- Walmart, AMZN and Instacart leading the way in terms of online grocery.

- Based on a survey of 2,500 adults by Cowen.

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

Long Term Stock Exchange Blog

- We previously covered the LTSE here and some companies (e.g. Airbnb) are indicating a desire to list there.

- They have started publishing a blog where they discuss all issues related to long-term shareholders and companies.

- The latest piece covers grading fund managers on how long term they are – LT Score.

- “This shows that the companies with the highest LT Scores trade at volatility levels that are as much as 30% lower than those with the lowest LT Scores when looking at average 100-day and 250-day historical volatility levels. This is a striking difference.“

Future of Mobility

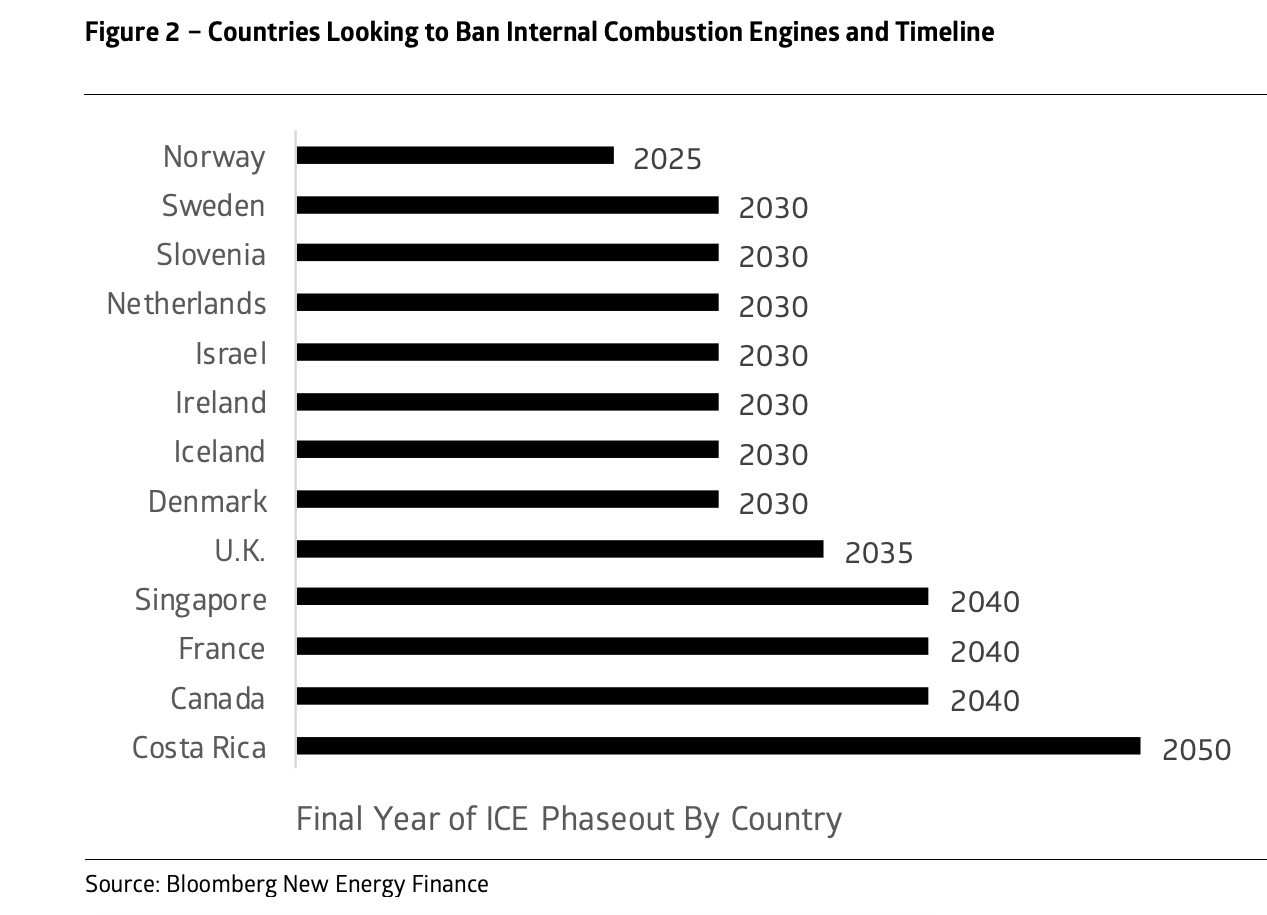

- A good chart highlighting the countries aiming to ban internal combustion engines and related timelines.

