- This is a chart of defensive sectors (think e.g. utilities) vs. cyclical sectors (think industrials).

- Interesting to see how for the majority of the recovery defensive sectors actually outperformed. This stopped only after 2016.

- The most recent rally has been mostly led by defensives as well.

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

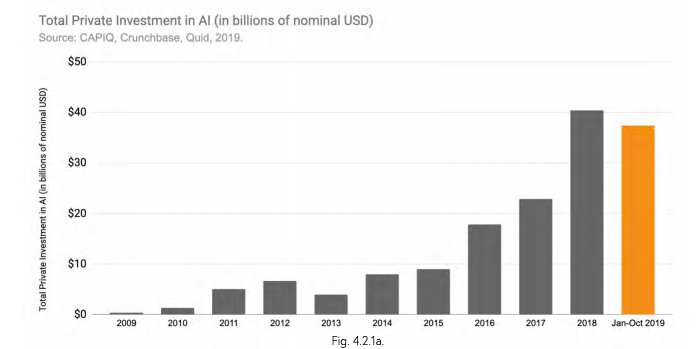

Artificial Intelligence (cont)

- The level of investment going into AI is ballooning.

- The chart only covers private investment.

- Source.

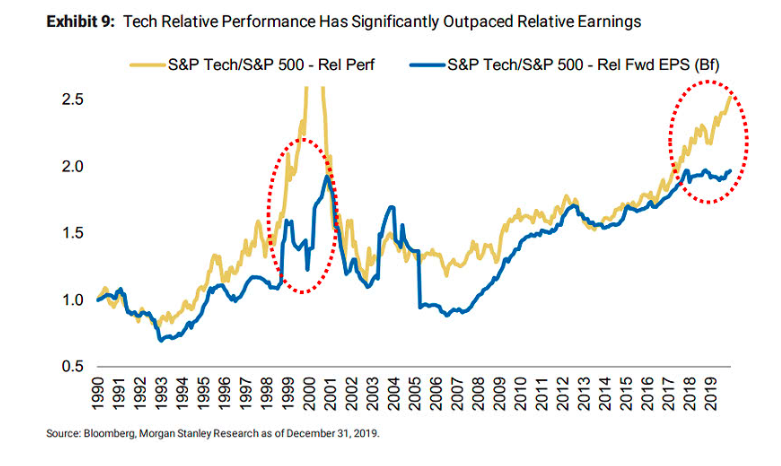

Tech Performance

- Tech is starting to decouple from earnings.

- This chart shows that the relative share price performance of tech is outpacing the relative EPS performance.

Artificial Intelligence

- Fantastic resource for anyone interested in AI.

- Especially worth checking out AI Index which has an absolute treasure trove of data (and makes it available via Google drive) on all aspects of AI.

- The improvement in capabilities (see analysis and charts in the report) are exponential.

- AI really has exploded on the scene – the chart shows attendance at big AI conferences. Notice the cyclicality though …

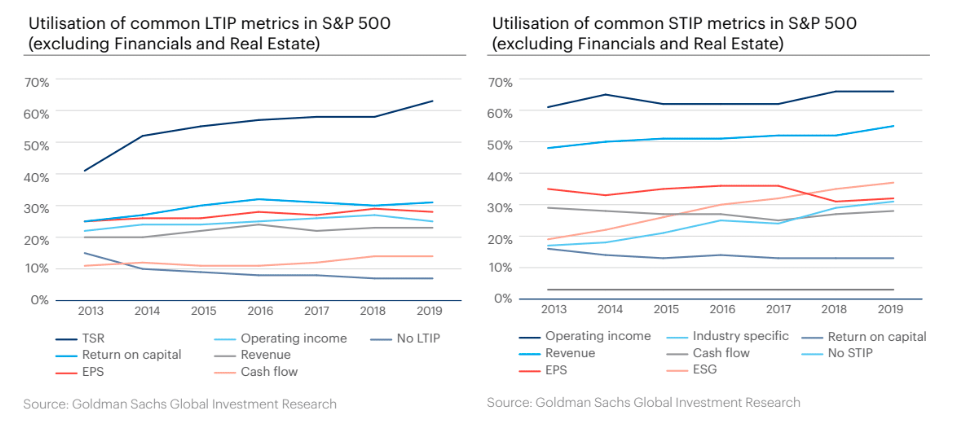

Executive Compensation

- Interesting chart showing, over time, what metrics are used for executive compensation – both long term (LTIP) and short term (STIP).

