- A fascinating glimpse into the world of how the decision to total a car by an insurance company after an accident is made.

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

Japan Becoming More Dynamic

Transsion Holdings

- China’s Transsion Holdings is a smartphone maker you may have never heard of.

- Not only are they the world’s number five, but more impressively they command 40% market share of Africa’s smartphone market.

Retail Investors – a new base level

- It looks like retail trading has seen a step change since the pandemic that has stuck and even accelerated.

- Source.

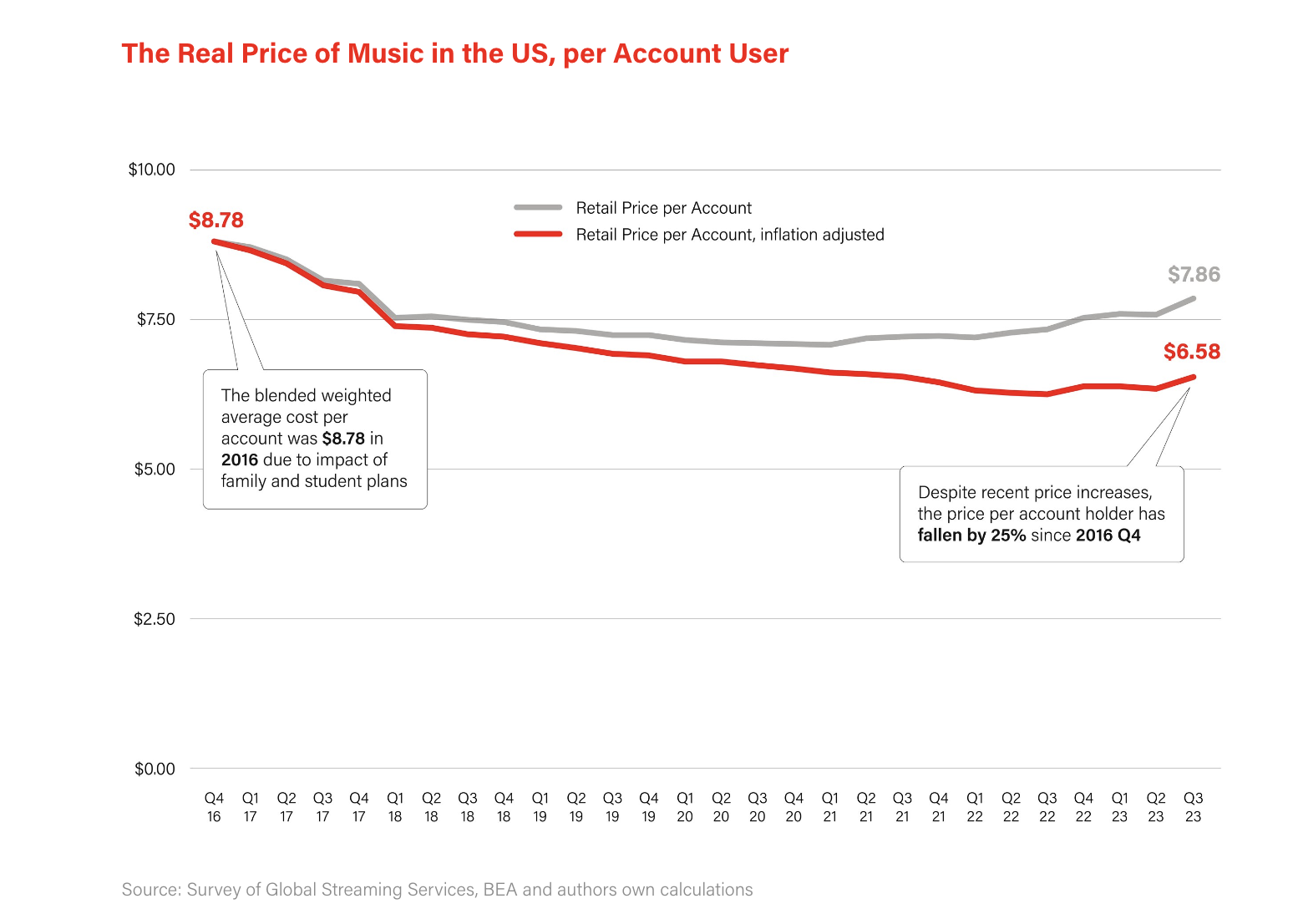

Streaming Prices

- Music streaming has seen declining prices when adjusted for inflation and new shared plans.

