- There is a lot of press about eCommerce in the US.

- Yet staggeringly only 14% of US retail sales are online.

- The number is growing but the runway is clearly long.

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

Online Ad Targeting

- Two years ago Apple introduced Intelligent Tracking Prevention for Safari browser in mobile and desktop.

- This meant that advertisers lost the ability to target ads on Safari.

- It has been remarkably successful – the cost of reaching Safari users has fallen 60% in the last two years, while other browsers have risen.

- That is a huge change in the landscape especially in mobile where Safari market share is 53% and tend to be higher value eyeballs.

China and Tech

- China is ordering all state offices to remove all foreign tech in 3 years.

- This is going to hurt MSFT, HP, Dell.

- Only a matter of time before it spreads to state owned enterprises and possibly private business.

Brunello Cucinelli

- Interesting article about the “cashmere king”, who, over 40 years, built the business that bears his name from nothing.

- His company doesn’t allow any emails after 17:30 among many other interesting ideas about how a business should be run.

- Those who come to me and say, “You know, I work 15 hours a day,” I say, “I am not interested.” I am interested in the quality of working hours, not the quantity. The brain of the human being. Do you think that during the first five hours of the day you are the same as you are in the last five hours? No way. You’re tired, and if you’re tired, you stop listening, and the decisions you make are risky.

Spotify & TikTok

- Good article analysing the threat of TikTok, who are planning to launch a rival music streaming service in India, Indonesia and Brazil.

- TikTok has had nearly 1.5bn downloads, a staggering number.

- The latest is that the streaming service will involve so clever social features. Will be interesting to watch.

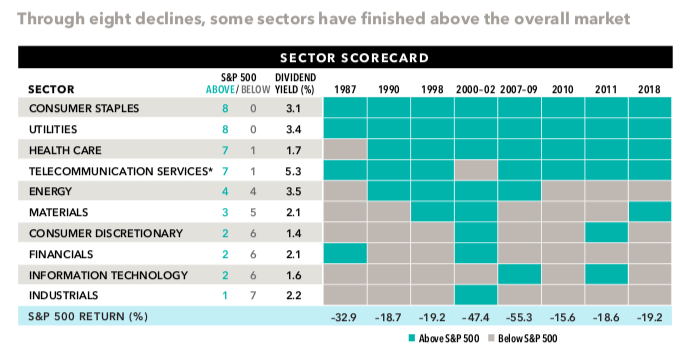

Sectors during Market Falls

- Table showing sector outperformance in the last eight market falls.

- Will come in handy if you are worried where the market is headed.

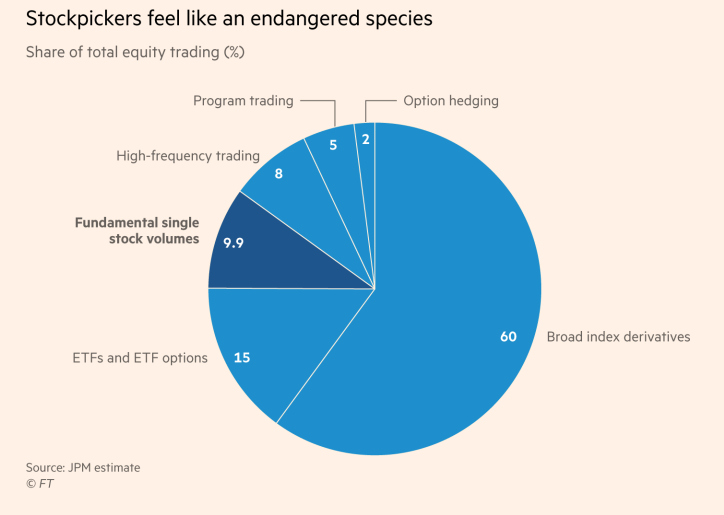

Stock Picking

- This chart from the FT is sobering.

- Only 10% of stocks traded are by fundamental stock pickers.

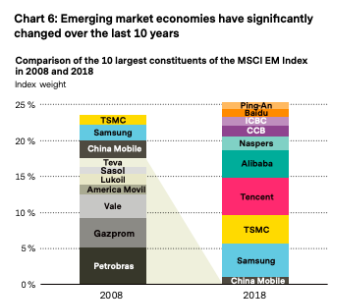

EM composition

- Amazing change in the composition of emerging market (EM) indices over the last 10 years.