- Sourced from the comprehensive Future of Mobility report.

Spotify Transition

- Spotify is transitioning and not just via their podcast investments.

- They are starting to enter the world of advertising and arming artists with tools to reach audiences, at a price.

- First via Marquee mode – mobile app pop ups to advertise new releases. These see 20% conversion rates, 2.2x lift on saved/playlisted tracks which itself leads to increased playing by 250%.

- Second via a new Discovery mode – where an artist can boost a track in Spotify’s algorithm in return for a lower take.

- Interesting post covers the logic behind this as well as price increases.

Advertising

- “Marc Pritchard, Chief Brand Officer at P&G, the world’s largest advertiser, dropped a bombshell at the ANA conference a few weeks ago. He said that P&G would be moving away from the upfront model of TV ad buying. With TV advertising going digital, it makes no sense to make massive uninformed bets just because that’s the way it’s been done for decades. Now they can apply data to those decisions and be more deliberate ” The Trade Desk CEO Jeff Green.

- Source.

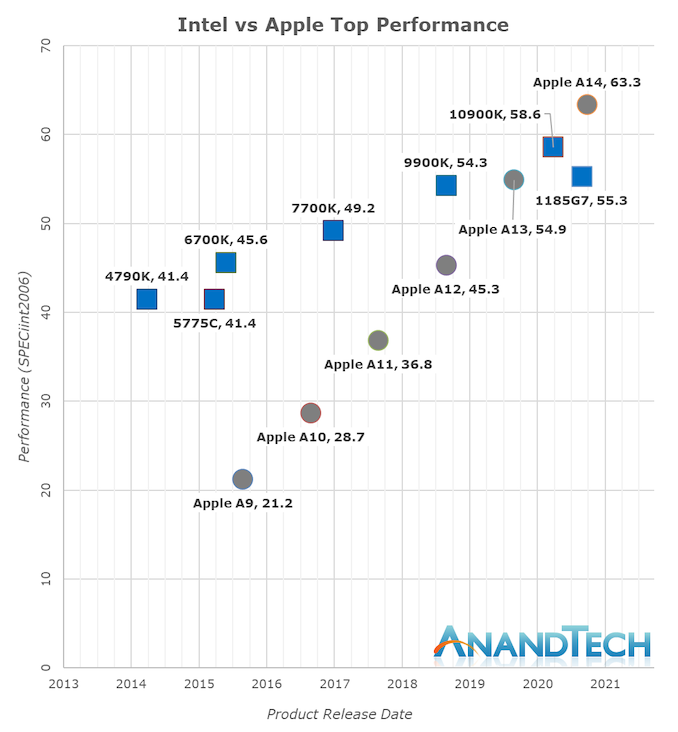

Apple’s Silicon

- Apple silicon performance improvement has been staggering – “Whilst in the past 5 years Intel has managed to increase their best single-thread performance by about 28%, Apple has managed to improve their designs by 198%, or 2.98x (let’s call it 3x) the performance of the Apple A9 of late 2015.“