- Source: Pivotal (lots of interesting charts on music streaming inside).

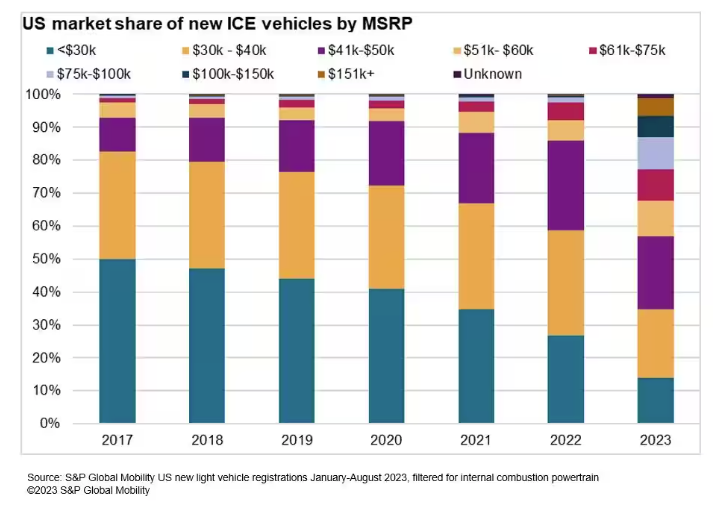

Cheap Cars are Disappearing

- “Based on S&P Global Mobility analysis of registration data since 2017, the US market has seen a significant decline in the share of new vehicles registered below a $30,000 price point. In just seven years, the percentage of vehicles registered with an MSRP below $30,000 has decreased from half the market to barely one-quarter – with vehicles in the $41,000-$60,000 band taking up nearly the entirety of that vehicle count.“

- Source: S&P Global

Autonomous Vehicle Safety

- “In over 3.8 million miles driven without a human being behind the steering wheel in rider-only mode, the Waymo Driver (Waymo’s fully autonomous driving technology) incurred zero bodily injury claims in comparison with the human driver baseline of 1.11 claims per million miles. The Waymo Driver also significantly reduced property damage claims to 0.78 claims per million miles in comparison with the human driver baseline of 3.26 claims per million miles.“

- Source: Swiss Re.

