- Inversion is often a powerful thinking tool.

- One interesting idea from The Market Ear is to invert stock charts.

- This chart is Apple’s stock price inverted.

- The question to ask is – would you short more?

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

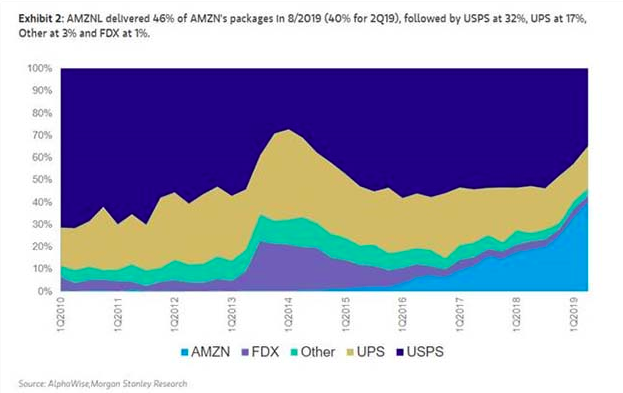

Amazon Logistics

- Amazon’s logistics investments are coming into their own.

- They employ 90,000 people and delivered 46% of amazon’s own packages in the latest datapoint.

- In 2019 they are on track to deliver 3.5bn packages – more than FedEx.

- Likely a big issue for parcel companies if they open up the network to non-AMZN volume.

Bank of Fintechs

- Interesting article about the bank fuelling lending focussed fintechs.

- They have been writing $1bn of new loans per month all sourced from 15 or so VC backed fintech start-ups.

- They effectively provide the regulatory infrastructure. Most loans are then sold off with a portion retained.

- Some choice quotes – “Our strategy is to be the only financial services provider to the fintech ecosystem globally,” Gade says excitedly. “Changing people’s lives is why we do this, before anything else.”… “The talk about a recession or a credit cycle that’s going to start going the other way is much ado about nothing.”

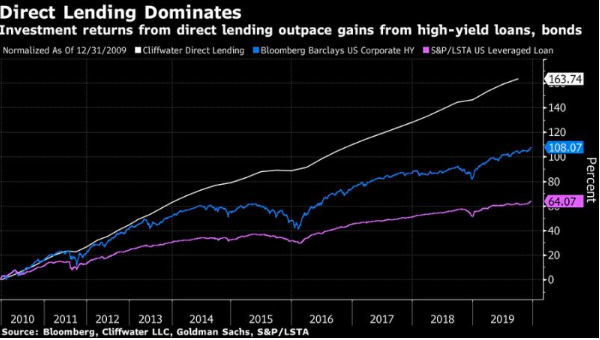

Direct Lending Revolution

- There is a big new trend in the world of finance – direct lending.

- Private equity firms are grabbing a slice of the leveraged lending market from the big wall street banks.

- It is leading to lots of competition – leveraged loan syndication fees are down 29%.

- Apollo think that private could gain as much as 10% share in the $2.5 trillion high yield loan and bond market in the next 5 years.

- This could be a function of higher bank risk weights eroding balance sheet advantage and huge fund raising capacity of private equity.

- Returns as well could be an explanation.

- The risks are clear as more and more lending is slipping into less regulated corners of the financial markets.

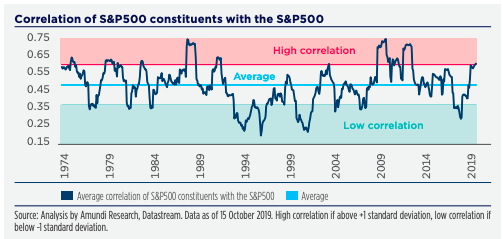

Internal Correlation of S&P

- The correlation between the components of the S&P 500 index is back to the high correlation zone.

- This suggests that stocks are moving in unison and is a difficult environment for active management.

HSBC

- Moody’s downgrades HSBC rating to negative outlook.

- Credit rating is the key cost of goods sold variable for banks so this should be monitored carefully for any investors.

- “The negative outlook on HSBC Holdings’ ratings is driven by the execution risk attached to the planned repositioning of HSBC Bank and of the group’s US business“. These businesses are 34% of risk weighted assets. HSBC has been restructuring for nearly a decade.