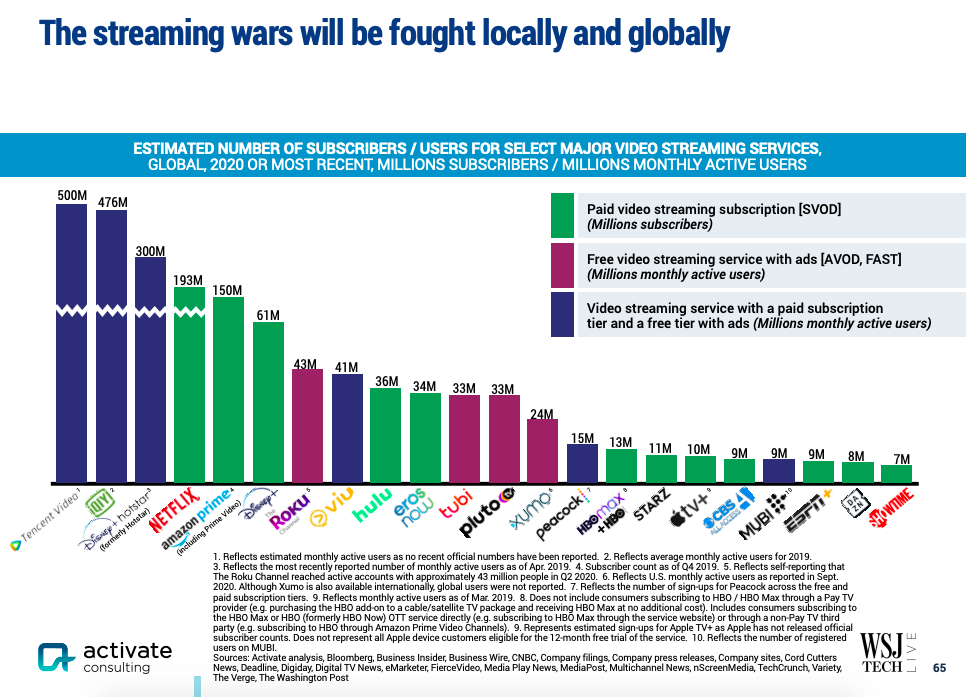

Video Streaming

- Global landscape of streaming companies by number of users/subs.

- Source.

Teen Survey

- 40th edition of the semi-annual survey of 10,000 teens and their preferences has been released.

- Amazon, SHEIN, male skin-care, Tik-Tok, Netflix, Video games, Louis Vitton – on the up.

- Female cosmetics, Instagram, Michael Kors – on the down.

