- In 2023 the FTC substantially changed guidelines for antitrust enforcement.

- This has had far and wide ramifications for the pharmaceutical industry.

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

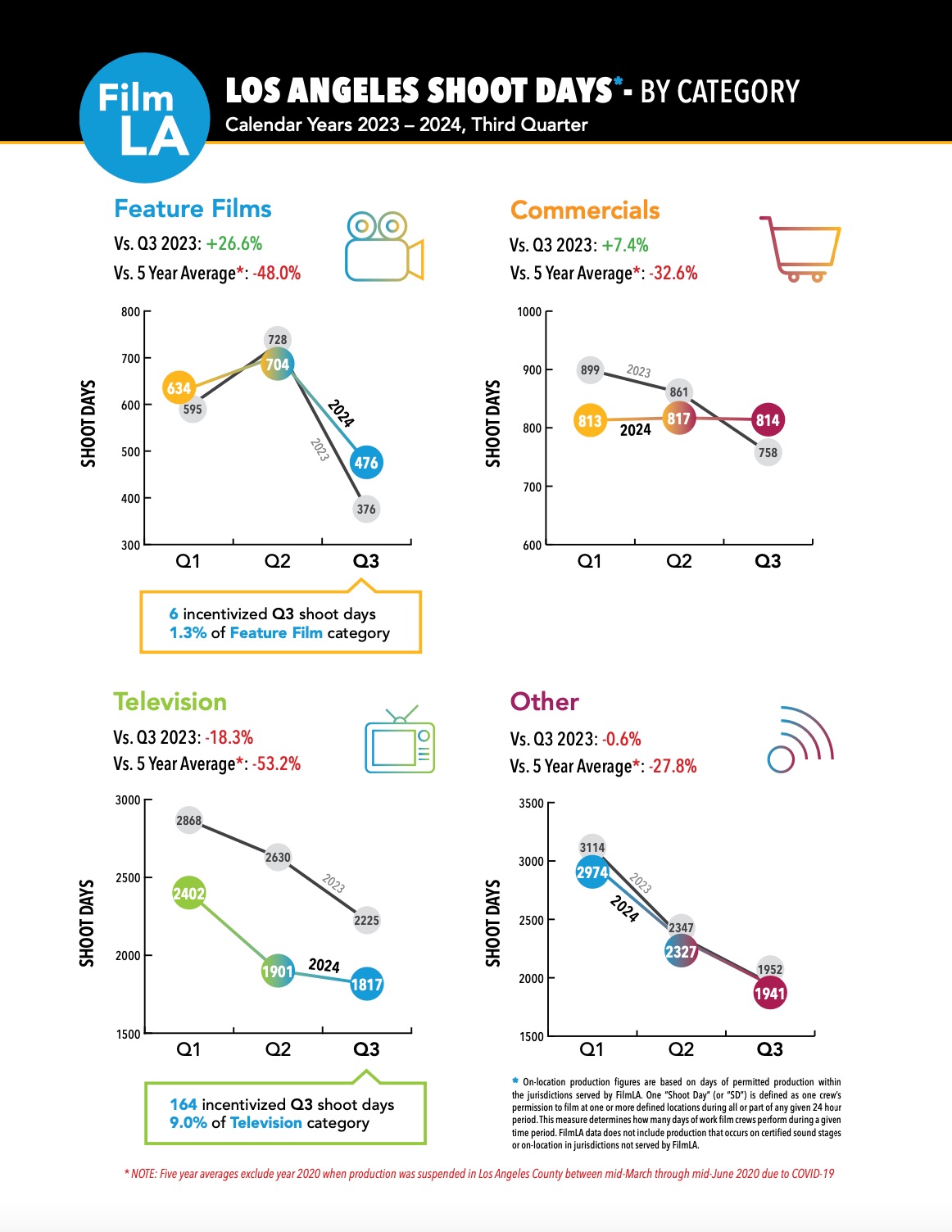

Decline of LA Film and TV Production

- Remarkable.

- Source: Hollywood reporter.

Problem for Media Companies

- If you have ever tried to cancel a subscription you know how hard it can sometimes be.

- After 16,000 public comments, the FTC is acting.

- This could be a problem for media companies.