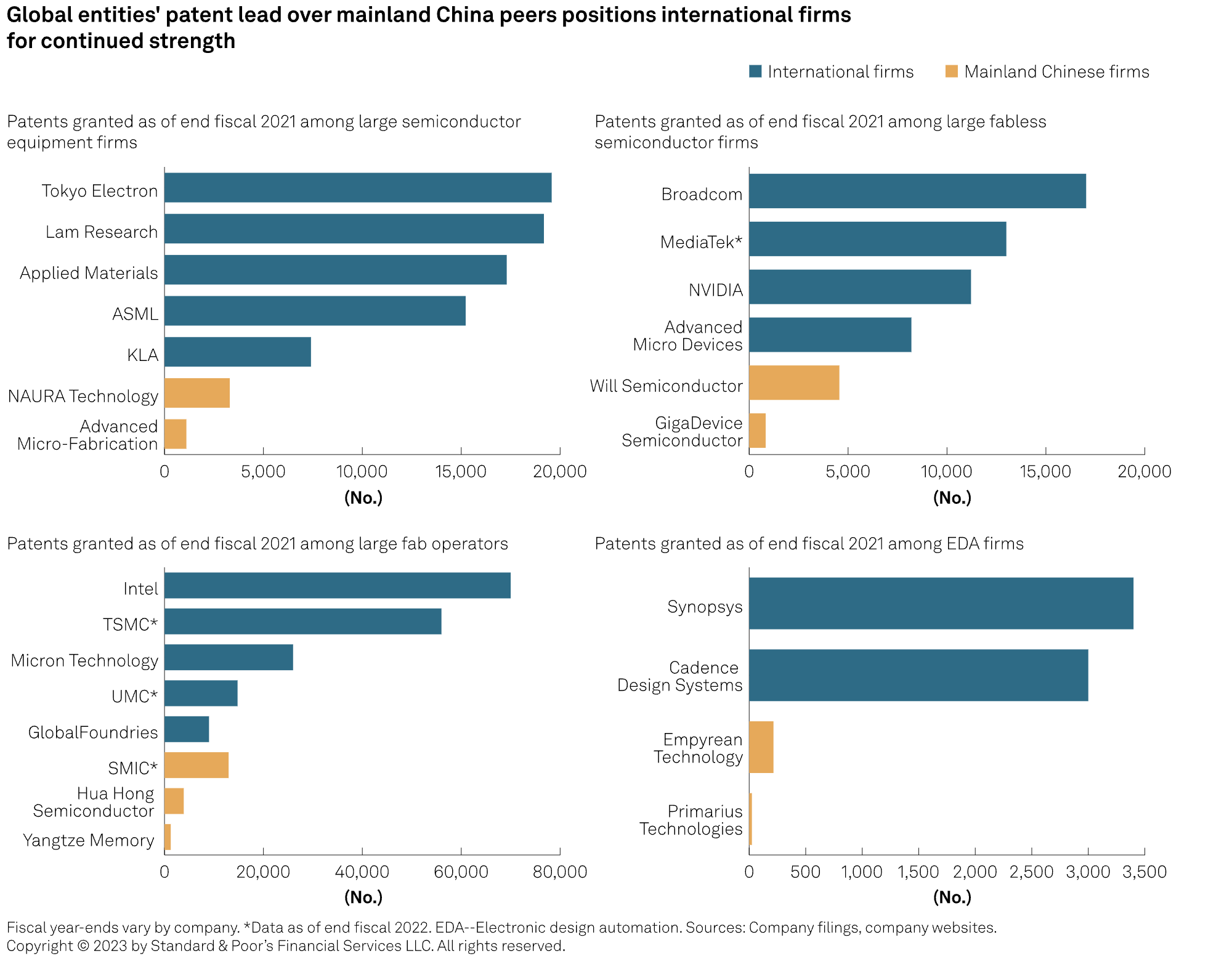

Semi Patents in China

- Major firms badly lag international peers in terms of patents.

- Source.