ESG Funds

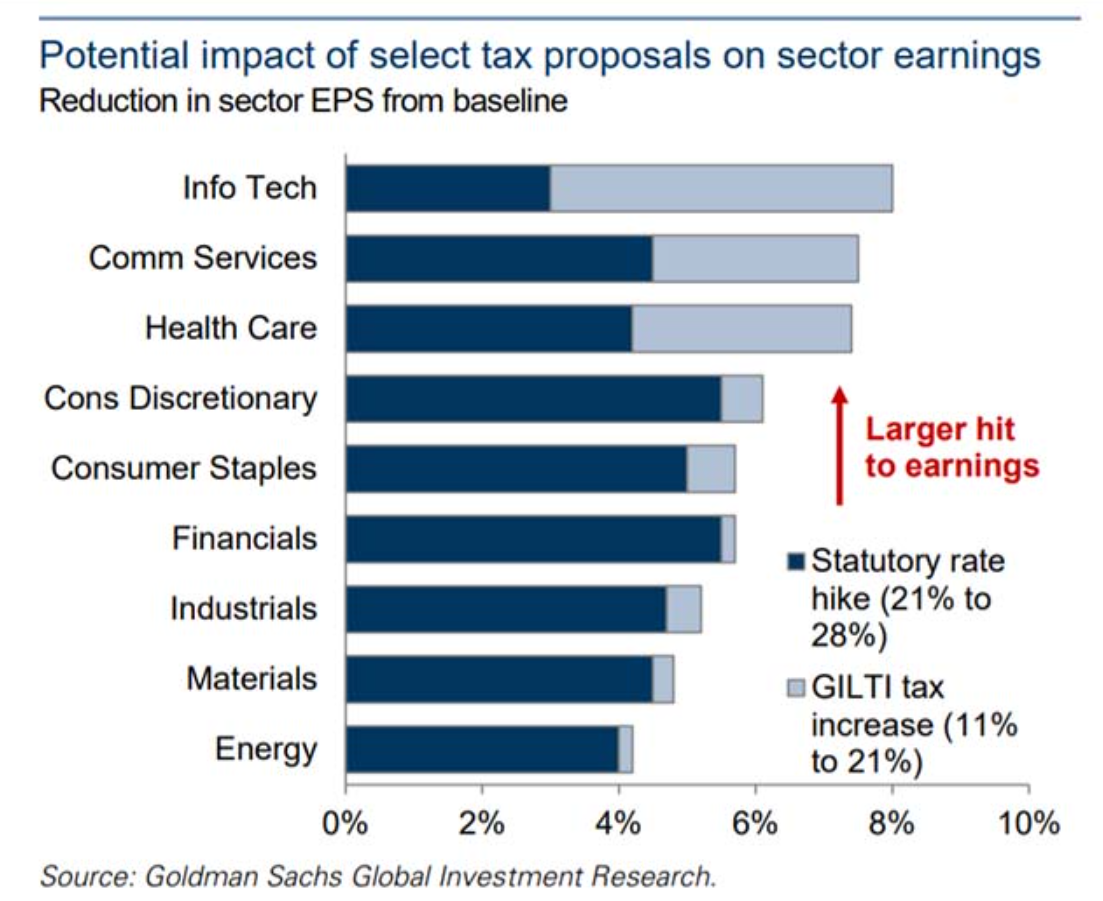

Tax impact

- Biden’s election is likely to lead to a rise in taxes for companies in the US and this chart shows the hit to EPS by sector from these policy changes.

- Tech and Healthcare will be hit the worst.

Hotel Occupancy

Biogen Saga

- Earlier this year we covered Biogen’s decision to file Aducanumab (their experimental treatment for Alzheimer’s Disease) here and here.

- This saga reignited this past week with the publication of FDA adcom documents which on the surface looked positive sending the shares soaring only to be voted down (8-1) at the meeting on Friday sending them crashing down.

- This really good blog post discusses these events and why it is always important to read all the details.

- The final FDA outcome is yet to be determined (Adcom decisions aren’t binding) and as previously highlighted could be political.

Rangebound

- Interesting chart curtesy of themarketear pointing out that despite all the action the S&P 500 has been rangebound since the summer.

