- Remarkable how Sky Bet has gone from 5th in 2015 to 1st today.

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

EU Banks

- “Some banks trade at valuations equal to (or less than) their surplus capital, implying that the banks themselves—including their interest-rate-resilient wealth management divisions, trading and operations segments, and automobile and mortgage lending businesses—are free.“

- Source.

Reed Hastings Profile

- Interesting NYT profile of the CEO of Netflix.

- On culture – “part of daily life at Netflix with a daily Circle of Feedback and annual written and live 360 Assessments, in which you meet with the team to get ripped apart.“

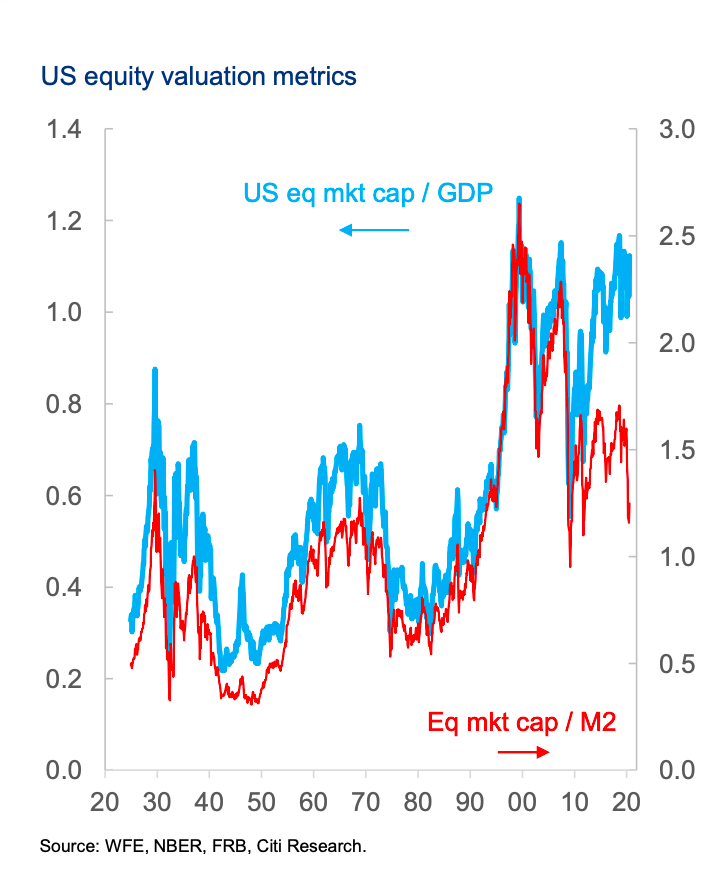

Equity Valuation

- When compared to fundamentals (GDP) equities look expensive but not if compared to money measures (M2). Interesting contrast.