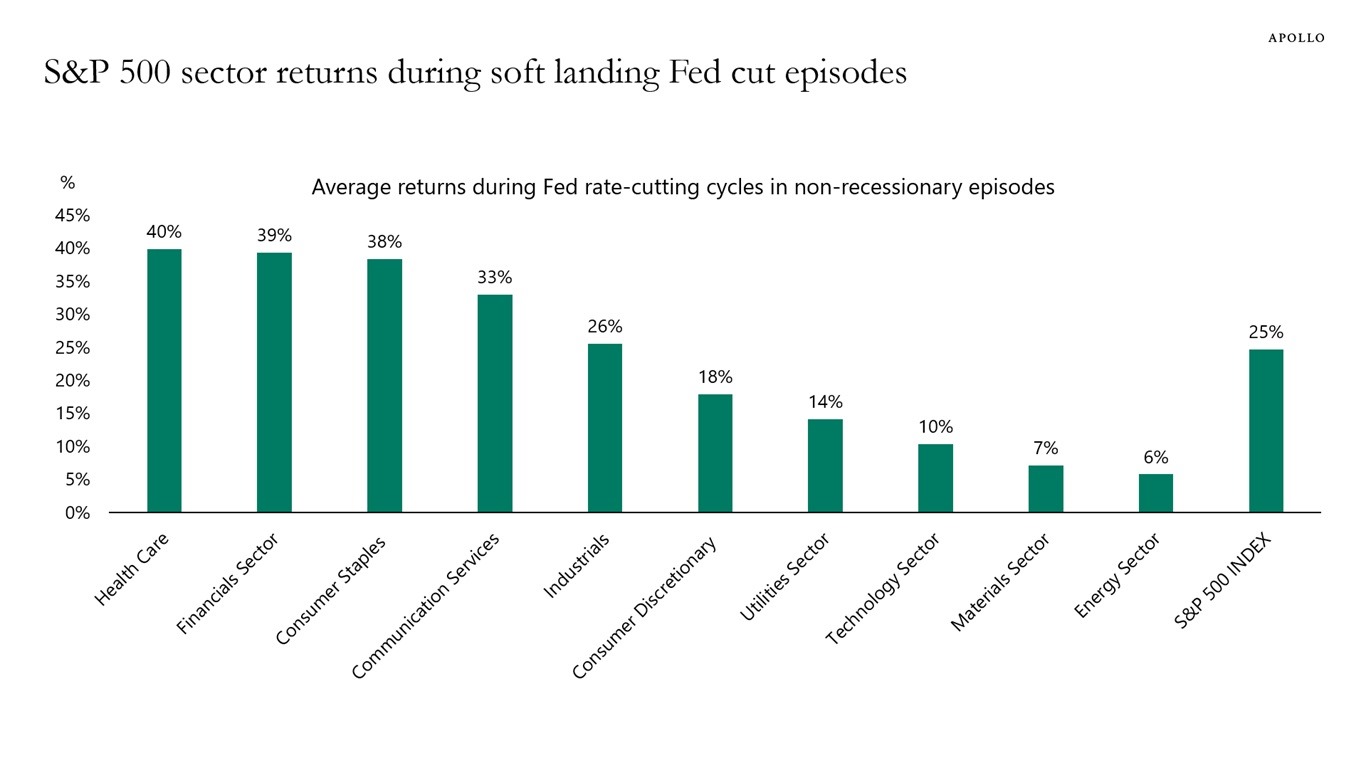

Sector Returns from here?

- During previous instances of soft landing (if there is one) + rate cuts sector returns looked like this.

- Source: Apollo.

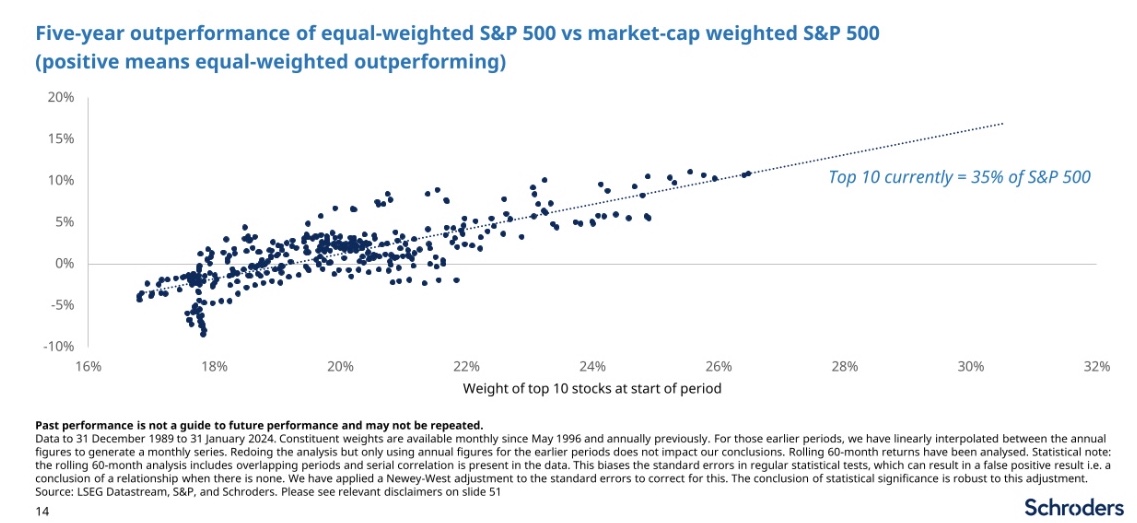

Lean against Concentration

- It has historically paid to deviate from the market as concentration rises.

- Source: Schroders.

Seeing like a CEO

- What really happened at Boeing?

