- “This column uses data on thousands of buyouts in the US to examine the effects on employment, job reallocation, productivity, and worker compensation.”

- They find some interesting results. As usual it all depends on the cycle.

- “… an overarching result: Buyout effects differ greatly by type of buyout, with credit conditions at the time of buyout, and with the post-buyout evolution of credit conditions and the macroeconomy.“

- They find for example that net employment fell 4.4% after buyouts, yet for private-to-private buyouts it actually rose 13% and for large public buyouts it fell 16%.

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

Goldman and Deserve

- Extending credit is difficult.

- One needs to do it over multiple business cycles to build the experience of doing it profitably.

- GS have announced they are leading $50m investment in Deserve.

- “Deserve offers credit cards directly to nontraditional consumers using machine learning and alternative data to deem creditworthiness”

- There are so many things wrong with this statement.

- “Nontraditional consumers” usually means those of poorer credit quality – which is risky.

- Yet Deserve knows how to price this risk (despite having no experience) using “machine learning and alternative data”.

- We will see how this turns out in the next recession.

Timing matters

- This is a gem of a piece on how important timing is for innovation and start-ups.

- “I basically think all the ideas of the ’90s that everybody had about how this stuff was going to work, I think they were all right, they were all correct. I think they were just early.” Marc Andressen, 2014.

- A must read.

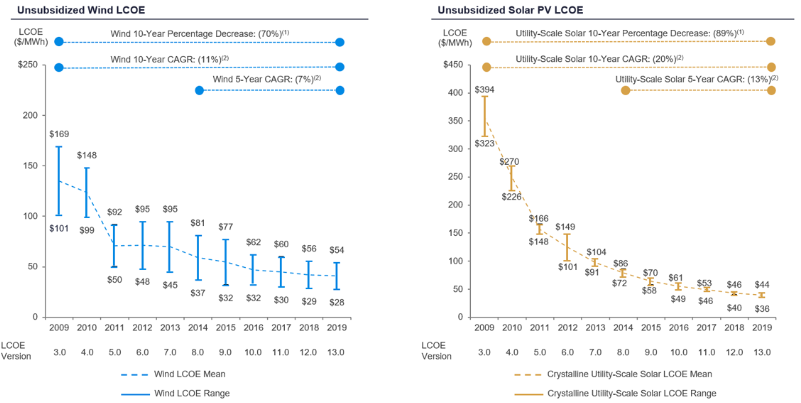

Renewable Energy cont.

- LCOE is the levelised cost of energy – a consistent measure of the cost of different methods of electricity generation.

- This chart shows how these costs have trended over time for Wind and Solar.

- Interesting to see that the gains are starting to level off.

- From latest Lazard Report.

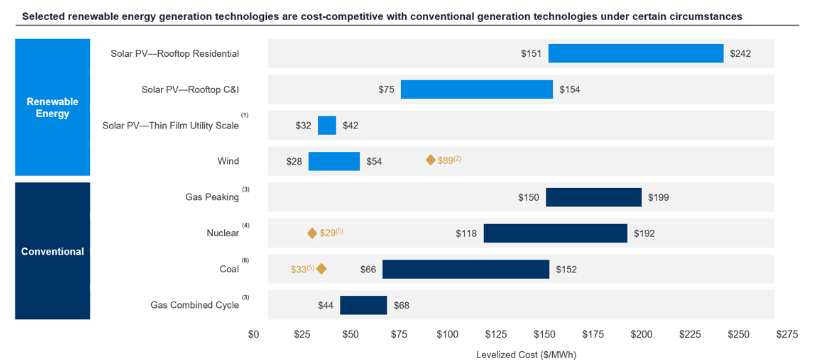

Renewable Energy

- Renewable energy is starting, under certain conditions, to be competitive with conventional generation.

- LCOE is the levelised cost of energy – a consistent measure of the cost of different methods of electricity generation.

- From latest Lazard Report.

Microsoft

- Smart move from Microsoft repositioning Bing and Edge.

- Mimics MSFT success elsewhere in repositioning to serve businesses and developers.

Climate Change

- You might not be aware but state attorney generals are suing Exxon on climate change.

- The claim is that documents show that scientists at Exxon knew that fossil fuels were harmful for the climate but the company hid this.

- It will be interesting to see how this develops (over many years no doubt).

Coffee in China

- “… the coffee consumption in China … now sits at less than four cups per year, per person, compared to 300 in the US, this is a huge opportunity“ Starbucks President on the latest Earnings Call.

- No wonder Starbucks has 4,000 stores in China already with 1,000 more planned for 2020.