Spotify

- Spotify are making a big bet on content in podcasts.

- This article chronicles what they have been up to – recruiting some heavy hitters like the Obamas.

- They will need to convince the market that the cash burn will pay off … ala Netflix.

- “Just like TV has moved from offline to now online, we’re doing the same to radio,” Ek says. “When you look at the amount of time that people consume audio, it’s about the same in the U.S. as people spend watching video. But the audio industry is less than one-tenth of the size of the whole video industry. The question one needs to ask oneself, are your eyes worth 10 times as much as your ears? My view is that they aren’t and that is going to be even more valuable in the future.”

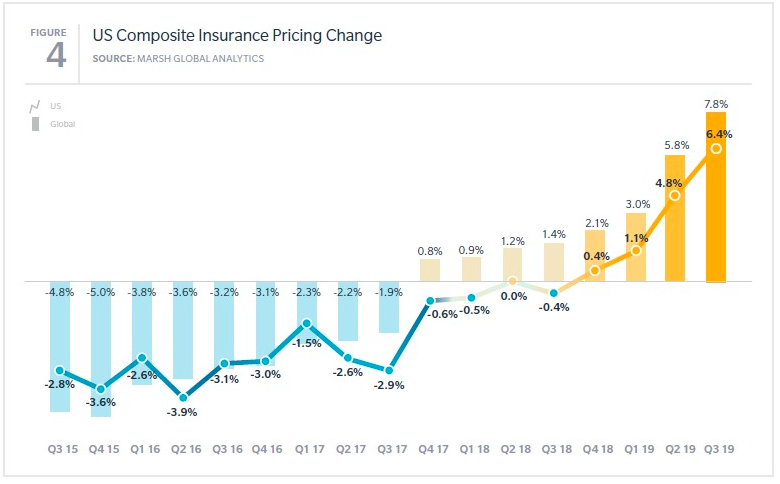

Insurance Pricing

- US Insurance Pricing has moved up sharply.

- This is going to affect the costs of every business around the country.

- This blog post tries to explain why pricing is rising – it is a response to rising losses for insurance companies.

Apple

- CNBC interview with John Malone (the king of cable) is interesting.

- This part on Apple was picked up by The Transcript.

- JOHN CARL MALONE: “I think Apple is going to surprise everybody with the numbers they achieve in a short period of time .. even though they’re thin on content. Their distribution strategy of, essentially anybody who buys anything from Apple gets a free trial for a year. And, of course, Apple already has their credit card. So, when you start with 460 million credit cards or 460 million consumer relationships. And you give them something for free. And they get to use it for a year and then they put it on your bill. That’s a very interesting way to get large numbers fast.”

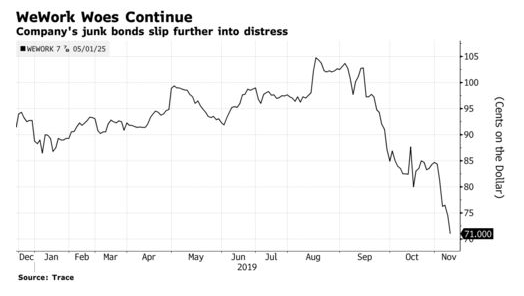

WeWork (cont.)

- One more article on WeWork. This one a must read.

- Hard to believe some of the things coming out of this saga.

- “So confident was Neumann of his job security that he once declared during a company meeting that his descendants would be running WeWork in 300 years.“

- “Last summer, some WeWork executives were shocked to discover Neumann was working on Jared Kushner’s Mideast peace effort.“

- Meanwhile the bonds of WeWork are hitting new lows.

US Sports Betting

- US online sports gambling has come a long way.

- 19 states have legalised, 14 are live and 11 are reporting monthly data.

- This is forcing some brokers (e.g. Morgan Stanley) to upgrade total (online/on-ground) market estimates – they think it will be worth $7bn in 2025 vs. $5bn before.

- This is largely due to higher market revenue than they expected.

- September in New Jersey annualised at $40/adult which is close to the UK/Australia number of $43/$45 (excluding horse racing).

- Explains reports of DraftKings being acquired.