- You can see clearly the rise of TSR (Total Shareholder Return) but also how ESG is starting to be used for short term compensation.

- Data from Goldman Sachs.

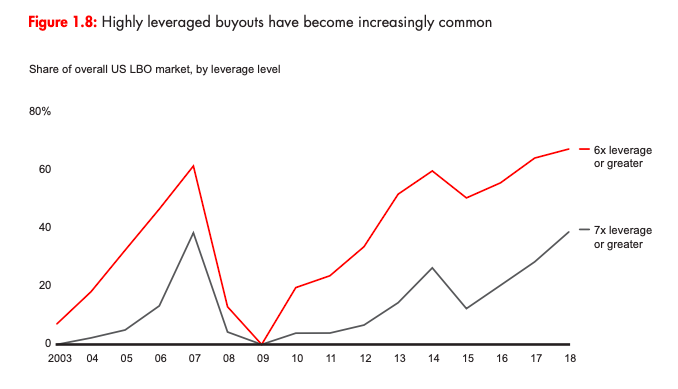

Private Equity

- Prevalence of very leveraged private equity deals (those >6 or >7x leverage) are back to pre-crisis levels.

- Multiples paid are also near highs around 11x EV/EBITDA

- Good report from Bain on the state of PE with the latest data.

Electric Cars

- Interesting piece from FTAlphaville on the carbon impact of electric vehicles.

- First a staggering chart from VW – because battery production is so energy intensive it takes their new e-Golf 120,000 km of driving to breakeven in terms of carbon emissions vs. a diesel Golf.

- This does depend on where the electricity used to charge comes from (VW address this) and ignores other gas emissions.

- Some analysts suggest that because battery technology is yet to improve the best impact on CO2 emissions is to drive a hybrid.

- Food for thought.

Biotech

- Biotech investors take note – Eli Lilly are out for deals.

- “Eli Lilly and Co aims to announce roughly one $1 billion to $5 billion deal every quarter in 2020, its chief financial officer told Reuters, as the U.S. drugmaker looks to build up its pipeline of future products.“

- “It will focus largely on earlier stage opportunities across key therapeutic areas including oncology, pain, immunology, and neurology“

US Shale

- Schlumberger’s Chairman, who sees everything in the oil patch, is predicting more deals in the US shale space as growth slows.

- “What is likely to happen over the next 5 to 10 years is that some of the smaller companies will get consolidated… get gobbled up by the majors,” Papa said.

Drug Pricing

- Pharma companies are starting to really come into their own with introducing innovative ways of pricing.

- Alnylam only charges the $575k price for givosiran if the effect seen is on par with clinical trials.

- Novartis now collects the $2.1m price tag for Zolgensma over 5 years.

- Sanofi are offering $99/month subscriptions for insulin.

- Pricing is a big issue for US Pharmaceuticals. There are start-ups looking at this issue as well – Generics 2.0.

Stock Market Bulls

- A few hedge fund managers, worth listening to, continue to be bullish.

- David Tepper is one. “I love riding a horse that’s running” and continue to do so to a point”

- Stanley Druckenmiller is another:

- “I revealed a very bullish posture intermediate-term since October when Powell guaranteed he would not rescind the insurance [rate] cuts unless inflation was persistently above target,” Druckenmiller recalled. “Since then, both have worked out, and the Fed is still whining about inflation being below target.”

- Trump “election prospects have increased with two trade agreements and big win in Iran, which the Democrats have responded poorly to,” Druckenmiller added. “So I am still ‘riding the horse’ and bullish immediate term,”

- Disclaimer: Make sure you do your own work and use common sense when investing!