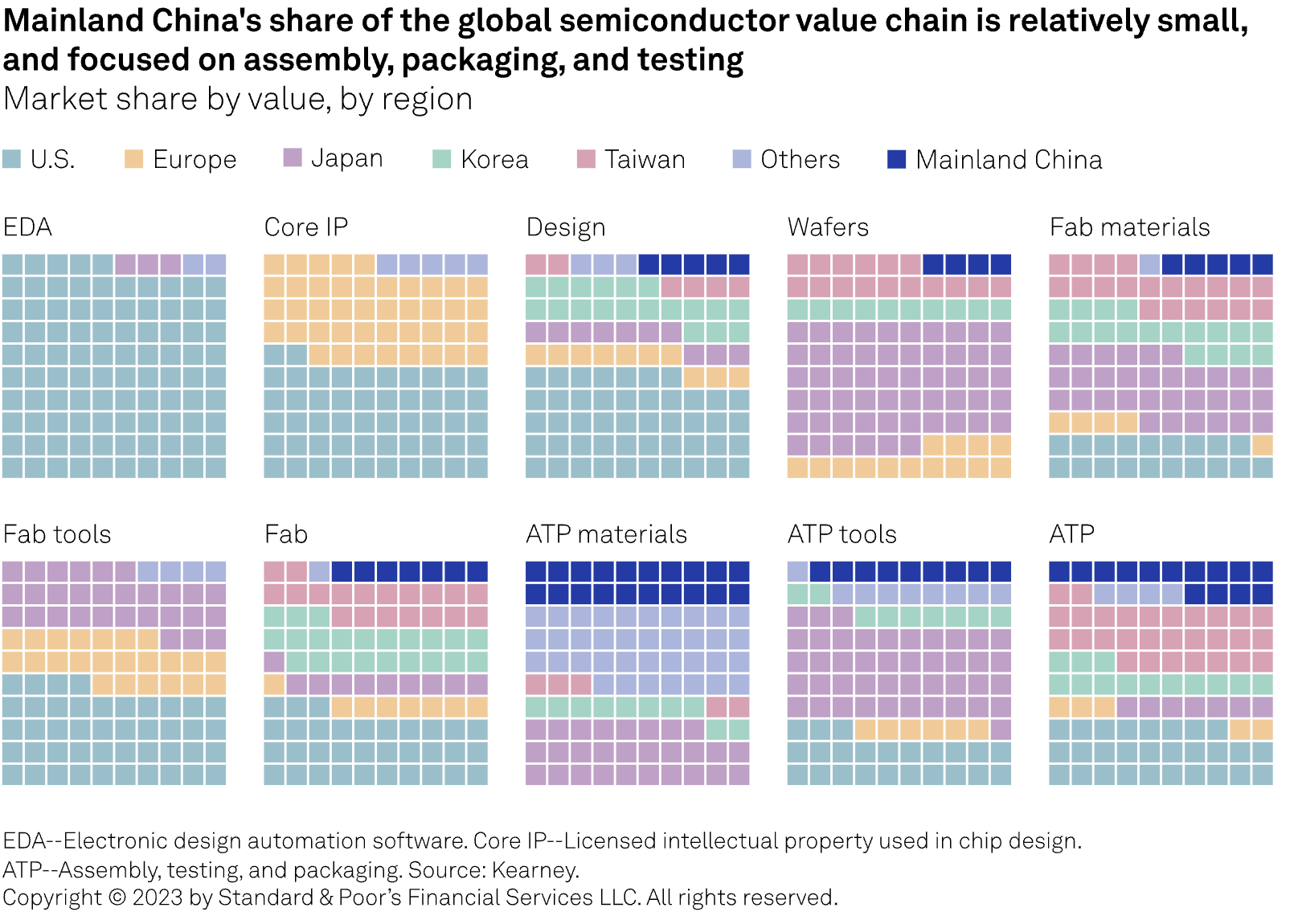

China’s Position in Semis

- Source: S&P Global.

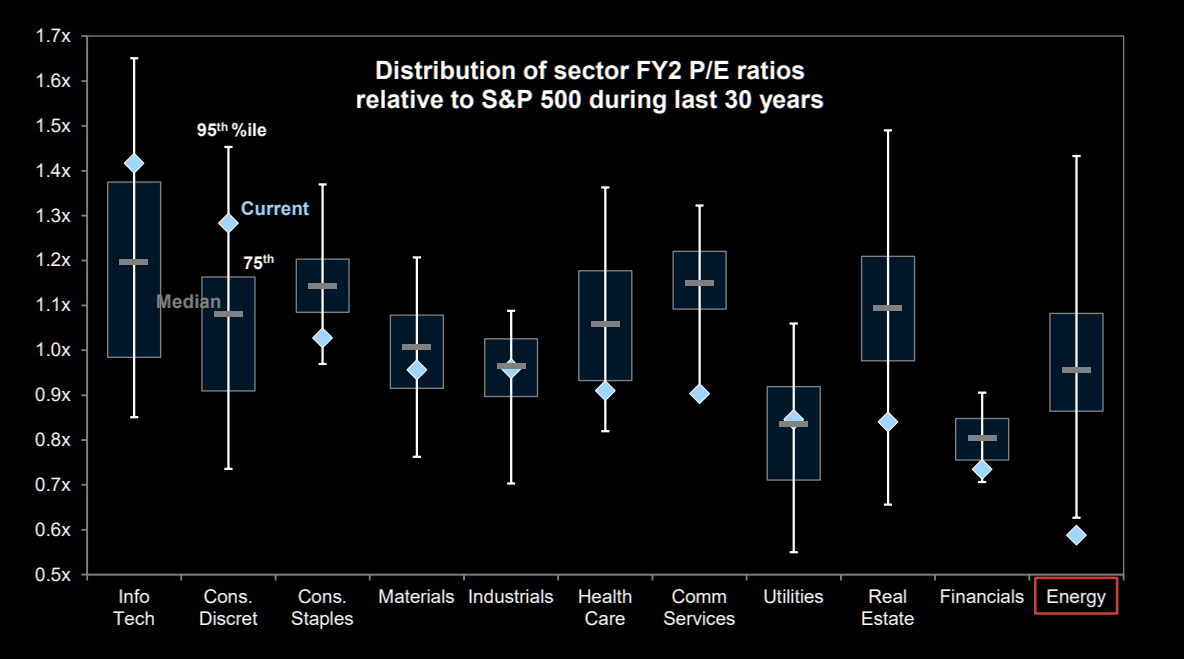

Sector Valuations

- Chart of SPX sector P/E ratios vs their own history.

