- 40% of new (straight) relationships in the USA started online.

- Due to Covid this is likely higher today than in 2017 where the data ends.

- “The intensity with which singles are swiping and chatting is visible across all Match Group dating apps, which include Tinder, OKCupid, Match.com, Hinge and Plenty of Fish. Amarnath Thombre, the chief executive of Match Group Americas, said that messages were up 30 to 40 percent on most of the company’s apps compared with the same time last year.”

- Source.

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

Sugar

- Interesting long read on the quest to chemically redesign sugar.

- In 1880 the average American would have lived and died never having encountered a single manufactured candy. Today the average American ingests more than nineteen teaspoons added sugar every day.

- Despite a turn in public opinion against sugar, alternatives don’t work – “none of sugar’s artificial replacements offer anything close to the same range of functionality. Sucrose reduces ice-crystal formation in ice cream; it adds crispness to baked goods, volume to dough, and a mouth-filling viscosity to drinks; it improves emulsion stability in dressings, reduces grittiness in chocolate, and even increases shelf life.”

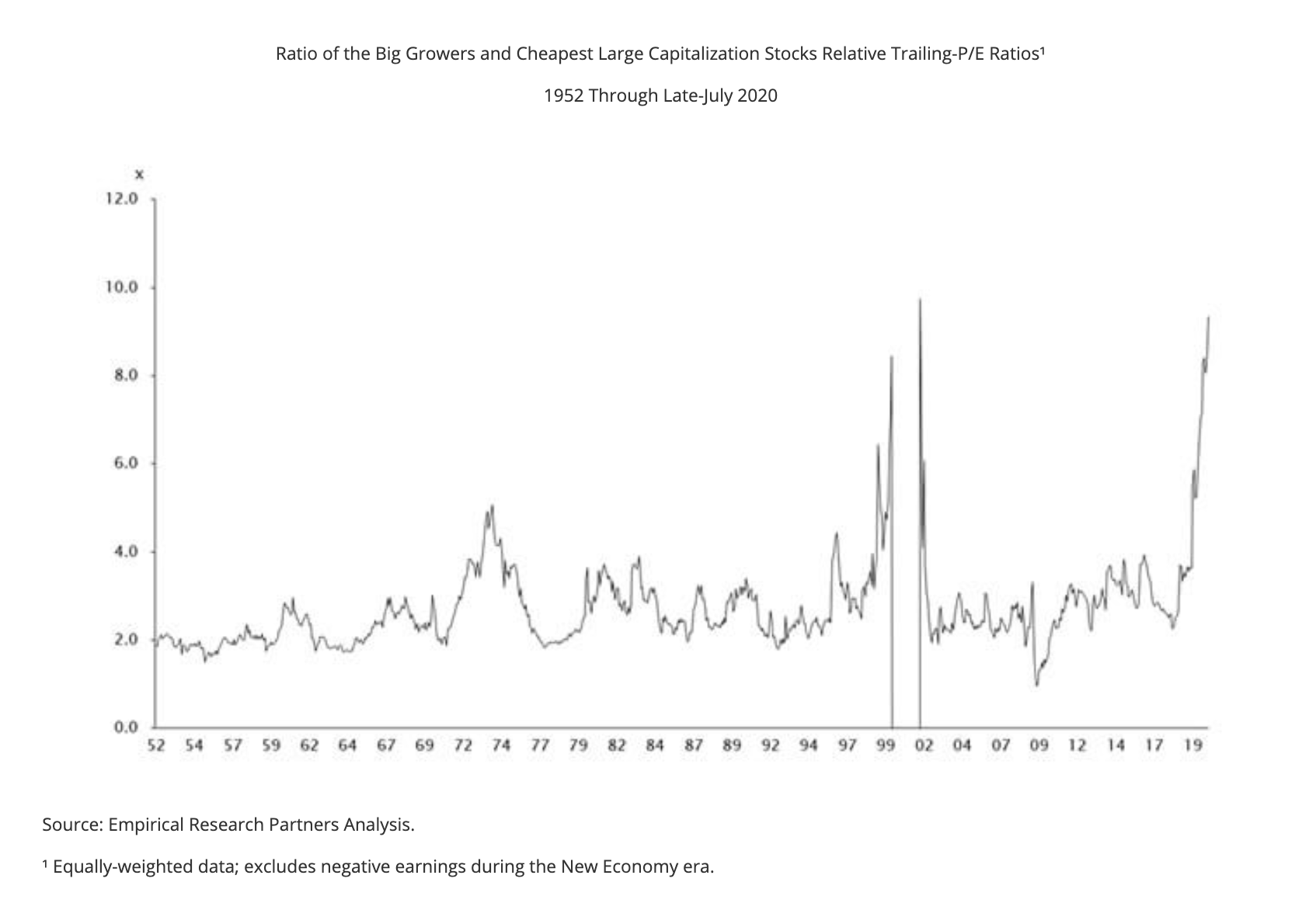

Growth Premium

- Premium to growth is three to four times larger than normal.

- This chart compares the P/E of 75 fast growing companies and the P/E of the 100 lowest P/E companies.

- For 70 years this ratio, ex a 1999, was 2-3x.

- Today that ratio is 10x – justified somewhat by low interest rates.

- Source.