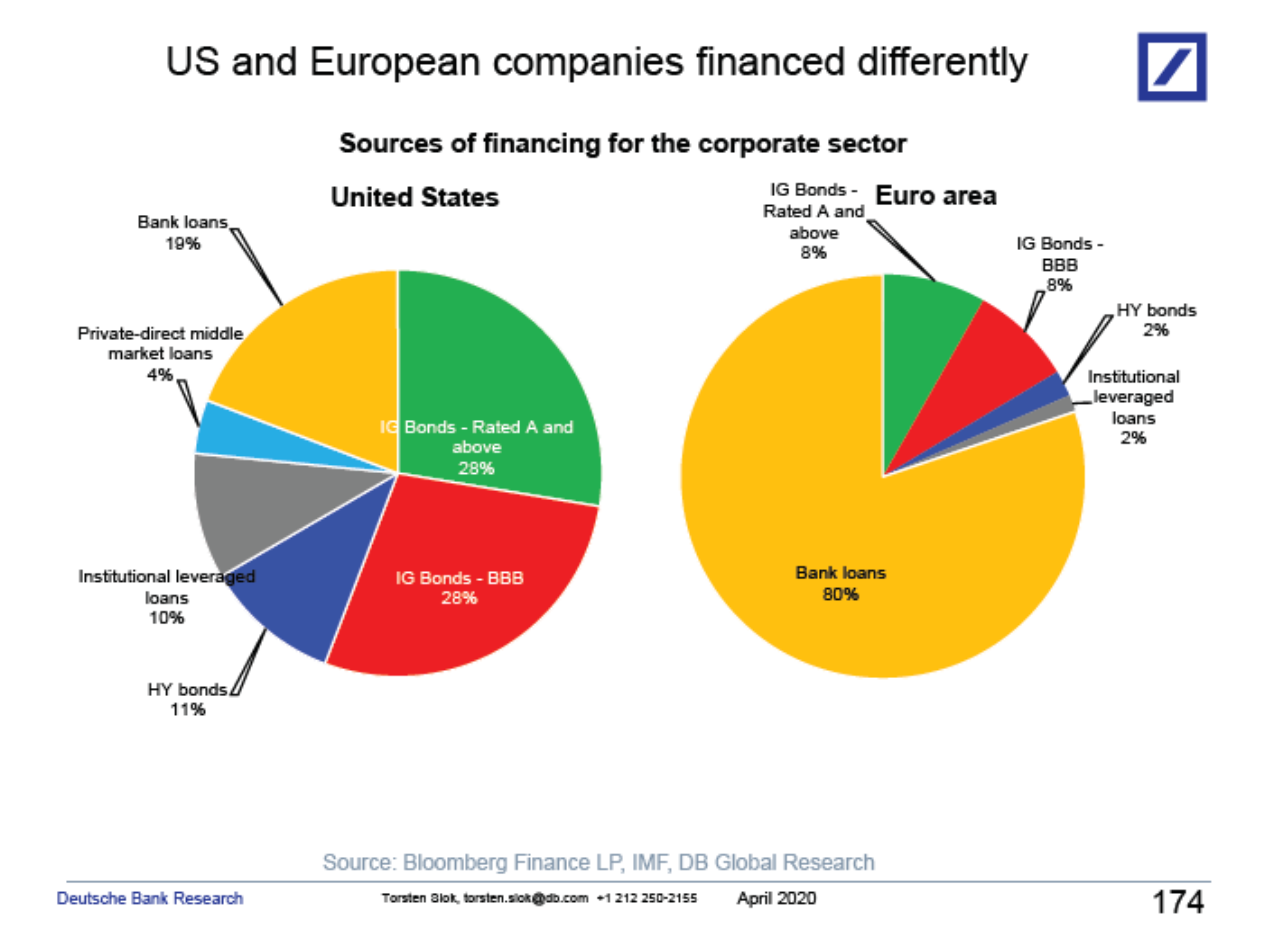

Finance US vs. EU

- Always worth remembering the huge difference in how US and European companies are financed.

- Source.