- “and our expectation of subdued profitability in 2020 and 2021. It also reflects pressures on asset quality and profitability in Asia due to a more difficult operating environment in Hong Kong and the rest of the region“

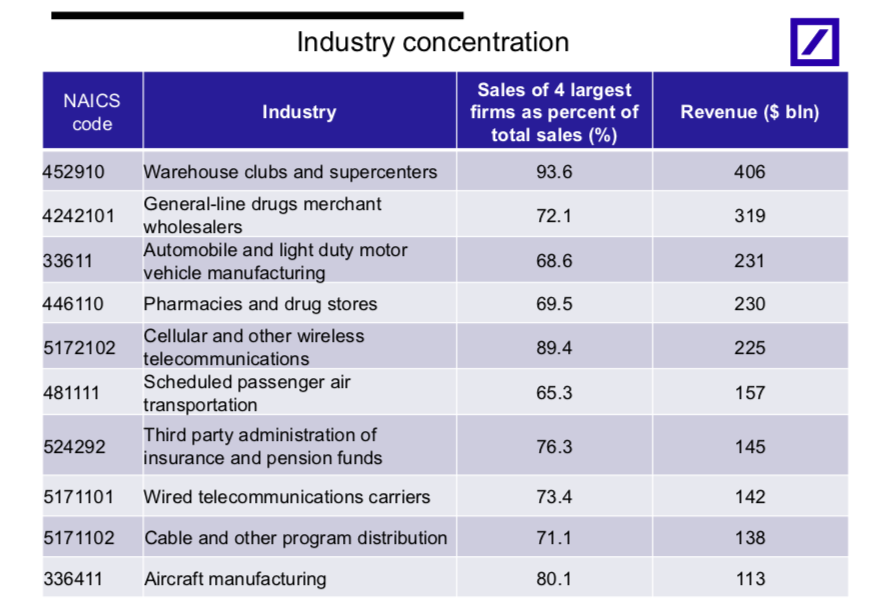

Industry Concentration

- This table shows what % of the total sales of an industry come from the top four companies.

- This is the list of the most concentrated industries in the US.

- A few usual and some unusual suspects.

Cloud Computing

- “What is happening with cloud computing at large is to think about what the total spend in technology today is, it’s around 5% of GDP. On a secular basis, I think it’s going to be 10% which is going to double in the next 10 years. And that’s because every industry, whether it’s in retail, whether it’s in healthcare, whether it’s in manufacturing, they’re all being transformed by digital technology and this technology stack we have and the platform approach Microsoft has, means we will be able to participate in that 10% on the doubling of tech spend, but more importantly, really helping the global economy grow because of digital technology. And that’s what I think is the way to think about our opportunity.” Microsoft CEO

- Sometimes it is about thinking about the big picture runway. Microsoft (MSFT) have a long one in front of them.

10 Laws of the Cloud

- In 2008 Bessemer Venture Partners published the famous 10 laws of cloud computing.

- They have now come up with an updated version after having invested in over 200 such companies.

- Worth keeping an eye on these if you are invested in cloud stocks.

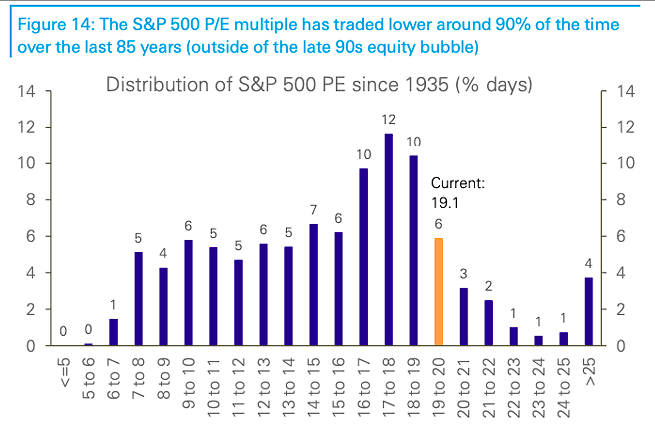

Distribution of S&P P/E

- Interesting chart showing distribution of S&P 500 P/E since 1935.

- The distribution is % of days S&P P/E spends in a particular range.

- Around 90% of the time the S&P has been cheaper.