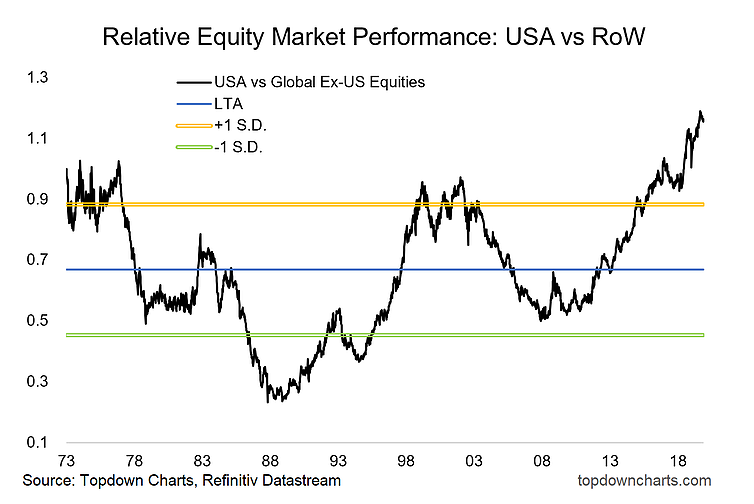

US vs. ROW

- It is really amazing how far the US market has outperformed the rest of the world.

Media

- In media the number one rule is – people will pay for good content.

- The success of The Athletic in the US demonstrates this clearly in a category, sports news, that everyone has forgotten about.

- Some of the best analysis on Google, their ad business and anti-trust that we have read.

- “There is a strong argument to be made that Google is an unstoppable juggernaut. That said, the regulatory risks to the business are real, and there are several scenarios that investors must game out to illuminate the risks and opportunities the company has in front of it.”

- h/t FT Alphaville

Gambling UK

- A few weeks ago the UK published a report on online gambling.

- The recommendation from the all-party parliamentary group was to reduce the stake in online casinos to £2 maximum (in line with land based regulation).

- Worth a quick flick for those invested in the sector.

Global Supply Chains

- This was fascinating from Samsonite (h/t The Transcript).

- Shows the plasticity of global supply chains.

- In a year they have taken sourcing for their US business from 90% China to 67% by Q3 and aiming for 50% next year.

- “…we’re very rapidly accelerating the shifting of sourcing from China for our U.S. business … I’m happy to say that for Q3, we’re already at 67%. And as we look to next year, we start to feel like we can get very close to 50% source from China, which for just the core U.S. business was close to 90% just at the start of this year. So, it’s a pretty dramatic shift” – Samsonite CEO

Cisco

- Cisco, the networking equipment maker, is a good economic bell-weather. Some telling comments from the Q3 call (h/t The Transcript).

- “So, you heard Chairman Powell yesterday talking about his concern over business investment. And I think that’s the issue that we’re facing. The consumer in the U.S., as you see from Walmart and from others, has remained very strong.“

- “What we see, when we see our customers pause, there are a few things that are just – that are usually signatures of that. First of all, our close rate on our funnel or our pipeline goes down, which we saw. We see deals getting pushed down, and we see some deals that start out bigger and then get smaller. And we saw all of those things occur. And it’s just a classic signal that we’ve seen historically. I have been doing this a long time. And I mean, it looks exactly like what we’ve seen in the past. Now the thing that I would point out is, some of these large customers that, you know, when they start saying, ‘I need one more signature. Let’s add another step into the procurement process,’ they’re just expressing caution that they’re concerned about what’s going on in the macroenvironment.“ CEO Cisco

Cosmetics vs. Skincare

- Trends in the US are suggesting heavy cosmetics are going out of fashion while skin care is accelerating.

- “All the successful products now enhance and don’t cover.”

- The article puts this down to the #nomakeup trend.

- “We believe recent declines in color cosmetics in the US are due to several factors. Trends change and a more natural appearance is now involved, which requires fewer products that went contouring and other looks were popular … In addition, Gen Z consumers are discovering the benefits of skin care, spurred by more social media activity in that category.” Estee Lauder Conference call.

- Or L’Oreal in the latest sales release on North America “In a difficult market context, the Consumer Products Division is still very much impacted by its wide exposure to the makeup market currently flat, but is posting good growth in skincare“