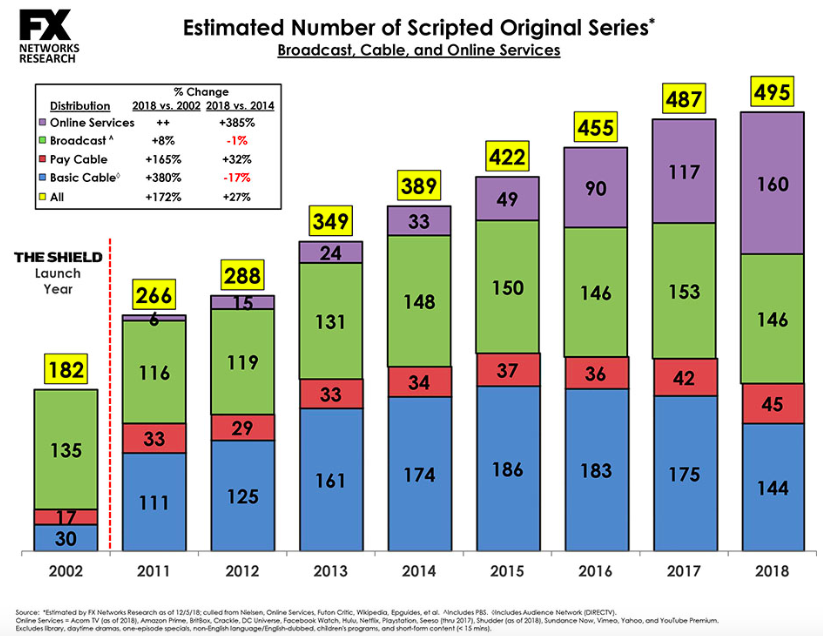

TV Series

- Original scripted series hit a new record in 2019 of 532.

- Growth was 7% this year, up from 1.6% in 2018 which was a previous record of 495 shows.

- The charts is from 2018 – showing massive growth in online – FX have stopped producing the split.

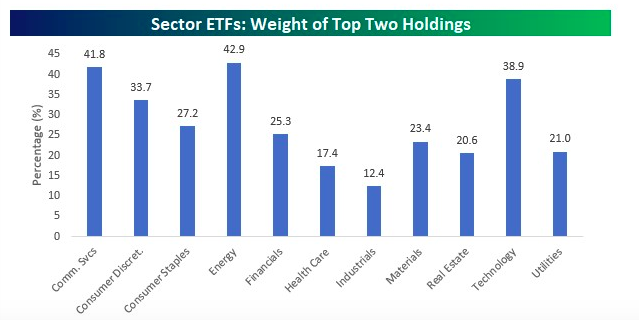

Concentration of ETFs

- Table showing weight of top two holdings of sector ETFs.

- Amazingly 3 ETFs have two holdings account for ca. 40% of the assets.

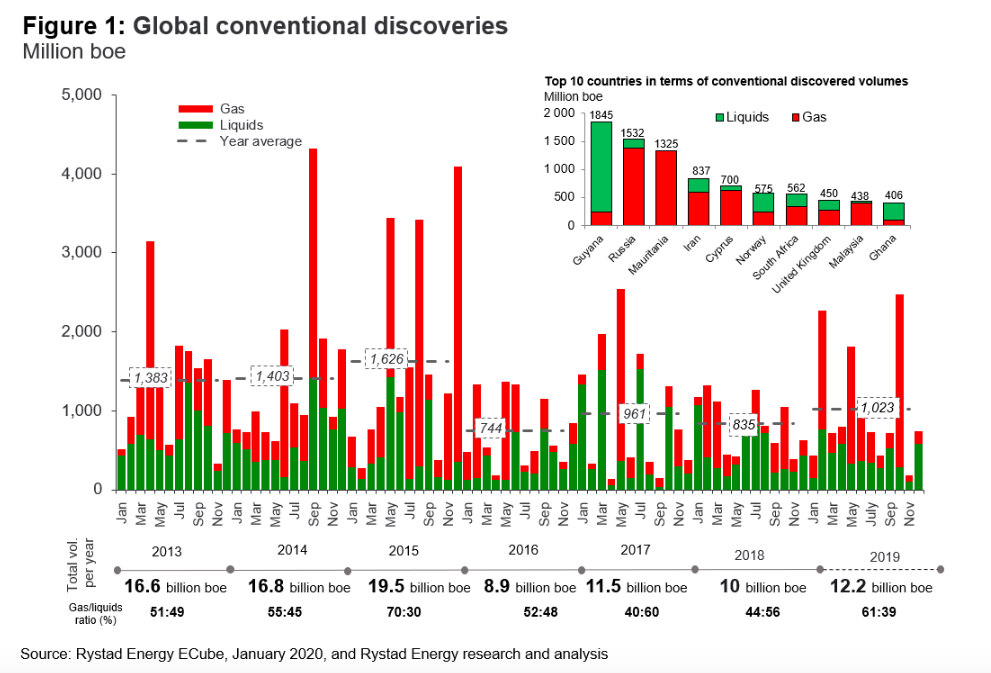

Oil Discoveries

- Oil discoveries in 2019 were at a four-year high (Rystad Energy).