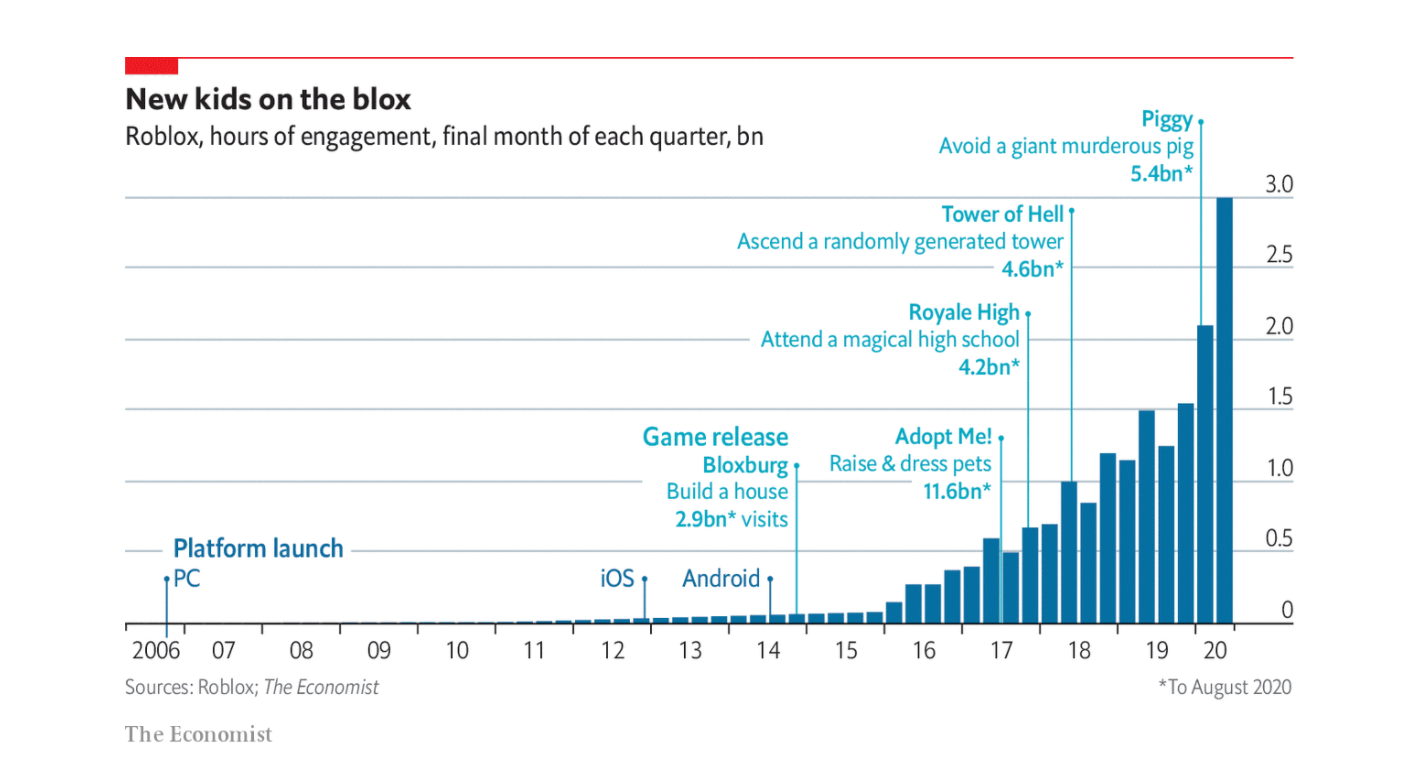

Roblox

- Roblox is filing for IPO.

- If you haven’t heard about it – its an online platform that lets users program their own games.

- It boasts 150m MAUs (more than Minecraft) and on track to make $250m of revenue (more than double 2019). Engagement, as pictured, is off the charts.

Daniel Ek Interview

- Interview with Spotify founder and CEO Daniel Ek.

- Interesting insights throughout.

- “A great meeting has three key elements: the desired outcome of the meeting is clear ahead of time; the various options are clear, ideally ahead of time; and the roles of the participants are clear at the time.“

- “I think that’s the single largest source of optimization for a company: the makeup of their meetings. To be clear, it’s not about fewer meetings because meetings serve a purpose. Rather, it’s key to improve the meetings, themselves. A lot of my efforts focus on teaching people this framework. Ironically, I find that most people are just challenged by that stuff.“

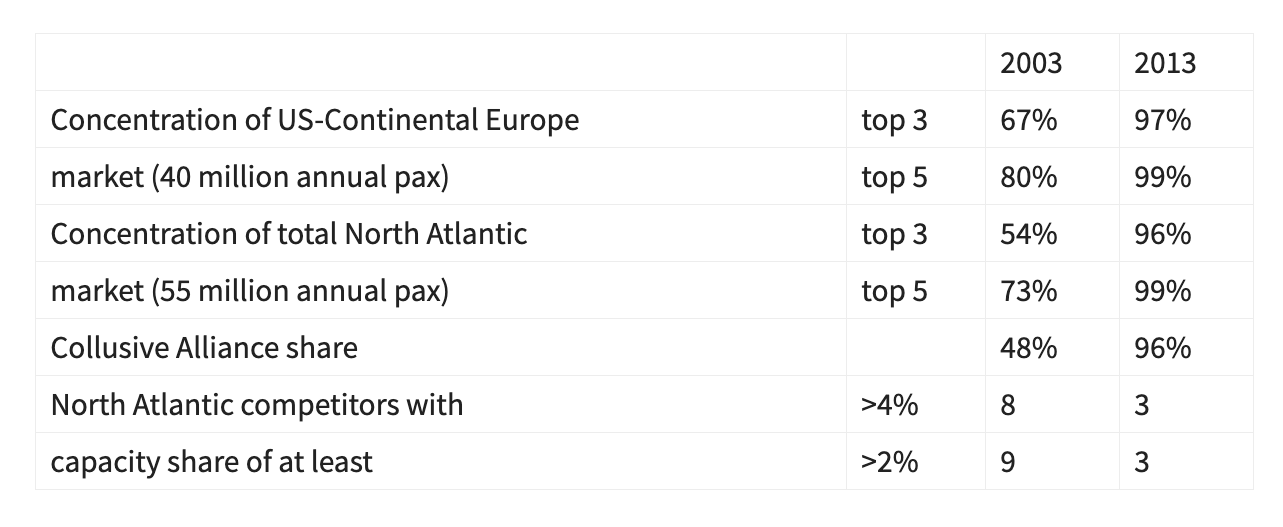

Airlines

- A very bearish video on the future of the airline sector.