- The word China was mentioned 52 times on the call …

Facebook & eCommerce

- Facebook is turning to commerce.

- They are launching payments.

- They have introduced storefronts to WhatsApp.

- Just as they did for Instagram back in March, allowing users to check out items directly in the app.

- Interesting moves all round.

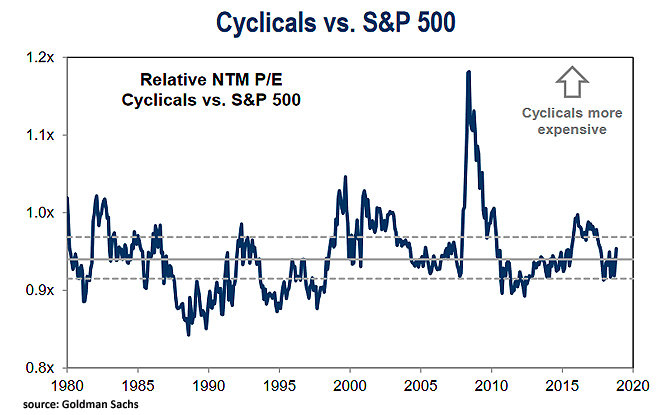

Cyclicals Valuation

- Cyclical stocks aren’t expensive.

- h/t Goldman Sachs Strategy.

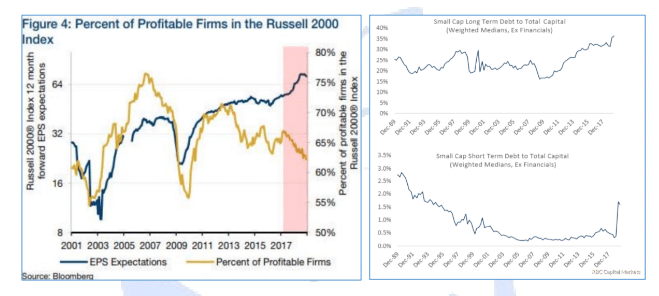

US Small Caps

- US Small caps (as presented by the Russel 2000 index) are showing some worrying patterns.

- Earnings (EPS) estimates continue to march up, while the % of profitable firms in the index is falling (the lowest this expansion).

- Even more worrying long term debt is at records and short term debt has recently jumped.

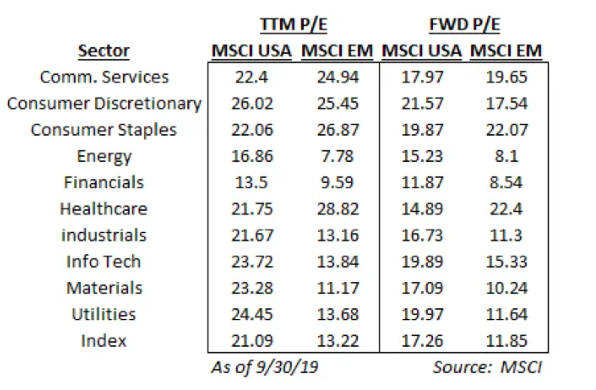

Be careful with Indices

- This is a great article which shows the danger of looking at the index level when arguing about valuation.

- At index level Emerging Markets (EM) trade at 12x P/E vs. the US at 17x = attractive right?

- If you dissect by sector the valuation difference is entirely in domestic focussed sectors (e.g. Financials) and mining/oil & gas.

- Global facing sectors have very similar valuations.

- So an investor in emerging markets is basically taking a bet that the former valuations will close … a very different proposition.

- i.e. you need China Construction Bank to re-rate vs. Bank of America.

WeWork in London

- WeWork impact is interesting.

- Morgan Stanley (via FT Alphaville) point out a Savills report (here and here) – if WeWork walked away from every commitment they have in London Offices it would raise the months of supply from 12 to 18.5 (City) and 15 (West End).

- This is below the 20 months considered over supply.

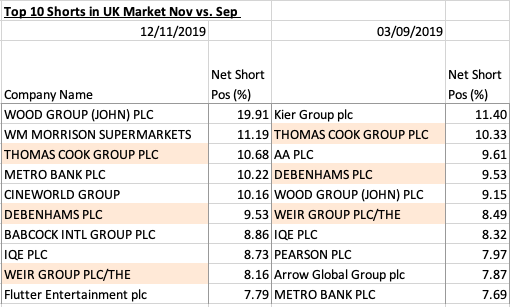

Short Positions (redux)

- We previously told you about short positions disclosure.

