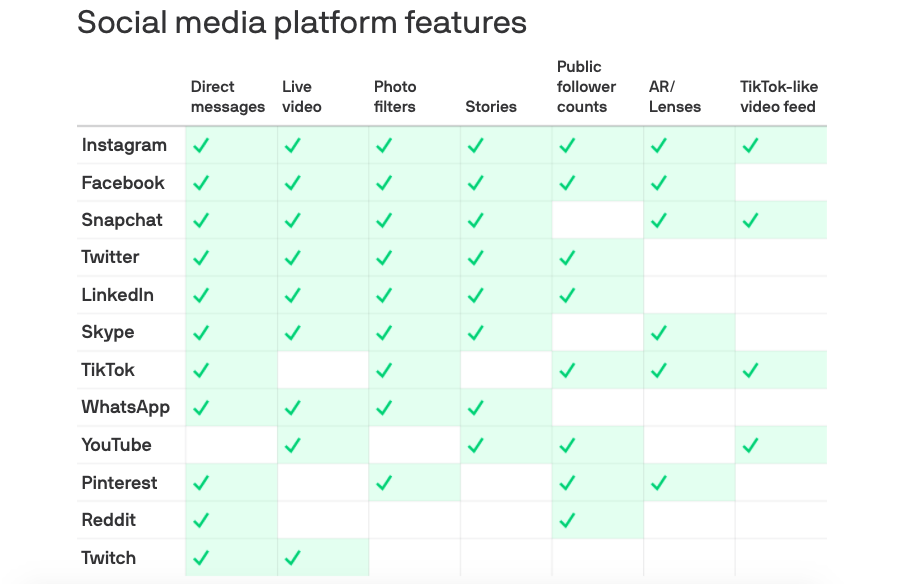

Social Media

- Social Media companies are all starting to look the same.

- Innovation is meant to be about new ideas?