Exchanges

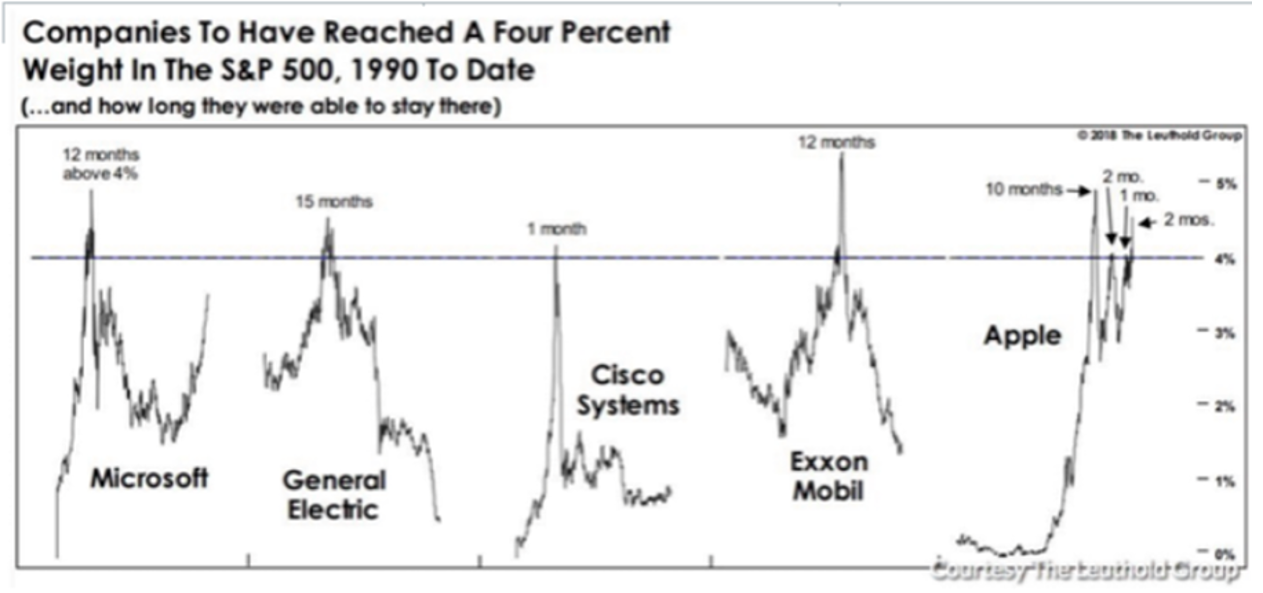

Hype doesn’t pay

- Chart showing how it doesn’t pay to chase when the biggest stocks roof it.