- It argues that consolidation of the airline sector has made it far less capable of dealing with the current collapse in revenues.

- h/t FT Alphaville.

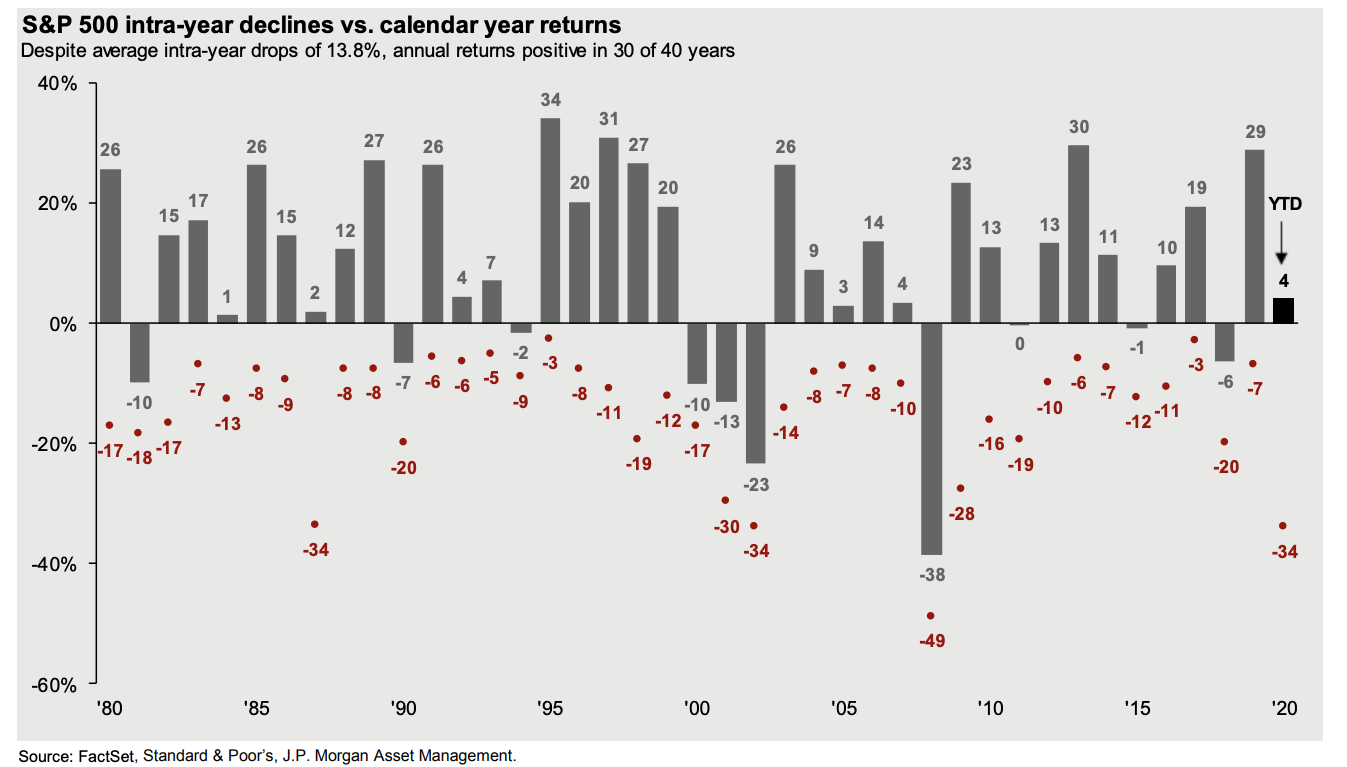

Intra-year declines

- Nice chart showing annual stock market performance (bars) as well as intra-year declines (red-dots).

- Despite intra-year falls of an average -13.8%, 30 of the last 40 years have seen positive annual returns.

- Source.