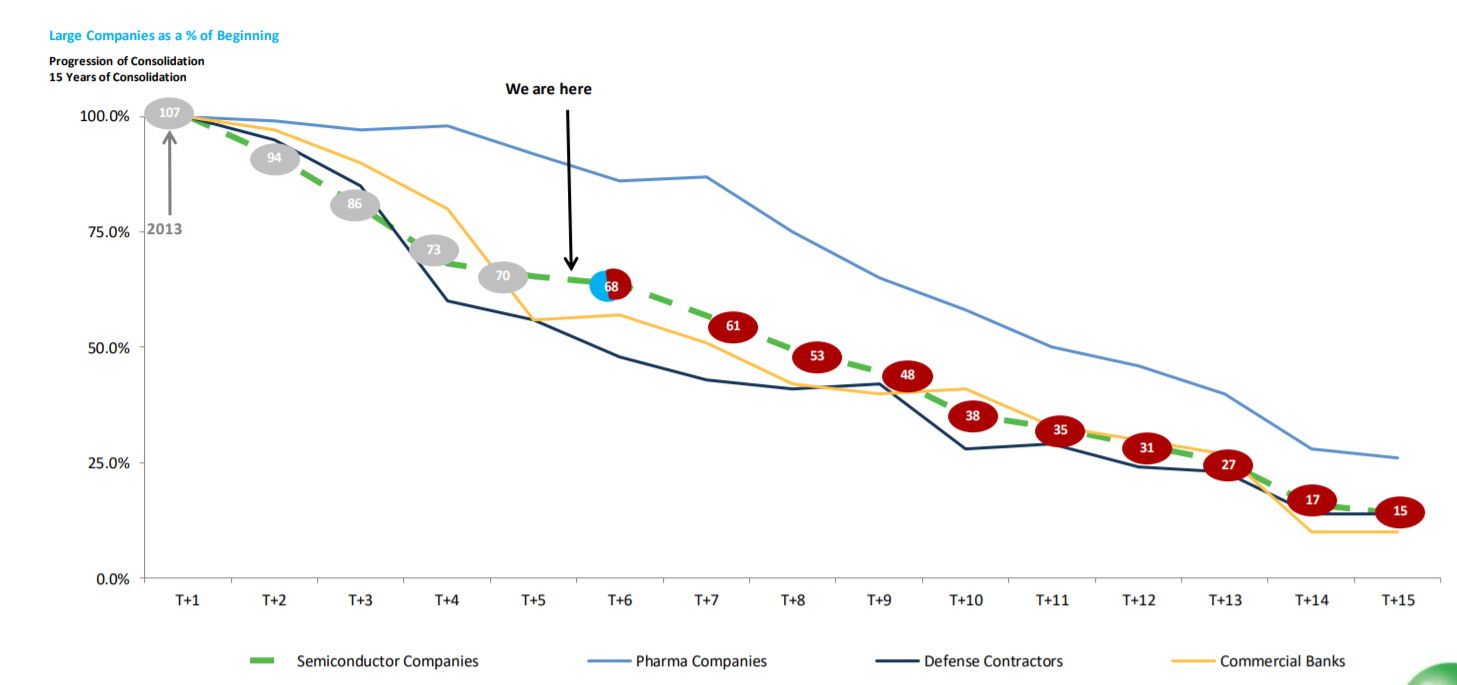

Semiconductor Consolidation

- Interesting chart suggesting semiconductor firm consolidation has a long way to run when compared to other industries.

India and Jio

- Jio’s 4G network has dramatically transformed Indian mobile internet both in terms of both speed (82x) and cost (-95%).

- Perhaps one of the greatest contributions by any single company to bringing technology to the greatest number of people?

Apple

- Fascinating article on how apple is organised.

- “Believing that conventional management had stifled innovation, Jobs, in his first year returning as CEO, laid off the general managers of all the business units (in a single day), put the entire company under one P&L, and combined the disparate functional departments of the business units into one functional organization.“

- Apple has retained this structure despite revenues being 40x larger. As the number of employees went from 17k to 137k the number of VPs only doubled from 50 to 96.

