- Great article from Wired on Google X.

- “We are a creativity organisation, not a technology organisation.”

- “The real test is 15 to 20 years from now, when the dust is settled and we look backwards. Then how are we doing?” Teller says. Until then, there will always be more crazy ideas worth chasing. “The world’s got more than enough problems, sadly.”

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

Softbank becoming Hedge Fund

- Softbank is slowly trying to get into becoming a Tech focussed hedge fund.

- This is strategy drift due to poor performance in venture investing.

- Also the reality of running $100bn – liquidity.

Energy vs. Tech

- Energy relative to Tech has not seen these levels since Pearl Harbour.

Schrodinger

- Citron Research, famed for short selling reports, are recommending long this stock – Schrodinger (SDRG).

- They describe it as – “the most disruptive software platform to ever hit the pharmaceutical industry, which also happens to be backed by the world’s most sophisticated investors, has just gone public.“

- Looks interesting and is worth investigating. The shares are sadly ca. +100% since IPO already.

- As always with investing – this is not a recommendation, do your own work, use common sense.

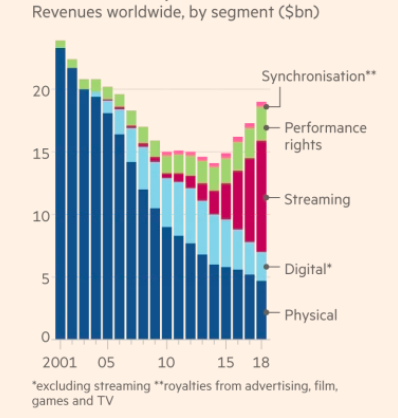

Music Industry

- Amazing chart from FT on turnaround in the Music Industry.

- It went from “terminal” decline back to growth.

- Well done to Len Blavatnik for scooping up Warner Music for just $3.3bn in 2011. Likely worth 5x that now.

- Interesting that owners of both Warner and Universal are looking to sell.

UK Valuation

- UK is the cheapest developed market on Free Cash Flow yield metric.

Salmon

- Salmon, as it is a fresh high value discretionary product, could be an interesting lead indicator?

- “Right now there is no trade with China of salmon, although you can find the air freight for the salmon. It doesn’t help because you don’t have the clients. And the price is also very high because of the cost of air freights…There people do not go out and eat….95% of the salmon consumption in China is through restaurants and the likes. So 120,000 tonnes of that market is out.” Mowi Conference Call via thetranscript.

Hedge Fund Closure

- Interesting article about Michael Platt.

- After shutting BlueCrest he continued to trade his own money.

- Last year they returned 53% net after costs.

- Interesting to see a pattern – successful hedge fund gets too big, loses focus and closes down after bad returns.

- Manager reverts to running own money and focus on one strategy – starts to perform strongly again.

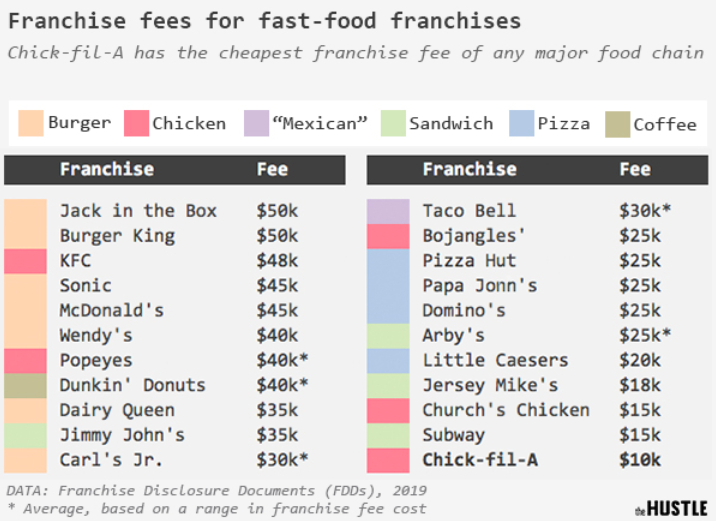

Franchises in the US

- A great article full of tons of information on franchises.