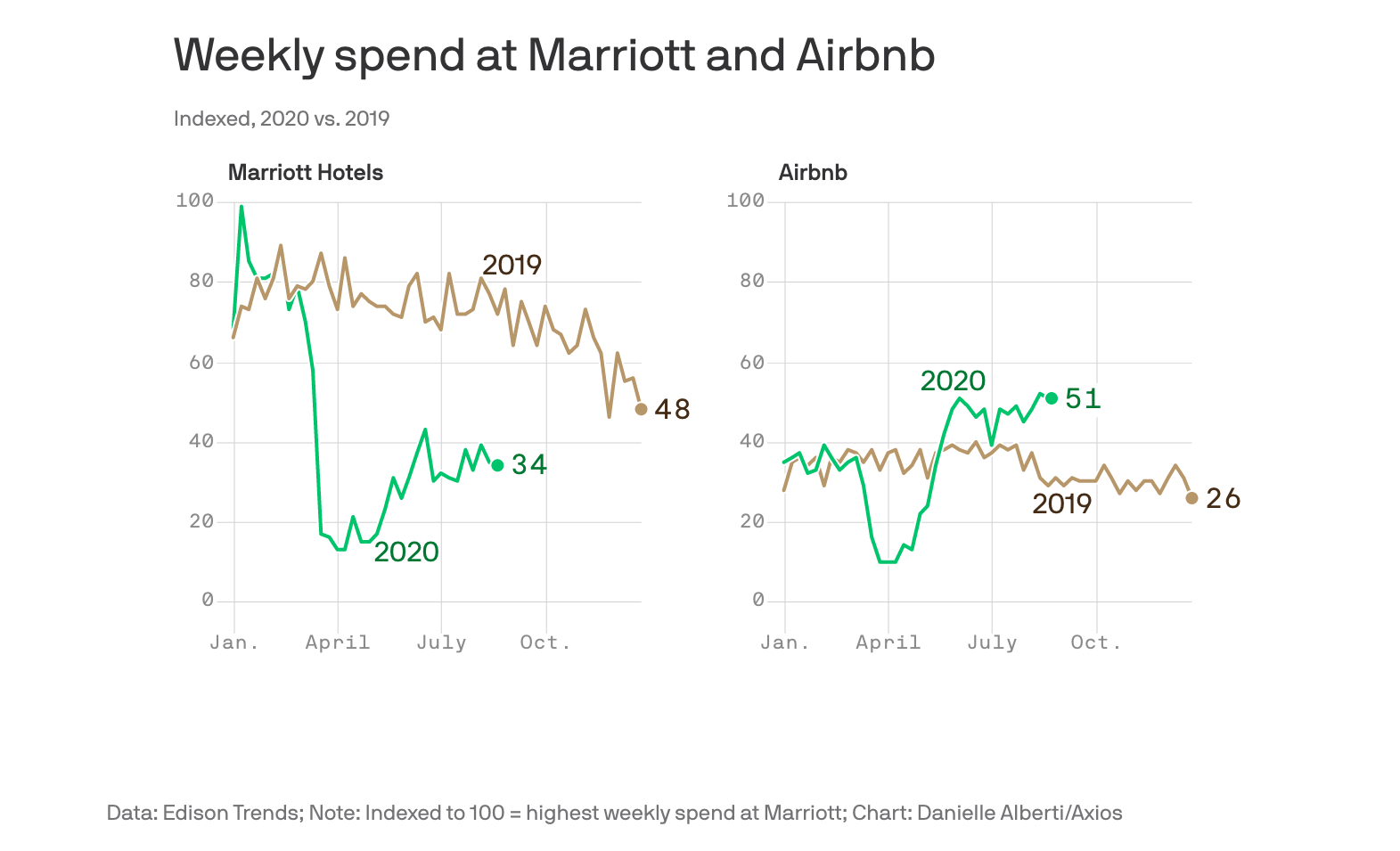

Airbnb

- Interesting to see Airbnb bounce back like this.

- “Airbnb spending is running a whopping 75% higher than this time last year according to Edison Trends, based on a panel of spending data including more than 65,000 Airbnb transactions.“