Coatue AI Revolution Deck

- Interesting deck that has been doing the rounds.

- To be taken with the usual “bottom left to top right charts” pinch of salt.

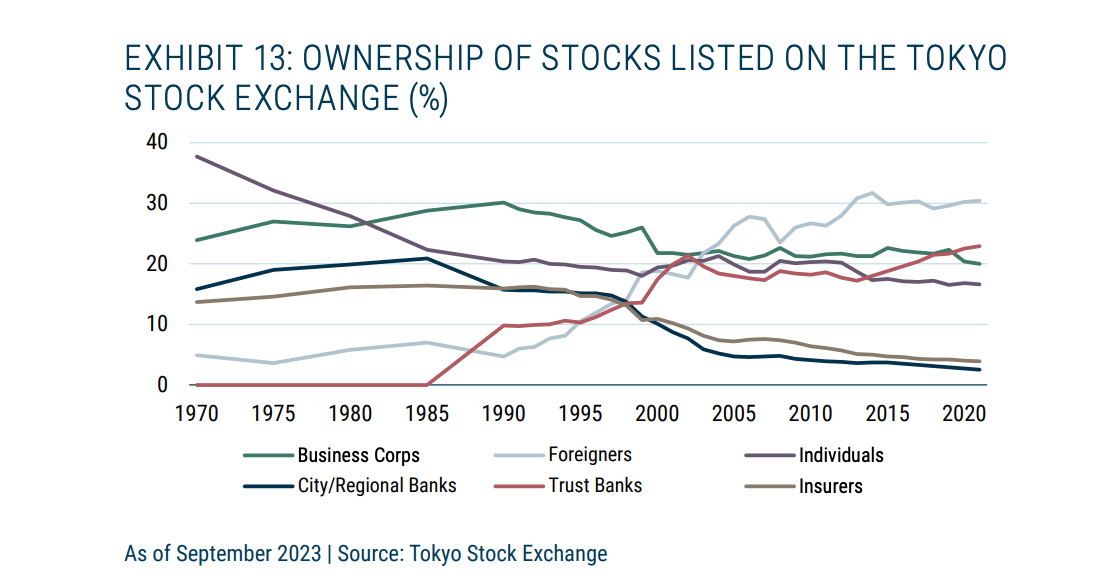

Japanese Stock Ownership

- Dramatic transformation over the past 20 years.

- If you split it up into insiders (financial/corporate) and outsiders (everyone else), the former ownership peaked at 70% during the bubble years and has come down to 20%.

- Source: GMO

IRA and Pharma

- Interesting set of company quotes on views about the impact of IRA on Medicare negotiating drug prices.

- Most of the industry has launched multi-pronged lawsuits (including constitutional challenges) against this.

- To read more transcripts from AlphaSense Expert Insights get a free two-week trial here [use work email].

Activate TMT Outlook 2024

- Handy report on everything technology and media with useful stats.