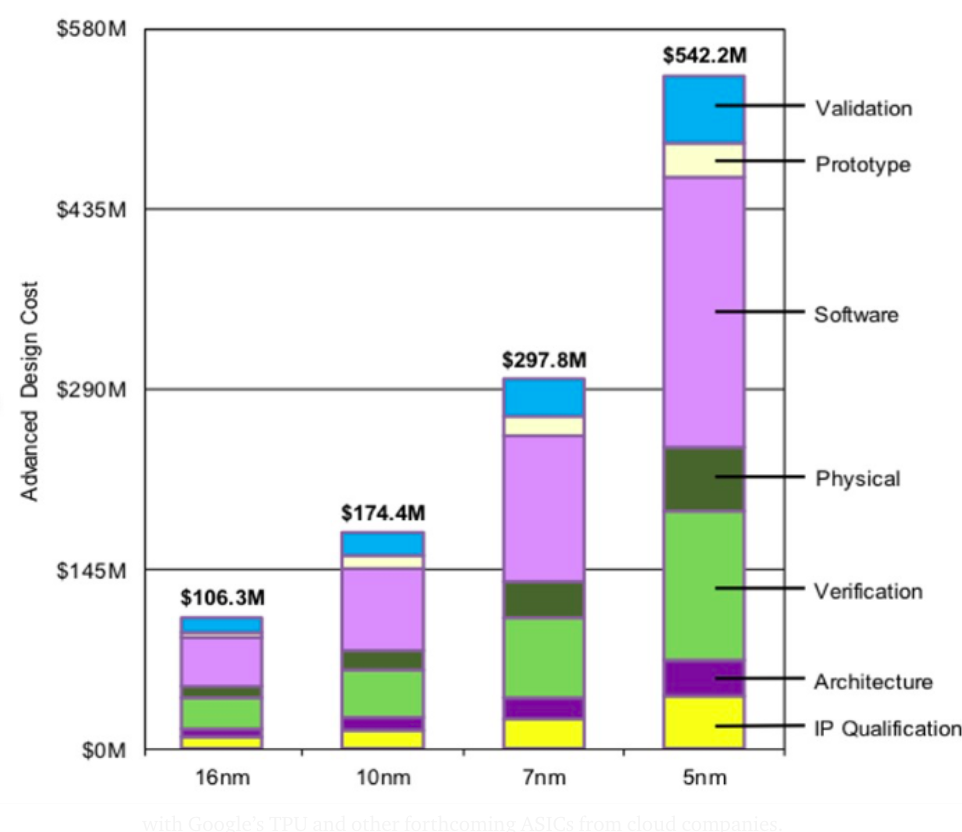

Semiconductor Design Costs

- It costs a lot to design a semiconductor, much like a biotech drug.

- As a result start-ups will likely struggle to assail established firms.

L’Oreal

- L’Oreal keeps pushing digital boundaries with a new line of virtual make-up for social media and video calling apps.

Intangible Value

- We covered the topic of the misuse of intangibles by some participants in our innugral blog post.

- This is an interesting academic paper that corrects this by appreciating that the question is one of developing better valuation metrics.

- The authors improve on the classic value factor by adding intangible assets (based on cumulative SG&A spending) – creating a new and better performing valuation measure.

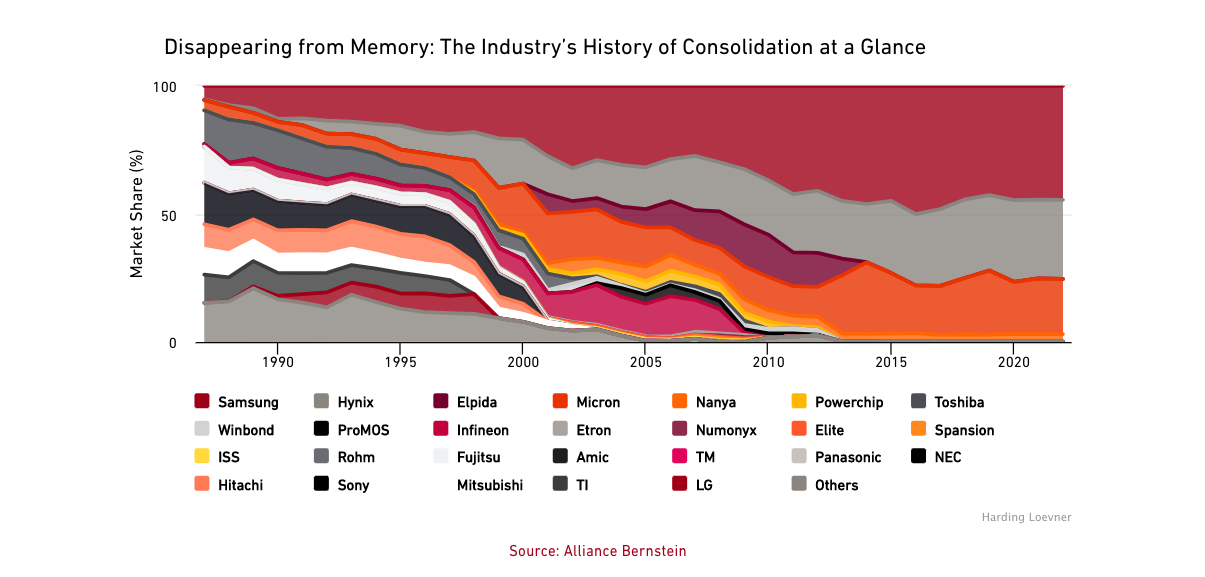

Memory Industry

- A fascinating graphic showing the dramatic evolution of the memory industry to essentially three players (Source).

Autonomous Cars

- Sometimes the biggest challenge to a new technology isn’t what everyone focusses on … click to find out.