- This chart shows the fee for opening a franchise.

- Notice how stand out Chick-fil-A is. This is because they pay for all the opening costs.

- In return Chick-fil-A charges 15% royalty (vs. typical 4%-8%) and takes 50% of net profit.

- Arguably this is a different model.

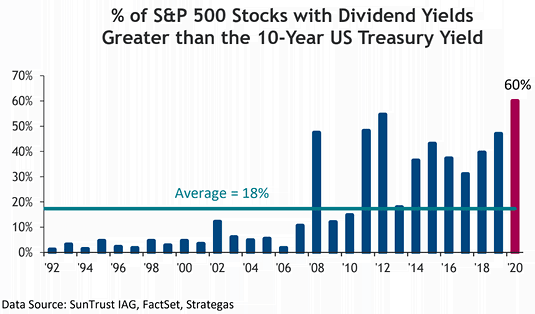

Dividend Yields

- This chart shows that currently 60% of the S&P 500 has a dividend yield greater than the 10-year US Treasury yield.

- This is the highest level since 1992, and since zero interest rate policy/quantitative easing was introduced.

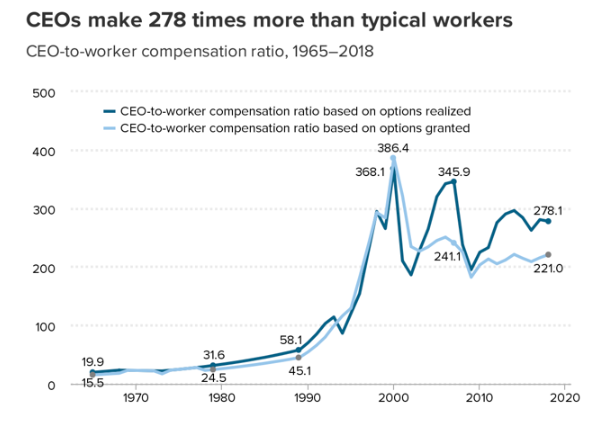

CEO Compensation

- An amazing chart showing what has happened to CEO pay as a multiple of the average worker.