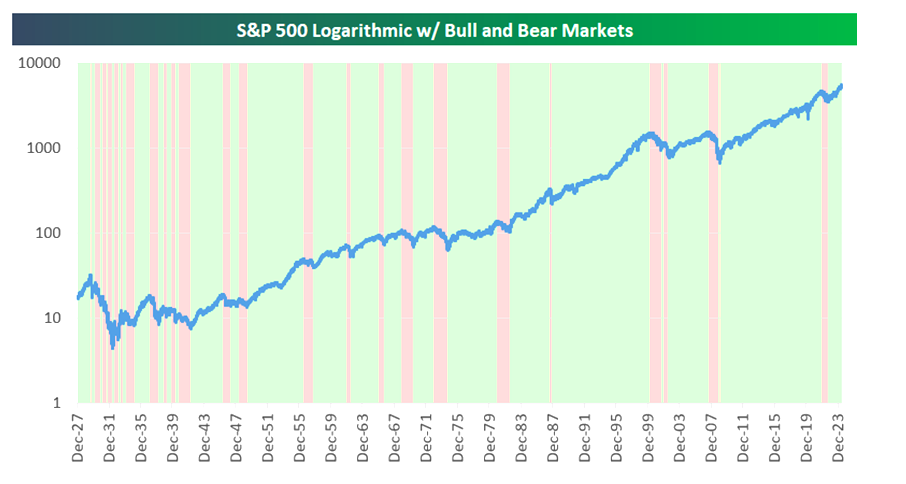

Bull and Bear Markets

- This chart is a good visual of how long bull markets last compared to bear markets.

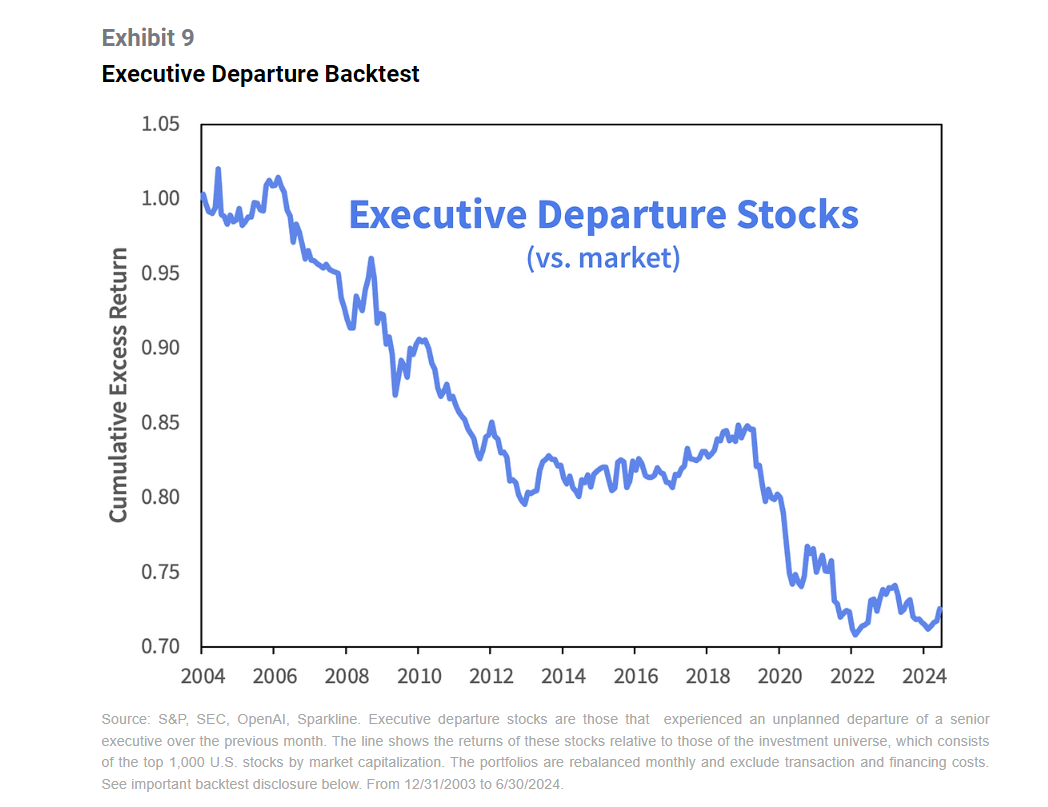

Executive Departure

- Interesting use of LLM to parse 8-Ks for unplanned executive departures.

- “Executive departure stocks are those that experienced an unplanned departure of a senior executive over the previous month. The line shows the returns of these stocks relative to those of the investment universe, which consists of the top 1,000 U.S. stocks by market capitalization. The portfolios are rebalanced monthly and exclude transaction and financing costs. See important backtest disclosure below. From 12/31/2003 to 6/30/2024.“

- Other AI-based analysis use cases in the source.