Airbnb

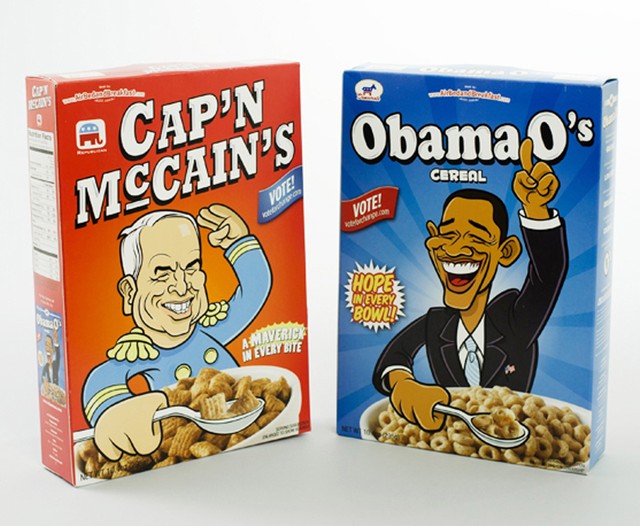

- The stories of the early days of Airbnb, who recently filed to go public, are the stuff of legend including how the founders turned to selling themed cereal to survive.

- The cereals were called “Obama O’s, the Cereal of Change,” and “Cap’n McCain’s, a Maverick in Every Box.” – a throwback to their first success housing delegates of the Democratic National Convention in 2008. It was also what got them a spot on Y Combinator.