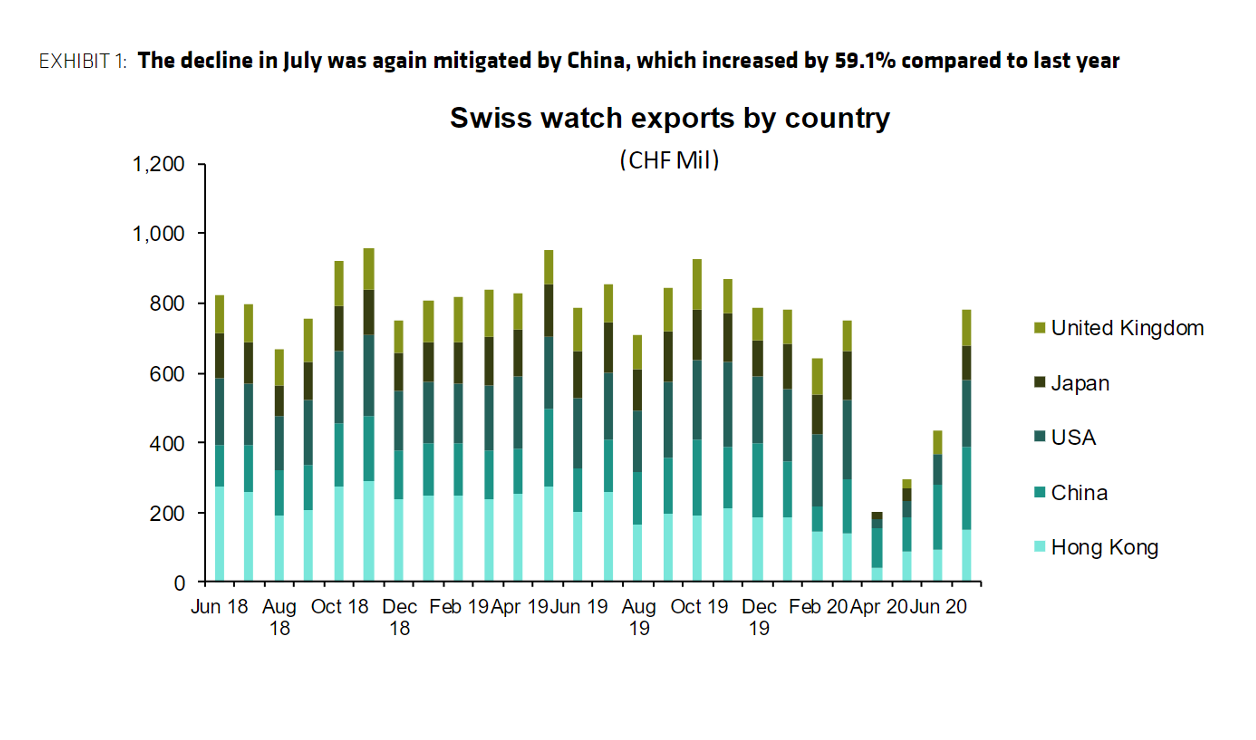

Swiss Watch Exports Recover

- Recovery is being primarily supported by China.

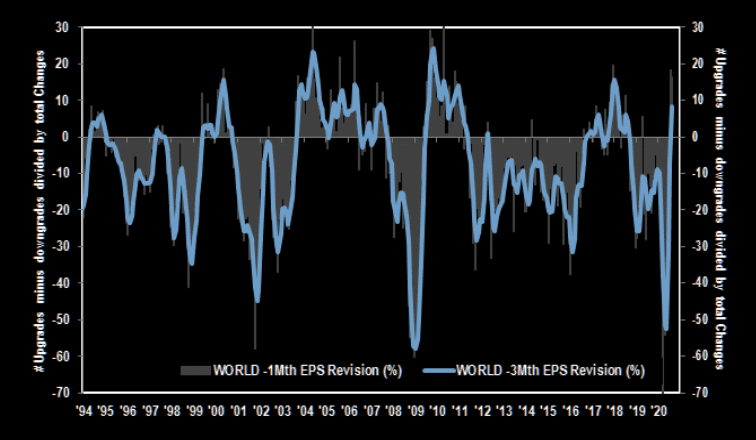

Earnings Revisions

- Earnings revisions are back to positive.

- h/t The Market Ear.

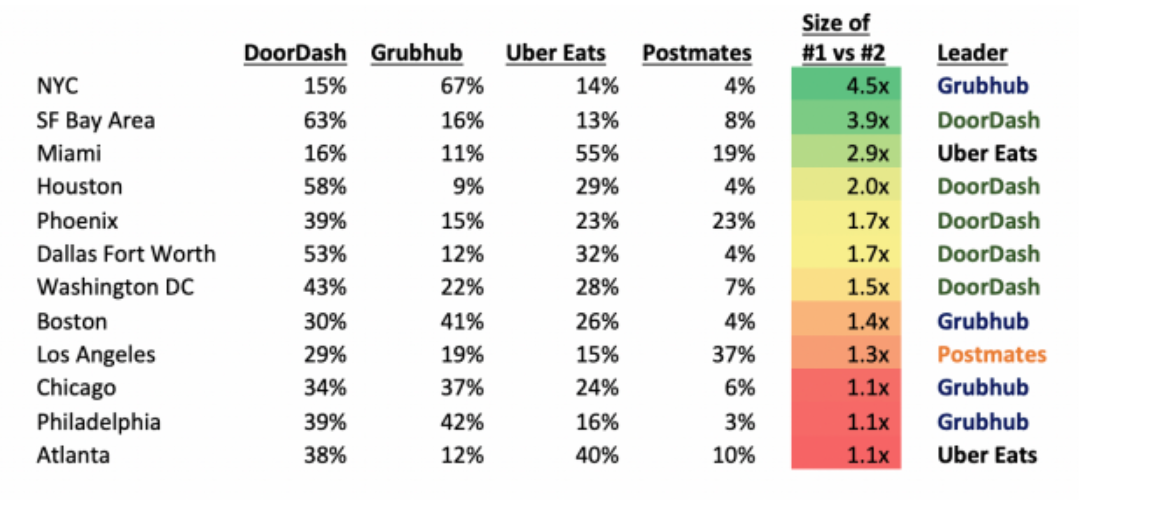

Food delivery and competition

- Brilliant article on the monopolistic power of food delivery businesses especially as they begin to vertically integrate and merge around the world.