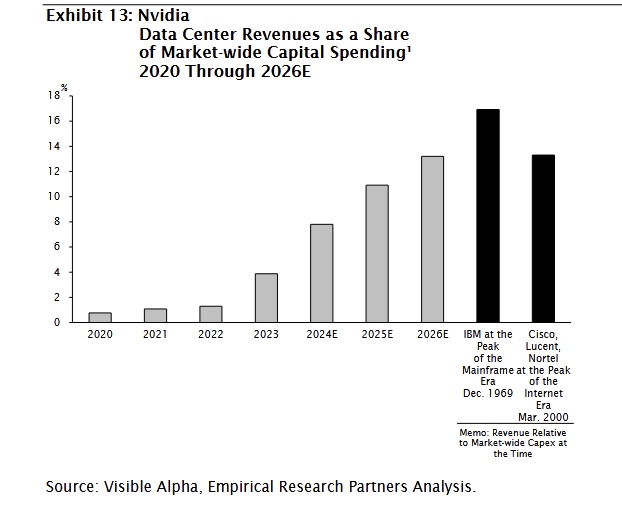

NVDA Peak?

- Revenue as a share of market-wide capital spending – getting close to what historic bubbles looked like.

- Paired nicely with this report from JPMAM.

A Peek Inside Google

- Anti-trust cases are interesting because they allow a peek inside the inner workings of a company.

- Here for example are all the exhibits from the DOJ case against Google.

Price Fixing

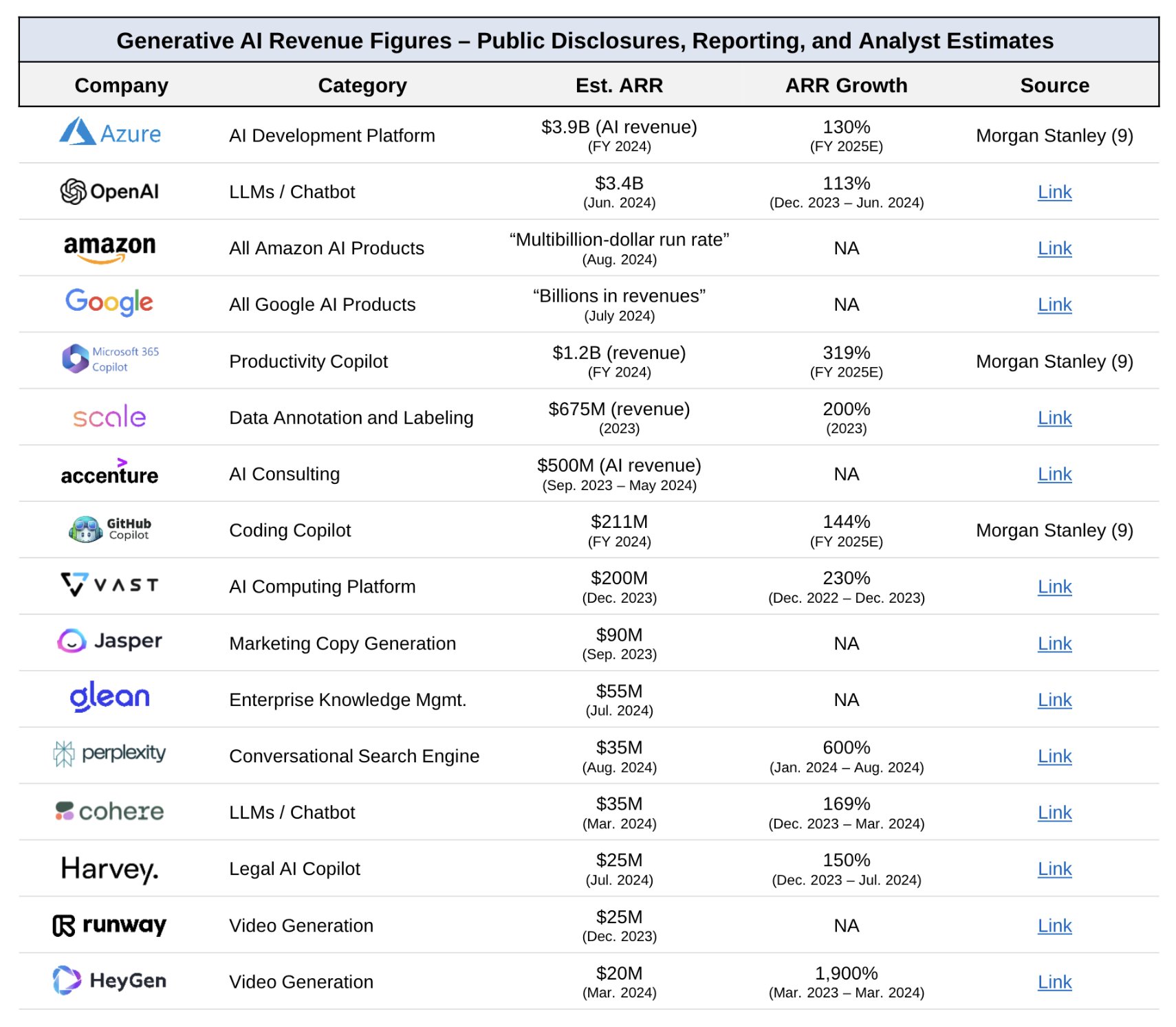

Is AI hype or Does it Work?

- A few links/stats on the topic.

- Github co-pilot in this study led to substantial savings (30-50% time saved or reduced in some tasks).