- There were 26 discoveries of more than 100 million barrels of oil equivalent (boe).

- Exxon (XOM) was explorer of the year for a second year adding 1bn boe driven by discoveries in Guyana.

Dotdash

- Dotdash, a business created by IAC from the remnants of About.com, is a very interesting business you probably haven’t heard about.

- It reaches 100m monthly users, is profitable ($40m of EBITDA) and growing.

- It is also unique event in digital media – a turnaround.

- “Our job is to make great content that loads quickly with relevant non-intrusive advertising,” he insists. “If we execute, the search results will be fine.” His critics call this naive, but Vogel is trying to build a billion-dollar publishing business, not a search colossus. He’s betting that Google will drive traffic to the best content.

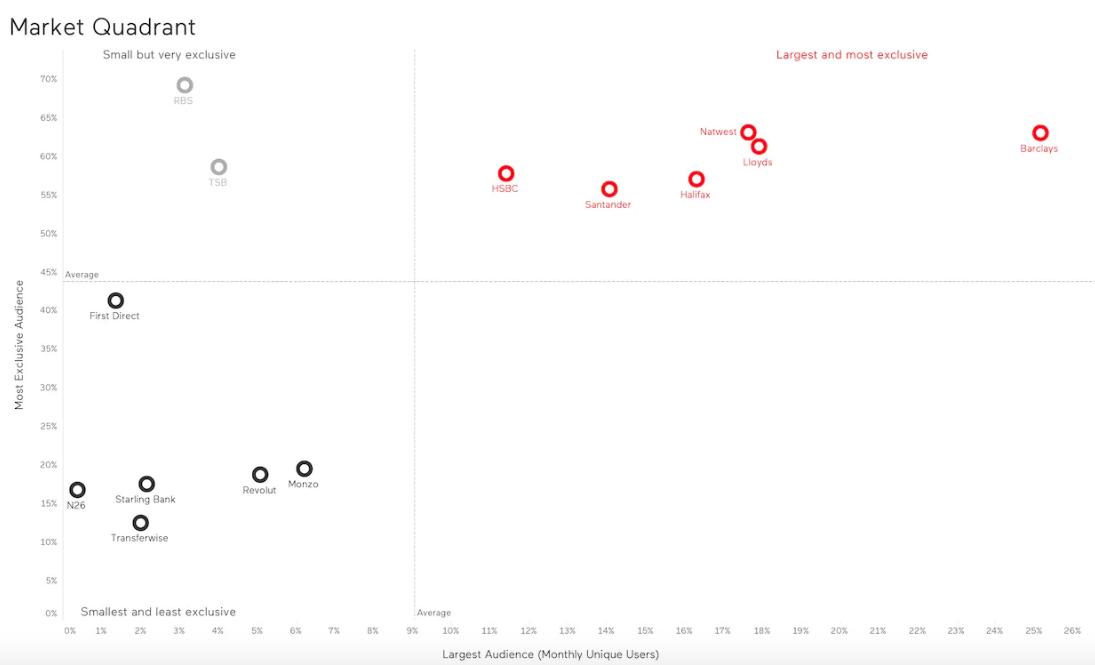

Fintechs Threat to Banks

- Interesting chart from Alphaville.

- This is analysis from the behaviour of 688,000 mobile banking users for 3 months of 2019.

- The x-axis shows the proportion of people who use each of the major banking apps at least once a month.

- The y-axis shows the proportion of those people that use that banking app exclusively.

- It suggests that high street banks not only have the highest share of mobile app usage, but also a far more loyal base of users.

- Lots of further interesting stats inside the article.