- “Losing money to acquire market power, or to steal from investors, is a form of counterfeiting, because it drives honest competitors that have to generate a profit out of the market“.

Rapid Covid Testing

- There was a lot of excitement about the FDA approving a rapid (15 minute, $5) SARS-CoV-2 test.

- This is an interesting analysis of when such a test would be useful and when not?

- In short – if the true infection rate of the population you are testing is very low (<1%) it won’t be useful.

- Which means using such a test on cruise ships, as some have suggested, won’t work.

Greensill

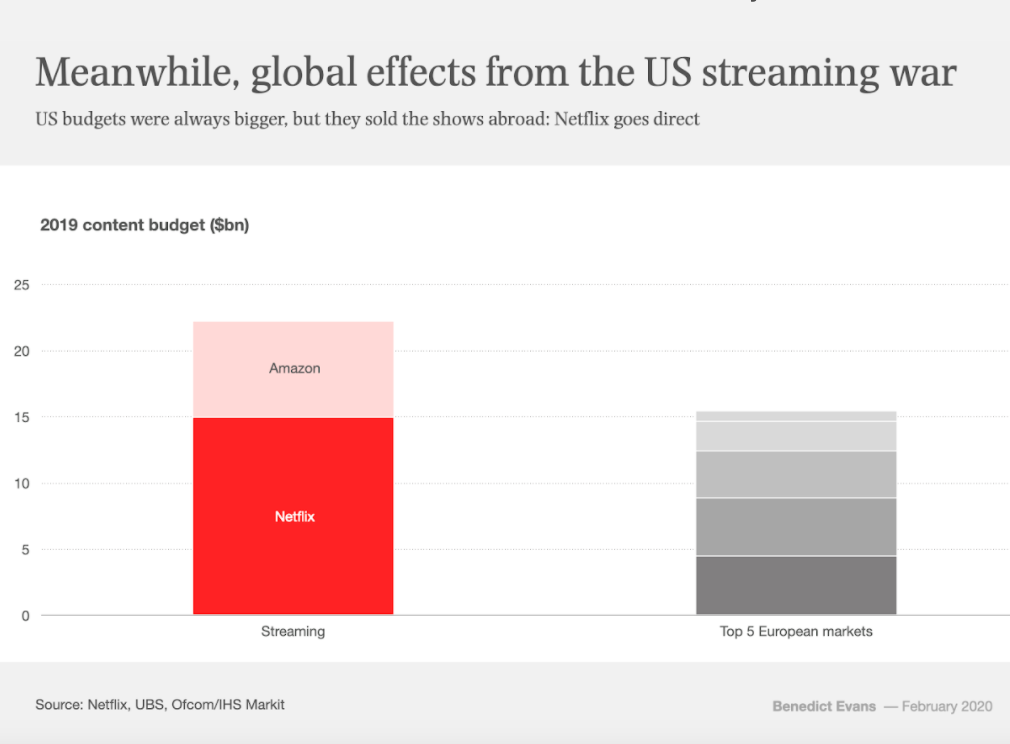

Content Wars

- Netflix has a bigger content budget than the top five European countries combined.

- From a brilliant slide deck by Benedict Evans.