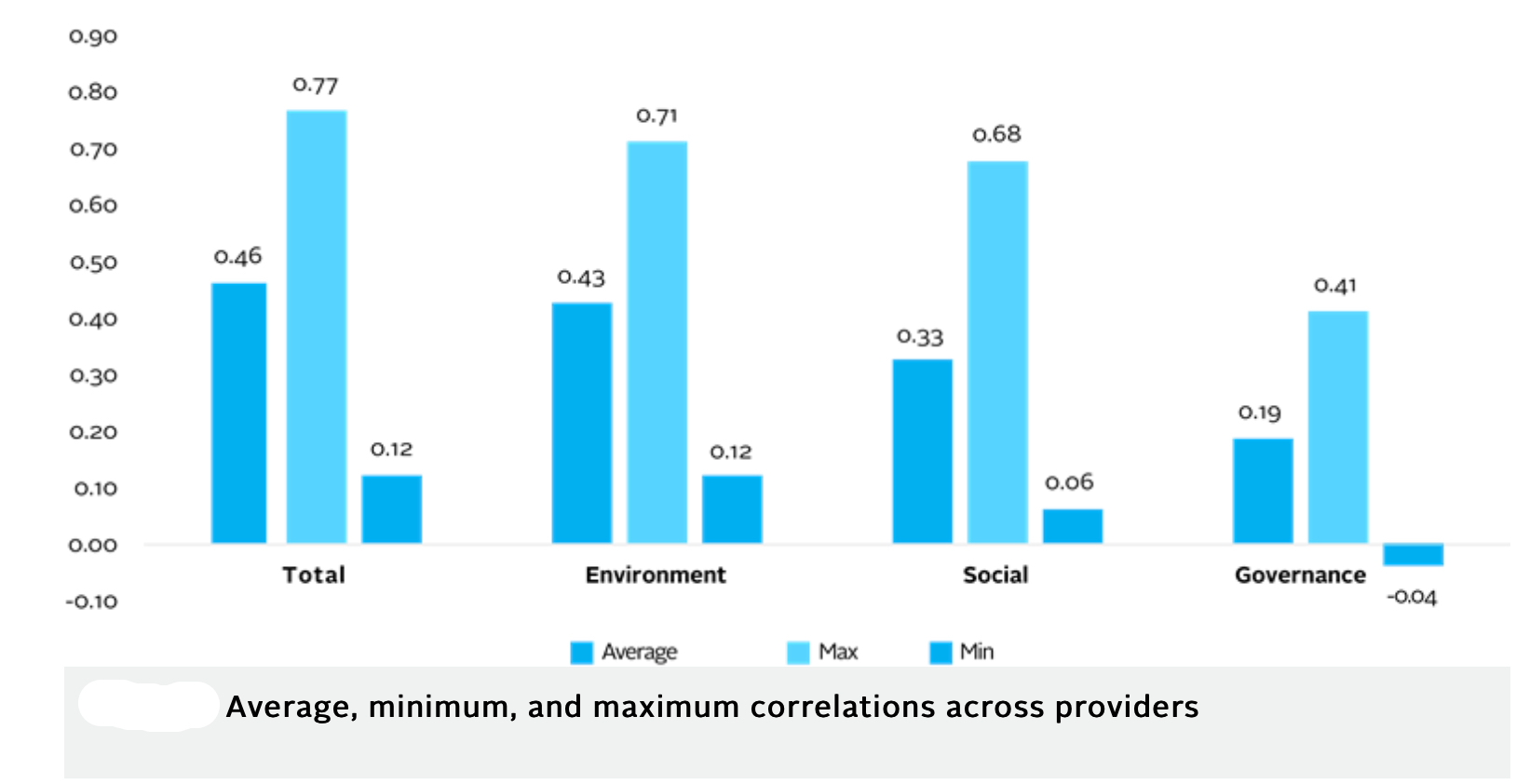

ESG

- A sceptics view on ESG full of interesting ideas.

- Current ESG scores are contradictory as seen in the chart showing correlation across providers.

- This point, rarely raised about ESG, argues that markets adjust to price things in – “If there is an investing lesson embedded here, it is the unsurprising one that investors who hope to benefit from ESG cannot do so by investing mechanically in companies that already identified as good (or bad), but have to adopt a more dynamic strategy built around either aspects of corporate social responsibility that are not easily measured and captured in scores, or from getting ahead of the market in recognizing aspects of corporate behavior that will hurt the company in the long term.”

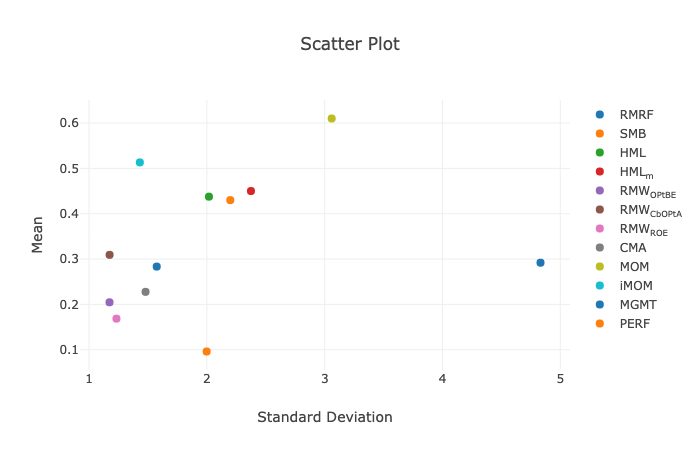

Global Factor Premia

- A site that estimates local factor returns – underrepresented and useful variables in asset pricing models.

- It features twelve common factors for over 50 international markets.