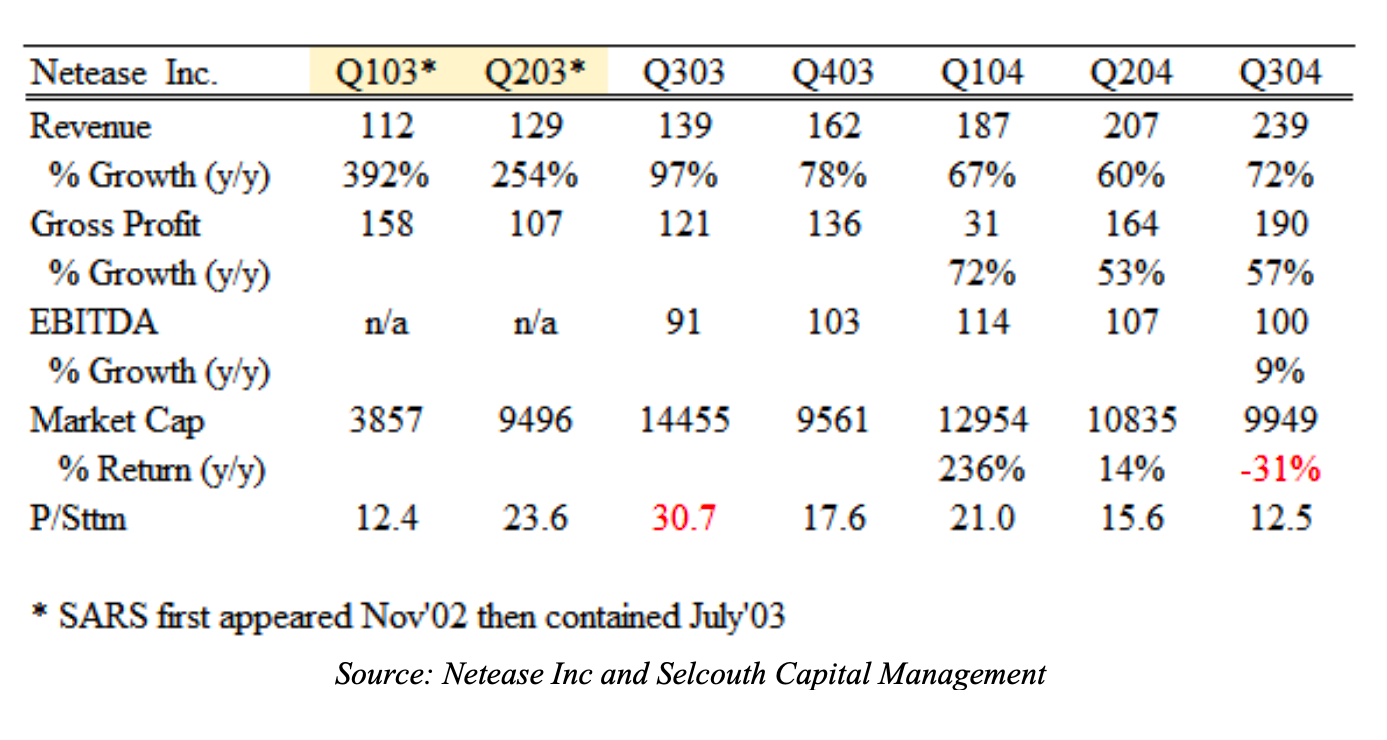

Analysing Impact of Covid – History

- Although the events of 2020 are in many ways unprecedented one can look at the 2002 SARS outbreak in Asia as a possible analogy, after all it involved a lot of people in China staying at home.

- Netease, a gaming company, was one of the few publicly listed stocks that reported financials at the time.

- This table (h/t Selcouth Capital Management) shows what happened to quarterly financials at Netease at the time.

- Netease saw a huge boost to revenue and a re-rating. Yet, eventually revenue slowed against tough comps and the stock deflated.

- Will the same happen to the current crop of beneficiaries?