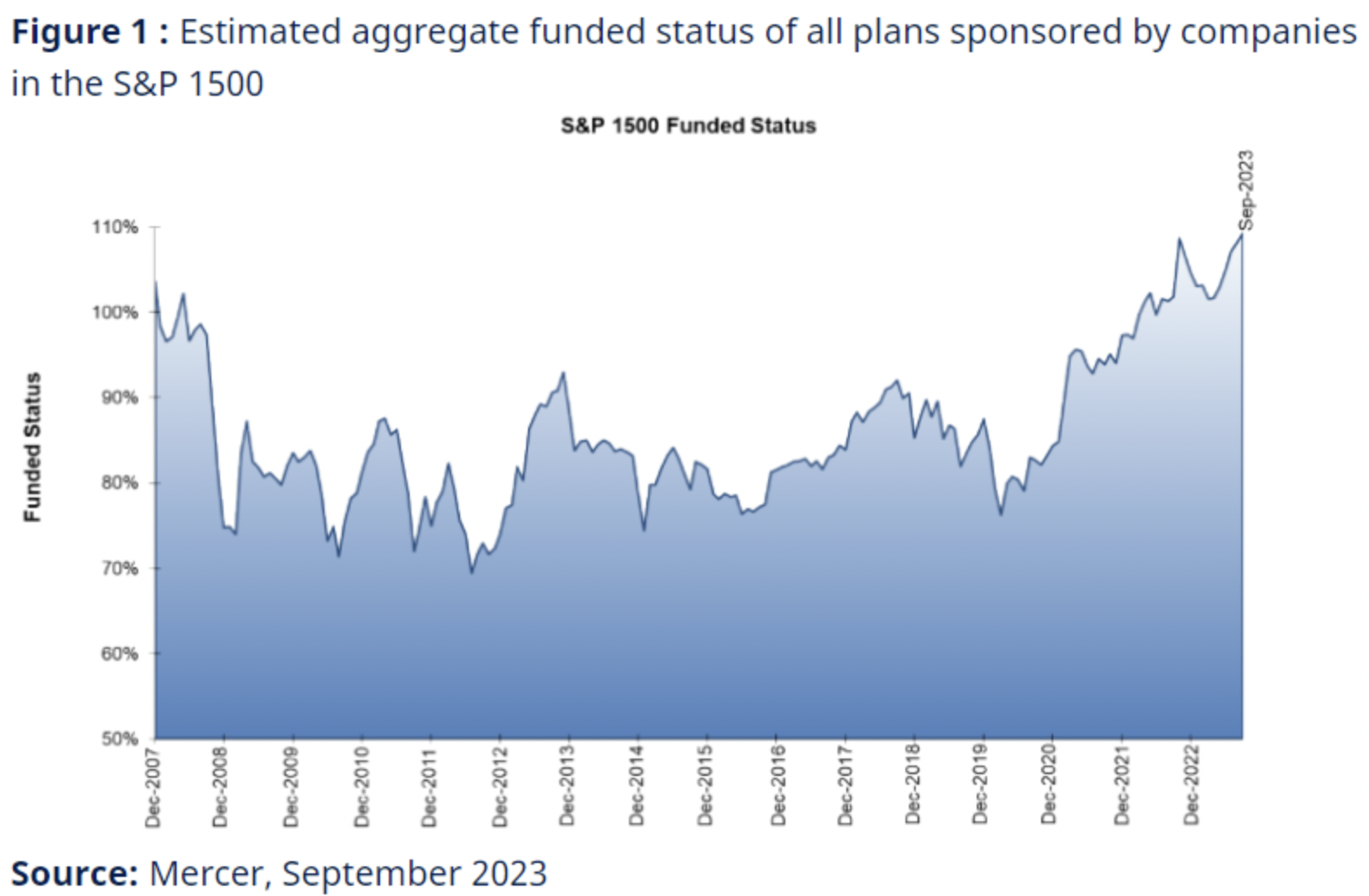

Pension Plans

- One upside of rising bond yields is pension plan liabilities. These are pricing downwards pushing many pension plans into surplus relieving the cash flow pressure on sponsor companies.

AI and Healthcare

- Healthcare is one area where the application of AI, in its LLM and other forms, could be enormous.

- This nice article from AlphaSense Expert Insights explores the topic, mirroring the huge rise in expert calls in the sector mentioning the term.

- It is not all areas that can be bent to the will of ML. As this piece argues, academic literature and the correspondent knowledge graph is both difficult and not that useful to program.

- If you want to read some of these transcripts, you can grab a two-week free trial.