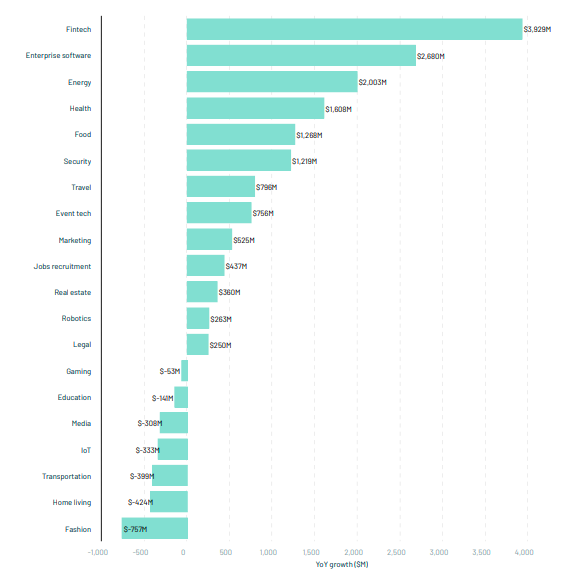

VC Investing by Sector

- Interesting chart showing year on year change in Venture Capital investing by sector in Europe 2019 vs. 2018.

- This is useful to track for equity market investors – it shows you where capital is being added.

- Fintech, Enterprise Software and Energy are top additions, while Fashion, Home living and Transport seeing less money going in.

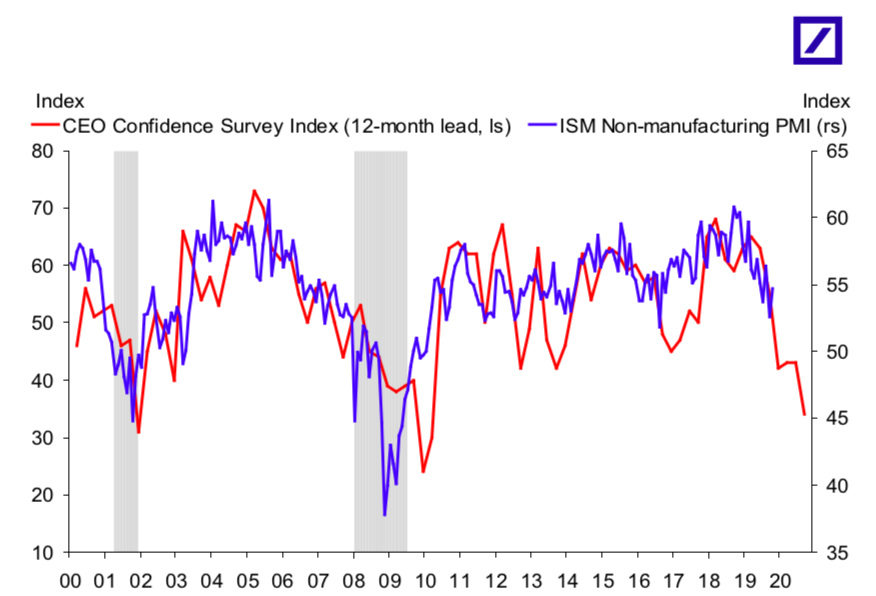

ISM and CEO Confidence

- CEO confidence has about a 12 month lead on ISM.

- The correlation is not perfect but suggests PMIs won’t recover just yet.

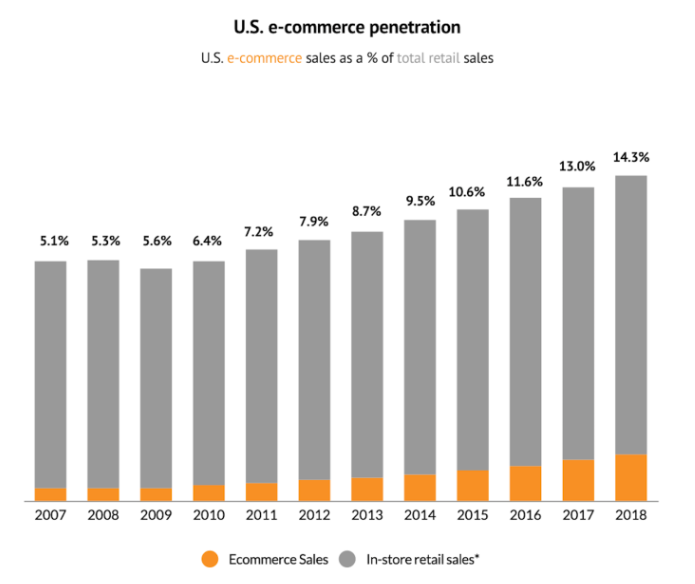

eCommerce

- There is a lot of press about eCommerce in the US.