- You can actually find daily updated spreadsheets here for the UK.

- In the file below we use pivot tables to look at short positions by:

- Stock (Sheet: Pivot Table Company)

- Fund manager (Sheet: Pivot Table Position Holder)

- The latter could be helpful for interviews?

- The table below shows top 10 shorts in September vs. now.

- Only three names are the same.

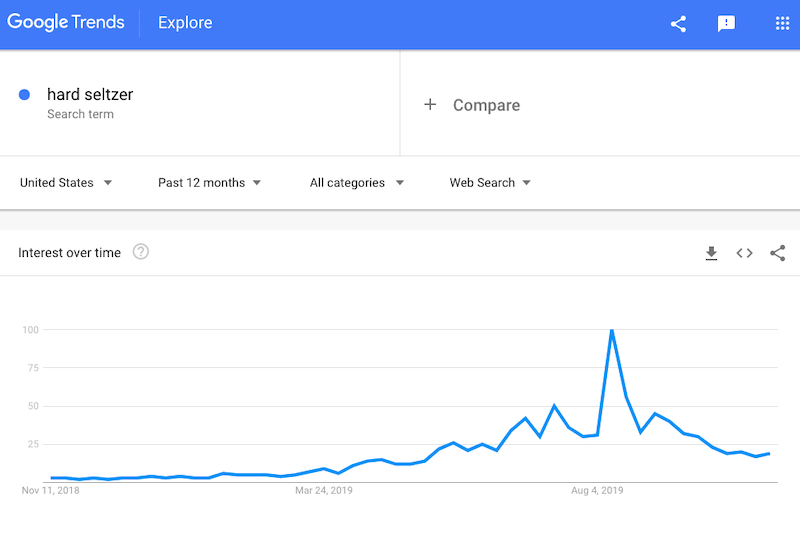

Alcoholic Fizzy Water?

- There is a fast growing market in the US for alcoholic or hard seltzer (i.e. fizzy water). Biggest brands are White Claw and Truly.

- It is on trend for a health conscious younger demographic that has shunned beer.

- So far this has been largely a US phenomenon but is likely to spread to the rest of the world.

- The big brewers are waking up and bringing in their own brands.

- Google search trends do suggest it was a summer phenomenon.

Cyclicals vs. Defensives

- We are at a crucial point of cyclical sectors vs. defensives.

- h/t Sober Look.

Asset Management

- “Just over 20 years have passed since the publication of Mark Carhart’s landmark 1997 study on mutual funds.

- Its conclusion—that the data did “not support the existence of skilled or informed mutual fund portfolio managers”—was the capstone of an academic literature, which began with Michael Jensen in 1968, that formed the conventional wisdom that active management does not create value for investors.

- We review the literature on active mutual fund management since the publication of Carhart’s work to assess the extent to which current research still supports the conventional wisdom.

- Our review of the most recent literature suggests that the conventional wisdom is too negative on the value of active management.“

- Full paper here.

- Although fully disclosed this paper was supported by IIA Active Managers Council and hence might be biased.

Peter Lynch

- Interview with the legend.

- He produced 29.2% return between 1977-1990, double the S&P 500.

- Always interesting to hear from successful investors.

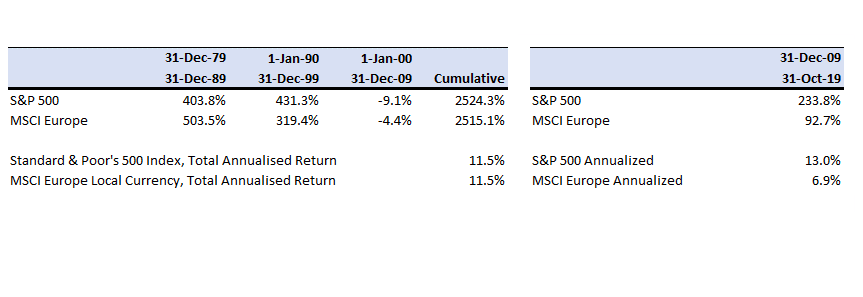

Europe vs. US

- This is an interesting to think about.

- For three decades from 1979 to 2009 the annualised returns of US and European stocks were almost identical (both +11.5% pa).

- Yet in the last decade (2009-2019), which is coming to a close, the picture is widely different.

Warren Buffet

- An interesting debate is going on about Berkshire Hathaway (BRK).

- This is partly because BRK stock, which has risen 4% this year, has lagged the 21% return from the S&P 500 Index.

- What, if anything, is Buffet going to do with the $122bn of cash he has in the company?