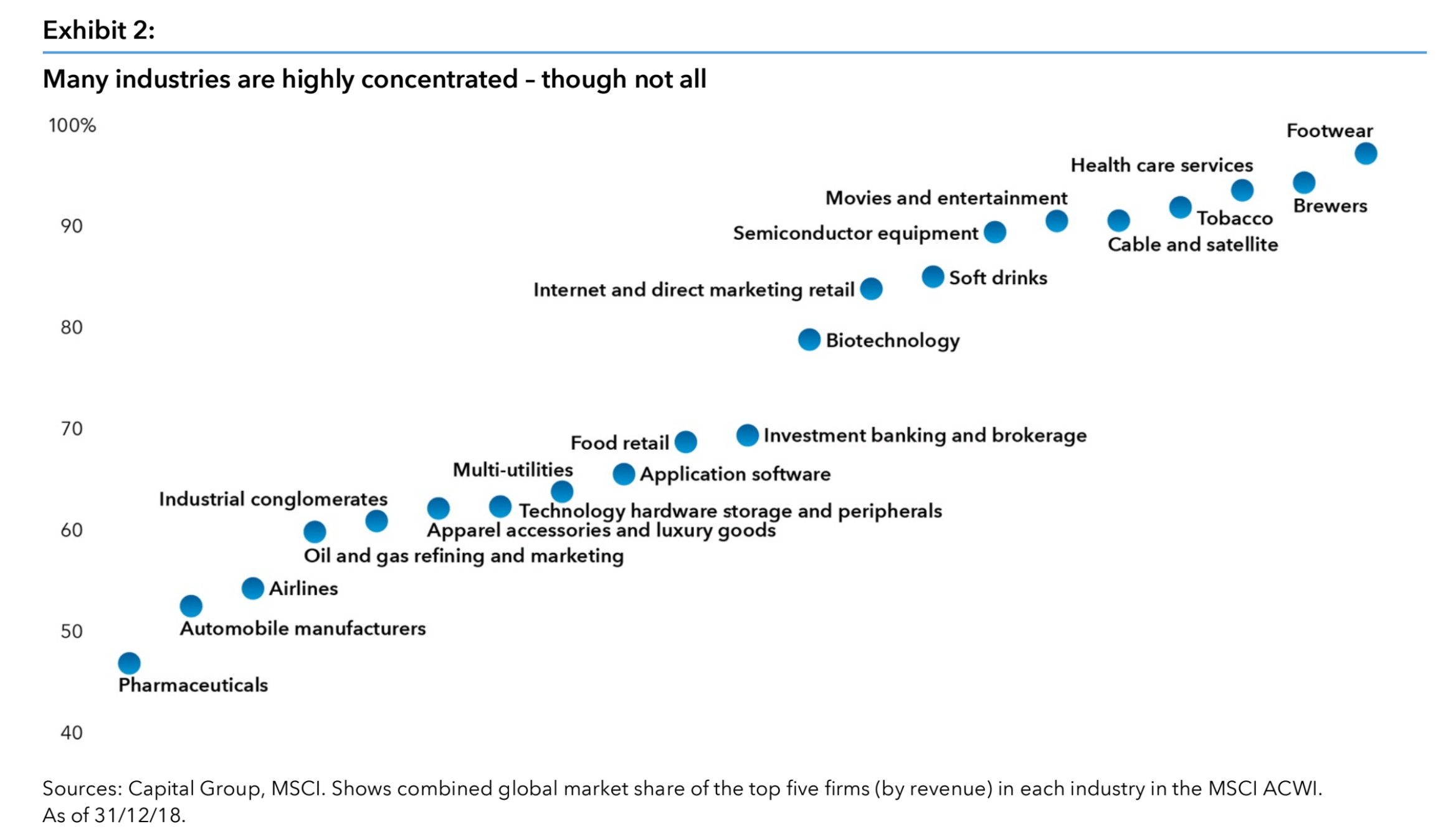

Industry Concentration

- Fascinating chart of concentration by industry.

Short Research

- Nice video on conducting research on shorts using NMC Healthcare as an example.