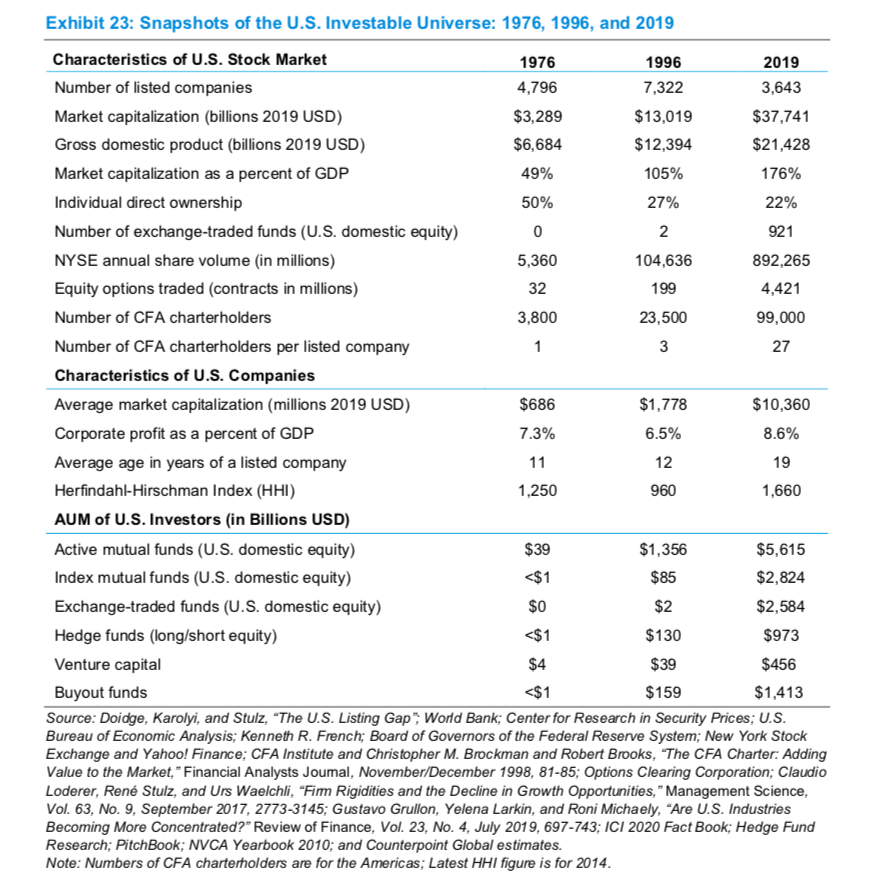

Then and Now

- Snapshot of US stock market, companies and investors in 1976, 1996 and 2019.

- Source.

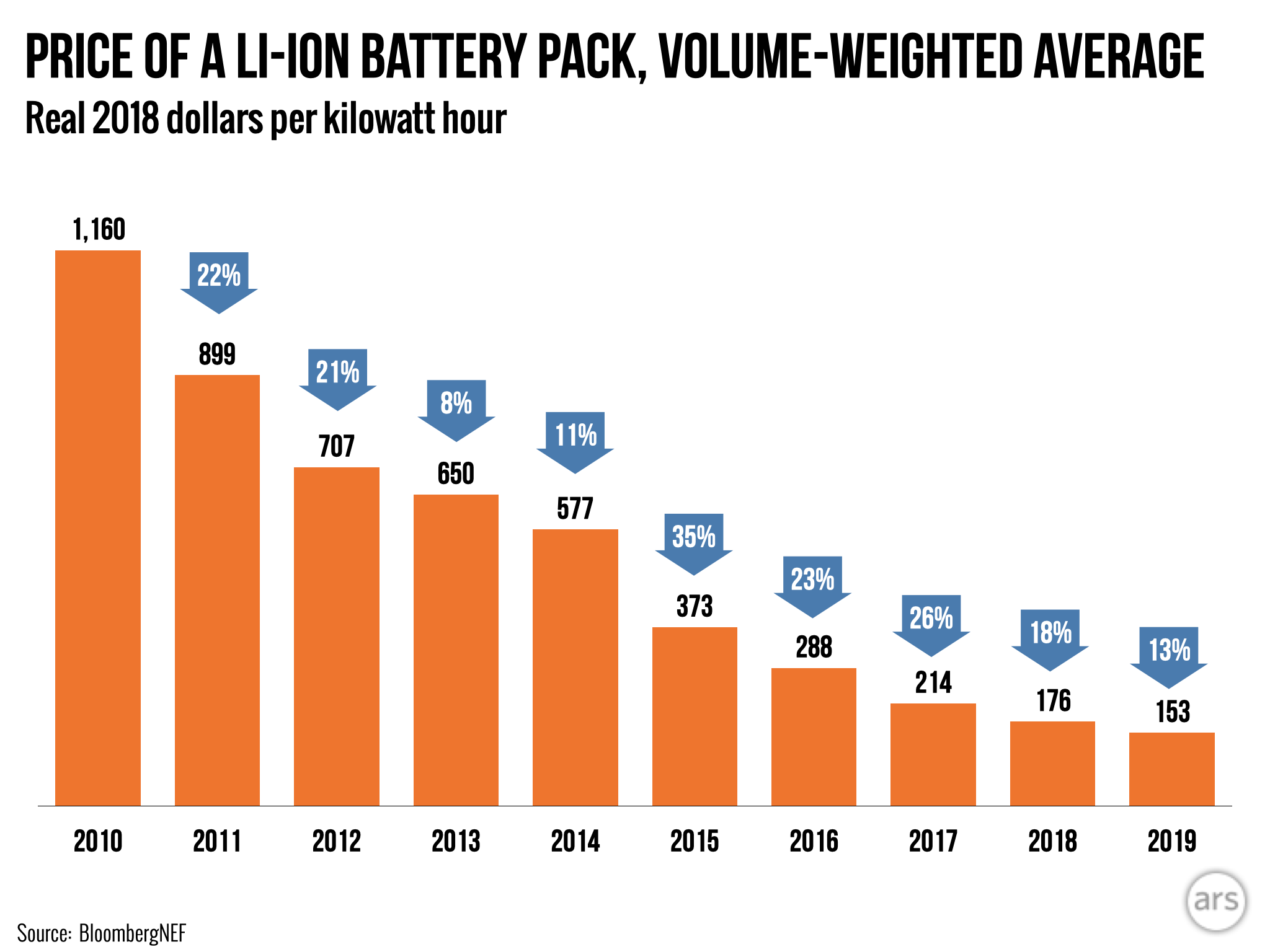

Battery Prices

- Battery costs have fallen six fold since 2010.

- Nice article on the economics of cheaper batteries.