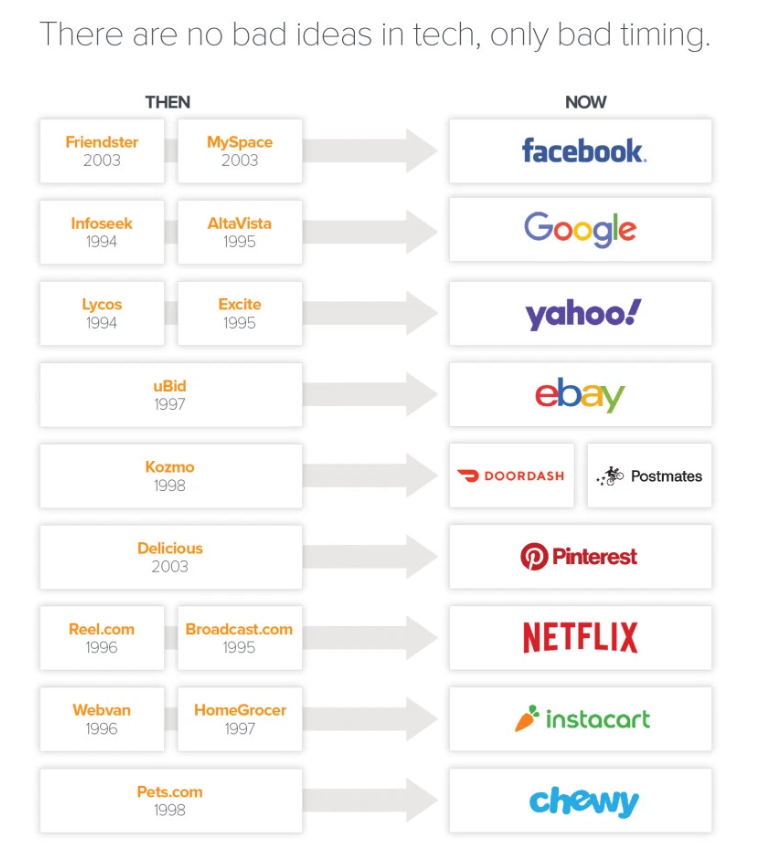

Timing

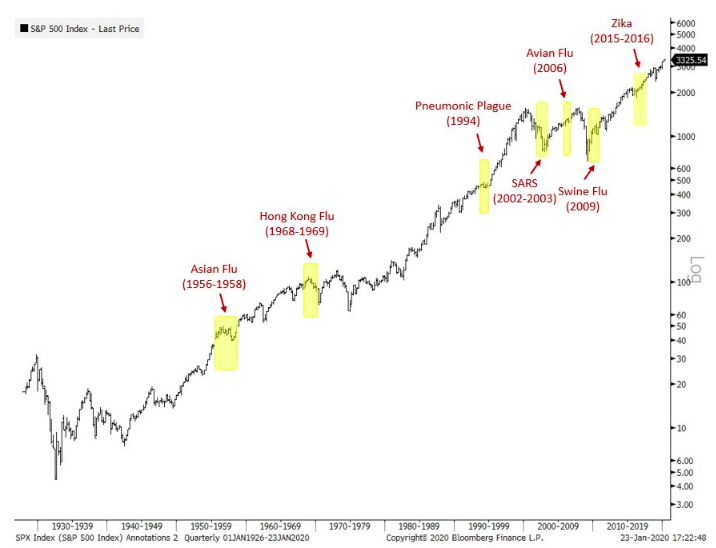

Stock Markets and Epidemics

- SPX historic chart with all epidemics marked.

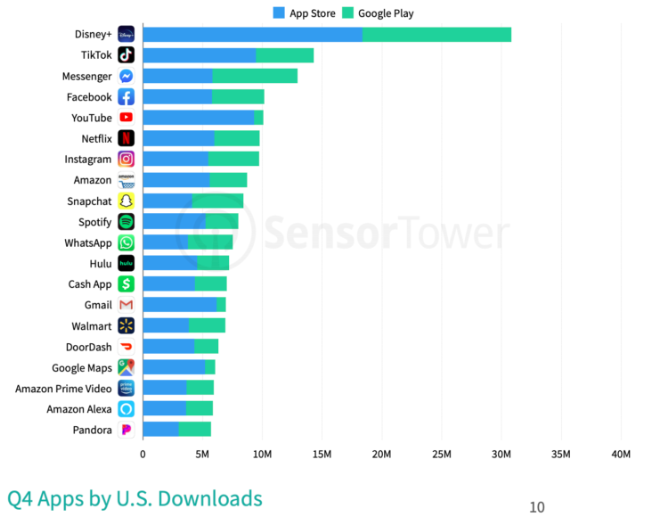

Disney

- This is a chart of the top app downloads in US. Check out Disney.

- “The launch of Disney+ in mid-November was unprecedented in the U.S. Its 31 million downloads in Q4 2019 was more than double the total for the next closest app, TikTok.”

- It was still top despite launching Nov 12 – some way into the quarter.

- Source: Sensor Tower (lots of good app stats inside report).

- h/t The Big Picture.