- Bloomberg Odd Lots podcast episode with the CIO of Goldman Sachs on the use of AI.

- Good overview of current revenue run rate for gen AI products (chart).

- A rather bullish tour of AI and semiconductors by Gavin Baker.

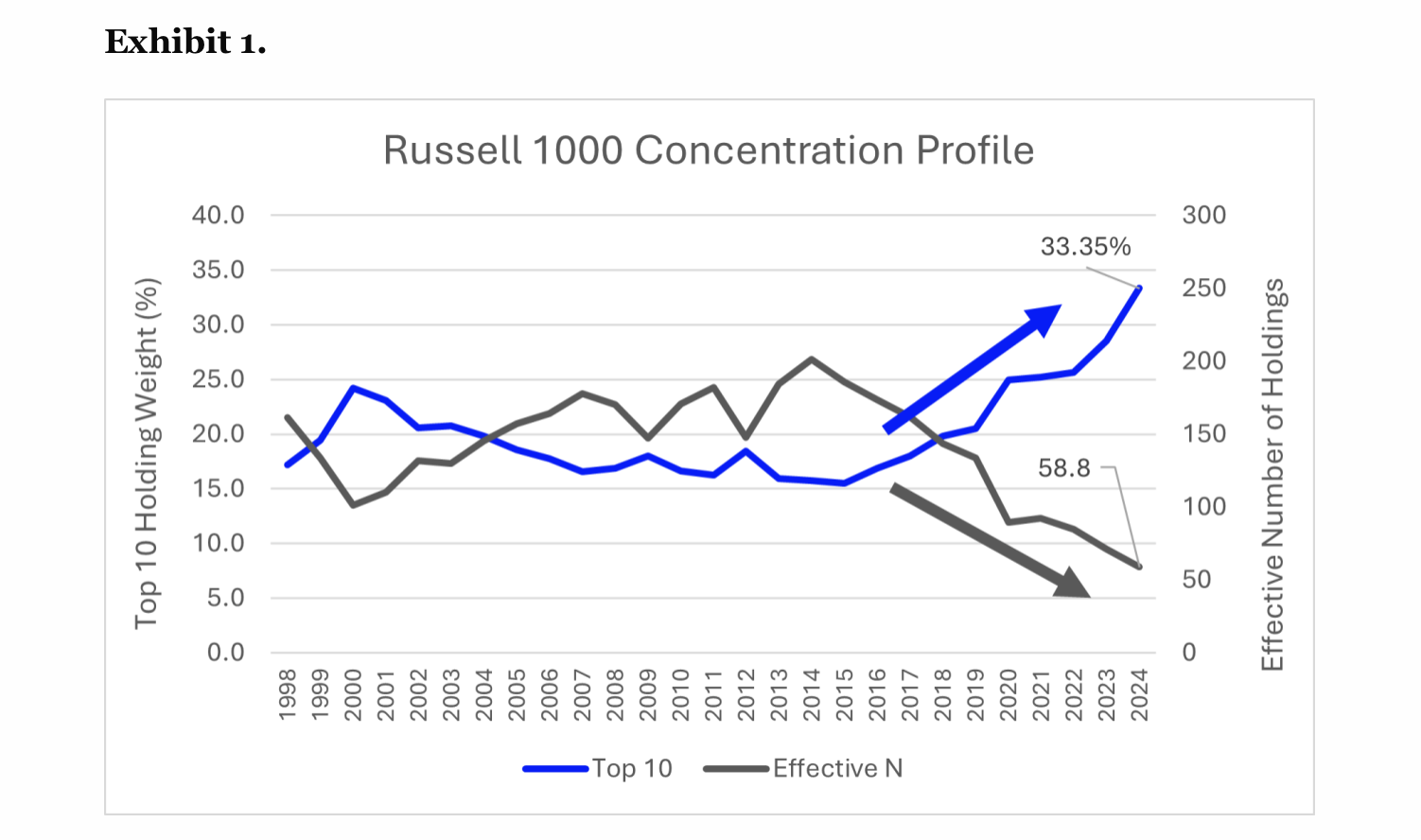

Index Concentration Crisis

- We all know indices are concentrated right now, more than ever. Just how bad is it?

- “The startling conclusion is that, despite the Russell 1000 nominally providing exposure to its namesake number of stocks, the index affords an effective diversification of only 59 stocks.“

- “Not only does market-cap weighting induce substantial single-stock risk, but the diversification provided by this foundational asset class has evaporated by 70% over the past decade.“

- Equal weight, as the article argues, is not the solution here, as it “suffers from significant operational costs, underperformance, questionable assumptions, and skewed risk bets.“

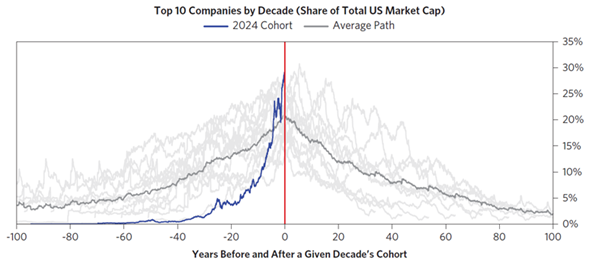

Top Stocks Rarely Stay on Top

- Source: Bridgewater.