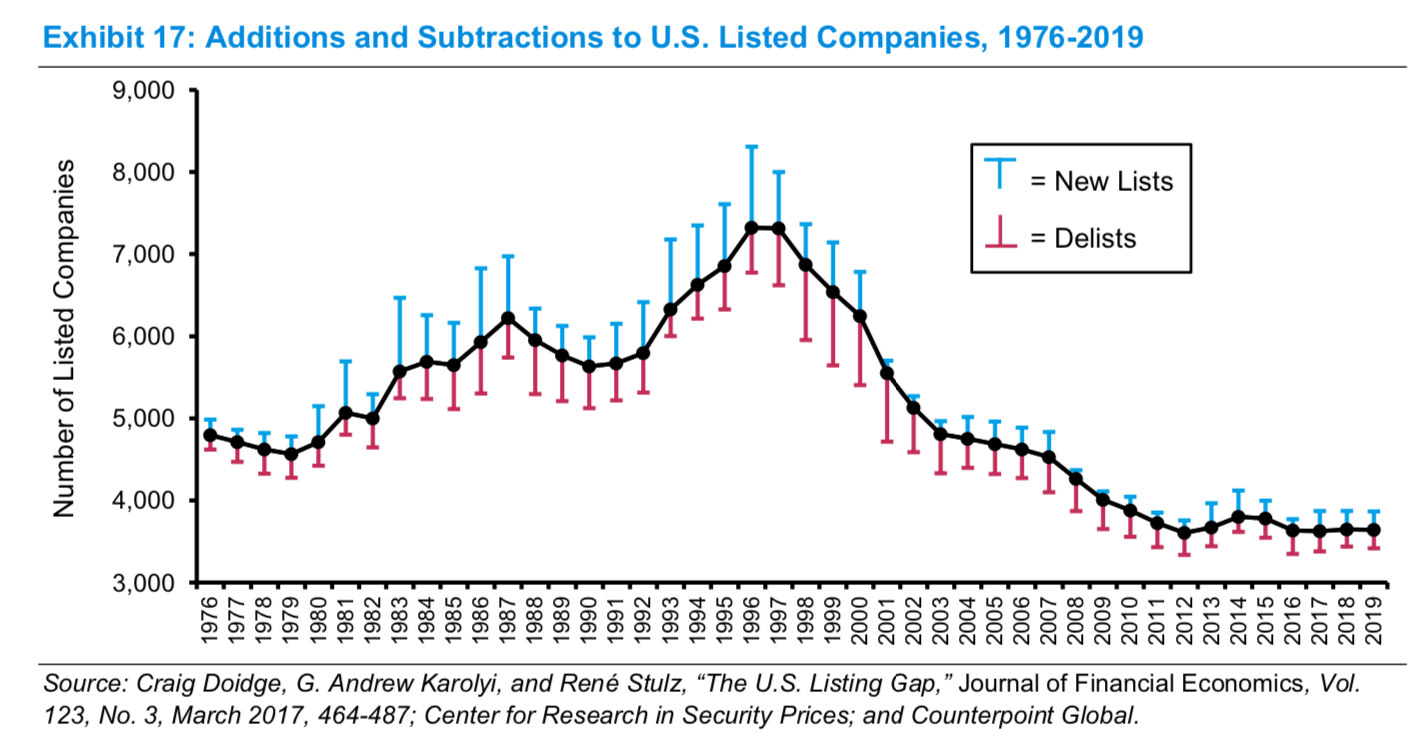

Listed Companies in the US

- The number of publicly listed companies in the US has fallen since the mid-1990s.

- This chart captures this decline in the total number of listed stocks, including additions and subtractions each year from 1976 to 2019.

- “There are one-half as many public companies as there were in 1996 and three-quarters as many as there were in 1976. The Wilshire 5000 Total Market Index, launched in 1974 to reflect the complete U.S. equity market, had 3,473 stocks as of December 31, 2019.”

- Source.

Public to Private Equity

- “Over the past quarter century there has been a marked shift in U.S. equities from public markets to private markets controlled by buyout and venture capital firms. This change has had reverberations for asset managers, investors, executives, and policy makers.“

- A phenomenal and must read note from Mauboussin.