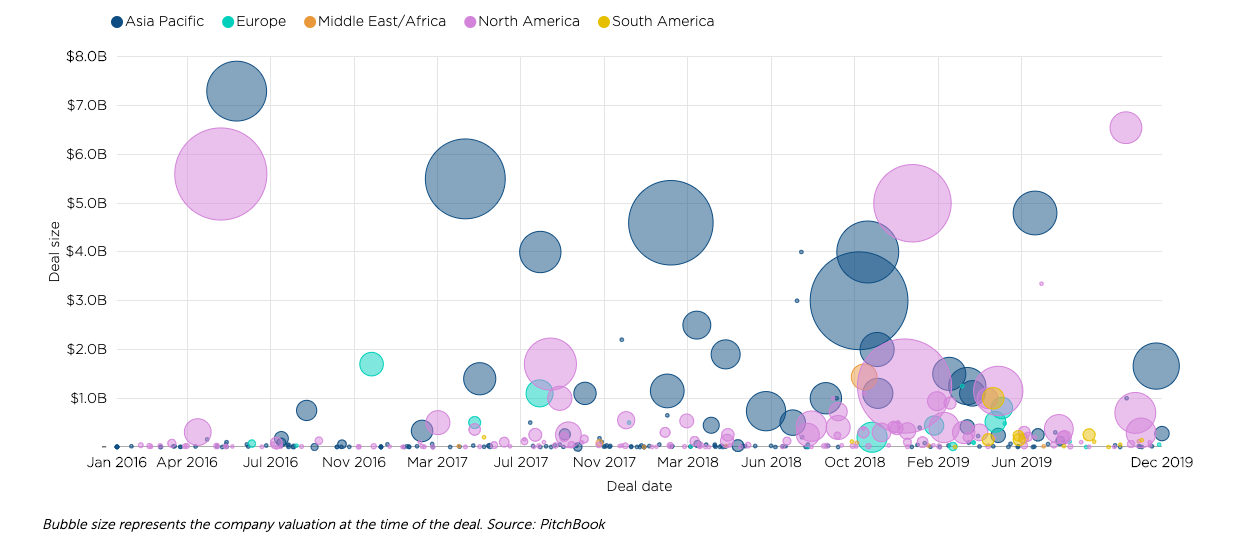

Softbank Continues to Invest

Value Factor

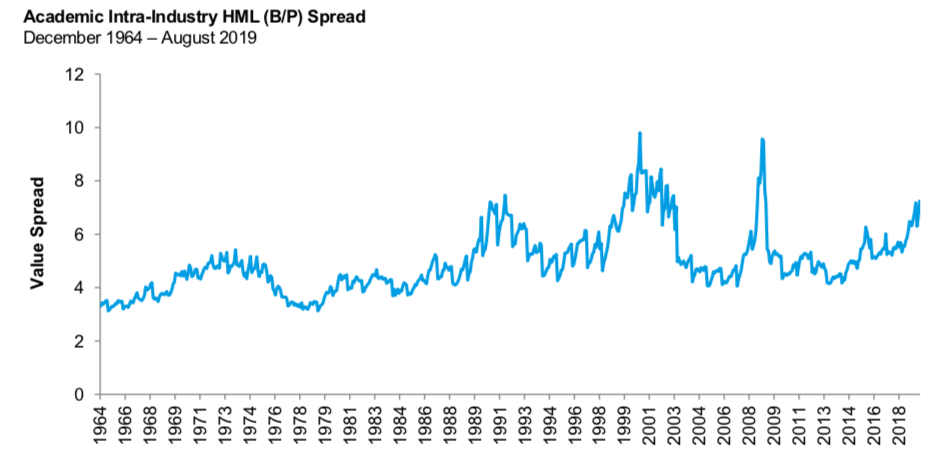

- Interesting piece by Cliff Asness of AQR on the value factor.

- Valuation of value stocks (the cheapest ones) are near historic levels against the most expensive stocks on several measures – suggesting now might be a good time to invest in this factor.

- This chart shows the price to book ratio of the expensive 30% of stocks divided by this ratio for the cheapest 30%, adjusted for industry.

- The spread is now in 97th %ile of the ex-tech bubble range.

Tech

- Fascinating read about one of the early backers of Silicon Valley.

- Roger McNamee first ran the T-Rowe Price Science and Tech Fund from 1989 and then co-founded private equity firm Silver Lake Partners.

- He has now turned a critic of big tech that he backed early on.