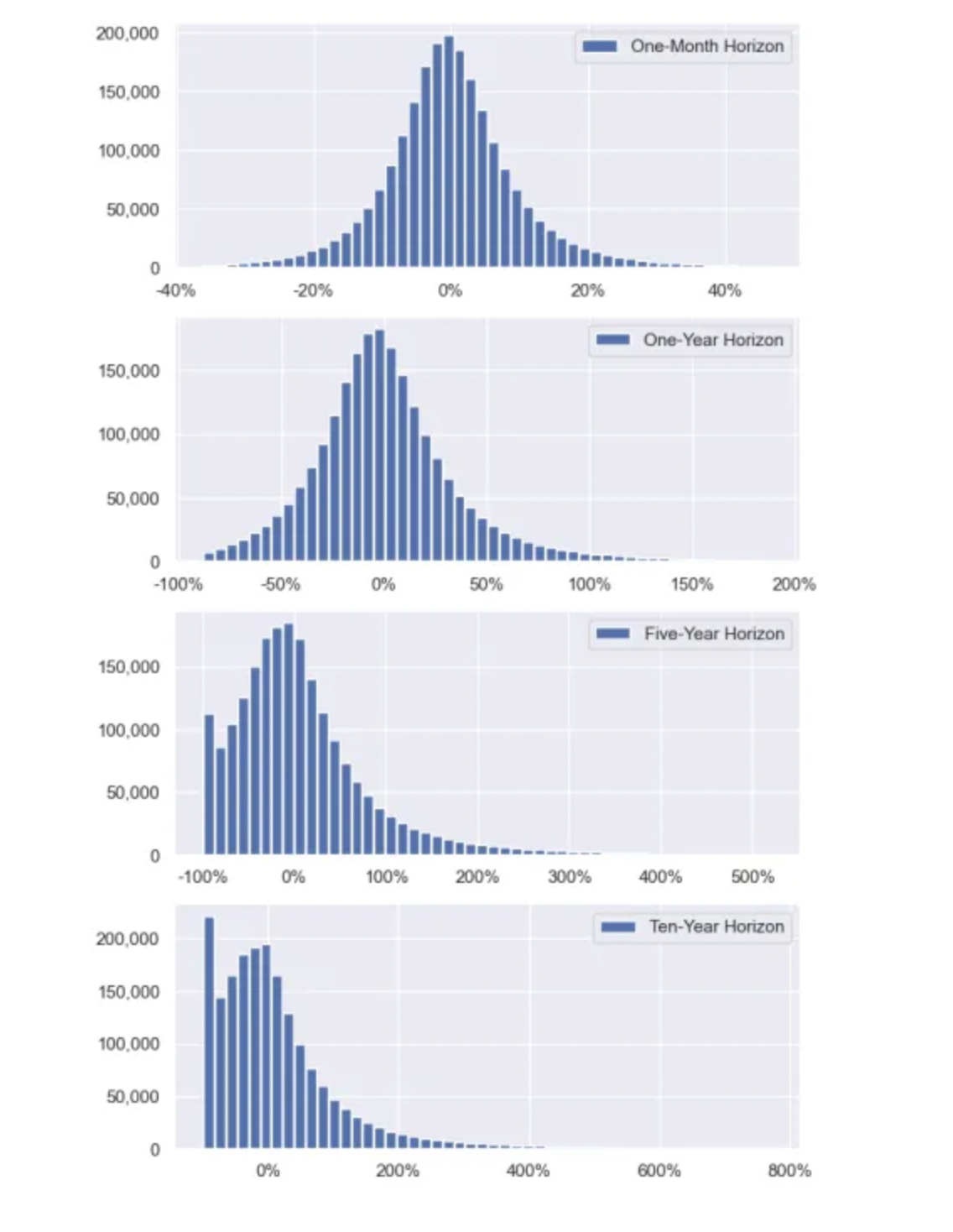

Average is not Median

- “Antti Petajisto analyzed the return distribution of all US stocks in the CRSP database going back to 1926. Below is the distribution of returns for different investment horizons. Note that the distribution gets more and more skewed to the left as investment horizons increase and that the left-hand side of the distribution is not zero, but a total loss of investment (-100% return).“

- Source.