- Yet staggeringly only 14% of US retail sales are online.

- The number is growing but the runway is clearly long.

Online Ad Targeting

- Two years ago Apple introduced Intelligent Tracking Prevention for Safari browser in mobile and desktop.

- This meant that advertisers lost the ability to target ads on Safari.

- It has been remarkably successful – the cost of reaching Safari users has fallen 60% in the last two years, while other browsers have risen.

- That is a huge change in the landscape especially in mobile where Safari market share is 53% and tend to be higher value eyeballs.

China and Tech

- China is ordering all state offices to remove all foreign tech in 3 years.

- This is going to hurt MSFT, HP, Dell.

- Only a matter of time before it spreads to state owned enterprises and possibly private business.

Brunello Cucinelli

- Interesting article about the “cashmere king”, who, over 40 years, built the business that bears his name from nothing.

- His company doesn’t allow any emails after 17:30 among many other interesting ideas about how a business should be run.

- Those who come to me and say, “You know, I work 15 hours a day,” I say, “I am not interested.” I am interested in the quality of working hours, not the quantity. The brain of the human being. Do you think that during the first five hours of the day you are the same as you are in the last five hours? No way. You’re tired, and if you’re tired, you stop listening, and the decisions you make are risky.

Spotify & TikTok

- Good article analysing the threat of TikTok, who are planning to launch a rival music streaming service in India, Indonesia and Brazil.

- TikTok has had nearly 1.5bn downloads, a staggering number.

- The latest is that the streaming service will involve so clever social features. Will be interesting to watch.

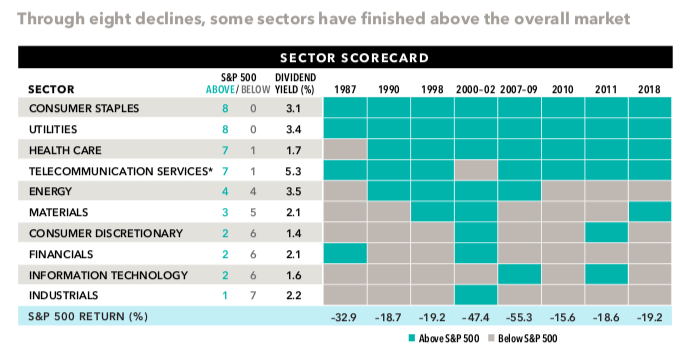

Sectors during Market Falls

- Table showing sector outperformance in the last eight market falls.

- Will come in handy if you are worried where the market is headed.

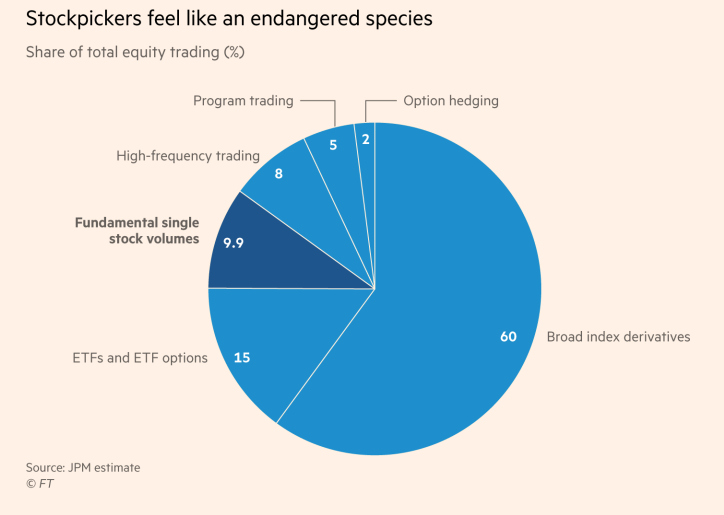

Stock Picking

- This chart from the FT is sobering.

- Only 10% of stocks traded are by fundamental stock pickers.

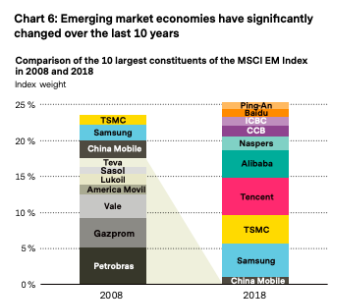

EM composition

- Amazing change in the composition of emerging market (EM) indices over the last 10 years.