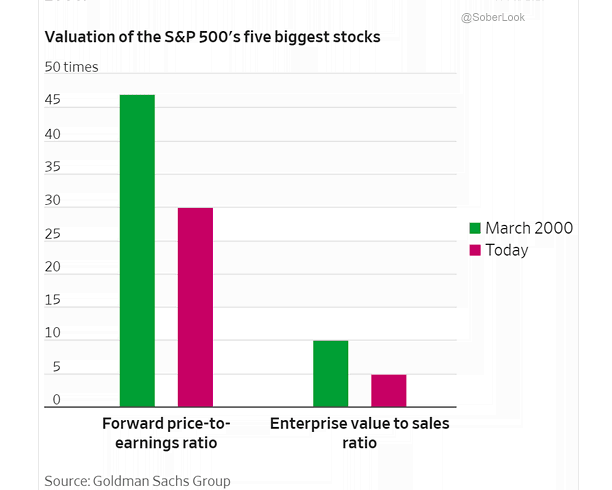

Valuation of Top 5

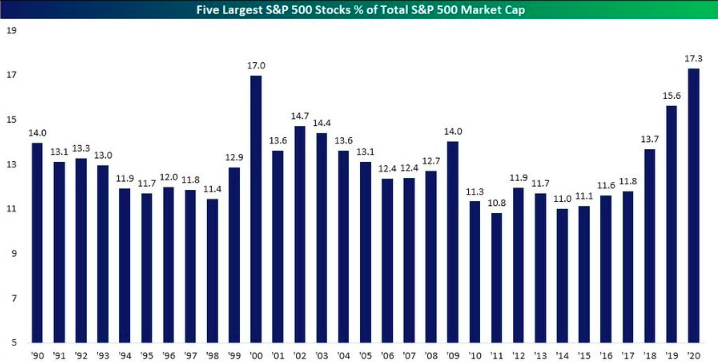

- Yesterday we showed how the concentration of the top five stocks in the S&P 500 index is back to highs.

- This chart looks at the valuation of the top five today compared to March 2000 (the last record).

- Suggests that the multiples are a lot more acceptable.

Index Concentration

- The top 5 stocks of the S&P 500 make up a record 17.3% of the index.

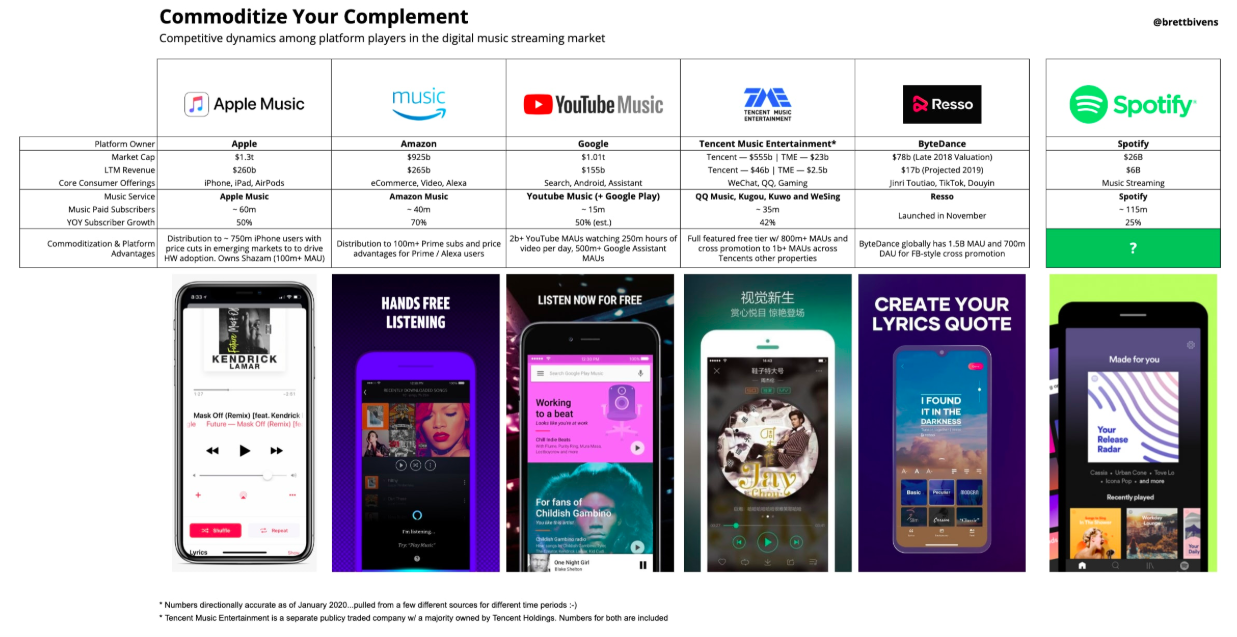

Spotify

- Great article on Spotify.