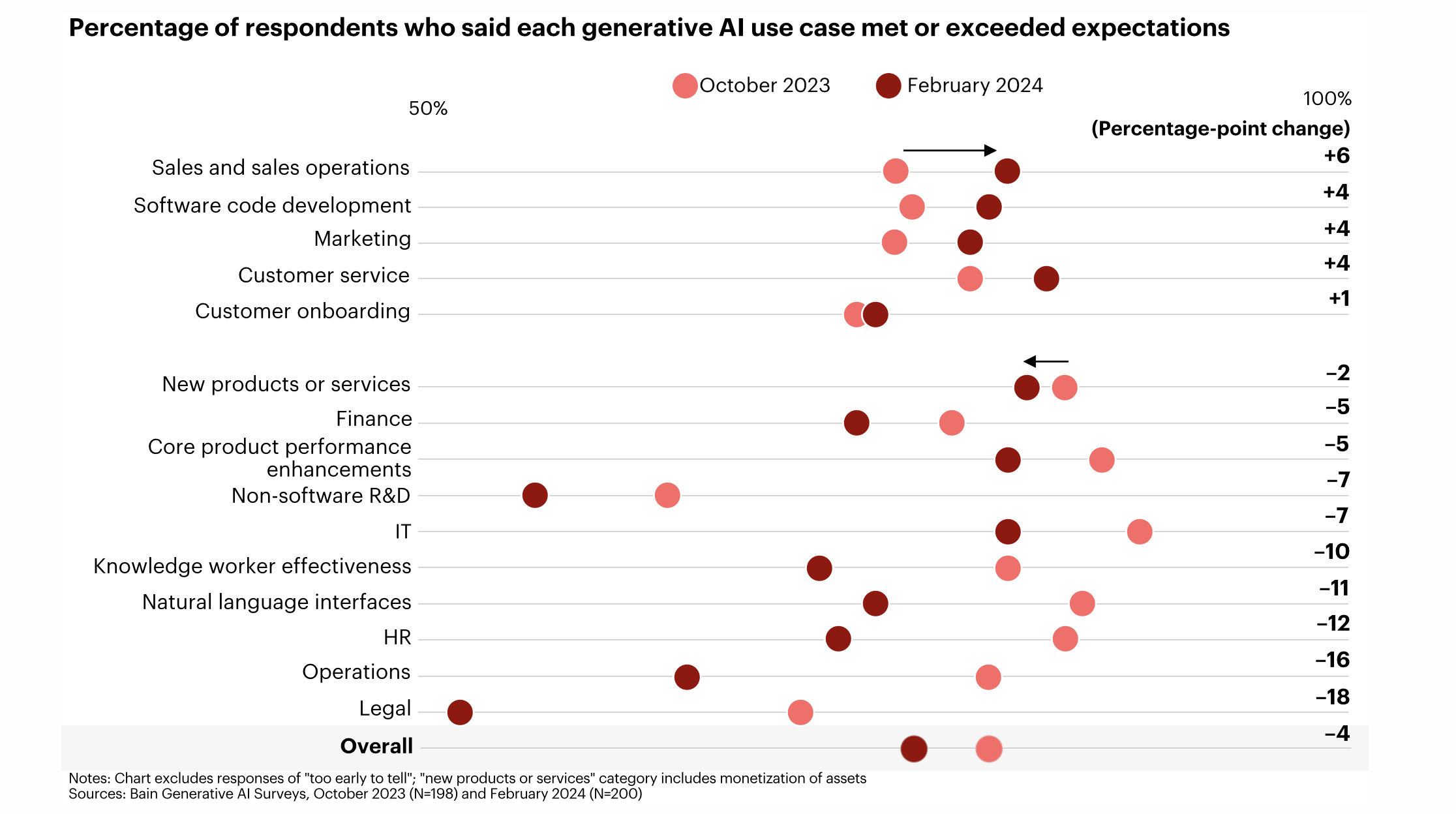

Gen AI Use-cases in Real Life

- An interesting survey from Bain shows how different functions have found Gen AI has stacked up against expectations.

- Source.