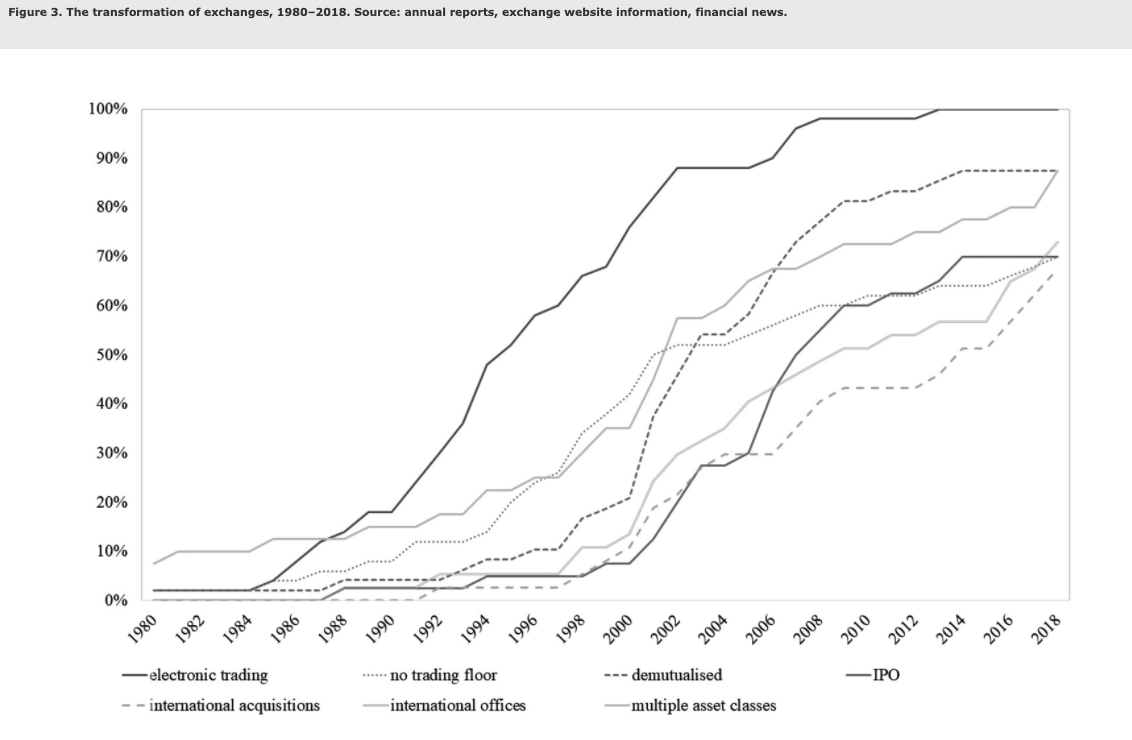

The story of ICE

- A great post about the history of Intercontinental Exchange and its founder Jeffery Sprecher. Its success was based on a few factors.

- (1) “Sprecher gave away 80% of the company to his customers as an incentive for them to trade at his venue.”

- (2) “the company had a lucky break when Enron went bust.”

- (3) Lots of deals meant diversification especially into oil trading and clearing. 20 deals in the past 15 years. Three criteria drove these – enhance network, new content, turnarounds.

- It also comes down to three insights – analogue to digital, using regulation as an opportunity and the power of data.

Apple launching a search engine?

- Intriguing post about Apple possibly launching their own search engine with lots of supporting evidence.

Bezos Statement to Congress

- The statement Jeff Bezos gave to US Congress at the end of July is worth a read.

- A great piece on what it takes to build a business.