- “The rise of AirPods, smart speakers, and other wearable devices may not signal the onset of a true platform shift, but it undoubtedly represents a transformational evolution in the way we will consume media — and this emerging paradigm of distributed, “eyes up” device interaction directly benefits audio more than other content categories.“

- Nice table comparing the music services as well.

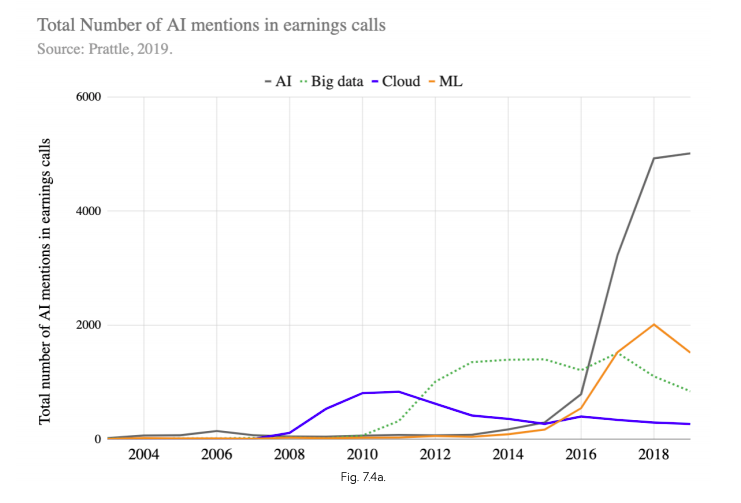

Artificial Intelligence (cont)

- This chart shows number of times AI is mentioned on an earnings call for US companies.

- Financial companies are leading the charge.

- Source.

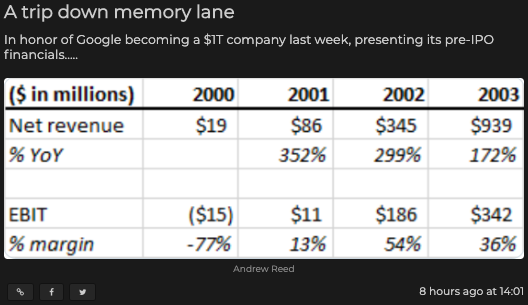

- Table showing Google’s pre-IPO financials h/t themarketear.

- Today Alphabet has a $155bn top line and $36bn of profit.

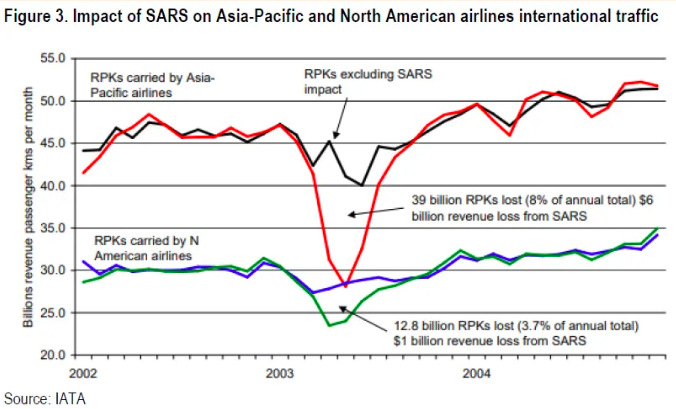

Airlines

- For those wondering what the impact on airlines is of viral epidemics.

- This is the impact on North American and Asian Airlines of SARS.

- RPK is Revenue Passenger Kilometers.

- Together some $7bn of revenue was lost.