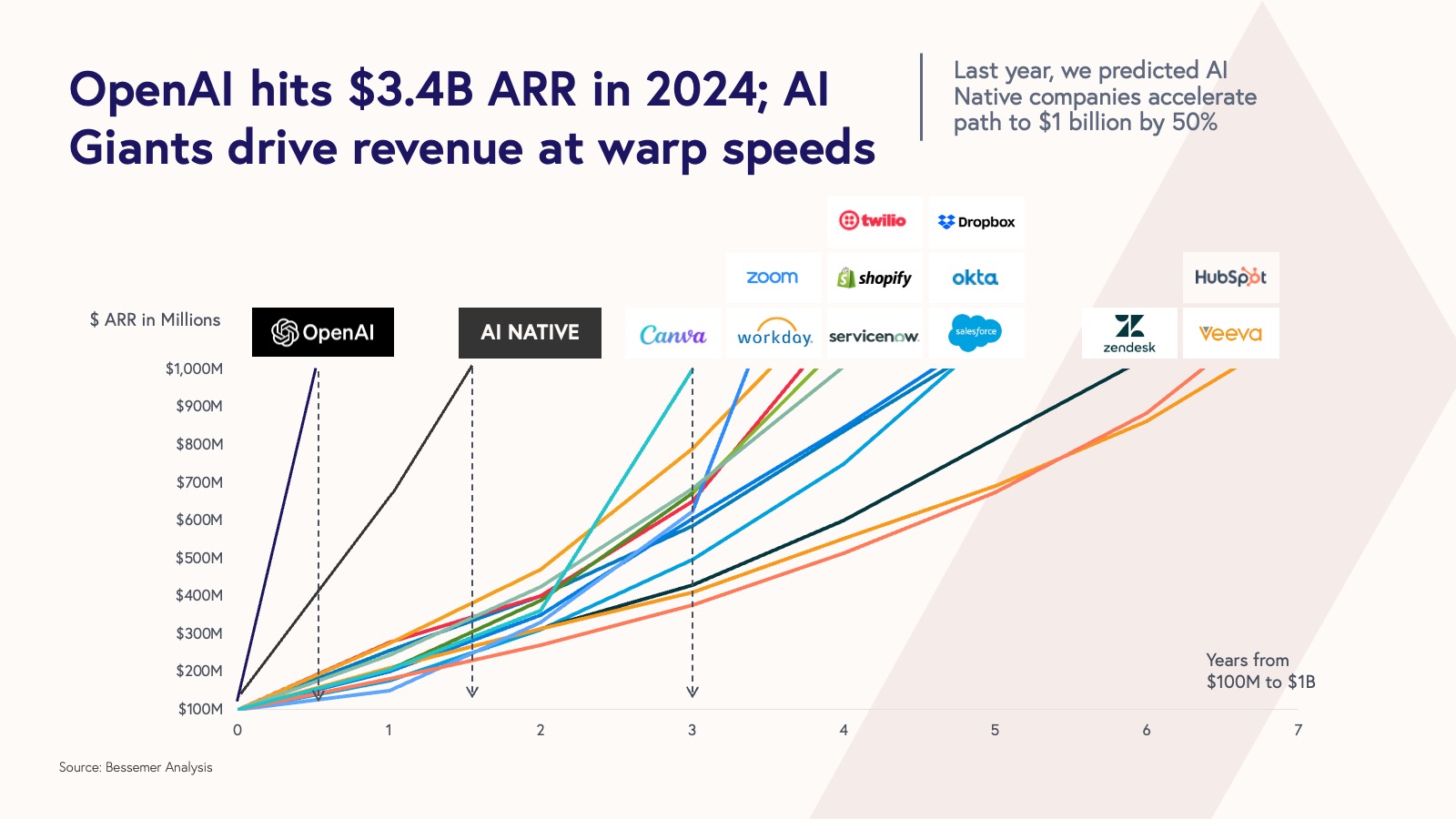

Bessemer State of the Cloud 2024

- Annual report from Bessemer Ventures, which this year is renamed State of the AI Cloud.

- This chart probably explains why AI startups are attracting all the funding.

Shein and Temu – the tax loophole

- Shipping goods with a value less than $800 in the US (150 EUR in Europe) is import duty free – something Chinese firms have been taking advantage of.

- By some estimates these firms account for 30% of these de minimis shipments in the US. Most is by air freight.

- This is all about to change in the EU. Will the US follow?

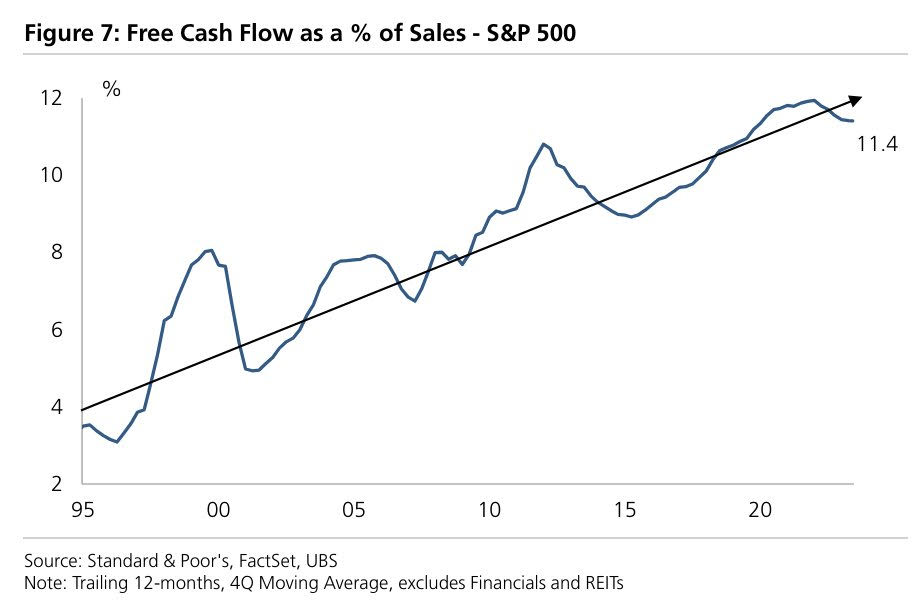

S&P FcF Margin

- Have been rising for three decades (in part due to mix to tech).

- Source.

Bridge RNA

- This looks like a big deal – “The bridge RNA system is a fundamentally new mechanism for genome design,” said Dr. Patrick Hsu, senior author of the study and an Arc Institute Core Investigator and University of California, Berkeley Assistant Professor of Bioengineering. “Bridge recombination can universally modify genetic material through sequence-specific insertion, excision, inversion, and more, enabling a word processor for the living genome beyond CRISPR.“

- Full Arc Institute blog here and AI simplified version here.