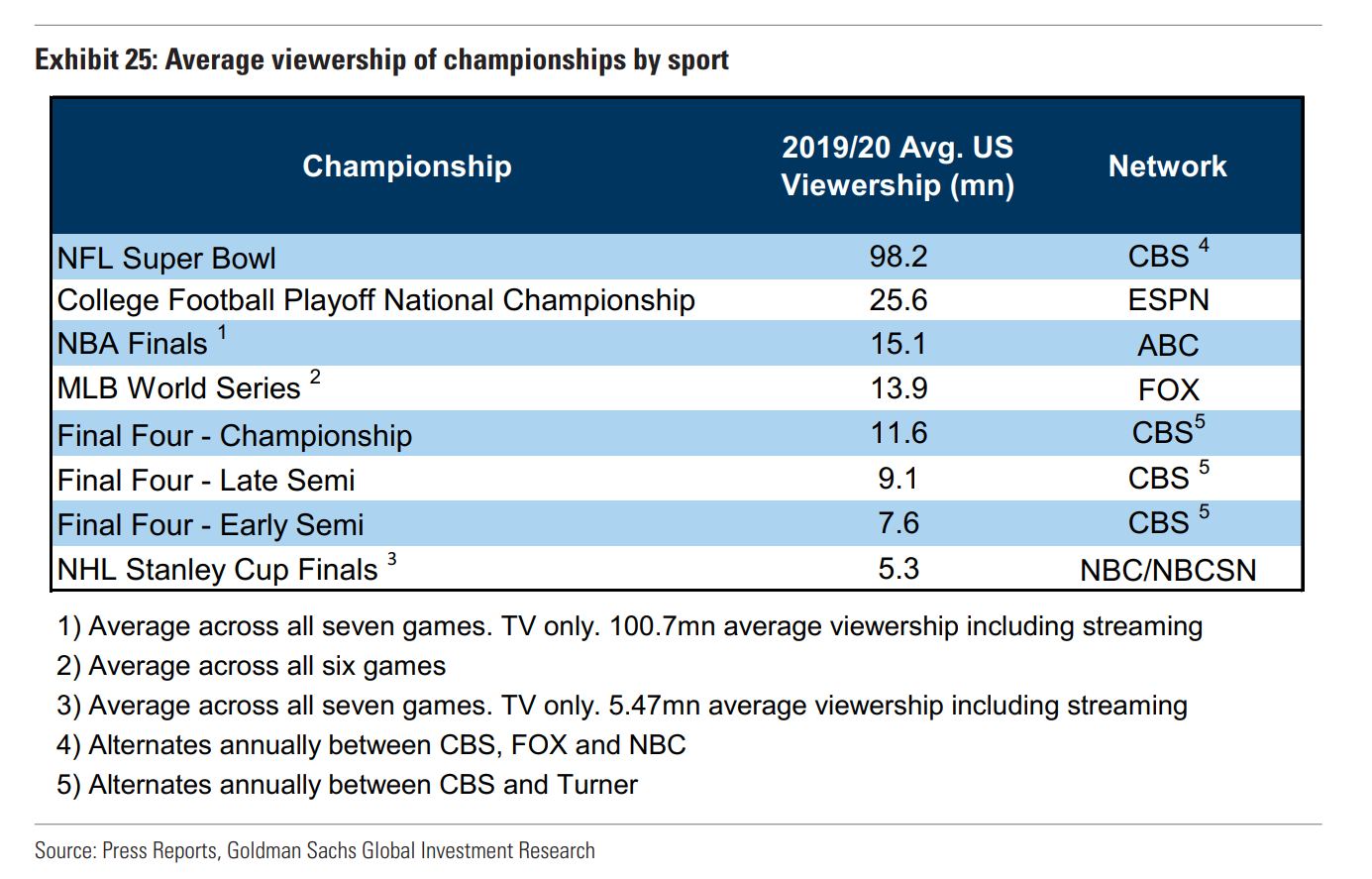

US Sports Viewership

- Amazing that the second most viewed US sporting event is college football with 70% higher viewership than the NBA finals.

Brick and Mortar the Real Winners?

- A fascinating and thought provoking read on why it is the category leading brick and mortar retailers who will be the real winners in the post Covid era.

- In one word – omni-channel.

- “Wal-Mart’s digital revenue in Q2 was an annualized $42 billion, growing 94% — faster than Amazon … Perhaps the simplest way to express what has happened during Covid is to note that Amazon has actually lost share in e-commerce during Covid.”

- A nice quote – “nothing accelerates change like success“

Toyota on Tesla

- “I am hesitant to say this — Tesla’s business, if you want to use the analogy, is like that of a kitchen and a chef. They have not created a real business in the real world yet. They are trying to trade recipes. The chef is saying ‘Our recipe is going to become the standard of the world in the future!’ At Toyota, we have a real kitchen and a real chef too, and are creating the dishes already. There are customers, who are very picky about what they like to eat, sitting in front of us, and eating our dishes already.” Toyota President Akio Toyoda.

- Source.