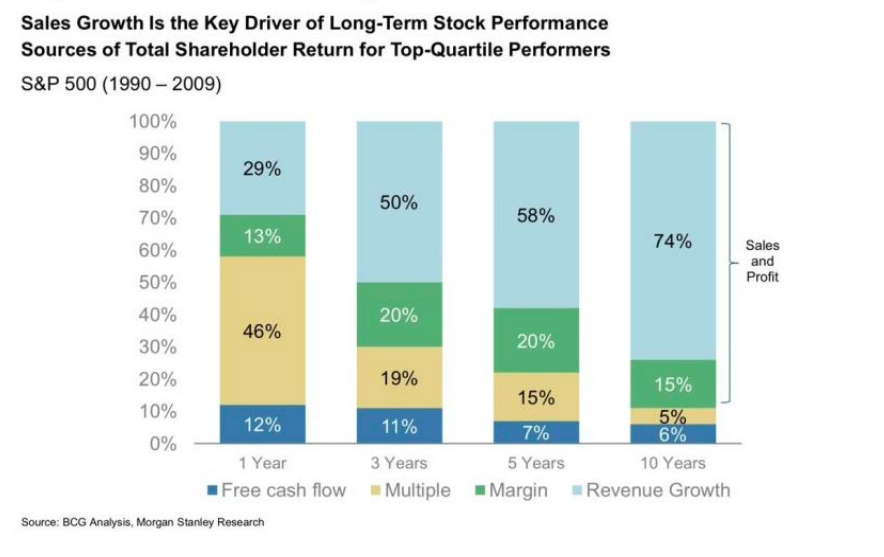

Drivers of Long-Term Stock Performance

- Interesting chart showing the drivers of individual stock performance 1990-2009 from BCG/Morgan Stanley study.

- The study found that sales and (eventual) profit growth are the most important drivers – and that their importance increases with investment period.