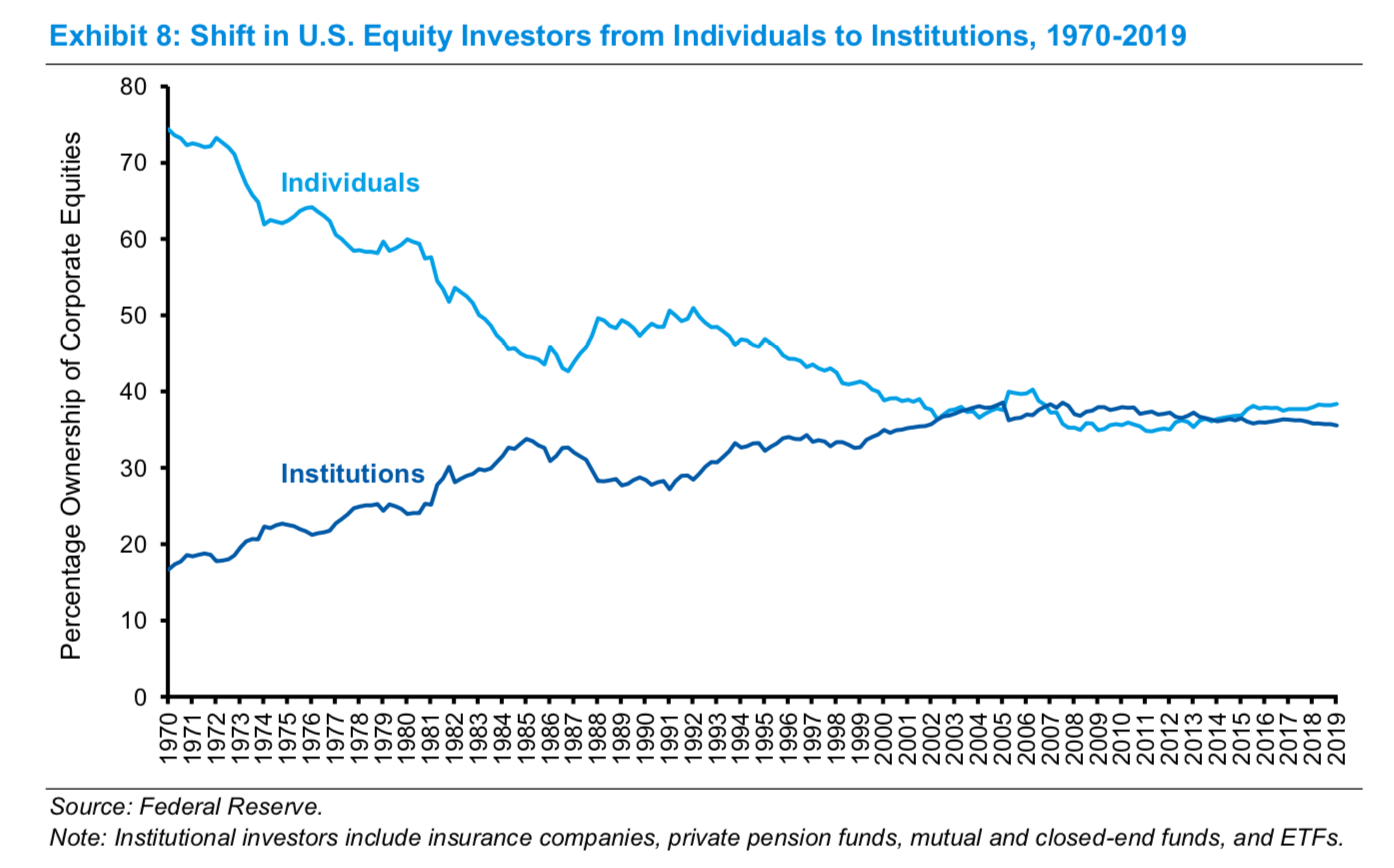

Institutions Took Over

- “In 1970, individuals held roughly 75 percent of public equities and the institutional investment management industry was nascent”

- This has moved steadily downwards as institutions took over.

- “We estimate that the number of chartered financial analyst (CFA) charterholders per public company increased from roughly 1 in 1976 to 27 in 2019.“

- Source.

Nintendo

- A really insightful and bearish essay on Nintendo.

- “However, the “Nintendo is Disney” thesis is deeply flawed. It feels more like a desire to apply a pattern than to find a real analogue. Elements of Nintendo certainly represent Disney, but they represent Disney insofar as both companies are best in class creators of four-quadrant, multi-generational content. Otherwise the businesses are fundamentally different, their management styles fundamentally different, and their approaches to content itself are fundamentally different, too.”

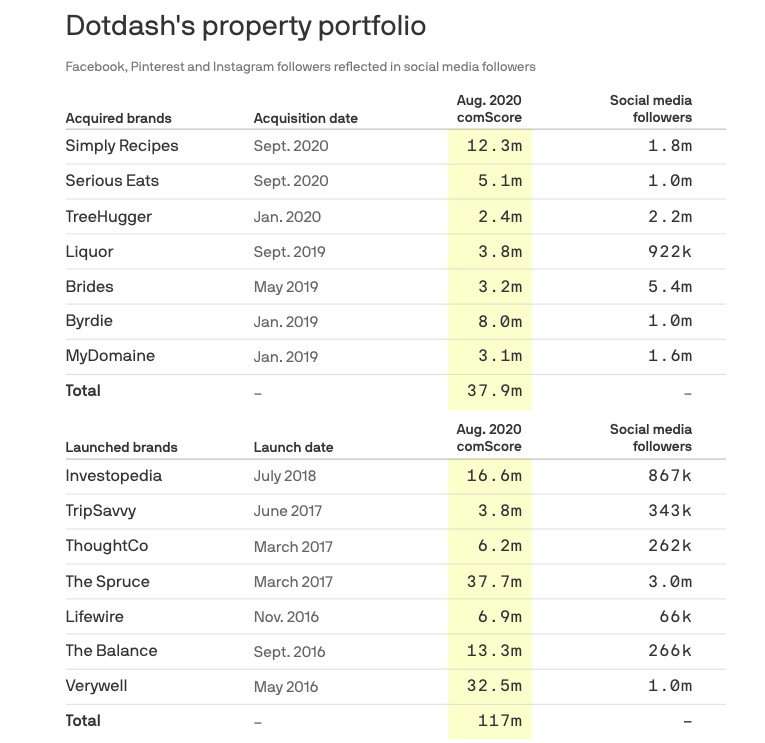

Dotdash Pt II

- Snippet has previously written about DotDash, owned by IAC.

- The business is annualising $180m of revenue, made 24% EBITDA margins last year and continues to grow double digits.

- Part of the strategy is to grow the portfolio – organically and inorganically – and this is a nice table capturing it so far.

Tik Tok

- TikTok is a phenomenon.

- Their rise had a lot to do with a huge advertising campaign in the US

- This stat is staggering – for a period in 2018 “nearly 22% of all ads seen by U.S. Apple device users on Facebook ad network came from TikTok and its Chinese counterpart Douyin”

- As the article points out this actually provides more evidence of Facebooks dominance.

Uber

- A fascinating piece tearing apart Uber’s business model.