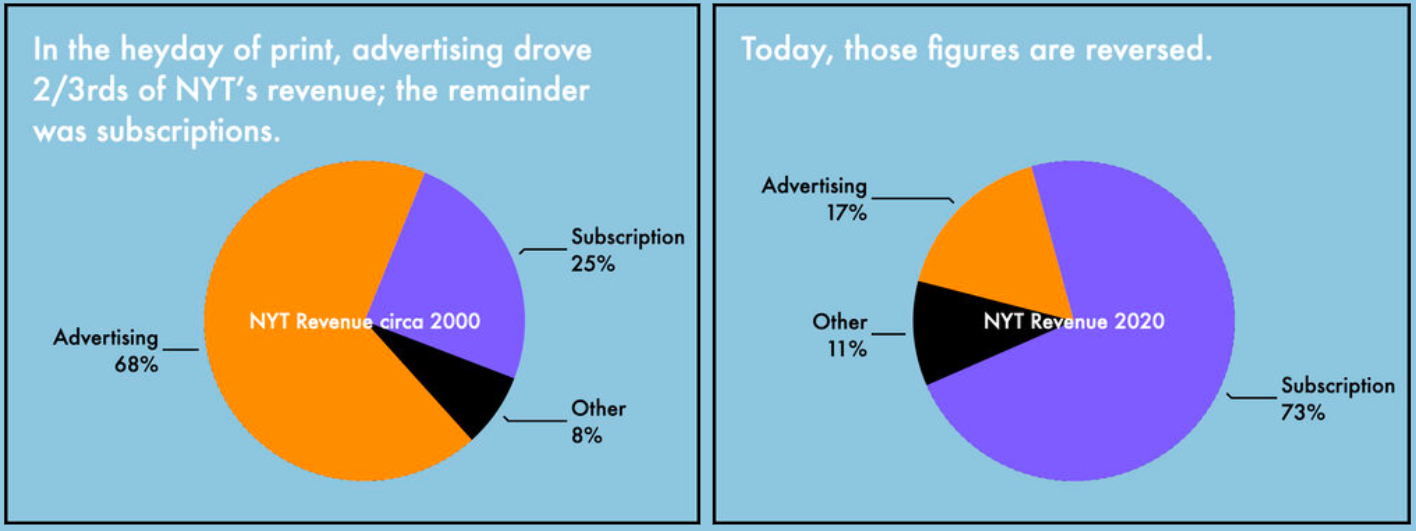

NYT Transformation

- Great set of slides on the transformation at New York Times since 2011.

- The company just crossed a milestone where digital overtook print.

- This is also a fascinating read about what happened inside the NYT newsroom during the Trump years and whether this boost was partly responsible for its growing business success.

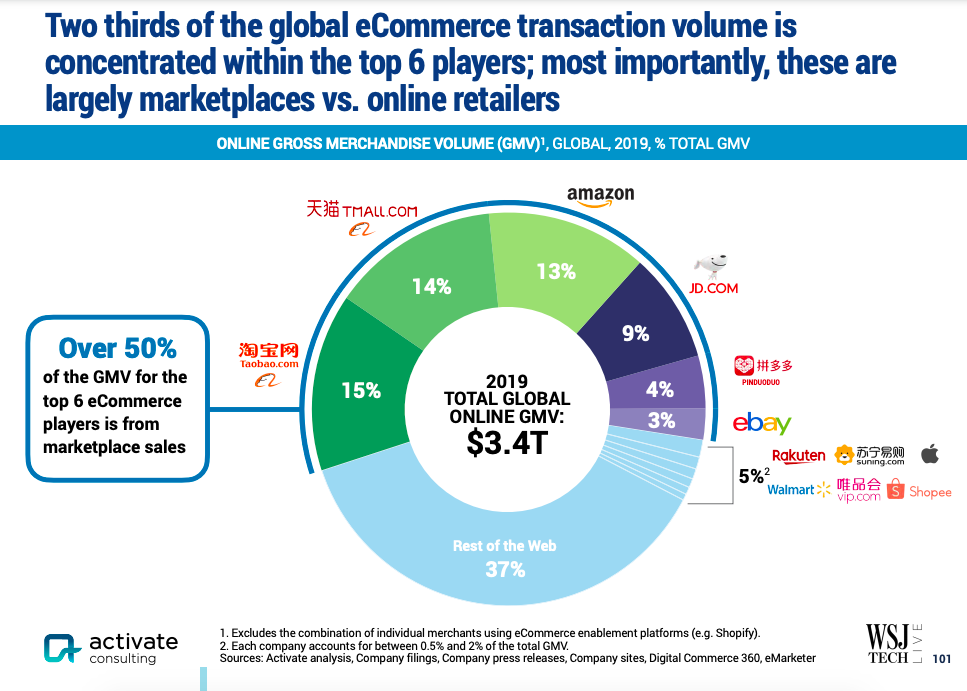

eCommerce

- Is eCommerce winner takes all? Data suggests global top 6 dominate.

- Source.

Take Two Interactive

- Interview with Strauss Zelnick of TTWO.

- “[The] mission of the company is to be the most creative, the most innovative and the most efficient entertainment company — not interactive entertainment company, entertainment company — on earth,“