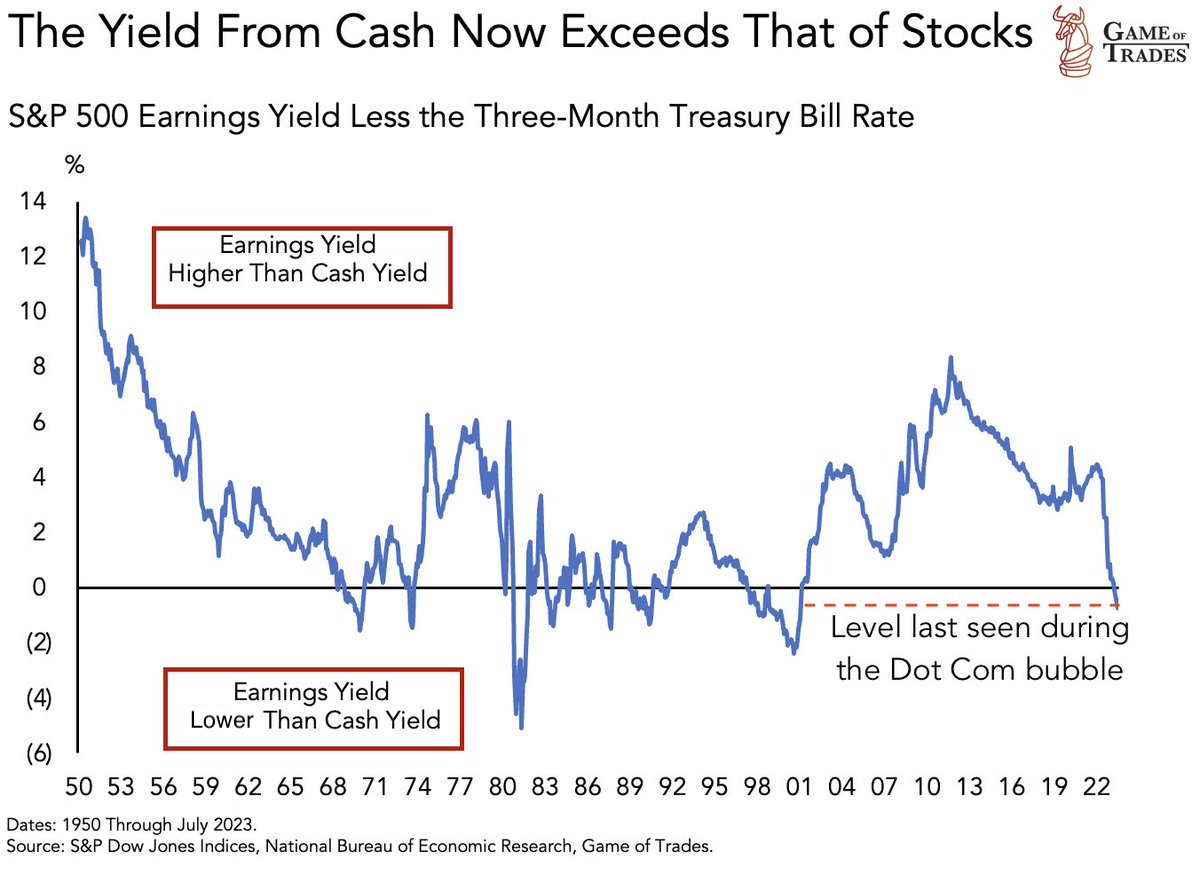

Earnings Yield vs. Cash Yield

- Rare to see S&P earnings yields go far below cash yields.

Regulatory Capture

- Bill Gurley’s September 2023 talk “2,851 Miles.” is a very interesting read on this very important topic in economics and investing.

- As a rule, regulation is acquired by the industry and is designed and operated primarily for its benefit.” I like to say, “Regulation is the friend of the incumbent.”

Gen AI Retention

- Is a serious problem when compared to pretty much any internet service.

SEC New Short Disclosure Rules

- SEC is increasing disclosure around shorts.

- Investment managers that carry large short positions in equity securities will be required, within two weeks after each month, to report those positions and related short sale activity to the Commission. The threshold for reporting will be met when an investment manager’s short position in a particular equity security of a reporting issuer is at least $10 million or the equivalent of 2.5 percent or more of the total shares outstanding on average during a month.

- Based upon the filings to the Commission, the Commission will make public, within four weeks after the end of each month, aggregated, anonymized data about the gross, end-of-month large short positions. The Commission also will publish the net aggregated daily activity data for each settlement day.

- The UK (and EU) have good disclosures on shorts >0.5% of shares outstanding.