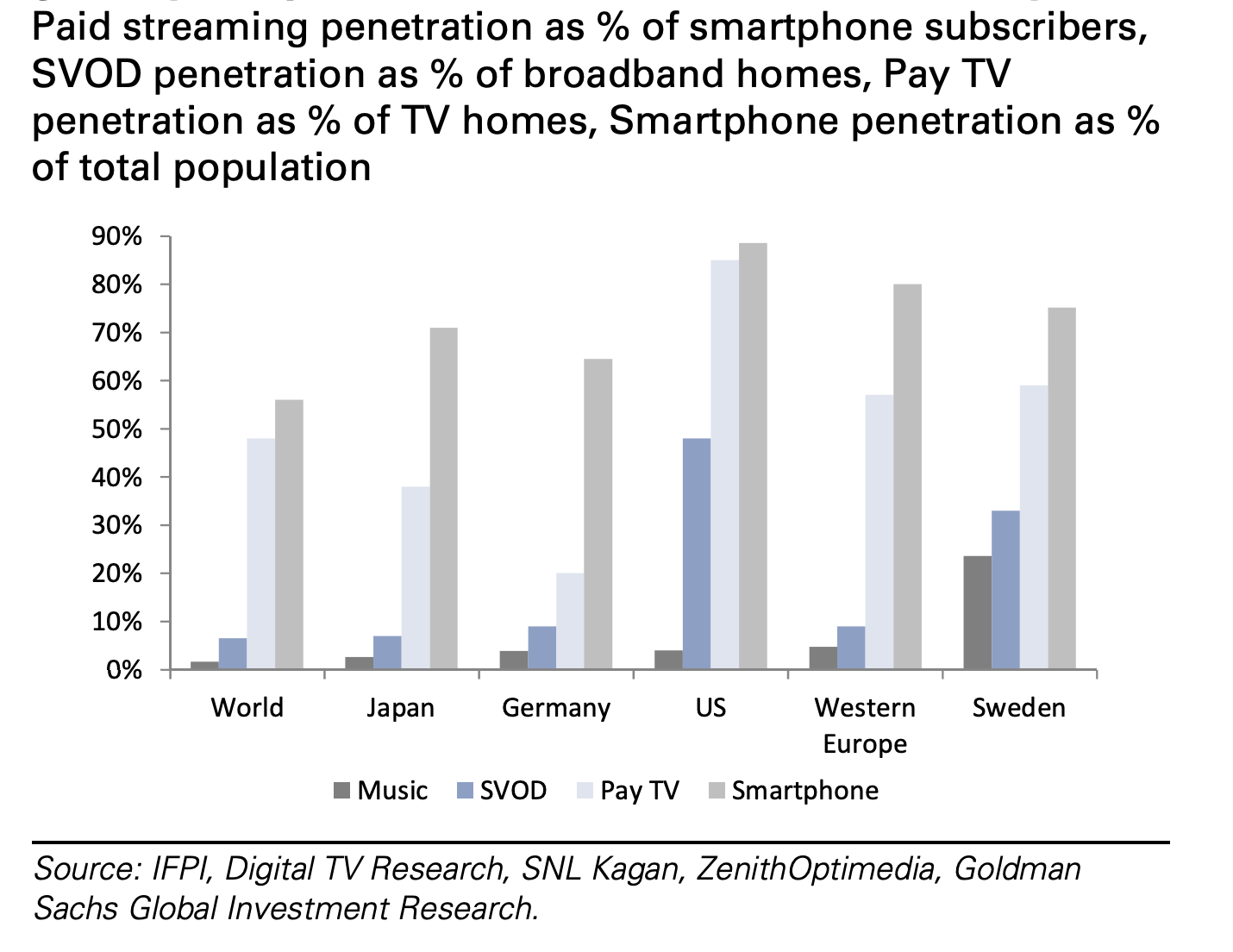

Music Streaming Penetration

- Paid streaming penetration is only 2%.

- This is low when compared to 6% for SVOD and 48% for Pay TV.

- The advertising opportunity is also tremendous – Radio alone still pulls in $30bn in advertising vs. estimated $1.5bn for streaming.

Online is Taking Over Pt II

- Eye opening stat from Domino’s Pizza courtesy of The Transcript.

- “There was a trend toward digital ordering pre-pandemic, and that significantly accelerated during the pandemic. I don’t expect customers to go back to calling on the phone, I expect digital ordering to continue to grow post-pandemic. And I feel that we are very well-positioned in that space today with 75% of our sales in the U.S. digital as we sit here today”

Music Streaming

- A good chart showing positioning of music streaming services.

- Spotify is well ahead of the pack.

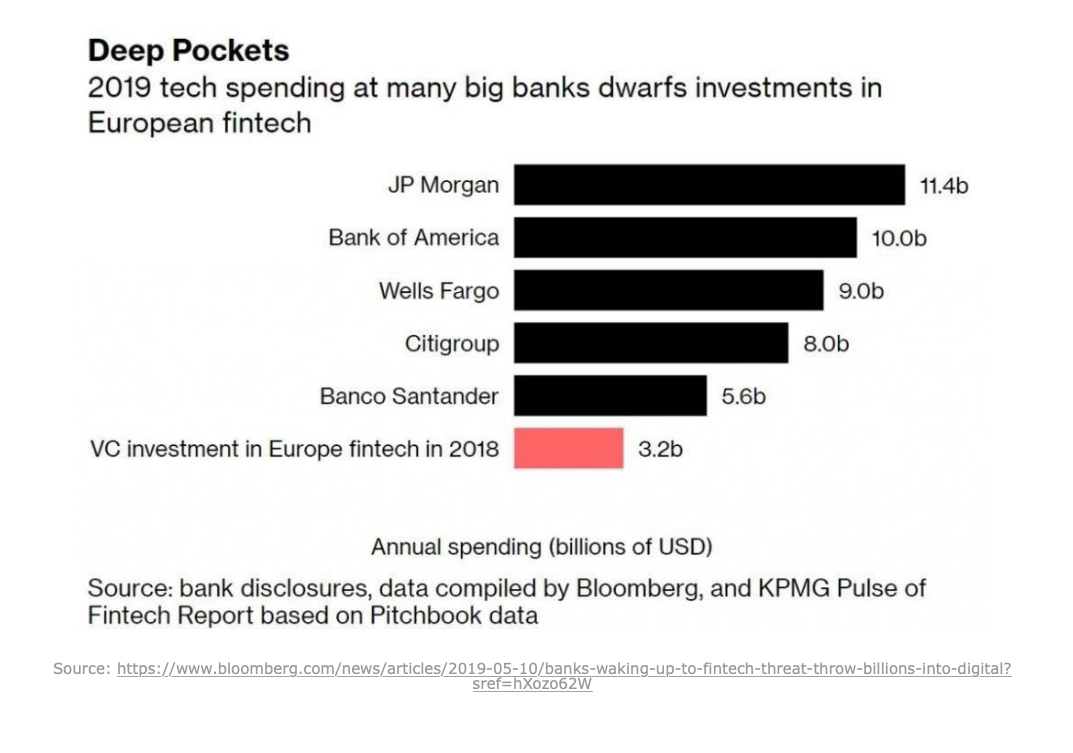

Bank Tech Budgets

- A nice chart showing how big bank annual tech investment dwarfs all investment in fintech in Europe.

- h/t GraphicOne.