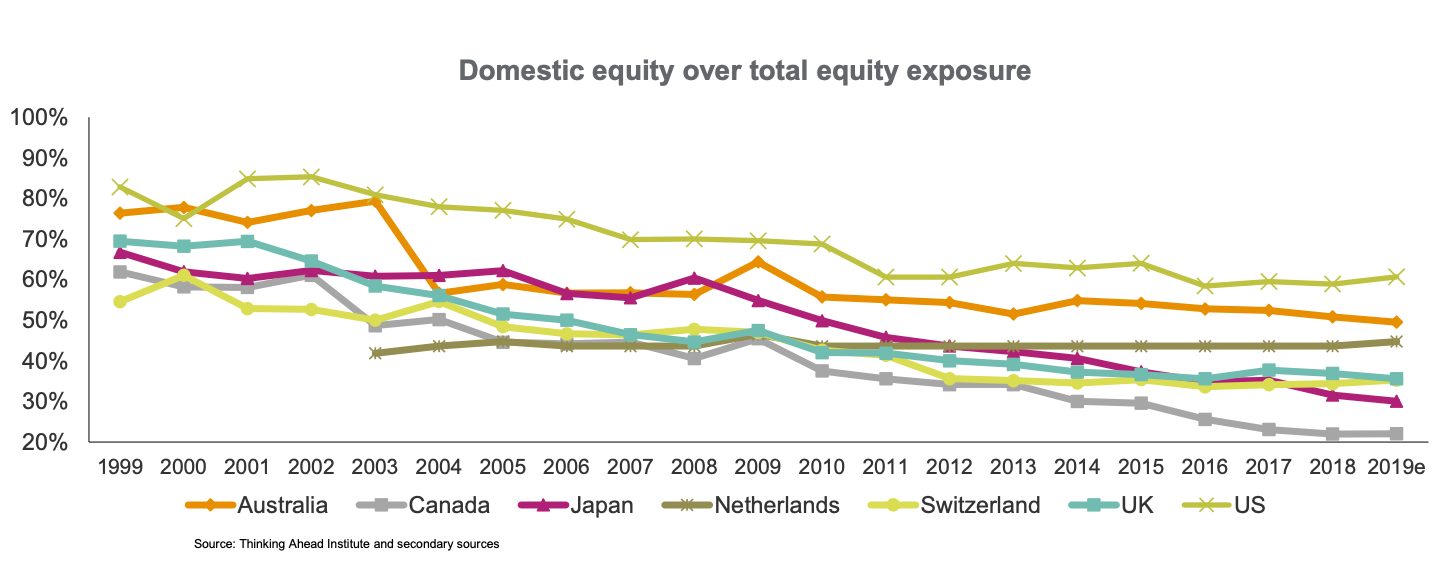

Equity Home Bias

- For Pensions – “There is a clear sign of a reduced home bias in equities, as the weight of domestic equities has fallen, on average, from 68.6% in 1999 to 39.7% in 2019.”

- Source.

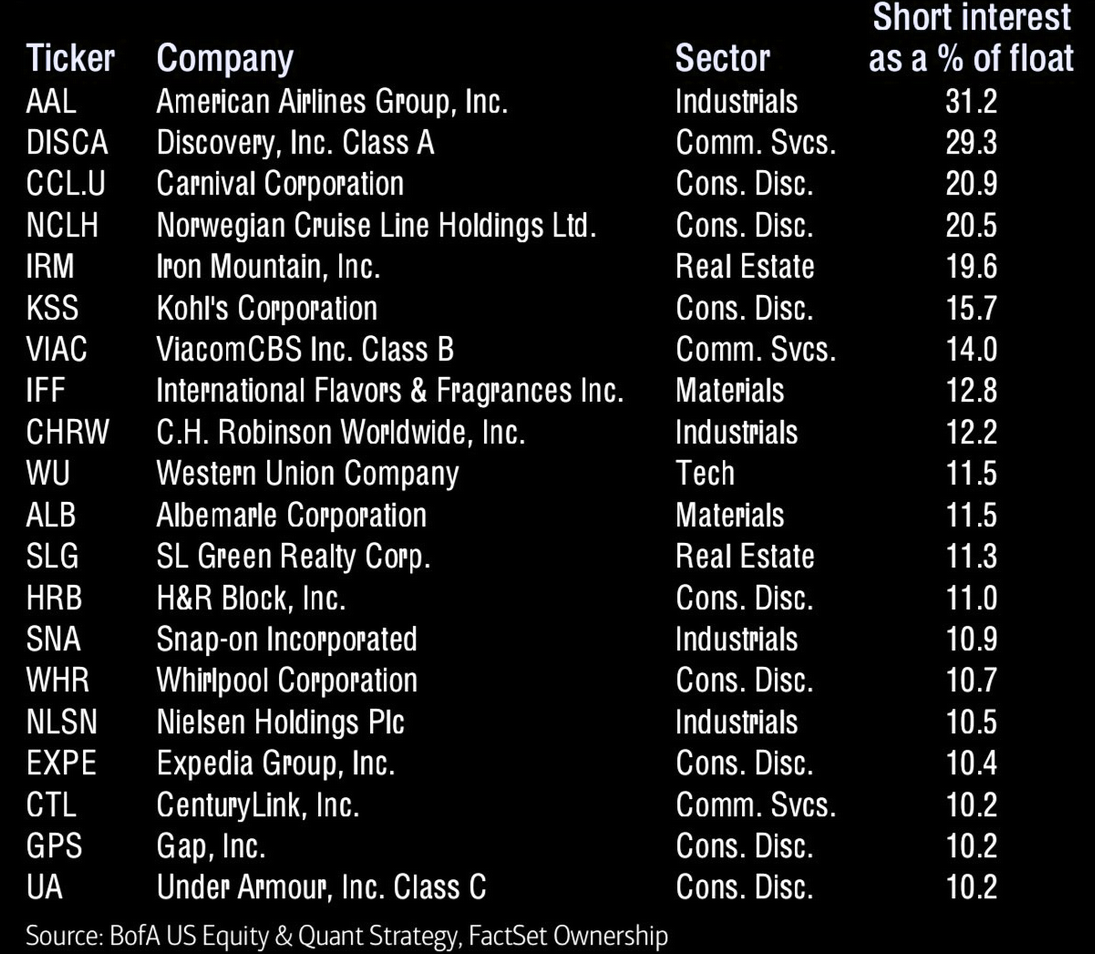

Most Shorted US Stocks

- h/t themarketear.