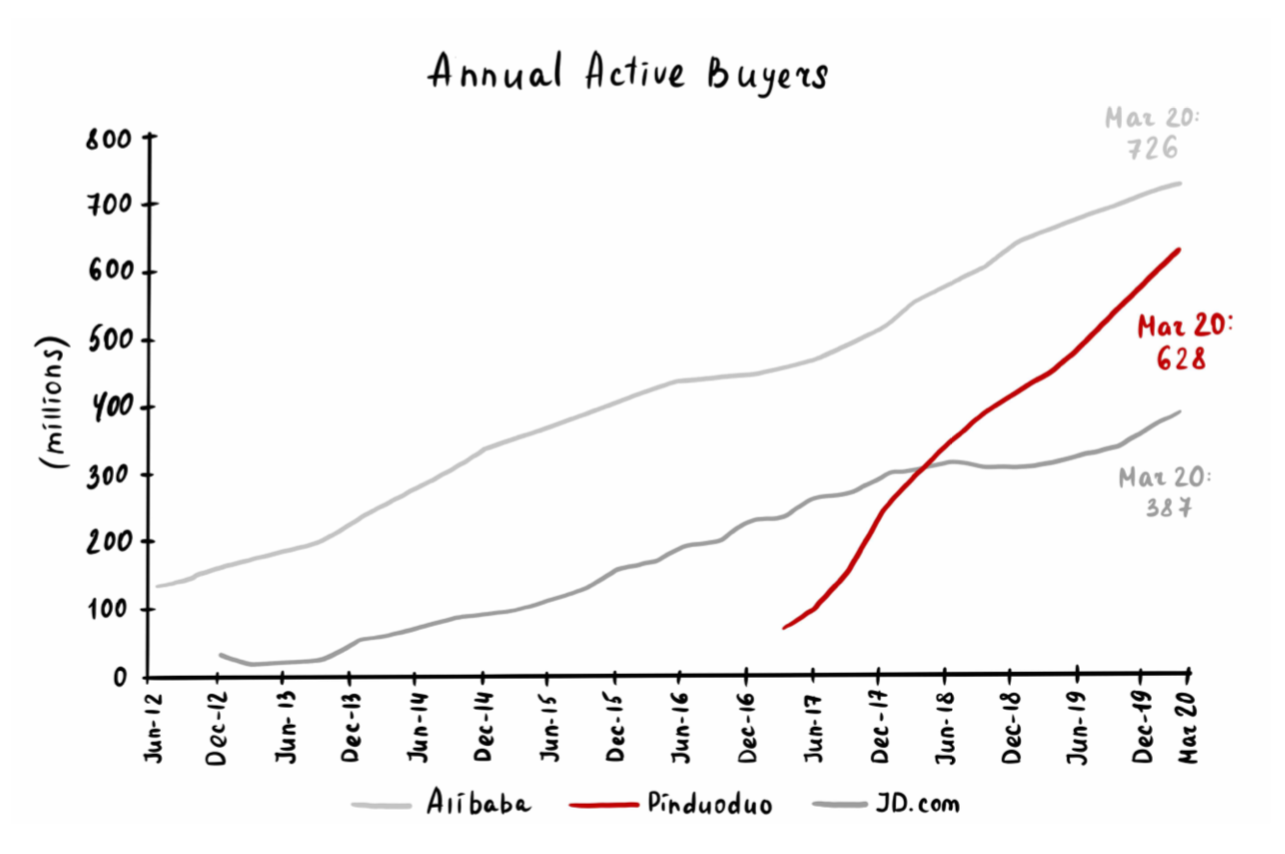

Pinduoduo

- A great presentation and separate post about a huge eCommerce business you probably haven’t heard of, founded only in 2015.

- Its success is down to a team buying feature, social integration, gamification and live streaming.

- These features have led to a daily active user (DAU) to monthly active user (MAU) ratio, a measure of engagement, of almost 50% – the highest, by some margin, among peers.

- h/t Benedict Evans.

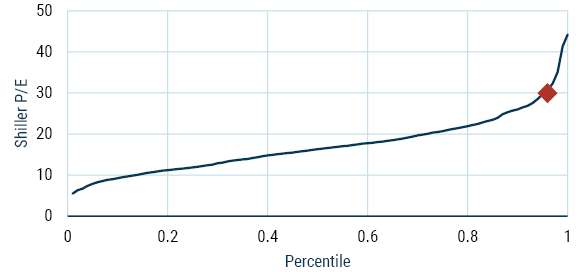

Market Valuation

- Chart showing valuations of the US stock market using Shiller P/E from latest piece by GMO, who argue that it is “absurd”.

- Valuations on this basis are in the 95th percentile (right up there in terms of one of the most expensive markets of all time).

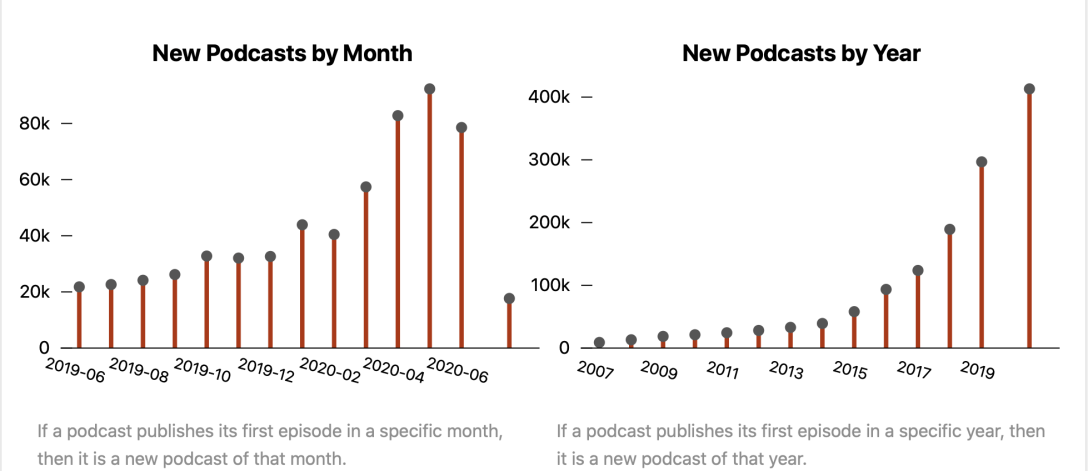

Podcasts

- The growth of podcasts has gone parabolic.

- So has listening – growing 31% since Jan 2020.

- It is likely a $1bn advertising industry by next year.